XAUUSD Major 25-year Resistance getting tested!Gold (XAUUSD) has been on a multi-decade uptrend since the 2000 bottom and shortly after the launch of its ETF. With the exception of the aggressive 2006 break-out, the majority of its price action has been inside the (blue) Channel Up but the use of the Fibonacci extension Channel allows us to catch the key levels of the post 2006 action too.

What's more important is that the market is testing the top of that (blue) Channel Up, i.e. the 1.0 Fibonacci level, for the first time since August 2020, which was a major market top and the start of a 3-year Bear Phase.

As mentioned, the only time this Resistance broke was in April 2006, when Gold truly turned parabolic. The question is, what will it be this time? A macro level bullish break-out to the Fib 1.5 extension or the more short-term dynamic of the top of the blue Channel Up and a rejection back to the long-term Support of 1M MA50 (blue trend-line)?

Tell us your thoughts in the comments section!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gc1!!

GOLD Reached it's Apex and is ready for a dumpIn my earlier posts I said that Gold has the potential to reach the U-MLH, which has become true.

Up there, the price of Gold is stretched. Yes it can go up even more beyond the Upper-Medianline-Parallel. But the overall numbers of occurrences are small.

So, at this natural stretch, price has a high probability to revert to the mean. And this is supported by the fact, that the overall indexes are heavenly oversold and already showing the signs of a pullback to the North (see my last NQ post).

Why not just watch how it plays out, and make a decision for a trade after the FOMC, or even tomorrow. Don't rush into these unknowing situations. Be patient and wait for clear signs to take action.

Gaza conflict and Trump tariffs push GOLD higher againOANDA:XAUUSD rose more than 1% on Tuesday to a new record high and are currently trading around $3,035/oz, close to yesterday's peak. Trade uncertainty due to rising tensions in the Middle East and US President Trump's tariff plans have boosted investor demand for safe-haven assets.

Israeli airstrikes kill more than 400 in Gaza

Early Tuesday morning local time, the Israeli military carried out heavy airstrikes on Gaza City in the northern Gaza Strip, Deir el Balah, the Nusayrat refugee camp in the central Gaza Strip, as well as Khan Yunis and Rafah in the south.

The British news agency Reuters reported that Israeli airstrikes killed more than 400 people in Gaza, threatening a two-month ceasefire.

Israeli Prime Minister Benjamin Netanyahu said the airstrikes were carried out because Hamas has repeatedly refused to release Israeli detainees. Defense Minister Israel Katz warned that if Hamas does not release the detainees, "our attacks will intensify."

Hamas said Israel's move was a unilateral end to the ceasefire, leaving Israelis held in Gaza "to face an unknown fate."

There were unconfirmed reports that an Iranian vessel collecting intelligence during the Gaza offensive was sunk by US forces, escalating tensions in the Middle East.

Saudi media reported on Tuesday that the Iranian Navy's most advanced intelligence ship, the Zagros, was hit by an unidentified missile in the Red Sea on Monday evening local time, causing its hull to be damaged, leaking and sinking.

World Media reported that the US military was then attacking Houthi armed forces in the area outside the Red Sea, while the Israel Defense Forces conducted a large-scale bombing of Gaza, and the origin of the missile that hit the Iranian naval vessel could not be determined.

Trump's Tariffs

Meanwhile, US President Trump has proposed a series of US tariff plans, including a 25% flat tariff on steel and aluminum (which took effect in February), as well as reciprocal tariffs and sectoral tariffs that will be applied on April 2.

Trump said he would impose general reciprocal tariffs on April 2, with additional tariffs targeting specific industries. Trump told reporters on Air Force One on Sunday that both tariffs would be applied to foreign goods imported into the United States “under certain circumstances,” “They tax us, we tax them, and then we’ll tax other industries beyond autos, steel, aluminum.”

Ultimately, Gold is often considered a safe investment in times of economic or geopolitical uncertainty, and in the current environment, it is still fundamentally well supported.

There are also many other supports such as demand from central banks, national reserves, and ETF volumes, the decline of the Dollar, the Fed's monetary policy, etc. Readers can review previous publications for more information.

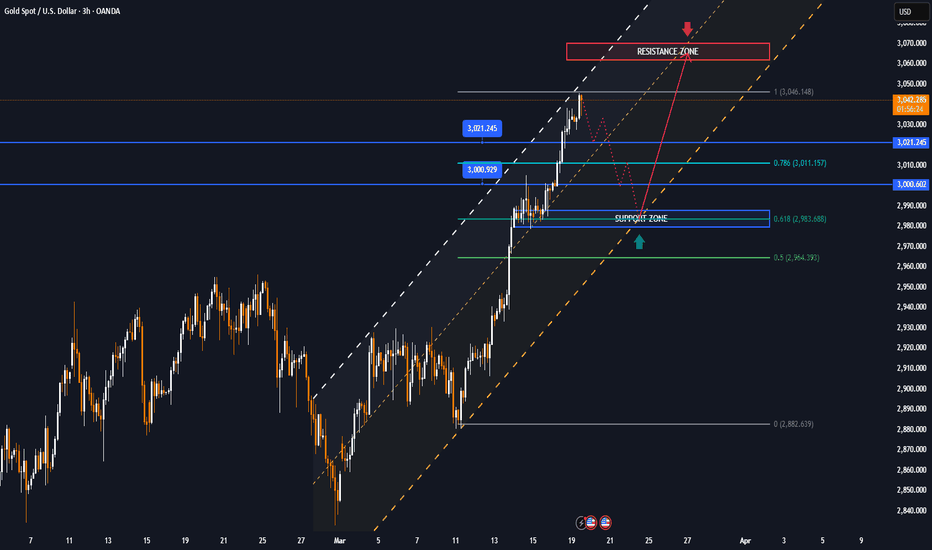

Technical outlook analysis of OANDA:XAUUSD

On the daily chart, although the RSI is operating in the overbought area, it has not shown any signal to indicate a significant downside correction. A signal for a correction is a crossover of the RSI below 80.

Meanwhile, the sustained price action above the 0.50% Fibonacci extension level is a positive signal with the expectation of further upside and the next target is the 0.618% Fibonacci extension position at the price point of $3,065.

Currently, there is no notable resistance ahead, so until the level of 3,065 USD gold can still rise freely.

The intraday uptrend of gold will be noticed again by the following notable positions.

Support: 3,021 – 3,000 USD

Resistance: 3,065 USD

SELL XAUUSD PRICE 3068 - 3066⚡️

↠↠ Stoploss 3072

→Take Profit 1 3060

↨

→Take Profit 2 3054

BUY XAUUSD PRICE 2984 - 2986⚡️

↠↠ Stoploss 2980

→Take Profit 1 2992

↨

→Take Profit 2 2998

GOLD MARKET ANALYSIS AND COMMENTARY - [March 17 - March 21]Last week, the international OANDA:XAUUSD increased sharply, from 2,880 USD/oz to 3,005 USD/oz. Then, profit-taking pressure caused the gold price to drop to 2,978 USD/oz and closed the week at 2,986 USD/oz.

The reason for the sharp increase in gold prices in recent days is that US inflation figures (CPI, PPI) have decreased more sharply than expected, raising expectations that the FED will cut interest rates twice more this year.

In addition, concerns about US public debt have increased as the US Congress is unlikely to pass the Budget Bill, putting the US government at risk of a shutdown.

The FED meeting next week will play an important role in shaping expectations about the FED's interest rate policy. This could be the main driver for gold prices next week, given the inverse correlation between gold and the USD.

However, in recent comments, the FED Chairman has remained cautious about inflationary pressures due to concerns that the Trump administration's tariff policies will fuel inflation in the medium and long term. Therefore, it is possible that the FED Chairman will continue to maintain interest rates at current levels in the next meetings. If so, this will be a shock to gold prices next week, causing gold prices to fall next week.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

This week is shaping up to be a volatile one for gold, with markets digesting a number of key economic releases.

Central banks continue to dominate the calendar, with the Bank of Japan announcing its interest rate decision on Tuesday, followed by the Federal Reserve on Wednesday and the Swiss National Bank and Bank of England on Thursday.

There are also a number of key US economic data releases, including Retail Sales and the Empire State Manufacturing Index on Monday, Housing Starts and Building Permits on Tuesday. On Thursday, markets will be watching the weekly Unemployment Report, Existing Home Sales and the Philadelphia Fed Manufacturing Survey.

📌Technically, in the short-term perspective on the H1 chart, gold prices next week may maintain their upward momentum to find the 161.8 fibo level around 3035. Or they may temporarily reduce and adjust around the Trendline at 2915.

Notable technical levels are listed below.

Support: 2,977 – 2,956 USD

Resistance: 3,000 – 3,021 USD

SELL XAUUSD PRICE 3036 - 3034⚡️

↠↠ Stoploss 3040

BUY XAUUSD PRICE 2914 - 2916⚡️

↠↠ Stoploss 2910

GOLD surges as geopolitical risks unexpectedly boost gainsOANDA:XAUUSD continued to rise in the short term, with gold prices just hitting a new all-time high of $3,014/oz.

As investors focused on US economic data, which raised concerns about an economic slowdown, and escalating tensions in the Middle East, the precious metal's appeal as a safe haven was highlighted.

Israel Strikes Hamas Targets Across Gaza, Killing Over 200

Israel said it carried out military airstrikes on Hamas targets in the Gaza Strip, a move that risks derailing a fragile ceasefire. Palestinians reported multiple airstrikes by Israel on various areas of the Gaza Strip. Traders were also looking at U.S. retail sales data, which showed a smaller-than-expected increase in February. Falling yields on 10-year U.S. Treasury notes also helped boost non-interest-bearing gold.

Israel has launched a series of airstrikes on the Gaza Strip as a nearly two-month-old ceasefire appeared to be rapidly unraveling, with Prime Minister Benjamin Netanyahu saying his government would “increase its military force” against Hamas.

Palestinians reported Israeli airstrikes in several areas of Gaza on Tuesday morning, and an Israeli statement confirmed the attacks took place across Gaza.

Hamas’ media office said on Tuesday that Israeli airstrikes on the Gaza Strip had killed more than 200 people.

The attack shattered a fragile ceasefire that had been suspended for 15 months in the war ravaging the Gaza Strip. It was the heaviest bombing since a ceasefire brokered by Egypt, Qatar and other countries took effect in January.

Technical Outlook Analysis OANDA:XAUUSD

After reaching and breaking the original price level which is also the bullish price target of 3,000 USD, gold is continuing to aim for the target level behind that, pay attention to readers last week at 3,021 USD in the short term, which is the location of the 0.50% Fibonacci extension level.

Meanwhile, the Relative Strength Index (RSI) is sloping up with a significant slope and has not completely moved above the overbought area, showing that momentum and room for growth is still ahead.

Next, the main trend and outlook remains bullish with price channels and mid- to short-term trend. The main support is seen by the EMA21.

As long as gold remains above the EMA21, it remains technically bullish, the current dips should only be considered as a short-term correction or a buying opportunity.

The following areas of interest will also be noted.

Support: $3,000 – $2,977

Resistance: $3,021 – $3,065

SELL XAUUSD PRICE 3036 - 3034⚡️

↠↠ Stoploss 3040

→Take Profit 1 3028

↨

→Take Profit 2 3022

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

→Take Profit 1 2957

↨

→Take Profit 2 2963

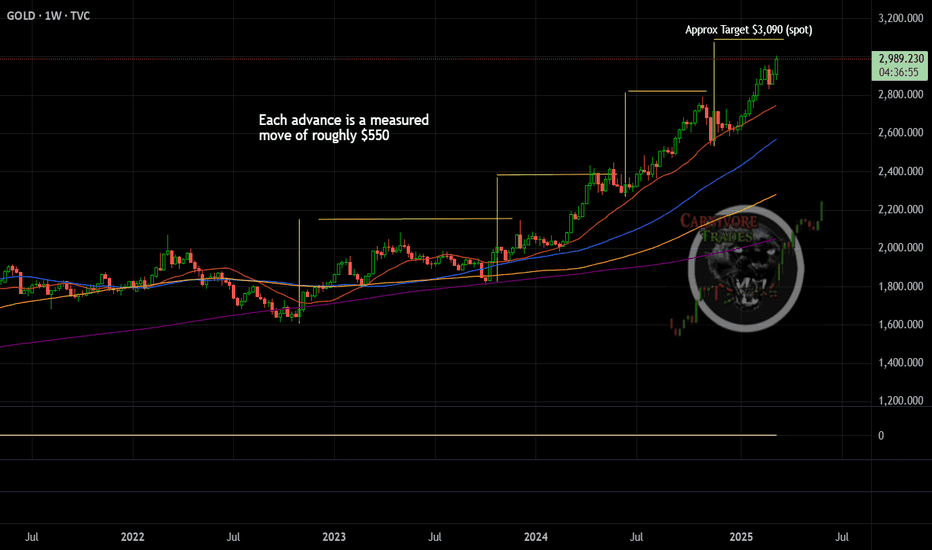

Gold Measured Move Target (Spot)Gold has finally climbed to over $3,000/oz for the first time in history however the yellow metal may not be done quite yet. Based on this repeated measured move of roughly $550 on each bull advance, we should expect the price of spot to get close to the $3,100 handle sometime soon. Seasonally, gold likes to rally into early/mid April before a cool off period so it is likely coming in the next 2-4 weeks.

GOLD nears $3,000 as trade tensions escalateOANDA:XAUUSD have surged to an all-time high, just shy of the key $3,000-an-ounce mark as global trade tensions and expectations of a Federal Reserve rate cut push them closer to a record high. They have risen nearly 14% this year, following a 27% gain in 2024.

WASHINGTON (Reuters) - President Donald Trump on Thursday threatened to impose 200% tariffs on wine, champagne and other alcoholic beverages from France and the rest of the European Union, marking a further escalation in global trade tensions.

Trump tweeted Thursday that he would impose import tariffs if the European Union continues to impose duties on U.S. whiskey exports. The EU's move is in retaliation for Trump's steel and aluminum tariffs that took effect on Wednesday.

Trump also had harsher words for the European Union. The EU has been one of the United States' closest allies for decades. Trump posted on his Truth Social platform: "The European Union is one of the most hostile and abusive tax and tariff organizations in the world, and their sole purpose is to take advantage of the United States. They just put a disgusting 50% tariff on whiskey. If this tariff is not removed immediately, the United States will soon put a 200% tariff on all wine, champagne and spirits coming from France and other EU member states. This will be a tremendous boon to the American wine and champagne industry."

Trump’s trade policy changes have boosted the price of gold, an asset favored by investors during times of geopolitical and economic uncertainty.

In addition, the Wall Street Journal reported that Russian President Vladimir Putin had rejected plans for an immediate ceasefire in Ukraine, which also contributed to the safe-haven buying of gold.

Russian President Vladimir Putin said Thursday that Russia will not agree to an immediate end to fighting in Ukraine and called for further discussions on ending the war permanently, The Wall Street Journal reported. Moscow’s military is now advancing rapidly, aiming to push Ukrainian troops out of the Kursk region. Putin said any ceasefire at this stage would be in Ukraine’s interests because Russia is winning on the battlefield and there are many issues that need to be resolved before a ceasefire can be reached.

SPDR Gold Trust, the world's largest gold ETF, said its holdings rose to 907.82 tonnes on February 25, the highest since August 2023. Meanwhile, data from China's central bank showed China bought gold for a fourth straight month in February.

Over the weekend, data on US consumer confidence and inflation expectations will be less in the spotlight than tariffs and geopolitical headlines.

For economic data, readers can find more details in the signature section through brief comments during the day.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold is down slightly year-to-date after approaching the important raw price level of $3,000.

The current correction is also not significant as the uptrend will still dominate the chart with the price channel as the nearest support at present, the main support is noted by the EMA21 and the other support is the 0.382% Fibonacci extension level.

Meanwhile, the Relative Strength Index (RSI) has not yet risen above the overbought zone, indicating that there is still room for upside.

Intraday, as long as gold remains above the price channel and the 0.382% Fibonacci extension level, its main short-term outlook remains bullish. Even if gold falls below the aforementioned support area, it remains in an overall bullish trend, so the current declines should be viewed as a short-term correction or a buying opportunity.

Next, the target will be the full price point of $3,000 in the short term and more at the 0.50% Fibonacci extension level.

The notable positions for the day are listed as follows.

Support: $2,977 – $2,956

Resistance: $3,000 – $3,021

SELL XAUUSD PRICE 3037 - 3035⚡️

↠↠ Stoploss 3041

→Take Profit 1 3029

↨

→Take Profit 2 3023

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

→Take Profit 1 2957

↨

→Take Profit 2 2963

GOLD hits Bullish targets, heading for all-time highAs tariff uncertainty pushed money into safe havens, cooling US inflation kept market expectations of a Fed rate cut intact and optimism over a ceasefire between Russia and Ukraine cooled, OANDA:XAUUSD surged and broke out of its recent sideways consolidation trading range.

OANDA:XAUUSD surged past the $2,942/oz target on safe-haven demand. Weaker US CPI data also supported expectations of a Federal Reserve rate cut, pushing gold higher.

The US consumer price index (CPI) rose 2.8% year-on-year in February, slightly below the 2.9% expected and down from January's 3.0%. The year-on-year increase in the core CPI, which excludes volatile food and energy prices, eased to 3.1% from January's 3.3%.

Recent news of a ceasefire between Russia and Ukraine also cooled earlier optimism.

British news agency Reuters reported on Wednesday that Russian officials were skeptical about the U.S. proposal for a 30-day ceasefire in Ukraine. Kremlin spokesman Dmitry Peskov said on Wednesday that the Kremlin was still waiting for the United States to announce its proposal for a ceasefire in Ukraine. The Kremlin needs to hear the results of the U.S.-Ukraine talks before commenting on whether Russia can accept the ceasefire.

Commenting on a ceasefire proposal that has been accepted by both U.S. and Ukrainian officials, an influential Russian lawmaker insisted on Wednesday that any deal must be reached on Russian terms, not U.S.

A senior Russian source said President Vladimir Putin would be unlikely to agree to a ceasefire proposal without finalizing the terms and receiving some guarantees.

Ukraine accepted a US proposal for a 30-day ceasefire with Russia on Tuesday in exchange for the Trump administration resuming suspended military aid and intelligence sharing. The deal was announced by US and Ukrainian officials after eight hours of talks in Saudi Arabia on Tuesday.

Trump said US officials would meet with their Russian counterparts on Wednesday and he could meet with Russian President Vladimir Putin this week.

The World Gold Council (WGC) revealed that central banks continued to buy gold. The People's Bank of China and the National Bank of Poland added 10 tonnes and 29 tonnes of gold, respectively, in the first two months of 2025.

Traders will next keep a close eye on the release of the US producer price index (PPI) for February, initial jobless claims and the University of Michigan consumer sentiment data.

OANDA:XAUUSD technical outlook analysis

On the daily chart, as of the time of writing, gold has achieved all the bullish targets noted by readers in the weekly publication, along with all the conditions for the possibility of a price increase when there is no more resistance ahead other than the all-time high.

The short-term price channel is noted as the trend at the moment, along with the Relative Strength Index RSI maintaining above 50, surpassing 61, showing that the bullish momentum dominates the market and there is still a lot of room for price increase ahead because it is still quite far from reaching the overbought area.

The most notable supports now are the $2,929 level in the short term, followed by the EMA21 area.

Overall, the uptrend is dominating on the daily chart, with notable price levels listed below.

Support: $2,929 – $2,915

Resistance: $2,956

SELL XAUUSD PRICE 2761 - 2974⚡️

↠↠ Stoploss 2980

→Take Profit 1 2968

↨

→Take Profit 2 2962

BUY XAUUSD PRICE 2904 - 2906⚡️

↠↠ Stoploss 2900

→Take Profit 1 2912

↨

→Take Profit 2 2918

GOLD recovers and stays above $2,900, pay attention to CPI dataOANDA:XAUUSD rebounded, driven mainly by safe-haven flows as trade war concerns dampened market risk sentiment and markets focused on US inflation data.

TVC:DXY hit a four-month low, making gold more attractive. Meanwhile, the main event of the week is the US CPI report today (March 12), which could cause major market moves. Positive data could lead to a sharp sell-off in gold, while weak data could give the green light for further gains in gold.

CPI is expected to have risen 0.3% in February, according to a Reuters poll. The New York Federal Reserve's latest consumer expectations survey forecasts inflation at 3.1% over the next year, up slightly from 3% in January. Markets are now expecting the Federal Reserve to cut interest rates in June.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, in terms of trend, gold is still in the accumulation phase after recovering from the $2,880 level noted by readers in the previous editions and the break above the $2,900 level provides conditions for further testing of the $2,929 level in the short term.

For now, gold is still trading around the EMA21 and is still in a consolidation state, but in terms of technical conditions, it is more likely to increase in price. With the price channel as a short-term trend, and the RSI activity above 50, quite far from the overbought zone, it shows that the bullish momentum is still ahead.

However, the technical chart still needs a strong impact to break the current accumulation structure. And during the day, the notable positions will be listed as follows.

Support: 2,900 - 2,880 USD

Resistance: 2,929 - 2,942 USD

SELL XAUUSD PRICE 2961 - 2959⚡️

↠↠ Stoploss 2965

→Take Profit 1 2953

↨

→Take Profit 2 2947

BUY XAUUSD PRICE 2899 - 2901⚡️

↠↠ Stoploss 2895

→Take Profit 1 2907

↨

→Take Profit 2 2913

XAUUSD: Turning sideways short term but Channel Up intact.Gold remains on very balanced bullish levels on its 1D technical outlook (RSI = 58.055, MACD = 27.200, ADX = 21.896) a direct outcome of its long term pattern, which is a Channel Up. With the late February high made near the top of the Channel Up and the 1D RSI on a decline ever since, this the the kind of behaviour that was previously had Gold consolidate before the next rally. You can scalp this range until the price gets near the 1D MA100 and place a more medium term buy (TP = 3,200).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD recovers to trade around $2,900, still has a lot of supportOANDA:XAUUSD has stabilized and recovered after falling more than $20 yesterday and is now trading around $2,900. Earlier, investor concerns about a US economic slowdown caused a broad decline in stocks and commodities, dragging down precious metals, especially gold.

OANDA:XAUUSD held above $2,880 after falling nearly 1% on Monday. US President Donald Trump said over the weekend that the US economy could get worse before it gets better and that he was adjusting trade policy through tariffs, fueling market concerns about a possible economic recession.

When broader financial markets take a hit, investors may sell gold to cover losses in other assets, causing the price of gold to fall in the short term. Gold prices have rallied 10% so far this year, hitting a new high. The rally has been fueled by uncertainty surrounding the Trump administration’s policies, central bank purchases of gold, and expectations that the Federal Reserve could cut interest rates further. Lower borrowing costs typically benefit non-yielding assets like gold.

While rising gold prices have dented physical demand in some major Asian economies, inflows into gold ETFs have remained steady. Holdings of gold ETFs hit their highest level since December 2023 as of last week, according to data compiled by Bloomberg.

Investors had begun to reduce their exposure to gold ahead of Monday’s sharp market sell-off. Hedge funds’ long gold positions fell to their lowest in nine weeks, according to the latest data from the U.S. Commodity Futures Trading Commission (CFTC).

While this correction appears to be broad-based, the underlying forces will still be a solid support for gold's upside potential, from the geopolitical landscape to Trump's policies creating global trade conflicts to expectations of Fed rate cuts. Overall, gold still has a lot of support.

Markets focus on US inflation data and Fed policy expectations

Investors are now focused on upcoming US inflation data to gauge whether the Federal Reserve will cut interest rates further:

US Consumer Price Index (CPI) – due on Wednesday

US Producer Price Index (PPI) – due on Thursday

Traders are now fully pricing in the possibility of a Federal Reserve rate cut in June. Federal Reserve Chairman Jerome Powell said on Friday that it is not yet known whether the Trump administration’s tariff policies will lead to higher inflation.

In general, lower interest rates increase the appeal of gold because it is a non-interest-bearing asset, making it cheaper to hold than other assets.

OANDA:XAUUSD Technical Outlook Analysis

On the daily chart, after gold fell to the support level noted by readers in the previous issue at 2,880 USD, it received support to recover, currently trading around 2,900 USD.

A break above the 2,900 USD price level would be considered a positive signal with the next target being the EMA21 area, followed by 2,929 USD rather than 2,942 USD.

In the short term, gold has not yet shown a specific trend when entering the accumulation phase, which is described by 2 green trend lines. But in the medium and long term, the possibility of price increase is still very good when in terms of momentum, the Relative Strength Index RSI is still above 50.

During the day, gold is in the accumulation phase with the main trend leaning towards price increase, the notable positions will be listed as follows.

Support: 2,880 - 2,868 USD

Resistance: 2,900 - 2,929 - 2,942 USD

SELL XAUUSD PRICE 2908 - 2906⚡️

↠↠ Stoploss 2912

→Take Profit 1 2900

↨

→Take Profit 2 2894

BUY XAUUSD PRICE 2857 - 2859⚡️

↠↠ Stoploss 2853

→Take Profit 1 2865

↨

→Take Profit 2 2871

XAUUSD One more push to 3100 to price the Top.Gold (XAUUSD) continues to trade within its 2025 Channel Up, in fact the uptrend started a little bit sooner on the November 14 2024 bottom. As we've mentioned before and you can see again today, this is a recurring pattern which has been in effect since October 2022, the bottom of the Inflation Crisis.

This involves the market forming Channel Up patterns of around +20% price increase, which are supported by the 1D MA50 (blue trend-line) and when that breaks, they bottom around the 0.382 Fibonacci retracement level and then turn into a buy opportunity for the next Channel Up.

The 1D RSI Double Tops and signals the price (Channel Up) High. It's first Top is where Gold is right now, typically within the 0.5 - 0.382 Fib Zone. The only time it was above the 0.382 Fib, was when it rose by +22%. As a result, we expect a similar course and a price peak around $3100 but the most effective sell signal remains when the 1D RSI Double Tops.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD falls slightly as Dollar recovers, news, main trendsOANDA:XAUUSD has just dropped to around $2,912/ounce, down nearly $10 from the intraday high of $2,918/ounce reached earlier in the session.

The recovery of the US Dollar can be seen as the current pressure causing gold prices to slightly decline from the intraday high.

Overview of data and event news

The Labor Department report showed the U.S. economy added 151,000 jobs in February, compared with economists polled by Reuters who expected a gain of 160,000, and the unemployment rate was 4.1%, compared with expectations of 4%.

Federal Reserve Chairman Jerome Powell said early Friday that the Fed would take a cautious approach to easing monetary policy, adding that the economy “remains in good shape.”

While gold is a hedge against inflation, rising interest rates could reduce the appeal of non-yielding bullion.

The market is now expecting the Fed to continue cutting interest rates starting in June, with a total of 76 basis points of interest rate cuts over the rest of the year.

Market attention is focused on the upcoming Federal Reserve meeting. In addition, inflation reports and retail sales data will also provide additional guidance for market trends in general and the gold market in particular.

On the daily chart, gold is generally still in the accumulation phase with the positioning conditions tilted towards the upside.

The short-term trend is highlighted by the price channel, while the nearest support is the EMA21 and the technical level of 2,900 USD. At the raw price point of 2,900 USD, it also created significant price increases in the last 2 days of the weekend.

The relative strength index is facing some resistance from the 61 level noted in the previous issue, where once the RSI breaks this level it will continue to head towards the oversold zone which is a signal that will facilitate the possibility of gold price increasing in terms of momentum.

In the coming time, as long as gold remains above 2,900 USD, it will still tend to be bullish in the short term, and the target continues to be the all-time high or higher.

The notable technical price points will be listed as follows.

Support: 2,900 – 2,880 – 2,868 USD

Resistance: 2,929 – 2,942 – 2,956 USD

SELL XAUUSD PRICE 2956 - 2954⚡️

↠↠ Stoploss 2960

→Take Profit 1 2948

↨

→Take Profit 2 2942

BUY XAUUSD PRICE 2877 - 2879⚡️

↠↠ Stoploss 2873

→Take Profit 1 2885

↨

→Take Profit 2 2891

GOLD | XAUUSD Weekly Market Forecast: Mar 10-14 In this video, we will analyze the GOLD Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

Gold has consolidated for the last half of the previous week. Trading in a ranging market is not recommended! But waiting until there is an obvious sweep of the high or low liquidity pools can give us an indication which side the market will break the consolidation. Patience and a watchful eye will allow us to take advantage of the momentous opportunity.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD MARKET ANALYSIS AND COMMENTARY - [March 10 - March 14]OANDA:XAUUSD have recovered strongly this week, rising from $2,858/oz to $2,930/oz before adjusting to $2,910/oz. The main reason is political tension when US President Donald Trump stopped military aid to Ukraine and threatened to sanction Russia if it did not negotiate a ceasefire. This increased instability, supporting gold prices. However, if Russia and Ukraine move towards peace negotiations, gold prices may face downward pressure in the short term, although the possibility is still low.

Furthermore, Mr. Trump’s move forced the European Union (EU) to launch a spending package of nearly 1 trillion euros to strengthen the defense of EU member states. This means that the EU’s budget deficit will become larger, leading to higher inflation and lower growth, thereby increasing the role of gold as a safe haven.

The US non-farm payrolls (NFP) figure for February came in at 151,000, slightly below the forecast of 159,000. The unemployment rate edged up slightly to 4.1% from 4% in January, but the labor market remains untroubled. As a result, the Fed may maintain its current interest rate. Fed Chairman Jerome Powell also stressed that the central bank is in no hurry to cut interest rates as the labor market remains strong and inflation risks remain high.

Rising inflation while the Fed maintains stable interest rates has caused real interest rates to fall, supporting gold prices. In addition, economic instability due to US tariff policies and the complicated developments of the Russia-Ukraine war have also increased the demand for safe haven gold. However, since most of the risks have been reflected in prices, gold may not increase sharply next week and there is a risk of correction due to short-term profit-taking pressure.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

Inflation will be in focus next week as markets digest a number of key data on US prices and consumer spending. The most notable is the February CPI report on Wednesday, followed by the PPI on Thursday, and the University of Michigan consumer sentiment survey on Friday. Other key events include the US JOLTS jobs report on Tuesday, the Bank of Canada interest rate decision on Wednesday morning, and the US weekly jobless claims report on Thursday.

📌Technically, gold prices will fluctuate in a relatively narrow daily range next week with support at $2,890/oz and resistance at $2,930/oz. If gold prices rise above $2,930/oz next week, they could rise to $2,950/oz, followed by strong resistance at $3,000/oz. However, if gold prices are pushed below $2,890/oz next week, they could fall to the $2,835-$2,860/oz range.

Notable technical levels are listed below.

Support: 2,900 – 2,880 – 2,868USD

Resistance: 2,929 – 2,942 – 2,956USD

SELL XAUUSD PRICE 2976 - 2974⚡️

↠↠ Stoploss 2980

BUY XAUUSD PRICE 2809 - 2811⚡️

↠↠ Stoploss 2805

Market Forecast UPDATES! Monday, Mar 3rdIn this video, we will update the forecasts posted last March 2nd for the following markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Markets hesitant, GOLD sideways on NFP data dayIn the Asian trading session on Friday (March 7), the spot OANDA:XAUUSD maintained a very slight decline during the day and the current gold price is around 2,911 USD/ounce. On this trading day, investors will pay attention to the US non-farm payrolls report, which is expected to impact the main trends in the gold market.

The US non-farm payrolls are expected to increase by 160,000 in February. Gold is likely to react more strongly to disappointing employment data than to an optimistic non-farm payrolls report because this will push gold prices higher, ending the period of downward adjustment and subsequent recovery and accumulation in the past.

The US will release its February non-farm payrolls report at 20:30 Hanoi time on Friday.

Surveys show that the number of non-farm payrolls in the US will increase by 160,000 in February, after increasing by 143,000 in January. The US unemployment rate is expected to remain at 4.0% in February.

Surveys also show that the monthly increase in average wages in the US is expected to slow to 0.3% in February, after increasing by 0.5% in January. Average hourly earnings are likely to increase at an annual rate of 4.1% in February.

The Federal Reserve is closely monitoring signs of weakness in the labor market as it tries to balance supporting the labor market and controlling inflation. The slowdown in employment data certainly adds complexity to the Fed’s decision-making process.

Review of expected data: A large negative surprise in non-farm payrolls, at 100,000 or lower, could put significant pressure on the dollar and open the door for a move higher in gold to help it end the week on the positive side. On the other hand, if the non-farm payrolls figure reaches or exceeds 180k, the dollar could remain firm and limit the upside potential for gold.

Technical outlook for OANDA:XAUUSD

Gold is still in the process of accumulation before receiving a strong impact of structural change from NFP data released today. Up to now, the upward momentum is limited but short-term price declines are supported from the base price area of 2,900 USD, this is considered the closest support to pay attention to readers in the previous publication.

Technically, the short-term trend is currently unclear as the Relative Strength Index (RSI) is also moving sideways in the 60-50 range, indicating that market sentiment is still hesitant.

However, considering the overall fundamental and technical picture, my personal opinion is to defend the bullish view, with each decline only being considered a short-term correction or a buying opportunity.

During the day, the technical outlook for gold continues to target the technical level of 2,942 USD in the short term, more than the all-time high. Notable positions will also be listed as follows.

Support: 2,900 - 2,880 USD

Resistance: 2,942 - 2,956 USD

SELL XAUUSD PRICE 2976 - 2974⚡️

↠↠ Stoploss 2980

→Take Profit 1 2968

↨

→Take Profit 2 2962

BUY XAUUSD PRICE 2877 - 2879⚡️

↠↠ Stoploss 2873

→Take Profit 1 2885

↨

→Take Profit 2 2891

GOLD fluctuates strongly, affected by ADP and Trump's policiesOANDA:XAUUSD Spot trading fluctuated strongly due to the impact of US jobs data and news of Trump's tariffs.

ADP's national jobs report, also known as the "small nonfarm" report, showed that private-sector job growth in the United States slowed in February, with just 77,000 jobs created, well below the expected 140,000 jobs.

"Policy uncertainty and slowing consumer spending may have contributed to a slowdown in layoffs or hiring last month."

ADP chief economist Nela Richardson said in a statement. "Our data, combined with other recent indicators, shows that employers are hesitant to hire as they assess the future economic environment."

After the ADP data was released, the US Dollar index fell sharply, and spot gold prices recovered strongly from the lowest level in Wednesday's trading session of 2,894.27 USD/ounce. As of the time this article was completed, spot gold was trading at 2,923USD/oz, an increase equivalent to 0.15% on the day.

WASHINGTON (Reuters) - U.S. President Donald Trump will waive tariffs on Mexico and Canada for one month for automakers, responding to calls from industry leaders, the White House said on Wednesday.

"We will give a one-month exemption to any imported cars that come in through USMCA," White House press secretary Karoline Leavitt said. "The tariffs will still be in effect on April 2, but at the request of the USMCA companies, the president will give them a one-month exemption so they are not financially disadvantaged."

According to Bloomberg, US President Trump is considering reducing tariffs on some agricultural products from Canada and Mexico. On Wednesday local time, US Secretary of Agriculture Brooke Rollins said "everything is on the table" and hoped the government would decide to provide relief to the agricultural sector.

Specific waivers and exceptions for the agriculture industry, which could include potash and fertilizers, have not yet been determined, Rollins said at the White House. “We believe that the President (Trump) cares very much about these communities,” Rollins said at the White House.

On the geopolitical front, aides to Ukrainian President Volodymyr Zelensky discussed steps toward peace with the U.S. national security adviser, and Ukraine and the United States agreed to meet soon. The cooling geopolitical situation in Ukraine can be seen as a pressure on gold prices in the short term.

Analysis of technical prospects for OANDA:XAUUSD

Concerns about Trump's tariffs have pushed safe-haven gold prices to an all-time high 11 times this year, peaking at $2,956 an ounce on February 24 and rising 11% this year.

On the daily chart, gold is currently trading with a newly formed price channel, and the next notable target level at $2,942 is more of an all-time high. However, in terms of momentum, it is facing some obstacles due to the 61 level of the RSI Relative Strength Index. If RSI breaks above this level, this will be a positive signal for price momentum.

Even if gold falls below the price channel, it still has a bullish outlook, the current declines should still only be seen as a short-term correction or a buying opportunity.

Some notable locations of the day will be listed as follows.

Support: 2,900 – 2,880USD

Resistance: 2,942 – 2,956USD

SELL XAUUSD PRICE 2943 - 2941⚡️

↠↠ Stoploss 2947

→Take Profit 1 2935

↨

→Take Profit 2 2929

BUY XAUUSD PRICE 2877 - 2879⚡️

↠↠ Stoploss 2873

→Take Profit 1 2885

↨

→Take Profit 2 2891

XAUUSD: Last push before major correction.Gold is bullish on its 1D technical outlook (RSI = 60.610, MACD = 34.740, ADX = 32.308) as the recent geopolitics and tariff fundamentals are strengthening it as a safe haven. Fundamentals aside, the price is also being guided higher by the technical similarities with the October 2024 pattern. As you can see, it was after an identical Cup and Handle pattern that bottomed on the 4H MA200 that initiated a Channel Up to the 2.0 Fib extension that completed a +18.50% rise. Long, TP = 3,050.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD recovers, fueled by trade risks as key support Influenced by US President Trump's imposition of new tariffs on imports from Canada and Mexico and the doubling of tariffs on Chinese goods, the situation has raised fears of a global trade war. OANDA:XAUUSD found support after fresh tariff concerns and rebounded to target $2,900 and above it the momentum is waning.

Trump's tariff policy continues to boost inflation expectations while weakening economic growth expectations, and real yields continue to decline.

The upcoming Nonfarm Payrolls (NFP) and Consumer Price Index (CPI) reports will have an important impact on the market. If data shows rising inflation, gold prices could fall as the market may reduce expectations for an interest rate cut by the Federal Reserve. Recently, the market expected the Federal Reserve to cut interest rates by 75 basis points by the end of the year, up from 44 basis points last week.

Trump's tariff action, which could affect nearly $2.2 trillion in annual US two-way trade with China, takes effect at 12:00 Hanoi time on Tuesday. China responded immediately by imposing additional tariffs of 10%-15% on certain US imports effective March 10 and imposing a series of new export restrictions on certain designated US entities, according to Bloomberg.

Meanwhile, Canadian Prime Minister Justin Trudeau said Ottawa will immediately apply a 25% tariff on $20.7 billion worth of US goods.

JPMorgan said it has a structurally long-term bullish view on gold and expects gold prices to reach $3,000 by the fourth quarter of 2025. Trump's tariffs are considered inflationary and have prompted many investors to move money into the safe-haven gold, which has risen more than 10% this year.

However, higher inflation in the United States could force the Federal Reserve to maintain high interest rates for longer, which could reduce the appeal of non-yielding bullion. Markets await the ADP jobs report on Wednesday and the US nonfarm payrolls report on Friday for more information on the Federal Reserve's interest rate path.

Analysis of technical prospects for OANDA:XAUUSD

On the daily chart, gold has achieved the $2,900 target gain readers noticed in previous editions since it reached support at $2,835.

Temporarily, the recovery momentum is weakening but maintaining price activity above the original price level of $2,900 is considered a positive signal for continued upside, and the next target is $2,942 in the short term, more than the all-time high of $2,956.

The interim relative strength index is also showing signs of reacting to the 61 resistance level, a continued break towards the overbought area would be a positive signal for bullish expectations in terms of momentum.

During the day, gold's price recovery prospects and notable positions will be listed as follows.

Support: 2,900 – 2,880 – 2,868USD

Resistance: 2,942 – 2,956USD

SELL XAUUSD PRICE 2941 - 2939⚡️

↠↠ Stoploss 2945

→Take Profit 1 2933

↨

→Take Profit 2 2927

BUY XAUUSD PRICE 2884 - 2886⚡️

↠↠ Stoploss 2880

→Take Profit 1 2892

↨

→Take Profit 2 2898

XAUUSD Resistance rejection expected.Gold (XAUUSD) is rising after an exact rebound on its 4H MA200 (orange trend-line). Every time the 17-month Channel Up posted a similar 4H MA200 rebound, Gold got rejected on the upper Resistance and re-tested one more time the 4H MA200.

A trading plan involving a buy targeting 2960 (Resistance) and then reversing to a sell targeting 2880 (4H MA200) is technically viable based on those occurrences.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇