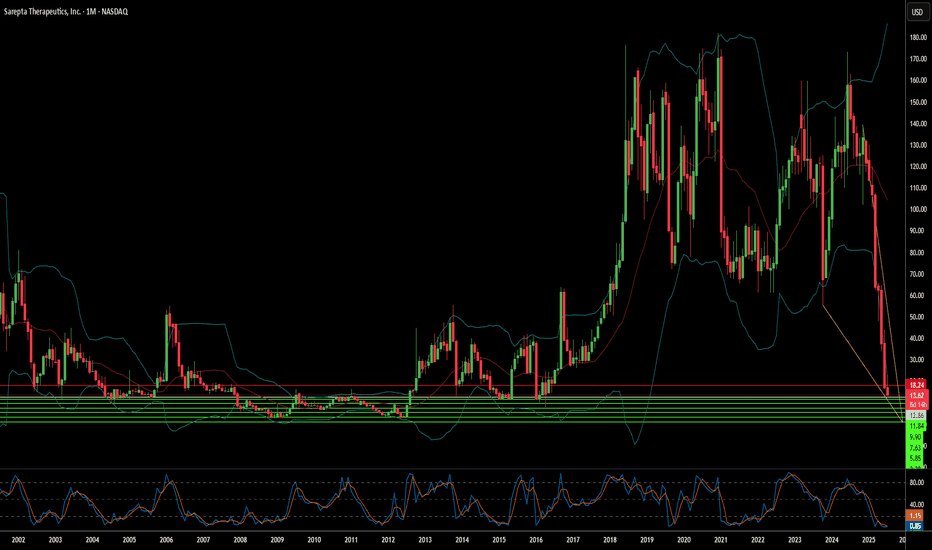

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

Genetherapy

Is Decentralization the Future of Cell Therapy?Orgenesis Inc. (OTCQX: ORGS) champions a revolutionary approach to cell and gene therapy (CGT) manufacturing. The company focuses on decentralizing production, moving away from traditional, centralized facilities. This strategy, centered on their POCare Platform, aims to drastically improve accessibility and affordability of life-saving advanced therapies. Their platform integrates proprietary therapies, advanced processing technology, and a network of clinical partners. By enabling onsite therapy production at the point of care, Orgenesis directly addresses critical industry hurdles like high costs and complex logistics, which currently limit patient access.

Orgenesis's innovative model is already yielding promising results. Their lead CAR-T therapy candidate, ORG-101, targeting B-cell Acute Lymphoblastic Leukemia (ALL), showed compelling real-world data. A study demonstrated an 82% complete response rate in adults and an impressive 93% in pediatric patients. Crucially, ORG-101 also exhibited a low incidence of severe Cytokine Release Syndrome, a common safety concern with CAR-T therapies. These positive clinical outcomes, coupled with a cost-effective, decentralized production method, position ORG-101 as a potentially transformative treatment option.

The broader pharmaceutical industry stands at a pivotal juncture, with cell and gene therapies driving unprecedented innovation. The global CAR T-cell therapy market alone anticipates substantial growth, projected to reach \$128.8 billion by 2035. This expansion is fueled by increasing chronic disease prevalence, significant investment, and advancements in gene-editing technologies. However, the industry grapples with high treatment costs, manufacturing complexities, and logistical challenges. Orgenesis's decentralized GMP-validated platform, along with their recent acquisition of Neurocords LLC assets for spinal cord injury therapies and the MIDA Technology for AI-based stem cell generation, directly confronts these barriers. Their approach promises to accelerate development, enhance production efficiency, and reduce costs, potentially democratizing access to advanced medicine.

SOLID BIOSCIENCES—$SLDB CASHES UP FOR GENE THERAPY PUSHSOLID BIOSCIENCES— NASDAQ:SLDB CASHES UP FOR GENE THERAPY PUSH

(1/9)

Good afternoon, Tradingview! Solid Biosciences is stacking cash—no revenue yet, but a $200M raise has tongues wagging 📈🔥. NASDAQ:SLDB ’s betting big on gene therapy—here’s the scoop! 🚀

(2/9) – CASH, NOT SALES

• Revenue: Zilch—clinical-stage vibes 💥

• Q3 ‘24 Loss: $0.61/share, missed $0.58 est. 📊

• Cash Boost: $200M offering just landed

No sales, but NASDAQ:SLDB ’s war chest is growing!

(3/9) – BIG MOVE

• Feb 18 Raise: $200M via 35.7M shares, warrants 🌍

• Cash Pile: Was $171M, now nearing $350M 🚗

• Goal: Fuel SGT-003 trials into ‘27 🌟

NASDAQ:SLDB ’s loading up for the long haul!

(4/9) – SECTOR CHECK

• Market Cap: $500M post-raise 📈

• Vs. Peers: Sarepta’s 13B dwarfs it—revenue rules

• Edge: Low EV ($150M), big therapy dreams

Undervalued biotech bet or long shot? 🌍

(5/9) – RISKS ON DECK

• Trials: SGT-003 flops could sink it ⚠️

• Sentiment: 30% drop from Jan peak—jitters 🏛️

• Burn: $20-25M/quarter—clock’s ticking 📉

High stakes, high risks—can it deliver?

(6/9) – SWOT: STRENGTHS

• Cash: $200M raise powers trials 🌟

• SGT-003: Early data dazzles, Fast Track nod 🔍

• DMD Focus: Huge need, blockbuster shot 🚦

NASDAQ:SLDB ’s got fuel and firepower!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: No revenue, all-in on one play 💸

• Opportunities: $2-4B cap if trials pop 🌍

Can NASDAQ:SLDB turn cash into a cure?

(8/9) – NASDAQ:SLDB ’s $200M haul—your take?

1️⃣ Bullish—Gene therapy gold ahead.

2️⃣ Neutral—Wait for trial proof.

3️⃣ Bearish—Risks outweigh the buzz.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:SLDB ’s revenue-free, but $200M keeps SGT-003 alive—stock’s buzzing 🌍🪙. Low EV vs. peers, yet trials and rivals loom. Cure or bust?

KRRO a biotech company with earnings coming LONGKRRO is in the biotechnology space in the gene-editing realm. It is in portfolios of C. Woods .

A recent analyst gave it an upside to 100 which is very favorable given its product line and track

record with an all-time high of about $250 ( which is about 450% over current valuation)

On the one-hour time frame, it has had a great week and is breaking out over its moving

averages as well as bullish momentum on the dual TF RSI indicator. This is a stock-long trade

in the biotechnology sector which is prognosticated to be among the best of 2024. The dramatic

reversal on the chart tells me this is a long entry. Targeting $57.5 in the short term and

$75.00 for most of the position in consideration of the analyst report.

TSHA a medtech penny stock pumps on news and earnings LONGTSHA is a gene technology medical company which reported on its clinical trials for Rett

Syndrome which is a neurobehavioral disorder separate from others like autism or

schizophrenia. This could be a breakthrough medication for those who suffer from Rett.

TSHA102 could be heralded as a miracle treatment ( not a cure). Price had trended up

in February and then down in March and is now situated at the mean anchored VWAP.

Relative volumes are 5-10X the running mean. I am taking a sizeable position here based

also on my background as well as the forecasts of medical technology stocks as being hot right

now especially small caps. Risk is definitely on. TSHA has been selling off parts of its pipeline

to fortify its core. This tells me leadership is realistic and has a survival plan which is a big plus

in the world of young and small medical technology companies. The earnings report from

yesterday showed a big earnings beat and a transition from cash burning to positive earnings.

Part of this is from selling off part of its future. Nonetheless, that future may be very bright

with what remains. I believe that TSHA will consolidate and gain consensus as to fair value

but then resume bullish continuation. This may be a buy and hold until the next earnings while

watching for clinical trial news that will give a hint as to the growth path.

(MGX)Metagenomi, Inc.: A Genetic Medicine Powerhouse on the RiseNASDAQ:MGX

here's an analysis of Metagenomi, Inc.: Chart Data is limited..

Financial Performance:

Market Cap: $456.337 million

Previous Close: $12.25

52 Week Range: $9.74 - $12.74

Volume: 392,654

Avg. Volume: 1,187,350

Recent News:

Introduction:

In the dynamic realm of genetic medicine, where breakthroughs hold the promise of revolutionizing healthcare, one company stands out for its pioneering efforts and recent market buzz – Metagenomi, Inc. With a low share price and a scorching-hot market for gene research, investors are eyeing Metagenomi with keen interest. Let's delve into the company's profile, recent developments, and the compelling reasons why it might just be the next big investment opportunity.

Company Overview:

Metagenomi, Inc., headquartered in Emeryville, California, emerges as a leading player in the gene editing biotechnology sphere. Established in 2016, Metagenomi is dedicated to developing therapeutics using its proprietary metagenomics-derived genome editing toolbox. This arsenal comprises programmable nucleases, base editors, and RNA/DNA-mediated integration systems, positioning the company at the forefront of genetic medicine innovation.

Recent IPO and Insider Trading:

A recent initial public offering (IPO) catapulted Metagenomi into the spotlight, with 6,250,000 shares of common stock issued at a public offering price of $15.00 per share. Additionally, insider trading activity has surged, with Novo Holdings A/S, a notable insider, acquiring a significant stake of 900,000 shares at a price of $14.47 per share. This insider confidence underscores Metagenomi's potential and serves as a bullish indicator for prospective investors.

Financial Performance and Market Positioning:

Despite its relatively modest market capitalization of $456.337 million, Metagenomi boasts a compelling growth trajectory. Recent financial data indicates a positive momentum, with total revenue reaching $37.952 million, signaling robust demand for the company's innovative genetic therapies. Furthermore, the company's strategic collaborations with industry giants like ModernaTX, Inc. and Ionis Pharmaceuticals, Inc. underscore its market credibility and growth potential.

Gene Research Revolution:

Metagenomi's strategic focus on precision genetic medicines aligns perfectly with the burgeoning gene research revolution. As the healthcare landscape increasingly gravitates towards personalized therapies and gene editing technologies, Metagenomi stands poised to capitalize on this paradigm shift. The convergence of cutting-edge science, favorable regulatory tailwinds, and heightened investor interest in genetic medicine positions Metagenomi as a prime beneficiary of the gene research boom.

Investment Considerations:

While Metagenomi's low share price and the red-hot gene research market present compelling investment opportunities, prudent investors must weigh certain considerations. The biotechnology sector inherently entails high risk and volatility, with clinical trial outcomes, regulatory approvals, and competitive dynamics exerting significant influence on stock performance. Additionally, Metagenomi's status as an early-stage company necessitates a long-term investment horizon and a tolerance for market fluctuations.

Conclusion:

In conclusion, Metagenomi, Inc. emerges as a compelling investment opportunity in the genetic medicine landscape. With a low share price, recent IPO buzz, and a strategic foothold in the gene research revolution, Metagenomi embodies the quintessential blend of innovation, potential, and market positioning. While investors must exercise due diligence and navigate the inherent risks of the biotechnology sector, Metagenomi's transformative vision and burgeoning market opportunities make it a stock worth watching and potentially adding to one's investment portfolio.

TNYA Biotechology Penny NASDAQ LONGTNYA has been in consolidation the past two days being in the flag of

a bull flag pattern on the 1H chart. Earnings about six weeks ago were

solid especially for a biotechnology stock which are generally priced

based on future potential and not current performance.

( Fundamentally TNYA is in the gene splicing /slicing place which is

perhaps the most lucrative and therapeutic of all of the various

areas in the biotechnology realm. Seemingly, its potential is

expodentially high. )

The zero lag MACD lines have crossed under the histogram which in

general can be considered as a buy signal. The histogram has flipped to

positive.

Upside to the overhead resistance zone by the Luxalgo indicator

is from an entry of about 5 to 6 or about 20%.

Very recent high relative volume as compared with

the 50 day moving average further supports a long trade at this

time. The stop loss would be $.02 below the POC line of the

volume profile.

I will play this with options to further leverage the price action.

Both options and stock are inexpensive for a small account.

BNTC Gene Therapy Penny Stock at All Time LowBNTC Benitec Biopharma Inc is a development-stage biotechnology company which focuses on the development of novel genetic medicines.

The company develops DNA-directed RNA interference based therapeutics.

BlackRock Inc., Renaissance Technologies LLC, Vanguard Group Inc. and Morgan Stanley have stakes in it.

On 2/17/2022 P. Trucchio from HC Wainwright brokerage Initiated Coverage for BNTC with a Buy rating and a price target of $10.00.

The price of the stock can easily double in my opinion.

AVRO 1330% upside potential according to this analyst!!!AVROBIO is a clinical-stage gene therapy company to treat rare diseases following a single dose worldwide.

AVRO just released positive data on their Phase 1/2 trial testing the safety and efficacy of AVR-RD-04.

73.42% of the shares are controlled by institutional investors, which gives me a lot of trust in the company.

JPMorgan Chase and BlackRock Inc. have the largest stakes in the company with an average around $9 per share.

On 1/5/2022 Barclays brokerage Boosted the Price Target of AVRO from $6.00 to $22.00.

The stock is now at all time low: $1.65.

the MARKET CAP is only 71.978Mil

I think it can be an easy buyout at this point.

What are we waiting for?

Benitec Biopharma Inc. BNTC can explode anytime nowBenitec Biopharma Inc., a development-stage biotechnology company, focuses on the development of novel genetic medicines. The company develops DNA-directed RNA interference based therapeutics for chronic and life-threatening human conditions. It is developing BB-301, an adeno-associated virus based gene therapy agent for treating oculopharyngeal muscular dystrophy and chronic hepatitis B virus infection. (Source: Yahoo Finance)

On April 15, 2020, the Company completed the re-domiciliation of the Company from Australia to the United States. As a result, the Company is now incorporated in the United States and its common stock is listed on Nasdaq. (Source: prnewswire.com)

Market Cap 17.093M

Please leave me a message if you want to test the buy and sell indicators that i am using.

Sangamo Therapeutics $SGMO overblown selloff, could bounce highLook for sustained rally upwards from 50 day average, powerfull buy signal could be triggered and could move the stock closer to its consensus price target of $13.50

www.smarteranalyst.com

NASDAQ:SGMO

investor.sangamo.com

investor.sangamo.com

BLCM #VolatilityWatchBLCM has been in continuous long-term downtrend since IPO. Stock price has been showing signs of a bo...

Click here to read the rest of my analysis on BLCM.

Disclosure: I am long BLCM. This is not a recommendation to buy/sell as I am NOT a financial advisor. Please do your homework before investing.

RGNX BTFDRGNX sold off 12% today on news of a partial clinical hold on an NVS gene therapy trial using its vector.

After reading the press release I think this was an overreaction and the stock price will bounce back swiftly into RGNX earnings catalyst on 11/08/2019. It is sold off right to the bottom of its channel making for a beautiful setup!

Gartley + Additional data release todayFriday, October 11, 2019

ADVM is a clinical-stage gene therapy company targeting unmet medical needs in ocular and rare diseases,

ADVM is set to present additional clinical data for the first cohort of patients (n=6) in the OPTIC phase 1 clinical trial of ADVM-022, intra-vitreal injection gene therapy in wet age-related macular degeneration (wet AMD) at the Retina Sub-specialty Day Program of the American Academy of Ophthalmology (AAO) 2019 Annual Meeting in San Francisco, CA.

NEXT EARNING: Nov 11, 2019

MARKET CAP: $333.254 Million

Technical Analysis:

-Bullish Gartley pattern

-Fibonacci 876 retracement is an important reversal level in high volatility trades.

-Our MS Signal oscillator indicating RSI moving higher and now being a potential good time to buy for a bounce.

-MS CCI Squeeze also indicating that bulls are re-gaining control (over mid-line suggests potential squeeze incoming)

Please like, share, and follow so I can continue finding awesome trades. Check out MS Money Trade Ideas for pre-researched trades to add to your watchlist!! Thanks in advance.

Disclosure: I am long ADVM. I may buy or sell within the next 72 hours. This is not a recommendation to buy or sell. Please do your homework before investing.

Sangamo's: Doom or Gloom ScenarioRecent data release may have changed SGMO's future outlook. Sangamo's long-term chart suggests a potential pullback to $4 is a possibility, but that was before a recent data release by the company for updated Phase 1/2 Results for SB-525 . This is an investigational Hemophilia-A gene therapy that showed sustained increased Factor VIII Levels with no reported bleeding events and no factor usage for as long as 24 weeks of follow-up.

Some traders do not believe in technical analysis, that's fine, but I think you may want to re-consider and hear me out on this one. Most didn't believe in Sangamo either (aren't I right Sangamo fan's)!!

What Does The Chart Say?

The long-term pattern (from day of IPO) suggests that if Sangamo Therapeutics stock price continued its trend, it was a possibility that pattern would repeat therefore potentially pulling back to December 2016 lows of around $3.67. Although this may still be a possibility, Sangamo caught wind in its sails on good data release recently, re-igniting investor optimism. I remain cautiously optimistic with Sangamo, so I went ahead and put together a short-term game plan just in case. Take a look at short list of what I will be watching for while I wait for further confirmation of long-term trend indication.

When making previous highs, Sangamo's stock price has entailed devastating 5-wave corrections, however:

The daily chart suggests that instead of a 5-wave correction that could potentially take SGMO to sub $4, SGMO's chart details an AB=BC corrective wave that could potentially mark the low of the long-term selloff.

AB=BC corrective waves are equal in length/or magnitude and on a Bullish correction would bounce off the 0.786 retracement level.

SGMO had a sharp bounce off this level in Feb 2019 and closed the day right above the 0.786 retracement zone. This is a very important level of support to close upon.

If this did not happen I would be on the other side of the trade waiting for a wash, down to $4. But from my experience there still may be fighting chance.

Short-term (from Feb 2019 to now) SGMO continues to make higher lows, this is #Bullish.

Although SGMO looks to have failed to break current resistance in the chart above,volume/optimism packed enough punch to test $11.85 which is a 1.618 Fibonacci extension (normal extensions range from 1.272 or 1.414).. . #Bullish

May not be exactly what a Long-term investor's of SGMO would want to hear, but a pullback around .618-.786 retracement (shown in green-zone on chart) would be a nice place to add for swing-trade up to earnings.

Previous earnings have brought 10-20% run-ups, but be careful to not get trapped in an earnings selloff.

If SGMO continues to make higher-lows, this could be a potential range to be looking for a swing position.

Breakout of this zone could mean big $$

Fall below blue trend line could mean devastation

my stop-loss will be set below blue trend-line.

Again, it's a long way down to $4 if trend continues to follow its Long-term pattern. Previous trends have issued 5-wave correction, peak to trough, the current pattern details an AB=BC harmonic pattern (outlined in #RED) please press play and zoom out to see what I am referring to.

Tip # 5 : A trend line in mathmatical terms means the line of best fit. When using them, make sure they touch as many points as possible on the chart.

Please like and follow so I can continue doing technical analysis. Thank you in advance everyone =)

@VolatilityWatch

@scooby_snack

Disclosure: I do not own SGMO. I may buy/sell within the next 72 hours. This is not a note to buy or sell. Please do your homework before investing.

//----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Check out my some of my current trades.