Gold shows a bearish gapThe daily chart of gold shows a clear gap after the price peaked around $3,495/ounce. This is a warning sign of a reversal when strong selling pressure causes the opening price to be significantly lower than the closing price of the previous session. This gap often reflects distribution pressure from big players, especially in the context of gold having just experienced a hot rally.

In addition, the long red candle appearing right after the gap shows decisive selling pressure, pushing the price down to the $3,310/ounce area. Currently, although gold has slightly recovered to around $3,340, the short-term trend is leaning towards a correction as fundamental news continues to put downward pressure on prices.

President Trump's conciliatory statement on US-China trade and expectations of tariff reduction have significantly improved risk sentiment in the market. Strong money flows into stocks, causing gold to lose its safe-haven role. At the same time, the wave of profit-taking after the peak is also the main reason why gold "evaporated" tens of USD in just 24 hours.

Technically, if gold does not soon fill the GAP around the $3,390–$3,420 area, the correction trend will likely continue to expand to the EMA34 support area around the $3,200–$3,250 mark. A more positive scenario will only be triggered if gold regains the GAP and closes above $3,430.

In the current context, investors need to be cautious, prioritizing the strategy of waiting to sell when recovering to the resistance area, especially the area around the unfilled GAP.

Gold-trading

Gold Drops Shock: Breaking Up the Upward ChannelThe 4-hour chart of gold shows a clear scenario of breaking the upward channel. After reaching a peak of nearly $3,495/ounce, the gold price has plummeted and is currently fluctuating around $3,325 – close to the EMA89 support and in the accumulation zone (green box) as per technical analysis. The EMA34 line has also been penetrated, confirming that the medium-term uptrend is losing strength.

This decline is not only due to technical factors but also due to the influence of political and economic information. President Trump's statement about not firing the FED Chairman and the expectation of future interest rate cuts have helped the risk sentiment recover. US stocks have rebounded strongly, causing investors to withdraw capital from gold – a safe-haven asset – and return to stocks.

Combining both technical and news factors, this deep decline is largely due to the reversal of market sentiment and strong profit-taking pressure after a prolonged increase. The chart pattern also suggests that the price may continue to fluctuate in the $3,280–$3,340 range to consolidate before a new round of volatility. If it breaks below the green box, gold could continue to correct deeper towards the $3,200 mark.

Gold accelerates thanks to US-China tensions and a weakening USDGold prices continued to show their strength when breaking through the old peak of 3,434 USD and moving up to 3,460 USD/ounce, equivalent to an increase of more than 61 USD in less than a day, showing that safe-haven buying is overwhelming the entire market. On the 1H chart, the bullish structure is clear with EMA34 and EMA89 maintaining a strong slope, the price continuously increased after short technical corrections, confirming that the uptrend is still very sustainable. In terms of news, gold is being supported by two factors: trade tensions between the US and China escalated after Beijing decided to sharply reduce crude oil imports from the US and shift to Canada, increasing global risk concerns.

At the same time, global stock markets fell sharply, while President Donald Trump's controversial statement asking the FED to immediately cut interest rates sent the USD to a 3-year low. The combination of political uncertainty, risk aversion and a weak greenback has created a strong catalyst for gold to continue to be sought after by investors. In the short term, the $3,440–$3,450 zone could be new support, and if it holds above this zone, gold could continue to extend its rally towards the psychological $3,500 level.

Gold targets $3,475: Strong wave has not stoppedThe world gold price's uptrend continues to hold steady after a technical correction to the support zone around $3,336 - $3,369 (Fibonacci 0.5 - 0.618), coinciding with EMA34 on the H4 frame, showing that buying power is still dominant in the main trend. The price has now recovered to around $3,395/ounce and continues to maintain a strong uptrend pattern with the target of expanding to the $3,475 zone - the 100% Fibonacci level of the most recent uptrend. The convergence between the technical structure and macro news creates a solid foundation for the uptrend: safe-haven money continues to flow into gold amid geopolitical instability, a weakening USD and market sentiment worried about risks from US economic policy.

Comments from experts such as Sean Lusk and Christopher Vecchio also reinforce the bullish outlook, especially as speculative money and central bank buying have yet to show signs of cooling off. With the EMA34 and EMA89 maintaining a positive slope, the possibility of the price continuing to climb to the target area of $3,475 is very high, before a short-term correction to test the breakout zone may appear. In the short term, any correction to the $3,370–$3,390 area is seen as an opportunity to increase long positions following the trend.

Trump is controlling the world marketFear gripped global markets earlier this week as major economies clashed over tariffs that threatened to push the United States and the world into recession.

Donald Trump said on Sunday that the United States was taking “medicine” to cure its trade “disease.” But the pressure on the Trump administration is growing as Americans’ investment and retirement accounts have plummeted. Even Trump’s staunchest supporters, including Sen. Ted Cruz, Rep. Mitch McConnell and Elon Musk, have begun to voice concerns.

JP Morgan CEO Jamie Dimon warned that the tariffs would push up commodity prices and slow economic growth, potentially leading to “stagflation.”

The market is currently pricing in five rate cuts by the Federal Reserve this year, totaling 1.25%. Many investors believe the Fed could make an emergency rate cut before its next policy meeting.

Technically, despite the weakness in gold prices, buyers still have the technical advantage in the short term. The overnight rebound suggests that sellers may be exhausted. The buyers’ target is to close above the resistance level of $3,201.60/ounce (the contract high). On the other hand, sellers want to push prices below the support level of $2,950/ounce.

Gold reverses sharply after Trump's tax announcementThe world gold price has reversed sharply because the global market has just received information last night (Hanoi time) that US President Donald Trump has just signed an executive order to impose taxes on all goods imported into the US, many countries will have to pay high taxes of up to tens of percent.

Specifically, the UK, Brazil, Singapore will be subject to a 10% tax. The European Union, Malaysia, Japan, South Korea, and India will be subject to 20-26%. China, Thailand, and Vietnam are among the countries subject to the highest tax rates, at 34%, 36%, and 46%, respectively. The highest is Cambodia, which will be subject to a tax rate of up to 49%. This tax rate will be applied from April 9. In addition, Mr. Trump said that a 10% import tax will be applied to all goods imported into the US from April 5.

Mr. Trump said that every year the US loses 1,200 billion USD due to the trade deficit due to 3,000 billion USD of imported goods.

After this information, the global financial market was shaken, in which the US stock market had a strong decline, losing from more than 1% to more than 2%. On the contrary, gold - an asset that ensures capital safety in case of risk - has benefited from a strong increase in price.

Many experts commented that the Trump government's tariff policy has increased global trade tensions. Previously, the US imposed tariffs on some goods from Canada, Europe and China, aluminum and steel. These countries have responded to the tariffs on the US.

Gold prices remain on the riseLast week, the world gold price surpassed the historical peak of over 3,057 USD/ounce but quickly decreased due to profit-taking pressure from investors. However, the price remained above the psychological support level of 3,000 USD/ounce - a level that many experts predicted would be an important support in the coming time.

The general sentiment in the market is still leaning towards optimism. Many central banks continue to increase their gold reserves as a way to diversify away from the USD. Meanwhile, individual investors and ETFs have also begun to return to the gold market.

Data from the SPDR Gold Shares fund shows that the amount of gold held has increased by more than 37 tons this year, to 910 tons. Although this figure is still lower than in 2020, the upward momentum is returning due to concerns about inflation and escalating trade tensions.

FOMC today ?World gold prices increased by 3 USD, to 3,030 USD/ounce. In the US trading session (night of March 18), gold at one point rose to a record high of 3,035.4 USD/ounce. The safe haven demand for gold has pushed prices to a record high. Investors are worried about the increase in global trade wars and new geopolitical developments between countries, so they have bought gold.

Israel launched airstrikes across the Gaza Strip early Tuesday morning, killing at least 400 Palestinians, including women and children, according to hospital officials. The surprise bombing broke a ceasefire that had been in place since January and threatened to completely reignite the 17-month war. Over the weekend, the US attacked Houthi targets in the Middle East and vowed to attack more.

In addition, investors are now watching the Federal Reserve Open Market Committee (FOMC) meeting, which begins Tuesday morning and ends Wednesday afternoon. The market is not expected to make any changes to interest rates at this meeting, but will closely analyze the wording of the FOMC statement and Fed Chairman Jerome Powell's press conference.

GOLD hit 3000$ The first notable event is the Bank of Japan (BOJ) monetary policy meeting on Tuesday, followed by the US Federal Reserve (FED) interest rate decision on Wednesday. The Swiss National Bank (SNB) and the Bank of England (BOE) will announce their interest rate policies on Thursday.

These moves can directly affect the strength of the USD and capital flows into gold. This expert believes that if the FED maintains a "hawkish" stance and takes a cautious view on cutting interest rates, the USD may continue to strengthen, putting pressure on gold prices. On the contrary, if the signals from the FED are more easing, the precious metal may maintain its upward momentum.

Commodity experts at Macquarie have raised their gold price forecast to $3,500 an ounce by the third quarter of 2025. They had previously targeted $3,000 for mid-year, but gold prices have hit that mark earlier than expected.

Donald Trump is supporting gold prices more than any factor FedWorld gold prices increased in the context of the USD's decline. Recorded at 8:45 a.m. on March 10, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.632 points (down 0.17%).

This week, market sentiment has changed significantly compared to last week, especially from the Wall Street experts. In the previous survey, only 21% of experts predicted that gold prices would increase, while 64% said that prices would decrease.

However, this week, the percentage of experts expecting gold to increase jumped to 67%, while only 5% predicted a decrease - a significant change reflecting a reversal in analysts' views.

The percentage of investors predicting gold prices to rise has increased from 45% to 67%, while the number of those expecting prices to fall has decreased from 28% to 18%.

Notably, the number of participants in this week's survey reached 251 people - the highest level in 2025, showing greater investor interest in the gold market.

Jim Wyckoff - senior analyst at Kitco - affirmed that gold prices will continue to maintain an upward trend thanks to increasing geopolitical instability. "The gold price trend remains steady, thanks to positive technical indicators and increasing geopolitical uncertainties, especially the impact of the US President Donald Trump's administration."

Nonfarm forecast tonight ? 🔴US Expected to Add 170,000 Jobs in February, But Job Outlook Worsens

————

⚫February Jobs Forecast: Nonfarm payrolls report projects 170,000 jobs added, up from 143,000 in January, while unemployment remains at 4%.

⚫Mixed Signals: While official data shows the labor market remains strong, surveys show many workers are worried about their jobs and less willing to look for new opportunities, while job seekers are having a tough time.

⚫Layoffs Rising: Staffing firm Challenger, Gray & Christmas reports that businesses are announcing the highest level of layoffs since July 2020, with 62,000 jobs tied to the Trump administration's federal workforce cuts.

⚫Consumer Confidence Falls: A report from the Conference Board and the University of Michigan showed consumer confidence is falling sharply amid fears about growth and the labor market.

⚫Impact of Government Layoffs: Some economists warn that government layoffs could spread and affect as many as 500,000 jobs, undermining confidence in the economy.

⚫Wage Growth: Average wages are expected to rise 0.3% month-over-month and 4.2% year-over-year, up from 4.1% in January.

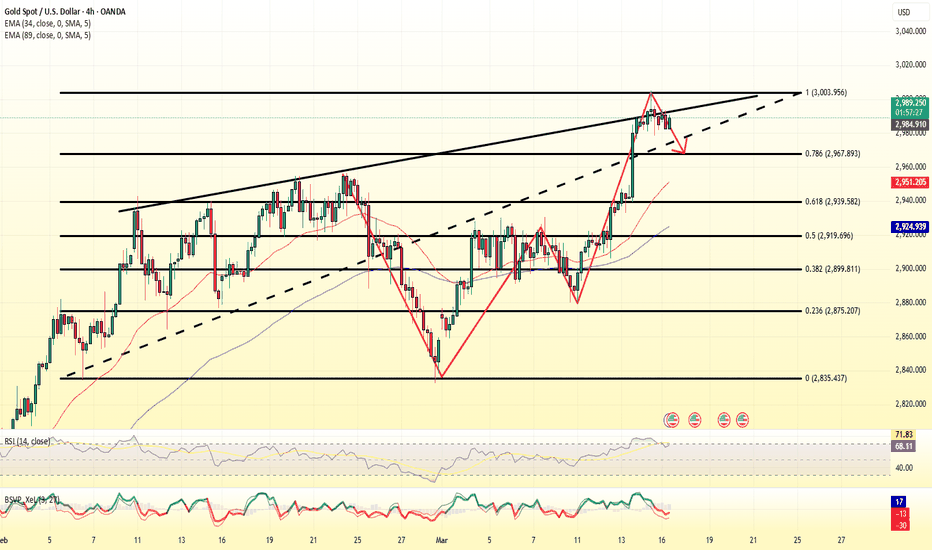

GOLD RALLIES STRONGLY – WILL THE BULLS MAINTAIN CONTROL?💠 GOLD ANALYSIS – 03/05/2025

📌 Market Overview

Gold continues its strong upward trajectory, holding firm above key resistance levels. Following the release of ADP Nonfarm employment data, the market responded with increased demand, reinforcing the bullish sentiment.

🔥 Macroeconomic Factors at Play

The U.S. dollar (USD) has weakened due to ongoing tariff uncertainties and mixed economic data from the U.S. While there was a short-lived recovery in the dollar late last week, the overall sentiment suggests further strength in gold. Given this outlook, buying opportunities remain attractive as the price action aligns with technical confirmations.

💡 Strategic Focus for Today

During the Asian and European trading sessions, traders should closely monitor resistance levels to assess potential early BUY entries. If gold reaches the 2928 - 2926 zone, this could present an ideal setup for short-term SELL scalping, similar to yesterday’s move, which yielded a 150-pip profit.

🔹 Key Support & Resistance Levels

🔺 Resistance Levels:

2928 - 2942 - 2954

🔻 Support Levels:

2904 - 2894 - 2886 - 2874

🎯 Trading Plan for Today

🟢 BUY ZONE:

Entry: 2886 - 2884

Stop Loss (SL): 2880

Take Profit (TP): 2890 - 2894 - 2898 - 2905

🔴 SELL SCALP:

Entry: 2942 - 2944

Stop Loss (SL): 2948

Take Profit (TP): 2938 - 2934 - 2930 - 2925 - 2920

🔴 SELL ZONE:

Entry: 2954 - 2956

Stop Loss (SL): 2960

Take Profit (TP): 2950 - 2946 - 2942 - 2938 - 2934 - 2930

📌 Key Considerations & Risk Management

✔ Risk Control: Strictly adhere to Take Profit (TP) and Stop Loss (SL) levels to protect capital.

✔ Market Behavior: Prices may consolidate before tomorrow’s Nonfarm Payroll (NFP) data release, requiring patience and a disciplined approach.

✔ Confirmation Before Execution: Avoid premature entries—wait for clear signals to maximize trade efficiency.

📢 Will gold continue its bullish momentum or face a pullback? Drop your insights below! 🚀🔥

Gold futures for April are trending upWorld gold prices continued to rise amid a weakening US dollar. The US Dollar Index – a measure of the greenback’s strength against six major currencies – fell 0.49% to 106.145 points.

Risk aversion remains high in the market due to geopolitical tensions and new tax policies. The US has just imposed tariffs on goods imported from Mexico, Canada and China. In response, these countries have also applied retaliatory measures, affecting about $1,000 billion of global trade.

China is likely to let the yuan depreciate to reduce the impact of tariffs and boost exports. If the yuan continues to weaken, many investors in China may flock to gold as a safe haven.

Asian and European stock markets are trending lower, while US stocks are also forecast to open with slight losses.

SUPPORT : 2900 , 2892

RESIST : 2930 , 2950

World gold price today"Gold's increase over the past two months has exceeded the normal trend, so there may be a correction. However, I think this decline will only be short-lived and insignificant. The reasons why investors buy gold are still there, while North American investors have not increased strongly."

"Gold reached a record high of nearly 2,955 USD/ounce on February 20. However, technically, it is starting to show signs of being susceptible to a downward correction. The increase of more than 13% from the beginning of the year until now may cause investors to falter and slow down their buying momentum."

The world gold market continues to fluctuate strongly due to the impact of President Donald Trump's policies. Kitco News' latest weekly gold survey results show that industry experts are cautious about the yellow metal's short-term prospects. Meanwhile, retail traders are optimistic, with prices forecast to continue rising this week.

World gold prices increased in the context of the USD fallingFinancial markets became more concerned on Thursday due to concerns of new tariffs from the US and rising tensions between the US and Europe. In addition, the tense relationship between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy also makes the market uneasy, especially when there are signs that Donald Trump may be leaning towards Russian President Vladimir Putin in negotiations on the Russia-Ukraine war.

Gold prices delivered in April maintain a strong upward trend, with the main motivation coming from safe haven demand and speculative cash flow. Currently, the important resistance level is identified at 2,973.4 USD/ounce - the highest level just established, followed by 2,985 USD/ounce. If gold surpasses $3,000/ounce, the upward momentum could continue.

Resist : 2954 , 3000

Support : 2933 , 2900 , 2850

Gold prices are also maintaining at historic peak levelsAccording to analysis, the domestic and foreign gold markets are being strongly influenced by the forums of the US Federal Reserve (FED) and the main US trade lists.

Recently, President Donald Trump continued to announce that he could impose a 25% tax on imported cars, semiconductors and pharmaceuticals...

Investors continue to look to gold as a safe foreign channel, amid worries about international trade tensions and negotiations to end the conflict in Ukraine that have not yet had positive results as expected.

The USD index remained at its lowest level in about 2 months, around 106.9 points, also supporting the rise of gold prices.

The gold market has largely recovered after the sharp sell-offGold prices have been suppressed, but this is about to end as supply is tight and gold flows out of London and the US could re-price gold.

Andy Schectman - President of Miles Franklin Precious Metals said that one of the most worrying problems in the current gold market is that it is increasingly difficult to find and buy physical gold. "Currently, the LBMA takes six to eight weeks to deliver gold - in essence, this is almost a form of default," he said.

In China, some major banks have announced they have run out of gold products due to strong demand. In South Korea, the country's mint has temporarily stopped selling gold bars because of tight supply.

The world's largest gold ETF - SPDR Gold Trust (GLD) has just withdrawn 16 tons of gold. He said this could be a sign that institutional investors are withdrawing physical gold from the fund, reflecting a loss of confidence in the "paper gold" market.

World gold continues to run out of timeGold prices today in the world February 17: Trade tensions pushed gold prices to record highs

Precious metals investors have endured a volatile week, as dismal US economic data and escalating tariff threats pushed gold prices to new record highs. However, at the end of the week, some optimistic news about the US economy and the US-Russia peace negotiations caused gold to take profit and fall sharply. The downward trend has not stopped today, gold is still trading below 2,900 USD/ounce.

Unfavorable economic data from the US has also pulled the USD down, possibly creating opportunities for commodities traded in USD. Specifically, retail sales in the US in January decreased by 0.9%, in contrast to the increase of 0.7% (adjusted from 0.4%) in December, according to an announcement from the US Census Bureau on Friday. This decrease is lower than market expectations, only -0.1%.

With this situation, although gold prices are currently trending down in the short term, unstable factors from Trump's tax policy or concerns about trade wars can still create momentum to help gold prices go up in the future, especially when the demand for safe assets increases.

Gold is in an extremely strong setupWhile a weaker USD is the main driver pushing gold prices higher, this stems from two factors, including tariff concerns and January's Producer Price Index (PPI) report.

Anxiety continues to increase after US President Donald Trump's announcement of imposing reciprocal tariffs on countries that tax imports from the US. Besides, the US has just released the January PPI index, showing that producer prices increased by 0.4% this month.

"Gold is in an extremely strong setup. As the USD strengthens, we are seeing a surge in gold buying from Asia, including central banks, retail investors, and financial funds."

FED Chairman's testimony before CongressGold prices fell from historic levels as investors evaluated Fed Chairman Jerome Powell's congressional testimony and new trade policy statements from US President Donald Trump.

Market sentiment is mainly influenced by two important developments. First, President Donald Trump's announcement on Sunday of plans to impose 25% tariffs on imported steel and aluminum, with no exceptions or exemptions, has raised concerns about potential trade conflicts.

Second, FED Chairman Jerome Powell's hearing also had a big impact on market developments. In his opening speech, Mr. Powell emphasized that the FED remains cautious in cutting interest rates, citing the solid economy and inflation continuously exceeding the FED's 2% target.

Investors are closely watching Mr. Powell's two-day testimony for clues about upcoming monetary policy, especially in the context of consumer price index (CPI) data about to be released. If inflation is higher than expected, market expectations of two interest rate cuts this year could be challenged.

The decline in gold prices from record highs also reflects profit-taking activities after a strong increase since mid-December, with an increase of about 370 USD, equivalent to 14.25%. This adjustment shows that investors are taking advantage of profit-taking opportunities, while reassessing the outlook for monetary policy and trade risks.

Decent pullback Google looks opportunistic hereGoogle traded higher into earnings only to have a decent pullback afterhours. Its trading into support which in my opinion is a decent buying opportunity. AMD also sold off below 110 and has finally reached a measured move from the start of its sell off last summer.

World gold price todayIn the international market, at 6:00 a.m. on January 24, the world spot gold price was $2,753/ounce, down $7 from the highest price in the overnight trading session of $2,760/ounce. However, the gold price later rose to a new high, around $2,770/ounce, up nearly $20/ounce compared to today.

According to Jim Wyckoff, senior analyst at Kitco Metals, recent better economic data from the US suggests that the Fed may have to delay cutting interest rates longer and the higher interest rate environment increases the opportunity cost of holding Lis gold.

This expert commented that in the US stock market, stock investors are trading very strongly, so gold is less interested.

Another factor that investors are paying attention to is that President Trump announced that he would impose tariffs on goods from the European Union and is considering applying a 10% tax on Chinese imports from February 1.

However, if these policies are considered to be inflationary, causing the Fed to maintain high interest rates for a long time, the attractiveness of gold as an inflation hedge may decrease.