Gc1!!

XAUUSD: 1H Channel Up bottomed and is rebounding for the new HHGold is neutral on its 1H technical outlook (RSI = 52.820, MACD = 3.110, ADX = 23.525) and as it just crossed under its 1H MA50 and rebounded, we have the conditions for the new bullish wave of the short term Channel Up. We are aiming for another +4.45% rise (TP = 3,425).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Markets revolve around US-China, GOLD seeks new peaksAs Powell's warnings about the impact of the trade war increased market volatility, US stocks and the US dollar fell sharply and gold prices hit new highs.

Powell warned that the central bank may have less flexibility to quickly mitigate the economic impact of President Donald Trump's trade war, comments that sent stocks lower on Wednesday. Powell reiterated that the Fed is in no rush to cut interest rates and that it would be "better to wait until the situation becomes clearer before considering any adjustments to the policy stance." He also acknowledged that the Fed could face a difficult situation where its two policy goals of price stability and maximum employment conflict, as Trump's tariffs could push up U.S. inflation and slow economic growth.

OANDA:XAUUSD have risen nearly $700/ounce, or nearly 28%, this year, driven by tariff disputes, expectations of interest rate cuts and strong central bank buying, outpacing the 27% gain in 2024.

Gold prices have continued to rise as the escalating trade war raises concerns of a global recession. At the same time, the Trump administration is preparing to pressure other countries to limit trade with China in response to US tariffs in US-China trade talks.

U.S. President Donald Trump on Tuesday ordered an investigation into possible tariffs on all critical minerals imported into the United States, marking a new escalation in his dispute with global trading partners and an effort to pressure China. The latest escalation in tensions between the world’s two largest economies has hurt sentiment in financial markets overall, sending investors fleeing to safe-haven assets like gold.

However, a profit-taking or positive developments in US-China trade relations could trigger a sell-off. Therefore, readers/traders need to closely monitor developments surrounding the trade war to make timely changes in their trading plans to suit the market context.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold continues to find and renew all-time highs with an absolutely supported uptrend in both the short, medium and long term. In the long term, the price channel will be set as the main trend with the main support from EMA21, while in the short term, gold is still in an uptrend with support from the 0.382% Fibonacci extension levels and the raw price point of 3,300USD right after.

In terms of momentum, the Relative Strength Index (RSI) is entering the overbought zone, a downward RSI below 80 would be considered a signal for a possible correction. Going forward, the trend and outlook for gold prices remain bullish, and declines should only be considered short-term corrections.

But this note will be important, in a market where assets (Gold) are overbought, making them a bubble, any correction will cause serious selling sentiment. As in the current context, we cannot know when the US-China war will cool down, and any positive move around this war will cause selling sentiment in the gold market, which is considered a traditional safe haven asset.

During the day, the bullish outlook for gold prices will be listed again by the following positions.

Support: 3,303 – 3,300 USD

Resistance: 3,337 – 3,371 USD

SELL XAUUSD PRICE 3396 - 3394⚡️

↠↠ Stop Loss 3400

→Take Profit 1 3388

↨

→Take Profit 2 3382

BUY XAUUSD PRICE 3309 - 3311⚡️

↠↠ Stop Loss 3305

→Take Profit 1 3317

↨

→Take Profit 2 3323

GOLD soars over $50, heading for new ATHSpot OANDA:XAUUSD surged, with an intraday gain of more than $50, now trading around $3,281/oz to fresh all-time highs.

OANDA:XAUUSD hit a record high as the Trump administration launched investigations that could widen the trade war, boosting demand for safe-haven assets, Bloomberg reported on Wednesday. U.S. President Donald Trump on Tuesday launched an investigation into the need to impose tariffs on critical minerals, the latest move in the widening trade war.

According to a White House fact sheet, the executive order signed by Trump on Tuesday directs the secretary of commerce to initiate a Section 232 investigation under the Trade Expansion Act of 1962 to “assess the impact of imports of these materials on the security and resilience of the United States.”

On Wednesday, gold traders will focus on U.S. retail sales data for March, as well as speeches from Federal Reserve officials, primarily Chairman Jerome Powell.

Technical Outlook Analysis OANDA:XAUUSD

After gaining support from the 3,200USD price level, which is an important support for readers to pay attention to in the weekly publication, gold has skyrocketed towards the weekly target level of 3,295USD.

Currently, there is no resistance that can prevent the gold price from heading towards 3,295USD, and the uptrend is still absolutely dominant on the technical chart.

In terms of momentum, the Relative Strength Index is just approaching the overbought zone and is not giving any signal of a possible correction in the short term. Therefore, in terms of momentum, gold can still continue to increase in price.

During the day, the upward trend of gold prices will be noticed again at the following positions.

Support: 3,245 – 3,223 – 3,200 USD

Resistance: 3,295 – 3,300 USD

SELL XAUUSD PRICE 3315 - 3313⚡️

↠↠ Stop Loss 3319

→Take Profit 1 3307

↨

→Take Profit 2 3301

BUY XAUUSD PRICE 3223 - 3225⚡️

↠↠ Stop Loss 3219

→Take Profit 1 3231

↨

→Take Profit 2 3237

Unpopular opinion, but I think it's time to short GoldThis melt-up is approaching resistance, and the symmetry on the chart is compelling. It could set up a great short opportunity as gold consolidates ahead of its next major move higher, likely in 2027.

However, if it breaks out of the current channel, we could be entering a true melt-up phase — and there's potential for significantly higher prices.

XAUUSD Reversal imminent. Potential short-term top reached.Gold (XAUUSD) hit the 1-month Higher Highs trend-line and has started to form a short-term Top. The last two short-term High sequences peaked on the 2nd High and pulled-back to at least the 4H MA50 (blue trend-line).

The peak formation on the 4H RSI of those two sequences was demonstrated with Lower Highs. Similarly the most optimal short-term buy was when the 4H RSI got oversold below 30.00. At the same time, the price hit the 4H MA200 (orange trend-line).

But for now, the best action is to sell and take profit when the price makes contact with the 4H MA50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I would take valid buy setups in Gold, but not in Silver. I would prefer sells in Silver. Trade one, not both. The stronger for buys and the weaker for sells.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Trade tensions escalate, GOLD receives support to break $3,200As trade tensions escalated, market risk sentiment suddenly spiked, with spot OANDA:XAUUSD surging above $3,200.

Data released on Thursday in the United States showed that the consumer price index (CPI) unexpectedly fell in March.

Data showed that the US CPI fell 0.1% month-on-month in March, the first decline in nearly five years, compared to expectations of 0.1% and the previous reading of 0.2%.

In addition, the US CPI rose 2.4% year-on-year in March, lower than the expected 2.5% and the previous reading of 2.8%; the US core CPI rose 2.8% year-on-year in March, lower than the expected 3% and the previous reading of 3.1%.

After the US CPI data was released, traders bet that the Federal Reserve will cut interest rates again in June, potentially totaling 100 basis points of rate cuts by the end of the year. Low interest rates are generally beneficial for gold because the metal does not pay interest.

Gold prices continued to rise above $3,200 an ounce in early trading in Asia on Friday, breaking the record set in the previous trading day.

Gold prices hit a new high as investors turned to safe-haven assets amid concerns about the impact of tariffs on the global economy, Bloomberg reported on Friday.

Gold’s safe-haven status has been hit again this week, Bloomberg reported. US President Trump’s erratic rhetoric on his tariff agenda has sparked a sell-off in stocks, bonds and the US dollar, as concerns about a global recession spread across Wall Street.

Even after Trump announced a 90-day pause on tariffs on dozens of trading partners, risks and uncertainties remain, with tariffs on all imports from China now at a rate of at least 145%.

The White House clarified to CNBC at noon ET on Thursday that the Trump administration's tariffs on China under the name of reciprocal tariffs are 125%, but this does not include the 20% tariffs that the United States imposed on China twice in early February and early March of this year due to the fentanyl crisis.

Therefore, during Trump's second term, the cumulative tariffs that the United States has applied to all Chinese goods exported to the United States have reached 145%.

The CNBC report also emphasized that the 145% tariff does not include the US tariffs on China before Trump's second term as US president, including various tariffs imposed on China during Trump's first term and the Biden administration.

Given the current market environment, gold is still going to continue to rise strongly. As a wise man at a coffee shop in Vietnam (TLTV) predicted, this war must be 500% to negotiate. If so, we could soon see gold approaching the $3,500 mark.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold has surged above the $3,200 base, and at its current position, it is likely to continue its upward move with the nearest target being the 0.786% Fibonacci extension level of $3,223. Whereas, once the $3,223 level is broken, gold will be in a position to continue its upward move with the next target around $3,295 in the short term.

On the technical front, the Relative Strength Index (RSI) is sloping upwards without any weakness as it approaches the overbought zone, indicating strong demand in the market and sending a positive signal for the bullish trend.

For the day, as long as gold remains above $3,167, it remains bullish in the short term, and any dip in the current scenario that does not take gold below the EMA21 should be viewed as a short-term correction rather than a trend, or as a buying opportunity.

The notable positions for the intraday uptrend will be listed again for readers as follows.

Support: $3,167

Resistance: $3,223

SELL XAUUSD PRICE 3250 - 3248⚡️

↠↠ Stoploss 3068

→Take Profit 1 3056

↨

→Take Profit 2 3050

BUY XAUUSD PRICE 3134 - 3136⚡️

↠↠ Stoploss 3130

→Take Profit 1 3142

↨

→Take Profit 2 3148

Gold - The Blow Off TopAs gold hit a high today I took a look at the chart. Incredible run going back many years. But what goes up must come down. Based on a Fib-extension we can see where price has hit resistance and turned it into support. It happened at 1, 1.272, 1.618, and briefly at 2.618. It has remarkably pushed through that. So in my studies of markets and fibonacci I've found that 4.236 often times bring about the top on a parabolic move. So by following that logic I would put the top, at least a local one, at $3,800. Roughly 25% from here. Anyways, that's my 2 cents on Gold. Happy trading.

GOLD surges to weekly targets, eyes era levelsSpot gold prices have surged on the back of US President Trump’s tariff announcement. Gold prices rose as much as 3.9% on Wednesday as markets were volatile, before closing up 3.4%. At the time of writing today, Thursday (April 10), gold is up as much as $44, or 1.4%, on the day.

Gold prices posted their biggest one-day gain in 18 months on Wednesday as confusion over US President Donald Trump’s tariff agenda prompted investors to buy the precious metal as a safe-haven asset, Bloomberg reported.

But after China announced plans to retaliate with 84% tariffs on US products starting Thursday, Trump immediately raised tariffs on China to 125%. The moves raised concerns that the world's two largest economies were heading toward a full-blown trade war.

Stock markets rallied after Trump announced the tariff suspension. US stocks had their best day since the financial crisis, with the S&P 500 index rising nearly 10% after falling to the brink of a bear market last week.

Bloomberg said the US government's erratic tax plans have shaken the world as investors look for direction and certainty. That has supported gold prices overall, with prices up 18% this year. Expectations of further monetary easing by the Federal Reserve and central bank gold purchases have also boosted prices.

Gold has gained more than $400 this year, hitting an all-time record of $3,167.57 an ounce on April 3.

Minutes from the Federal Reserve's March meeting showed policymakers almost unanimously warned last month that the U.S. economy faces the risk of rising inflation while economic growth slows. Some policymakers noted that there could be "difficult trade-offs" ahead.

According to CME Group's FedWatch tool, traders see a 72% chance that the Fed will cut interest rates in June. Gold itself does not generate interest rates, and will perform well in a low-interest-rate environment.

Investors are now looking to the U.S. consumer price index (CPI) due out today (Thursday) for further trading information.

Technical outlook analysis OANDA:XAUUSD

On the daily chart, gold surged to hit all the weekly upside targets noted and readers in the weekly publication at $3,056 in the short term and then the full price point of $3,100. Looking ahead, gold only has a $3,150 size creature to break to set a new all-time high or more.

The relative strength index (RSI) is building, signaling bullish energy in the near term, as long as gold remains in the price channel, the declines should only be limited corrections and not a trend.

As we have noted to our readers throughout our articles since Trump returned to the White House, dips can be viewed as buying opportunities.

And for the day, the notable positions for the bullish picture on the technical chart of gold will be listed again as follows.

Support: 3,103 – 3,100 – 3,056 USD

Resistance: 3,150 – 3,167 USD

SELL XAUUSD PRICE 3192 - 3190⚡️

↠↠ Stoploss 3196

→Take Profit 1 3184

↨

→Take Profit 2 3178

BUY XAUUSD PRICE 3050 - 3052⚡️

↠↠ Stoploss 3046

→Take Profit 1 3058

↨

→Take Profit 2 3064

Fundamental support remains stable, GOLD is losing some elementsIn the Asian trading session on Tuesday (April 8), spot OANDA:XAUUSD recovered in the short term after a sharp decline in the previous trading day. Gold prices just touched $3,000/ounce, having increased by nearly $20 during the day. Concerns about the escalation of the trade war have increased the risk-off sentiment in the market.

US President Donald Trump said on Monday that he will not suspend the policy of "reciprocal tariffs", although many trading partners want to avoid them

According to a statement posted on the website of the Chinese Ministry of Commerce on Tuesday, a spokesperson for the Ministry of Commerce made a statement on the US threat to increase tariffs on China. The statement pointed out that China noted that on April 7 Eastern time, the US threatened to impose an additional 50% tariff on China, and China firmly opposes this. If the US escalates the tariff measures, China will resolutely take countermeasures to protect its own rights and interests.

The US threat to increase tariffs on China is a mistake that has been compounded, once again exposing the US's blackmailing nature. China will never accept this. If the US insists on pursuing its own way, China will fight to the end. Such statements usually boost the market's risk-off sentiment, contributing to a short-term recovery in gold prices. Gold is a safe investment during times of political and financial uncertainty.

Last Thursday, gold hit an all-time high of $3,167.57/oz, driven largely by geopolitical uncertainty and strong central bank buying. And the gold market remains exposed to significant volatility in the short term, with a number of potential fundamental surprises, most of which are likely to support price gains.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold is struggling to maintain its price action within the main price channel, however, the recovery momentum is also limited by the $3,000 price level which is currently acting as the nearest resistance.

For now, gold is losing important support at the EMA21 and now the EMA21 has become a resistance level. For gold to have the conditions for a bullish possibility, gold needs to bring the price action back above the $3,000 level, then the target is $3,019 and maintain above this level.

The relative strength index RSI has some minor reaction at 50, which is considered a momentum support level on the RSI tool. But the signal is not significant.

Overall, the expectation for gold is to resume the uptrend but at the time of writing, the conditions are not yet sufficient. Meanwhile, a drop below $2,956 would bring the risk of further declines with the next target around $2,927 in the short term.

In the day, the notable technical positions will be listed as follows.

Support: $2,956 – $2,954 – $2,927

Resistance: $3,019

SELL XAUUSD PRICE 3064 - 3062⚡️

↠↠ Stoploss 3068

→Take Profit 1 3056

↨

→Take Profit 2 3050

BUY XAUUSD PRICE 2932 - 2934⚡️

↠↠ Stoploss 2928

→Take Profit 1 2930

↨

→Take Profit 2 2936

GOLD dropped dramatically then recovered in the short termOANDA:XAUUSD saw a short-term spike during the Asian trading session on Monday (April 7). The price of gold recovered to reach around $3,053/ounce, up $83 from the intraday low of $2,970.47/ounce reached earlier.

OANDA:XAUUSD fell sharply after the Asian open on Monday, with gold also falling sharply as equity markets suffered a sharp sell-off.

While gold typically benefits from periods of volatility, it is more prone to sell-offs during periods of high volatility, with investors likely to sell gold to cover losses elsewhere.

The stock market sell-off has prompted investors to cover their losses. However, rising trade wars and geopolitical risks could boost safe-haven demand, supporting gold prices.

Trump Makes Shocking Claim About Stock Market Crash: "Sometimes You Have to Take Medicine"

When asked about the stock market crash, US President Trump said on Sunday local time, "Sometimes you have to take medicine."

After plunging on Thursday and Friday last week, global stock markets continued to fall on Monday, creating the worst three-day losing streak in history.

“I don’t want anything to happen, but sometimes you have to take medicine to solve the problem,” Trump told reporters on Air Force One, speaking about the economic impact of his sweeping tariffs.

“I can’t tell you what’s going to happen in the markets,” Trump said. “But our country is stronger.” According to Reuters, Trump gave no indication that he would abandon the tariff plan during his speech.

Trump also said he did not intentionally orchestrate the market sell-off. “No, it wasn’t that,” he said.

Last Friday, Trump reposted a video on his social media platform in response to the stock market crash. The video opens with the assertion: “Trump is causing the stock market crash… but he’s doing it on purpose.” Trump’s “No, he’s not” comment came hours after his economic advisers said in a Sunday television interview that the market should not expect to be rescued from the tariff-driven sell-off.

The Stock Market as well as the Gold Market are now directly piloted by Captain Trump, so keeping an eye on Trump is essential for any trader.

One comment can also break all the technical structures, and we cannot trade the market without knowing what is happening in the market. The market is 50%, the rest is now Trump and a part of the FED along with trade and geopolitical developments.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, after the gold price fell, it received support from the lower edge of the price channel, an important position of the current main uptrend.

And the recovery brought the gold price back above the EMA21 level, however, the upside momentum is also limited by the technical level of 3,056USD, pay attention to readers in the weekly publication.

In terms of momentum, the Relative Strength Index RSI approached the level of 50, which is considered a support position for the RSI and the RSI bending upwards will be considered a positive signal for the bullish recovery momentum.

During the day, the technical uptrend of the gold price is still dominant with the price channel as the main trend and the notable positions will be listed as follows.

Support: 3,019 - 3,000 - around the lower edge of the channel

Resistance: 3,056USD

SELL XAUUSD PRICE 3093 - 3091⚡️

↠↠ Stoploss 3097

→Take Profit 1 3085

↨

→Take Profit 2 3079

BUY XAUUSD PRICE 3001 - 3003⚡️

↠↠ Stoploss 2997

→Take Profit 1 3009

↨

→Take Profit 2 3015

XAUUSD Channel Up holding but be ready to short if broken.Gold (XAUUSD) has been trading within a Channel Up on the 4H time-frame, hitting today its 4H MA200 (orange trend-line). That is the first time the price hits this trend-line since February 28 and the previous Higher Low of the pattern.

As long as it holds, expect a Bullish Leg similar to the previous one, to hit first the 0.786 Fibonacci retracement level at 3130 and then the 1.786 extension for a Higher High at 3280.

On the other hand, if we get a candle closing below the 4H MA200, we will be ready to take the loss and go short instead, targeting Support 1 (Feb 28 Low) at 2840, potentially also making contact with the 1D MA100 (red trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD MARKET ANALYSIS AND COMMENTARY - [April 07 - April 11]This week, the price of OANDA:XAUUSD increased sharply from 3,076 USD/oz to 3,168 USD/oz, then made a "reverse" move to 3,015 USD/oz and closed this week at 3,038 USD/oz.

The reason why the price of gold increased sharply to 3,168 USD/oz in the trading session on April 3 was because US President Donald Trump decided to impose reciprocal taxes from 10% to 49% on many trading partners. However, it was also because of the tariff issue that caused the gold price to break the upward trend right after the Trump administration announced a list of tariff exemptions for many goods.

Meanwhile, many countries have also proactively negotiated with the US to reduce import taxes on US goods, import more goods from the US to contribute to gradually balancing the trade balance with the US so that the Trump administration can remove tariffs.

In addition, the US non-farm payrolls (NFP) data for March unexpectedly jumped to 228,000 jobs, much higher than the forecast of 137,000 jobs. This shows that the US labor market is still positive, causing investors to believe that the FED may continue to delay cutting interest rates.

In addition, FED Chairman Powell also said that the Trump administration's recent reciprocal tariff policy will cause inflation to increase for a long time, risking pushing the US economy into recession. This implies that the FED will not cut interest rates in the upcoming meetings.

In particular, the stock market has fallen too sharply, causing investors to close profitable gold investment positions to add margin (cover losses) for stocks.

According to many experts, gold prices may continue to adjust next week, but will not fall too deeply. Because the Russia-Ukraine war and armed conflicts in the Middle East are still complicated. Moreover, China has just imposed an additional 34% tax on all US goods. Without hesitation, Canada also imposed a 25% import tax on all cars imported from the US that are not eligible for preferential treatment in the US-Mexico-Canada Agreement (USMCA). If more countries retaliate against the US like China and Canada, the trade war will become increasingly heated, pushing the world economy into instability, increasing the role of gold as a safe haven.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

Inflation and the Fed will be back in the spotlight next week, with the release of the minutes from the Federal Open Market Committee’s (FOMC) March monetary policy meeting on Wednesday. This will be followed by the US consumer price index (CPI) report for March on Thursday, and the producer price index (PPI) on Friday. Friday morning will also see the latest preliminary survey of consumer sentiment from the University of Michigan – a key indicator of how Americans feel about the outlook for the economy.

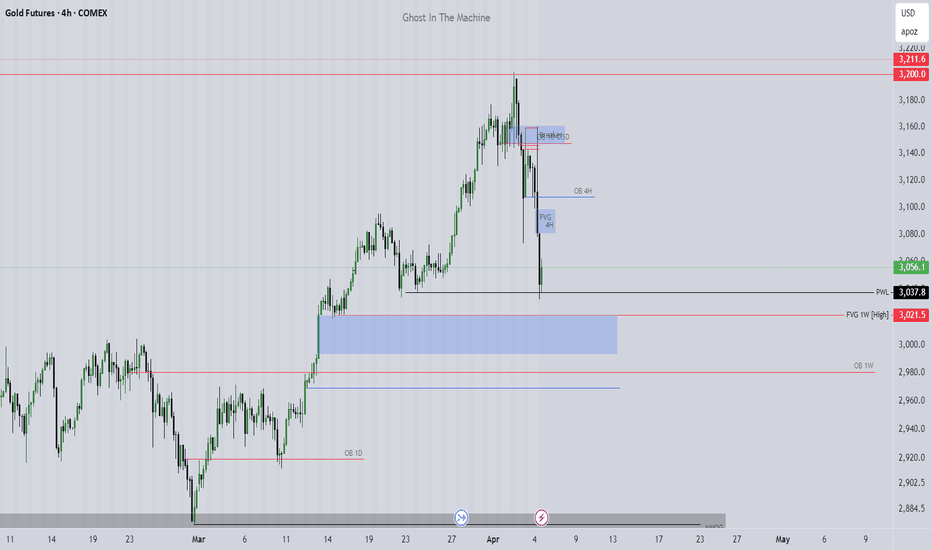

📌Technically, observing the H4 chart, it is necessary to pay attention to the important support level at 3,000 USD/oz. If next week the gold price trades above this level, it can re-enter the correction phase to 3085. In case the 3000 round resistance level is broken, the gold price will continue to be under selling pressure, causing the price to drop to around 2,900-2,950 USD/oz.

Notable technical levels are listed below.

Support: 3,019 – 3,000 USD

Resistance: 3,050 – 3,056 USD

SELL XAUUSD PRICE 3093 - 3091⚡️

↠↠ Stoploss 3097

BUY XAUUSD PRICE 2988 - 2990⚡️

↠↠ Stoploss 2984

GOLD corrects after hot rally, conditions remain optimisticOANDA:XAUUSD has retreated from an all-time high of $3,167.67/oz as investors began to take profits after a “parabolic” rally. While the rally was initially fueled by safe-haven demand stemming from US President Donald Trump’s plans for higher tariffs, questions are starting to arise about the sustainability of the rally as buying pressure wanes and the Relative Strength Index (RSI) moves into overbought territory.

Gold has rallied 19% so far in 2025 and this correction could be temporary

Gold prices have rallied 19% this year, supported by multiple macro uncertainties, historic central bank buying and continued inflows into ETFs. Despite the current pullback, from a fundamental perspective, this does not impact the overall bullish fundamental trend and the likelihood of near-term technical consolidation has begun to increase.

Trump’s tariffs a “catalyst” supporting the physical gold market?

Trump's proposal to impose 10% tariffs on most imports has stoked market concerns about slowing economic growth and rising business costs, while risk aversion has pushed gold prices higher.

However, the White House later clarified that "critical raw materials" including gold, copper and energy would be exempt, alleviating some concerns about supply chain disruptions and providing some support to the physical gold market.

Market sentiment remains bullish, with strong buying momentum on dips

Although the technical side is currently under some pressure, the market's optimism remains unshaken. It is difficult to try to assess the peak near the historical high, but it is clear that every pullback is quickly absorbed by buyers, which shows that the underlying bullish sentiment in the market is still strong.

Described by the sharp drop on Thursday, gold recovered very quickly after the drop.

Technical Outlook Analysis OANDA:XAUUSD

Gold may enter a correction phase after a long period of hot growth, depicted by the Relative Strength Index (RSI) falling below the overbought level, breaking the blue bullish channel. In the short term, if gold breaks below the short-term channel, converging with the 0.50% Fibonacci extension level, it will be in a position to correct further with the next target level around $3,066 in the short term, more than $3,040.

However, overall, gold still has a bullish technical outlook with the price channel as the long-term trend and the main support from the EMA21. As long as gold remains within the price channel and above the EMA21, the declines should be considered as corrections and not a trend. On the other hand, once gold recovers from the 0.50% Fibonacci extension and holds above the raw price point of $3,100, it will signal the end of the correction cycle, then the upside target will be the 0.786% Fibonacci extension in the short-term.

During the day, the long-term uptrend with the possibility of a short-term correction will be noticed again by the following positions.

Support: 3,086 – 3,066 – 3,040USD

Resistance: 3,100 – 3,106 – 3,135USD

SELL XAUUSD PRICE 3147 - 3145⚡️

↠↠ Stoploss 3151

→Take Profit 1 3139

↨

→Take Profit 2 3133

BUY XAUUSD PRICE 3061 - 3063⚡️

↠↠ Stoploss 3057

→Take Profit 1 3069

↨

→Take Profit 2 3075

Trump's Tariff War! GOLD nears targetIn Asian trading on Thursday (April 3), the market's risk-off sentiment increased, boosted by Trump's wide-ranging tariff actions. Spot gold prices jumped to $3,167.77/ounce in early trading, up nearly $37 in a day and hitting a new record high.

OANDA:XAUUSD Continues to Rise as Trump Launches Tariff Campaign

The US Dollar fell sharply in Asian trading on Thursday, contributing to the boost in gold prices. The US Dollar Index is currently at around 103.050, down more than 60 points on the day.

On April 2, local time, the White House issued a statement saying that US President Trump declared a national emergency on the same day to enhance US competitiveness, protect US sovereignty, and strengthen US national and economic security. Trump declared this as America's "declaration of economic independence".

The statement said that Trump will impose a 10% "base tariff" on all countries, effective from 0:01 a.m. Eastern time on April 5. In addition, Trump will impose higher, personalized "reciprocal tariffs" on countries with the largest US trade deficits, effective from 0:01 a.m. Eastern time on April 9. All other countries will continue to adhere to the original base tariff of 10%.

Gold prices hit a new record above $3,160 an ounce after US President Donald Trump announced comprehensive “reciprocal” tariffs, imposing a minimum 10% tax on imported goods, raising concerns that this could trigger a global economic recession.

Investors have flocked to gold as concerns about the health of the global economy have grown. Gold prices have risen 20% this year after a strong rally in 2024, driven largely by central bank buying and strong demand in Asia.

AND IT WILL KEEP RISE AS FUNDAMENTAL SUPPORT IS ABSOLUTELY IN PLACE!

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, after approaching the target level of attention to readers in yesterday's publication at the price point of the 1% Fibonacci extension, there are temporary signs of cooling down, mainly this is considered a correction state after a shock increase.

In terms of trends, gold is currently being noticed by the short-term price channel, this is an uptrend in which the medium-term trend at the price channel is also an uptrend channel, in addition, EMA21 is also the current main support.

On the other hand, the Relative Strength Index (RSI) is also in an uptrend channel, which shows that gold is also in an uptrend in terms of momentum, and a signal for a possible downward correction in terms of momentum can only occur when the RSI folds downwards below 80.

As long as gold remains in the price channel, it is still in an uptrend in the short term, and the notable positions for the day will be listed as follows.

Support: 3,135 – 3,106 – 3,100 USD

Resistance: 3,172 USD

SELL XAUUSD PRICE 3171 - 3169⚡️

↠↠ Stoploss 3175

→Take Profit 1 3163

↨

→Take Profit 2 3157

BUY XAUUSD PRICE 3098 - 3100⚡️

↠↠ Stoploss 3094

→Take Profit 1 3106

↨

→Take Profit 2 3112