Gbpusdshort

Mon 24th Mar 2025 GBP/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/USD Sell. Enjoy the day all. Cheers. Jim

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

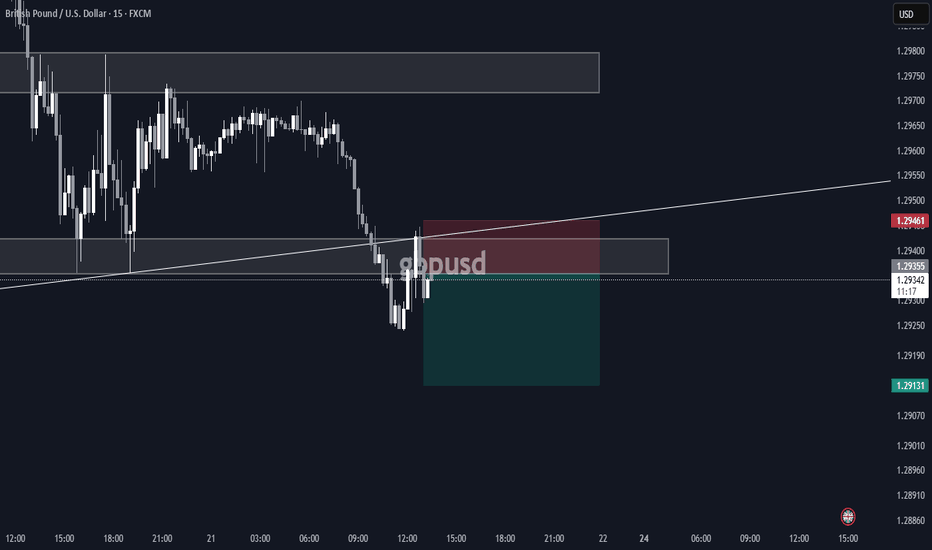

GBP/USD: Weekly Analysis and Key LevelsThis week, the GBP/USD exchange rate has experienced notable fluctuations. As of March 22nd, the pair stood at 1.29114, down 0.00540 (0.42%) from the previous day. The intraday high reached 1.2971, while the low touched 1.2887. On Thursday (March 20th), the Bank of England announced its interest rate decision, keeping the benchmark rate unchanged at 4.5% with an 8-1 vote. Following the announcement, GBP/USD faced brief downward pressure as the central bank did not signal potential rate cuts. However, the pair later regained some ground due to a weakening US dollar index.

Closely monitor the breakout of key levels. The area above 1.3010 is a significant resistance level. If the exchange rate can decisively break through and stabilize above this level, consider going long on dips in the short term, targeting 1.3050 or higher. Below, the 1.2860 level is a crucial support zone. If the exchange rate breaks below this level and sustains the move, consider cutting losses or going short on rallies, as further downside potential may open up. Until the exchange rate clearly breaks through or falls below these key levels, it is advisable to remain on the sidelines and wait for clear trend signals to emerge.

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

GBP/USD Breaks Rising Channel – Bearish Target Ahead!Key Observations:

Rising Channel: The price was trading within an ascending channel, bouncing between resistance and support.

Breakout & Sell Signal: The price has broken below the channel support, indicating a potential trend reversal.

Bearish Target: The next key support level is around 1.27024, aligning with a previous demand zone.

Confirmation: If the price stays below 1.29165, further downside movement is likely.

Trading Idea:

Short Entry: After confirmation of a breakdown below support.

Target: 1.27024 (next major support level).

Stop Loss: Above 1.30127 (previous resistance).

This setup suggests bearish momentum as long as the price remains below the broken support. Traders should watch for retests and volume confirmation.

Short-selling strategy for GBPUSDThe one - hour chart of GBPUSD indicates that the current price is 1.29750, with the market showing potential bearish sentiment. The 1.30000 level acts as a key resistance zone, with multiple support levels below. If the price fails to break through this resistance, a decline is likely.

GBPUSD

sell@1.29600-1.30000

tp:1.28500

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

GBP/USD – Potential Pullback from ResistanceChart Overview:

The 4-hour GBP/USD chart shows a strong uptrend contained within a rising channel.

The price has recently reached the upper boundary of the channel and is showing signs of rejection, indicating a possible pullback.

A downside move towards 1.27736 is anticipated, which aligns with a key support level.

Technical Outlook:

If the price respects the resistance zone, a retracement toward the 1.27736 target could be expected.

A confirmed break below this level could open the door for further downside.

However, if bullish momentum resumes, the price may attempt to break above the 1.3000 psychological level.

Trading Plan:

Short-term traders may look for selling opportunities targeting 1.27736.

Long-term traders may wait for a bullish reaction at support for potential continuation of the uptrend.

Key Levels:

Current Price: 1.29574

Support Target: 1.27736

Resistance: 1.3000

Would you like to add further details or modify the description

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GbpUsd is approaching a strong sell zoneExactly one week ago, I pointed out that while TRADENATION:GBPUSD strength persists, the pair is approaching a significant sell zone , starting at the psychological level of 1.30.

This level was touched recently, and the pair is currently fluctuating within this range now.

My view remains the same: GBP/USD is likely to experience a drop in the near future, and I’m now looking for potential entries for a swing trade.

As mentioned before, 1.30 is a key psychological level, with the technical resistance just above it at 1.3050. Additionally, GBP/USD is known for its volatility, and this resistance zone extends slightly above 1.31.

In conclusion, traders should consider selling rallies, with a target around 1.27, aiming for at least a 1:2 risk-to-reward ratio when setting their stop loss.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GBP/USD - 4H Chart Analysis & Trade Setup

Market Overview:

GBP/USD has been in an uptrend, forming a rising channel structure.

The price is now testing a resistance zone, potentially indicating a reversal.

Technical Analysis:

Trend: Bullish (but approaching key resistance)

Resistance Level: 1.29720 - 1.30000 (Highlighted Zone)

Support Level: 1.24906 (Potential target)

Stop Loss: 1.30970 (Above resistance)

Pattern: Rising Channel Breakout Setup

Trade Idea (Short Setup):

🔴 Sell Entry: Near 1.29720 (Resistance rejection confirmation)

✅ Target: 1.24906 (Major support zone)

⛔ Stop Loss: 1.30970 (Above resistance to avoid fakeouts)

Conclusion:

GBP/USD is testing key resistance and may face bearish rejection.

A break below the channel confirms bearish momentum towards 1.24906.

Traders may consider short positions with a defined risk-reward setup.

📉 Bearish bias unless price breaks above resistance.

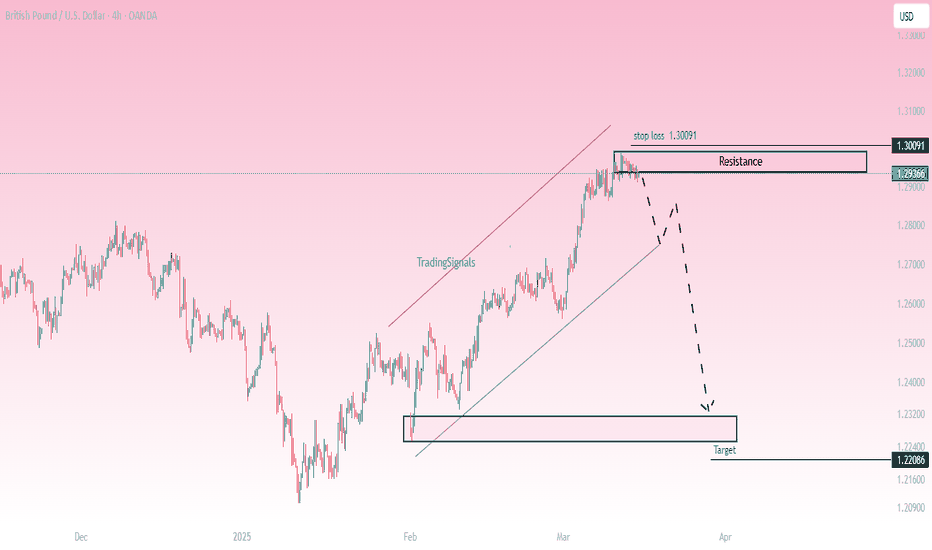

GBP/USD - Potential Bearish Reversal Setup

📉Market Structure:

The pair has been in an uptrend, forming a rising channel. However, price is now facing strong resistance around 1.2936 - 1.3009, showing signs of exhaustion. A potential reversal could be forming.

🔍 Key Levels:

Resistance Zone: 1.2936 - 1.3009

Current Price: 1.2936

Target Support: 1.2208

📊 Trade Idea:

A rejection from the resistance zone could initiate a bearish move.

A confirmed breakdown below 1.2900 may trigger further downside toward the 1.2208 target zone.

Stop-loss placed above the 1.3009 resistance to manage risk.

🚨 Confirmation & Risk Management:

Bearish Confirmation: Rejection from resistance with strong selling momentum.

Invalidation: A breakout above 1.3009, indicating bullish continuation.

Risk Management: Stop-loss at 1.3009 with a favorable risk-to-reward ratio.

This setup suggests a short opportunity if price respects resistance and begins a downward move. Traders should watch for confirmation signals before entering.

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

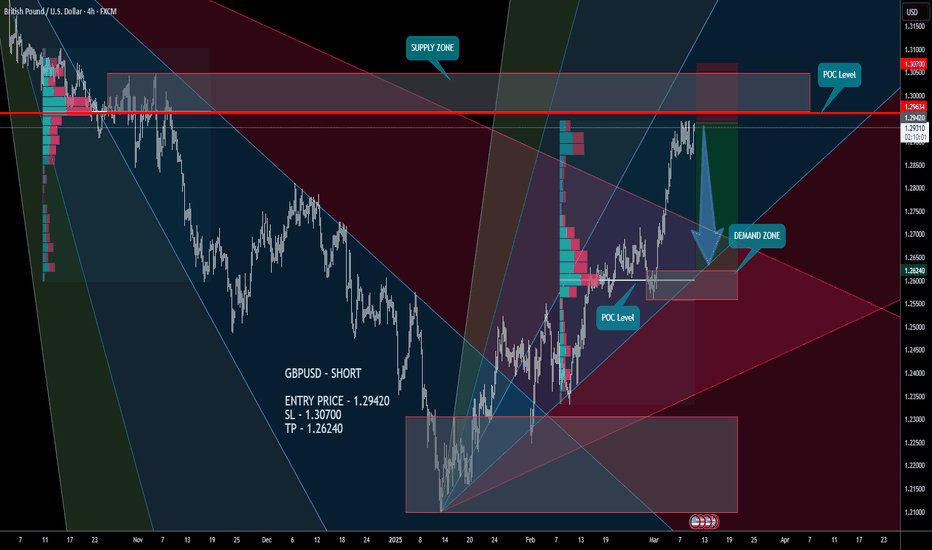

GBPUSD SHORTOn the weekly time frame, the first blue line is in a very attractive price range where we are likely to see a trend reversal, even a small one. This reversal can be up to 4%. I have 2 ranges above, the sacred 86 line and the range ceiling line. The POC time band is also in this area and overall it is a very good area and worth the risk. Please enter the trade on the trend reversal. I will update this position again and give an entry point when the trend wants to reverse.

GBPUSD - SHORTConsider the development of a strong South Impulse. Sell on a false breakout or current price level! Target the lower Demand Zone.

GBPUSD - SHORT

ENTRY PRICE - 1.29420

SL - 1.30700

TP - 1.26240

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

#GBPUSD 4HGBPUSD (4H Timeframe) Analysis

Market Structure:

The price is currently trading near a key resistance area, where previous selling pressure has been observed. This level has historically acted as a barrier, rejecting upward movements and leading to price declines.

Forecast:

A sell opportunity is anticipated from the resistance area if the price shows signs of rejection, such as bearish candlestick patterns or a decrease in buying momentum.

Key Levels to Watch:

- Entry Zone: Consider entering a sell position if the price fails to break above the resistance and confirms rejection.

- Risk Management:

- Stop Loss: Placed above the resistance area or recent swing high to manage risk.

- Take Profit: Target nearby support levels for potential downside movement.

Market Sentiment:

The resistance area is a critical zone to monitor for potential price reversal. Confirmation through bearish signals is recommended before executing a trade.

GBP/USD Breakout Confirmation – Next Move to 1.3068?Eye-Catching Heading:

Description:

GBP/USD has broken out of a falling wedge pattern, signaling a potential bullish continuation. The breakout aligns with strong momentum, and we are now observing a retracement before the next leg higher.

Key levels to watch:

Support Zone: 1.2880 - 1.2854 (marked in red)

Target Zone: 1.3068 (highlighted in green)

The price is currently in a pullback phase, which could offer a great buying opportunity before the next bullish wave towards the 1.3068 level. Confirmation of a higher low in the gray zone could validate further upside movement.

What are your thoughts on this setup

GBP/USD Double Top (11.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Double Top Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2784

2nd Support – 1.2724

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

SHORT ON GBPUSDGBPUSD has reached a key supply area and has given a change of character from up to down on the hour timeframe.

There is plenty imbalance/fvgs to the downside that I expect price to go and fill.

The Dollar Index is currently shifting to up from down, this should aid in this pair falling.

I will be selling GBPUSD to the next demand level for 300 pips.