Gbpjpyanalysis

gbpjpy sell signalIn this analysis, it has exited an ascending channel and entered a descending channel. According to the analysis, if that support floor is crossed and a pullback to that resistance level, that is, the price is 190.829, it is suitable for selling and the stop loss is at 191.87 with a risk to reward of 1 to 5.82.

GBPJPY LONG FORECAST Q2 W18 D28 Y25GBPJPY LONG FORECAST Q2 W18 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

✅Intraday 15' order block trading levels

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY SHORT FORECAST Q2 W18 D28 Y25GBPJPY SHORT FORECAST Q2 W18 D28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Daily 50 EMA

✅Intraday 15' order blocks

✅Tokyo ranges to be filled

✅Intraday 15' order block trading levels

✅

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

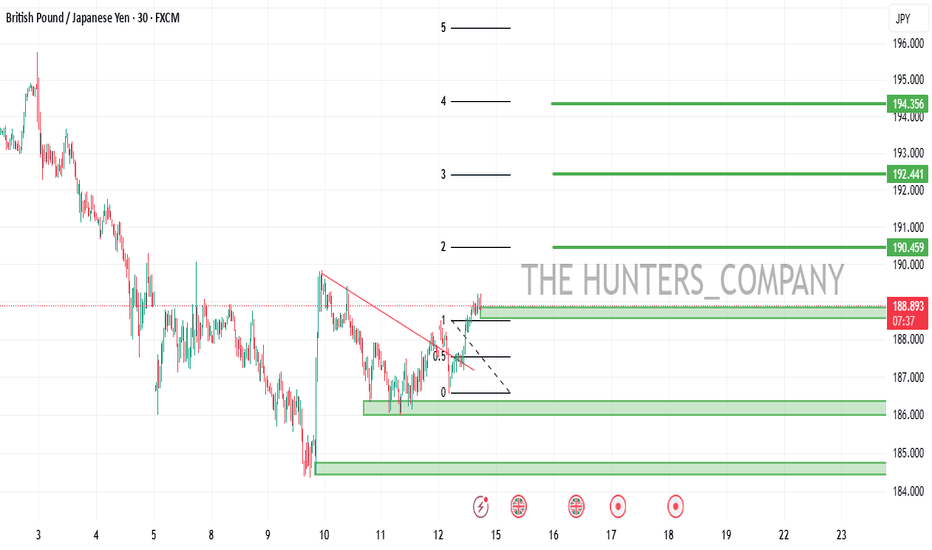

GBPJPY Reclaims 190 – Ready for 195?After breaking below the 188.00 support zone and testing 184.50 support, GBPJPY quickly reversed, signaling strong buying interest and a classic false breakdown.

Last week, the pair also reclaimed the key 190.00 level – an important technical and psychological area – showing clear strength and readiness for a potential continuation higher.

The key question now: Is GBPJPY ready to launch towards new highs?

Here’s why I stay bullish:

- Strong rejection at 184.50 confirms buyer dominance.

- Recovery above 190.00 is a major bullish signal.

- Market structure now favors buying dips

T rading Plan:

I’m looking to buy dips, staying bullish as long as 187.00 remains intact.

🎯 Targeting a move towards 195.00.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GBP/JPY TRADE ALERT!

GBP/JPY TRADE ALERT!

Potential Trend Reversal Ahead!

Current External Trend: BULLISH

Do you agree with our Daily Time Frame Forecast?

Market has given a CIDS (Candlestick Inside Day Setup), we'll enter after retesting CIDS.

Get ready to trade!

Potential Trend Reversal Ahead!

Current External Trend: BULLISH

Do you agree with our Daily Time Frame Forecast?

Market has given a CIDS (Candlestick Inside Day Setup), we'll enter after retesting CIDS.

Get ready to trade!

GBPJPY Potential longsFX:GBPJPY

After a week of bearish movement, the price has finally broke and closed above last week's high. This pair may give opportunity for some short-term bullish momentum towards the upside. On yesterday's PMI news, price broke above the fib zone and came back retesting, before continuing its second expansion upwards. Price has previously broke above the 4H swap zone but quickly came back to the 1H support zone at 188.24 and retested twice without breaching the support zone. This gives us extra confluence for entering longs.

For swing trading, we can take buys from the second half of the swap zone to the end of the 0.79 fib zone. The reason why we could also enter buys off the 4H swap zone is because price has already retested once on the fib zone, and the swap zone remains as a very strong support. As for intraday and scalping, I’d prefer to wait for short timeframe confirmations and enter with a smaller stop loss for more precise entry. We can target the buys towards 4H resistance zone at 191.180.

Trade safely 😃

GBP/JPY: Bearish Bias Pushes Price Toward Key Support LevelOver the last three trading weeks, the GBP/JPY pair has depreciated by more than 3%, establishing a firm bearish bias in favor of the yen in the short term. This perspective has remained intact primarily due to growing expectations of a more dovish monetary policy from the Bank of England, which left its interest rate unchanged at 4.5% in its latest meeting. Markets now anticipate a 25 basis point rate cut at the upcoming May 8 meeting, potentially bringing the rate down to 4.25%.

This expectation is supported by the fact that inflation in the UK currently stands at 2.6%, close to the central bank’s 2% target, further justifying the possibility of additional rate cuts in the short term. Lower interest rates in the UK reduce the appeal of GBP-denominated assets, which in turn can drive selling pressure on the pound.

Safe-Haven Demand for the Yen

It is also important to note that the Japanese yen is historically seen as a safe-haven currency, due to its relative stability compared to other major currencies. As the global tariff conflict intensifies and economic growth prospects weaken, demand for the yen is likely to increase further in the short term. This dynamic could lead to continued downside pressure on GBP/JPY.

Broad Sideways Channel Still Intact

Since August 2024, GBP/JPY has traded within a well-defined sideways channel, with resistance around 198.676 and support near 186.932. Recent bearish moves have not been strong enough to break below this key support, suggesting that this lateral formation remains the dominant structure for upcoming sessions.

Indicators Show Growing Neutrality:

MACD:

The MACD histogram is currently sitting around the neutral 0 line, indicating that the average momentum of recent moving averages remains in balance, with no dominant force in either direction.

RSI:

A similar situation is seen in the RSI, which is hovering near the neutral 50 zone. This reflects a constant balance between buying and selling pressure.

Together, these indicators suggest persistent neutrality, likely due to the strong support zone that the price is currently testing.

Key Levels to Watch:

190.14: A near-term resistance level, aligned with the Ichimoku cloud barrier. A bounce toward this level could reactivate short-term bullish momentum.

192.493: A significant resistance, located at the convergence of the 100- and 200-period moving averages. A return to this area could reinforce the validity of the sideways channel still visible on the chart.

186.93: Key support level, located at the lower boundary of the broad sideways range. Bearish moves that manage to break below this level could mark the beginning of a much more significant downtrend in the upcoming sessions.

Written by Julian Pineda, CFA – Market Analyst

DeGRAM | GBPJPY Broke Down Triangle📊 Technical Analysis

GBP/JPY continues to move within a triangle, staying below the 189 level.

The 189.00 level remains a strong ceiling; rejection here signals continued downside.

If pressure holds, price may retest support around 184.75.

✨ Summary

Technical weakness + soft UK data + JPY strength = bearish setup. Below 189.00, GBP/JPY may target 184.35.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

GBP/JPY Bearish Reversal Setup–Eyeing Breakdown from Supply Zone1. Supply Zone (Resistance Area) 🟦 Supply Zone:

Located around 189.500–190.000

🔺 Price got rejected here multiple times — strong selling pressure.

2. Ascending Trendline Support

📈 Trendline connecting higher lows (marked with yellow dots)

🟡 Support tested multiple times, acting as a rising wedge structure.

3. EMA (7) — Exponential Moving Average

⚫️ EMA (black line) is currently near price — indicating short-term trend stalling.

4. Bearish Breakout Setup

🔻 Anticipated price drop shown with red/orange arrows

📉 If price breaks below trendline:

🎯 Target Point: 186.600

⬇️ Expected drop: ~1.51%

5. Price Movement Outlook

🔁 Possible minor pullback before breakdown

⛔️ Bearish signal increases if the trendline fails.

Summary (with emojis):

📍 Entry Idea: Short near resistance zone (189.500–190.000)

⛓ Trigger: Break of trendline support

🎯 Target: 186.600

⚠️ Stop-loss: Above 190.000 (above supply zone)

#GBPJPY: Will JPY Drop or Continue The Bullish Trend? As JPY strengthens, all ‘XXXJPY’ pairs sold heavily. This trade war scenario is uncertain, so it brings significant risk. If strong news supports the US DOLLAR, we’ll likely see a sharp price drop. Use accurate risk management and analyse before blindly following any advice.

Good luck and trade safely. We wish you the best.

Thanks for your support and love.

Team Setupsfx_

GBPJPY LONG FORECAST Q2 W16 D16 Y25GBPJPY LONG FORECAST Q2 W16 D16 Y25

Key- to await price to show its play.

The longer term retrace is of course the set that FRGNT would potentially call an A - set up, higher time frame order block long, lower time frame breaks, you know the drill. BUT what if price action does not match your forecast. We must adapt if the position makes sense.

Let's see if GBP has the legs to break 15' structure in London.

We are interested.

One thing is for sure, GJ moves and we endeavour to be part of those dances!

-15' break of structure first prior immediate long.

Trade well!

FRGNT X

GBP/JPY Awaits a Bearish BreakoutFenzoFx—GBP/JPY trades slightly above the 50-period SMA at 188.4, but the trend remains bearish below the 50.0% Fibonacci resistance level. The Stochastic Oscillator signals an overbought state, suggesting short-term pressure.

A downtrend may resume if GBP/JPY closes below 187.6, targeting 186.0. Conversely, a break above 190.2 resistance could extend momentum to 192.0.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

GBP/JPY) Bearish analysis Read The ChaptianSMC Trading point update

GBP/JPY 2-hour chart outlines a clear bearish setup within a well-defined downtrend. Here's a breakdown of the trading idea:

---

Technical Overview:

Downtrend Channel:

The pair is respecting a downward-sloping channel, with repeated rejections at the upper boundary, confirming bearish control.

Resistance Zone (~187.8 - 188.5):

Price has reached a highlighted resistance area that aligns with previous swing highs and trendline resistance — marked with red arrows for prior rejections.

Bearish Projection:

The analysis anticipates a rejection from this resistance zone followed by a downward impulse move. A pullback is expected, but continuation toward the target support zone around 179.150 is likely.

Target Zone (~179.150):

This level lines up with previous price action and matches the measured move (blue vertical box), adding confluence.

EMA 200 (around 190.36):

Price is well below the 200 EMA, reinforcing the bearish structure and trend bias.

RSI Indicator (~52):

RSI is slightly above 50 but not bullish — this neutral reading suggests the pair has room to drop if resistance holds.

Mr SMC Trading point

---

Trading Idea Summary:

Bias: Bearish

Entry Zone: 187.8 – 188.5 (resistance)

Confirmation: Bearish candlestick pattern or rejection signal

Target: 179.150

Invalidation: Break and close above 190.365 (above EMA 200 and prior highs)

---

plase support boost 🚀 analysis follow)

GBPJPY:SIGNALHello dears

Considering the heavy decline we had, you can see that buyers entered with a strong bullish spike, which is a good sign...

Now we can buy in steps on the price pullback and move with it to the specified targets, of course with capital and risk management.

*Trade safely with us*

GBP/JPY "The Beast" Forex Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Beast" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (189.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (186.500) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 191.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/JPY "The Beast" Forex Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY: From Oversold Bounce to Potential DowntrendFenzoFx—The GBP/JPY currency pair bounced from 184.42 due to RSI 14 being oversold. As of now, it trades near 187.7, having erased 1.0% of recent gains.

The trend remains bearish with prices below the 50-period simple moving average and the 50.0% Fibonacci resistance level at 190.2. Support is at 187.0, and a drop below this could target 184.42.

The Bullish Scenario

However, if GBP/JPY surpasses 190.2, bullish momentum may extend to 192.0.

Enter our Forex Analysis Contest to win a prize pool of $160.0 every week >>> FenzoFx Decentralized Forex Broker

GBP/JPY "The Dragon" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (190.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 199.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/JPY "The Dragon" Forex Bank Bullish Heist Plan(Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red MA Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing low or high level Using the 4H timeframe (192.000) Day/scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 198.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend target...

Before start the heist plan read it...go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩