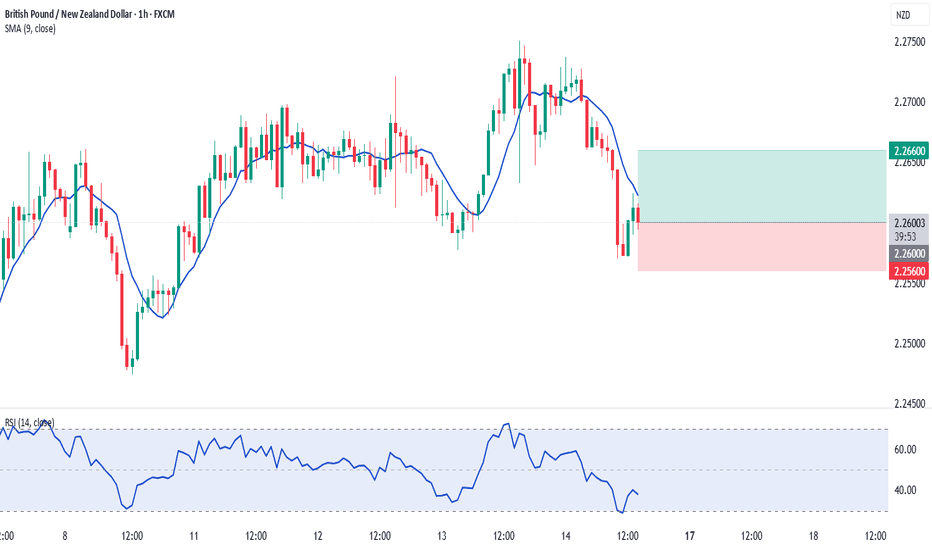

GBP/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 5H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.240 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD

GBPNZDhello trader, the price will likely reach the support area, before it reverse to resistance, the price today break the support and price is still bearish.. multiple bearish fvg up to daily tf, weekly still uptrend.. no sign of bullish reversal as price continue bearish in Asian session.. price may likely retrace to support trendline...

good luck..

GBPNZD: Bulls Will Push Higher

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the GBPNZD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP_NZD NEW LONG SIGNAL|

✅GBP_NZD is going down now

But a strong support level is ahead at 2.2454

Thus I am expecting a pullback

So we can prepare to enter

A long trade with the target 2.2562

And Stop Loss of 2.2406

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-NZD Strong Support Ahead! Buy!

Hello,Traders!

GBP-NZD is making a bearish

Correction after trading in an

Uptrend for some time but a

Strong horizontal support

Level is ahead at 2.2394

So after the retest we will

Be expecting a new

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD The Target Is DOWN! SELL!

My dear followers,

I analysed this chart on GBPNZD and concluded the following:

The market is trading on 2.2700 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 2.2629

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

GBPNZD Bullish Continuation - Will Buyers Push Toward 2.28000?OANDA:GBPNZD is trading within a well-defined ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish impulse suggests that buyers are maintaining control, indicating a potential continuation toward the upper boundary.

The price has recently broken above a key resistance zone and may come back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward 2.28000, which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook remains valid. However, a failure to hold the support zone would invalidate the bullish scenario and open the possibility for a deeper pullback toward the channel’s lower boundary.

Remember, always confirm your setups and trade with solid risk management.

Best of luck!

GBP/NZD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are now examining the GBP/NZD pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 2.240 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPNZD: Weak Market & Bearish Continuation

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPNZD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Weekly Watchlist & Market Outlook (#1)Welcome back, guys! I’m Skeptic , and today, I’m breaking down my weekly watchlist with key market setups. Having a structured plan before the trading week starts helps you stay mentally prepared, avoid impulsive trades, and stick to your strategy. So, let’s dive in!

1. XAUUSD (Gold) 🟡

Daily TF:

Gold has maintained a strong major uptrend and recently completed a price correction to 2842.15 (36% Fib) before resuming its upward movement. This signals a potential continuation of the bullish trend.

Trigger (Daily): Break above 2954.24 🔼

4H TF:

Price is currently in a range between 2896 (support) and 2927 (resistance).

Long trigger:Breakout above 2927

Short trigger: Below 2896 (although trading in the trend’s direction is recommended for better R/R).

2. EURJPY 💶

Daily TF: The pair is ranging between 155.551 (support) and 161.166 (resistance).

4H TF:

Long trigger: Breakout above 161.166 📈 (RSI entering overbought territory could add confluence).

Short trigger: Break below 159.291 targeting the range’s bottom.

3. GBPAU D

Daily TF: The key resistance at 2.02396 has been broken, signaling a new uptrend.

4H TF:

Long trigger: Breakout above 2.05139 🔼 for trend continuation.

Short trigger: If 2.02396 fails as support (fake breakout), look for lower TF confirmation.

4. GBPNZD

Daily TF: Similar to GBPAUD, 2.23992 resistance has been broken, and price has pulled back.

4H TF:

Long trigger: Breakout above 2.26565 📈 for continuation.

Short trigger: If 2.23992 fails (fake breakout scenario).

5. AUDNZD

Daily TF:

A strong uptrend was recently broken, potentially signaling a price correction.

4H TF:

Short trigger: Break below 1.10115 🔻 (sign of further downside).

Long trigger: If price reclaims the broken trendline, indicating a fake breakdown.

Final Thoughts 💡

Thanks for following this week’s watchlist! If you have specific pairs or assets you’d like me to analyze, drop them in the comments.

Growing alone may be fast, but in the long run, teamwork wins. Let’s grow together. ❤️

GBP-NZD Growth Ahead! Buy!

Hello,Traders!

GBP-NZD is making a

Local pullback while

Trading in an uptrend so

After the pair will soon

Hit a horizontal support

Of 2.2380 from where

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Maintains Bearish Momentum - Is 2.23800 the Next Target?OANDA:GBPNZD is trading within a well-defined descending channel, with price action respecting both the upper and lower boundaries. The price has broken below a key support zone and has now pulled back for a potential retest. This level previously acted as support and may now turn into resistance, aligning with a bearish continuation.

If sellers confirm resistance at this zone, the price is likely to move downward toward the 2.23800 target, which aligns with the lower boundary of the channel. However, a breakout above the resistance zone would invalidate the bearish scenario and could open the door for a stronger bullish reversal.

Remember, always confirm your setups and trade with solid risk management. Best of luck!

GBP/NZD Rounded Top (06.03.25)The GBP/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Rounded Top Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.2362

2nd Support – 2.2266

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBPNZD: Bullish Continuation is Expected! Here is Why:

Balance of buyers and sellers on the GBPNZD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

❤️ Please, support our work with like & comment! ❤️

GBPUSD BUY 📊 Technical Analysis & Entry Signal 💹

🔍 The chart shows a strong uptrend where the price has broken a key resistance level and is now pulling back to retest it. As highlighted in the analysis, it's crucial to wait for a complete pullback and confirmation before entering a trade.

📈 Entry Signal:

✅ Entry: After pullback confirmation around 1.27570

🎯 Targets:

First Target: 1.27952

Second Target: 1.28269

Third Target: 1.28645

🛑 Stop Loss: 1.27414 (Risk management is essential)

📝 Important Note: Always manage your risk and avoid entering without confirmation. 📉

GBPNZD Maintains Bullish Momentum - Is 2.27040 the Next Target?OANDA:GBPNZD is trading within a well-defined ascending channel, with price action respecting both the upper and lower boundaries. The recent bounce off the midline suggests buyers are maintaining control, supporting a potential continuation of the uptrend.

As long as the price remains above the support level and the channel's lower boundary holds, the bullish structure remains intact.

A potential upside target is 2.27040, aligning with the upper boundary of the channel. A break and close above this level could signal further bullish momentum.

However, a decisive break below the channel’s lower boundary or the support zone would invalidate the bullish outlook and could signal a shift in market sentiment.

Remember, always confirm your setups and trade with solid risk management.

Best of luck!

GBPNZD – ready to go long again ... the week of 03 Mar Monthly – bullish

Weekly – bullish

Daily – bullish, broke above previous highs already. Price above 200sma.

H4 – After the break out, price is pulling back. We have no idea where the pullback may terminate, but the support located around 2.2370 or preferably, the zone marked between 2.2212 – 2.21520 (or any other point in between) may hold price.

If there is no further pullback, I will not be interested in trading this pair for now. However, if price action develops as I anticipate, I will be looking for signs of a bullish continuation. My stop would be below the recent swing low and I will at first, target 2.2700 with the potential to extend much higher.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

GBP/NZD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/NZD pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 2.210 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

gbpnzd analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

GBPNZD Is Bearish! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 2.217.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 2.209 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!