GOLD v DXY in breakout move --- HVF hunt volatility funnelAlways good to measure against the DXY not just the USD value

Not perfect of course as it is mainly the Euro and Yen but still insightful.

Been watching the relationship for a while

currently breaking out to the upside

HVF theory means this should be a violent expansion

Target 1 coming up.

GLD

Perfect trade setup: $GLD to 325; DXY to 95Gold has been in a raging bull market since 2023 with the index making new higher highs and higher lows as shown in the weekly candle stick chart. In contrast the Dollar index TVC:DXY is making new lows every single day shown in dark blue line chart. In this blog space we have been continuously talking about the weakness in the Dollar and the major support and resistance levels in TVC:DXY for more than 3 months. As the TVC:DXY is below the psychological level of 100 and most probably heading lower where 95 is the key support level, I think the time for commodities like Gold has arrived. SPY Gold Spot ETF AMEX:GLD has made an ATH of 302 which is above the key psychological level of 300.

In my opinion AMEX:GLD is not done going up. If we plot the Fib retracement levels for the previous bear market ending in 2022, we see that AMEX:GLD can effectively reach 325 level which is the 4.236 fib level. This will indicate another 7% upside, a similar amount of potential downside in the $DXY.

Verdict: Long AMEX:GLD , Short TVC:DXY until trend reversal.

GLD Weekly Options Trade Plan 2025-04-16GLD Weekly Analysis Summary (2025-04-16)

Below is a consolidated view of the various model reports and our resulting trade rationale:

──────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report – Notes that GLD closed around $306.52 with recent upward momentum and bullish daily indicators. – Technicals (moving averages, Bollinger Bands, and MACD on daily charts) support a moderately bullish bias despite some near-term caution from 5‑minute signals. – Recommends buying the $311 call (premium ~ $0.99) with a plan to exit if the price breaks key support or slides 20% in premium.

• Claude/Anthropic Report – Highlights strong daily uptrend fundamentals with GLD well above its key moving averages, although the daily RSI is high (76.59) which raises a caution flag. – Points to robust call open interest at nearby strikes ($310) and suggests a bullish trade via the call option—even though a slightly lower strike ($310) is mentioned, the overall picture is bullish. – The recommended entry is at market open with a target around a 50% premium gain and a stop if the premium retracts significantly.

• Gemini/Google Report – Emphasizes strong longer‐term bullish momentum but expresses caution given immediate overbought conditions (daily RSI above 70 and price trading above the upper Bollinger Band). – Also notes the strangely low max pain ($275) in contrast to the current price, warning of potential early pullbacks. – Concludes that the overall picture is too conflicted to recommend a trade at the open at this time.

• Llama/Meta Report – Combines technical indicators (EMA, RSI, Bollinger Bands) with strong news sentiment to determine GLD is in a bullish phase. – Identifies the $311 call (premium ~$0.99) as attractive given its liquidity and distance from the current price (about 1.46% above). – Recommends market-open entry with targets set at roughly 150% of the premium and stop-loss based on a percentage of the premium.

• DeepSeek Report – Provides a balanced trade plan noting the very strong 30‑day price performance and bullish daily MACD while cautioning on the overbought RSI reading. – Recommends the $311 call (midpoint premium ~$0.99) with a profit target of roughly a 50% gain and a stop tied to technical support breaks (around $304.90). – Maintains a moderate confidence level (around 65%) because of the chance that short‑term pullbacks may materialize.

────────────────────────────── 2. Areas of Agreement and Disagreement

• Agreement: – Most models agree on an underlying moderately bullish trend for GLD based on daily technical indicators and positive news (e.g., fund inflows and safe‑haven demand). – A majority favor a call option trade on the weekly expiry, with many models arriving at the vicinity of the $311 strike (with premiums around $0.99) as an optimal entry.

• Disagreement: – The Gemini/Google report raises concerns about overbought conditions on the daily chart and highlights a very low max pain level that suggests downside pressure, recommending against an immediate open trade. – Claude mentions a slightly lower strike ($310) but still a call trade; however, the bulk of reports lean toward the $311 call as a balanced choice, accepting the premium being a bit above the ideal $0.30–$0.60 range.

────────────────────────────── 3. Conclusion and Trade Recommendation

Overall Market Direction Consensus: Most models point to an overall moderately bullish outlook on GLD. While the daily trend is robust, some short‑term technicals (e.g., the overbought RSI and near-term MACD signs) advise caution. Nevertheless, the prevailing momentum and strong news sentiment favor a bullish call—even if a temporary pullback remains possible.

Recommended Trade: Trade Idea: Buy a single‑leg, naked CALL option on GLD. • Strike: $311.00 (this strike shows sufficient liquidity with about 1,055 open interest and a traded premium of roughly $0.99) • Expiration: Weekly options expiring 2025‑04‑17 • Premium: ~ $0.99 (slightly above the ideal range, but justified by good risk/reward and high liquidity) • Entry Timing: At the open • Profit Target: Approximately a 50% increase (target premium ~ $1.50) • Stop Loss: Approximately 20% drop in the premium (≈ $0.79) • Confidence Level: Moderately confident (≈70%) given the bullish trend tempered by the risk of an intraday pullback • Key Risks/Considerations: – The daily RSI is in overbought territory, so be alert for any pullback. – The inherent conflict with the very low max pain point ($275) suggests potential short-term volatility. – Monitor support levels (e.g., $304.90 on the 5‑minute chart) for early signs of reversal.

────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "GLD", "direction": "call", "strike": 311.0, "expiry": "2025-04-17", "confidence": 0.70, "profit_target": 1.50, "stop_loss": 0.79, "size": 1, "entry_price": 0.99, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

GLD: in resistance zone to form mid-term top Price reached and important resistance levels to start forming the top of upward trend since 2022 bottom.

In precious metals fifth waves tend to extend beyond standard fib levels. So if price moves beyond 300, the door opens for a move to 308-330 resistance zone.

Wishing you successful trading and investing decision and thank you for attention!

Silver Massive C&H Bull Market 400%+ gains Lifetime opportunity🏆 Silver Market Update (April 13th, 2025)

📊 Technical Outlook Update

▪️Long-term outlook 2weeks/candle

▪️Massive C&H formation in progress

▪️40 USD breakout pending now

▪️PT BULLS 400%+ gains BUY/HOLD

▪️Price Target BULLS 125/150 USD

▪️Bull market still pending

▪️BUY/HOLD now or miss out on gains

📢 Silver Market Update – April 2025

📈Silver is widely used in electronics due to its exceptional electrical and thermal conductivity, making it ideal for various applications, including printed circuit boards, connectors, and contact surfaces.

🚀 It is also employed in devices like touch screens, batteries, and solar panels. Silver's high conductivity, solderability, and resistance to corrosion and oxidation contribute to its popularity in the electronics industry.

$GLD - bullish momentum soon to stallHello, I was bullish on AMEX:GLD for a bit and now examining the charts, multiple frames, this may be setting up for a good short. If geopolitics and tariff talks deescalate then this should cool off. The Elliot wave placed indicates some time for a correction/pull back on this hot commodity and the candle on the Daily from Friday is a spinning stop doji which can indicate reversal in an uptrend. Also, we have so many gaps up that happened in 3 day span, crazy actually. I labeled areas of targets to fill these gaps. Expecting a retracement to $280.

WSL.

GOLD Bull Market Price Target is 7 500 USD accumulate on dips🏆 Gold Market Long-Term Update 12/24 months

📊 Technical Outlook Update

🏆 Bull Market Overview

▪️2weeks/candle price chart

▪️Gold Bull market in progress

▪️1976/1979 650% gains - Bull Market 1

▪️1999/2012 650% gains - Bull Market 2

▪️2016/2027 650% gains- Bull Market 3

▪️Price Target BULLS 7500 USD

▪️650% gains off the lows

▪️will hit in 2026/2027

⭐️Recommended strategy

▪️BUY/HOLD accumulate dips

▪️BUY/HOLD physical gold

▪️BUY/HOLD GLD/GDX

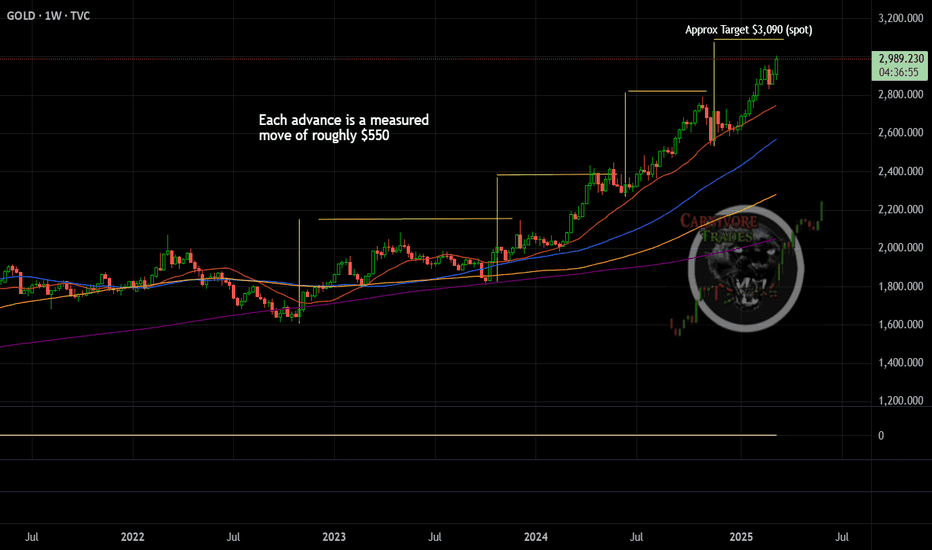

Gold Measured Move Target (Spot)Gold has finally climbed to over $3,000/oz for the first time in history however the yellow metal may not be done quite yet. Based on this repeated measured move of roughly $550 on each bull advance, we should expect the price of spot to get close to the $3,100 handle sometime soon. Seasonally, gold likes to rally into early/mid April before a cool off period so it is likely coming in the next 2-4 weeks.

Could One Event Propel Gold to $6,000?Gold has long been a refuge in times of crisis, but could it be on the brink of an unprecedented surge? Analysts now predict the precious metal could reach $6,000 per ounce, driven by a potent mix of geopolitical instability, macroeconomic shifts, and strategic accumulation by central banks. The prospect of a Chinese invasion of Taiwan, a major global flashpoint, could be the catalyst that reshapes the financial landscape, sending investors scrambling for safe-haven assets.

The looming threat of conflict in Taiwan presents an unparalleled risk to global supply chains, particularly in semiconductor production. A disruption in this critical sector could spark widespread economic turmoil, fueling inflationary pressures and eroding confidence in fiat currencies. As nations brace for potential upheaval, central banks and investors are increasingly turning to gold, reinforcing its role as a geopolitical hedge. Meanwhile, de-dollarization efforts by BRICS nations further elevate gold’s strategic importance, intensifying its upward trajectory.

Beyond geopolitical risks, macroeconomic forces add momentum to gold’s ascent. The U.S. Federal Reserve’s anticipated rate cuts, persistent inflation, and record national debt levels all contribute to a weakening dollar. This, in turn, makes gold more attractive to global buyers, accelerating demand. At the same time, the psychological factor—fear-driven safe-haven buying and speculative enthusiasm—creates a self-reinforcing cycle, pushing prices ever higher.

Despite counterforces such as potential Fed policy shifts or a temporary easing of geopolitical tensions, the weight of uncertainty appears overwhelming. The convergence of economic instability, shifting power dynamics, and investor sentiment suggest that gold’s march toward $6,000 is less a speculative fantasy and more an inevitable financial reality. As the world teeters on the edge of historic change, gold may well be the ultimate safeguard in an era of global upheaval.

Gold Update: $3,000 Is Not the Final DestinationGold futures broke above minor consolidation, so the map should be updated.

Wave 3 becomes extended (blue small waves) and it is looking to test the trendline resistance near magic $3,000 level.

But that's not all as we didn't see wave 4 yet.

It should be complex to alternate wave 2, which was simple.

Wave 4 could hit the $2,500-2,550 area to complete correction.

We can measure it after wave 3 will be completed.

And finally, wave 5 is usually extended in commodities.

It could be huge, wave 3 already travelled over $1,000,

imagine where wave 5 could rocket then.

It will depend on how deep wave 4 would retrace first.

Stay tuned, share your thoughts below, lucky trades to all of you!

Gold correction comingOur algo suggests a correction in physical gold prices. This might be a slow decline over a year or so.

Target price is around 2300 i.e. 23 for AAAU.

All the best.

Marketpanda

Disclaimer: The information provided is for general informational and educational purposes only, and does not constitute financial, investment, or legal advice. None of the content shared should be relied upon as the sole basis for making investment decisions. Prior to making any financial or investment decisions, it is strongly recommended that you consult with a qualified financial advisor, accountant, or other professional who is familiar with your individual circumstances and risk tolerance. Any reliance you place on the information presented is strictly at your own risk, and we are not responsible for any losses, damages, or liabilities resulting from your investment or trading activities.

Gold Update: Sideways Consolidation ^ $2,800 => $2,400-$2,500Gold futures follow the path posted earlier (see related).

It dropped quickly and deeply within a correction to hit the $2,542 mark.

Next was a strong rebound that stalled just above $2.7k

Then we saw a series of zigzags that shaped a small consolidation

All of this indicates of the sideways consolidation pattern which implies the

box type flat correction with top and bottom of the range defined by all-time high ($2,802)

and the valley at $2,542. The height of the range is around 300 bucks.

Next step for the price to retest or only touch the all-time high,

further we might face another drop to retest the valley of $2,542 or even lower

to touch the bottom of the bullish channel. Another downside target is at 38.2% Fib at $2,400.

After that, the consolidation could be over and the bullish trend to resume with new impulse.

A case for silver.Silver is currently under significant regulatory constraints, and its prevailing market price does not incentivize the allocation of capital toward ventures focused on increasing its supply. This creates a supply constraint for the asset.

Beyond its role as an inflation hedge, a characteristic shared by most commodities, silver possesses unique properties that are particularly valuable for industrial applications. As we stand on the brink of a new wave of industrial expansion, silver's conductivity and reflectivity make it indispensable in various technologies, such as solar panels (where China leads in production), antifreeze formulations, and numerous other applications.

Recently, President Putin announced that Russia will include silver in its strategic reserves. Meanwhile, China has been engaging in confidential agreements with miners and refiners to secure prices over extended periods. Due to China's relatively loose regulatory framework, these transactions are not publicly disclosed, and as a result, they are not reflected in silver's market price. This can be said for African, Latin-American, or other Asian countries with loose regulation for these kinds of markets. Silver pricing predominantly occurs on the futures market, which underscores cases where a disconnect arises between market prices and underlying realities, leading to potential distortions in valuation.

Case 1: JP Morgan commodities trading desk scandal.

" A federal jury in the Northern District of Illinois convicted a former trader at JPMorgan Chase and Credit Suisse today of fraud in connection with a spoofing scheme in the gold and silver futures markets.

According to court documents and evidence presented at trial, Christopher Jordan, 51, of Mountainside, New Jersey, was an executive director and trader on JPMorgan’s precious metals desk in New York from 2006 to 2009, and on Credit Suisse’s precious metals desk in New York in 2010. Between 2008 and 2010, Jordan placed thousands of spoof orders, i.e., orders that he intended to cancel before execution, to drive prices in a direction more favorable to orders he intended to execute on the opposite side of the market. Jordan engaged in this deceptive spoofing strategy while trading gold and silver futures contracts on the Commodity Exchange (COMEX), which is a commodities exchange operated by the CME Group. These deceptive orders were intended to inject false and misleading information about the genuine supply and demand for gold and silver futures contracts into the markets... Four other former JPMorgan precious metals traders were previously convicted in related cases. In August 2022, Gregg Smith and Michael Nowak... spoofing... In October 2018, John Edmonds pleaded guilty in the District of Connecticut... wire fraud, commodities fraud, price manipulation, and spoofing... In August 2019, Christian Trunz pleaded guilty in the Eastern District of New York to one count of conspiracy to engage in spoofing and one count of spoofing... "

This is the article if you'd like to read more: www.justice.gov

My thoughts; This type of practice is an example of how there always a disconnect with real life and markets. One must also remember how information travels and the infrastructure and systems in place that runs our financial system. I believe JP Morgan's swift settlement shows to me there was not much accountability addressed.

Case 2: Silver Thursday, Hunts Brothers, 1970s

" Nelson Bunker Hunt and William Herbert Hunt — oil company executives, investors and brothers — first began purchasing silver in the early 1970s at a price of less than $2 per ounce. The Hunt brothers’ fervor for silver accelerated dramatically following the death of their father in 1974, a Texas oil tycoon known as H.L. Hunt. His passing released a $5 billion fortune to members of the Hunt family.

Fueled by an enormous amount of capital, the Hunt brothers continued stockpiling silver and purchasing silver futures contracts. By early 1979, the price of silver had risen to about $6 per ounce. The Hunt brothers acquired roughly 195 million ounces of silver, about a third of the world’s total supply. They facilitated their silver purchases in part by investing in futures contracts through several brokers, including Bache Halsey Stuart Shields, Prudential-Bache Securities, and Prudential Securities. By December 1979, the market price for silver fluctuated between $20 and $25 per ounce.

Silver had become exorbitantly expensive even for practical uses. Doctors struggled to afford X-ray film for patients, families melted down their heirloom silver flatware, silver burglaries skyrocketed, and Tiffany’s & Co. was forced to drastically raise its jewelry prices. Tiffany’s even took out a full-page ad in the New York Times criticizing the Hunt brothers, writing, “We think it is unconscionable for anyone to hoard several billion, yes billion, dollars’ worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver.”

Silver reached a record high of $48.70 per ounce on Jan. 18, 1980. By some estimates, the Hunt brothers’ entire silver fortune peaked at a value of $10 billion.

Thursday, March 27, 1980

Facing out-of-control silver prices, COMEX (Commodity Exchange, Inc.), a division of the New York Mercantile Exchange (NYMEX), acted against the Hunt brothers. On Jan. 7, 1980, COMEX introduced Silver Rule 7, which placed heavy restrictions on the purchase of commodities on the margin.

Following its peak price of $48.70 per ounce, silver began its decline and the Hunt family’s silver fortune began to shrink.

On March 27, 1980, known as Silver Thursday, the price of silver dropped 50% in a single day, from $21.62 to $10.80 per ounce. The Hunt brothers failed to meet several margin calls and about $7 billion in paper assets suddenly turned into a $1.7 billion debt.

The sudden price drop threatened to collapse several investment firms and banks. To prevent widespread financial chaos, multiple banks joined together to issue the Hunt brothers a $1.1 billion line of credit..."

The original article: learn.apmex.com

My thoughts: Now you see that one entity can have huge influence on the market. Your once dusty silver mirror can become valuable enough for you to go and find it and clean it and sell it.

One actionable step you can take today is to capitalize on silver's current low valuation. There's clearly a lag between what's happening in the physical market and how that information gets reflected in exchange prices. Interestingly, we've seen noticeable price increases and premiums when buying physical silver, but there hasn’t been much movement in the more liquid instruments like the GLD or SLV ETFs—which, by the way, JPM vaults silver for. This disconnect exists because the market takes time to catch up to reality. What’s your take on this?

More articles:

marketsanity.com

www.justice.gov

www.reuters.com

www.investing.com

seekingalpha.com

investingnews.com

metalsedge.com

www.moneymetals.com

Gold - Ready to break higher as tariff tensions escalateGold has made modest ground through Asia, adding $8 on the day, however, the news flow certainly suggests a higher probability that we could soon see increasing buying flows, as investors start to seek out portfolio protection from the incoming tariff hostilities.

News that China added to its gold reserves for a second consecutive month in December, taking its reserves rise to 73.29m ounces from 72.96m in November, is one supportive factor.

Another could be its role as a hedge against the impending tariff news flow.

Tariffs are well known to markets and the idea that Trump will come in on 20 January and put through orders to hit various economies with tariffs is firmly discounted.

What is not priced is aspect of the counter response and the potential retaliation measures…. Of course, It’s not as if anyone expects those nations targeted by Trump’s tariffs to simply take it without a counter response, but it depends on what that response looks like and whether it leads to a painful and protracted tit for tat ‘battle’ that plays out on socials and the media headlines.

Today, amid Justin Trudeau’s resignation, speculation in the Canadian press suggested the Canadians could preannounce a list of US goods that will face retaliatory tariffs in the case of Trump hitting them with 25% tax on all Canadian products. Publishing this list before Trump takes office would be seen as a step in aggression and would not be taken well by either Trump and Jamieson Greer.

In China/HK, the US Defence department has added Tencent to its list of Chinese military companies operating in the US. Not a tariff as such, but this geopolitical development would be a big surprise, not just to the company (shares are -7.3%), but would be seen as an act in bad faith by the Chinese government. China themselves would be preparing for the worst when it comes to tariffs – they have not adhered to any of promises made in the prior agreements to buy certain US goods in a gesture to reduce the US trade deficit.

Trump will use that as in his negotiations, and if there is one economy that is unlikely to get much of a cushion in the upcoming trade talks, its China.

How will China respond? Depreciate the RMB, look at trade ties with other nations (we’re certainly seeing that with China-Mexico forging ties) or come back with counter tariffs on US imports.

The Washington Post reported yesterday that Trump’s aides were exploring universal tariffs only on critical imports and not on all goods – a fact that that was quickly shut down by Trump. If the WaPo are credible, and many suspect this will be the case, it ultimately could be a positive for risk in the long run. However, in the near-term, if the Canadian news comes to fruition, I think it opens the idea that we should prepare now for tit for tat retaliation, and its here where investors may start to look at gold as a hedge against this impending hawkish news flow.

So, while it all depends how hard ball each party wants to appear, it could create a new level of noise and uncertainty that could see higher market volatility and push gold through the range highs of $2726 and towards $2800.

GOLD Sell signalA bearish inside bar / pinbar pattern has formed in TVC:GOLD on the weekly charts. While these types of patterns can be quite strong, keep in mind that this is a counter trend trade which adds an additional element of risk to the setup. The invalidation level for this setup is the top of the pinbar @ $2730. Long term, key support sits at around $2080.

Gold vs. Silver: Is the Ratio Signaling a Major ShiftIntroduction:

Precious metals are displaying promising price action, warranting a closer look at the gold AMEX:GLD to silver AMEX:SLV ratio. This ratio provides valuable insights during bull markets:

Bullish Silver: In a strong bull market, silver typically outperforms gold, causing the ratio to decline.

Gold Leading: Recently, gold has taken the lead, advancing in a corrective rally, but there are signs this could change.

Analysis:

Inverted Saucer Formation: On the gold-to-silver ratio chart, a large inverted saucer formation is emerging. This bearish pattern indicates a potential breakdown below key support levels, signaling silver’s outperformance in the months ahead.

What to Watch:

A confirmed breakdown of support in this ratio could signal a major shift in favor of silver.

If silver outperforms, prices could surge to retest its 2011 highs of $48-$50 next year.

Gold Outlook: Despite the shift in favor of silver, gold remains bullish. A breakout could target significant upside, with price projections of $3,300-$3,400.

Trade Setup:

Silver Bullish Setup:

Trigger: A breakdown in the gold-to-silver ratio, confirming silver’s relative strength.

Target: SLV retesting $48-$50.

Stop Loss: Manage risk by placing stops near recent support levels in silver.

Gold Bullish Setup:

Gold continues to show strength, targeting $3,300-$3,400. Monitor for breakouts in gold prices alongside silver’s potential surge.

Conclusion:

The precious metals setup looks increasingly bullish. The gold-to-silver ratio is hinting at a shift toward silver outperformance, a hallmark of true bull markets. If this scenario plays out, silver could retest its 2011 highs, while gold targets new all-time highs. This is a chart and setup worth keeping a close eye on in the coming months. Which metal do you think will lead the charge? Share your thoughts below!

Charts:

(Include charts showing the gold-to-silver ratio with the inverted saucer formation, key support levels, and projected breakdown targets. Add gold and silver price charts highlighting bullish setups.)

Tags: #Gold #Silver #PreciousMetals #GLD #SLV #BullMarket #TechnicalAnalysis #TradingIdeas

$GLD Double Bottom, Bullish Inverted H&S AND Bull flagging?! Am I blind? Are you? Holy moly. This looks textbook under the reversal patterns I have documented. To be HONEST, it doesn't look 100% but it's showing signs. In my previous AMEX:GLD posts I said $242.73 needs to hold and it has. I think AMEX:GLD is creating a new floor of support for the next 3-6 months. I'm going to be entering GETTEX:250C for months out in 2025. + EOY rally. $250 target gets AMEX:GLD to a 30% YTD. AMEX:SPY in the same boat, 30% YTD - I posted a chart on it as well, check that out. Leave a comment to let me know your thoughts. I looked through many time frames and this one looks the best. I can't say I'm a fan of the big Elmo candles but I see a flag forming. Leave a follow and a comment.

wALL sTreeT L0S3R