Gbpusdsetup

GBP/USD Breakouts as UK Battles Inflation and Economic ChallengeRecent reports have indicated that the United Kingdom is facing its highest inflation levels in years, with various factors contributing to this uptrend. While this may raise concerns for some, as astute traders, we know that volatility often presents opportunities for substantial gains. The GBP/USD pair has become an enticing market to explore, reflecting the ongoing struggle between inflationary pressures and economic data.

You might be wondering, "Why should I consider adding GBP/USD market orders to my trading strategy?" Well, dear traders, the answer lies within the potential for significant profits derived from this exciting market. By closely monitoring the UK's economic landscape and keeping a keen eye on inflationary trends, we can seize the moment and capitalize on the fluctuations of the GBP/USD pair.

So, let's dive into the call to action! I encourage you to take advantage of this moment and consider adding GBP/USD market orders to your trading repertoire. By doing so, you position yourself to potentially reap the rewards of the UK's highest inflation levels and the impact of poor economic data on the pound. As we navigate these challenging times, let us remember that adversity often breeds success for those willing to take calculated risks.

To maximize your potential gains and minimize risks, I recommend conducting thorough research, staying updated with the latest news, and utilizing technical analysis tools to identify breakout points and establish appropriate stop-loss levels. Remember, knowledge is power, and a well-informed trader is successful!

GBP/USD Continues to Navigate DownAnd it remains bearish, targeting $1.23.

Short-Term Price Action Sub $1.24

Despite efforts to shape support from the $1.24 region, recent hours witnessed price elbow beneath the psychological level. This followed a near-pip-perfect H1 AB=CD harmonic bearish formation taking form at $1.2467 (denoted by a 100% projection ratio), a base that was bolstered by a H1 trendline support-turned-resistance taken from the low $1.2392. Downside support can be seen nearby at $1.2356, with a break paving the way for follow-through selling towards $1.23.

GBP/USD is losing ground as traders react to inflation reports from UK. Inflation Rate declined from 10.1% in March to 8.7% in April, compared to analyst consensus of 8.2%. Core Inflation Rate increased from 6.2% to 6.8%, so the BoE will have to raise rates at the next meeting to fight inflation.

In case GBP/USD settles below the support at 1.2345, it will move towards the next support level at 1.2300. A successful test of this level will push GBP/USD towards the support at 1.2275.

R1:1.2370 – R2:1.2410 – R3:1.2440

S1:1.2345 – S2:1.2300 – S3:1.2275

View from Higher Timeframes Show Scope for Further Downside

The bigger picture continues to put forth a bearish bias. The weekly timeframe recently tested a major long-term trendline resistance drawn from the high of $1.4250, placing weekly support at $1.1851 in view as a potential long-term support target.

Aiding the weekly timeframe’s resistance, an additional layer of resistance made its way into the frame at $1.2638 on the daily chart in mid-May. This has positioned daily support at $1.2272 on the radar and pulled the Relative Strength Index (RSI) south of the 50.00 centreline towards indicator support at 37.78.

In the United Kingdom, the most important categories in the consumer price index are Transport (16 percent of the total weight) and Recreation and Culture (15 percent). Housing, Water, Electricity, Gas and Other Fuels accounts for 13 percent; Restaurants and Hotels for 12 percent and Food and Non-alcoholic Beverages for 10 percent. The index also includes: Miscellaneous Goods and Services (9 percent); Clothing and Footwear (7 percent); Furniture, Household Equipment and Maintenance (6 percent). Alcoholic Beverages and Tobacco; Health, Communication and Education account for remaining 11 percent of total weight.

The consumer price inflation in the UK fell to 8.7% year-on-year in April 2023, the lowest since March 2022, due to a sharp slowdown in electricity and gas prices. Still, the inflation rate exceeded market expectations of 8.2% and remained well above the Bank of England's target of 2.0%. Housing & utilities inflation dropped to 12.3% from 26.1% in March, with the cost for electricity, gas & other fuels increasing 24.3%, compared with 85.6% the month before. Prices have also advanced at a slower pace for restaurants & hotels (10.2% vs 11.3%) and furniture, household equipment & maintenance (7.5% vs 8.0%). Meanwhile, food & non-alcoholic beverages inflation remained close to March's record high (19.0% vs 19.1%), while cost accelerated for transport (1.5% vs 0.8%), recreation & culture (6.3% vs 4.6%) and miscellaneous goods & services (6.8% vs 6.7%). The core rate, which excludes food and energy, jumped to 6.8%, the highest since March 1992 and above well forecasts of 6.2%.

Given the scope to post additional underperformance, GBP/USD is likely to cross beneath H1 support from $1.2356 and target $1.23, followed by daily support mentioned above at $1.2272. A H1 close lower, therefore, could ignite breakout selling.

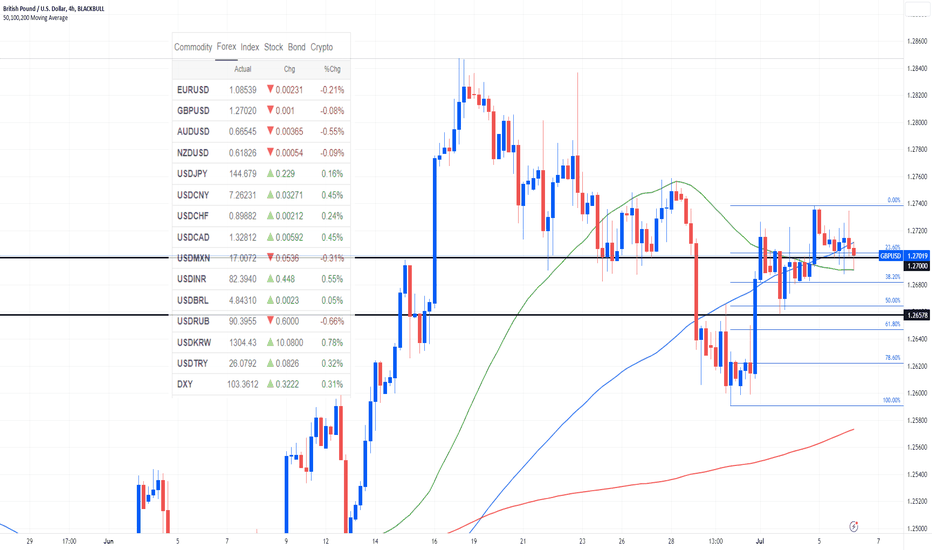

GBP/USD bulls eye a retest of 1.2800GBP/USD remains in a strong uptrend on the daily chart, although prices began retracing on June 16th. We're now looking for momentum to revert to its bullish trend.

Whilst prices failed to hold above May high, they're now back above them having formed a 3-day bullish reversal pattern (Morning Star). A small bearish inside day formed due to the 3-day weekend in the US, and prices remain beneath a retracement line. But bulls could seek evidence of a swing low around support zones such as 1.2664/67 (weekly pivot point/May high) or the 1.2575 (volume node and lower 1-week implied volatility band).

We're targeting the 1.800/50 area near cycle highs and the upper implied volatility band.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD Long Term Trading IdeaHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

FOMC Minutes in the Charts: EUR/USD & GBP/USDDuring their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

GBPUSD - SHORT; SELL it right here!What better of a (short) entry than just as this starts working it's way through that massive Shark on the Weekly ?! ...

SHORT

Not to mention that up to this point the Pound is the manifestation of everything that could be (and has been) thrown at it (monetarily speaking), including the kitchen sink. E.g., There just isn't much left in the BoE's arsenal that could prop this up any farther vs. the USD, endowing this Short Entry with an excellent Risk/Reward ratio!