GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bulls 📈

* **Volatility (VIX):** Favorable for directional plays

🧠 Model Consensus:

> “Momentum weak, but bullish flow + low VIX = cautiously bullish.”

> Some models recommend **no trade**, others suggest **tight-risk long call**.

---

### ✅ WEEKLY SETUP AT A GLANCE

* 🔍 **Volume:** Weak (distribution risk)

* 📉 **Momentum:** RSI fading

* 💬 **Options Sentiment:** Bullish bias (calls > puts)

* ⚙️ **Volatility:** Favorable

**Overall Bias:** 🟡 *Moderate Bullish*

---

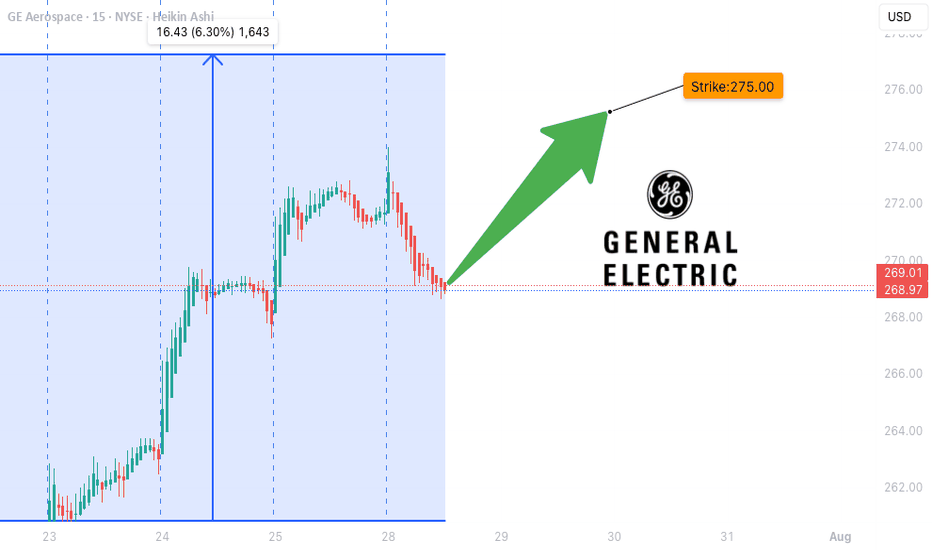

### 💥 TRADE IDEA: GE \$275C

* 🎯 **Strategy:** Long Weekly Call

* 🔵 **Strike:** 275.00

* 📆 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \$1.10

* ✅ **Profit Target:** \$1.80

* 🛑 **Stop Loss:** \$0.55

* 📈 **Confidence Level:** 65%

* 🧮 **Risk Level:** Medium (momentum divergence = tread carefully)

* ⚠️ **Support Watch:** Monitor for drop below \$268–270 for potential exit.

---

### 📦 TRADE\_DETAILS (Algo/Backtest Ready JSON)

```json

{

"instrument": "GE",

"direction": "call",

"strike": 275.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.80,

"stop_loss": 0.55,

"size": 1,

"entry_price": 1.10,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 12:08:59 UTC-04:00"

}

```

---

### 📌 NOTES FOR TRADERS

* 🤖 Models split between *no trade* vs *tight-risk long*

* 🚨 **Momentum divergence** is real – don’t oversize

* 🧭 **Watch Friday theta decay** — manage exits accordingly

* 🔍 Chart check: Watch price action near \$275 and \$268

---

**#GE #OptionsTrading #WeeklyPlay #CallFlow #UnusualOptionsActivity #GEcalls #AITrading #RiskManagement**

Generalelectric

GE on the Rise: Bullish Momentum in an Ascending Channel!Current Price: $187.31

Stop Loss: $166 (below key support).

TP1: $195 (near-term resistance).

TP2: $210 (channel resistance).

TP3: $230 (analyst high target).

🚀Why GE is a Bullish Opportunity

1️⃣ Strong Earnings Potential (Jan 23, 2025)

Analysts expect: EPS: $1.03 and Revenue: around $9.85 billion, showcasing year-over-year growth.

2️⃣ Aerospace Momentum

Projection: GE Aerospace is on track to achieve an operating profit of $6.7 billion to $6.9 billion for 2024, benefiting from robust demand in both commercial and defense sectors.

3️⃣ Bullish Technicals

Technical Indicators: GE stock is trading within a strong upward channel. Indicators like Stochastic (potentially showing bullish crossover), RSI (at a balanced level of 51, suggesting room for growth), and MACD (indicative of bullish momentum) support this view.

4️⃣ Analyst Sentiment

Consensus Price Target: Analysts have set an average target of $209.78, with some forecasts reaching up to $230, offering an upside potential of 15% to 23% from the current price of $187.31.

General Electric due for +20% rally NYSE:GE confirms next leg up

Mentioned in the past few reports for members as one of the quiet performance leaders since bottoming in 2023 and breaking out of a multi-decade consolidation after.

The depth of the consolidation projects a target up to $265 per share, or about +30% from here. Prices are breaking out today, and on a risk-adjusted basis, this is my best new shot at a long.

Beyond Technicals:

GE's order book and backlog are at record levels, providing clear visibility into future revenues.

GE reinstated its Dividend policy.

GE General Electric Company Options Ahead of EarningsIf you haven`t bought GE before the previous earnings:

Then analyzing the options chain and the chart patterns of GE General Electric Company prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $8.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GE has a solid ongoing trend higher LONGGE on a 240 minute chart shows an anchored VWAP and volume profile both anchored back into

October and a price action breakout beginning after the November earnings report and

sustained through the early February earnings report. Both reports showed significant beats

on earnings as well as good beats on revenue. I see GE as a solid long term long swing trade

into at least the next earnings in about ten weeks. Another approach aside investing is

a long term call option more than one year out to capture the tax advantage of the long- term

capital gains tax rate. I will zoom into a 30 minute time frame and go long with the best

entry of a pivot low.

"GE Stock Faces Retracement to $80-$90 Range"Navigating GE Stock: Market Overview and Potential Retracement

General Electric (GE) stock, a stalwart of the industrial sector, is currently under scrutiny as investors assess its performance amidst changing market conditions. With the recent push-up from 2020 to 2024 showing signs of exhaustion, GE may be poised for a retracement to the $80-$90 range. This retracement could test the micro upward trend while remaining within a massive downward range channel, presenting key support and resistance levels for strategic buying and selling opportunities. However, if GE fails to hold the $80-$90 price range, it could signal a continuation of the downward trend, potentially leading to another significant drop.

Understanding GE Stock

GE is a multinational conglomerate with interests spanning across various industries, including aviation, healthcare, renewable energy, and more. As one of the oldest and most well-known companies in the United States, GE has a storied history of innovation and resilience. However, in recent years, the company has faced challenges, including restructuring efforts, asset divestitures, and changes in leadership, which have impacted its stock performance.

Current Market Conditions

In the midst of ongoing market volatility and economic uncertainty, GE stock has been subject to fluctuations driven by a combination of internal and external factors. While the recent push-up from 2020 to 2024 provided some relief for investors, signs of exhaustion have emerged, raising concerns about the sustainability of the uptrend. With the possibility of a retracement looming, investors are closely monitoring GE's price action for potential buying or selling opportunities.

Retracement Potential

The anticipated retracement to the $80-$90 range represents a critical juncture for GE stock. This price level not only serves as a test of the micro upward trend but also aligns with major support and resistance levels within the broader downward range channel. For investors, this presents an opportunity to capitalize on strategic entry or exit points, depending on their outlook for GE's future performance.

Key Buying and Selling Opportunities

Within the context of the retracement, key support and resistance levels provide valuable insights for investors seeking to capitalize on buying or selling opportunities. By identifying these levels and monitoring price action closely, investors can make informed decisions to maximize their returns while managing risk effectively.

Potential Downside Risk

While the retracement to the $80-$90 range offers potential buying opportunities, there remains a significant downside risk if GE fails to hold this price level. A breach of support could trigger a cascade of selling pressure, leading to another massive drop in GE stock. Investors should exercise caution and remain vigilant in monitoring GE's price action to mitigate potential losses.

Conclusion

In conclusion, GE stock is facing a pivotal moment as it navigates changing market conditions and the potential for a retracement to the $80-$90 range. While the recent push-up from 2020 to 2024 provided a glimmer of hope for investors, signs of exhaustion suggest caution is warranted. By carefully analyzing key support and resistance levels within the broader downward range channel, investors can position themselves strategically to capitalize on potential buying or selling opportunities while managing risk effectively in the face of uncertainty.

GE General Electric Company Options Ahead of EarningsIf you haven`t bought GE ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of GE General Electric prior to the earnings report this week,

I would consider purchasing the 105usd strike price in the money Calls with

an expiration date of 2023-11-17,

for a premium of approximately $5.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

General Electric bouncing off 20-EMA.General Electric Company - 30d expiry - We look to Buy at 111.71 (stop at 108.71)

The primary trend remains bullish.

There is no clear indication that the upward move is coming to an end.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

20 1day EMA is at 111.54.

We look to buy dips.

Previous resistance at 111 now becomes support.

Our profit targets will be 119.21 and 120.21

Resistance: 115.70 / 117.96 / 120.00

Support: 113.45 / 111.00 / 110.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GE General Electric Company Options Ahead of EarningsAnalyzing the options chain and chart patterns of GE General Electric Company prior to the earnings report this week,

I would consider purchasing the 110usd strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $3.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

AMAT -ter of Time for this Value Industrial Blue ChipAMAT is a strong company, clean financials, legacy business entrenchment (moat) and plenty of upside potential. However buying today is not favorable risk-reward, wait a few months to see if 2023 gives another ideal buying opportunity

Sector: Producer Manufacturing

Industry: Industrial Machinery

Applied Materials, Inc. provides manufacturing equipment, services and software to the semiconductor, display and related industries. It operates through the following segments: Semiconductor Systems, Applied Global Services, and Display & Adjacent Markets. The Semiconductor Systems segment includes semiconductor capital equipment for etch, rapid thermal processing, deposition, chemical mechanical planarization, metrology and inspection, wafer packaging, and ion implantation. The Applied Global Services segment provides solutions to optimize equipment, performance, and productivity. The Display & Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes, equipment upgrades, and other display technologies for TVs, monitors, laptops, personal computers, smart phones, and other consumer-oriented devices. The company was founded on November 10, 1967 and is headquartered in Santa Clara, CA.

www.reddit.com

GE: Strength Ahead of Earnings ReportThis old company struggled to reinvent after the banking debacle destroyed its consumer financing division. Older companies CAN reinvent and start a new life.

I'm showing the Weekly Chart first so you can see the support zone below and the strong resistance above, where the stock may head sideways for a time.

Around $67 is the high of a completed short-term bottom that provides strong support for the current price action.

The stock entered the strong resistance level of the Trading Range highs of 2021 - 2022 with what I call a "pre-earnings" run.

On the daily chart:

GE had a strong momentum run ahead of its earnings report. This was a pre-earnings run, which tend to develop 2-4 weeks ahead of the earnings release. The company is reporting Tuesday this week.

The strong reversal candle on Friday after 2 down days is also an indication that the report will be good.

GE-BULLISH SCENARIOThe American multinational conglomerate is one of the hottest possibilities now.

The chart formed an uptrend channel supported by strong fundamentals. With a P/E ratio of 32.65 (the industry has an average Forward P/E of 14.47), and a PEG ratio of 4.66, the company seems undervalued compared to the sector.

The short–term expectations are for the uptrend to continue to the $88-$90 resistance level.

If a breakout occurs the next resistances are located as follows:

R1 $ 100

R2 $ 116

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

General Electric remains bearish.General Electric Company - 30d expiry - We look to Sell a break of 82.98 (stop at 86.11)

We are trading at overbought extremes.

The primary trend remains bearish.

Bearish divergence is expected to cap gains.

Posted a Double Bottom formation.

A break of the recent low at 83.20 should result in a further move lower.

Trading has been mixed and volatile.

A higher correction is expected.

Our profit targets will be 75.15 and 73.15

Resistance: 86.60 / 87.60 / 88.40

Support: 84.70 / 83.20 / 80.00

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

GE: Double Bottom?!General Electric Company

Short Term - We look to Buy at 72.25 (stop at 68.61)

Posted a Double Bottom formation. This is positive for sentiment and the uptrend has potential to return. A weaker opening is expected to challenge bullish resolve. Support is located at 70.00 and should stem dips to this area. Dip buying offers good risk/reward.

Our profit targets will be 81.26 and 83.00

Resistance: 81.50 / 96.00 / 108.00

Support: 70.00 / 60.00 / 44.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

GE | General Electric | Potential Inverse Head & ShouldersGE | General Electric | Potential Inverse Head & Shoulders

General Electric is showing the potential for an "Inverse Head & Shoulder Pattern"

The price should bounce above $81 in order to confirm

this pattern.

Targets:

🎯 95.61

🎯 102.58

🎯 114.73

Thank you and Good Luck!

PS: I know that the economy may face a recession soon so let's say out of this topic😂

I am discussing only the technical perspective and what I see on the charts:)