Gold is reversing before reaching the round $3,000 mark.Gold is reversing before reaching the round $3,000 mark.

As you can see on the chart, we’ve hit the 227% Fibonacci level.

— Back in 2008, after testing this level, we went into a correction.

— I think we might see a similar scenario play out from here.

Dollar Index:

SP500/SPY:

Gc1

Middle East heats up, GOLD rises more than 20 USDIn the Asian trading session, the spot price of OANDA:XAUUSD suddenly jumped by more than 20 USD in the short term and the gold price just touched 3,135 USD/ounce. The situation in the Middle East suddenly became tense and the US Department of Defense sent more aircraft carriers and bombers to the Middle East, increasing risk aversion, which boosted the demand for safe havens.

The latest news from Bloomberg News in the US said that in the context of the US declaring to continue the fight against the Iran-backed Houthi rebels and escalating tensions with Iran over Iran's nuclear program, US Secretary of Defense Pete Hegseth ordered the dispatch of more troops to the Middle East, including the USS Carl Vinson aircraft carrier strike group and many fighter jets.

The Carl Vinson will arrive in the region after completing the Indo-Pacific exercise. Pentagon spokesman Sean Parnell said in a statement Tuesday that the Defense Department will also extend the deployment of the USS Harry S. Truman Carrier Strike Group in the region. The rare deployment of two aircraft carriers echoes a show of force last year under the Biden administration.

"Secretary Hegseth made clear once again that if Iran or its proxies threaten U.S. personnel and interests in the region, the United States will take decisive action to protect our people," Parnell said.

Iran's Supreme Leader Ayatollah Ali Khamenei said on Monday that any attack by the United States or Israel would be met with "decisive retaliation." US President Donald Trump has previously threatened to bomb Iran if it does not sign a deal to give up its nuclear weapons.

Last week, Iranian Foreign Minister Abbas Araghchi said there would be no direct talks with the United States as long as the Trump administration continued its "military threats." "If there is no deal, the bombing will come," Trump warned in an interview last weekend.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold tested the 0.786% Fibonacci extension level and declined slightly after receiving support from the 0.618% Fibonacci extension level. As we have communicated to our readers in previous publications, given the current fundamental context and technical chart conditions, further price declines are possible, but should only be considered as short-term corrections and not a trend. Or we can consider the downward corrections as another buying opportunity.

As long as gold remains within the price channel, there is still a long-term main uptrend, with the main support from the EMA21 and the short-term trend is highlighted by the price channel.

For now, gold is capped by the $3,135 level, once this level is broken above gold, there will be conditions to continue to refresh the all-time high set on yesterday's trading day with the next target being the $3,172 price point of the 1% Fibonacci extension.

During the day, the bullish outlook of gold will be highlighted by the following technical levels.

Support: $3,108 – $3,100 – $3,086

Resistance: $3,135 – $3,149 – $3,172

SELL XAUUSD PRICE 3171 - 3169⚡️

↠↠ Stoploss 3175

→Take Profit 1 3163

↨

→Take Profit 2 3157

BUY XAUUSD PRICE 3085 - 3087⚡️

↠↠ Stoploss 3081

→Take Profit 1 3093

↨

→Take Profit 2 3099

INTRADAY MOVEMENT EXPECTEDi can see still there is liquidity above at the poc of the weekly volume

but if the price can cross up the level it can visit the next resistance above

so if the price at london session cross down the value area i will expect visit the levels shown on the chart as support and make the rejection

so we have to follow the plan and and use the levels on the chart risk management safe the profit secure the orders after the price move stop at break even

we wish happy trade for all

XAUUSD: Flashing a strong sell signal.Gold is highly overbought on its 1D technical outlook (RSI = 75.258, MACD = 52.020, ADX = 63.587) and today is having its first strongly bearish 4H candle. This is because the price hit the top of March's Channel Up and got rejected. The HH should now give way to a bearish wave for a HL on the 4H MA50. This is a validated sell opportunity to go for yet another -1.80% decline and target the bottom of the pattern (TP = 3,093).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

4 consecutive days of increase, GOLD support from TrumpIn the Asian session, spot OANDA:XAUUSD continued to rise, surpassing $3,145/ounce, up more than $24 on the day.

The global trade war has caused concerns in the market, continuing to push gold prices to new highs. Gold prices rose 8% in March and have increased for three consecutive months this year.

Gold prices have increased more than 18% this year, following a 27% increase last year, thanks to a favorable monetary policy environment, strong central bank buying and demand for exchange-traded funds (ETFs).

Trump: Tariff details could be announced soon (Bloomberg)

US President Trump said on Monday local time that details of the tariffs could be announced either Tuesday night (April 1) or April 2.

Trump also said the US would be “very friendly” to other countries and that tariffs could be significantly reduced in some cases. Trump then talked about other issues before returning to the issue of tariffs, adding: “The tariff plan is already in place.”

White House spokeswoman Karoline Leavitt said on Monday that US President Trump will announce a plan for reciprocal tariffs "country by country" in the White House Rose Garden on April 2 and that no tariff exemptions are currently being considered.

In the latest escalation in the trade war, Trump is set to impose broad “reciprocal” tariffs on all U.S. trading partners on Wednesday, a day he has called “Liberation Day.” Trump also plans to impose a 25 percent tariff on all non-U.S.-made cars this week.

Asked about the reciprocal tariffs and which countries would be affected, Leavitt declined to provide details. Asked whether lower tariffs would be applied to products used by U.S. farmers, Leavitt said “there are no exemptions at this time.”

Trump also said on Sunday that he would impose secondary tariffs of 25% to 50% on buyers of Russian oil if he finds Russia intends to obstruct US efforts to end the war in Ukraine.

Technical Outlook Analysis OANDA:XAUUSD

4 days of soaring, gold is heading for its 4th consecutive strong day of gains as it breaks the target at the 0.618% Fibonacci extension of $3,139, followed by the target at the 0.786% Fibonacci extension of $3,177.

With the current technical conditions, there is no resistance or signal for a significant technical correction.

With the medium-term trend being highlighted by the price channel and a blue price channel as the short-term trend. As long as gold remains above the EMA21, it will remain technically bullish in the long-term.

Meanwhile, the Relative Strength Index (RSI) is operating in the overbought zone but is not giving any signal of a possible downside correction.

For the day, the technical outlook for gold prices remains bullish, and any current downside correction should only be considered as a short-term correction or a buying opportunity.

With that, the notable positions for the uptrend will be listed as follows.

Support: 3,128 – 3,113 USD

Resistance: 3,177 USD

SELL XAUUSD PRICE 3157 - 3155⚡️

↠↠ Stoploss 3161

→Take Profit 1 3149

↨

→Take Profit 2 3143

BUY XAUUSD PRICE 3085 - 3087⚡️

↠↠ Stoploss 3081

→Take Profit 1 3093

↨

→Take Profit 2 3099

GOLD surges above $3,100 as April 2 approachesThe international OANDA:XAUUSD has jumped above 3,100 USD for the first time in this trading day, as concerns about US President Donald Trump's tariff policy and its possible economic consequences, along with geopolitical uncertainties, have prompted a new round of safe-haven investment.

As of press time, spot OANDA:XAUUSD was up 0.86% at $3,111/oz, having earlier hit an all-time high of $3,111.55, surpassing the all-time high set last Friday.

Trump signed a proclamation last week imposing a 25% tariff on imported cars, and markets are bracing for so-called “reciprocal tariffs” that the White House is expected to announce on Wednesday.

Gold has hit a record high and is up more than 18% this year, cementing its status as a hedge against economic and geopolitical uncertainty.

Earlier this month, gold prices broke through the psychological $3,000 mark for the first time, a milestone that reflects growing market concerns about economic uncertainty, geopolitical tensions and inflation that will continue to drive gold higher.

Since taking office, Trump has pushed through a series of new tariffs to protect U.S. industry and reduce the trade deficit, including a 25% tariff on imported cars and parts and an additional 10% tariff on all imports from China. He plans to announce a new round of reciprocal tariffs on April 2.

In addition to trade tensions, strong central bank demand for gold and inflows into exchange-traded funds (ETFs) will continue to support the incredible rally in gold prices this year.

In short, until there is a resolution to this back-and-forth tariff war, the tariff issue will continue to push prices higher in the near term.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold has achieved a key bullish target at the confluence of the 0.50% Fibonacci extension with the upper edge of the price channel. Once gold breaks this level (3,113 USD), it will be eligible for further upside with the next target around 3,139 USD in the short term, which is the price point of the 0.618% Fibonacci extension.

In the meantime, the steep RSI remains active in the 80-100 area but shows no signs of weakening or correction, so in terms of momentum, the bullish momentum remains very strong.

As long as gold remains within the channel, it has a medium-term bullish outlook, otherwise the channel will become a short-term bullish trend channel.

During the day, the bullish outlook for gold will be highlighted by the following technical levels.

Support: 3,086 – 3,057 – 3,113 USD

Resistance: 3,139 USD

SELL XAUUSD PRICE 3140 - 3138⚡️

↠↠ Stoploss 3144

→Take Profit 1 3132

↨

→Take Profit 2 3126

BUY XAUUSD PRICE 3085 - 3087⚡️

↠↠ Stoploss 3081

→Take Profit 1 3093

↨

→Take Profit 2 3099

GOLD MARKET ANALYSIS AND COMMENTARY - [March 31 - April 04]This week, the international OANDA:XAUUSD increased sharply from 3,003 USD/oz to 3,087 USD/oz and closed this week at 3,085 USD/oz.

The reason for the sharp increase in gold prices is that US President Donald Trump decided to impose a 25% tax on imported cars into the US. This seems to go against Mr. Trump's previous statement about "easing" tariffs, causing investors to worry that US partner countries will retaliate, making the global trade war more intense.

Some countries, such as the UK and Japan, have taken some steps to appease and actively negotiate to avoid US tariffs, while many other countries have announced their readiness to retaliate against US tariffs. Therefore, many experts believe that the tariff policy announced by Mr. Trump on April 2 will be very unpredictable.

If Mr. Trump still decides to impose tariffs on many countries, the gold price next week may continue to increase sharply, far exceeding 3,100 USD/oz. However, if Mr. Trump narrows the scale of tariffs as announced and does not impose additional industry-specific tariffs on lumber, semiconductors, and pharmaceuticals, the gold price next week is at risk of facing strong profit-taking pressure, especially when the gold price is already deep in the overbought zone.

In addition to the Trump administration's tax policy, investors also need to pay close attention to the US non-farm payrolls (NFP) report to be released next weekend, because this index will directly impact the Fed's interest rate policy.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

The most notable economic news in the coming week will be the US implementation of global trade tariffs on Wednesday, along with the March non-farm payrolls report due Friday morning. Experts warn that both events could increase the appeal of gold as a safe-haven asset. In addition, a number of other important US economic data will be released, including the ISM manufacturing PMI and JOLTS job vacancies on Tuesday, the ADP employment report on Wednesday, along with the ISM services PMI and weekly jobless claims on Thursday.

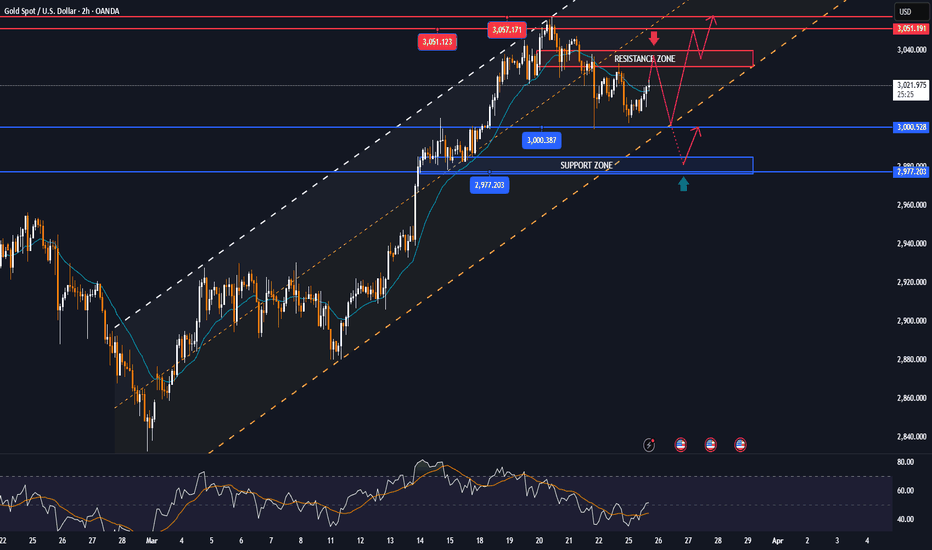

📌Technically, short-term perspective on the H1 chart, gold price next week may continue to surpass the 3100 round resistance level, approaching the Fibonacci 261.8 level around the price of 3,123 USD/oz. The current support level is established around the 3057 level, if next week gold price trades below this level, gold price is at risk of falling to around the 3,000 USD/oz round resistance level.

Notable technical levels are listed below.

Support: 3,057 – 3,051USD

Resistance: 3,100 – 3,113USD

SELL XAUUSD PRICE 3133 - 3131⚡️

↠↠ Stoploss 3137

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

XAUUSD Time to start selling?Gold (XAUUSD) finally hit our 3 month $3000 target that we've been pursuing since the very first week of this year (January 06, see chart below) and in later stages upgraded to $3100:

Now the price has reached the top of the 1.5-year Channel Up, forming a similar 1D MACD peak formation while completing the +22.50% rise that the previous two major Bullish Legs had. As you can see, the pattern makes its Higher High on the 2nd MACD Bearish Cross and in 2 out of 3 Bearish Legs it retraced all the way to the 0.5 Fibonacci level, while on the remaining it the correction was contained to just above the 0.382 Fib.

On all cases the price came close to the 1D MA100 (green trend-line) before bottoming. As a result, even though some more Trump announcements may cause a momentary push upwards, we technically think that it is a solid level to turn bearish now with a fair 2900 Target on the 0.382 Fibonacci where by the end of April it should come close to the 1D MA100.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Unstoppable, GOLD could rise in Big Data WeekOANDA:XAUUSD markets maintained solid gains in the initial reaction to higher-than-expected inflation data, with OANDA:XAUUSD surging to a record high as investors flocked to the safe-haven asset amid concerns that US President Donald Trump’s latest tariffs will spark a global trade war. It is now up more than 17% for the quarter, which would be its best quarterly performance since 1986.

PCE data slightly exceeds expectations, but has limited impact on rate cut expectations

Data showed that the US personal consumption expenditures (PCE) price index rose 0.4% month-on-month in February, above market expectations of 0.3% and in line with January.

While inflation data was somewhat upbeat, it was not enough to significantly change market expectations for a Fed rate cut.

The Fed has yet to adjust its policy rate this year, having previously cut rates three times through 2024. Markets now expect the Federal Reserve to cut rates by a total of 63 basis points starting in July this year, and could start cutting rates by 50 basis points by mid-year.

Gold is traditionally a safe-haven asset that performs well in an environment of political and economic risk and low interest rate expectations.

Trump is about to announce "reciprocal tariffs", and the market is very wary of inflation and growth risks

The market is closely watching the Trump administration's plan to announce "reciprocal tariffs" on April 2. Trump's policies have the effect of promoting inflation, not only increasing the risk of economic recession, but also may exacerbate global trade tensions.

This is beneficial for gold prices!

Looking ahead to next week, in addition to the technical upside and current support for gold, gold prices remain well supported as US economic data continues to highlight slowing growth. Next week’s jobs data is expected to be a significant mover. Any weakness in the labor market could weigh on equities and boost safe-haven demand for gold.

Therefore, as usual, the employment data will be the focus of the economic calendar next week, and more detailed analysis will be sent to readers in the next editions. In particular, along with the economic data, traders also need to monitor how the world reacts to the implementation of US trade tariffs, which are expected to take effect on April 2. This will deeply affect the US Dollar and the price of gold, any risk of escalating tariff conflicts will cause gold prices to increase immediately.

Economic Data to Watch Next Week

Tuesday: US ISM Manufacturing PMI, JOLTS Jobs Open

Wednesday: US Global Tariffs, ADP Nonfarm Payrolls

Thursday: US Weekly Jobless Claims, ISM Services PMI

Friday: US Nonfarm Payrolls (NFP)

A Gold'en Newtonian Sell-Off Porjected By MedianlinesSir Isaac Newton stated the Third Law of Motion in his landmark work, Philosophiæ Naturalis Principia Mathematica (commonly called the Principia), which was first published in 1687. This law appears in Book I, in the section titled Axioms, or Laws of Motion.

(Axiom: A self-evident truth)

Newton did explicitly present it as an axiom. In fact, it's Axiom III (or Law III) of his three fundamental laws of motion. Here's how he phrased it in the original Latin and in his own English translation:

"To every action there is always opposed an equal reaction: or the mutual actions of two bodies upon each other are always equal, and directed to contrary parts."

And what does this have to do with Medianlines / pitchforks?

This tool measures exactly that: the action — and the potential reaction!

Medianline traders know that pitchforks project the most probable direction that a market will follow. And that direction is based on the previous action, which triggered a reaction and thus initiated the path the market has taken so far.

…a little reciprocal, isn’t it? ;-)

So how does this fit into the chart?

The white pitchfork shows the most probable direction. It also outlines the extreme zones — the upper and lower median lines — and in the middle, the centerline, the equilibrium.

We see an “undershoot,” meaning a slightly exaggerated sell-off in relation to the lower extreme (the lower median line). And now, as of today, we’re seeing this overreaction mirrored exactly at the upper median line!

Question:

What happened after the lower “overshoot”?

New Question:

What do you think will happen now, after the market has overshot the upper median line?

100% guaranteed?

Nope!

But the probability is extremely high!

And that’s all we have when it comes to “predicting” in trading — probabilities.

Why? Because we can’t see the future, can we?

Gold?

Short!

Looking forward to constructive comments and input from you all

Gold Prices Doubled in 5 years. What Does It 'Historically' MeanOver the past five years, Gold prices OANDA:XAUUSD have experienced a significant surge, doubling in value over the past 5 years, from mid-March 2020 to mid-March 2025.

This is the 3rd time in history ever, the price of gold doubled in U.S. dollars (we counted only events when it has been observed first time only over 5-years time span).

🥇 The 1st time "A Doubling" event happened in the first quarter of 1973, when Gold hit $80 mark per ounce (google: "1973 Arab–Israeli War").

⚒ What happened next with Gold prices after that? - Hmm.. Gold doubled in price again! (and even more) over the next three years. Watch historical charts to learn more.

⚒ S&P500 Index folded in half over the same next three years.

🥇 The 2nd time "A Doubling" event happened more than 30 years later, in the first quarter of 2006 when Gold prices hit $500 barrier by the end of the year 2005, for the first time since 1987.

Some analysts blamed inflation in the US and concerns about the state of the global economy.

⚒ What happened next with Gold price after that? - Hmm.... Gold price also doubled in price again! (and even more) over next three years. Watch again historical charts to learn more.

⚒ S&P500 Index folded in half again over the same next three years (google: "2008 financial crisis").

🥇 Now is the 3rd time "A Doubling" event has happened with Gold prices, first time over last almost 20 years.

Several factors have contributed to this increase, including economic uncertainty, inflation fears, geopolitical tensions, central bank activity, and investment demand.

Economic Uncertainty: Times of economic turmoil often drive investors towards gold as a safe haven asset. The increase in global economic uncertainty has been a primary driver of gold's price surge.

Inflation: The threat of inflation also contributes to the rising price of gold. Investors often turn to gold as a hedge against the devaluation of fiat currencies during inflationary periods.

Geopolitical Tensions: Geopolitical instability encourages investors to seek safe-haven assets like gold. The Ukraine war, along with conflicts in the Middle East, have further fueled the rise in gold prices.

Central Bank Demand: Central banks' buying and easing cycles influence gold prices. Central banks often purchase gold to diversify their reserve holdings, and this demand can impact gold prices significantly.

Investment Demand: Demand from technology, jewelry, and investors influences gold prices. Gold price movements are sometimes driven by investor demand.

--

Best #GODL (Gold On Dear Life) wishes,

@PandorraResearch Team

GOLD breaks and refreshes All-Time High, on PCE Data dayOn Friday (March 28) in the Asian trading session, the spot OANDA:XAUUSD unexpectedly accelerated and the gold price surpassed the level of 3,077 USD / ounce, up more than 20 USD on the day.

The threat of additional tariffs by US President Trump has affected the USD. Gold still maintains a positive growth momentum and is expected to reach a new record high.

The spot OANDA:XAUUSD closed up 37.50 USD on Thursday as new auto tariffs announced by President Donald Trump have increased trade tensions around the world and sent stock markets plunging, sending investors fleeing for safe-haven assets.

Gold traders will focus on U.S. PCE inflation data on Friday to gauge the Federal Reserve's rate-cutting path.

Markets will now focus on upcoming U.S. economic data. On Friday, the U.S. will release data on the personal consumption expenditure (PCE) price index for February, the Federal Reserve's preferred inflation gauge.

The U.S. core PCE price index is expected to have risen 2.7% year-on-year in February, up slightly from 2.6% in January.

“A mild PCE inflation reading could reinforce the Fed’s dovish stance and maintain support for gold”

Gold is traditionally seen as a safe haven from economic and political uncertainty and tends to perform well in low-interest-rate environments.

Technical Outlook Analysis OANDA:XAUUSD

Continuing to rise, gold reached all the target levels sent to readers in the weekly publication and also broke these levels. With the current position, gold is expected to continue to rise with the next target at the 0.382% Fibonacci extension level.

The RSI is upright moving back to the 80 area, showing surprisingly strong buying momentum without any signs of weakening in the oversold area.

In the short term, the confluence of the upper edge of the price channel with the 0.50% Fibonacci extension will be the most important position to watch, as it acts as an expected resistance for a slight correction when the RSI enters the overbought zone. However, once gold continues to break $3,113, there will be nothing to stop gold from continuing to increase rapidly.

Overall, the overall bullish outlook for gold prices during the day will be focused on the following technical levels.

Support: $3,057 – $3,051

Resistance: $3,086 – $3,100 – $3,113

SELL XAUUSD PRICE 3101 - 3099⚡️

↠↠ Stoploss 3105

→Take Profit 1 3093

↨

→Take Profit 2 3087

BUY XAUUSD PRICE 3004 - 3006⚡️

↠↠ Stoploss 3000

→Take Profit 1 3012

↨

→Take Profit 2 3018

GOLD holds above $3,000, aiming for weekly targetOANDA:XAUUSD continues to recover and maintain an upward trend, as uncertainty over the Trump administration's tariff policy has boosted safe-haven demand. Meanwhile, the market is focusing on US inflation data due this week to further determine the path of interest rates.

Tariff and inflation concerns have fueled safe-haven buying, with gold up more than 15% this year

US President Donald Trump said on Monday that tariffs on imported cars were coming, but hinted that not all of the threatened tariffs would take effect on April 2 and that some countries could be exempted.

This is sure to raise concerns that if the tariffs are officially implemented, they could push up inflation and stifle economic growth, so investment flows in the market have shifted to traditional safe-haven assets such as gold for allocation.

Gold has always been considered a hedge against inflation and macroeconomic instability. Since the beginning of the year, the price of gold has increased by more than 15% and reached an all-time high of $ 3,057.21 / ounce on March 20.

Market Focuses on PCE Inflation Data, Fed Maintains Dovish Expectations

The market is now paying attention to the US Personal Consumption Expenditures (PCE) price index, which will be released on Friday. This index is considered the core data for the Federal Reserve to assess inflation trends and may provide further material for assessing the path of interest rate cuts this year.

If the PCE inflation index does not show any unusual changes, it will further strengthen the Fed's dovish stance and continue to push gold prices up. More detailed assessments will be sent to readers in later publications.

Last week, the Federal Reserve kept its benchmark interest rate unchanged but signaled it could start cutting rates later this year. Since gold does not yield interest, it is often more attractive in a low-interest-rate environment.

Technical Outlook Analysis OANDA:XAUUSD

Gold continues to rally since receiving support from the $3,000 raw price level, which was a key support noted by readers in previous issues.

The current position above the 0.50% Fibonacci extension level is a positive signal for gold to target the initial upside target in the weekly issue at $3,051 in the short term, more likely an all-time high.

The relative strength index (RSI) is also bent upwards, which should be considered a corrective signal due to the weakening/ending profit-taking momentum.

Going forward, the technical structure remains unchanged with the daily chart dominated by the bullish trend with the price channel as the main trend and the EMA21 as the main support.

As long as gold remains above the EMA21, it still has a bullish outlook in the medium term, along with that, the notable positions for this trading day will be listed as follows.

Support: 3,021 – 3,000 USD

Resistance: 3,051 – 3,057 USD

SELL XAUUSD PRICE 3062 - 3060⚡️

↠↠ Stoploss 3066

→Take Profit 1 3054

↨

→Take Profit 2 3048

BUY XAUUSD PRICE 2989 - 2991⚡️

↠↠ Stoploss 2985

→Take Profit 1 2997

↨

→Take Profit 2 3003

XAUUSD: Channel Down about to start the new bearish wave.Gold is neutral on its 1H technical outlook (RSI = 52.608, MACD = 1.710, ADX = 25.254) which, as the price test the top of the Channel Down, indicates that it is about to start the new bearish wave. The trigger for that sell trade would be a break under the 1H MA200. Aim for a -1.88% decline (TP = 2,980).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Staying above $3,000, risk cools but still supports GOLDOANDA:XAUUSD prices corrected lower and then recovered slightly, maintaining price action above the $3,000 flat level, which is an important support for the short-term bullish outlook, as US President Trump eased his stance on imposing tariffs on trade partners and market risk appetite increased significantly, putting pressure on safe-haven assets such as gold. In addition, gold prices were also dragged down by the US Dollar hitting a more than two-week high.

OANDA:XAUUSD prices have hit a record high 16 times this year, reaching an all-time high of $3,057.21/oz last week.

Trump May Exempt Some Countries from Tariffs, Wall Street Optimistic

Trading sentiment on Wall Street was positive as US President Trump suggested a partial delay in some tariffs originally scheduled to be imposed on April 2.

According to the Wall Street Journal, US President Trump said he may reduce retaliatory tariffs scheduled to be imposed on US trading partners next month and some countries may be exempted.

According to Bloomberg, US President Trump announced on April 2 that he would impose tariffs on specific countries instead of reciprocal tariffs on most countries. These measures target the so-called “Dirty 15” trading partners.

Trump’s tariff policy stance has shown signs of softening, easing investors’ concerns about the risk of a global trade war.

Gold is traditionally seen as a safe investment during times of geopolitical and economic uncertainty, and it typically performs well in low-interest-rate environments.

The Federal Reserve kept interest rates unchanged last week, signaling the possibility of two 25-basis-point cuts this year.

U.S. and Russian officials are holding talks in Saudi Arabia in hopes of making progress on a broad ceasefire in Ukraine. Washington also hopes to negotiate a separate maritime ceasefire in the Black Sea before reaching a broader agreement.

Overall, the market is showing some signs of cooling down, providing the possibility of a correction for gold prices after a long period of consecutive increases. However, in terms of the overall market picture, gold is still fundamentally on the rise, as potential risks still appear frequently and any unexpected impact from geopolitical and trade risks will also cause gold prices to increase strongly.

Technical outlook analysis of OANDA:XAUUSD

On the daily chart, gold corrects lower but remains fixed above the base price of 3,000 USD, which is noted as an important support for the short-term bullish outlook, sent to readers in the previous issue.

In the short term, the upside target is around 3,021 USD, the price point of the 0.50% Fibonacci extension, once this level is broken on gold, it can continue to increase with the target of 3,051 USD in the short term, more than the all-time high then the 0.618% Fibonacci extension.

Overall, as long as gold remains within the price channel, above the EMA21, it still has a bullish technical outlook, the current price declines should only be considered as a short-term correction without changing the main trend.

During the day, the technical uptrend of gold will be focused again as follows.

Support: 3,000 – 2,977 USD

Resistance: 3,021 – 3,051 – 3,057 USD

SELL XAUUSD PRICE 3037 - 3035⚡️

↠↠ Stoploss 3041

→Take Profit 1 3029

↨

→Take Profit 2 3023

BUY XAUUSD PRICE 2978 - 2980⚡️

↠↠ Stoploss 2974

→Take Profit 1 2986

↨

→Take Profit 2 2992

XAUUSD The 4H MA50 makes all the difference.Gold (XAUUSD) is so far maintaining its long-term bullish trend and will continues to do so even on the short-term, as long as it holds the 4H MA50 (blue trend-line). There are three different Channel Up patterns involved and as long as the 4H MA50 holds, the (dotted) short-term Channel targets 3080 at least.

If the price breaks below the 4H MA50 and the dotted Channel Up, it would be best to close any buys and short instead, targeting the 4H MA200 (orange trend-line) at 2960. It has to be said that every time the 4H RSI traded downwards as it has since Wednesday, a stronger pull-back to the bottom of the long-term Channel Up took place, so that has to favor 2960.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD MARKET ANALYSIS AND COMMENTARY - [March 24 - March 28]Last week, although the OANDA:XAUUSD had a sharp decrease in the last 2 sessions of the week, overall, the gold price this week continued to increase for the 3rd consecutive week. After opening at 2,985 USD/oz, the gold price increased to 3,057 USD/oz, but then dropped sharply to 2,999 USD/oz in the last session of the week, then recovered and closed the week at 3,023 USD/oz.

The reason why the gold price decreased sharply in the last session of last week was because the USD increased again after the FED meeting, when some US economic indicators, such as initial unemployment benefits, production index... were all at a positive level, showing that the US economy has not shown any signs of recession. In addition, some FED officials said that the FED is not in a hurry to continue cutting interest rates, although the FED's dot chart previously showed that the FED will still aim to cut interest rates twice this year.

This week, the US will release a number of important indicators, such as PMI, consumer confidence, revised Q4/2024 GDP, and personal consumption expenditures (PCE). Of these, PCE will receive special attention from the market, because this index is the inflation measure that the FED is most interested in. If PCE increases sharply, the FED will continue to cut interest rates. On the contrary, the FED will continue to keep interest rates unchanged in the upcoming meetings.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

Several key economic data releases this week, including the S&P Global Manufacturing and Services PMIs on Monday and the U.S. Consumer Confidence Index on Tuesday, will give the market a clearer picture of where the U.S. economy is headed.

However, the most important data for investors will be the Federal Reserve's preferred inflation gauge, the core personal consumption expenditures (PCE) index, due Friday morning.

Other notable data releases include new home sales on Tuesday, durable goods orders on Wednesday, and pending home sales, weekly unemployment figures, and U.S. fourth-quarter GDP on Thursday.

📌Technically, the key support level for gold this week is around $2,954/oz, while the resistance level is at $3,057/oz. If gold continues to break above $3,057/oz next week, it could open the door for a further rally towards the $3,100/oz resistance zone. On the contrary, gold could face profit-taking pressure, causing the price to fall to around $2,950/oz.

Notable technical levels are listed below.

Support: 3,021 – 3,000USD

Resistance: 3,051 – 3,057 – 3,065USD

SELL XAUUSD PRICE 3101 - 3099⚡️

↠↠ Stoploss 3105

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

GOLD at absolute fundamental support but RSI overboughtOANDA:XAUUSD have now fallen to around $3,048/ounce, down $9 from the historic high reached in early Asian trading today, March 20.

On Thursday, the US Federal Open Market Committee (FOMC) announced its interest rate decision and summarized economic expectations; Federal Reserve Chairman Powell held a press conference on monetary policy.

The FOMC kept its policy rate unchanged at 4.25% - 4.50% after the Trump administration imposed tariffs, while officials raised their inflation forecasts for this year and lowered their economic growth forecasts.

After concluding a two-day monetary policy meeting, the Federal Reserve announced at 2 p.m. ET on Wednesday that it would maintain its benchmark interest rate at 4.25% to 4.5% and announced it would slow the pace of its balance sheet reduction starting in April.

The Fed also released its FOMC statement, predicting rising U.S. inflation and lowering its economic growth forecast.

Amid signs of stagflation, the Fed still announced that it would cut interest rates twice by 2025, similar to the dovish signal it gave when it cut interest rates sharply last September.

The statement noted that recent indicators show that economic activity continues to grow at a solid pace. In recent months, unemployment has remained low, labor market conditions have remained strong, and inflation has remained moderately elevated.

Federal Reserve Chairman Powell first mentioned tariffs at a press conference after the meeting, acknowledging that Trump’s policies have affected the economy. Powell also indicated that the policies of the new Trump administration will affect the economy, but he will be careful to avoid making too clear assessments of this impact. Powell also used the word “uncertainty” several times. He reiterated that there is still uncertainty about the potential impact of tariffs on the U.S. economy and highlighted the risks to the Fed’s expectations for employment and inflation. – Bloomberg –

Last week, US President Trump raised tariffs on steel and aluminum imports to 25% and said new reciprocal tariffs and industrial duties would take effect on April 2.

On the geopolitical front, hostilities between Russia and Ukraine continued despite a 30-day ceasefire aimed at halting attacks on energy facilities. Meanwhile, conflict in the Middle East escalated as Reuters reported that an Israeli airstrike on Tuesday killed 400 people.

Two UN staff were killed in an attack on the UN building in Deir el Balah, central Gaza Strip, a UN source told AFP on Wednesday.

Gold prices have risen more than 15% this year. Gold has long been seen as a safe investment in times of economic or geopolitical uncertainty, and since it does not yield interest, it is even more attractive in a low-interest-rate environment.

Technical outlook for OANDA:XAUUSD

Gold continues to refresh its all-time highs as it finds support from the 0.50% Fibonacci extension noted by readers in yesterday’s edition and currently has no technical barriers ahead, with the next upside target being the 0.618% Fibonacci extension.

While all technical conditions are in favor of the upside with the channel acting as short-term support and the RSI showing no signs of a significant downside correction, downside corrections when they do occur are typically strong after a long period of hot growth like the current one.

Traders can definitely prepare for a downside correction with a target of around $3,037 in the short term and the 0.618% Fibonacci extension is a position that can fit this expectation.

I will try to describe that if you try to sell around the 0.618% Fibonacci level is a counter-trend decision, but since the RSI has been operating in the overbought area and 6 consecutive bullish sessions have occurred, there is a possibility for a downside correction. However, the need to do for the expectation (Adjustment) means that the open short positions should be completed in the short term because it is counter-trend.

During the day, the uptrend in gold prices with the expectation of a downside correction will be noticed again by the following technical levels.

Support: $3,037 – $3,021 – $3,000

Resistance: $3,065

SELL XAUUSD PRICE 3101 - 3099⚡️

↠↠ Stoploss 3105

→Take Profit 1 3093

↨

→Take Profit 2 3087

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

→Take Profit 1 3007

↨

→Take Profit 2 3013

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.