Gold(XAU/USD) at All-Time Highs – Breakout or Blow-Off Top?📊 XAU/USD Daily Technical Analysis – April 2025

Gold has surged to fresh all-time highs, with price currently trading above $2,320 after an explosive rally in recent weeks. The momentum has been relentless, but price action is now approaching a potential inflection zone, where either a continuation or a sharp correction could emerge.

📈 Trend Overview:

The trend on the daily chart is strongly bullish. Since the breakout above the previous all-time high near $2,075 in early March, gold has been in a near-vertical climb, forming successive higher highs with shallow pullbacks.

However, with price now significantly extended from recent bases, and psychological levels being tested, bulls may face their first real challenge in weeks.

🔹 Key Resistance Zones:

$2,325 – $2,345: Immediate resistance zone based on recent price clustering. A decisive break above this could fuel further upside toward…

$2,400: Psychological milestone and potential magnet for bullish momentum if the rally continues.

🔸 Key Support Zones:

$2,280: Minor support from the most recent consolidation zone — the first level to watch if gold pulls back.

$2,240: A more solid support based on previous breakout structure.

$2,180 – $2,200: Major structural demand zone — this is where buyers are most likely to step back in if a deeper correction occurs.

📐 Technical Structures to Watch:

Gold is forming what appears to be a rising wedge on the daily chart — a pattern that often emerges during strong trends but can signal momentum loss or potential reversal when the wedge narrows.

Additionally, recent price action shows signs of stalling candles (small-bodied candles with long wicks), suggesting hesitation or possible profit-taking at current levels.

While there’s no confirmation yet of a reversal, these are early warning signs traders should monitor closely.

🧭 Possible Scenarios:

✅ Bullish Continuation:

If gold breaks and holds above $2,345, the next logical upside target would be $2,400, followed by potential extensions toward $2,450 on high momentum or geopolitical catalysts.

❌ Bearish Pullback:

Failure to break higher — especially with reversal candles — could trigger a retracement toward $2,280 or deeper to $2,240. A breakdown below $2,200 would indicate a more serious correction and likely shift sentiment short-term.

📌 Conclusion:

Gold is in a powerful uptrend, trading at never-before-seen levels. But price is now testing a key zone where momentum could either continue explosively or stall into a correction. Watch for breakout confirmation above $2,345 — or signs of exhaustion below $2,280. Either way, a major move is coming.

💬 Is this the start of Gold 2.0? Or is a correction brewing? Let’s talk below 👇

Gbpusdshort

GBPUSD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish momentum

No opposite signs

Expecting bearish continuation until the two Fibonacci resistance zones hold

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD(20250409)Today's AnalysisMarket news:

The U.S. Customs and Border Protection Agency reiterated that the specific tax rates for each country will be announced at 12:01 a.m. on April 9.

Technical analysis:

Today's buying and selling boundaries:

1.2764

Support and resistance levels:

1.2862

1.2825

1.2802

1.2726

1.2702

1.2666

Trading strategy:

If the price breaks through 1.2802, consider buying, the first target price is 1.2825

If the price breaks through 1.2764, consider selling, the first target price is 1.2726

GBPUSD I may have entered too early.. But im not backing out yet!

Observations from the Data

Trend Confirmation via Moving Averages: Several key moving averages and trend indicators (EMA at 1.30829, DEMA, HT Trendline at 1.31043, KAMA, Linear Regression) are positioned well above the current market level of 1.28234. This indicates that, on an hourly basis, the longer-term trend remains bearish.

Directional Indicators: The directional movement figures are very telling. With PLUS_DI at about 4.97 and MINUS_DI at around 31.38, sellers clearly dominate the market. A low DI(+) against a high DI(–) reinforces that the overall bias is to the downside.

Momentum & Oscillators:

The RSI is extremely low at ~15, indicating an oversold condition. In isolation, this might hint at a potential short-term bounce.

However, other momentum indicators, such as the Chande Momentum Oscillator (-70.09) and a slightly negative MACD (-0.00185), suggest that the underlying bearish momentum has been strong.

Oscillators like Williams %R (at -89.21) further underscore that the market is deep into oversold territory.

Volatility Metrics: An ATR of 0.0043 and relatively low standard deviation indicate modest volatility, meaning your stop-loss and target levels can be measured with reasonable precision.

Context and Rationale

Overall Trend: The majority of your trend-following indicators (e.g., EMA, DEMA, HT Trendline, KAMA) are positioned higher, confirming a prevailing bearish bias. Even though the RSI shows an extreme oversold reading (around 15), in a strong downtrend like this, oversold conditions can simply trigger a temporary bounce rather than a reversal. My sell entry at 1.27752 aligns with staying in the trend.

Directional Pressure: With the MINUS_DI (31.38) greatly outweighing the PLUS_DI (4.97), the directional movement clearly favors sellers. My entry at 1.27752 positions me within this selling pressure, assuming the bounce to fail and the downtrend to resume.

Entry Timing: Instead of waiting for a higher bounce ideal for a pullback short, my entry at 1.27752 suggests that I chose to capture a move early in the downswing or perhaps because price action broke a key support level. This could be advantageous if momentum continues as anticipated.

Why This Trade Setup Works

Alignment with Trend: Maintaining a sell position aligns with the overall bearish structure indicated by your moving averages and directional indicators.

Captchaing a Bounce Rejection: Even if a short-term bounce occurs from oversold conditions, your entry near 1.27752 could capture the early phase of a bearish continuation provided that the rally fails to sustain.

Confluence of Technical Signals: The combination of oversold conditions (which in a downtrend often predict a short-lived bounce) and the strong directional indication from MINUS_DI and related momentum oscillators creates a setup where a rejection of a minor recovery can lead to further downside moves.

GBPUSD Watch – Bearish Momentum Building Below Supply ZoneGBPUSD pair has broken sharply below the long-standing accumulation range between 1.2857 – 1.3012, signaling a shift in market sentiment. The recent bearish engulfing structure has pushed price into a corrective pullback phase, with sellers likely to re-enter on rallies.

Key Technical Levels:

Current Price: 1.2795

Resistance (Supply Zone): 1.2857 – 1.2863

First Support Target: 1.2688 – 1.2690

Mid-Level Target: 1.2568 – 1.2570

Final Bearish Target: 1.2383 – 1.2390 (demand zone & key support)

Trade Scenario:

📉 Bearish Bias:

Price is expected to retrace into the supply zone (1.2857–1.2863) and then reject.

If resistance holds and structure remains intact, expect continuation toward:

TP1: 1.2689

TP2: 1.2568

TP3: 1.2385

🔁 Invalidation Zone:

A sustained break and close above 1.2863 would invalidate the bearish setup and could trigger a move toward 1.3012.

Technical Confluence:

✅ Previous consolidation turned into a strong resistance zone

✅ Bearish breakout from range

✅ Clean lower highs and lower lows structure

✅ Volume drop on the pullback (likely a corrective move)

Lets Talk about GBPUSD..Trade Setup: Short GBP/USD

Entry: Sell now!

Stop Loss: Place your stop just above the recent intraday swing high. A level around 1.2790 offers a buffer in case of whipsaw moves.

Take Profit: With the risk defined by the difference between 1.2790 and your entry near 1.2725 (approximately 0.0065, or 65 pips), aiming for a reward roughly twice that size can be attractive. Setting a target near 1.2580 gives you a risk/reward ratio around 1:2.2. This level is in the vicinity of prior support from the day’s price action.

Rationale

Technical Overbought Signals: The elevated RSI, Stochastic, CCI, and Ultimate Oscillator values suggest that buyers might be exhausted and a pullback is due. With oscillators teetering in the overbought zone, the market’s momentum appears at risk of reversing.

Directional Indicators: The fact that the minus DI is significantly higher than the plus DI indicates that downward pressure is gaining strength, even though the ADX (≈21.65) and ADXR (≈23.32) hint that the trend isn’t yet fully solidified. This sets the stage for a potential reversal from an overextended area.

Price Action & Key Levels: Today’s price action has been squeezed into a narrow range with support clustered around 1.272–1.273 (supported by DEMA and SAR levels). A confirmed break below this zone would likely trigger further selling into established support areas.

Fundamental Surprises: With the mix of U.S. and U.K. fundamentals on the horizon this week, be mindful of possible volatility. If, for example, UK data comes in stronger than expected, it might buoy the GBP despite the technical caution—at which point you might re-assess or even consider a counter-trend long if the pullback reverses.

GBPUSD(20250408)Today's AnalysisToday's buying and selling boundaries:

1.2787

Support and resistance levels:

1.3011

1.2927

1.2873

1.2701

1.2647

1.2564

Trading strategy:

If the price breaks through 1.2787, consider buying, the first target price is 1.2873

If the price breaks through 1.2701, consider selling, the first target price is 1.2647

GBP/USD Bearish Setup – FVG Retracement to Target Liquidity ZoneThis chart shows a bearish price setup for GBP/USD on the 1-hour timeframe, with smart money concepts, key EMAs, and a clear projection of price movement.

🔍 Technical Analysis Breakdown

1. Price Context

Current Price: 1.28987

Trend: Price has broken market structure to the downside, suggesting a potential shift from bullish to bearish.

Key Indicator Levels:

EMA 30 (Red): 1.29948 – now acting as dynamic resistance.

EMA 200 (Blue): 1.29760 – another strong resistance level just above.

📌 Key Zones Identified

🔵 Fair Value Gap (FVG) – Supply Zone

Location: Between ~1.29760 and 1.30172

Significance: This is a potential liquidity zone where institutions might offload positions.

Plan: Price is expected to retrace up into this FVG before continuing lower.

🔻 Target Zone – Demand Area

Location: Around 1.27396

Labeled: “target point EA”

Significance: This area is projected as the final bearish target, likely aligning with equal lows or liquidity zones.

CHoCH (Change of Character)

Visible at the structure break, confirming bearish intent and a shift in momentum.

🧠 Projected Price Action (In Blue Arrows)

A potential retracement to the FVG zone.

Rejection from this zone.

Continuation to the downside through intermediate pullbacks.

Final target at 1.27396.

🛠️ Trade Idea Summary

Sell Setup:

Entry Zone: 1.29760–1.30172 (FVG)

Target: 1.27396

Stop-Loss: Above 1.30172 (safely outside the FVG)

🧾 Conclusion

This setup aligns with smart money principles — a CHoCH followed by a retracement into an FVG, with downside continuation into a liquidity target zone. The EMAs support the bearish thesis, offering confluence for rejection.

EURUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD DAILY TIMEFRAME UPDATESHello folks, this is my daily timeframe analysis on GU, this idea base on the retracements, the zone above would be our stop loss.

The target are indicated xxx below.

Entry at daily see chart above.

this is only my view on daily timeframe.

Good luck. stop loss above the zone. pewwpeww

GBPUSD A clear downward move toward downside find out the targetHello Guys,

Wish you and Your Family a Very Happy Eid.

I Found out one very easy to target GBPUSD trade setup for the week . here i can see GBPUSD is building a short term wave towards downside to target 1.2780 or below .

As we have created a Higher time frame OTE model

GBPUSD 4H SHORT [UPdate]In line with expectations of a decline in GBPUSD, the price interacted with the primary order block. To feel safe in this position, I move the stop order to $1.29620

I expect the downward trend I mentioned in the main review to continue to my targets:

$1.28609

$1.28030

$1.27534

$1.26722

GBPUSD Be bullishWhen the GBPUSD pair executes a definitive breach of the 1.30000 resistance ceiling — a level of both psychological and technical significance — it is poised to precipitate a substantial influx of bullish sentiment. This event not only satisfies key technical prerequisites for an upward price trajectory but also catalyzes a profound shift in market sentiment.

Consequentially, diverse market participants, ranging from institutional hedge funds to high - volume forex dealers and astute retail investors, will be drawn to the market, precipitating a marked upswing in trading volumes. The resultant robust buying momentum is forecast to drive the formation of a pronounced uptrend, propelling the pair to appreciably higher price levels.

From a forward - looking perspective, resistance levels at 1.31400 and 1.32100 are likely demarcated by prior price action, Fibonacci retracement ratios, or psychologically significant thresholds. As the pair gravitates towards these levels, short - term traders who previously established short positions at higher price points will likely execute mass short - covering, inundating the market with selling pressure.

Simultaneously, long - term bulls seeking to realize profits will contribute to the selling pressure, further exacerbating the downward - leaning market dynamics. These converging forces may well impede the pair’s upward progression and potentially instigate a short - term price correction.

Should the GBPUSD pair fail to surmount the 1.30000 resistance hurdle and commence a retracement, the 1.28800 level — identified as a zone of prior price congestion or corroborated by key technical indicators — is anticipated to attract value - seeking buyers. The influx of buying interest at this level may effectively arrest the downward momentum.

Deeper into the price spectrum, the 1.27000 level, which aligns with major moving averages or critical trendlines, functions as a pivotal line of defense. Given its status as a widely recognized strong support zone, a substantial influx of buying pressure is likely to materialize as the price approaches this level, thereby forestalling a more significant price decline and fostering market stability.

💎💎💎 GBPUSD 💎💎💎

🎁 Buy@1.28800 - 1.29000

🎁 TP 1.30000 - 1.31400

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

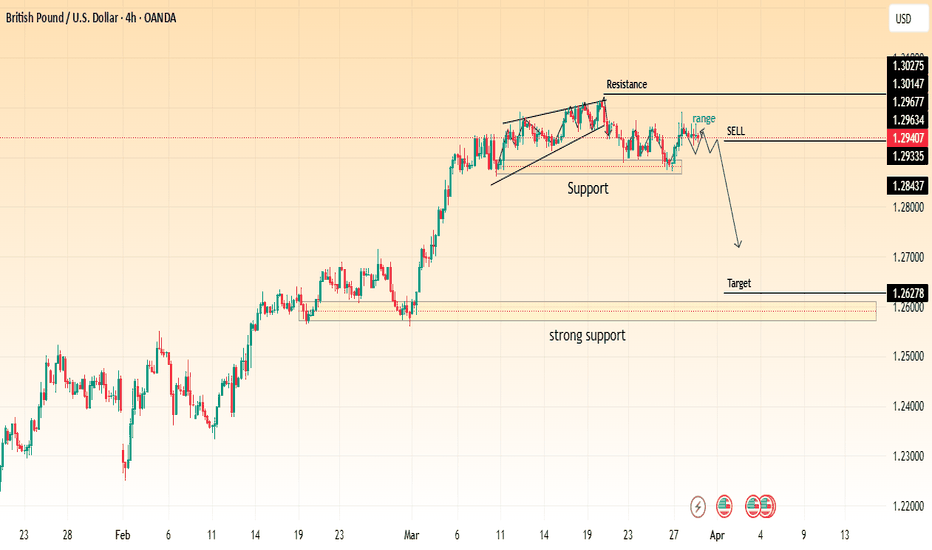

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

GBPUSD | APRIL 2025 FORECAST | Chopping Block is Hot!GBP/USD is approaching the psychological 1.3000 level, a key battleground for bulls and bears. The pair has been trading within a rising channel, but recent price action suggests momentum could be shifting.

🔹 Trend & Structure: GBP/USD remains in a broader uptrend but is struggling to maintain bullish momentum above 1.3000. A confirmed break could signal continuation, while rejection may trigger a retracement toward 1.2800-1.2750.

🔹 Technical Outlook:

Support Levels: 1.2850, 1.2750

Resistance Levels: 1.3050, 1.3150

Indicators: RSI hovers near 65, signaling slight overextension; MACD shows bullish momentum but weakening.

🔹 Fundamental Factors:

BOE policy expectations vs. Fed’s stance on rate cuts.

US & UK economic data—watch CPI and employment figures.

If GBP/USD clears and holds above 1.3000, it could open doors for a rally toward 1.3150. But if sellers defend this level, we might see a pullback toward 1.2850-1.2750 before the next move.

Will 1.3000 hold, or is a reversal on the horizon? Drop your predictions below! 📉📈 #GBPUSD #ForexTrading #MarketAnalysis

GBPUSD(20250328)Today's AnalysisToday's buy and sell boundaries: 1.2936

Support and resistance levels:

1.3057

1.3012

1.2983

1.2890

1.2861

1.2816

Trading strategy:

If the price breaks through 1.2983, consider buying, the first target price is 1.3012

If the price breaks through 1.2936, consider selling, the first target price is 1.2890

GBPUSD 4H SHORTAt the moment, GBPUSDT the asset is being marked down. There was a price reaction to the POI range from which a reaction was received instantly. I missed this moment due to personal matters, although there was a reminder. I understand that the risk of not opening, or the receipt of new variables from the market, can break the trend, but I will try to open a short from the designated mark 1.29686$

Targets

$1.28609

$1.28030

$1.27534

$1.26722

Risk for stop order -1%

GBP/USD Breakdown – Bearish Momentum Ahead?This 4-hour chart of GBP/USD shows a clear bearish setup:

🔹 Rising Wedge Breakdown – The pair has broken below a rising wedge pattern, signaling potential downside pressure.

🔹 Support and Resistance Levels –

Resistance at 1.29206 - 1.30275

Support at 1.28000 - 1.28437

Strong support at 1.27539

🔹 Sell Confirmation – A sell signal is indicated, suggesting further downside movement towards the target zone.

📉 Trading Plan:

✅ Possible short entries below the 1.28956 level.

✅ Target price: 1.27539

✅ Stop-loss above 1.29206 for risk management.

⚠️ Risk Note: Always manage risk properly and watch for any trend reversals before entering trades.

What are your thoughts? Are you bearish or bullish on GBP/USD? 🤔💬

GBP/USD: Struggles at Resistance, Risks of Weak Oscillation PersDuring the European session on Tuesday, GBP/USD held steady above 1.29000. However, the technical outlook maintained a bearish bias. The US dollar strengthened due to upbeat data, suppressing the rebound of the British pound. The exchange rate faced resistance at key resistance levels when attempting to rise.

If it fails to break through these resistance levels, in the short term, it may continue the weak, oscillatory downward trend, and the downside risks still remain. The market lacks strong momentum, and overall, it stays in a weak, oscillatory pattern.

GBPUSD

sell@1.29600-1.29900

tp:1.28800

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.