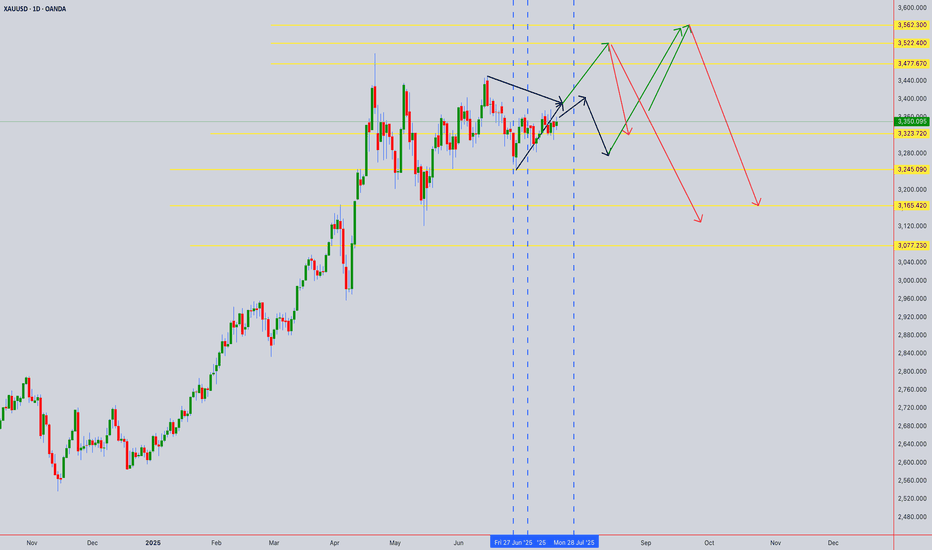

XAUUSD 24-Hour Technical Analysis Forecast - UTC+4 Current Price: $3,350.095 (Close: Friday, July 18th, 2025) UTC+4

Analysis Period : Next 24 Hours (July 21-22, 2025) UTC+4

Market Status: Weekend - Preparing for Monday Open 02:00AM 21st July 2025

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bearish (Short-term)

Key Resistance: $3,375 - $3,390

Critical Support: $3,285 - $3,300

Expected Range: $3,300 - $3,380

Volatility Level: Moderate to High

CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

Pattern: Doji-like formation at resistance zone

Significance: Indecision after testing $3,350+ levels

Volume: Moderate - no strong conviction breakout

Context: Failed to close decisively above $3,375 resistance

Expected 24H Patterns

Monday Gap: Potential gap down to $3,320-3,330 area

Reversal Patterns: Watch for hammer/doji at support levels

Continuation Signals: Break below $3,300 could trigger bearish continuation

HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

Primary Pattern: Potential Bearish Bat completing

X: $3,285 (previous low)

A: $3,390 (recent high)

B: $3,320 (61.8% retracement)

C: $3,375 (78.6% projection - current area)

D (Target): $3,300-3,285 (88.6% completion zone)

Fibonacci Levels (24H Focus)

Golden Ratio Resistance: $3,375 (current test area)

61.8% Support: $3,320

78.6% Support: $3,300

88.6% Critical Support: $3,285

Pattern Completion Probabilities

Bearish Bat Completion: 70% probability targeting $3,285-3,300

Bullish Cypher Setup: 30% if break above $3,390

ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count

Macro Structure: Wave 5 of larger impulse possibly topping

Current Sub-wave: Wave (c) of corrective structure

Mini Count: 5-wave decline from $3,390 high in progress

24-Hour Wave Projection

Wave 1: $3,390 → $3,320 (Completed)

Wave 2: $3,320 → $3,360 (Completed - 50% retrace)

Wave 3: $3,360 → $3,285 (In Progress - Target Area)

Wave 4: $3,285 → $3,310 (Projected)

Wave 5: $3,310 → $3,260 (Extended target)

Critical Levels

Wave 3 = 1.618 × Wave 1: $3,285 (Primary target)

Invalidation: Above $3,390 (Wave 2 high)

WYCKOFF THEORY - 24H PHASE

Current Market Phase

Phase Assessment: Distribution Phase C (Testing Supply)

Composite Operator Action: Testing demand at $3,350 area

Volume Analysis: Declining volume on recent rallies (bearish)

Expected 24H Wyckoff Action

Phase Transition: Moving toward Phase D (Markdown begins)

Supply Test: Failed test at $3,375 confirms distribution

Target: Initial markdown to $3,285-3,300 area

Key Wyckoff Signals (24H)

No Demand: Expected at current levels

Selling Climax: Possible if break below $3,285 with high volume

Automatic Rally: Dead cat bounce to $3,320-3,330

W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

Current Position: 3350° on Gann wheel

Next Cardinal Point: 3375° (90° angle - strong resistance)

Support Angles: 3300° (natural support), 3285° (critical angle)

Geometric Progression: $3,285 = perfect square root relationship

Time Theory - 24H Cycle

Natural Time Window: 24-hour cycle from Friday's high

Critical Time: 14:00-16:00 UTC Monday (historical turning point)

Lunar Influence: New moon phase approaching (bearish for commodities)

Angle Theory

45° Line: Currently at $3,320 (rising support)

63.75° Line: $3,285 (steep support angle)

26.25° Line: $3,375 (resistance angle)

Price Forecasting (Gann Methods)

Primary Target: $3,285 (Square root of 81²)

Secondary Target: $3,240 (Square root of 80²)

Resistance: $3,375 (Square root of 82.5²)

Time Forecasting

Turn Time 1: 06:00 UTC Monday (18 hours from Friday close)

Turn Time 2: 14:00 UTC Monday (26 hours from Friday close)

Major Turn: 22:00 UTC Monday (34 hours - Fibonacci time)

MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

Trend: Bearish momentum building

Pattern: Lower highs, lower lows since Friday high

Key Levels:

Resistance: $3,360-3,365

Support: $3,330-3,335

RSI: Approaching oversold (35-40 range)

Volume: Increasing on down moves

15-Minute Chart Analysis

Structure: Bearish flag formation

Breakdown Level: Below $3,340

Target: $3,300-3,310 (flag pole projection)

Moving Averages: Price below EMA 20 ($3,358)

MACD: Bearish crossover confirmed

30-Minute Chart Analysis

Primary Trend: Corrective phase active

Chart Pattern: Descending triangle

Apex: Around $3,335-3,340

Breakout Direction: 65% probability downward

Volume Profile: Heavy selling at $3,350-3,375

1-Hour Chart Analysis

Major Structure: ABC correction in progress

Current Position: C-wave development

Fibonacci Target: $3,285 (127.2% extension)

Bollinger Bands: Price touching lower band

Stochastic: Oversold but no divergence yet

4-Hour Chart Analysis

Macro Trend: Still bullish above $3,200

Correction Depth: 23.6% retracement maximum expected

Support Zone: $3,280-3,300 (confluences)

Resistance Zone: $3,375-3,390 (proven strong)

Ichimoku: Price approaching cloud support

TECHNICAL INDICATORS MATRIX

Momentum Indicators

RSI (4H): 42 (Neutral-Bearish)

RSI (1H): 35 (Oversold approaching)

Stochastic: %K: 28, %D: 35 (Oversold)

Williams %R: -75 (Strong oversold)

Trend Indicators

MACD (4H): Bearish crossover pending

ADX: 28 (Moderate trend strength)

Parabolic SAR: $3,365 (Sell signal if broken)

Volume Indicators

OBV: Declining (distribution pattern)

Volume Rate of Change: Negative

Accumulation/Distribution: Slight distribution

KEY SUPPORT & RESISTANCE LEVELS (24H)

Immediate Resistance Levels

R1: $3,365 (Previous support turned resistance)

R2: $3,375 (Major psychological & Gann resistance)

R3: $3,390 (Recent swing high)

R4: $3,410 (Extended resistance)

Critical Support Levels

S1: $3,330 (Immediate support)

S2: $3,300 (Psychological & Fibonacci)

S3: $3,285 (Major harmonic & Gann target)

S4: $3,260 (Extended support)

24-HOUR TRADING SCENARIOS

Scenario 1: Bearish Breakdown (60% Probability)

Trigger: Break below $3,330 with volume

Target 1: $3,300-3,310

Target 2: $3,285-3,290

Extended Target: $3,260-3,270

Stop Loss (Shorts): Above $3,370

Scenario 2: Range-Bound Consolidation (25% Probability)

Range: $3,320-3,375

Strategy: Fade extremes

Buy Zone: $3,320-3,330

Sell Zone: $3,365-3,375

Breakout Confirmation: Volume spike

Scenario 3: Bullish Reversal (15% Probability)

Trigger: Break above $3,375 with volume

Target 1: $3,390-3,400

Target 2: $3,410-3,420

Invalidation: Below $3,285

RISK FACTORS & CATALYSTS (24H)

Bearish Catalysts

US Dollar strength continuation

Risk-off sentiment from geopolitical tensions

Profit-taking ahead of weekend

Technical breakdown confirmation

Bullish Catalysts

Safe-haven demand surge

US Dollar weakness

Central bank buying speculation

Technical oversold bounce

High-Impact Events (Next 24H)

Asian market opening sentiment

US Dollar Index movement

Cryptocurrency correlation effects

Weekend gap analysis

TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M)

Strategy: Fade bounces to resistance

Entry: $3,355-3,365 area

Target: $3,335-3,340

Stop: $3,375

Risk/Reward: 1:2

For Swing Traders (1H-4H)

Primary Setup: Short on retracement

Entry Zone: $3,350-3,360

Target 1: $3,300

Target 2: $3,285

Stop Loss: $3,385

Conservative Approach

Wait for: Clear breakdown below $3,330

Entry: $3,325 (confirmation)

Target: $3,285-3,290

Stop: $3,345

CONFLUENCE FACTORS

Bearish Confluence at $3,285

Harmonic Bat pattern completion (88.6% level)

Gann Square of Nine critical angle

Elliott Wave 3 = 1.618 × Wave 1 target

Fibonacci 78.6% retracement level

Previous significant support area

Wyckoff markdown initial target

Resistance Confluence at $3,375

Gann 90-degree angle resistance

Harmonic pattern resistance

Elliott Wave corrective high

Previous breakout level

Psychological round number

FINAL 24H FORECAST SUMMARY

Expected Price Action: Controlled decline toward $3,285-3,300 support zone with potential for brief consolidation before further weakness.

Primary Targets (Downside):

First: $3,300-3,310

Second: $3,285-3,290

Extended: $3,260-3,270

Key Invalidation: Sustained break above $3,375 would shift bias bullish toward $3,390-3,410.

Risk Management: Position sizing should be conservative due to high volatility expectations and weekend gap risks.

Probability Assessment:

60% - Bearish scenario

25% - Sideways consolidation

15% - Bullish reversal

Disclaimer: This analysis is for educational purposes only. Gold trading involves substantial risk. Always use proper risk management and never risk more than you can afford to lose.

Volume profile resistance

GOLD-BUY

Gold prices fall in the short term – What's next?Hello everyone, what’s your take on gold?

Today, gold continues to attract short-term selling pressure as USD buying momentum returns and expectations for Fed rate cuts diminish. On the other hand, an overall positive risk sentiment is also seen as another factor weighing on the precious metal.

At the time of writing, gold is trading around the EMA 34 and 89 near 3,336 USD. With no major updates expected, the market is likely to remain steady throughout the day.

From a technical perspective, the bearish trend persists, with prices capped below the trendline. A series of lower highs and lower lows could push XAUUSD to retest deeper levels, potentially reaching the 3,300 USD mark. However, lingering trade uncertainties may limit losses for this safe-haven asset.

This is just my view on the market, not financial advice.

XAUUSD 1440M forecast Based on the latest available information for July 15, 2025, the overall sentiment for XAUUSD (Gold) in the next 24 hours leans towards a bullish outlook, though with potential for short-term fluctuations and pullbacks.

Key Drivers for Bullish Outlook:

Escalating Trade Tensions: US President Donald Trump's ongoing tariff and trade policies are a significant factor. New tariffs and threats against various countries (EU, Mexico, Japan, South Korea, Brazil, Canada) are creating global economic uncertainty, which typically boosts gold's appeal as a safe-haven asset.

Geopolitical Uncertainty: Broader geopolitical risks, including those related to Russia and Ukraine, also contribute to safe-haven demand for gold.

Inflation Concerns: Tariffs are linked to inflation concerns. Gold performs strongly in a high-inflation environment, and market expectations are shifting towards a more gradual easing of interest rates by the Fed, allowing for inflation to be a potential driver.

Central Bank Demand: Central banks globally, particularly the US and China, continue to be strong buyers of gold, indicating a sustained structural trend of higher gold purchases.

Technical Support: Several analyses point to gold finding support at key levels (e.g., around $3340-3345, 200 EMA), suggesting potential for bounces and continuation of an upward trend.

"Buy on Dip" Strategy: Many analysts are recommending a "buy on dip" strategy, indicating an underlying bullish bias and viewing any short-term declines as buying opportunities.

Factors to Watch (Potential for Pullbacks/Volatility):

Short-Term Weakness/Consolidation: Some technical indicators suggest short-term weakness or consolidation, with gold testing resistance levels (e.g., $3375-3380, $3400).

US Dollar Strength: While trade tensions can weaken the dollar, there are mixed signals. A stronger US dollar can put downward pressure on gold prices as it makes gold more expensive for holders of other currencies.

Inflation Data and Fed Signals: Investors are closely watching US inflation data (CPI) and signals from Federal Reserve officials regarding interest rate cuts. While some expect cuts later in the year, any hawkish surprises could temper gold's rise.

Trade Deal Hopes: Any signs of de-escalation in trade tensions or progress towards agreements could temporarily reduce safe-haven demand for gold.

Specific Price Levels Mentioned:

Resistance: $3375-3380, $3400, $3432, $3450-3470, $3500 (all-time high).

Support: $3340-3345, $3325-3330, $3289-3303, $3240-3246.

In summary, the prevailing sentiment for XAUUSD over the next 24 hours appears to be bullish, driven by ongoing global trade tensions and safe-haven demand. However, be prepared for potential short-term pullbacks or consolidation as the market digests new information and tests key resistance levels.

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

GOLD BUY M15 Gold (XAU/USD) 15-Minute Chart Analysis – July 7, 2025

Trade Setup: The chart shows a bullish trade setup based on a potential reversal from a "Weak Low" support area around 3304. After forming a BOS (Break of Structure) and a small consolidation (highlighted box), price is expected to move higher.

Entry:

Long position initiated slightly above the consolidation zone.

Stop Loss (SL):

Set at 3304, just below the recent weak low support.

Target (TP):

Final target at 3326, where a key resistance level lies.

Key Levels:

Support Zone: 3304 (Weak Low)

Resistance Levels:

3317.5

3222.9

3326.2 (Final Target)

Market Structure Notes:

CHoCH (Change of Character) indicates potential shift to bullish momentum.

Price is expected to form higher highs and higher lows on its way to the target.

GOLD OPENS BULLISHJust as analysed, there was a strong bullish setup at the close of last week so this move was just taking out top liquidity, continuing its course of bullish rally. We can also spot a bullish trend build up from the 3400's which projected to the 3450's before making its retracement last week.

we expect Gold to go for more higher liquidity as we are close to the ATH, in other words; ROAD TO 3500'S as a visible path has been analysed

GOLD PATH TO 3500We see a visible path to 3500 on the xauusd market.

After the breakout at 3400 which extended to 3440's clearing a solid supply zone, gold then had a retracement and rallied back to 3420's which has a solid outlook on the 4hour time frame.

Do not forget that today is friday so dont push the moves .

.......Further breakdown on the lower timeframe

gold after the inertviez of jerome todayAs of April 4, 2025, gold prices have experienced significant volatility amid escalating trade tensions and market uncertainties. Following President Trump's announcement of new tariffs and China's subsequent retaliation with 34% tariffs on U.S. goods, investors have increasingly turned to gold as a safe-haven asset. This surge in demand propelled gold prices to record highs, surpassing $3,130 per troy ounce

XAUUSD ( GOLD ) TODAY'S CHART MAPPING IN 30M TFWelcome To Another Day Of TRADING Guys

As you know Xauusd is already at higher position and it's still in buying zone

Probably Xauusd make again 2790 so here is set-up for today

Support level 2770

2nd Support level 2762/59

Target well be. 2789

Let me know your thoughts in the comments section have a good trade guy's

XAUUSD GOLD NEXT EXPECTED MOVE ! Gold (XAUUSD) is currently in an uptrend, but we are waiting for a retracement before entering a buy position. A pullback to a key support zone will provide a better entry opportunity, allowing us to catch the next bullish move with lower risk.

If the price corrects and shows strong buying signals, we will look for confirmations to enter. This strategy helps in maximizing gains while managing risk effectively.

Stay patient and wait for the right setup before taking action! 🚀

Gold is nearing the retrace area.Hey Traders, In today's session we’re closely monitoring Gold for a potential buying opportunity around the 2655 zone. The price has broken through the 2655 resistance and is now in a corrective phase, approaching a key retracement area.

Stay vigilant and trade wisely!

– Joe

Gold Potential UpsidesHey Traders, in traders, in today's trading session we are monitoring XAUUSD for a buying opportunity around 2620 zone, Gold is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 2620 support and resistance area.

Trade safe, Joe.

Gold will complete it's C corrective move 2728!TVC:GOLD is in correction and will complete it's C corrective move UpTo 2728, in that level we will look for sell entry after getting 7-8 confirmation including technical and fundamental analysis. Traders don't rush for buy entry at these level just hold for good opportunity for entry, I will update in ideas section when gold breach 2728

Tudor Gold Mining Chart looks very interesting poised to do well from a Bull market Golden Triangle play. Any North American jurisdiction mining company will benefit as we see tensions rise globally. Speculation that we will see an increase in currency devaluation to continue and possibly accelerate.

TSXV:TUD OTC:TDRRF

now time to buy gold for nice swing Trade Description for Buy Position on XAU/USD

Position Type: Buy

Trading Instrument: XAU/USD (Gold)

Entry Price: (Please specify the entry price if you have one)

Stop Loss Level: 2524

Take Profit Level: (Consider setting a take profit level based on your target by the level on chart )

Trade Rationale: (You may include reasons for entering this trade, such as bullish market trends, economic indicators, or technical analysis signals.)