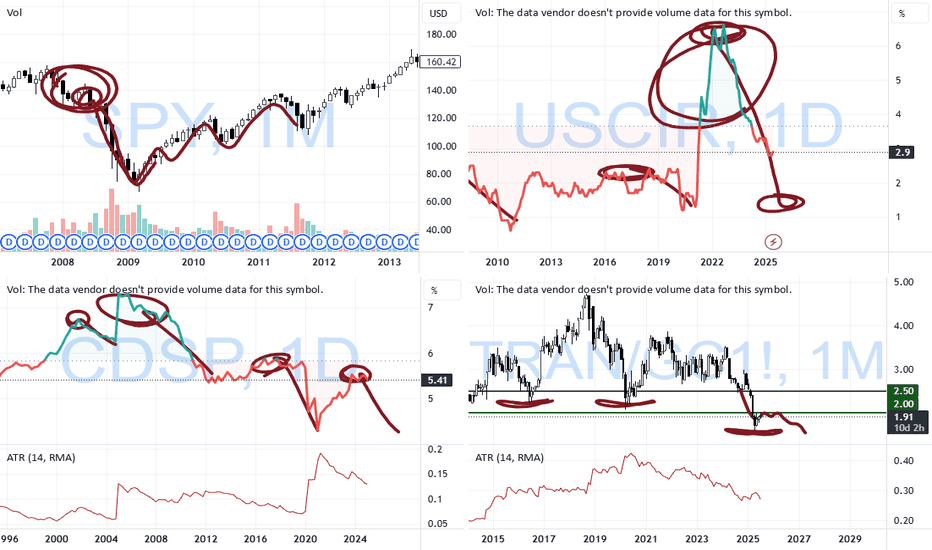

July 21 Special Update : Metals, SPY & More. What's Next.This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD.

Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse.

And, the economic data I see from my custom indexes suggests the markets are moving into a very volatile and potentially dangerous topping pattern.

As I've stated many times in this video. I'm not saying the markets have topped and you should SELL EVERYTHING. I'm suggesting this market is extremely over-valued in terms of the underlying risk factors at play and the very clear data that suggests the markets are already in a recessionary price trend.

You may ask, "How can the markets continue to rally like this in a moderate recession?".

The answer is simple.

All bubbles end with a super-speculative phase. This phase is where everyone piles into a euphoric attempt to ride the rally higher.

It happened in the late 1990s. It has happened again through the 2000-2005+ housing bubble. Heck, it has occurred in the collectors market over the past few decades where people spent fortunes on the "hottest items" (think Beanie-Babies) only to find out they bought at the height of the bubble.

That is why I continue to urge traders to remain cautious and to withdraw profits from this speculative rally phase. Protect your investment capital immediately and consider the risks associated with the information I share in this video.

I'm not trying to scare anyone. I'm just trying to be realistic in terms of what I see in my data and why I believe now is the best time to MOVE TO SAFETY.

My data suggests that the markets are about to enter a fragile and potentially dangerous pullback phase. If you want to ride it out - go for it.

Otherwise, prepare for significant volatility over the next six months or more.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

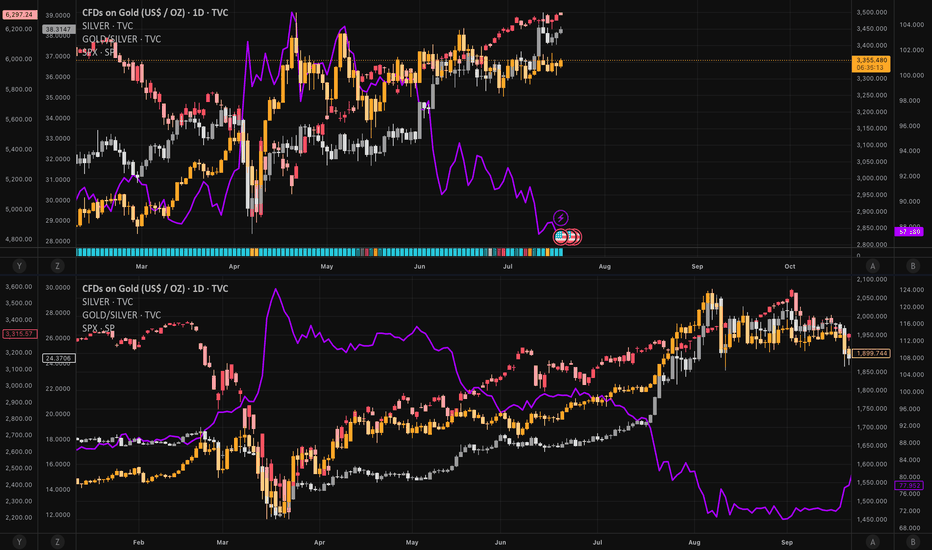

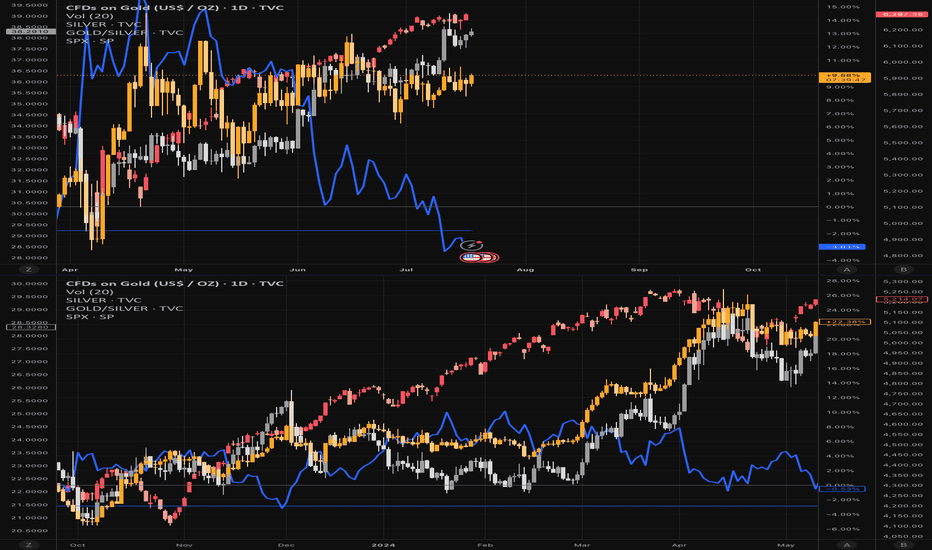

GOLD-SILVER

Bear-Trap armed: Gold ticks 4 / 5 boxes - waiting for the spark1️⃣ Why the 2020 déjà-vu is EVEN louder

2025 (now) 2020 (pre-rally)

TradingView ideas still bearish 💬

> 70 % 60 % bearish

Managed-money net-longs ≈ 115 k

-35 % from Apr. –25 % from peak

+ $741 m PM-ETF inflow Record IN-flows

G/S ratio 87 (< 90) Fell to 95

S&P keeps making highs Ditto

2️⃣ What’s still different

Real 10-y TIPS yield +0.7 % vs -1 % in 2020 → smaller monetary tail-wind.

Gold is already at an infl-adj. record – expect a short & sharp squeeze, not a fresh multi-year super-cycle (yet).

3️⃣ Checklist – updated

Signal Status 18 Jul Comment

———————————————————

Gold DAILY close ≥ $3 200–3 250 YES – $3 354 ✔

G/S ratio < 90 YES – 87 ✔

CFTC net-longs < 150 k YES – ~115 k ✔

ETF flows turn positive. YES – $741 m ✔

Equity stress (VIX > 25 or SPX −5 %) NOT YET – VIX 16.5 ✖

4 / 5 boxes = 99 % primed. One spark missing.

4️⃣ What could light the fuse

Date Potential trigger Why it matters

22 Jul Mega-tech Q2 earnings (NVDA/AMD) Any guidance miss → SPX wobble

30 Jul FOMC Fed holds but sounds dovish USD dump + yield spike risk

1 Aug Trump s “reciprocal” duties Imported-inflation scare → VIX pop

Early Aug. DXY crashes < 96 in < 5 days. Disorderly USD slide = funding stress

Hit ≥ 2 of: DXY < 96, VIX > 25, SPX -5 % or HY-spread +75 bp → final ✔.

Bottom line

The bear-trap thesis aged well: sentiment, positioning, ETFs, and G/S ratio have already clicked bullish.

Only equity-market stress is missing. A fast USD slide or a tariff shock right after a neutral Fed is the most likely detonator.

Stay nimble: Collect premium inside $3 250-3 400 while volatility sleeps – but keep alarms on VIX 25 and DXY 96. One red headline could still launch the squeeze.

Disclaimer: Educational opinion, not investment advice. Futures & CFD trading is risky – do your own research and consult a professional.

1 minute ago

Bear-Trap armed: Gold ticks 4 / 5 boxes - waiting for the spark

1️⃣ Why the 2020 déjà-vu is EVEN louder

2025 (now) 2020 (pre-rally)

TradingView ideas still bearish 💬

> 70 % 60 % bearish

Managed-money net-longs ≈ 115 k

(-35 % from Apr) –25 % from peak

+ $741 m PM-ETF inflow, first after months Record IN-flows

G/S ratio 87 (< 90) Fell to 95

S&P keeps making highs. Ditto

2️⃣ What’s still different

Real 10-y TIPS yield +0.7 % vs -1 % in 2020 → smaller monetary tail-wind.

Gold is already at an infl-adj. record – expect a short & sharp squeeze, not a fresh multi-year super-cycle (yet).

3️⃣ Checklist – updated

Signal Status 18 Jul Comment

———————————————————

Gold DAILY close ≥ $3 200–3 250 YES – $3 354 ✔

G/S ratio < 90 YES – 87 ✔

CFTC net-longs < 150 k YES – ~115 k ✔

ETF flows turn positive. YES – $741 m ✔

Equity stress (VIX > 25 or SPX −5 %) NOT YET – VIX 16.5 ✖

4 / 5 boxes = 99 % primed. One spark missing.

4️⃣ What could light the fuse

Date Potential trigger Why it matters

22 Jul Mega-tech Q2 earnings (NVDA/AMD) Any guidance miss → SPX wobble

30 Jul FOMC Fed holds but sounds dovish USD dump + yield spike risk

1 Aug Trump s “reciprocal” duties Imported-inflation scare → VIX pop

Early Aug. DXY crashes < 96 in < 5 days. Disorderly USD slide = funding stress

Hit ≥ 2 of: DXY < 96, VIX > 25, SPX -5 % or HY-spread +75 bp → final ✔.

Bottom line

The bear-trap thesis aged well: sentiment, positioning, ETFs, and G/S ratio have already clicked bullish.

Only equity-market stress is missing. A fast USD slide or a tariff shock right after a neutral Fed is the most likely detonator.

Stay nimble: Collect premium inside $3 250-3 400 while volatility sleeps – but keep alarms on VIX 25 and DXY 96. One red headline could still launch the squeeze.

Disclaimer: Educational opinion, not investment advice. Futures & CFD trading is risky – do your own research and consult a professional.

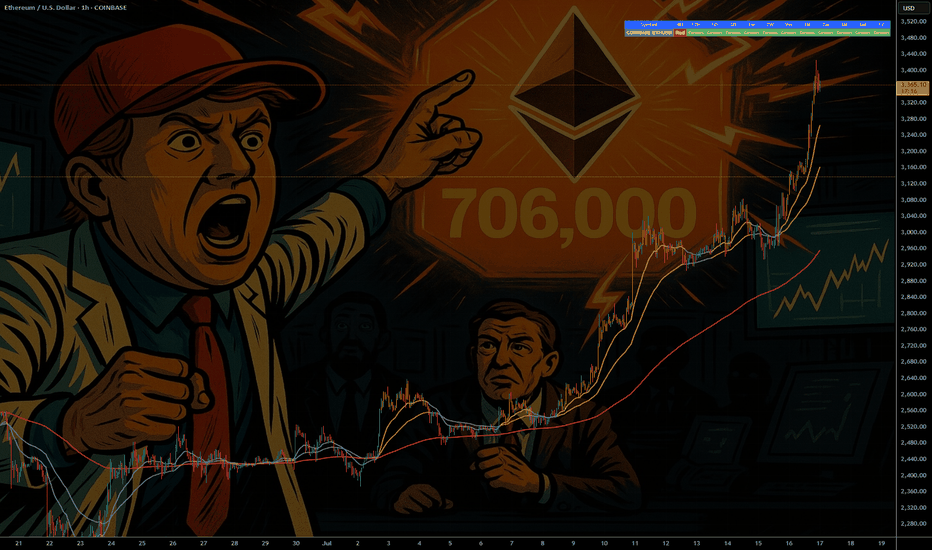

ETH - If You Know ...... You Know whats Coming

NYSE:BLK $BUIDL tokenized U.S.-Treasury fund launched on COINBASE:ETHUSD in Mar 2024—Wall Street is already settling real dollars on-chain.

NYSE:JPM JPMD stablecoin just went live on Base (an COINBASE:ETHUSD L2), piping wholesale payments from a $4 T balance-sheet straight through COINBASE:ETHUSD rails.

COINBASE:ETHUSD isn’t just riding the next crypto cycle—it’s becoming Wall Street’s settlement layer. From BlackRock’s on-chain Treasury fund to JPMorgan’s and soon Bank of America’s dollar tokens, a tidal wave of institutional stable-coin flows is lining up behind ETH. Fewer coins, more real-world volume—if you know, you know what’s coming.

NYSE:BAC CEO says they’ll issue a dollar-backed token the moment regulators nod—another tier-1 bank boarding the Ethereum train.

Stablecoin cap has blasted past $230 B , with 80 %+ of all on-chain transfers riding Ethereum (plus BSC) blocks.

Corporate settlements via stablecoins grew 25 % YoY in 2024 as multinationals replaced SWIFT with instant on-chain clearing.

Daily stablecoin throughput averages $7 B—each hop burning ETH and tightening supply.

BCG projects tokenized real-world assets to exceed $16 T by 2030 , with EVM chains as the default plumbing.

Over 500 M wallets already interact with stablecoins , a 30 % YoY surge led by emerging-market demand.

L2s like BINANCE:ARBUSDT & BINANCE:OPUSDT cut transaction fees 35 % yet still settle back to mainnet—meaning ETH captures the fee stream and the burn.

Bottom line: a tidal wave of bank-grade stablecoins + tokenized assets is lining up behind ETH; supply shrinks, demand soars—if you know, you know what’s coming.

quote] Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

SPY/QQQ Plan Your Trade Special Update : BUCKLE UPThis video is a special update for all TradingView members. I felt I needed to share this information and present the case that I believe poses the most significant risk to your financial future - and it's happening right now.

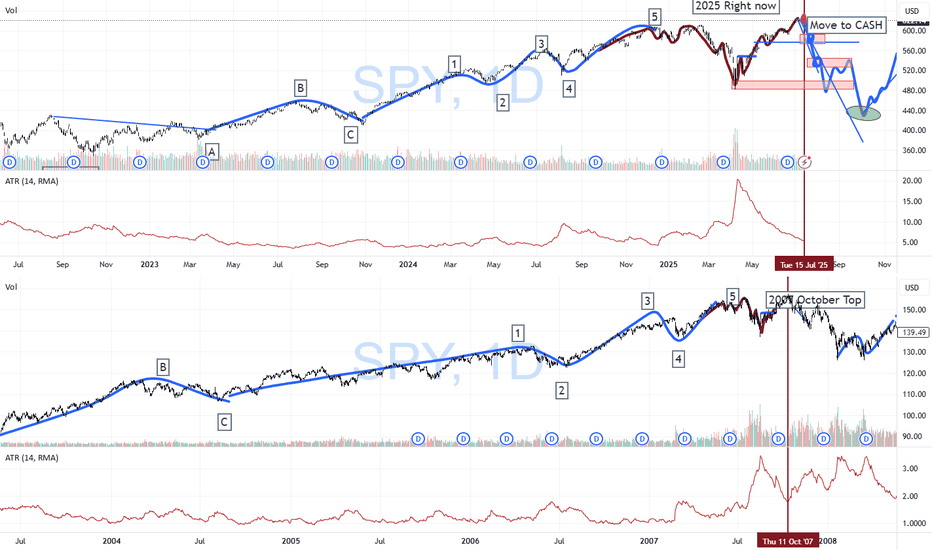

Several weeks ago, I identified a very unique mirror setup in the SPY and kept an eye on how it was playing out. I needed to see confirmation of this setup before I could say it had any real likelihood of playing out as I expected.

As of today, I'm suggesting that we now have excellent confirmation that the US/Global markets are about to enter a deep consolidation phase, lasting through the rest of 2025 and possibly into 2026 and early 2027.

The interesting thing about this price pattern/structure is that it is almost exactly the same as the 2003-2007 structure, which I believe is the origin of this mirror setup. Almost down to the exact type of price bars/patterns I'm seeing.

Many of you are already aware that I've been calling for a critical low cycle in the SPY on July 18 for many months. What you may not realize is that the pattern is based on Weekly price data. The July 18 cycle low can have a span of +/- 1-3 weeks related to when and how the cycle low pattern plays out.

Watch this video. If you have any questions, message me or comment.

I'm still here, doing my best to identify and unlock the secrets of price action and to help as many traders as I can.

Price is the Ultimate Indicator.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Did Bitcoin Just TOP OUT ??????

COINBASE:BTCUSD has just collided with an 8-year rising trendline that capped the market’s last two cyclical peaks—historically, this level has triggered multi-month corrections and Bear Markets.

Triple-test significance : a third touch of a long-term trendline ➜ heightened odds of a reaction; failure to break cleanly often confirms a major top.

Watch for confirmation signals —weekly bearish RSI divergence, waning volume, or rejection wicks can validate a reversal scenario.

Breakout = regime change : a decisive close and hold above the line flips it to support, opening the door to fresh price discovery and potential parabolic upside.

Large Orders at $114k create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level.

Risk-management alert : consider tightening stops, reducing leverage, or hedging until trendline fate is resolved.

The buy pressure has been relentless but this is always worth paying attention to

Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

"Ethereum Is The New Bitcoin" - Tom Lee ETH / Stablecoins Are the ChatGPT of Crypto

Stablecoins are exploding in adoption — just like ChatGPT took over AI and Ethereum is the engine driving that revolution. In this post, we break down 10 reasons why Tom Lee is extremely bullish on Ethereum and why it could be the single most important digital asset in the future of finance . If you're sleeping on ETH, this might be your wake-up call.

Top 10 Bullish Points from Tom Lee on Ethereum:

• Ethereum is the backbone of stablecoins , which Tom Lee compares to the “ChatGPT of crypto” due to their viral adoption and massive utility.

• Over 51% of all stablecoins operate on Ethereum , contributing to around 30% of the network’s total fees.

• Ethereum network fees could 10x as stablecoin usage grows from $250 billion to $2 trillion.

• Ethereum is positioned to lead the tokenization of real-world assets , including stocks and real estate.

• ETH could reach $10,000 if asset tokenization becomes a mainstream financial practice.

• Ethereum has a regulatory edge in the U.S. , making it the preferred platform for compliant financial innovation.

• A $250 million ETH treasury strategy is underway , aiming to use Ethereum as a long-term reserve asset.

• Institutions will buy and stake ETH to secure stablecoin networks, making ETH the “next Bitcoin.”

• Ethereum dominates the crypto ecosystem , with nearly 60% of activity including DeFi, NFTs, and dApps built on its chain.

• HODL ETH for long-term growth , as its utility, demand, and institutional support continue to rise.

Conclusion:

Ethereum isn’t just a Layer 1 blockchain — it’s becoming the core financial infrastructure for the digital age . As stablecoins expand and institutions enter, ETH could be the most asymmetric opportunity in crypto right now.

📢 Drop a like, leave your thoughts in the comments, and don’t forget to follow for more powerful macro + crypto insights. 👍👍

Canadian Venture index --- Inverse head & shouldersGold has reached unprecedented heights, approaching the $3000 mark—a prediction we made with precision. Now is the moment to turn our attention to silver and the mining sector.

To start, let's examine the Canadian venture index, which is displaying a promising inverse head and shoulders pattern. I am confident that the logarithmic projection will be achieved without much difficulty.

Gold/Silver Ratio to 72 Minimum - Imminent Silver BreakoutGoldSilver Ratio is following a clear pattern of behavior. We can expect a return to mean conservatively hitting 72 at a minimum. This puts silver at $46-58 if Gold doesn't move higher. I think we will see silver 5-10X over the next few years. Easy 25-50% in the short term (6-12 months).

SPY/QQQ Plan Your Trade End Of Week Update For 7-4Happy 4th of July

I've been very busy with projects and new tools for traders, as well as the new book I'm working on, and thought I would deliver an End Of Week update for everyone.

In this video, I cover the past Cycle Patterns and how they played out for the SPY/QQQ, Gold/Silver, and Bitcoin, as well as add some of my own insight related to the market trends.

All of my systems are still LONG and have not changed. I still believe this market is extremely overbought, and I believe it could roll over at any moment into a pullback - but we need to wait to see if/when that may/does happen.

Gold made a big move higher this week, and I believe that move could continue throughout July.

Bitcoin made a surprising Double-Top and is not rolling downward. Could be a breakdown in the markets as BTCUSD tends to lead the QQQ/NQ by about 3-5 days.

The SPY/QQQ rallied like a rocket all week. It was absolutely incredible to see the markets rally like this. But, I'm still cautious of a sudden rollover top.

I managed to catch some nice trades with options spreads this week, and my metals positions were on fire. I'm still trading from a "hedge everything" mode as I don't trust this rally, and I'm still watching for REJECTIONS near these new highs.

Stay safe and GET SOME.

DM me if you have any questions.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 7-1 : Post Market UpdateToday was a very powerful day for the Cycle Patterns - particularly for Gold and BTCUSD.

Gold rallied as the Cycle Pattern predicted a RALLY in TREND mode.

BTCUSD collapsed on a CRUSH Cycle Pattern.

The SPY Cycle Pattern predicted a Gap Reversal pattern. We did see the Gap today and a moderate reversal in price. But the SPY, as usual, continued to try to melt upward.

I highlighted a very interesting TWINNING pattern in Bitcoin in this video. Pay attention.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

GOLD/SIlver Ratio Signals Risk On Gold/Silver ratio represents the appetite for risk

Stronger gold means risk off and vice versa

In spring, the ratio had hit the target for leg 2 (blue) within

large consolidation that took over 4 years to emerge

It travelled the equal distance of leg 1 (blue) and then reversed.

The next step might be the continuation to the downside for the ratio.

The minimum target is to hit the bottom of red leg 1 at 63.

The next target is located at the distance of the red leg 1 subtracted from the peak of blue leg 2. It was set at 43.

Both downside targets are within historical range.

Gold/Copper ratio shows same dynamics of "Risk-On" attitude on the market.

STEEL-NERVE SETUP – ARE WE RE-LIVING GOLD’S 2020 BEAR-TRAP?Retail sentiment is ultra-bearish, positioning is cooling, Silver is outperforming and the S&P 500 is screaming risk-on … exactly the cocktail we saw in June 2020, right before Gold & Silver exploded higher.

1️⃣ WHY THIS FEELS LIKE 2020 AGAIN

2025 (now) 2020 (pre-rally) Read-through

> 70 % of TradingView ideas are bearish 💬 > 60 % were bearish Crowd may be offsides again

Managed-money net-longs -18 % from April peak 📉 -25 % from March peak Powder for fresh longs

First monthly ETF outflow (-$1.8 bn) 🚪 Record inflows Capitulation, not euphoria

Gold/Silver ratio down to 94 ⚖️ Fell to 95 Silver leadership = bottoming tell

S&P 500 at new ATH 📈 S&P at new ATH Risk-on backdrop identical

2️⃣ WHAT’S DIFFERENT THIS TIME

Real 10-y TIPS yield +0.7 % (2020: -1 %) → smaller monetary tail-wind.

Gold already at inflation-adjusted ATH → upside could be shorter & sharper, not a fresh super-cycle (yet).

3️⃣ CHECKLIST FOR A REAL BEAR-TRAP

Signal Watch-level

Gold holds $3 200–3 250 (100-d SMA + fib) Daily close above zone

Gold/Silver ratio breaks < 90 Momentum confirmation

CFTC net-longs < 150 k Position flush

ETF flows turn positive Fear → FOMO

S&P stumbles / vols spike Classic risk-bid for Gold

Need 3 of 5 boxes ticked to validate the squeeze thesis.

4️⃣ CATALYST CALENDAR

3 Jul – NFP: sub-75 k print could fire the opening salvo.

9 Jul – Tariff freeze decision: escalation would revive safe-haven demand.

15 Jul – CPI & 30-31 Jul – FOMC: dovish turn + soft data could complete the squeeze.

Disclaimer: This post reflects my personal opinion for educational purposes only; it is not financial advice. Trading futures and commodities involves substantial risk and can lead to total loss of capital—do your own research (DYOR) and consult a qualified professional before acting.

SPY/QQQ Plan Your Trade for 6-25 : Breakaway PatternToday's Breakaway pattern suggests the SPY/QQQ may attempt to move into another breakaway price move - very similar to yesterday's price move.

I will add that I believe the SPY cycle patterns have already moved through a breakaway phase with the ceasefire news early this week. I believe the gap and breakaway move yesterday may be the breakaway trend we are expecting today.

That would suggest the markets could pause and pullback a bit over the next few days.

Gold and Silver are trying to find a bottom after the brief selling that took place over the past few days. I really do believe Gold and Silver are poised to make a big move higher.

Bitcoin is on a terror to the upside. But be cautious of the downward cycle channel that may prompt a rollover in BTCUSD near the $107,500 level.

I spend a little time near the end of this video highlighting my work on the Tesla 3-6-9 price theory and going over a few examples for my new book on trading.

Enjoy the quick look at some of the more advanced techniques I'm working to unlock for all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 6-24 : Post Market UpdateThis post-market update highlights the weakening volume while my primary proprietary modeling system continues to stay BULLISH.

The markets are really quite interesting right now. Weakening volume in this Gapping uptrend, today, suggests traders are not buying into the ceasefire between Iran and Israel.

Additionally, the move in metals suggests a PANIC phase has setup in the US markets.

This type of panic phase typically leads to selling of assets and moving capital into CASH.

I suggest traders continue to prepare for a moderate melt upward trend over the next few days - but be prepared for any potential breakdown (possibly trying to FILL THE GAP).

This market appears to be running on fumes.

While I believe Trump's policies will lead to a stronger bullish price trend over the next few years, these disruptions and the potential for consumers to pull away from spending/economic activity over the second half of 2025 is still very real.

Buckle up.

At this point, hedge your trades, move some capital into CASH and prepare for bigger price volatility as we move into July 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 6-23 : Afternoon UpdateWhat happened to the CRUSH pattern?

Everyone wants to know why the CRUSH pattern didn't show up today. Well, I keep telling all of you these SPY Cycle Patterns are based on GANN, Tesla and Fibonacci price structures. They do not take into consideration news, global events, or anything outside of PRICE.

They are predictive - meaning they attempt to predict potential price shapes/patterns weeks, months, and years in advance.

The markets, obviously, are seeking some normalcy after the Iran conflict. I thought the CRUSH pattern would have been a perfect fit for today - but obviously the markets didn't agree.

If you have been following my videos, you know I keep saying the US stock market is acting as a global hedge for risks. Traders are pouring capital into the US stock market as a way to avoid global risk factors.

Traders are also pouring capital into Gold/Silver. Demand for physical metals is through the roof right now.

Time will tell if my Excess Phase Peak pattern plays out as I expect or if we rally to new ATHs.

Obviously, this sideways rollover topping pattern could present a breakaway in either direction.

Again, my patterns are not correlated based on news or other events. They are strictly price-based.

Get some...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 6-23 : CRUSH PatternToday's CRUSH pattern suggests the markets will struggle to find any support for a rally. A CRUSH pattern is usually a large breakdown type of price bar that moves aggressively against the dominant trend.

Som, today I'm expecting some fairly large price action and I believe the markets may start a breakdown move this week as we continue to get more news related to the Israel/Iran/US conflict.

This week will be a "resettling" week in my opinion. Buyers will start to actively liquidate and reposition assets as we move deeper into this conflict. When buyers turn into sellers (to get out), the markets usually react very aggressively in trend.

Metals continue to hold up without making any big moves. I believe the increased FEAR level could play out as a moderate rally for metals over the next 15-30+ days.

BTCUSD broke down very hard (more than 6%) over the past 3-4+ days. This is a big move downward for Bitcoin and could suggest US technology stocks/sectors could also collapse on fear of a "rollover top" in the US stock market.

Smart traders will hedge and pull capital away from this potential top - just like I've been suggesting for the past 2-3+ weeks.

Oddly enough, if we do get a rollover/top this week because of the Iran conflict, it plays right into my Excess Phase Peak pattern and the predictions I've been making over the past 4+ months.

No, I don't foresee events like this Israel/US/Iran conflict. I can't see into the future.

What I can do, and continue to try to deliver, is the best analysis I can offer without becoming BIASED by indicators, comments, or other inputs.

I just read the chart and will tell you what I see as the most likely outcome.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Middle East Tension & Markets: My Honest Stance🌍🕊️✌️ Middle East Tension & Markets: My Honest Stance 💣 🔥 🗡️

Hi everyone,

It’s Friday, June 20th — and we face a fragile moment: the uncertainty of possible US military action against Iran. 📉📰✈️

On my charts:

Bitcoin (BTC) reached key resistance and now ranges sideways as we await clarity.

Gold (XAUUSD) remains the classic safe haven — it holds an ascending structure, but profit-taking could trigger dips if markets crash.

Silver (XAGUSD) is similar, yet needs broader industrial strength to outperform gold.

Crude Oil (WTI) could spike dramatically if bombs fall — but I choose not to profit from pain.

USDJPY & USD pairs reflect global trust in the dollar and US stability — I’ll cover this more next week.

My personal stance is simple:

💙 I never short disasters. I never profit from human suffering. I am LONG on humanity and peace. 🕊️✌️🌈

👉 I expect potential market gaps between now and Monday:

✅ Bad news (war) → gold, silver, oil likely pump

✅ Good news (diplomacy) → risk assets rebound, oil stabilizes

I am positioned carefully with small risk and clear stops. My goal: protect my capital, trade my plan, but never bet on pain. If I lose because peace prevails — I win as a human.

Stay safe, trade wisely, and never forget: sometimes the best trade is no trade at all.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

SPY/QQQ Plan Your Trade For 6-20 : Pause Bar PatternToday's Pause Bar pattern suggests the SPY/QQQ will slide into a sideways type of PAUSE in price action today. I'm not expecting much to happen and if we do see any breakaway or breakdown trending it will likely be related to news.

While we have options expiration today and a host of other things that could drive the markets, I believe the markets are struggling to find direction right now. Thus, a pause in trading would be somewhat normal after a holiday-shortened trading week.

Gold and Silver are struggling after a brief rally last week. I believe this is fear related to the Israel/Iran conflict. Metals should continue to move higher.

BTCUSD is slightly higher (forgot to cover BTCUSD in the video), but not moving into a breakaway phase.

Overall, everything is very flat in early trading today. It may stay that way with my PAUSE BAR pattern.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Gold Ready to Shine Again? Watch This Battle Zone Closely!Gold is consolidating above the 50% retracement (3372) after defending key structure at 3368–3378. Bullish momentum is building as Silver continues to lead, and the US Dollar (DXY) weakens post-FOMC. If buyers step in here, we could see a clean breakout toward 3415–3450 and beyond. But if 3368 breaks, the bull case is temporarily invalidated.

🧭 Technical Highlights:

✅ Support Zone: 3368–3378 (Fibonacci + bullish order block)

✅ Resistance Targets: 3395, 3415.84, 3451.84, 3470+

🔄 Silver Divergence: XAGUSD broke higher → leading XAU bullishly

🔼 Bias: Bullish (as long as 3368 holds)

🌐 Fundamental Drivers:

🏦 Fed dot plot turns dovish – Only 1–2 cuts, but no hikes planned; supports gold upside.

⚔️ Middle East tensions rising – Iran vs. Israel/US rhetoric keeps risk premium high.

📉 DXY weakens after Powell avoided hawkish tone; real yields remain capped.

💬 Silver outperforming on safe-haven + industrial hedge flows.

💡 Trading Plan Summary:

Buy Zone: 3372–3380

TP Zones: 3395, 3415, 3450+

Invalidation: Close below 3368

Confirmation: Break and close above 3395 with volume = signal to scale in

🔔 Keep an eye on:

US Jobless Claims, SNB & BoE Decisions

DXY 98.70 key level

Silver reaction near 36.70–37.20

SPY/QQQ Plan Your Trade For 6-19: GAP Reversal Counter TrendToday's pattern is a GAP Reversal in Counter Trend mode. I believe this could represent a breakdown in the ES/NQ as the US stock market is closed for the Juneteenth holiday.

Obviously, after the Fed comments yesterday (stating "uncertainty") and with the continued Israel/Iran conflict playing out, it makes sense to me that the US markets would move into a pre-weekend consolidation phase.

Even though the US stock market will be closed, the futures market will likely stay open and will carry some general market sentiment and reactions to news.

Watching Gold/Silver and Bitcoin should be very interesting today. I suspect the markets will continue to consolidate downward today - leading to a potential breakdown seeking support day on Friday.

Buckle up. We'll likely have 3-5+ days of news related to the Israel/Iran conflict and other issues over this weekend. It could be very interesting to see how the global markets move through this news.

Get some.

Happy Juneteenth

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Gold Market Update: Bulls Will target 3750 USD after 3500 USD🏆 Gold Market Mid-Term Update (June 19, 2025)

📊 Price & Technical Outlook

Current Spot Price: ~$3,365

Technical Setup

Inverted H&S pattern forming/completed on higher timeframes — confirms bullish reversal structure.

Reload (buy) zone: $3,250–$3,275 (ideal accumulation range for bulls if price pulls back).

Swing trade setup: Entry: $3,250–$3,275 (reload zone)

Take Profit (TP): $3,750

Support: Major at $3,250–$3,275 (break below = reassess bullish bias).

Resistance: $3,450–$3,500 ; next major resistance: $3,600, then $3,750.

Price consolidating above $3,250–$3,350 is technically healthy — maintaining bullish structure.

🏆 Bull Market Overview

The pullback appears complete; uptrend resumes amid strong macro/geopolitical drivers (inflation, rates, safe haven flows).

Key Levels: $3,000 (macro support), $3,250 (bulls must defend), $3,500 (breakout zone), $3,750 (swing TP).

Short-term dips = buying opportunities — “Buy the Dip” remains favored as long as support holds. Upside targets: Immediate: $3,600 Swing target: $3,750

Summary:

Gold remains in a bullish mid-term structure, with the inverted H&S pattern pointing to higher prices ahead. Bulls look to reload at $3,250–$3,275, targeting $3,750 for swing trades. As long as $3,180–$3,200 holds, buying dips is the play. A sustained breakout above $3,400–$3,600 opens the door for new all-time highs.

SPY/QQQ Plan Your Trade For 6-18 : GAP Potential PatternToday's GAP Potential pattern suggests the SPY/QQQ may GAP a bit higher at the open, then move into a melt-up phase, trying to identify resistance, then roll into a topping pattern and move downward.

I believe the recent "rollover" of the markets (initiating last Friday with the Israel/Iran conflict) is still dominating the markets and news related to the ongoing conflict could drive a moderate pullback in US assets.

Headed into the Juneteenth holiday (Thursday, June 19), I suggest traders prepare for the US markets to move into somewhat of a SETTLEMENT mode today - where traders don't want to hold too many open positions into Friday's trading.

Additionally, Gold and Silver could move into a very strong upward price move over the next 4-5+ days. So be prepared for metals to hedge risks when the US stock market is closed.

BTCUSD seems to be struggling into the FLAG APEX. I'm waiting to see if my FLAG count is correct and if we get the breakdown in BTCUSD as I expect.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver