Gbpusdanalysis

GBP/USD Breakdown – Bearish Momentum Ahead?This 4-hour chart of GBP/USD shows a clear bearish setup:

🔹 Rising Wedge Breakdown – The pair has broken below a rising wedge pattern, signaling potential downside pressure.

🔹 Support and Resistance Levels –

Resistance at 1.29206 - 1.30275

Support at 1.28000 - 1.28437

Strong support at 1.27539

🔹 Sell Confirmation – A sell signal is indicated, suggesting further downside movement towards the target zone.

📉 Trading Plan:

✅ Possible short entries below the 1.28956 level.

✅ Target price: 1.27539

✅ Stop-loss above 1.29206 for risk management.

⚠️ Risk Note: Always manage risk properly and watch for any trend reversals before entering trades.

What are your thoughts? Are you bearish or bullish on GBP/USD? 🤔💬

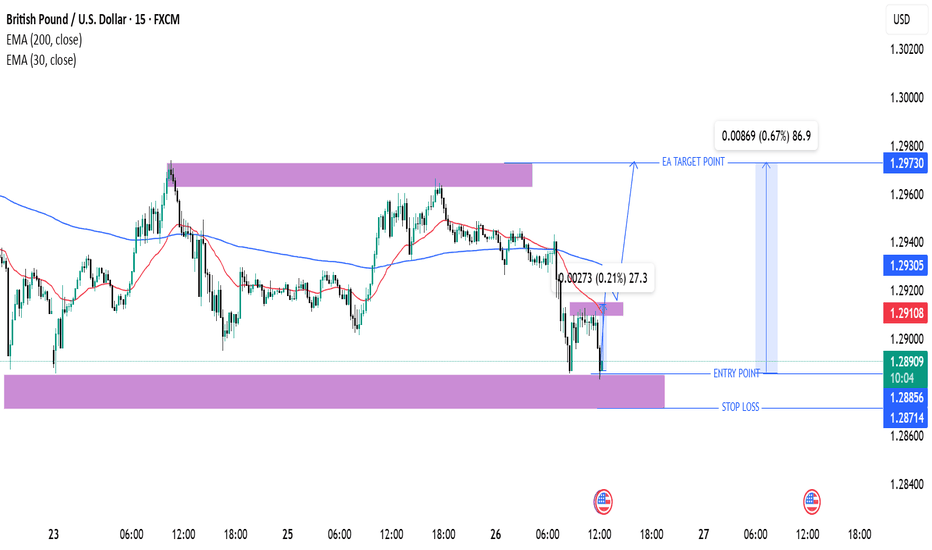

GBP/USD Trade Analysis: Bullish Reversal from Support ZoneExponential Moving Averages (EMAs):

200 EMA (Blue) at 1.29309: Represents the long-term trend.

30 EMA (Red) at 1.29122: Represents the short-term trend.

Price is currently below both EMAs, suggesting a bearish trend.

Support and Resistance Zones:

Resistance Zone (Purple at the top): Price previously reacted strongly at this level.

Support Zone (Purple at the bottom): A potential demand area where price is currently bouncing.

Trade Setup:

Entry Point: Near 1.28875 (highlighted on the chart).

Stop Loss: Set around 1.28714-1.28856, below the support zone.

Target Point: 1.29730, above the resistance and near the 200 EMA.

Risk-to-Reward Ratio: The setup aims for a higher reward than risk.

Trade Idea:

Bullish Reversal Trade: The price is reacting at a support zone, and the target aligns with a previous resistance level.

A confirmation (strong bullish candle or break of 30 EMA) could indicate a move toward 1.29730.

EMA Crossover Watch: If the 30 EMA crosses above the 200 EMA, it may confirm a stronger uptrend.

Potential Risks:

If price breaks below 1.28714, the bullish idea is invalid.

Resistance at 1.29309 (200 EMA) could slow the move upward.

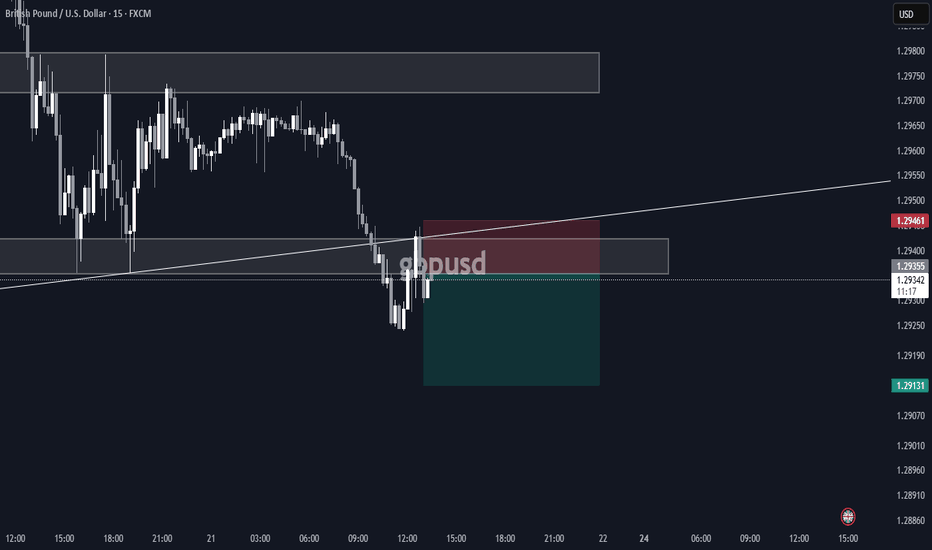

GBP/USD: Struggles at Resistance, Risks of Weak Oscillation PersDuring the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise.

If it fails to break through these resistance levels, in the short term, it may continue the weak, oscillatory downward trend, and the downside risks still remain. The market lacks strong momentum, and overall, it stays in a weak, oscillatory pattern.

GBPUSD

sell@1.29600-1.29900

tp:1.28800

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

GBP/USD Breakdown – Support Under Pressure, Bearish Target AheadChart Analysis:

The GBP/USD pair is currently trading around 1.29578, facing resistance near 1.30366.

A support zone has been identified around 1.29000, which the price is testing.

If this support level breaks, we could see a bearish move toward the next target near 1.26970.

Strong support is positioned lower, which may act as a key reversal point if the decline continues.

Trading Outlook:

Bearish Scenario: If the price breaks below the current support, a drop toward 1.26970 seems likely.

Bullish Scenario: If GBP/USD holds above support, we may see a retest of resistance at 1.30366.

Conclusion:

Traders should watch for a confirmed breakout or rejection at support before taking positions. A clean break below could trigger a stronger bearish move. 🚨

CAD JPY Trade Setup 1 hour timeframe CAD JPY Trade Setup 1 hour timeframe

Following last week's trade setup CAD JPY is moving in an uptrend making Higher Highs and Higher Lows, so we will keep looking for Buying opportunities.

CAD JPY is forming a bullish break and retest continuation pattern that also align with the 0.618-0.50 Fib Retracement level.

Lets wait for the price to pull back to the retest level then enter base off candlestick confirmation

GBP/USD Breaks Rising Channel – Bearish Target Ahead!Key Observations:

Rising Channel: The price was trading within an ascending channel, bouncing between resistance and support.

Breakout & Sell Signal: The price has broken below the channel support, indicating a potential trend reversal.

Bearish Target: The next key support level is around 1.27024, aligning with a previous demand zone.

Confirmation: If the price stays below 1.29165, further downside movement is likely.

Trading Idea:

Short Entry: After confirmation of a breakdown below support.

Target: 1.27024 (next major support level).

Stop Loss: Above 1.30127 (previous resistance).

This setup suggests bearish momentum as long as the price remains below the broken support. Traders should watch for retests and volume confirmation.

GBP/USD Analysis: Pair Fails to Hold Above Psychological LevelGBP/USD Analysis: Pair Fails to Hold Above Psychological Level

As shown in today’s GBP/USD chart, the pair failed to maintain its position above the psychological level of 1.3000 USD per pound, where it had reached its highest point since early 2025. The decline followed recent central bank decisions and statements, with both the Bank of England and the Federal Reserve keeping interest rates unchanged.

On one side, the Bank of England:

→ Warned of inflation risks, partly driven by external factors such as US trade tariffs.

→ Indicated a potential rate cut in the coming months.

On the other hand, the US dollar strengthened on Thursday after the Federal Reserve signalled reluctance to rush further rate cuts this year, despite uncertainties surrounding US tariffs.

These statements highlighted the challenges market participants face in assessing the risks posed by tariffs on global trade.

Technical Analysis of GBP/USD

In March, the pound followed an upward trend against the US dollar, forming an ascending channel (marked in blue). However, once the price moved above the key 1.3000 level, the upper boundary of the channel appeared out of reach—possibly signalling weakening buying momentum.

As a result, the price broke below the lower boundary of the channel, which has now shown signs of resistance (indicated by an arrow). If bearish pressure persists, the price could fall towards the dotted trendline below the channel, at a distance equal to its height. Additionally, a test of the previous local low around 1.2911 cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBPUSD(20250321)Today's AnalysisToday's buy and sell boundaries: 1.2972

Support and resistance levels:

1.3050

1.3021

1.3002

1.2943

1.2924

1.2895

Trading strategy:

If the price breaks through 1.2972, consider buying, the first target price is 1.3002

If the price breaks through 1.2943, consider selling, the first target price is 1.2924

GBP/USD – Potential Pullback from ResistanceChart Overview:

The 4-hour GBP/USD chart shows a strong uptrend contained within a rising channel.

The price has recently reached the upper boundary of the channel and is showing signs of rejection, indicating a possible pullback.

A downside move towards 1.27736 is anticipated, which aligns with a key support level.

Technical Outlook:

If the price respects the resistance zone, a retracement toward the 1.27736 target could be expected.

A confirmed break below this level could open the door for further downside.

However, if bullish momentum resumes, the price may attempt to break above the 1.3000 psychological level.

Trading Plan:

Short-term traders may look for selling opportunities targeting 1.27736.

Long-term traders may wait for a bullish reaction at support for potential continuation of the uptrend.

Key Levels:

Current Price: 1.29574

Support Target: 1.27736

Resistance: 1.3000

Would you like to add further details or modify the description

GBP/USD Bullish Channel – Buy Opportunity! Overview:

The British Pound (GBP) against the US Dollar (USD) is currently trading within an ascending channel on the 4-hour timeframe. The price is approaching a key buy zone at the lower trendline, presenting a potential long opportunity if bullish momentum continues.

Key Market Structure Analysis:

🔹 Uptrend in Progress: GBP/USD has been forming higher highs and higher lows inside a well-defined rising channel.

🔹 Support Zone: A potential buy entry is around 1.2925, aligning with the lower boundary of the channel.

🔹 Target Projection: If the price bounces from support, the next key resistance target is 1.3085.

Potential Trade Setup:

✅ Bullish Scenario:

A retest and bounce from 1.2925 could trigger a buy setup.

Upside target:

🎯 1.3085 – Key resistance level within the channel.

⚠️ Bearish Scenario (Invalidation):

A break below 1.2925 could invalidate the bullish setup and signal a deeper retracement.

Below the channel support, price might target the 1.2600 region as the next demand zone.

Final Thoughts:

GBP/USD remains in a strong uptrend, with the lower channel support acting as a key decision point. If bulls defend this level, we could see further upside momentum. However, a breakdown of the structure could shift the sentiment.

Will GBP/USD continue its bullish momentum? Share your thoughts below!

GBP/USD Intraday Market Analysis: Potential Upside ReversalThe GBP/USD 15-minute chart suggests a possible bullish reversal following a period of consolidation near the 200-period moving average. Price action formed multiple rejection wicks at a key support level, indicating buying interest. A bullish engulfing candle has emerged, confirming a potential shift in momentum.

The risk-to-reward setup highlights a long position, with stop-loss protection just below the recent lows and a target towards previous liquidity zones. The stochastic-based momentum indicator shows a crossover in oversold territory, further supporting potential upside movement.

If price sustains above the 200 EMA and breaks through immediate resistance, further bullish continuation is likely. However, failure to hold above the entry level could invalidate the setup, leading to further downside pressure.

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GbpUsd is approaching a strong sell zoneExactly one week ago, I pointed out that while TRADENATION:GBPUSD strength persists, the pair is approaching a significant sell zone , starting at the psychological level of 1.30.

This level was touched recently, and the pair is currently fluctuating within this range now.

My view remains the same: GBP/USD is likely to experience a drop in the near future, and I’m now looking for potential entries for a swing trade.

As mentioned before, 1.30 is a key psychological level, with the technical resistance just above it at 1.3050. Additionally, GBP/USD is known for its volatility, and this resistance zone extends slightly above 1.31.

In conclusion, traders should consider selling rallies, with a target around 1.27, aiming for at least a 1:2 risk-to-reward ratio when setting their stop loss.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.