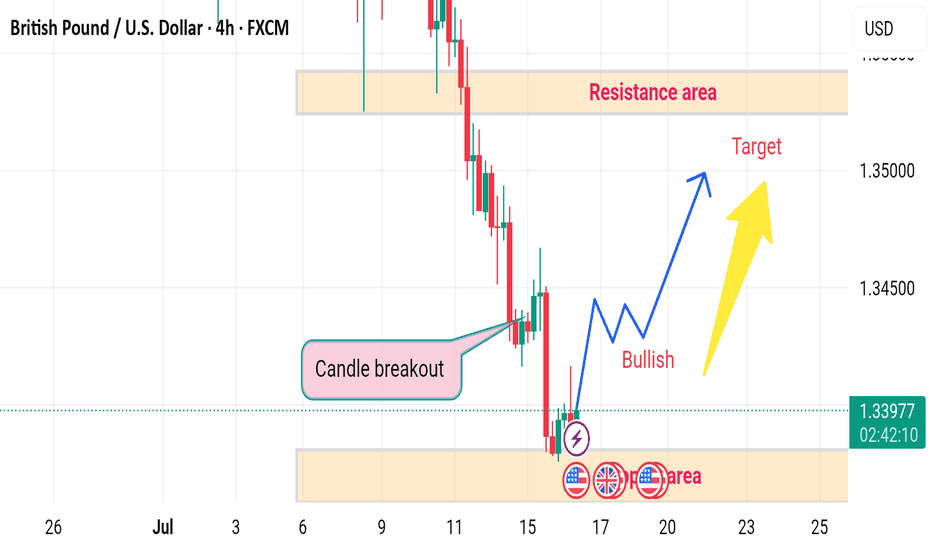

GBPUSD H4 RISESDisruption Analysis – GBP/USD (4H)

🕯️ Candle Breakout Misleading

The marked “Candle Breakout” area is followed by weak bullish momentum, but lacks strong volume confirmation or higher timeframe reversal structure.

The quick rejection after the breakout may indicate a false breakout, not a sustainable trend reversal.

⚠️ Demand Zone Weakness

The “Support Area” (demand zone) has already been tested multiple times.

Multiple touches weaken the demand zone—buyers may be exhausted, increasing the chances of a breakdown instead of a bounce.

📉 Macro Trend Still Bearish

The recent sharp downtrend shows a strong bearish structure (lower highs, lower lows).

A few bullish candles are not enough to confirm a reversal—this could just be a retracement.

💣 Upcoming Fundamental Risks

The presence of multiple economic event icons (UK & US flags) indicates high-impact news—could result in unexpected volatility or trend reversals.

Fundamental factors may disrupt the projected bullish move entirely.

🎯 Bullish Target Overoptimistic

Target near 1.35000 lies within the Resistance Area, which has previously caused sharp rejections.

Without a strong breakout above 1.3400, this target is unrealistic in current market conditions.

Gbpsud

GBPUSD ready to jump?GBPUSD after retest of the daily support has got a bounce back to the upside with a momentum as the price already has got rejected back, we may see potential trend continuation. We can spot the double bottom on the lower timeframe from this support and may continue to rise to the resistance. A bullish trade is high probable after confirmation of potential inverted head and shoulder

GBPUSD: Weekly overviewThe indicated levels are determined based on the most reaction points and the assumption of approximately equal distance between the zones.

These points can also be confirmed by the mathematical intervals of Murray.

After reacting to the following zones, you can enter the trade. Place the stop loss slightly above/below the zone to which the reaction was shown. The profit point is the next zone.

The drawn channels and their medians can also be considered as moving support and resistance. I usually use them as target points.

* I don't trade the white zone (1.32190), the channel borders and median are so close to it and any breaks below it does not necessarily mean a potential continue in the break direction.

My most important zone is the blue one (1.34291). I'm more ready to take short from it. however, the long option is possible if confirmed.

This analysis is valid until the end of the week.

**************************************

Important news that could change the direction of the trade:

Wednesday: Britain CPI

GBPUSD 1H Long Trade - 1:3 RRRSL: 1.26505

TP: 1.28380

In this trading strategy, I present a compelling opportunity for a long position on the GBPUSD currency pair, focusing on the 1-hour timeframe. By incorporating key technical indicators such as the Exponential Moving Average (EMA) 200, Moving Average Convergence Divergence (MACD) for trend analysis, and Supertrend for entry signals, traders can aim to achieve a favorable risk-to-reward ratio of 1:3.

Indicators:

EMA200: The EMA200 serves as a critical indicator of the long-term trend direction.

MACD Trend: The MACD indicator helps traders assess the strength and direction of the trend.

Supertrend: The Supertrend indicator acts as a reliable tool for identifying entry points in alignment with the prevailing trend.

GBP/USD higher with eye on employment reportThe British pound is slightly higher on Monday. GBP/USD is up 0.20%, trading at 1.2549 in the European session at the time of writing.

The UK labor market has held up well despite high interest rates but cracks have appeared and Tuesday’s job report is expected to be soft. Employment change is expected to slide by 215,000 in the three months to March, after declining by 156,000 in the previous release.UK wage growth including bonuses is forecast to fall to 5.3%, down from 5.6% and the unemployment rate is expected to creep up to 4.3%, up from 4.2%.

The Bank of England will be keeping a close eye on Tuesday’s employment report. A decline in employment and wage growth will indicate that the labor market continues to cool down which could complicate the BoE’s plans to lower interest rates.

The UK ended last week on a high note, as GDP grew 0.6% q/q in the first quarter, higher than the 0.4% market estimate. The stronger data still left a question mark about the central bank’s rate path, as the market pricing of a rate cut in June is around 48%. BoE Governor was non-committal about a June hike at his press conference at last week’s policy meeting. Still, Bailey didn’t rule out a June hike and said that he was “optimistic that things are moving in the right direction”.

In the US, the University of Michigan consumer confidence index fell to 67.4 in May, compared to 77.2 in April and shy of the market estimate of 76.2. One-year inflation expectations rose from 3.2% to 3.5%, which indicates that consumers are less confident about inflation receding.

GBP/USD tested support at 1.2522 earlier. Below, there is support at 1.2449

1.2597 and 1.2680 are the next resistance lines

GBPUSD 4H (Pivot Price: 1.2697)GBPUSD

stabilizing above 1.2697 will support rising to touch 1.2752 then 1.2783 then 1.2822

stabilizing under 1.2697 will support falling to touch 1.2629 then 1.2586

Pivot Price: 1.2697

Resistance prices: 1.2752 & 1.2783 & 1.2822

Support prices: 1.2629 & 1.2586 & 1.2553

time frame: 4H

USDCHF I Brief short and break of neckline Welcome back! Let me know your thoughts in the comments!

** USDCHF Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

GBPUSD at BreakoutBased on 04 hours TF, after break of previous high level, GBPSUD make new high of 1.28484$.

From new highs level, we see a good profit booking from 1.28500 level nd make a new Resistance Line from Lower swing high.

Now we see a good bounce from 1.260 level, which act a strong support.

And now we see that GBPUSD Try to break It's resistance line, If it sustain above Resistance line than we can see GBPUSD to previous high level and also probability of new high level.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

opportunity to capitalize on a bullish move in the GBPUSD Are you looking for an opportunity to capitalize on a bullish move in the GBPUSD currency pair?

Our GBPUSD Wait For Demand Zone Tapped For Bullish Move product can help you do just that. With this product, you can wait for the approach of a demand zone, then look for a bullish move. We always use confirmation in a small time frame for maximum accuracy.

FEATURES:📈 Bullish Move: This product can help you identify and capitalize on a bullish move in the GBPUSD currency pair.

⏳ Wait For Demand Zone: You can wait for the approach of a demand zone before looking for a bullish move.

🔍 Small Time Frame Confirmation: We always use confirmation in the small time frame for maximum accuracy.

SPECIFICATIONS:- Currency Pair: GBPUSD

- Trading Type: Bullish Move

- Time Frame: Small

HOW IT WORKS:1. Identify the demand zone in the GBPUSD currency pair.

2. Wait for the zone to be approached.

3. Look for a bullish move.

4. Use confirmation in a small time frame for maximum accuracy.

FAQ:Q: What currency pair does this product apply to?

A: This product applies to the GBPUSD currency pair.

Q: What type of trading does this product use?

A: This product uses bullish move trading.

Q: What time frame should I use for confirmation?

A: We recommend using the small time frame for confirmation.

A traders' week ahead - the hunt to win over the markets UK politics commands the international spotlight from time to time and that time is now. Yet, while we fraternise over Fed policy and how high the Fed could take the fed funds rate into 2023, UK politics and the impact on the UK gilt (bond) market and the GBP is firmly front and centre – the connection between British politics and the capital markets will almost certainly result in increased volatility for the GBP this week.

The last few weeks have been one which has not only captivated the world’s financial markets but could be a case study for those bright academics studying at Oxbridge, keen for a future position in the cabinet, on just how mighty the markets can be – and of course, how not to implement new fiscal policies.

Truss’s time as PM seems to be slipping by the day, and the weekend press is alive with speculation of a revolt that could soon see 1922 Committee head Graham Brady giving Truss the nod to step down. Naturally, Rishi Sunak is feeling his time to lead is fast approaching and his view that Truss’s tax policies would cause wild gyrations in financial markets have been vindicated and greatly enhanced his brand. Further speculation that Defence minister Ben Wallace may be in the running as a future PM and is also doing the rounds.

Truss is moving away from the agenda to spend and talk of “austerity” is becoming ever louder. After last week’s call from the Institute of Fiscal Studies that the UK is in the hole for around £60b if the tax cuts go ahead without massive adjustments to spending is one that has been fully acknowledged and the sums are there for all to see - Truss’s credibility is shot to pieces, and uncertainty is the short-term dynamic that will further rattle UK financial markets.

While a change of guard is heavily debated, it won’t happen overnight. The question in the near term is whether Jeremy Hunt can win over the capital markets. While Hunt is well respected within party ranks, the consensus position is that Hunt is facing a true uphill battle and even if the remaining tax cuts are rolled off then the Truss govt will also have to cut spending and that will win her even fewer friends, at a time when her approval rating is at rock bottom.

The Sunday papers are already detailing that we’re to hear of further U-turns and a repel of Truss’ ‘mini budget’, with a formal announcement that the planned reduction to the basic rate of income tax will be pushed out by 12 months – more measures should be announced through the week.

In a world where we analyse the distribution of outcomes in markets, unless we get a true risk on vibe through markets, lifting equities higher, then it’s hard to see how the GBP rallies this week – the path of least resistance for the GBP is, therefore, lower, with EURGBP longs likely getting a strong showing as traders look to take the USD out of the equation.

Hunt seems to have found a friend in BoE gov Andrew Bailey, but the markets may take their pound of flesh and go after something more substantial – they want to feel real credibility. They want a firm government that truly understands the balance between fiscal policy, monetary policy, and government issuance – A Truss/Hunt combo doesn’t quite cut the mustard.

With the BoE’s temporary bond-buying program out of action – for now – we watch the UK gilt market reaction, and one suspects that UK 30-year gilts push towards 5% and above. FX traders will get their say before the UK bond market opens and could set a bearish tone – given that GBPUSD closed just off session lows, the heavy tape suggests 1.1000 is more likely than 1.1300, but an open mind is always advantageous when dealing with flows around the interpretation of politics and markets.

It’s another big week for markets – the UK bond market will be front and centre – judging the link between politics and markets is always a struggle but where do you see the balance of risk?

Aside from the above market consideration, traders will need to navigate:

• UK CPI (Wed)- the market expects no change at 9.9% - above 10% and it could get lively in the GBP

• EU CPI (Wed) – a big jump expected to 10% - we also get a raft of ECB speakers too and ahead of the ECB meeting (27 Oct) we can see the market pricing a punchy 75bp hike at this meeting

• NZ CPI (18 Oct - 08:45 AEDT) – the market expects CPI to fall to 6.5% from 7.3% - could this set a trend of firmly lower inflation reads in G10 FX countries?

• China Q3 GDP and industrial production (18 Oct at 1pm) – the market expects Q3 GDP to come in at 3.5% - a solid rise from the Q2 pace of 0.4%.

• Aussie employment (Thurs at 11:30 AEDT) – 25k jobs are expected to have been with the unemployment rate unchanged at 3.5% - Hard to see a number that changes the markets view of a 25bp hike in the November RBA meeting.

• No tier 1 US data – we do get 9 different Fed speakers and their views could move markets – the data suggests they should all be hawkish.

• US earnings – 15% of the S&P500 report – including Netflix, IBM, and Tesla

Will GDP shake up GBP/USD?GBP/USD is trading quietly for a second straight day. In the North European session, GBP/USD is trading at 1.1035, down 0.18%.

The pound has not posted a winning day since October 12th and has lost 400 points during that time. GBP/USD dropped below the symbolic 1.10 line earlier today, and a break below 1.10 will likely increase talk of the pound following the euro and dropping to parity with the dollar.

The UK labour market is one of the few bright spots in the economy, and today's employment report reaffirmed that the job market remains tight. Unemployment in the three months to August dipped to 3.5%, down from 3.6%, while average earnings jumped to 6.0%, up from 5.5% and ahead of the consensus of 5.9%. These rosy numbers are dampened by an inflation rate of 9.9%, which has badly hurt real UK incomes.

The strong job market bolsters the likelihood of the Bank of England will deliver some tough medicine at its November meeting, perhaps a super-size rate hike of 1.0%. The BoE was forced to intervene on an emergency basis after the mini-budget almost caused a bond market crash, and investors have circled October 14th, which is the expiry date of the BoE's gilt-buying intervention. There are concerns that if the BoE does not renew its bond-buying, the result could be another exodus from UK government bonds. On Wednesday, the UK releases GDP for August, which is expected at 0% MoM, down from 0.2% in July.

In the US, inflation will be in focus this week, with PPI data on Wednesday and CPI a day later. Headline inflation is expected to fall to 8.1% in September, down from 8.3% in August, but core CPI is expected to rise to 6.5%, up from 6.3%. Unless inflation surprises sharply to the downside, the release will not cause the Fed to rethink its hawkish policy.

GBP/USD faces resistance at 1.1085 and 1.1214

There is resistance at 1.0935 and 1.0776

GBPUSD | LIMITED DOWNSIDEGBPUSD has approached to its June 2020 support with multiple bullish signs indicating limited downside.

We have bullish divergence on key support.

We have oversold RSI level on key support.

Price Action supports bulls with hammer formation on key support.

Let us know what do you think of this pair.

Pound pushes above 1.38, GDP nextThe British pound has punched above the 1.38 level in the Thursday session. GBP/USD is currently trading at 1.3858, up 0.63% on the day.

After posting three straight days of losses, the British pound has rebounded strongly on Thursday. The US dollar is in retreat against the majors, despite a positive unemployment claims release earlier in the day. Claims fell to 310 thousand, down from 345 thousand a week earlier.

We'll get another look at US inflation data on Friday, with the release of PPI for August expected to indicate that inflation remains red-hot. The consensus stands at 6.5% (YoY) compared to 6.2% in July. The Federal Reserve continues to insist that the surge in inflation is transitory and has been reluctant to respond with a tightening of policy, fearing that the time is not ripe for a scaling back of QE. Still, more investors are sure to join the skeptics if inflation continues to remain at high levels in the final months of 2021.

In the UK, the markets will be treated to a data dump on Friday. The key events are GDP and Manufacturing Production. With the Delta variant of Covid continuing to hurt economic growth, July GDP is expected somewhere around zero, which could mean a small decline. Manufacturing Production is also expected to be sluggish with a forecast of 0.1% (MoM). We could see some strong movement from the pound, depending on the performance of these two releases.

There is resistance at 1.3924. Above, there is resistance at 1.3988, just below the symbolic line of 1.40.

On the downside, we have support at 1.3763 and 1.3666

GBPUSD approaching significant monthly support!!Hello Traders, GBPUSD is approaching a very significant level of support on the monthly weekly and daily timeframe. it is highly likely that if today's candle touches this level, it will have a big bounce and may provide a very good trading opportunity.

LONG POSITIONGBP/USD bears stepping in at the psychological 1.4000 area.

Bears look for a test of the prior resistance and a 38.2% Fibo confluence level in 1.3880.

There are now expectations of a significant correction to test the prior resistance which has a semi-confluence with a 38.2% Fibonacci retracement level near to 1.3880

If you find this helpful and want more FREE Updates on TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated! ❤️

💎 Want us to help you become a better Forex trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

Trade well, ❤️

1_GFX English Support Team ❤️

GBPUSD top-down analysisHi Guys, this is the full breakdown of this pair. We will take this trade if all the conditions are satisfied as discussed in the analysis video. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover my next analysis.

Also let me know your thought in the comment section what you think about this pair.

Red-hot pound punches past 1.41, GDP nextThe pound is in positive territory on Tuesday. In the European session, GBP/USD is trading at 1.4144, up 0.20%.

The Scottish National Party (SNP) handily won the Scottish election, but investors sighed with relief as the pro-independence party came up just short of a majority. This means that plans for another referendum on Scottish independence may be delayed, which should ensure political stability for the time being. The pound responded with huge gains of close to 1.0% on Monday.

The British government has given the green light for a further easing of health restrictions, as of May 17. The positive news on the Covid front has also been bullish for the streaking pound.

Attention has shifted to UK GDP for the first quarter, which will be released on Wednesday (6:00 GMT). The market is bracing for a contraction in GDP. This would reflect the lockdown that was in effect for much of the first quarter and had a chilling effect on economic activity. The consensus stands at -1.6% (MoM) and -6.1% (YoY).

Inflation concerns have been dominating the financial markets, sending equities lower and boosting the safe-haven US dollar. The US and China, the world's two biggest economies and both showing signs of rising inflationary pressures, which is causing jitters for investors.

In China, PPI climbed 6.8% (YoY), above the 6.5% forecast and up sharply from 4.4% in March. The US releases April inflation numbers on Wednesday. The consensus stands at 2.3% for Core CPI (YoY), compared to 1.6% in March. If Core CPI matches or exceeds the estimate, investors may be of the opinion that the Fed may have to tighten policy sooner rather than later, which would be bullish for the US dollar.

GBP/USD is testing resistance at 1.4137, followed by resistance at 1.4269. There are support lines at 1.3859 and 1.3727