Germany

GER30 Investors Strive to Break Above Historical High LevelPrimeXBT is here again with another technical analysis breakdown, and today we are taking a look at the GER 30 .

The Germany 30 Index has continued to churn sideways above the 12900 key medium-term pivotal support and slightly below its strong resistance that exists around its all-time highs near 13590.

The price action combined with the Relative Strength Index is staying strong, but GER30 has formed a bearish divergence, which often indicates that a trend reversal is forming from bullish to bearish, and a downtrend or valuation adjustment could soon follow.

In addition, given the bearish configurations seen in the S&P 500, we don't have the conviction to maintain the bullish bias for the Germany 30 Index. Thus, its trend will likely turn neutral at this juncture between 13590 and 12900. A break below 12900 and the middle line of the rising channel validates a potential corrective decline below the 12500 levels.

On the flip side, only a daily close above 13600 opens up the gates for a further rally to target the next resistance at 14550, which is a 1.272% Fibonacci level and upper boundary the large ascending channel.

Once the price reaches the resistance 1.272% Fibonacci level, a rejection could cause a fall to the previous all-time high level.

Support level: 12900

Resistance level: 13590

Day's range: 13361.8 — 13508.0

We appreciate the continued support that PrimeXBT has received from readers and traders like you, and hope you have great success with all your future trades!

ridethepig | EUR Market Commentary 2020.01.07EUR ticking higher for the open as liquidity returns from the holiday period. On the whole I am happy with how the euro has held, while we discussed yesterday macro hands betting on the reflation theme are hardly moonwalking but we are making progress nonetheless.

Continue to buy dips here, I am becoming increasingly aggressive with sizings, however certainly aware that 1.12xx is proving difficult. A sustained failure to break here will see us retrace towards the lower end of 1.11xx otherwise its business as usual with the initial target at 1.125 (see below diagram).

Additionally, we can comfortably lean on the macro charts over the coming months as we see the green shoots reappearing in Europe:

Those mid and long term plays can continue to eventually target 1.21xx and 1.25xx in macro portfolios with most the hard work to begin the move largely complete:

While the Weekly technicals are much clearer:

Good luck to those trading EURUSD in 2020 and already in longs or for those waiting patiently on the sidelines for the momentum break to form.

As usual thanks so much for keeping your support coming with likes and jumping into the comments!

(DAX30) +750 POINT UPSIDE POTENTIALHypothetical scenario:

(1) Entry @ 12750.0 (Buy Limit)

(2) Stop Loss @ 12512.0 (238 points)

(3) Target 1 @ 12989.0 (477 points) - close 30% - cut stop by 50%

(4) Target 2 @ 13304.0 (550 points) - Close 80% - move stop to b/e

(5) Target 3 @ 13509.0 (759 points) - Close 100%

Stay tuned for the updates

Follow and leave a like if you liked this idea and want to see more!

*DISCLAIMER*

This post is solely for educational purposes and does not constitute any form of investment / trading advice.

Yen feeds from continued risksThe Japanese yen keeps a path of gains as the Sino-US trade war remains unresolved and anti-Communist protests in Hong Kong intensifies in violence. The euro saw now major change after the German economy dodged a recession in the year's 3rd quarter with a GDP figure of 0.1 percent. The pair price resumes its downward trajectory towards the lower line of the more recent, ascending channel. 119.00 and later if the drop in price increases 118.50 can be watched.

Morgan Stanley warns, Powell & inflation under scrutinyThe current week is full of informational events around the oil market. Which continues to play into the hands of sellers. Yesterday, for example, Morgan Stanley analysts warned that if OPEC + participants at their next meeting on December 5 do not announce a higher reduction in production (current volumes of 1.2 million barrels), then Brent quotes will drop to $ 45 (now the price is around 62). That is, the scale of the fall will be about 25-30%.

The chances of a new agreement are small, since countries that are not members of OPEC + are increasing production, so it’s not worth counting on the fact that Cartel members will aloud another loses. Accordingly, the downward pressure on oil quotes in December may increase sharply. Recall that this week we revised our intraday asset position and again recommend oil sales.

And a few words about the oil market, but in the context of our recommendation to sell the ruble. According to Saudi Aramco, the cost of producing a barrel of oil in Russia exceeds $ 40, two times more compared with Saudi Arabia, and in general, is one of the highest rates in the world (even higher than in the UK and the USA). That is, Russia is one of the most vulnerable countries in the world for falling oil prices. That is why we recommend the sale of the Russian ruble.

Meanwhile, ZEW data for the Eurozone as a whole and Germany, in particular, show that economic expectations are still pessimistic, so yesterday's downward pressure on the euro is understandable.

The pound reacted quite positively to the statistics on the labour market in the UK, but yesterday there were no strong movements in pound pairs. We continue to wait for news from the Brexit, but for now, there is none - we work with the pound without obvious preferences on the intraday basis - you can buy or sell it, also use the oversold/overbought time zones as guidelines.

Today, the reason for the pound volatility jump may be inflation statistics. Given that at the last meeting of the Bank of England Monetary Policy Committee, two members spoke out in favour of lowering the rate, weak inflation data could well trigger a pound decline. We recommend using this for cheaper purchases.

Also, data on consumer inflation will be published in the United States. It will be interesting in the context of the fact that in the evening Fed Chairman Jerome Powell will speak to the Congress. The markets are now very concerned about what the Fed is going to do next. The current consensus is a pause in the Fed's actions. But any Powell's allusions to the possibility of an early rate cut will almost certainly provoke a dollar sale in the foreign exchange market.

US and China buck up markets, Bank of England disagreesThursday was not full in events however we could observe some movements that were mainly focused on safe-haven assets, in which a mass exodus of traders was observed.

You do not have to guess what is markets concern about, just look throughout the dynamics of gold or the Japanese yen, you can see is there any progress or not in negotiation between the USA and Sino.

Since gold, like the Japanese yen, was sold yesterday, it is clear that something positive happened between the United States and China. Indeed, China and the United States have agreed to tariffs phase-out before the deal to be made.

This is a very strong confirmation signal for markets that were expecting the successful completion of the first phase of negotiations by the end of the month. Accordingly, investors relaxed and began to leave the safe-haven assets, which provoked sales in government bond markets and safe-haven assets.

In connection with such news, we will wait a while with the purchase of safe-haven assets, since in the short term it is difficult to say how long it will take to work out this fundamental factor. Although in the medium term we remain bulls (gold), and we consider the current decline as an opportunity for cheaper purchases.

Progress in trade negotiations contributed to the oil prices growth so that diversification once again proved to be the best ( losses in gold were offset by oil earnings). Well, our recommendation to buy oil continues to be relevant.

The Bank of England decided to keep the base rate at the same level. However, the voting results surprised: 7 members of the Monetary Policy Committee spoke in favour of the invariance of the rate, but two of them voted in favour of a cut. Which, of course, was a negative signal for the pound. However, support for 1.2810 has survived. Accordingly, our recommendation to buy GBPUSD on intraday day basis remains valid. But do not forget about the stops, and it does not make any sense to put them largely- the bears may well seize the initiative and take the pair to the bottom 1.27.

The euro was not lucky yesterday, industrial production in Germany fell by 0.6% (a 0.4% decline was expected). Given the rather strong downward pressure today, we are more likely to sell the euro than to buy it. But today, instead of pairs with the euro, we will work in pairs with the Canadian dollar. Labour market statistics are likely to lead to a volatility jump. Well, recall that for commodity currencies (which include the Canadian dollar is included), progress in trade negotiations is a positive signal. Yesterday it was ignored by the markets, but it is likely to be worked out today.

DAX 30: Week 43 OutlookA favorable response out of Germany in the last few weeks to the economic and geopolitical data leading news headlines. The German Dax rallied a full +2.38% on the week before settling up +1.42%. This is off the back of comforting U.S. - China trade negotiations looking up. As a major exporter, Germany will benefit massively from a favorable deal between the two countries.

In addition, as the largest economy in the European Union, the BREXIT negotiations ending in a good light Friday. The deal was listed by analyst as favorable for the E.U., and plus for German traders and investors.

From a technical perspective, we have changed our forecast. With such strength in the market, it invalidated the downside continuation pattern and rallied massively to 12,820.00 The last 3 days of trading saw a range of 12,600.00 to 12,700.00 indicating a correction may be forming.

THE PLAY: A close below 12,600.00 on the Daily will signal us to sell into the correction before a higher rally overall. Target 12,250.

DAX-30The DAX (Deutscher Aktienindex (German stock index)) is a blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. Germany is the strongest economy in Europe. But in Europe is not very good there are more indebted debtors Greece, Italy, Spain ..., England has already fled the sinking ship. And the situation in the European Union will deteriorate. On technical analysis, showed the wave theory of the Elliott. We paint the fifth wave and after down the ABC correction. At the top showed a yellow line of resistance that with a black support line makes an rising wedge - a reversal pattern.

More EUR/USD weakness!!The EUR/USD was rejected big, 2 days in a row. Lots of selling pressure. Obviously, this was due to the strong US market on Thursday and Germany getting closer and closer to a recession.

I may look for an entry tomorrow at open, if the 4 hour or 1 hour charts look promising. Or, I might wait to see if the low can be broken, then wait for it to fall to that green demand zone and enter a counter play. We shall see!!

Chemical Industry Collapse - BASF Is The BellweatherMacro

German industry in freefall - ESI Lower & PMIs lower.

Consumer confidence lower, the chemical industry relies heavily on consumer products.

China PMIs lower again.

Micro

60% of sales are based in China/Europe new orders slowing

"In China, the world’s largest automotive market, the decrease was more than twice as high, at around 13%."

Profit warning 30% revision.

The strategy has been to move into Asian markets but they are all contracting.

If the share price is higher than December 2018 and Germany is going into recession, how is the current price justified?

"Basf predicts a slower year For 2019, we expect the global economy to continue to grow at a

slightly slower pace than in the previous year. "

DAX - Inverse head and shouldersLooks like this is getting away from our ideal entry level. However, it looks a good candidate to buy on dips on the short term.

Trade Idea

Broken out of the Head and Shoulders formation to the upside.

Positive overnight flows lead to an expectation of a firm open this morning.

Price action looks to be forming a bottom.

Bespoke support is located at 11750.

Further upside is expected although we prefer to set longs at our bespoke support levels at 11750, resulting in improved risk/reward.

We look to Buy at 11750

Stop: 11680

Target 1: 12070

Target 2: 12200

Johnson's insidious plan, US GDP and dollar’s reactionBoris Johnson asks Queen to suspend parliament.

The decision will cut dramatically the time MPs will have to take action to prevent no-deal Brexit. he is going to ask the Queen to suspend parliament for five weeks from mid-September.

It seems like the Queen is ready to be in. And this means that the opposition will have time until September 12 to prevent the "no-deal" Brexit. The value of the pound has fallen by 1% following news that Prime Minister Boris Johnson is planning to suspend parliament

The signal is more than alarming. Chances of the "no-deal" Brexit have increased dramatically. And this means that you need to be careful. Now we consider such pound descents of 150 points as an opportunity for cheaper purchases. But with stops. Once again, we note that events are developing against the pound, for now.

Data on US GDP for the second quarter will be the main event. Experts expect a slight downward revision. The GDP growth rate is expected to remain at 2 %. Our expectations are more pessimistic. The fact is that the global economy as a whole and individual countries are increasingly showing signs of a slowdown. Very indicative is the data on German GDP, which, recall, showed a decrease in the second quarter. And most importantly, the decrease was due to the slow negative dynamics of exports. That is the direct evidence of the destructiveness of a trade war. There are reasons to expect further deterioration of the situation.

Thus, we will not be surprised if the data is reviewed for the worse, but not by 0.1%, but more for example 1.5%. That will shock markets and the dollar will inevitably suffer. Moreover, the dollar will be under double pressure: the reaction to weak economic data will be multiplied by the growth of confidence in the Fed rate cut in September. So today we will sell the dollar across almost the entire spectrum of the foreign exchange market.

Arrangements, collapse in Germany and data from the USAThe China-United States Trade War is an ongoing economic conflict between the world's two largest economies. Two countries cannot even agree if they are talking. According to Trump, he got a call from Chinese officials, however, China did not confirm that yet. Well, quite possible that there was no call. this means that we are in a situation where the parties are in the active phase of the confrontation. In the light, we will continue to look for points to buy for safe-haven assets (the Japanese yen in the foreign exchange market and gold in the commodity market).

Yesterday extremely weak data on the business climate in the largest economy of the Eurozone came out, today German GDP in the second quarter fell by 0.1%. Another quarter with a minus mark and the recession will be announced officially. Recall recession is a period of general economic decline, defined usually as a contraction in the GDP for six months (two consecutive quarters) or longer. An extremely alarming signal was the decline in German GDP mainly due to a sharp drop in the country's exports (it took 0.5% of GDP growth, actually leading it into the negative zone). This is an example of how the trade war could hurt.

This news confirmed our recommendation to avoid buying euros. Instead, we suggest selling the euro against the Japanese yen and the British pound. This trading idea this week works just great.

As for the dollar, not everything is that simple. Yesterday's data on orders for durable goods, consumer confidence and business activity in the US came out better than expected, which suggests that the US economy is getting better. But, our position on the dollar is unchanged - we are looking for points for its sales. First of all, against the pound and the Japanese yen. Also, on Thursday, revised data on US GDP for the second quarter will be published. Weak data may trigger a short dollar.

Balance, G7 and Jackson Hole outcome, problems of GermanyTrump: China is ready to go back to the negotiating table. China, for its part, reiterated its desire to resolve trade problems through negotiations. safe-haven assets against this background have slightly adjusted and provided excellent opportunities. Despite the optimistic comments from Trump’s side as well as Chinese, everything might change. We have recently observed something similar and buying safe-haven assets tactics on the descents over the past few weeks was the right decision. So our recommendation is to buy gold and the Japanese yen. The only thing, given the increased volatility, do not forget to set stops - it is better to re-enter.

The G7 meeting results can be called insignificant. We did not hear any revolutionary statements. So we believe that this event is already “played out” and taken into account.

As for the Jackson Hole symposium outcome, there was a lot of concern, but representatives of the Central Banks have stated that crisis and cyclical issues need to be solved not only by monetary methods but also by fiscal ones.

Returning to Powell’s speech on Friday, he did not say anything fundamentally new and did not clarify the current state of affairs. Nevertheless, our position on the dollar is unchanged - we are looking for points for its sales.

As for the euro. Data on the business climate in the largest economy of the Eurozone (Germany) again frankly disappointed. The IFO business climate index in August came out worse than expected 94.3 with a forecast of 95.1. This is the minimum value for the last 7 years. Therefore, markets expectations as for the monetary policy easing only intensified. So it’s better to wait a while with euro purchases. But its sales against the pound or the Japanese yen look like good trading ideas.

2 Ways to ride this trendForecast: I am expecting Bund to continue its uptrend going forward next 2 weeks. Currently, this week weekly candle close as an inside bar, suggesting consolidation period. Bund will either expand this coming week or next week.

First: Expansion next week, How to get in?

Trade entry: Long the Daily demand zone, with stop below

Confirmation: Reclaim last week low and eventually reclaim both H4 Support and Last week mid range

Invalidation: Daily candle close below Demand zone

Second: Expansion this week, first wait for monday range to develop, trade will be active afer confirmation is seen

Trade entry: Long at either last week high or weekly open after low of the week is in

Confirmation: Break of previous swing high OR Monday being a down candle and Price reclaim Weekly Open

Key levels mentioned:

- Monthly Open

- Last week high / low / mid - range

- Daily Demand zone

- H4 Support level

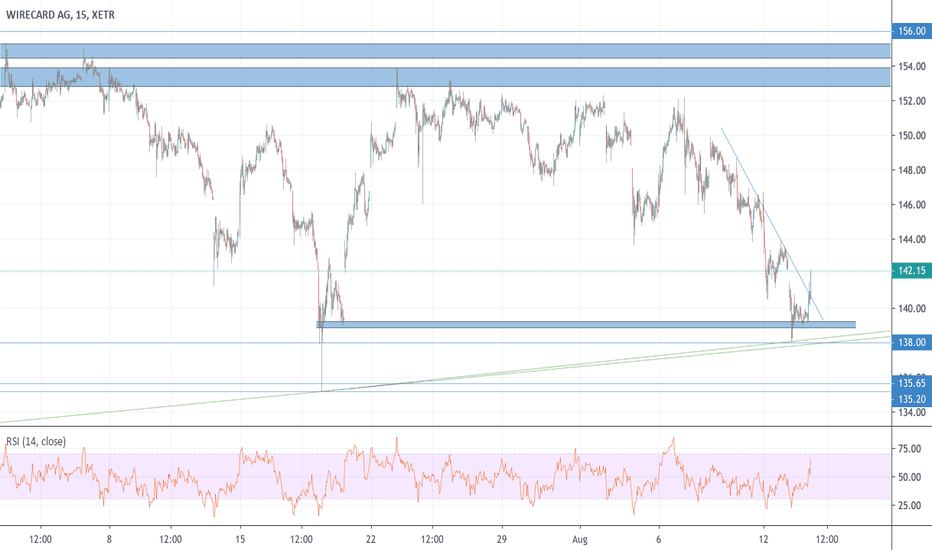

Wirecard - not long until bullrunthere are some technical resistances, but we got extreme support areas and an "long" term uptrend. the fundamentals are extreme bullish, we got an growth company with solid financials here. Im sure it will outperform the DAX(Germany 30) this year by a lot.

German Dax 2 hour set upBeen in a prolonged downtrend on the German Dax...world equities really, and it seems we began to bottom out here. We stopped making lower highs and lower lows.

We hit a support one and from there have gained some bids. Seems we got what appears to be a wedge/triangle break above a resistance zone on the 2 hour followed by higher highs and higher lows. A good risk vs reward trade.

Watching the 11920 zone as an interim target, and another zone at 12050 zone.

I still think central banks can cut rates and go back to QE/stimulus so markets can still remain propped...wall street can keep the party going a little longer.

Et tu DAX?Like the big US Indices DJ:DJI and SP:SPX we got a MASSIVE bearish divergence and a an ascending wedge on the 2 Months chart.

The German Economy really does not exude confidence since the creation of the Euro. As we know the EZB is already on an interest rate of 0% and there is no mild exit anymore from this state of economy in the Eurozone. Soon we will see the price they will have to pay, it does not look cheap..