Gbpusdtrade

GBP/USD Continues to Navigate DownAnd it remains bearish, targeting $1.23.

Short-Term Price Action Sub $1.24

Despite efforts to shape support from the $1.24 region, recent hours witnessed price elbow beneath the psychological level. This followed a near-pip-perfect H1 AB=CD harmonic bearish formation taking form at $1.2467 (denoted by a 100% projection ratio), a base that was bolstered by a H1 trendline support-turned-resistance taken from the low $1.2392. Downside support can be seen nearby at $1.2356, with a break paving the way for follow-through selling towards $1.23.

GBP/USD is losing ground as traders react to inflation reports from UK. Inflation Rate declined from 10.1% in March to 8.7% in April, compared to analyst consensus of 8.2%. Core Inflation Rate increased from 6.2% to 6.8%, so the BoE will have to raise rates at the next meeting to fight inflation.

In case GBP/USD settles below the support at 1.2345, it will move towards the next support level at 1.2300. A successful test of this level will push GBP/USD towards the support at 1.2275.

R1:1.2370 – R2:1.2410 – R3:1.2440

S1:1.2345 – S2:1.2300 – S3:1.2275

View from Higher Timeframes Show Scope for Further Downside

The bigger picture continues to put forth a bearish bias. The weekly timeframe recently tested a major long-term trendline resistance drawn from the high of $1.4250, placing weekly support at $1.1851 in view as a potential long-term support target.

Aiding the weekly timeframe’s resistance, an additional layer of resistance made its way into the frame at $1.2638 on the daily chart in mid-May. This has positioned daily support at $1.2272 on the radar and pulled the Relative Strength Index (RSI) south of the 50.00 centreline towards indicator support at 37.78.

In the United Kingdom, the most important categories in the consumer price index are Transport (16 percent of the total weight) and Recreation and Culture (15 percent). Housing, Water, Electricity, Gas and Other Fuels accounts for 13 percent; Restaurants and Hotels for 12 percent and Food and Non-alcoholic Beverages for 10 percent. The index also includes: Miscellaneous Goods and Services (9 percent); Clothing and Footwear (7 percent); Furniture, Household Equipment and Maintenance (6 percent). Alcoholic Beverages and Tobacco; Health, Communication and Education account for remaining 11 percent of total weight.

The consumer price inflation in the UK fell to 8.7% year-on-year in April 2023, the lowest since March 2022, due to a sharp slowdown in electricity and gas prices. Still, the inflation rate exceeded market expectations of 8.2% and remained well above the Bank of England's target of 2.0%. Housing & utilities inflation dropped to 12.3% from 26.1% in March, with the cost for electricity, gas & other fuels increasing 24.3%, compared with 85.6% the month before. Prices have also advanced at a slower pace for restaurants & hotels (10.2% vs 11.3%) and furniture, household equipment & maintenance (7.5% vs 8.0%). Meanwhile, food & non-alcoholic beverages inflation remained close to March's record high (19.0% vs 19.1%), while cost accelerated for transport (1.5% vs 0.8%), recreation & culture (6.3% vs 4.6%) and miscellaneous goods & services (6.8% vs 6.7%). The core rate, which excludes food and energy, jumped to 6.8%, the highest since March 1992 and above well forecasts of 6.2%.

Given the scope to post additional underperformance, GBP/USD is likely to cross beneath H1 support from $1.2356 and target $1.23, followed by daily support mentioned above at $1.2272. A H1 close lower, therefore, could ignite breakout selling.

GBPUSD Analysis 10July2021GBPUSD is still in accordance with the last analysis. the trend looks bullish. now the price has reached fibo expansion 1. the length of wave 5 is the same as wave 3. if the price today can form a new HH, then there is a high probability that the price will form a bullish continuation again.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPUSD - Bullish price action ✅Hello traders!

‼️ This is my perspective on GBPUSD.

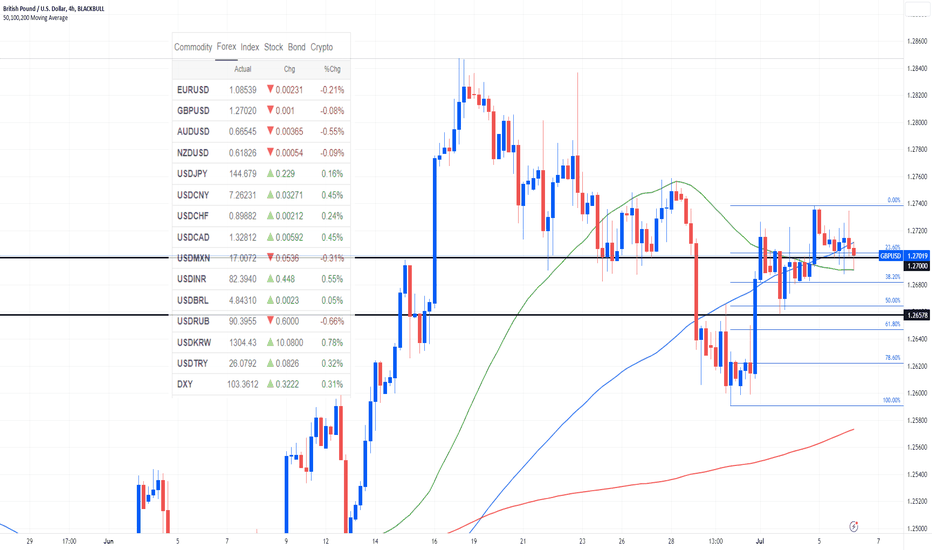

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I am looking for longs. I see bullish continuation as price rejected from bullish order block + institutional mid figure 1.27500.

Fundamental analysis: This week we have a lot of news on GBP and USD. On Wednesday will be released monthly and yearly CPI on USD, as well on Thursday monthly PPI on USD and monthly GDP on GBP. Pay attention to the results in order to validate the analysis.

Like, comment and subscribe to be in touch with my content!

GBP/USD about to fall after NFP?Dear traders, we saw some whipsaw moves in GBP/USD yesterday during

the ADP data. With NFP data coming out in a few hours, expect a similar

move today as well.

During the NFP data release, if GBP/USD climbs to either of the supply levels

indicated in my chart, I would consider selling GBP/USD with long-term TP at

1.2470.

GBPUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

FOMC Minutes in the Charts: EUR/USD & GBP/USDDuring their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

GBP/USD daily chart analysis, potential for a 250 Pip fallDear traders, if you look the daily chart in GBP/USD, the last few candlesticks

indicate that the bullish momentum is fading. Wicks at the top of the last three

candles indicate mounting bearish pressure.

Based on this, we can consider sell entries in GBP/USD@1.2730-1.2750

with SL above 1.2780 and TP at 1.2460 .

GBP/USD daily chart analysis : 1.2450 on the cards?Dear traders, in the daily chart of GBP/USD, we can see that the bullish

momentum has faded in the last 6-7 days. After hitting the 1.2830 level, price

is slowly retreating.

Yesterday's daily candle is a long-legged doji which indicates indecision in the market .

However, looking at the price action it seems 1.2720 is now a solid resistance in the

hourly chart .

So, as long as price stays below the 1.2720 level, GBP/USD can fall further to 1.26 and

eventually to 1.2450 level.

GbpUsd could test the recent high (Confirmation needed)After the recent high just under 1.29, GbpUsd started to drop, however, this drop hasn't altered the bullish trend that started at the end of May, and on Friday the pair reversed just from the trendline support.

The pair could resume its up move, but considering the price staled at the falling trend line resistance, confirmation is needed.

I'm slightly bullish as long as 1.26 is holding