GBPUSD Approaching Key Psychological Zones!Hey friends 👋

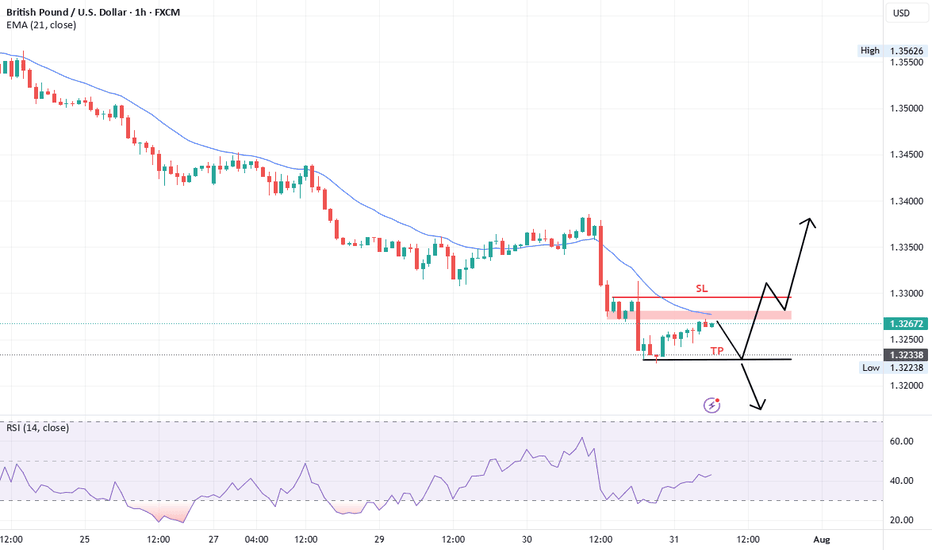

Here’s a fresh GBPUSD analysis I’ve prepared for you. I’m planning to open a **buy** position between **1.32506 – 1.32246**, aiming for a target level of **1.33298**.

Every single like you send my way is a huge source of motivation for me to keep sharing these insights. Big thanks to everyone supporting with a like 🙏

Gbpusdshort

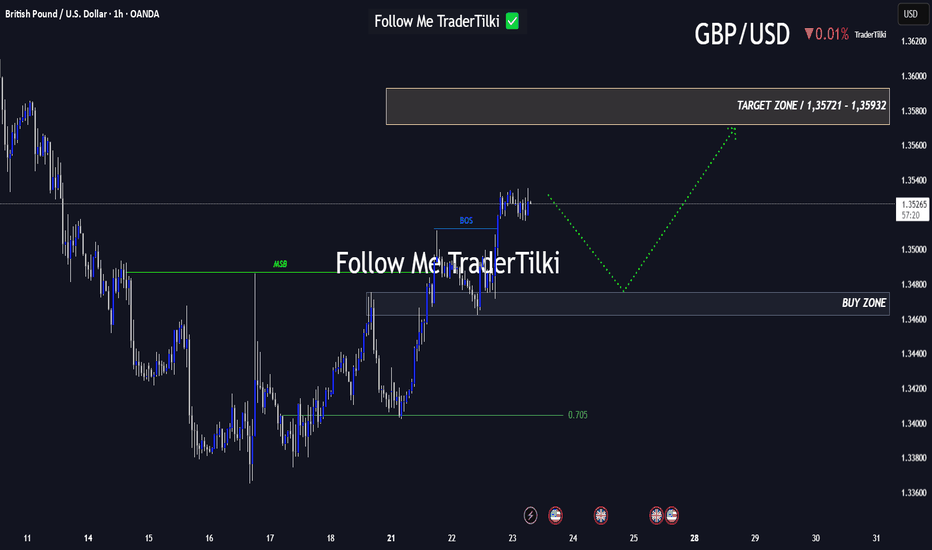

Every Like Is a Boost: This GBPUSD Analysis Is Just for You!Good morning, friends 🌞

Due to the recent shift in GBPUSD’s market structure, I plan to enter a buy position when price reaches the 1.34753 – 1.34623 range.

Target levels: 1.35721 and 1.35932 📈

Every like you send fuels my motivation to share fresh analyses. Thank you to everyone who’s supporting this journey ❤️

Technical Scenario for TodayTechnical Scenario for Today

According to the current technical analysis:

If above 1.3384, resistance targets around 1.3408 or even 1.3438 could be targeted

Akhbar Forex

.

If 1.3351 is broken, the market could test lower support around 1.3321 or deeper if the pressure continues

📉 Expected intraday range

According to StockInvest's Daily Volatility model (based on 14-day ATR ~0.0064), GBP/USD could move within a range of ±0.48% from the opening price. If it opens around 1.330, the range could be 1.3246 – 1.3354

CoinCodex and MidForex also forecast an average price around 1.344, however this is more in line with the weekly and monthly forecasts, less related to intraday developments

coincodex.com

.

GBPUSD SELLGBP/USD holds steady above 1.3250 as investors brace for US ISM Services PMI release

The GBP/USD pair trades on a flat note near 1.3280 during the Asian trading hours on Tuesday. Nonetheless, rising odds of Federal Reserve rate cuts could weigh on the US Dollar against the Cable. Investors will keep an eye on the US ISM Services Purchasing Managers Index data, which is due later on Tuesday.

The broad-based selling pressure surrounding the US Dollar (USD) helped GBP/USD gain traction and allowed the pair to snap a six-day losing streak.

The monthly data published by the US Bureau of Labor Statistics (BLS) showed that Nonfarm Payrolls (NFP) rose by 73,000 in July, missing analysts' estimate of 110,000, while the Unemployment Rate edged higher to 4.2% from 4.1%, as expected. More importantly, the BLS announced that it revised down May and June NFP increases, noting that NFP growth in this two-month period combined was 258,000 lower than previously reported.

The probability of a 25 basis points Federal Reserve (Fed) rate cut in September jumped above 70% from about 30% before the data, as per CME FedWatch Tool. In turn, the USD weakened sharply against its peers.

The economic calendar will not feature any high-tier macroeconomic data releases on Monday. Later in the week, the Bank of England (BoE) will announce monetary policy decisions.

In the meantime, market participants will keep a close eye on US politics. Following the dismal employment report, US President Donald Trump fired BLS Chief Erika McEntarfer, accusing her of manipulating the numbers for political purposes. Additionally, Fed Governor Adriana Kugler, whose term was scheduled to end on January 31, 2026, announced her resignation.

Investors could opt to stay away from the USD in case political developments feed into concerns over the Fed or the BLS losing independence.

SUPPORT 1.32382

SUPPORT 1.31758

SUPPORT 1.32382

RESISTANCE 1.33086

RESISTANCE 1.33375

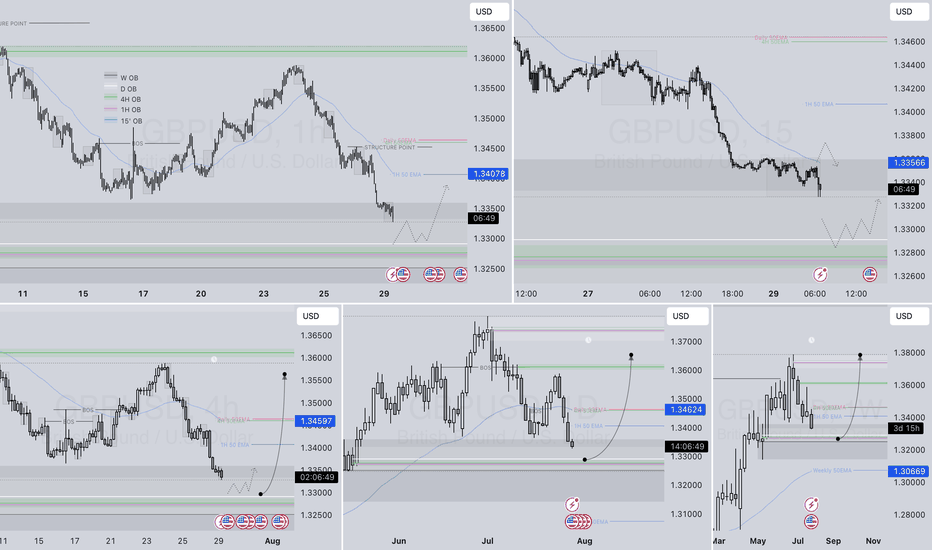

GBPUSD – DAILY FORECAST Q3 | W32 | D7 | Y25📊 GBPUSD – DAILY FORECAST

Q3 | W32 | D7 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:GBPUSD

Fundamental Market Analysis for August 6, 2025 GBPUSDSterling stays on the back foot ahead of tomorrow’s Bank of England decision: consensus expects the Bank Rate to be held at 5.25 percent, but markets price only one or two modest cuts by year-end as inflation has slowed to 2.6 percent while June retail sales fell 0.9 percent m/m.

Additional pressure stems from fiscal concerns: the UK Treasury warned that GBP 4 billion of spending cuts will be needed in 2026 to keep the deficit at the 3 percent-of-GDP target, stoking stagflation fears and capping the pound’s upside.

The dollar is buoyed by inflows into US yield assets: the 10-year Treasury yield has climbed to 4.47 percent, widening the spread over 10-year gilts to 155 basis points—historically associated with GBPUSD weakness.

Trading Recommendation: SELL 1.32850, SL 1.33050, TP 1.31800

GBPUSD ANALYSISAfter seeing the previous day close and reject an area of resistance and a break below the trendline area of support on the lower timeframe, but with the daily still bearish the 4hr is pushing to the upside. A break of 4hr structure support could be a clear signal that sellers are now pushing price.

GBPUSD Update — July 16As shown in the pinned analysis from July 16, both of the marked zones played out beautifully and offered solid profits.

I’m still holding my short, and the current level on the chart could be a great area to pyramid the position.

Also, for those who missed the initial move, this might offer a fresh opportunity to join the short side.

📌 We remain open to all scenarios:

If this level breaks upward, we’ll wait for a pullback to go long.

If price reaches this level and offers a valid signal, we’ll enter short.

Rather than trying to predict the market with rigid opinions—like many tend to do on social media—we choose to listen to the market, respond to what it shows us, and follow price action with discipline.

No ego. No bias. Just clarity and flexibility.

🎯 Stay sharp. Stay prepared. Stay profitable.

GBP/USD pair on a 4H timeframMy analyzing the GBP/USD pair on a 4H timeframe using the Ichimoku Cloud and Volume Profile (Visible Range), along with marked support and resistance zones. From this image, I can guide you with a target price level, but you'll need to validate with price action confirmation.

Observations:

1. Ichimoku Cloud (Kumo):

Price is currently trading above the cloud, indicating a bullish bias.

However, the cloud ahead is thin and flat, suggesting weak support if a pullback happens.

GBPUSD showing clear downtrend - 4HMarket structure still bearish on GBPUSD

making consistent Lower Highs and Lower Lows

Price just bounced back near previous support area, now acting as resistance.

Planning to short from this zone, expecting downtrend to continue

Timeframe: 4H

Entry: 1.33068

Stop Loss: 1.36220

Take Profit: 1.29864

1:1 RR looks good with trend direction

This is just my personal view, not any financial advise

GBPUSD – WEEKLY FORECAST Q3 | W32 | Y25📊 GBPUSD – WEEKLY FORECAST

Q3 | W32 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

FX:GBPUSD

GBPUSD is in the Selling Direction after Testing ResistanceHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPUSD: Bearish Momentum vs. Fundamental Repricing – Key LevelsGBPUSD is at a critical juncture, balancing a clear technical breakdown with a fundamental backdrop favoring near-term volatility. The pair has slipped from its rising wedge structure and is now testing key retracement zones while markets reprice expectations for Fed rate cuts after weak US jobs data. Traders are closely watching whether this bearish momentum will extend toward the 1.3128 support or if a rebound from oversold conditions could trigger a corrective bounce.

Technical Analysis (8H Chart)

Pattern: Clear breakdown from a rising wedge, confirming bearish bias.

Current Level: Price sits near 1.3278, struggling to reclaim the 1.3300 resistance zone.

Key Support Zones:

1.3128 (61.8% Fibonacci retracement) – main bearish target.

1.2945 (78.6% retracement) – extended downside target if selling pressure deepens.

Resistance Levels:

1.3300 (immediate resistance, prior support now flipped).

1.3380 (secondary resistance if a retracement rally occurs).

Projection: Likely bearish continuation toward 1.3128, with a potential retest of 1.3300 before continuation.

Fundamental Analysis

Bias: Bearish in the short term, but Fed policy and risk sentiment remain key drivers.

Key Fundamentals:

USD: Weak NFP (73K), higher unemployment (4.2%), and downward revisions boost Fed cut bets (~75% for September), typically a USD-negative factor.

GBP: BOE maintains a cautious stance due to sticky inflation but lacks clear hawkish conviction as growth slows.

Tariffs: US tariffs add a mild negative weight on GBP trade sentiment.

Risks:

Hot US CPI could slow Fed cut bets, supporting USD.

Hawkish BOE comments could limit GBP downside.

Global risk sentiment shifts could either favor USD (risk-off) or weaken it further (risk-on).

Key Events:

US CPI and PPI for USD direction.

BOE policy updates and UK CPI.

US jobless claims and Fed commentary.

Leader/Lagger Dynamics

GBP/USD is a lagger, mainly reacting to USD shifts. However, its moves directly influence GBP crosses such as GBP/JPY and GBP/CHF.

Summary: Bias and Watchpoints

GBP/USD remains in a bearish phase, targeting 1.3128 with a potential corrective bounce toward 1.3300 first. The primary driver is the technical breakdown, while fundamentals add volatility around US CPI and BOE policy. If CPI surprises lower, the bearish outlook could reverse into a short-term rebound; if CPI is hot, downside momentum could extend. You should monitor USD-driven events closely as GBP/USD sets the tone for broader GBP movements.

GBPUSD: Selling the Retest | Clean Break, Wait for Confirmation🔻 GBPUSD | Sell the Retest of Broken Support

Timeframe: 1H

Bias: Bearish

Type: Break and Retest

📊 Technical Setup

GBPUSD has broken a key 4H support zone (~1.3460–1.3494) which now acts as a turncoat resistance. Price is currently pulling back, offering a prime opportunity to sell the retest.

• Entry: 1.3460–1.3490 (after confirmation of rejection)

• SL: Above 1.3508

• TP: 1.3398

• RR: ~1:2

• RSI: Bearish momentum, RSI < 50 with mild recovery—ideal for a fade trade

📉 Macro & Fundamental Confluence

• GBP: Despite hawkish BOE tone, GBP is showing technical weakness and soft CFTC positioning

• USD: Strong macro bias with rising conditional score and delayed Fed cuts (still supporting USD strength)

• Seasonal Bias: GBPUSD marked bearish in seasonal chart

• COT Data: GBP positioning turning bearish after previous net build-up

🧭 Gameplan

“Wait for the retest of broken support-turned-resistance to reject before entering short. Stick to the zone.”

🔔 Set alerts around 1.3460–1.3490 and monitor for bearish engulfing or pinbar confirmation.

GBPUSD BUYGBP/USD rebounds from lows, back above 1.3200

GBP/USD now alternates gains with losses in the low-1.3200s, reversing an early pullback to the 1.3180 zone. Meanwhile, Cable's inconclusive tone is accompanied by some renewed selling pressuron on the the US Dollar in the wake of US data releases.

Robust macroeconomic data releases from the United States (US) and the Federal Reserve's (Fed) cautious tone on policy-easing fuelled a bullish rally in the US Dollar (USD) midweek, causing GBP/USD to decline sharply.

The US Bureau of Economic Analysis' (BEA) first estimate showed that the United States' (US) economy staged an impressive comeback following the 0.5% contraction seen in the first quarter. The Gross Domestic Product (GDP) grew at an annual rate of 3% in the second quarter, surpassing the market expectation of 2.4%. Additionally, ADP Employment Change came in at 104,000 in July, beating analysts' estimate of 78,000 by a wide margin.

Later in the day, the Fed announced that it maintained the policy rate at the range of 4.25%-4.5% in a widely expected decision. The policy statement showed that Governor Christopher Waller and Governor Michelle Bowman dissented, preferring a 25 basis points (bps) rate cut, which was also anticipated.

In the post-meeting press conference, Fed Chairman Jerome Powell refrained from confirming a rate cut at the next meeting in September, citing heathy conditions in the labor market and explaining that the current policy stance as being appropriate to guard against inflation risks. Moreover, Powell said that the policy was not holding back the economy despite being still modestly restrictive.

According go the CME FedWatch Tool, the probability of a 25 basis points Fed rate cut in September dropped toward 40% from above-60% before the Fed event. In turn, US Treasury bond yields pushed higher and the USD outperformed its rivals during the American trading hours.

The BEA will release Personal Consumption Expenditures (PCE) Price Index data for June on Thursday. Powell said that they expect the annual PCE inflation and Core PCE inflation to come in at 2.5% and 2.7%, respectively. Weekly Initial Jobless Claims will also be featured in the US economic calendar. Ahead of Friday's critical July employment report, investors could remain hesitant to take large positions based on this data.

It's important to note that month-end flows on the last day of July could ramp up volatility toward the end of the European session and trigger irregular movements in the pair.

SUPPORT 1.33727

SUPPORT 1.33128

SUPPORT 1.32590

RESISTANCE 1.3052

RESISTANCE 1.31567

Market Trap Alert! GBP/USD Bearish Robbery Plan🔥💸 "The Cable Heist" – GBP/USD Robbery Plan Using Thief Trading Style 💸🔥

— Unfiltered Forex Forecast with Risky Intentions —

🌍 Hey Money-Makers, Market Hustlers & Chart Bandits! 🤑✈️

Hola! Bonjour! Marhaba! Hallo! Ciao! Welcome to the Forex streets where the smart rob the charts, not banks.

Ready for the GBP/USD Heist? Let’s break it down with our infamous Thief Trading Style – raw, unapologetic, and built for profits.

💼 Operation Name: “The Cable Forex Bank Robbery”

🎯 Pair: GBP/USD – aka “The Cable”

⚔️ Style: Scalp / Day Trade / Swing Heist

📊 Bias: Short (Bearish Setup)

🛠 STRATEGY SETUP: "Follow the Shadows"

🔍 Analysis Basis:

Smart-Money Traps at Key Levels

Oversold ≠ Reversal (Read between the candles)

Liquidity Hunting Zones

Retail Stop Clusters Exposed

Thief-style DCA Entries (Staggered Entry Levels)

Multi-timeframe Confirmation

COT, Sentiment & News-Driven Volatility

🎯 ENTRY ZONE:

Enter short (sell) using 15M or 30M chart.

Sell Limits near recent highs (pullback zone).

DCA (Layered Entry) recommended – Thief loves catching price slipping.

Let the liquidity work for us.

🛑 STOP LOSS (SL):

Base SL around 1.34000 on 4H Chart – above swing high.

Adjust SL per position size and total entries.

Manage risk, but remember: thieves don’t panic, they plan!

🎯 TARGET ZONE:

TP near 1.31000 or adjust using price action.

Escape before target if market mood flips – no need to be greedy.

Trail SLs if market momentum dies down.

👀 Scalpers' Special Note:

Only SHORT — don’t mess with long side unless you’re a liquidity donor.

Quick ins & outs. If you're loaded with capital, jump in big – else follow the swing team.

Use trailing SLs for safety — protect the loot.

📢 FUNDAMENTALS TO WATCH:

News Impacting GBP/USD

COT Reports

Sentiment Indicators

Macro Trends / Yield Spreads

US Dollar Strength Index (DXY)

UK Economic Reports (CPI, GDP, Rate Decisions)

⚠️ RISK MANAGEMENT TIPS:

🚨 Avoid new entries during news releases

🚨 Use trailing stops during volatility spikes

🚨 Secure running trades before major announcements

🚀 Boost the Robbery – Support the Strategy

💖 Smash that BOOST BUTTON if you're vibing with this setup. Help the Thief crew grow stronger!

Let’s keep milking the market 💸 – one “heist” at a time. Stay dangerous, stay smart.

🔓 NOTE: This isn't investment advice. Just a wild trading idea from a chart outlaw.

Always DYOR – Do Your Own Robbery (Research).

Market conditions shift fast. Stay alert, adapt, and respect your capital.

#ForexThiefStyle #CableHeist #GBPUSDShort #SmartMoneyMoves #LiquidityHunters #ChartOutlaws #TradingRebels #DayTradeLife #ScalpersParadise #ForexGang #FXHeistPlans

Fundamental Market Analysis for July 31, 2025 GBPUSDGBPUSD:

The pound remains under pressure as consumer spending and the labor market in the UK are weakening, reducing the likelihood of an aggressive response from the Bank of England. Core inflation has dropped to 3.3% y/y – the lowest in two years – allowing the regulator to keep rates steady for longer.

External factors are also unfavorable: demand for the defensive dollar is strengthening ahead of the FOMC meeting, and the yield spread between 10-year gilts and USTs has narrowed to 115 basis points – the lowest since March, stimulating flows into the dollar.

Additional negative dynamics come from the rise in the UK current account deficit to 3.9% of GDP, amid higher prices for imported energy and declining exports of services. Expectations of tighter fiscal consolidation are increasing fiscal risks and encouraging investors to reduce long GBP positions.

Risks to the bearish outlook are limited: these would be a surprise in the form of hawkish Bank of England comments or a sharp deterioration in US macro data that could weaken the dollar.

Trade recommendation: SELL 1.32700, SL 1.32900, TP 1.31700

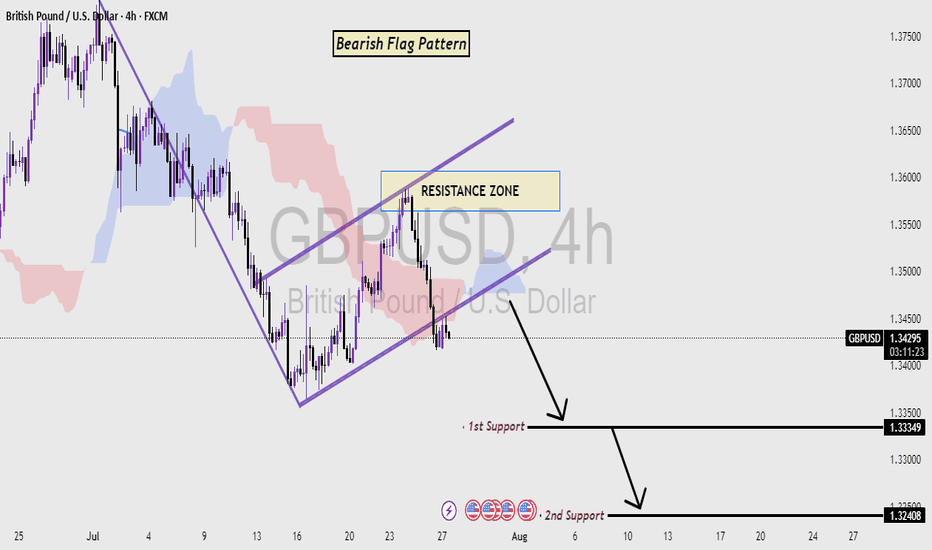

GBP/USD 4H Chart Analysis (Bearish Flag) Read the caption📉 GBP/USD 4H Chart Analysis

Pattern Identified: Bearish Flag Pattern

Timeframe: 4-Hour (4H)

Currency Pair: GBP/USD

🔍 Chart Explanation:

This chart illustrates a classic Bearish Flag Pattern, which is a continuation pattern signaling a potential further decline in price after a temporary consolidation.

Downtrend Leg (Flagpole):

The strong and sharp bearish move on the left side of the chart forms the flagpole, indicating aggressive selling pressure.

Consolidation (Flag Formation):

Price enters a rising channel (the flag) which reflects a short-term corrective phase or pullback. This consolidation occurs within the Resistance Zone, suggesting weakening bullish momentum.

Resistance Zone:

Marked in blue, this zone is where the price struggled to break above, and it acts as a ceiling. Rejection from this zone confirms bearish pressure and increases the likelihood of a breakdown.

Breakdown & Target Levels:

The chart shows that price has broken out downward from the flag pattern, triggering a continuation of the prior downtrend.

Two important support levels are highlighted:

🔸 1st Support: 1.33449 – This is the immediate target where price may pause or react.

🔸 2nd Support: 1.32408 – This is the extended target if selling pressure continues.

Ichimoku Cloud (Background):

The cloud behind the price action represents market sentiment. The red cloud suggests a bearish bias aligning with the flag pattern breakdown.

🧠 Technical Summary:

This setup favors a sell-side outlook. The rejection from resistance within a bearish flag and subsequent breakdown confirm bearish momentum. Traders may look for selling opportunities below the flag breakdown with targets at the mentioned support zones.

GBPUSD – DAILY FORECAST Q3 | W31 | D29 | Y25📊 GBPUSD – DAILY FORECAST

Q3 | W31 | D29 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:GBPUSD