GBPUSD(20250416)Today's AnalysisToday's buying and selling boundaries:

1.3214

Support and resistance levels:

1.3301

1.3268

1.3247

1.3180

1.3159

1.3127

Trading strategy:

If the price breaks through 1.3247, consider buying, the first target price is 1.3268

If the price breaks through 1.3214, consider selling, the first target price is 1.3180

Gbpusdanalysis

Market Analysis: GBP/USD Rockets HigherMarket Analysis: GBP/USD Rockets Higher

GBP/USD is gaining pace above the 1.3220 resistance.

Important Takeaways for GBP/USD Analysis Today

- The British Pound is attempting a fresh increase above 1.3220.

- There is a key bullish trend line forming with support near 1.3245 on the hourly chart of GBP/USD at FXOpen.

GBP/USD Technical Analysis

On the hourly chart of GBP/USD at FXOpen, the pair remained well-bid above the 1.2850 level. The British Pound started a decent increase above the 1.3000 zone against the US Dollar.

The bulls were able to push the pair above the 50-hour simple moving average and 1.3150. The pair even climbed above 1.3200 and traded as high as 1.3263. It is now consolidating gains and trading well above the 23.6% Fib retracement level of the upward move from the 1.3030 swing low to the 1.3263 high.

On the upside, the GBP/USD chart indicates that the pair is facing resistance near 1.3260. The next major resistance is near 1.3320. A close above the 1.3320 resistance zone could open the doors for a move toward 1.3450.

Any more gains might send GBP/USD toward 1.3500. On the downside, there is a key support forming near a bullish trend line at 1.3245.

If there is a downside break below 1.3245, the pair could accelerate lower. The next major support is at 1.3145. It is close to the 50% Fib retracement level of the upward move from the 1.3030 swing low to the 1.3263 high.

The next key support is seen near 1.3030, below which the pair could test 1.2860. Any more losses could lead the pair toward the 1.2745 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Inflation in the UK Has FallenInflation in the UK Has Fallen

According to Forex Factory, the Consumer Price Index (CPI) reading came in below expectations: while analysts had forecast a decline to 2.7% year-on-year from the previous 2.8%, the actual CPI figure was 2.6%.

Following the release of this news, the GBP/USD exchange rate rose to 1.3280 – the highest level in seven months.

On the one hand, falling inflation is a sign of a healthy economy and a relief for the Bank of England, especially considering that CPI stood in double digits just two years ago. As a result, analysts may now predict that interest rates could be cut at the meeting scheduled for 8 May.

On the other hand, demand for the dollar remains volatile due to Trump’s tariff policies, fears of a US recession, and a wave of bond sell-offs.

Technical Analysis of the GBP/USD Chart

In just one week, the pound-to-dollar rate has risen by approximately 4.2%, with the RSI indicator now hovering near extreme overbought levels. Furthermore, the price is approaching the upper boundary of the ascending channel, which has been in play since the beginning of 2025.

In such conditions, a correction (with a bearish breakout of the ascending trendline, shown in blue) appears a logical development. However, a key factor in sustaining the current trend of dollar weakness could be the speech by Federal Reserve Chair Jerome Powell, scheduled for today at 20:30 GMT+3.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBP/USD Breaks $1.3202: Bullish Market InsightsFenzoFx—The GBP/USD currency pair shows strong bullish momentum, breaking above $1.3202 yesterday. With overbought signals from the Stochastic indicator, a consolidation phase may lead to declines toward $1.3144 and $1.3030.

Traders should watch for bullish candlestick patterns near these support levels.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

GBPUSD SHORT FORECAST Q2 W16 D16 Y25GBPUSD SHORT FORECAST Q2 W16 D16 Y25

Thoughts- It's not if, it's WHEN !

All longs are null until the weekly order block has been breached or price drops considerably. In the here and now the short seems to be closing in.

It is as always important to stack confluences in favour of the short prior risking capital.

15' break of structure is an absolute requirement as this point of price action.

Within the higher time frame order block- looking for a lower time frame order block is not enough to short from therefore scrolling back months to find is pointless in our opinion.

We will let price show us, we will reaction with price.

What are your thoughts...

Are we dropping today?

FRGNT X

“GBP/USD Long Setup: Demand Zone Bounce Toward 1.35000 Target ”🔍 Trade Setup

🟦 Entry Point: 1.32171

➤ Price is near the 7 EMA – good for a possible bounce.

🟩 Demand Zone: 1.31761 - 1.31500

➤ This is where buyers previously stepped in.

➤ Strong support area – watch for bullish reversal candles here.

🔻 Stop Loss: 1.31141

➤ Below the demand zone to protect against a fakeout.

🎯 Target Point: 1.35000

➤ Big upside target – aiming for a strong rally.

⚖️ Risk to Reward

❌ Risk: 1.32171 → 1.31141 = ~103 pips

✅ Reward: 1.32171 → 1.35000 = ~283 pips

⚖️ R:R Ratio: ≈ 1:2.75 – very favorable!

✅ Summary

🔸 Trend is bullish with strong momentum

🔸 EMA is acting as dynamic support

🔸 Demand zone is clearly respected

🔸 Great R:R setup for a long trade

GBPUSD: Continue to riseFor GBP/USD, we still mainly choose to go long during the pullback and go short as a supplement.

GBPUSD trading strategy

buy @:1.31900-1.32100

sl 1.31000

tp 1.32750-1.32850

Today, the trend of GBPUSD basically coincides with what I predicted yesterday. You can click on my personal profile to view the previously published content.

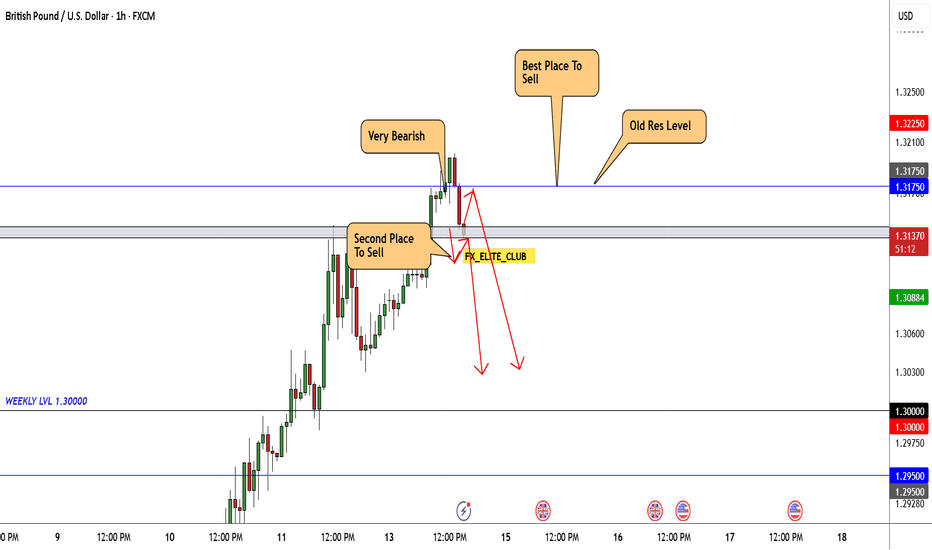

GBP/USD At Interesting Area To Sell , Should We Sell Now ?Here is my Opinion About GBP/USD , I Have an old res and the price respect it 100% and gave us a very good bearish P.A , So i think we have 2 places to sell it , first one if the price back to retest my res level 1.31750 and if the price give us a good bearish price action we can enter and targeting 200 pips . if the price didn`t back to retest the res level we can wait he price to close below support with 4h candle and then we can enter a sell trade with the same target .

DeGRAM | GBPUSD retest of resistanceGBPUSD is in an ascending channel between the trend lines.

The price has approached the resistance level, which has already acted as a pullback point.

The chart formed an ascending wedge and kept the harmonic pattern relevant.

On the 4H Timeframe, the indicators indicate a bearish divergence.

We expect a pullback in case of consolidation under the resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

GBPUSD and EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD - its breakout? what's next??#GBPUSD.. as you know guys our area was 1.3035 and in first go market boke that area but then drop towards bottom due to tariff implantation.

now market again break our area in today so if that is clear breakout then we can expect a further bounce towards 3400 and 1.3500

good luck

trade wisely

GBP/USD 4H Chart Analysis – Bullish Reversal from Demand ZoneGBP/USD 4H Chart Analysis

Current Price: 1.27883

Timeframe: 4H (OANDA)

Key Zones:

🟦 Demand Zone (Support Area):

📍 Between 1.26873 (🔻 Stop Loss) and current price

This is where buyers are expected to step in and push the price higher.

🚀 Expected Move: The price is consolidating in the demand zone and might breakout upward.

➡️ Possible path:

1. Small pullback within demand zone

2. 📈 Breakout up to 1.29162 (🔵 First Resistance)

3. 📈 Continuation up to 1.31083 (🎯 Target Point)

Important Levels:

🔻 Stop Loss: 1.26873

(If price drops below this, setup is invalid)

🛑 Mid-Resistance Level: 1.29162

(Might face temporary selling pressure here)

🎯 Target Point: 1.31083

(Take-profit zone)

Conclusion:

📉 If price breaks below 1.26873 → trade invalid ❌

📈 If price holds and breaks above resistance → bullish potential ✅

Risk/Reward setup looks favorable from demand zone to target

GBPUSD Are the Bears back? I've been analyzing GBP/USD closely, and here's my outlook for this week. The pair is currently trading at 1.31123, testing a significant resistance zone that has been crucial in recent sessions. Technically, short-term indicators show overbought conditions—the RSI on the 1-minute chart is at 87, and Stochastic RSI is at extreme levels, both signaling a high probability of a rejection from resistance rather than a continued breakout.

Digging deeper into trend and momentum indicators, I see that ultra-short-term readings (such as the Aroon Oscillator on the 1- and 5-minute charts) are bullish, but longer-term indicators suggest waning momentum. Linear regression slopes and moving averages like KAMA and EMA indicate slowing upward momentum. Meanwhile, the Average True Range (ATR) is low, signaling consolidation rather than strong trend continuation. Considering these factors, I expect a retracement soon and am watching 1.308–1.307 as potential entry points.

Fundamentally, things aren’t looking great for the Pound. GBP economic releases this week—including BRC Retail Sales, Employment Change, and Inflation figures—are expected to show weakness. Softer retail sales and job growth numbers could weigh on GBP further. Meanwhile, the USD is strengthening, with upbeat Retail Sales data and an important speech from Fed Chair Powell likely reinforcing the Dollar's momentum.

Based on my analysis, I anticipate GBP/USD will move lower this week and am leaning toward a bearish trade. My plan is to wait for a rejection from resistance before entering a short position, ideally around 1.308 or lower.

Please note things do change so let's see what this week brings :) !

GBPUSD: Likely to maintain its upward momentum next weekTrump announced a 90-day suspension of the new tariff plan for most of his trading partners, which has, to some extent, reduced the systemic risks in the market and warmed up the risk appetite. The British pound, due to its nature as a risk currency, has become a beneficiary in the improvement of the global sentiment. At the same time, global stock markets plunged this week due to the uncertainty of trade policies, but the GBPUSD rose against the trend, indicating that the market has a strong bullish sentiment towards the British pound. This sentiment is likely to continue next week.

GBPUSD broke through some key resistance levels this week, such as the 1.3000 mark, opening up room for further upward movement. In the short term, although the RSI has reached a highly overbought level, if the bullish sentiment in the market is strong enough, the GBPUSD still has the potential to continue rising, breaking through the recent high of 1.3145. The next resistance levels might be at 1.3200 and even higher.

GBPUSD trading strategy

buy @:1.30400-1.30480

sl 1.29950

tp 1.30750-1.30810

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GBPUSD BIG DROP ?Market Structure Overview

Previous Trend: Strong bullish move after a long bearish trend.

Current Behavior: Price has entered a higher-timeframe supply zone (highlighted in green) and is showing signs of rejection.

Supply Zones:

Major Supply: 1.31750 – 1.32000

Minor Supply: 1.31000 – 1.31300

Demand Zones:

First Demand Zone: ~1.30380

Second Demand Zone: ~1.29919

📉 Trade Setup & Plan

🅰️ Primary Bias: Bearish Rejection from Supply

🔹 Scenario 1: Ideal Short Setup

Entry: Around current price (~1.30824) or after a retest of the 1.31000–1.31300 zone.

TP1: 1.30380 (first demand zone)

TP2: 1.29919 (second demand zone)

TP3 (extension): Below 1.29000 if momentum continues

SL: Above 1.31300 (to avoid fakeouts in supply)

🧩 Reasoning:

Price failed to break above supply with strong rejection wicks.

Break of structure + liquidity taken above local highs = possible start of bearish leg.

🔹 Scenario 2: Pullback Before Continuation Lower

Wait for Break of 1.30380, then look for pullback entries (break & retest).

Entry: On bearish confirmation after price retests 1.30380 zone from below.

TP: 1.29919, and if broken, continue to trail toward 1.2900s

✅ Extra Notes

Watch for rejection patterns (e.g., pin bars, engulfing candles) on the 15M or 30M to confirm entries.

Avoid entries during high-impact news, especially UK or US CPI, interest rate decisions, or NFP.

Manage risk wisely: Max 1-2% per trade.

GBP/USD Short Setup – Rejection from Resistance Zone with High REMA 30 (red line)

EMA 200 (blue line)

---

Key Levels:

Entry Point: 1.31324

Stop Loss: 1.32303

Target (TP): 1.28102

---

Analysis:

1. Trend Context:

The market shows a recent bullish move approaching a key resistance zone (highlighted in purple).

The price is now reacting to that resistance zone and potentially forming a reversal.

2. EMA Insight:

Price is currently trading slightly above the EMA 200 and EMA 30, indicating short-term bullish momentum.

However, the suggested trade setup appears to be short (sell), anticipating a reversal from resista

GBPUSD potential buy zone in inverted head & shoulder!GDP in GBPUSD had spike in actual value with the forecast has boost in this pair. Prior to data release this instrument had a break of structure has given strong liquidity grab as it has broken from long term trend line. As the market structure remain intact we may see the price to bounce back to the daily resistance line. 15m timeframe already has formed an inverted head & shoulder which signaling potential breakout. Any liquidity grab may give us potential entry in this lower timeframe.

Analysis of the Trend of the GBPUSDThe GBPUSD is currently showing a gradually rising trend. An important support level is 1.28850, which is the lower boundary of the current range. Once it is broken below, it may suggest a reversal of the trend to a bearish one. Before that, we should still mainly choose to go long and use short selling as a supplement.

GBPUSD trading strategy

buy @:1.29200-1.29300

sl 1.28850

tp 1.29750-1.29850

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GBP/USD Breakdown Incoming? Bearish Setup Unfolding!Hi traders! Analyzing GBP/USD on the 1H timeframe, spotting a potential rejection at the descending trendline:

🔹 Entry: 1.29660

🔹 TP: 1.28652

🔹 SL: 1.30650

Price is reacting to the descending trendline after testing a key resistance zone. This level has acted as dynamic resistance in the past, and price shows signs of rejection.

The RSI is in the overbought area, suggesting a possible pullback. If the bearish momentum confirms, we could see a clean move back down to the previous support levels.

⚠️ DISCLAIMER: This is not financial advice. Every trader must evaluate their own risk and strategy.

GBP/USD Bullish Breakout Setup – Entry, Target & Stop Loss AnalyEMA 200 (blue line): 1.28423 – typically used to define long-term trend direction.

EMA 30 (red line): 1.28253 – shorter-term trend indication.

Currently, the price is above the 30 EMA and slightly above the 200 EMA, suggesting short-term bullish momentum with potential for trend reversal or continuation.

🟪 Key Zones and Levels:

Entry Point Zone: Around 1.28242–1.28423 (highlighted in purple).

Stop Loss: Set slightly below the purple demand zone at 1.27931.

Target (EA TARGET POINT): Marked around 1.29809.

🧠 Trade Setup Summary:

Risk/Reward: Good – aiming for a ~1.19% gain (~152.5 pips), with a relatively tight stop loss.

Structure:

The price has broken above a consolidation range (demand zone) and retested the zone (potential bullish retest).

EMA crossover could soon occur if the 30 EMA crosses above the 200 EMA, confirming bullish sentiment.

✅ Bullish Confirmation Signs:

Higher lows forming.

Break and retest of previous resistance (now support).

EMA proximity breakout is occurring.

Strong bullish candles near the entry level.

⚠️ Things to Watch:

If price closes strongly above 1.2860–1.2870, that could signal momentum continuation.

Failing to hold 1.2824–1.2800 might invalidate the setup and trigger the stop loss.

Watch for fundamental events (economic news, especially from UK/US) that could cause sudden volatility.

GBP/USD "The Cable" Forex Bank Heist Plan (Swing / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1.30500) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (1.27000) Swing/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.35000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸GBP/USD "The Cable" Forex Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩