GBPUSD

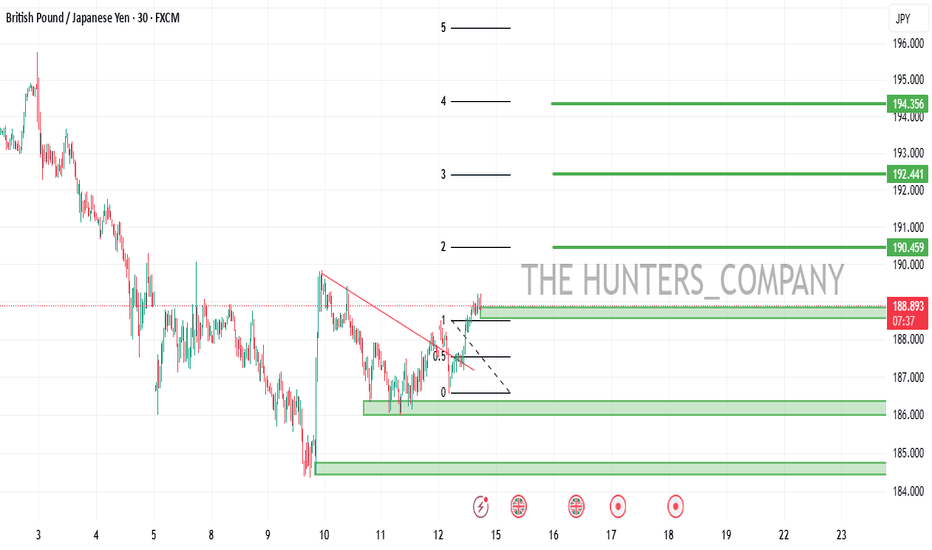

GBPJPY:SIGNALHello dears

Considering the heavy decline we had, you can see that buyers entered with a strong bullish spike, which is a good sign...

Now we can buy in steps on the price pullback and move with it to the specified targets, of course with capital and risk management.

*Trade safely with us*

GBPUSD Analysis Update 4/14 10:18am, pending confirmationI've been closely analyzing GBP/USD this week, and here's my updated view based on all the technical indicators and fundamental data.

Price Action & Key Levels

Right now, GBP/USD is trading at 1.31537, after rejecting 1.320 resistance earlier in the session. The market made a strong attempt to break above 1.320, but sellers stepped in, causing a pullback. Given this rejection, I'm watching 1.317 closely—if price fails to reclaim that level, a bearish continuation toward 1.312–1.310 becomes increasingly likely.

Technical Indicators & Market Signals

Momentum & Trend Strength

RSI: Short-term signals suggest price is consolidating (RSI at 48.78), while the daily RSI (76.08) indicates overbought conditions, meaning a larger pullback may be ahead.

Aroon Oscillator: Weakening bullish strength, suggesting trend exhaustion.

ADX: At 10.1 (1-hour), showing weak trend momentum, meaning price might stay range-bound or reverse lower.

MACD: Mixed signals—some divergence appears, showing signs of a potential downward move.

Fibonacci Retracement Levels (From 1.320 High)

23.6% retracement: 1.3172 → Minor resistance zone.

38.2% retracement: 1.3158 → Current price zone.

50% retracement: 1.3143 → Potential short-term support.

61.8% retracement: 1.3129 → Stronger support level.

78.6% retracement: 1.3110 → Critical breakdown point.

If GBP/USD fails to reclaim 1.317, I anticipate further downside toward 1.312–1.311, where stronger support exists.

Bollinger Bands Confirmation

Upper Band (~1.320): Acted as resistance—price rejected this zone, confirming sellers stepped in.

Middle Band (~1.315–1.316): Price hovering here—neutral consolidation phase.

Lower Band (~1.312–1.313): If price breaks below 1.314, downward momentum is likely toward this level.

Fundamental Factors Supporting Bearish Bias

GBP Weakness: Expected softer BRC Retail Sales, Employment Change, and Inflation Rate data, which could weigh on GBP/USD.

USD Strength: Strong Retail Sales figures and upcoming Fed Chair Powell’s speech might bolster the Dollar, adding further downside pressure to GBP/USD.

Trade Setup & Execution Strategy

Bearish Case:

If GBP/USD fails at 1.317, I’ll look to enter short below 1.3155, targeting 1.312 or lower.

Bullish Case:

If GBP/USD reclaims 1.317, buyers could push price back toward 1.320 resistance.

Conclusion

At the moment, GBP/USD is at a decision point—while short-term indicators suggest some consolidation, rejection at 1.320 confirms bearish pressure. If sellers hold control, I expect price to move toward 1.312–1.311 in the coming sessions, making a short setup favorable. However, if price reclaims 1.317, buyers may attempt another test of 1.320 resistance.

XAU/USD: A Huge Fall Ahead? (READ THE CAPTION)By re-examining the gold chart on the 30-minute timeframe, we can see that the price once again moved exactly as expected and finally managed to rise back above $3100, reaching as high as $3136.5! Currently, gold is trading around $3120, and I expect we will soon see further decline in gold. The potential downside targets are $3115, $3105, and $3100 respectively. This analysis will be updated again!

The Last Analysis :

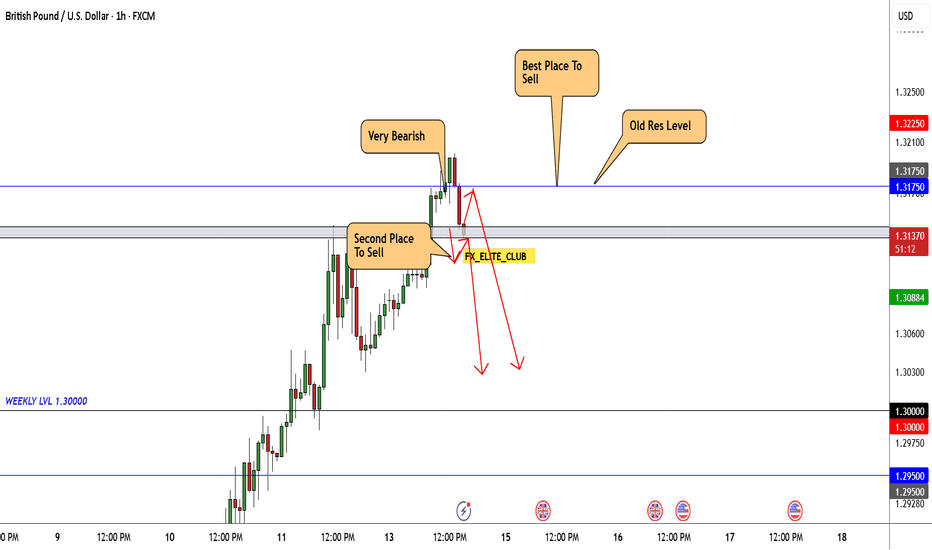

GBP/USD At Interesting Area To Sell , Should We Sell Now ?Here is my Opinion About GBP/USD , I Have an old res and the price respect it 100% and gave us a very good bearish P.A , So i think we have 2 places to sell it , first one if the price back to retest my res level 1.31750 and if the price give us a good bearish price action we can enter and targeting 200 pips . if the price didn`t back to retest the res level we can wait he price to close below support with 4h candle and then we can enter a sell trade with the same target .

DeGRAM | GBPUSD retest of resistanceGBPUSD is in an ascending channel between the trend lines.

The price has approached the resistance level, which has already acted as a pullback point.

The chart formed an ascending wedge and kept the harmonic pattern relevant.

On the 4H Timeframe, the indicators indicate a bearish divergence.

We expect a pullback in case of consolidation under the resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD INTRADAY Bullish breakout supported at 1.3014GBP/USD maintains a bullish bias, with the broader trend and structure supporting upside continuation. The recent intraday move appears to be a bullish breakout toward a key prior consolidation area.

Key Support: 1.3014 – aligns with the previous consolidation zone and potential bullish inflection point.

Upside Targets:

1.3255 – initial resistance level

1.3328 and 1.3418 – medium to long-term bullish targets

If price finds support at 1.3014 and forms a bullish reversal, it would confirm the continuation of the uptrend toward the mentioned resistance levels.

However, a break and daily close below 1.3014 would invalidate the bullish scenario, suggesting deeper retracement toward 1.2980, with further support at 1.2900 and 1.2815.

Conclusion

GBP/USD remains bullish above 1.3014. Look for a bounce from this level to confirm upside continuation. A daily close below 1.3014 would turn the outlook bearish, exposing lower support levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD - its breakout? what's next??#GBPUSD.. as you know guys our area was 1.3035 and in first go market boke that area but then drop towards bottom due to tariff implantation.

now market again break our area in today so if that is clear breakout then we can expect a further bounce towards 3400 and 1.3500

good luck

trade wisely

GBPUSD today should buy or sell?GBP/USD continues to build on its bullish momentum, reclaiming the 1.3100 level on Monday morning. The ongoing weakness of the U.S. dollar suggests that the path of least resistance for this pair remains to the upside.

The key monthly employment report is set to be released on Tuesday, followed by the latest consumer inflation data on Wednesday. In addition, investors this week will also face the release of U.S. monthly Retail Sales figures and pay close attention to a speech by Federal Reserve Chairman Jerome Powell — a speech that could play a crucial role in shaping the USD’s price dynamics. These events are expected to provide meaningful catalysts for the GBP/USD pair in the latter part of the week.

GBP/USD 4H Chart Analysis – Bullish Reversal from Demand ZoneGBP/USD 4H Chart Analysis

Current Price: 1.27883

Timeframe: 4H (OANDA)

Key Zones:

🟦 Demand Zone (Support Area):

📍 Between 1.26873 (🔻 Stop Loss) and current price

This is where buyers are expected to step in and push the price higher.

🚀 Expected Move: The price is consolidating in the demand zone and might breakout upward.

➡️ Possible path:

1. Small pullback within demand zone

2. 📈 Breakout up to 1.29162 (🔵 First Resistance)

3. 📈 Continuation up to 1.31083 (🎯 Target Point)

Important Levels:

🔻 Stop Loss: 1.26873

(If price drops below this, setup is invalid)

🛑 Mid-Resistance Level: 1.29162

(Might face temporary selling pressure here)

🎯 Target Point: 1.31083

(Take-profit zone)

Conclusion:

📉 If price breaks below 1.26873 → trade invalid ❌

📈 If price holds and breaks above resistance → bullish potential ✅

Risk/Reward setup looks favorable from demand zone to target

Fundamental Market Analysis for April 14, 2025 GBPUSDThe initial market reaction to US President Donald Trump's decision last week to suspend sweeping reciprocal tariffs for 90 days was short-lived amid heightened fears of a US recession amid an escalating trade war between the US and China. China's 84 per cent tariffs on US goods went into effect on Thursday, and Trump raised duties on Chinese imports to an unprecedented 145 per cent. Given that the US still imports a number of hard-to-replace materials from China, these developments have weakened confidence in the US economy.

Meanwhile, data released last week showed that the US consumer price index (CPI) declined 0.1% in March, while core CPI rose +2.8% year-on-year, below consensus forecasts. In fact, markets are now pricing in the likelihood of a 90 basis point rate cut before the end of this year. Conversely, investors believe the likelihood of a Bank of England (BoE) interest rate cut next month is slightly less likely.

The aforementioned favourable fundamental backdrop supports a positive outlook for spot prices in the near term, although bulls seem reluctant to make aggressive bets and prefer to wait for important UK macro releases. Tuesday will see the release of the all-important monthly employment report, followed by the latest consumer inflation data on Wednesday. In addition, this week investors will be keeping an eye on the release of monthly US retail sales data and Fed Chairman Jerome Powell's speech, which will play a key role in influencing dollar price action. This, in turn, should give a significant impetus to the GBP/USD pair in the second half of the week.

Trading recommendation: BUY 1.3130, SL 1.3010, TP 1.3310

GBPUSD H4 | Rising toward the key resistanceBased on the H4 chart analysis, the price is falling toward our buy entry level at 1.3013, a pullback support.

Our take profit is set at 1.3260, a pullback resistance.

The stop loss is placed at 1.2864, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPUSD Are the Bears back? I've been analyzing GBP/USD closely, and here's my outlook for this week. The pair is currently trading at 1.31123, testing a significant resistance zone that has been crucial in recent sessions. Technically, short-term indicators show overbought conditions—the RSI on the 1-minute chart is at 87, and Stochastic RSI is at extreme levels, both signaling a high probability of a rejection from resistance rather than a continued breakout.

Digging deeper into trend and momentum indicators, I see that ultra-short-term readings (such as the Aroon Oscillator on the 1- and 5-minute charts) are bullish, but longer-term indicators suggest waning momentum. Linear regression slopes and moving averages like KAMA and EMA indicate slowing upward momentum. Meanwhile, the Average True Range (ATR) is low, signaling consolidation rather than strong trend continuation. Considering these factors, I expect a retracement soon and am watching 1.308–1.307 as potential entry points.

Fundamentally, things aren’t looking great for the Pound. GBP economic releases this week—including BRC Retail Sales, Employment Change, and Inflation figures—are expected to show weakness. Softer retail sales and job growth numbers could weigh on GBP further. Meanwhile, the USD is strengthening, with upbeat Retail Sales data and an important speech from Fed Chair Powell likely reinforcing the Dollar's momentum.

Based on my analysis, I anticipate GBP/USD will move lower this week and am leaning toward a bearish trade. My plan is to wait for a rejection from resistance before entering a short position, ideally around 1.308 or lower.

Please note things do change so let's see what this week brings :) !

GBPUSD(20250414)Today's AnalysisMarket news:

Fed Collins: It is currently expected that the Fed will need to keep interest rates unchanged for a longer period of time. If necessary, the Fed is "absolutely" ready to help stabilize the market; Kashkari: No serious chaos has been seen yet, and the Fed should intervene cautiously only in truly urgent situations; Musallem: The Fed should be wary of continued inflation driven by tariffs.

Technical analysis:

Today's buying and selling boundaries:

1.3064

Support and resistance levels:

1.3245

1.3177

1.3133

1.2995

1.2951

1.2883

Trading strategy:

If the price breaks through 1.3133, consider buying, the first target price is 1.3177

If the price breaks through 1.3064, consider selling, the first target price is 1.2995

“EUR/USD Nears Wave (C) Climax – Will Smart Money Step In?”EUR/USD is approaching the final leg of its corrective A-B-C structure. With wave (C) targeting the 1.15–1.18 supply zone, a major reversal setup is brewing.

Wave (A)-(B)-(C) correction structure in play

Current bullish momentum likely completing wave (C)

Watch for potential 50% and 78% Fibonacci retracement zones for next sell setups

Embedded Wyckoff distribution schematic suggests institutional unloading soon

If you're tracking smart money, the final wave up could be the perfect setup to sell the rally once signs of distribution confirm.

Key Levels to Watch:

Supply Zone: 1.15–1.18 (Wave C Top)

First Demand: 50% zone

Deeper Demand: 78% retracement = high confluence

#EURUSD #ElliottWave #WyckoffMethod #SmartMoney #ForexForecast #WaveC

--

“GBP/USD Bulls Eyeing the Final Wave V – Will Cable Hit the Targ”

The GBP/USD weekly chart is unfolding beautifully under Elliott Wave theory. After completing wave (iv), price is charging upward in wave (v) toward the final resistance zone around 1.38–1.42.

This impulsive structure is playing out textbook-style:

Wave 1–2–3–4–5 mapped clearly

Recent breakout confirms bullish strength

Wave (v) target aligned with historical supply zone

If you're riding the wave, keep eyes on short-term pullbacks for re-entry before the final leg completes!

Next Key Levels:

Pullback demand near 1.2750–1.2850

Major resistance in the 1.38–1.42 zone

Wave V completion zone = high probability reversal area

#GBPUSD #ElliottWave #ForexForecast #WaveAnalysis #FXTrading #CableAnaly

GBPUSD: Likely to maintain its upward momentum next weekTrump announced a 90-day suspension of the new tariff plan for most of his trading partners, which has, to some extent, reduced the systemic risks in the market and warmed up the risk appetite. The British pound, due to its nature as a risk currency, has become a beneficiary in the improvement of the global sentiment. At the same time, global stock markets plunged this week due to the uncertainty of trade policies, but the GBPUSD rose against the trend, indicating that the market has a strong bullish sentiment towards the British pound. This sentiment is likely to continue next week.

GBPUSD broke through some key resistance levels this week, such as the 1.3000 mark, opening up room for further upward movement. In the short term, although the RSI has reached a highly overbought level, if the bullish sentiment in the market is strong enough, the GBPUSD still has the potential to continue rising, breaking through the recent high of 1.3145. The next resistance levels might be at 1.3200 and even higher.

GBPUSD trading strategy

buy @:1.30400-1.30480

sl 1.29950

tp 1.30750-1.30810

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GBPUSD What Next? SELL!

My dear followers,

I analysed this chart on GBPUSD and concluded the following:

The market is trading on 1.3089 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.2979

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPUSD BIG DROP ?Market Structure Overview

Previous Trend: Strong bullish move after a long bearish trend.

Current Behavior: Price has entered a higher-timeframe supply zone (highlighted in green) and is showing signs of rejection.

Supply Zones:

Major Supply: 1.31750 – 1.32000

Minor Supply: 1.31000 – 1.31300

Demand Zones:

First Demand Zone: ~1.30380

Second Demand Zone: ~1.29919

📉 Trade Setup & Plan

🅰️ Primary Bias: Bearish Rejection from Supply

🔹 Scenario 1: Ideal Short Setup

Entry: Around current price (~1.30824) or after a retest of the 1.31000–1.31300 zone.

TP1: 1.30380 (first demand zone)

TP2: 1.29919 (second demand zone)

TP3 (extension): Below 1.29000 if momentum continues

SL: Above 1.31300 (to avoid fakeouts in supply)

🧩 Reasoning:

Price failed to break above supply with strong rejection wicks.

Break of structure + liquidity taken above local highs = possible start of bearish leg.

🔹 Scenario 2: Pullback Before Continuation Lower

Wait for Break of 1.30380, then look for pullback entries (break & retest).

Entry: On bearish confirmation after price retests 1.30380 zone from below.

TP: 1.29919, and if broken, continue to trail toward 1.2900s

✅ Extra Notes

Watch for rejection patterns (e.g., pin bars, engulfing candles) on the 15M or 30M to confirm entries.

Avoid entries during high-impact news, especially UK or US CPI, interest rate decisions, or NFP.

Manage risk wisely: Max 1-2% per trade.