GBP-NZD Will Grow! Buy!

Hello,Traders!

GBP-NZD is trading in a

Strong uptrend but is

Making a bearish correction

However, a strong long-term

Rising support is ahead

From where we will be

Expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

GBPNZD

GBPNZD Massive Long! BUY!

My dear followers,

I analysed this chart on GBPNZD and concluded the following:

The market is trading on 2.1887 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2015

Safe Stop Loss - 2.1821

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

GBP/NZD Swing: Identifying Double Sell Limit OpportunitiesWe’re analyzing the GBP/NZD currency pair with a focus on establishing a swing position using a double Sell limit setup at key Fibonacci levels. This strategy aims to capitalize on expected retracements or reversals.

Strategic Entry Points

Our primary Fibonacci levels of interest are the 50% and 61.8% retracement levels. These points are based on recent price actions and are where we anticipate potential reversals could occur.

Short-Term Trend Focus

By employing this setup, we aim to capture short-term market fluctuations on a daily basis. Monitoring price movements closely allows us to adapt swiftly to changing market conditions.

Conclusion

Traders should keep an eye on GBP/NZD for signs of reversal at these Fibonacci levels, implement effective risk management, and remain flexible in their strategies. This approach may provide opportunities to benefit from short-term trend reversals in this dynamic market.

✅ Please share your thoughts about GBP/NZD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GBP/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/NZD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.193 level.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD Channel Breakout (5.2.2025)The GBP/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.1862

2nd Support – 2.1765

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

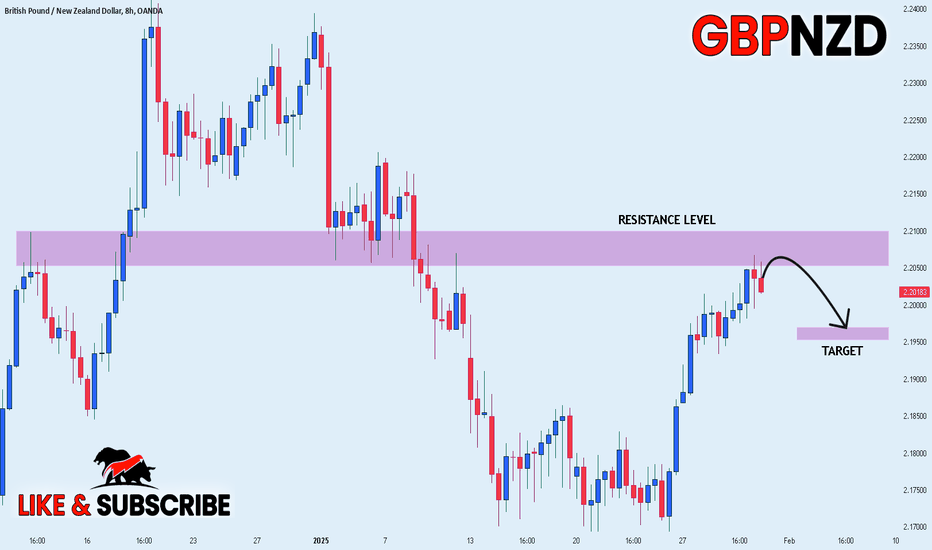

GBPNZD Approaching Key Resistance – Potential Sell SetupOANDA:GBPNZD is approaching a critical resistance zone that has previously attracted strong selling interest, making it a key level to watch.

If rejection signals appear, such as bearish engulfing candles or increased selling volume, I anticipate a move toward 2.19900. However, if the resistance fails to hold, it may open the door for further upside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Please boost this post, every like and comment drives me to bring you more ideas! I’d love to hear your perspective in the comments.

Best of luck , TrendDiva

GBPNZD Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

GBP/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

GBP/NZD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 12H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.158 area.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD: Bearish Continuation & Short Trade

GBPNZD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GBPNZD

Entry - 2.1991

Stop - 2.2074

Take - 2.1842

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

GBPNZD Will Go Lower! Sell!

Please, check our technical outlook for GBPNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 2.192.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 2.165 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD Bullish ReversalGBPNZD price seems to exhibit signs of Bullish Reversal on the lower timeframes as the price action forms a credible Higher High on key Fibonacci and Support levels.

Trade Plan :

Entry @ 2.19027

Stop Loss @ 2.1659

TP 1 @ 2.21458

TP 1 @ 2.23901

Move Stop Loss to Break Even if TP1 hits.

GBPNZD Technical buy opportunity below the 1D MA50.Last time we looked into the GBPNZD pair (October 02 2024, see chart below), we issued a clear buy signal at the bottom of the long-term Channel Up, that easily hit the 2.1900 Target:

Yet again, the price got rejected at the top of the Channel Up and pulled-back where it is consolidating below the 1D MA50 (blue trend-line). In the 12 months of this pattern, this has always been an excellent technical buy opportunity, with the minimum immediate rally being +4.15%.

As a result, we feel confident buying this pair and target 2.2550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBP/NZD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are going long on the GBP/NZD with the target of 2.235 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

We are now examining the GBP/NZD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.177 level.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD - The pound, at peace?!The GBPNZD currency pair is below the EMA200 and EMA50 in the 4-hour timeframe and is trading in its ascending channel. If the downward trend continues, we can see the demand zone and buy this currency pair in that zone with the appropriate risk reward. The upward correction of this currency pair will provide us with the opportunity to sell it again.

According to Bloomberg, in response to rising borrowing costs, the UK bond market has requested that the government reduce the issuance of long-term bonds next year. During annual consultation meetings held on Monday, traders strongly advocated for a reduction in the maturity of bonds issued for the fiscal year 2025-2026 compared to current levels.

The majority of investors favor increasing the issuance of short-term bonds due to declining demand for long-term bonds from pension funds. The Debt Management Office mentioned in its meeting minutes that the market requires greater flexibility due to “uncertainty.”

The recent rise in UK bond yields has posed new challenges for the government, and these proposals could help the government adapt to the shifts in demand.

As reported by the Financial Times, UK Treasury Minister Rachel Reeves has expressed support for regulatory plans aimed at reducing restrictions on mortgage lending.These plans, which are being reviewed by the Financial Conduct Authority (FCA), aim to allow banks to take on more risk with mortgage loans, enabling more people to become homeowners.

In an interview with the Financial Times, Reeves stated her willingness to consider the FCA’s proposals for easing mortgage restrictions. She said, “I am fully prepared to explore ideas that can help working families achieve homeownership.”

This week, Reeves traveled to Davos to participate in the World Economic Forum and promote the UK as a prime destination for investment. This effort is part of the Labour government’s strategy to stimulate economic growth, as the UK experienced a recession in the second half of last year.

Given the stringent fiscal rules Reeves has imposed on herself and the decline in business confidence following her decision to raise employer national insurance contributions in the October budget, the Treasury Minister has faced significant political pressure since the start of the year. The Treasury is at the forefront of the government’s efforts to push regulators to introduce growth-enhancing measures. Last week, Reeves met with several UK regulatory officials to gather their ideas on this matter.

Data from the Office for National Statistics (ONS) revealed that the number of job vacancies in the UK decreased to 812,000 in the quarter ending December. Additionally, the economic inactivity rate dropped to 21.6% in the three months ending November.

Traders have increased their bets on an interest rate cut by the Bank of England, expecting a reduction of 64 basis points this year.

Moreover, December data indicates that the UK’s public sector net debt (excluding banking groups) rose to £17.8 billion, up from the previous figure of £11.2 billion. Public sector tax receipts increased to £19.9 billion, a notable rise compared to the previous £13.0 billion. Similarly, central government net debt climbed to £19.9 billion, up from £16.3 billion previously.

Meanwhile, in the latest Global Dairy Trade (GDT) auction in New Zealand, the GDT price index increased by 1.4%, while whole milk powder prices rose by 5%.

GBPNZD I Swing Long Opportunity from Weekly Welcome back! Let me know your thoughts in the comments!

** GBPNZD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

GBPNZD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for EUR/USD below:

The instrument tests an important psychological level 2.1703

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.1748

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK