"Planning the Perfect DE40 Robbery? Here’s the Setup!"💥🔥Thief Trading Style: The Ultimate Market Heist Plan for DE40/Germany40🔥💥

"Steal the Trend, Escape the Trap, and Vanish with Profits!"

🌍🌟**Hola, Hallo, Marhaba, Bonjour, Ola, and Hey Traders!**🌟

Welcome to the Thief Trading Vault – where we don’t just trade, we plan market heists with precision and escape like professionals!

To all my fellow Profit Pirates, Smart Robbers, and Money Hunters – this one's for you. 🤑💸💼

🔐💹DE40/Germany40 Master Robbery Plan – Swing Trade Setup

Strategy Type: Swing & Scalp Friendly

Market Direction: Neutral ➜ Bullish Bias

Approach: DCA + Tactical Entry Zones + News-Conscious Trading

📍ENTRY (The Vault Is Open!)

Break in like a pro! We are eyeing a long entry setup.

Wait for price to dip near key pullback zones (within recent 15m or 30m swing highs/lows). Use buy limit orders to scale in.

🛠 Thieves love layering: DCA style entry strategy ensures lower average cost.

💡“Swipe smart, enter silently.”

📍STOP LOSS (Secure Your Exit!)

Our risk control is set at recent 4H swing low – around 23950.00.

However, your SL can vary based on risk profile, lot size, and number of entries.

Protect the stash! 💼🔒

📍TARGET (Getaway Point!)

🎯 Target: 24570.00 or exit early if resistance becomes tight.

We’re approaching a “Red Zone” – a high-risk area loaded with fake-outs, bear traps, and profit-takers.

🔁Scalpers' Goldmine Tips

Only scalp LONG SIDE ONLY.

Big accounts? Jump in anytime.

Small accounts? Tag along with swing setups.

Always use a trailing SL to secure gains and avoid traps.

🧠Technical + Fundamental Blend

This setup isn’t just chart-based.

We analyze:

🔍 Fundamentals & Macro Trends

🧾 COT Reports & Sentiment

🌐 Geopolitical Events

📊 Intermarket & Index-Specific Data

🧭 Trader Positioning & Future Price Bias

📎 Full outlook & premium research available – Klickk the Lnk🔗🧠

📢IMPORTANT REMINDERS:

⚠️ Major news releases = High risk.

Avoid fresh entries during those hours.

Use trailing SLs to lock profits during volatile sessions.

🚀Support The Thieves – Hit Boost!

Smash that 💥Boost Button💥 if this plan helped you plan your next profit heist.

More boosts = More strategies unlocked.

Join our elite robbers’ squad and conquer the market daily with the Thief Trading Style! 🏆💰❤️

📌DISCLAIMER:

This is a general swing trade strategy and not financial advice.

Always evaluate your own risk level and market understanding before entering trades.

Markets shift fast – adapt, stay sharp, and never trade blindly. 🎯

📅 Stay tuned – more robbery plans, more precision trades, and more fun ahead!

Follow & Boost if you want in on the next mission!

🕶️🐱👤 See you at the getaway spot!

Ger40signals

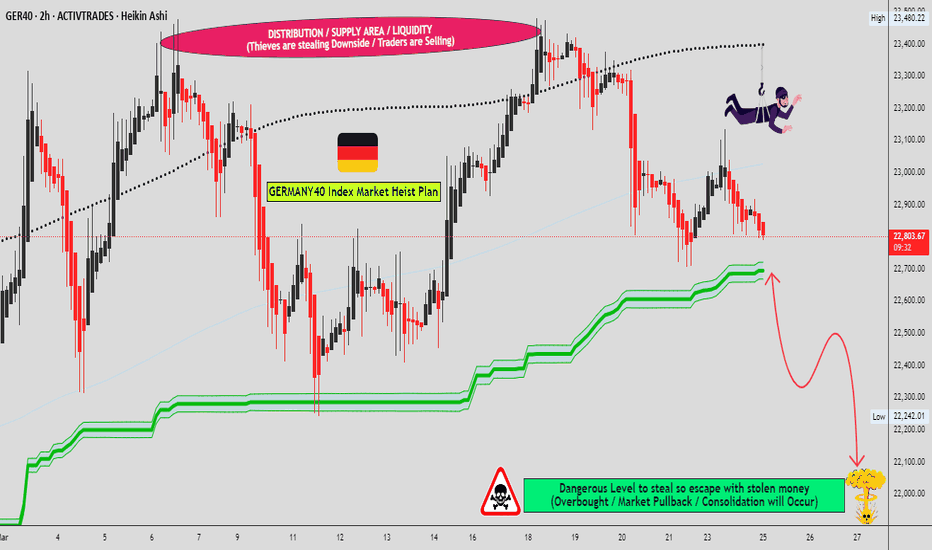

“GER40 Heist in Progress – Bearish Blueprint Deployed!”🦹♂️💼 “Operation: Black Forest Heist” – DAX Day/Swing Trade Plan 💼🦹♀️

📍Thief Trading Style | CFD Tactical Chart Blueprint | GER40 Recon Mission

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers, Risk Raiders & Precision Planners 🧠💸,

Suit up for a clean-cut operation on the Germany 40 (GER40) Index! 🎯

With our sharp-edged Thief Trading blueprint 🔪, we’re scanning for a potential bearish trap—market’s heating up with oversold setups and momentum cracks near key resistance. Watch for the green MA zone—we suspect it's where bullish imposters hide. 🕵️♂️📉

🔓 Entry Plan

“The vault’s cracking... get ready!”

Wait for price to breach the ATR Line (23000.0). Once the level is crossed cleanly, it’s go-time:

🧨 Use Sell Stop orders just under the breakout

🎣 Or hunt pullback setups on 15m/30m charts with Sell Limit entries at resistance

🔐 Stop-Loss Strategy

Keep it tight. Protect your loot.

🚧 Place SL around swing high/low on the 4H chart (e.g. 23400.0)

⚖️ Adapt SL based on lot size, risk appetite, and number of entries

🎯 Target Zone

Mission Objective: 22600.0

Or exit earlier if the security alarm (price action shift) starts ringing. Don't get greedy—get out smart. 💼🚪💨

📉 Market Outlook:

Current trend: Neutral but suspiciously wobbly – early signs of bearish dominance. 🐻

This trade aligns with multiple signals:

📊 Technical: Consolidation near highs

💼 Fundamental: Macro & news risks

🧠 Sentiment: Crowd leaning long = opportunity for reversal

📰 Caution Note – News Events = Laser Tripwires

Stay sharp during releases!

Avoid new setups when big headlines drop

Use trailing stops to secure gains on running trades

Position smart, manage tighter, act quicker 🕶️

💥 Smash that Boost Button if this plan sharpens your edge or adds value to your mission! 💥

Together, we move like shadows and strike like lightning—Thief Traders never miss a clean setup.⚔️🕵️♀️

Stay tuned for the next raid… the market’s full of opportunities waiting to be unlocked. 🗝️🚀

Bullish bounce off pullback support?GER40 has bounced off the support level which is a pullback support that aligns with the 50% Fibonacci retracement and could rise from this level to our take profit.

Entry: 24,101.42

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 23,934.55

Why we like it:

There is a pullback support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 24,396.66

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER40 Trading Plan: Ride the Wave or Get Trapped?🚨 DE40 Heist Alert: The Bullish Breakout Robbery Plan (Swing & Scalp Strategy) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the DE40 / GER40 "Germany40" Index. Follow the strategy on the chart—focusing on LONG entries—and escape near the high-risk Red Zone. This area is overbought, consolidating, and a potential reversal trap where bears lurk. 🏆 Take profits fast—you’ve earned it! 💪

🎯 Heist Entries:

📈 Entry 1: "The Breakout Heist!" – Wait for Resistance (24200) to break, then strike! Bullish profits await.

📈 Entry 2: "Big Players’ Pullback!" – Jump in at 23300+ for a safer steal.

🔔 Pro Tip: Set a chart alert to catch the breakout instantly!

🛑 Stop Loss Rules:

*"Yo, listen! 🗣️ If you’re entering with a buy-stop, DON’T set your SL until AFTER the breakout. Place it at the nearest swing low (4H timeframe) or wherever your risk allows—but remember, rebels risk more! 🔥"*

🏴☠️ Target: 24,800

🧲 Scalpers: Only play LONG! Use trailing SL to lock in profits. Big wallets? Go all in. Small stacks? Join the swing heist!

📊 Market Pulse:

The DE40 is neutral but primed for bullish momentum. Watch:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Positioning & Future Targets

📌 Check our bioo linkks for deep analysis! 🔗🌍

⚠️ Trading Alert:

News = Volatility! Protect your loot:

Avoid new trades during major news

Use trailing stops to secure profits

💥 Boost This Heist!

Hit 👍 & 🔄 to strengthen our robbery crew! Let’s dominate the market daily with the Thief Trading Style. 🚀💵

Stay tuned—another heist drops soon! 🎯🐱👤

DE40 / GER40 "Germany40" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DE40 / GER40 "Germany40" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (22250.0) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24700.0 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸DE40 / GER40 "Germany40" Index Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bullish momentum to extend?GER40 has bounced off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 23,511.62

Why we like it:

There is a pullback support level.

Stop loss: 23,150.34

Why we like it:

There is a pullback support level.

Take profit: 24,780.49

Why we like it:

There is a resistance level at the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish rise off pullback support?GER40 has reacted off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 22,032.93

Why we like it:

There is a pullback support.

Stop loss: 21,497.17

Why we like it:

There is a pullback support.

Take profit: 23,476.82

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (20500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 18400 (or) Escape Before the Target

"GERMANY 40" Index CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"GERMANY 40" Index CFD Market Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "GERMANY 40" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (22650) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 23000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GER40 "GERMANY 40" Index CFD Market Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

A high probability short setup on GER40! Hello traders,

GER40 is flashing a prime shorting opportunity! On the higher timeframe, the index has formed a double top, a classic reversal pattern. The setup has been confirmed with a decisive neckline break, signaling strong bearish momentum.

I'm watching for a slight pullback to the neckline, where I'll be looking to enter short positions. My initial target is 21,637, with an extended move down to 21,112 if sellers maintain control.

Stay tuned for updates, and if you find this analysis valuable, give it a boost! Let’s catch this move together. 🚀🔥

"GERMANY40" GER40/DAX Indices Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "GERMANY40" GER40/DAX Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 23000

Sell Entry below 22100

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 22600 for Bullish Trade

-Thief SL placed at 22600 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 24100 (or) Escape Before the Target

-Bearish Robbers TP 21200 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

"GERMANY40" GER40/DAX Indices market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

🔰Fundamental Analysis

The GER40 index has experienced a moderate decline of 2.5% in February, with the index currently standing at 22,500 points.

Company earnings have been mixed, with some companies exceeding expectations while others have disappointed.

The dividend yield for the GER40 is around 2.5%, which is relatively attractive compared to other major European indices.

🔰Macro Economics

The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation.

Germany's GDP growth rate is expected to slow down to 1.5% in 2025, due to the ongoing economic uncertainty.

Global trade tensions, particularly between the US and China, continue to impact the German market.

🔰Global Market Analysis

The GER40 is experiencing a bearish trend, with a 0.5% decline in the last 24 hours.

The index is currently trading at 22,500, with a high of 22,600 and a low of 22,400.

🔰COT Data

Speculators (Non-Commercials): 45,011 long positions and 30,015 short positions.

Hedgers (Commercials): 25,019 long positions and 40,011 short positions.

Asset Managers: 30,015 long positions and 20,019 short positions.

🔰Market Sentiment Analysis

The overall sentiment for the GER40 is bearish, with a mix of negative and neutral predictions.

55% of client accounts are short on this market, indicating a bearish sentiment.

🔰Positioning Analysis

The long/short ratio for the GER40 is currently unknown.

The open interest for the GER40 is approximately €10 billion.

🔰Quantitative Analysis

The GER40 has a relatively high volatility, with an average true range (ATR) of 150 points.

The index is currently trading below its 50-day moving average, indicating a bearish trend.

🔰Intermarket Analysis

The GER40 is highly correlated with the Euro Stoxx 50 index, with a correlation coefficient of 0.85.

The index is also highly correlated with the DAX index, with a correlation coefficient of 0.90.

🔰News and Events Analysis

The GER40 has been impacted by the ongoing economic uncertainty in Europe.

The index has also been affected by the decline in German industrial production.

🔰Next Trend Move

Bearish Prediction: Some analysts predict a potential bearish move, targeting 22,000 and 21,800, due to the ongoing economic uncertainty and decline in German industrial production.

Bullish Prediction: Others predict a potential bullish move, targeting 23,000 and 23,200, due to the attractive valuations and potential economic recovery.

🔰Overall Summary Outlook

The overall outlook for the GER40 is bearish, with a mix of negative and neutral predictions.

The market is expected to experience a moderate decline, with some analysts predicting a potential bearish move targeting 22,000 and 21,800.

🔰Real-Time Market Feed

As of the current time, the GER40 is trading at 22,500, with a 0.5% decline in the last 24 hours.

🔰Future Prediction

Short-Term: Bearish: 22,200-22,000, Bullish: 22,800-23,000

Medium-Term: Bearish: 21,800-21,600, Bullish: 23,200-23,400

Long-Term: Bearish: 21,400-21,200, Bullish: 24,000-24,200

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DAX Bullish Continuation (Potential New ATH After Elections)DAX price seems to exhibit signs of overall bullish continuation as the price action may form another credible Higher Low on key Fibonacci levels.

There might be a possibility that DAX may break it's All Time High Price of 22938.

With the German elections coming up, (given a pandemic free situation of the world), it might be worth observing price the action further if 22938 breaks. A potential break may be indicative of another top OR a prominent new high.

Trade Plan :

Entry @ 22240

Stop Loss @ 20980

TP 0.9 - 1 @ 23374 - 23500

GER40 "Germany 40" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 3H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22700.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices market is currently experiencing a bullish trend,., driven by several key factors.

🟡Macro Economics

The global economic slowdown is expected to continue in 2025, with a forecast of 3.0% global GDP growth rate. This slowdown may impact the German economy, leading to a potential decrease in demand for the Euro.

🟣COT Report

The latest COT report shows that non-commercials (speculators) are net long 10,000 contracts, indicating a bullish sentiment.

🟠Sentimental Market

Retail traders have a bullish sentiment towards GER40, with 60% being long. Institutional investors have a bearish sentiment towards GER40, with 55% being short.

🔵Positioning

Institutional traders are holding short positions in GER40, indicating a bearish sentiment. Retail traders are holding long positions in GER40, indicating a bullish sentiment.

🟢Overall Outlook

GER40 is expected to trend bullish in the short term, driven by the bullish sentiment among retail traders and the European Central Bank's accommodative monetary policy stance. However, the pair may experience a short-term correction due to the bearish sentiment among institutional traders.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GER40 "Germany 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40 "Germany 40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The heist is on! Wait for the breakout (21250.00) then make your move - Bearish profits await!"

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high or low level should be in retest.

Stop Loss 🛑:

Thief SL placed at 21500.00 (swing Trade) Using the 2H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

First Target 20800.00 (or) Escape Before the Target

Final Target 20300.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GER40 "Germany 40" Indices Market is currently experiencing a Neutral (there is a high chance for Bearish trend)., driven by several key factors.

🟠Fundamental Analysis

1. Earnings Growth: The Germany 40 index has experienced a decline in earnings growth, with a 5-year average earnings growth rate of 5%.

2. Dividend Yield: The dividend yield of the Germany 40 index is currently 2.5%, which is relatively low compared to historical standards.

3. Valuation: The price-to-earnings (P/E) ratio of the Germany 40 index is currently 15.6, which is slightly above its historical average.

⚪Macro Analysis

1. GDP Growth: The German economy has experienced a slowdown in GDP growth, with a 2022 growth rate of 1.4%.

2. Inflation: The inflation rate in Germany has remained relatively low, with a 2022 inflation rate of 1.4%.

3. Interest Rates: The European Central Bank (ECB) has maintained a dovish stance, keeping interest rates low to support economic growth.

🟢COT Analysis

1. Non-Commercial Traders: Non-commercial traders, such as hedge funds and institutional investors, have increased their short positions in the Germany 40 index, with a net short exposure of 10,000 contracts.

2. Commercial Traders: Commercial traders, such as banks and brokerages, have decreased their long positions in the Germany 40 index, with a net long exposure of 5,000 contracts.

⚫Sentiment Analysis

1. Retail Trader Sentiment: Retail traders have a bearish sentiment towards the Germany 40 index, with 55% being bearish.

2. Institutional Investor Sentiment: Institutional investors have decreased their bullish sentiment towards the Germany 40 index, with 50% being bullish.

3. Hedge Fund Sentiment: Hedge funds have increased their bearish sentiment towards the Germany 40 index, with 60% being bearish.

🟤Positioning Analysis

1. Long Positions: Long positions in the Germany 40 index have decreased, with a net long exposure of 50,000 contracts.

2. Short Positions: Short positions in the Germany 40 index have increased, with a net short exposure of 10,000 contracts.

3. Open Interest: Open interest in the Germany 40 index has decreased, with a current open interest of 500,000 contracts.

🟣Based on this analysis, the Germany 40 index is expected to trend bearish in the short term, with a 60% chance of a downtrend and a 30% chance of an uptrend. However, please note that market predictions can be unpredictable and influenced by various factors.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GER40/DAX "GERMANY 40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GER40/DAX "GERMANY 40" Indices Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a short trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 3H period, the recent / nearest high level.

Target 🎯: 19,300 or Before 19,400

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

Economic Factors:

Global economic slowdown: A slowdown in global economic growth, particularly in China and the US, could negatively impact German exports and growth.

Trade tensions: Escalating trade tensions between the US and China, as well as between the US and the EU, could negatively impact German exports and growth.

Brexit uncertainty: The ongoing Brexit process could lead to uncertainty and volatility in the European markets.

Monetary Policy Factors:

ECB's monetary policy: A less accommodative monetary policy from the European Central Bank (ECB), potentially leading to higher interest rates, could negatively impact the index.

Interest rate differential: A widening interest rate differential between the US and the EU could lead to a stronger USD and weaker EUR, negatively impacting the index.

Geopolitical Factors:

EU political instability: Political instability in the EU, potentially driven by a more fragmented European Parliament, could negatively impact the index.

Global geopolitical tensions: Escalating global geopolitical tensions, particularly between the US and China, could negatively impact the index.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any decisions.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GER 40 Trade Log GER40 1H Long Setup: Entering at 0.5 FVG Level

I'm eyeing a long position on the GER40 (DAX) based on the 1-hour timeframe. Here's the breakdown of my trade setup:

🔹 Entry Point:

- Entering at the 0.5 level of the hourly Fair Value Gap (FVG).

🔹 Risk Management:

- Risk: 1% of the trading account.

- Risk-Reward Ratio (RRR): 1:2.

- Stop Loss (SL): Placed below the 1H Kijun-sen line to account for potential volatility.

🔹 Trade Idea:

- Expecting a retracement to the FVG before resuming the upward trend.

- Aware that price action might slice through our SL, but willing to see how it unfolds.

📊 Technical Analysis:

- Ichimoku Cloud: The price is above the cloud, indicating a bullish trend. Placing the SL below the 1H Kijun-sen provides a safety net against sudden dips.

- FVG Levels: Fair Value Gaps often act as magnets for price retracements. The 0.5 level is a strategic entry point to capitalize on the potential bounce.

🌐 Macro Factors Supporting the Trade:

- Economic Resilience: Recent data shows that the German economy is demonstrating resilience amid global uncertainties, boosting investor confidence.

- ECB Monetary Policy: The European Central Bank's accommodative stance continues to support liquidity in the markets, which is positive for equities.

- Political Developments: Speculation around leadership changes, such as discussions about President Macron's position, might lead to increased investor optimism in European markets.

- Global Market Sentiment: A general shift towards risk-on sentiment globally can propel the GER40 higher.

📝 Note:

Trading always carries risk. While the setup aligns with both technical and macroeconomic factors, unforeseen events can impact the outcome. Stay vigilant and adjust your strategy as needed.

Let's monitor this trade and see how it plays out. Feel free to share your thoughts or any insights you might have!

GER 40 Trade LogGER40 Short Position (Discretionary)

Rationale :

- Overextension: The GER40 index appears significantly overextended without substantial fundamental support.

- Rising German Bond Yields: An increase in German government bond yields suggests a shift towards higher borrowing costs, potentially impacting equity valuations.

- MACD Divergence: A notable divergence between the MACD indicator and price action indicates a weakening bullish momentum, often preceding a trend reversal.

- CVD Divergence: Divergence in the Cumulative Volume Delta points to a disparity between buying and selling pressures, signaling a potential downturn.

Trade Details :

- Position: Short GER40 via market order

- Risk Management:

- Risk per Trade: 1% of trading capital

- Risk-Reward Ratio (RRR): 1:2

Note: This trade is discretionary and anticipates a sharp correction at market open. Despite the lack of a formal signal, the confluence of technical indicators and macroeconomic factors supports this decision.

GER40/DE40 "Germany 40 Index" Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GER40/DE40 "Germany 40 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 3h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

GER40 "Germany 40 Index" Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GER40 "Germany 40 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Heading into 50% Fibonacci resistance?GER40 is rising towards the resistance which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 19,326.61

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 19,557.03

Why we like it:

There is a pullback resistance level.

Take profit: 19,073.13

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Could the price bounce from here?GER40 is reacting off the support level which is a pullback support and could bounce from this level to our take profit.

Entry: 19,439.80

Why we like it:

There is a pullback support level.

Stop loss: 19,279.78

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Take profit: 19,673.35

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GER40 / GERMANY40 Market Money Heist Plan on Bearish SideHallo My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GER40 / GERMANY40 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

GER40 swing trade(UPDATE)Last week we were looking for a sell from 18500 with many technical confluences. We also had a 11 day straight bull run without any meaningful retracements. This is a continuation to the previous idea, as the price did not react from our level of interest and kept pushing higher. Currently waiting for 18800, which is the Weekly 0.786 fib level drawn from the all time high. We target 18500-18450 for our TP1. Will update next week. As always, trade safe and wait for confirmations before entering a trade.

Fractals Trading Community,

Mei