Market Trap Alert! GBP/USD Bearish Robbery Plan🔥💸 "The Cable Heist" – GBP/USD Robbery Plan Using Thief Trading Style 💸🔥

— Unfiltered Forex Forecast with Risky Intentions —

🌍 Hey Money-Makers, Market Hustlers & Chart Bandits! 🤑✈️

Hola! Bonjour! Marhaba! Hallo! Ciao! Welcome to the Forex streets where the smart rob the charts, not banks.

Ready for the GBP/USD Heist? Let’s break it down with our infamous Thief Trading Style – raw, unapologetic, and built for profits.

💼 Operation Name: “The Cable Forex Bank Robbery”

🎯 Pair: GBP/USD – aka “The Cable”

⚔️ Style: Scalp / Day Trade / Swing Heist

📊 Bias: Short (Bearish Setup)

🛠 STRATEGY SETUP: "Follow the Shadows"

🔍 Analysis Basis:

Smart-Money Traps at Key Levels

Oversold ≠ Reversal (Read between the candles)

Liquidity Hunting Zones

Retail Stop Clusters Exposed

Thief-style DCA Entries (Staggered Entry Levels)

Multi-timeframe Confirmation

COT, Sentiment & News-Driven Volatility

🎯 ENTRY ZONE:

Enter short (sell) using 15M or 30M chart.

Sell Limits near recent highs (pullback zone).

DCA (Layered Entry) recommended – Thief loves catching price slipping.

Let the liquidity work for us.

🛑 STOP LOSS (SL):

Base SL around 1.34850 on 4H Chart – above swing high.

Adjust SL per position size and total entries.

Manage risk, but remember: thieves don’t panic, they plan!

🎯 TARGET ZONE:

TP near 1.32500 or adjust using price action.

Escape before target if market mood flips – no need to be greedy.

Trail SLs if market momentum dies down.

👀 Scalpers' Special Note:

Only SHORT — don’t mess with long side unless you’re a liquidity donor.

Quick ins & outs. If you're loaded with capital, jump in big – else follow the swing team.

Use trailing SLs for safety — protect the loot.

📢 FUNDAMENTALS TO WATCH:

News Impacting GBP/USD

COT Reports

Sentiment Indicators

Macro Trends / Yield Spreads

US Dollar Strength Index (DXY)

UK Economic Reports (CPI, GDP, Rate Decisions)

⚠️ RISK MANAGEMENT TIPS:

🚨 Avoid new entries during news releases

🚨 Use trailing stops during volatility spikes

🚨 Secure running trades before major announcements

🚀 Boost the Robbery – Support the Strategy

💖 Smash that BOOST BUTTON if you're vibing with this setup. Help the Thief crew grow stronger!

Let’s keep milking the market 💸 – one “heist” at a time. Stay dangerous, stay smart.

🔓 NOTE: This isn't investment advice. Just a wild trading idea from a chart outlaw.

Always DYOR – Do Your Own Robbery (Research).

Market conditions shift fast. Stay alert, adapt, and respect your capital.

#ForexThiefStyle #CableHeist #GBPUSDShort #SmartMoneyMoves #LiquidityHunters #ChartOutlaws #TradingRebels #DayTradeLife #ScalpersParadise #ForexGang #FXHeistPlans

Gbpusdprediction

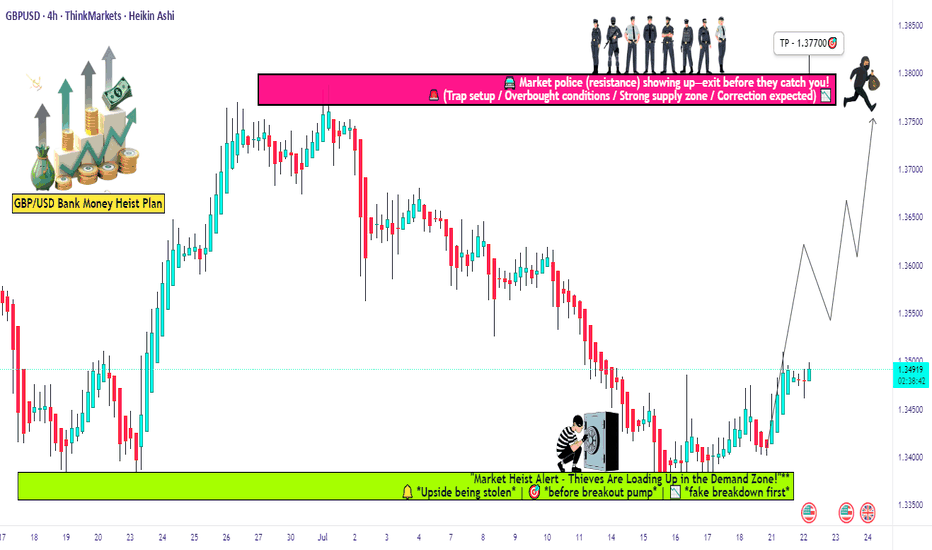

GBP/USD Long Setup: Loot & Escape Before Bears Attack!🏴☠️ GBP/USD HEIST ALERT: "The Cable" Bank Robbery Plan! 💰🚨

Thief Trading Strategy | Swing/Day Trade | High-Risk, High-Reward Loot!

🤑 DEAR MARKET PIRATES & MONEY SNATCHERS!

Based on our 🔥Thief Trading Masterplan🔥, we’re targeting the GBP/USD ("The Cable") for a bullish heist! Police barricades (resistance) are risky, but overbought markets = consolidation = TREND REVERSAL TRAP! Bears are strong here, but smart robbers take profits early!

🎯 Mission: LONG ENTRY + ESCAPE BEFORE THE POLICE (SELLERS) ARRIVE!

🔓 ENTRY: "VAULT IS OPEN!"

📍 Bullish Loot Zone: Swipe longs at any price—but smart thieves use Buy Limits near 15M/30M swing lows for pullback entries!

📍 Pro Thief Move: DCA/Layering strategy (multiple limit orders for max loot).

🛑 STOP LOSS: "DON’T GET CAUGHT!"

📍 SL @ Recent Swing Low (4H): 1.33700 (Adjust based on your risk, lot size, & entry layers!).

📍 Day/Swing Trade? Tighten SL if scalping!

🎯 TARGETS: "LOOT & BOUNCE!"

✅ 1.37700 (Main Heist Target)

✅ Scalpers: Trail SL & escape early!

✅ Swing Bandits: Hold for bigger payout!

📢 THIEF’S FUNDAMENTAL INTEL

Why GBP/USD? Bullish momentum from:

Macro Trends (COT Report, Sentiment, Liquidity Zones)

Intermarket Signals (Stocks, Bonds, Commodities)

News Trap Alerts (Avoid high-impact news chaos!)

🚨 THIEF’S GOLDEN RULES

✔ AVOID NEWS VOLATILITY! (No new trades during releases)

✔ TRAILING SL = SAFE ESCAPE ROUTE! (Lock profits like a pro)

✔ BOOST THIS IDEA! 💥 More boosts = stronger heist crew!

💎 FINAL WARNING

This is a HIGH-RISK heist! Only risk what you can lose.

Market conditions change FAST! Adapt or get caught.

Not advice—just a pirate’s plan! Do your own analysis.

🚀 NEXT HEIST COMING SOON… STAY TUNED, ROBBERS! 🏴☠️💸

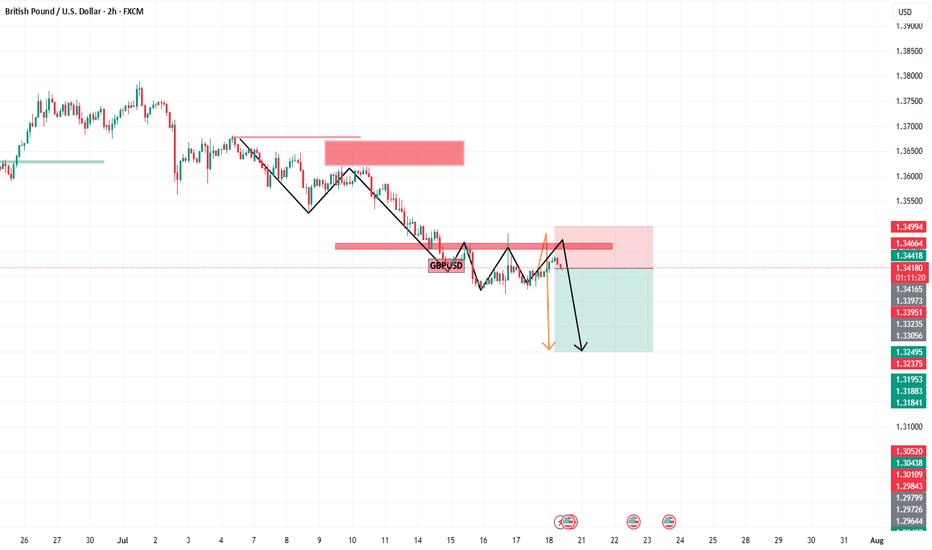

GBP/USD Longs to Shorts GU has been very bearish recently and is currently reacting from a clean demand zone with multiple confluences. While we may see a short-term push to the upside, I’ll be watching to see if price reaches the 3hr supply zone sitting at a premium level.

If price does reach that zone, I’ll be on the lookout for signs of Wyckoff distribution and a slowdown in momentum, which could signal the start of another bearish leg.

Confluences for GU Shorts:

Overall bearish trend remains intact — this is a pro-trend setup

Price may retrace to mitigate a 3hr supply zone

Liquidity to the downside still needs to be taken

Current demand zone may simply serve as a trigger for a retracement up to supply

P.S. If price fails to reach the supply zone and continues dropping, we’ll likely see a new break of structure and the formation of a fresh nearby supply zone, which we can then trade from.

Let’s stay sharp and have a profitable trading week ahead! 🔥📊💰

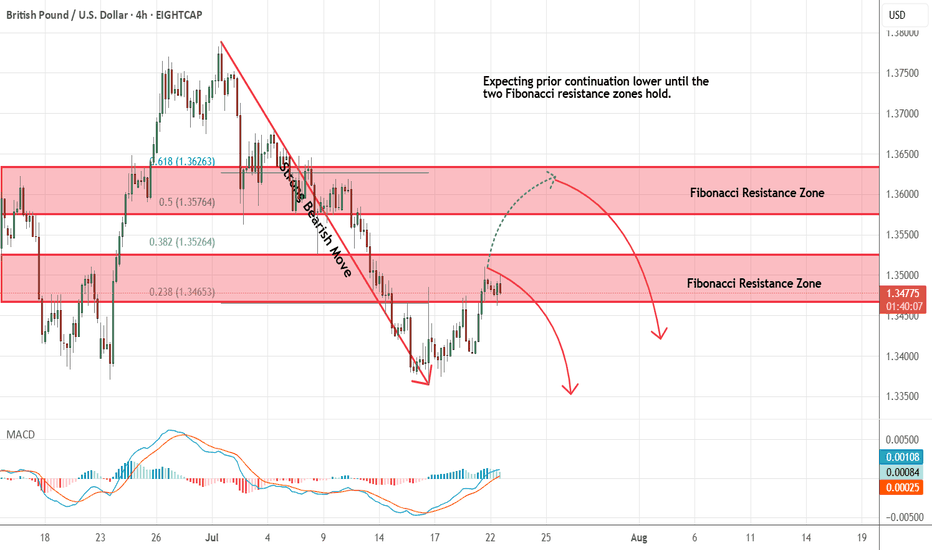

GBPUSD - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Market Trap Alert! GBP/USD Bearish Robbery Plan🔥💸 "The Cable Heist" – GBP/USD Robbery Plan Using Thief Trading Style 💸🔥

— Unfiltered Forex Forecast with Risky Intentions —

🌍 Hey Money-Makers, Market Hustlers & Chart Bandits! 🤑✈️

Hola! Bonjour! Marhaba! Hallo! Ciao! Welcome to the Forex streets where the smart rob the charts, not banks.

Ready for the GBP/USD Heist? Let’s break it down with our infamous Thief Trading Style – raw, unapologetic, and built for profits.

💼 Operation Name: “The Cable Forex Bank Robbery”

🎯 Pair: GBP/USD – aka “The Cable”

⚔️ Style: Scalp / Day Trade / Swing Heist

📊 Bias: Short (Bearish Setup)

🛠 STRATEGY SETUP: "Follow the Shadows"

🔍 Analysis Basis:

Smart-Money Traps at Key Levels

Oversold ≠ Reversal (Read between the candles)

Liquidity Hunting Zones

Retail Stop Clusters Exposed

Thief-style DCA Entries (Staggered Entry Levels)

Multi-timeframe Confirmation

COT, Sentiment & News-Driven Volatility

🎯 ENTRY ZONE:

Enter short (sell) using 15M or 30M chart.

Sell Limits near recent highs (pullback zone).

DCA (Layered Entry) recommended – Thief loves catching price slipping.

Let the liquidity work for us.

🛑 STOP LOSS (SL):

Base SL around 1.36200 on 2H Chart – above swing high.

Adjust SL per position size and total entries.

Manage risk, but remember: thieves don’t panic, they plan!

🎯 TARGET ZONE:

TP near 1.33800 or adjust using price action.

Escape before target if market mood flips – no need to be greedy.

Trail SLs if market momentum dies down.

👀 Scalpers' Special Note:

Only SHORT — don’t mess with long side unless you’re a liquidity donor.

Quick ins & outs. If you're loaded with capital, jump in big – else follow the swing team.

Use trailing SLs for safety — protect the loot.

📢 FUNDAMENTALS TO WATCH:

News Impacting GBP/USD

COT Reports

Sentiment Indicators

Macro Trends / Yield Spreads

US Dollar Strength Index (DXY)

UK Economic Reports (CPI, GDP, Rate Decisions)

⚠️ RISK MANAGEMENT TIPS:

🚨 Avoid new entries during news releases

🚨 Use trailing stops during volatility spikes

🚨 Secure running trades before major announcements

🚀 Boost the Robbery – Support the Strategy

💖 Smash that BOOST BUTTON if you're vibing with this setup. Help the Thief crew grow stronger!

Let’s keep milking the market 💸 – one “heist” at a time. Stay dangerous, stay smart.

🔓 NOTE: This isn't investment advice. Just a wild trading idea from a chart outlaw.

Always DYOR – Do Your Own Robbery (Research).

Market conditions shift fast. Stay alert, adapt, and respect your capital.

#ForexThiefStyle #CableHeist #GBPUSDShort #SmartMoneyMoves #LiquidityHunters #ChartOutlaws #TradingRebels #DayTradeLife #ScalpersParadise #ForexGang #FXHeistPlans

Intraday Drop into Support Zone — Can GBP/USD Bounce?Hi everyone,

GBP/USD continues to consolidate below the 1.36850 level. Price failed to break above and moved lower into the 1.35300–1.34600 zone, providing us with a clean intraday trade setup.

A drop into this area was highlighted as the more probable short‑term path, and we’re now looking for GBP/USD to find support in this region; and more importantly, to hold above the 1.33800 level to form the base for another push higher.

As previously noted, a decisive break above 1.37500 would renew our expectation for further upside, with the next key target around 1.38400. We'll be monitoring price action closely to see how it unfolds.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBP/USD: Short‑Term Pullback Likely Before Fresh Upside AttemptHi everyone,

GBP/USD continues to consolidate below the 1.36850 level. We expect a retest of this level today; should price fail to break above, we anticipate a move lower to find buying interest between the 1.35300 and 1.34600 zones. A drop into this area appears to be the more probable short‑term path and could set the stage for another push higher.

As previously noted, a decisive break above 1.37500 would renew our expectation for further upside, with the next key target around 1.38400. We'll be monitoring price action closely to see how it unfolds.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBP/USD Pulls Back After Rejection – Buyers Eye Lower LevelsHi everyone,

GBP/USD failed to break above the 1.37500 level and saw a rejection from that resistance, dropping further below the 1.36850 support. Since then, price has consolidated and ranged beneath this level.

Looking ahead, if price remains within this range, we anticipate a move lower to find buying interest between the 1.35300 and 1.34600 levels, which could set the stage for another push higher.

As previously noted, a decisive break above 1.37500 would renew our expectation for further upside, with the next key target around 1.38400. We'll be monitoring price action closely to see how it unfolds.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBP/USD Potential Shorts from 1.37000This week, my analysis for GBP/USD focuses on the continuation of the bearish order flow. I currently have a clean 16-hour supply zone that remains unmitigated, where we may see a potential bearish reaction in alignment with the prevailing downtrend. If price breaks through this zone, I will shift focus to an extreme 2-hour supply zone higher up.

There are several imbalances and pools of liquidity resting below that serve as potential downside targets. Additionally, I’m noticing the formation of engineered liquidity beneath current price, which further supports the bearish outlook.

Confluences for GBP/USD Sells:

The U.S. Dollar has reacted from a strong demand zone, suggesting we could see continued bullish pressure on the dollar, which may weigh on GBP/USD.

GBP/USD has shown a clear change of character to the downside, confirming bearish market structure—this is a pro-trend trade setup.

We have both a clean 16-hour and an extreme 2-hour supply zone, offering high-probability entry points for potential shorts.

Multiple liquidity targets below, including Asia session lows and unfilled imbalances, align well with the bearish narrative.

P.S. My next potential long opportunity lies at the 6-hour demand zone near 1.34400. From there, I’ll be watching for price to slow down, accumulate orders, and potentially shift structure to the upside.

Wishing everyone a successful and profitable trading week!

Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

Bullish Bias Holds for GBP/USD – Focus on 1.37500 BreakHi everyone,

A strong push up from our highlighted support level at 1.33800 toward 1.36850 saw GBP/USD enter a brief period of consolidation. During the week, price action ranged between this newly established support and the 1.37500 resistance level.

Looking ahead, we anticipate a decisive break above 1.37500, which could open the way for further upside.

As previously noted, the clearance of these levels strengthens our expectation for further upside, with the next key level of interest around 1.38400. We'll be watching to see how price action develops from here.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBP/USD Rally in Full Swing – Bullish Targets AheadHi everyone,

Price achieved the 1.36850 having found support near the 1.33800 level.

As previously noted, the clearance of these levels strengthens our expectation for further upside, with the next key level of interest around 1.38400. We'll be watching to see how price action develops from here.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low towards 1.40000 and 1.417000.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBPUSD - Expecting Bullish Continuation In The Short TermM15 - Strong bullish momentum followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

GBP/USD Rally Resumes – Bullish Targets AheadHi everyone,

As outlined in our previous GBP/USD analysis (idea linked below), the Cable confirmed its continued rally following a decisive break above the 1.35195 level. This was quickly followed by a move through our highlighted levels at 1.35630 and 1.35934.

As previously noted, the clearance of these levels strengthens our expectation for further upside, with the next key level of interest around 1.36850. We'll be watching to see how price action develops from here.

We’ll continue to provide updates on the projected path for GBP/USD as price approaches this target.

The longer-term outlook remains bullish, and we expect the rally to continue extending further from the 1.20991 January low.

We’ll be keeping you updated throughout the week with how we’re managing our active ideas. Thanks again for all the likes/boosts, comments and follows — we appreciate the support!

All the best for the week ahead. Trade safe.

BluetonaFX

GBP/USD Shorts from the daily supplyI’m anticipating a potential retracement as price has been heavily bullish and is now beginning to show signs of being overbought. After recently breaking major structure to the upside, there’s room for a temporary sell-off as price corrects before continuing higher.

I’ll be watching for possible reactions from the 59-minute demand zone for a minor bounce, but the more ideal long opportunity would be at the 12H demand zone around 1.3300, where structure is cleaner and confluences align.

Confluences for Short-Term Sells:

- A recent change of character (CHOCH) to the downside signals a shift in momentum

- A clean daily supply zone has been left behind that could initiate a deeper pullback

- Significant liquidity below, including the Asia low, ready to be swept

- For price to maintain long-term bullish movement, it must first correct, fill imbalances, and mitigate valid demand levels

P.S. If price drops further and breaks structure, we’ll likely see a new supply zone form. This will provide a closer and more refined opportunity to participate in the move.

Stay sharp and trade safe! 📉📈

GBP/USD Analysis: Price Searching for SupportGBP/USD Analysis: Price Searching for Support

In the second half of May, the British pound showed notable strength: from its 12 May low, GBP/USD climbed to a peak on 26 May — marking its highest level in over three years.

Demand for the pound has been driven by several factors:

→ A surge in inflation. CPI data released last Wednesday came in above expectations. As a result, market participants interpreted this as a reason for the Bank of England to remain cautious about cutting interest rates. Holding rates at elevated levels is generally considered bullish for the pound.

→ The pound’s relative resilience amid trade tensions, particularly following a newly signed agreement with the US, as well as strengthening trade ties between the UK and the EU.

Can the pound continue to rise? The GBP/USD chart offers reasons for doubt.

Technical Analysis of the GBP/USD Chart

Recent price movements have formed an ascending channel (outlined in blue), and earlier this week, demand was so strong that the pair briefly moved above the upper boundary. But what happened next?

That strong buying momentum appears to have faded — resulting in a sequence of lower highs (A→B→C→D), suggesting that the market may be searching for a foothold. Today’s bounce (highlighted by the arrow) hints that such a foothold may have been found. But how reliable is it? And can the uptrend be resumed?

→ From a bullish perspective: Support may be provided by the lower boundary of the channel, reinforced by the 1.345 level.

→ From a bearish perspective: The 1.352 level is acting as resistance, further strengthened by the median line.

It is possible that the area marked by lower highs (A→B→C→D) could ultimately prove to be an insurmountable barrier for the developing uptrend on the GBP/USD chart.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GBP/USD bullish run still going?This week’s analysis for GU is centred around the current pro-trend momentum and where we could see potential entries to continue riding it.

To begin with, there’s a refined 3D supply zone located at a premium level which could cause a short-term bearish reaction. I’ll be monitoring this area for any possible short setups — but only with strong confirmation.

However, the overall structure remains predominantly bullish, as shown by a series of higher highs and higher lows, along with significant breaks of structure. The most relevant point of interest for a bullish continuation sits around the 1.34200 level, where a clean 9H demand zone resides. This is where I’ll be looking to enter long positions if price retraces to that area.

Confluences for GU Buys:

- Clear formation of higher highs and higher lows, confirming bullish structure

- Strong 9H demand zone that initiated the recent break of structure

- Liquidity above still yet to be cleared

- DXY remains bearish, supporting continued bullish momentum on GBP/USD

P.S. Don’t get too caught up chasing countertrend moves. The real edge lies in identifying the nearest POI that aligns with the overall trend and waiting for your setup to unfold there.

GBP/USD "The Cable" Forex Bank Money Heist (Bearish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN MA Zone. It's a Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (1.32500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 (or) 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (1.33400) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.31600

💰💵💸GBP/USD "The Cable" Forex Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBP/USD Cable Heist:Join the Thief Trading Style to Raid Profit!GBP/USD Cable Heist Plan - Thief Trading Style 😎💸

Greetings, wealth chasers and market bandits! 👋💰

Welcome to the Thief Trading Style, blending sharp technicals with savvy fundamentals to raid the GBP/USD "Cable" Forex Market. 📊 Follow the strategy outlined in the chart, focusing on long entries targeting the high-stakes Red Zone. 🌋 Expect an overbought market, consolidation, or trend reversal where bears might set traps. 🐻 Nail the plan, grab your profits, and treat yourself—you’ve earned it! 🎯💵🎉

Entry 📈: The heist begins! 🚨 Wait for the MA breakout at 1.34700, then strike for bullish gains. 🐂 Set buy stop orders above the moving average or place buy limit orders within a 15/30-minute timeframe at the recent swing high/low. ⏰ Don’t miss the move—set a chart alert to catch the breakout! 🔔

Stop Loss 🛑: Listen up, crew! 🗣️ For buy stop orders, hold off on setting your stop loss until after the breakout. 🚀 Place it at the recent swing low on the 4H timeframe (1.33300) for swing/day trades. 📍 Adjust based on your risk, lot size, and number of orders. Play smart, or you’re dancing with danger! 🔥😈

Target 🎯: Aim for 1.37000 or bail early if the market shifts. 🏃♂️ Scalpers, stick to long-side trades. 👀 Got deep pockets? Jump in now. 💪 Otherwise, join the swing traders and execute the plan with a trailing stop loss to secure your loot. 🔒💰

Market Outlook: GBP/USD is riding a bullish wave, fueled by key fundamentals. 🐃 Dive into the COT Report, macro data, sentiment, intermarket analysis, and future trend targets via the linkss below for the full scoop. 🔗👉

Why This Trade?: The bullish setup on GBP/USD is backed by strong technical signals, with the MA breakout confirming upward momentum. 📈 Fundamentals, including favorable COT positioning and positive macro data, suggest sustained strength in the pound. 💪 Intermarket correlations and sentiment analysis further align with a bullish outlook, making this an ideal moment to strike the Cable for potential high rewards. 🌟 The Red Zone target at 1.37000 offers a prime risk-to-reward ratio for disciplined traders. 🤑

⚠️ Trading Alert: News & Position Management 📰:

News releases can shake up prices and volatility. 🌪️ To stay safe:

Skip new trades during news events. 🚫

Use trailing stops to lock in profits and protect open positions. 🔐

Boost the Heist! 🚀: Support our plan by hitting the Boost Button to supercharge our market raids. 💥 With the Thief Trading Style, we’re stacking profits daily. 📈 Join the crew, execute the plan, and let’s make money moves! 💪🤝😺

Stay sharp for the next heist plan. Until then, keep robbing the markets! 🤑🐱👤

GBP/USD potential shorts back downMy analysis revolves around a possible bearish reaction from the 2‑hour supply zones. If price does respect these zones, I’ll look for a sell setup to drive price lower—though I’ll approach with caution because there’s liquidity resting just above those points of interest.

Should price push downward, my next target is the 10‑hour demand zone that triggered the recent change of character. This discounted area could spark a bullish response.

Confluences for GU sells are as follows:

- An unmitigated 4‑hour supply zone overhead.

- A “sell‑to‑buy” scenario fits: price sits closer to supply and still needs a retracement.

- Imbalance and untapped liquidity lie below, inviting a move south.

- Liquidity has just been swept above, leaving a clean supply zone behind.

P.S. If price punches through these supply zones and breaks structure to the upside, I’ll watch for the new zone that forms—there could be a nearer‑term long opportunity from there.

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/USD "The Cable" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.28877) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 1.29600 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.27800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/USD "The Cable" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩