#GBPJPY: 681+ Pips Buying Chance from a Key Level. Dear Traders,

Since the Japanese Yen (JPY) experienced a significant decline in the market, prices have risen. This analysis examines two key areas: the complex bullish price behaviour and the rejection of prices at levels we are currently monitoring for potential entry. While this chart analysis serves as a secondary reference, it should complement your own trading strategies.

Best regards,

Team Setupsfx_

Gbpjpyforecast

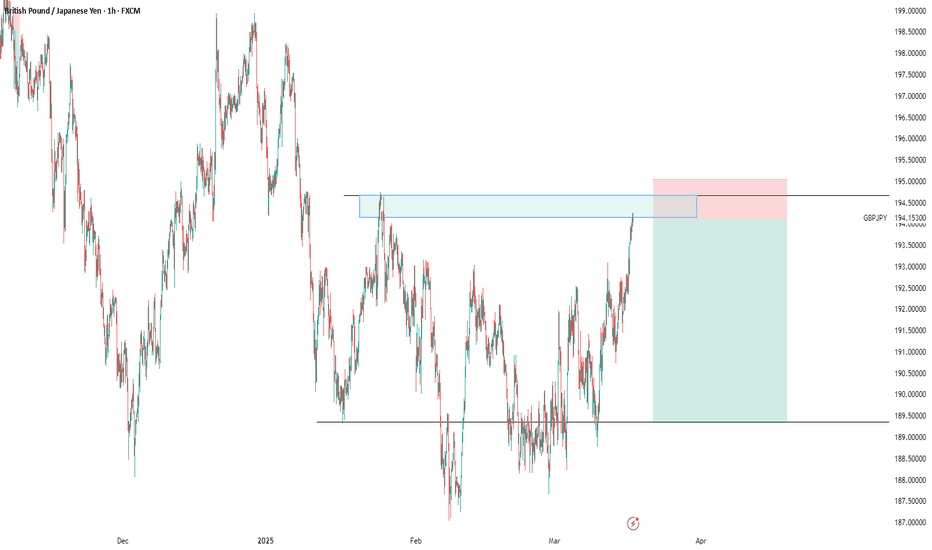

My Directional Bias on GBPJPY for the long run {29/03/2025}Educational Analysis says that GBPJPY may give countertrend opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

1) Break of structure on weekly range is down trend for the long run period of 10 years, may be it switch to new character or change its direction to bullish.

2) External pushback structure is the trading range where it trades on the smaller time frame,

On this structure range market on inside trading or smaller time frame is bullish towards fib of 1.618 and make turn to fill the fair value gaps of it.

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

GBPJPY - Short Term Sell Idea Update!!!Hi Traders, on March 26th I shared this idea "GBPJPY - Expecting Bearish Continuation In The Short Term"

We expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened until it was blocked by a bullish divergence.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY: Fibonacci Levels Signal Possible Bullish ContinuationTechnical Analysis: GBP/JPY Bullish Continuation 📈

The GBP/JPY chart provided highlights a bullish trend continuation setup, supported by Fibonacci retracement levels. Here's a detailed breakdown:

📊 Fibonacci Levels in Play

The swing low to swing high has been plotted, revealing key retracement levels.

The price is currently near the 50% retracement level (194.326), a critical support zone in bullish trends.

The 61.8% retracement level (194.165), often called the "golden ratio," serves as a stronger support below this.

📈 Bullish Bias

The overall trend remains bullish, with higher highs and higher lows visible on the chart.

The corrective pullback to Fibonacci levels suggests a potential continuation of the upward momentum.

🎯 Target Projection

The arrow on the chart points to a projected move toward the 195.683 level, aligning with the -50% Fibonacci extension.

This target aligns with the bullish trend and indicates a potential breakout above the recent high.

🔍 Confluence and Confirmation

The price action shows signs of rejection at the 50% retracement level, indicating buyer interest.

A bullish candlestick pattern or increased volume near this zone would further confirm the upward move.

⚠️ Risk Management

The 61.8% level (194.165) is a key invalidation point. A break below this level could signal a deeper retracement toward the 78.6% level (193.937) or even the swing low.

This analysis is for informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research and consult with a financial advisor before making trading decisions.

GBPJPY - Expecting Bearish Continuation In The Short TermM15 - Double uptrend line breakout

Lower Lows

Strong bearish momentum

Potential drop after retraces if the strong resistance zone will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

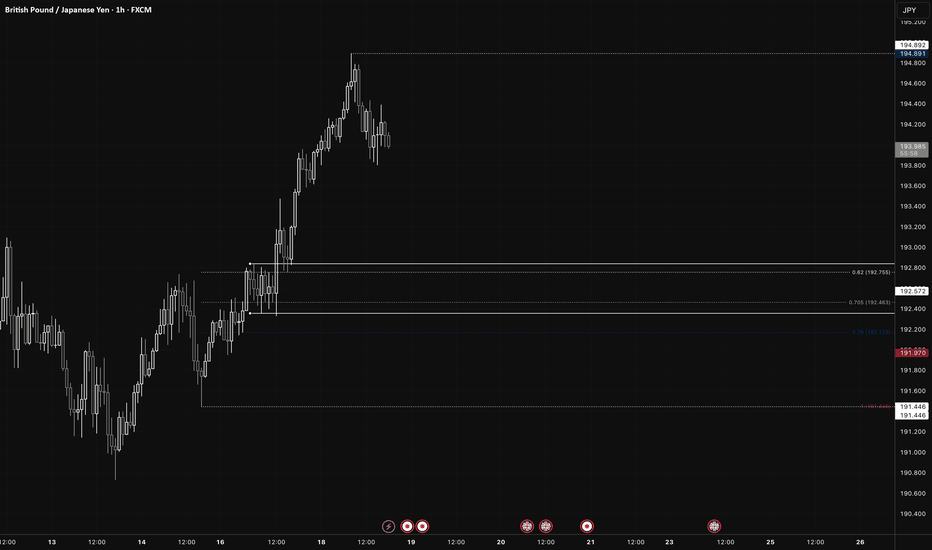

GBP/JPY (Long)Daily:

Price > 200EMA

Swing Period 10

Swing Low: 187.666

Swing Low: 194.892

Volume Imbalance: 2 Candles

Daily Order Block: 197.399 / 195.104

H4:

Price < 200EMA

Swing Period: 7

Swing High: 194.892

Swing Low: 190.728

Volume Imbalance: 2 Candles

H4 Order Block: 192.357 / 192.841

H1:

Swing Period: 5

Swing High: 194.892

Swing Low: 191.446

Volume Imbalance: 11 Candles

H1 Order Block: 192.357 / 192.841

Model 1:

Entry Price: 192.572

Stop Loss: 191.970

TP1: 191.970 @ 1:1 / 50%

TP2: 193.775 @ 1:2 / 25%

SL: Breakeven

TP3: 194.891 @ 1:3 / 25%

Model 2:

Entry Price: 192.750 - 192.159

Entry Trigger: 9EMA X 21EMA

SL: Above recent swing low

TP1: 1:2

SL: Trailing 9EMA

gbpjpy sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY - MASSIVE Swing Potential Buy - Happening Now (March)This is a longer term swing idea.

Top down analysis from HTF indicates that:

- Push lower on JPYX Yen index

- Retrace higher on XXXJPY pairs

- Divergence in the Yen pairs, confirming a low

- Price Action has created a lot of liquidity on the downside, which has been taken, signifying upside.

Comment below if you have questions. Happy to help.

Peaceful Trading to you all.

GBPJPY Bulls Are Back In TownAs explained in the video, we have several bullish confirmations...

Key Sup 190.3

Key Res 193

- Bullish CHoCH

- Formed a new HH and HL

- H4 TL break and retest

- Retest of bullish OB

- Multiple bullish FVGs

- Bullish MACD

I have a small position open...

🟢BUY GJ 192.315

SL 191.6

TP1 192.515

TP2 192.815

TP3 193.315

TP4 194.315

Will scale in another position if we get a break and close above 193.

GBP/JPY SELL IDEA (R:R=4.8)I just placed a sell order for GBP/JPY at 191.700. We have a wonderful X BAT that just formed on the 1 HOUR chart.

Please trade with proper risk management, since we have news announcements coming out at 8:15 AM EST today.

ADP Non-Farm Employment Change

Stop Loss: 192.368 (Daily High)

Take Profit: 188.450

Happy Trading!

GBP/JPY e Analysis & Probability Estimation March 4 2025Key Observations Across Timeframes:

1. Market Structure & Trend Analysis:

Short-term (M15, M30):

Price is consolidating near 189.200, testing the previous daily low (PDL) for liquidity.

A Break of Structure (BOS) occurred, signaling short-term bearish control.

The price is hovering at a key demand zone (PWL - 188.500/187.800).

If price breaks below 188.800, further downside is likely.

Mid-term (H1, H4):

The price rejected equilibrium (~189.800 - 190.000), showing weakness.

A Change of Character (ChOCH) to the downside suggests a bearish trend continuation.

Liquidity below PWL (187.800) could be a target before a potential bounce.

Long-term (D1):

The price is in a larger downtrend, failing to break above premium zones (~190.500 - 192.000).

Liquidity below PWL (~188.000 - 187.500) is uncollected, making it a likely target.

The next major support lies in the discount zone (~185.500 - 186.500).

2. Key Liquidity Zones & Supply/Demand Areas:

Premium Zone (~190.500 - 192.000): Major resistance; rejection happened here.

Equilibrium (~189.800 - 190.000): Price failed to hold above, signaling weakness.

Discount Zone (~187.500 - 186.500): Next strong demand area if price continues lower.

Previous Daily Low (PDL - 188.800): Price is testing this level for liquidity; a break here could lead to further downside.

Previous Weekly Low (PWL - 187.500): Untapped liquidity below, making it a strong target for price movement.

Probability-Based Scenarios:

1. Bearish Continuation to 187.800 - 186.500 (Break Below PDL & PWL)

Probability: 65%

Reasons:

Failure to hold above equilibrium (189.800).

Bearish BOS & ChOCH confirmations on H1/H4 suggest a move down.

Liquidity below 188.000 (PWL) remains uncollected.

Strong daily downtrend supports further downside.

Bearish Confirmation:

If price breaks and holds below 188.800, expect a move toward 187.500 - 186.500.

2. Bullish Reversal from Discount Zone (Bounce from 188.500 - 187.500)

Probability: 35%

Reasons:

Potential liquidity grab at PWL (188.000 - 187.500) before reversing.

Demand zone at 187.500 - 186.500 could cause a bullish reaction.

If price holds above 188.800, we may see a bounce to 189.800 - 190.000.

Bullish Confirmation:

If price fails to break below 188.500, a push back toward equilibrium (189.800) is possible.

Final Thoughts & Trade Plan:

Bearish bias (65% probability) for continuation toward 187.800 - 186.500.

Key Confirmation Levels:

Below 188.800: Bearish toward 187.500 - 186.500.

Above 189.200: Potential bullish recovery toward 189.800 - 190.000.

Trade Setup Overview:

Bias: Bearish (65% probability)

Entry Type: Breakout & Retest

📉 Sell (Short) Trade Setup:

🔴 Entry: Below 188.800 (Confirmed BOS)

🎯 Take Profit (TP) Targets:

TP1: 188.200 (PWL - Previous Weekly Low)

TP2: 187.800 (Liquidity sweep level)

TP3: 186.500 (Major discount zone)

🛑 Stop Loss (SL): 189.400 (Above minor liquidity)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Strong candle close below 188.800 (Break & retest scenario)

No immediate bullish rejection at 188.500

📈 Buy (Long) Trade Setup (Lower Probability - 35%)

🟢 Entry: Above 189.200 (Bullish rejection & BOS)

🎯 Take Profit (TP) Targets:

TP1: 189.800 (Equilibrium zone)

TP2: 190.500 (Supply zone)

TP3: 191.500 (Major resistance)

🛑 Stop Loss (SL): 188.700 (Below structure low)

📊 Risk-to-Reward (R:R):

TP1: ~1:2

TP2: ~1:3

TP3: ~1:5

🔹 Confirmation Needed:

Price needs to hold above 189.200 with strong bullish momentum.

No immediate rejection from equilibrium (189.800).

🛠️ Execution Tips:

🔄 Wait for a clear breakout & retest before entering.

⚖️ Adjust lot size based on risk tolerance (~1-2% per trade).

🕰️ Monitor price action on the lower timeframes (M15/M30) for entry precision.

GBP/JPY "The Beast" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗GBP/JPY "The Beast" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (187.700) then make your move - Bearish profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (190.500) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 185.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

GBP/JPY "The Beast" Forex Market is currently experiencing a Bearish trend in short term, driven by several key factors.

˗ˏˋ ★ ˎˊ˗Fundamental Analysis˗ˏˋ ★ ˎˊ˗

Interest Rates: BoE at 4-4.5% (easing cycle), BoJ at 0.25-0.5%—yield gap narrows, mildly bearish for GBP/JPY.

Inflation: UK at 2.5-3% (cooling), Japan at 2.5% (persistent)—neutral, balances GBP vs. JPY strength.

Growth: UK GDP ~1-1.5%, Japan ~1%—both modest, neutral impact.

Trade: UK exports lag, Japan benefits from U.S. tariff shifts—bullish for JPY, bearish for GBP/JPY.

Risk Sentiment: Safe-haven JPY gains in risk-off—bearish pressure.

˗ˏˋ ★ ˎˊ˗Macroeconomic Factors˗ˏˋ ★ ˎˊ˗

U.S.: Fed at 3-3.5%, PCE 2.6%—USD softness aids GBP/JPY—bullish (Eurostat/U.S. data).

Eurozone: PMI 46.2—stagnation weakens EUR, indirectly supports GBP—bullish (Eurostat).

Global: China 4.5%, Japan 1%—slow growth, JPY safe-haven appeal—bearish (ECB forecasts).

Commodities: Oil $70.44—stable, neutral for GBP/JPY (global data).

Trump Policies: Tariffs shift trade to Japan—JPY strength, bearish for GBP/JPY.

˗ˏˋ ★ ˎˊ˗Global Market Analysis˗ˏˋ ★ ˎˊ˗

Forex Markets: GBP/USD at 1.2650, USD/JPY at 150.00—GBP resilience vs. JPY strength—mixed.

Equity Markets: FTSE 100 stable, Nikkei range-bound—neutral correlation.

Crypto/Commodities: Gold at $2,930—risk-off supports JPY—bearish.

˗ˏˋ ★ ˎˊ˗Commitments of Traders (COT) Data˗ˏˋ ★ ˎˊ˗

Speculators: Net short JPY ~140,000 contracts (down from 150,000)—fading bearishness, mildly bullish JPY.

Hedgers: Net long JPY ~90,000—exporters expect JPY strength, bearish for GBP/JPY.

Open Interest: ~280,000 contracts—steady interest, neutral.

˗ˏˋ ★ ˎˊ˗Market Sentiment Analysis˗ˏˋ ★ ˎˊ˗

Retail: 65% short GBP/JPY at 189.50 (global X posts)—contrarian upside—bullish potential.

Institutional: Cautious, favoring JPY in risk-off—bearish outlook.

Corporate: UK/Japan firms hedge at 190-192—neutral.

Social Media Trends: Bearish setups to 185.00—short-term bearish sentiment.

˗ˏˋ ★ ˎˊ˗Positioning Analysis˗ˏˋ ★ ˎˊ˗

Speculative: Longs target 192.00-194.00, shorts aim for 188.00-185.00.

Retail: Shorts at 190.00-191.00—squeeze risk if price rises.

Institutional: Leaning short GBP/JPY, eyeing JPY strength.

˗ˏˋ ★ ˎˊ˗Quantitative Analysis˗ˏˋ ★ ˎˊ˗

SMAs: 50-day ~194.00, 200-day ~193.00—price below both, bearish signal.

RSI: 45 (daily)—neutral, fading bearish momentum.

Bollinger: 188.50-190.50—price near lower band, potential bounce.

Fibonacci: 38.2% from 198.94-189.31 at 190.50—resistance above.

Volatility: 1-month IV 10%—±1.80 daily range.

˗ˏˋ ★ ˎˊ˗Intermarket Analysis˗ˏˋ ★ ˎˊ˗

GBP/USD: 1.2650—GBP holds vs. USD, bullish for GBP/JPY.

USD/JPY: 150.00—JPY weakens vs. USD, bullish for GBP/JPY.

XAU/USD: $2,930—gold rise, JPY safe-haven—bearish.

FTSE 100: Stable—neutral.

Bonds: UK 10-year 4%, Japan 0.9%—yield gap narrows, bearish.

˗ˏˋ ★ ˎˊ˗News and Events Analysis˗ˏˋ ★ ˎˊ˗

Recent: Trump tariff threats (25% Mexico/Canada, 10% China, Feb 25)—risk-off lifts JPY—bearish.

Upcoming: U.S. PCE today (Feb 28)—hot data strengthens USD, pressures GBP/JPY; soft data boosts risk-on, supports GBP—mixed impact.

Impact: Bearish bias today, PCE reaction pivotal.

˗ˏˋ ★ ˎˊ˗Next Trend Move˗ˏˋ ★ ˎˊ˗

Technical:

Support: 188.50-188.00

Resistance: 190.50-192.00

Below 188.50 targets 185.00; above 190.50 aims for 194.00.

Short-Term (1-2 Days): Dip to 188.00 if PCE lifts USD; rebound to 190.50 if risk-on prevails.

Medium-Term (1-3 Months): Range 185.00-195.00, tariff/JPY strength key.

˗ˏˋ ★ ˎˊ˗Overall Summary Outlook˗ˏˋ ★ ˎˊ˗

GBP/JPY at 189.50 faces bearish short-term pressure from JPY safe-haven demand (tariffs, risk-off) and technicals (below SMAs), despite GBP resilience vs. USD. COT shows fading JPY shorts, sentiment leans bearish, and PCE today could sway direction. A short-term dip to 188.00 is likely, with medium-term consolidation unless macro shifts favor GBP.

˗ˏˋ ★ ˎˊ˗Future Prediction˗ˏˋ ★ ˎˊ˗

Bullish: 192.00-195.00 by Q2 2025 if USD softens (DXY to 105), risk-on resumes, or BoE holds rates.

Bearish: 185.00-188.00 if JPY strengthens (USD/JPY to 145), tariffs escalate, or risk-off persists.

Prediction: Bearish short-term to 188.00 (PCE/USD strength), then cautiously bullish to 192.00 by mid-2025 (risk-on recovery).

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/JPY Multi-Timeframe Analysis & Probability Estimation **Timeframes Covered:**

- **30-Minute (M30)**

- **1-Hour (H1)**

- **4-Hour (H4)**

- **Daily (D1)**

**Key Observations Across Timeframes:**

**1. Market Structure & Trend Analysis:**

- **Short-term:** (M30, H1) Price is trading near **equilibrium (~189.600 - 189.800)** with minor bullish structure.

- **Mid-term:** (H4) Price is rejecting from a previous **liquidity zone**, but still inside a bearish structure.

- **Long-term:** (D1) Overall, **GBPJPY is still bearish** with price bouncing from the **discount zone (188.000 - 187.500)** but failing to break above **key resistance (190.500 - 191.000).**

**2. Supply & Demand Zones:**

- **Premium Zone (~190.500 - 193.000):** Strong supply zone, price may reject if it reaches this level.

- **Discount Zone (~187.500 - 186.500):** Strong demand zone where price recently found buyers.

- **Equilibrium (~189.600 - 189.800):** Price is currently consolidating, meaning market is undecided.

**3. Liquidity Areas & Key Levels:**

- **Previous Daily High (PDH ~190.000) & Previous Weekly High (PWH ~192.000):** These levels may act as liquidity magnets.

- **Previous Weekly Low (PWL ~187.500):** If price drops, this will be the next area of interest for liquidity.

- **Weak High near 190.500:** If price struggles here, expect a reversal.

---

**Probability-Based Scenarios:**

**1. Bullish Scenario (Move Towards 190.500 - 192.000)**

- **Probability: 50%**

- **Reasons:**

- Short-term bullish momentum (M30 & H1) suggests price might push toward the **premium zone (190.500 - 192.000).**

- If price **breaks and holds above 189.800**, it could push higher.

- Liquidity above **PDH (190.000) could be a target** before a potential rejection.

**2. Bearish Scenario (Drop Below 188.500 Towards PWL)**

- **Probability: 50%**

- **Reasons:**

- **H4 & D1 remain bearish**, meaning a continuation of the downtrend is still possible.

- If price **fails to hold above 189.600**, expect a move lower towards **188.500 or even 187.500 (PWL).**

- The **0.618 Fibonacci level (190.626) is acting as strong resistance.**

**Final Thoughts & Trade Plan:**

- **Market is currently in a neutral zone (50/50 probability)**, meaning it can go either way.

- **Key Confirmation Levels:**

- **Above 189.800:** Bullish towards **190.500 - 192.000**.

- **Below 189.600:** Bearish towards **188.500 - 187.500**.

GBPJPY jumps above 190.50The GBP/JPY pair climbs to around 190.70 during the early European trading hours on Friday. The British Pound (GBP) gains strength against the Japanese Yen (JPY) following the release of the UK's January Retail Sales data.

The Office for National Statistics reported on Friday that UK Retail Sales rose by 1.7% month-on-month in January, compared to a decline of 0.3% in December. This figure exceeded the market's expectation of a 0.3% increase. On a yearly basis, Retail Sales grew by 1.0% in January, compared to a previously revised increase of 2.8% (originally 3.6%), surpassing the forecast of 0.6%. The GBP remains strong in immediate response to the positive UK Retail Sales figures.

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPJPY Analysis TodayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBP/JPY SELL IDEA (R:R=5.9)Placed a sell order for G/J at 190.695. We have a beautiful X CRAB that just formed on the 30 minute chart.

Trade with proper risk management please since we have news announcements coming out at 4:30 AM EST today.

GBP-Flash Manufacturing PMI

GBP-Flash Services PMI

Stop Loss: 191.285

Take Profit: 187.200

Happy Trading!

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade