pin bar daily candle @ 200 day EMA pretty simple set up ill be looking for a break above 10.57 to go long, if the scenario ends up a bearish one ill look for a break of that pivot level to take us down to S1 or that red support for a 3rd test 9.50-9.60 area, would be a great spot to get bullish again if we test and hold that 9.50-9.60 area

Generalelectric

GE - Daily 7-7-19Upside:

- Ascending triangle forming over the past month

- The bottom of the ascending triangle is closely in-line with the 20-day SMA, providing additional support

- Inverse head and shoulders set-up forming since early February

Downside:

- Stock price has failed to break above $10.71-$10.72 on three separate days, potentially leading to a double-top set-up

- Volume has slowly been trending down

Notable Prices:

- Top of ascending triangle (also potential double top level) is $10.72

- Bottom of triangle and 2-day SMA is $10.35

I am watching to see which way out of this narrow range the stock price breaks and the volume that is associated with it.

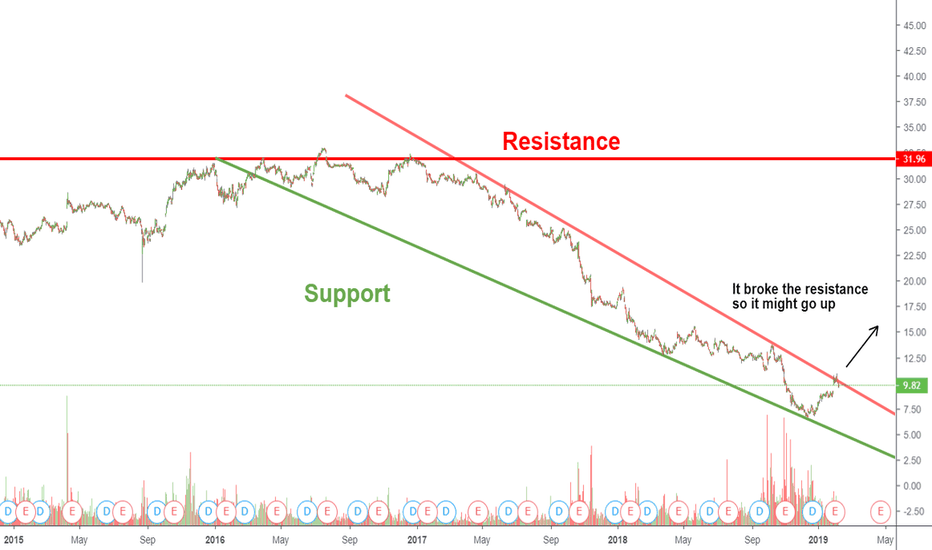

Will General Electric Run for Another 8 Years? Check it out! I couldn't ignore this chart when I looked at it. I noticed it instantly! 10 years later GE has returned back to the $10 range back from 2009.

GE did a 8 year run all the way to 2017 before falling off heavy for 2 years straight. I did another 8 year projection back to the same level it reached in 2017. I believe it will take this pair less than 8 years to reach back to the same level.

If this stock does take 8 years to recover than we should be looking around 2027 to reach the $30 per share range.

All in all I believe this is a very solid stock to invest in.

(Please comment and give your honest opinion.... Thank you)

General Electric Buy SignalThe Trading Chaos Expert has identified me that the price has formed a bullish divergent squat bar on the daily chart of General Electric shares. This signal, reliable as it is, is supported by Elliott wave structure, which is marked on the selected chart. Going long using pending levels that are marked on the chart.

GENERAL ELETRIC CO - Bottomed?Good evening everyone,

Lets take a look at G.E stock, as we can see on the weekly chart the stock is going in a very long downtrend since APR 17 , i believe we might've reached the bottom now,

As we can see price finally went out up of the channel, above the 10.0 psichological level.

The entrance should be evaluated on the daily chart, what do we see?

Price is struggling at the current zone and we might have a bearish divergence on RSI;

So i personally recomend to wait the price re-test the 10.0 zone + 50ema + .382 fibo and reject it before going long, dont forget, overall we are still on a bearish trend.

The S.L should be placed under the current bottom and the reasonable targets are ~13.50 and 18 levels.

But for now, wait a pullback we must.

This Trading Idea is to be used for educational purposes only. This idea does not represent financial advice and its NOT a signal. You should trade based only on your own technic and knowledge.

GE - A fresh look - Trade the breakoutNot financial advice. Do your own research. The ideas shared here are the personal opinions of the BitDoctor team. Trade at your risk.

If you've been following me for more than a couple days, or if you're part of our little group of collaborators, you know that I've been following and aggressively trading GE since about the time it bottomed in late 2018.

GE got a boost after earnings on Jan 31 and we've basically been flagging a bit since then. Basically, people are taking profit and people are buying dips and as that happens, consolidation kicks in and we start to get to a break out phase... but where will we go?

Only time will tell, and I always say to trade the breakout. I did it on IOST the other day, made a profit, and got out. I plan to do about the same thing here. I've been holding a lot of GE for a while now and if it goes up, I'll continue to hold it. If it falls out from under here and happens to break the 100 hourly moving average which happens to be at $9.95 right now, I'll probably sell in order to buy cheaper... eventually. :)

If the 25/50 hourly crosses bearish (they're only about $.02 apart right now), that'll be another confirmation that the trend is down. Until then, I'll hold and plan to get out eventually when I see some good divergence on higher timeframes. Until then, I monitor this consolidation wedge.

I should also add a disclaimer that I hold some options for mid-April expiration for $10 calls. If this pops up, I will cover most of those calls.

Trade safely friends!

<3 -CE-

GE - Topping OutNot financial advice. Do your own research. The ideas shared here are the personal opinions of the BitDoctor team. Trade at your risk.

GE has had a good run so far in 2019. I've made enough money in equity on GE that I am ready to move on. I'm going to leave about 20% of my equity in GE but I will be exiting this asset. There are others that I will start following but that doesn't mean I'm done analyzing this. I think there's a correction phase in the works here and we're finding some support well above the 200 hour MA and today above the 50 hour MA.

There's a wedge formation that is nearing the apex and there's likelihood that we'll break up. As you can see, we printed bearish divergence back in early February but that may have already played out when it for support at $9.50ish.

I have no doubt that you will see prices for GE over $11 this year. Indicators are still looking good which is why I'm keeping 20% in to monitor it.

Trade safely friends!

Good stop loss for GE would be around $9.50 otherwise I'll let it ride.

<3 -CE-