Falling towards 50% Fibonacci supprt?The Gold (XAU/USD) is falling towards the pivot and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 3,306.96

1st Support: 3,287.36

1st Resistance: 3,342.69

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gold

Waiting for the Perfect Entry: XAUUSD Market Structure Breakdown🔍 Taking a look at XAUUSD today: it’s clearly in a downtrend 📉 on the 4H chart, with consecutive lower highs and lower lows 🔽.

📌 My bias is bearish, and I’m patiently waiting for price action to set up for an entry 🎯.

If we get a break of market structure 🧱, followed by a retest and failure of the current range high 🚫, that could present an opportunity 👀 — not financial advice ⚠️.

DeGRAM | GOLD forming head and shoulders📊 Technical Analysis

● A double rejection at 3 358—confluence of the May-July descending trend-line and the long-term channel roof—has carved successive lower highs; the break of the inner up-trend (circled) shifts structure bearish.

● Price is now slipping out of a contracting pennant; sustained trade beneath 3 246 (pattern base / April pivot) exposes the mid-channel magnet at 3 202, with the outer rail projecting 3 121.

💡 Fundamental Analysis

● Surprise rise in NY Fed 1-yr inflation expectations and Daly’s “no urgency to cut” remarks lifted 2-yr real yields and the DXY, while ETFs saw a fifth straight day of outflows, signalling fading bullion demand.

✨ Summary

Sell 3 300–3 320; break below 3 246 targets 3 202 → 3 121. Short view void on a 4 h close above 3 358.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold (XAU/USD): Tugged Between Tariffs and Treasury YieldsGold is finding renewed interest from two forces: falling real yields and a cautious Fed. Despite the dollar’s strength, we’re seeing the yellow metal hold above $3,300. Treasury yields are sliding, and global central banks, especially China’s PBOC, are still net buyers of gold. The World Gold Council reported $38 billion in inflows to gold ETFs in the first half of the year, the highest in five years.

Technically, support remains stiff at the 50-day EMA ($3,305), with a ceiling at $3,340. If broken, $3,360 - $3,400 comes back into play. But failure to hold above $3,300 opens downside risk to $3,246, and possibly $3,185.

Early impulsive action got me active! This was a move I was looking to happen yesterday but got slapped trying. It just rocks out like that some time and you have to wait for the next opportunity. In this move early and looking for it to continue if it can hold well above yesterdays high. Trailing stop with every 50 ticks cause anything can happen turning price around and I dont want to give to much back.

Gold Loses Its Shine – Short-Term Sentiment Turns BearishHello everyone, great to see you again for today’s market chat!

The factors that once made gold appealing — inflation fears, economic uncertainty, and the flight to safety — are gradually fading. As confidence grows that the Fed will maintain high interest rates for an extended period, capital is steadily moving away from gold and into more stable, yield-generating assets.

Across the financial community, there’s growing consensus: gold is no longer a top investment priority. The U.S. dollar is gaining strength, Treasury yields are rising, and gold’s support structure is weakening. While investors await the Fed’s next move, many are staying on the sidelines — or even leaning toward a bearish outlook. Notably, the rebound in the DXY is also playing a key role in adding pressure.

Gold is currently lacking momentum, lacking support, and most of all — lacking conviction. At this stage, the trend is no longer a debate, but a widely accepted short-term reality.

What about you — where do you think gold is headed next?

Ramelius Resources (ASX: RMS) –A Tactical Re-Entry Zone?🟡 Gold-Linked Opportunity: Ramelius Resources (ASX: RMS) – A Tactical Re-Entry Zone?

Context: Ramelius Resources, a mid-tier Aussie gold producer, is showing signs of technical exhaustion after a strong rally from its 2024 lows. With gold prices consolidating and RMS pulling back to a key support zone, this could be a tactical opportunity for shareholders and swing traders alike.

📊 Technical Snapshot:

Current Price: $2.47

Trendline Support: The long-term ascending trendline remains intact, offering a potential re-entry zone for bulls.

Risk-Reward Setup: Defined green/red zones highlight a favorable R:R ratio for those targeting a rebound toward $2.80–$3.00.

🪙 Gold Correlation Insight:

The inset chart shows gold (XAU/USD) stabilizing after a volatile June. If gold resumes its uptrend, RMS could follow suit, given its strong correlation with bullion prices.

🧠 Psychological Angle:

After a 40%+ rally from the $1.78 low, some profit-taking is natural. But this pullback may shake out weak hands before a continuation move.

Watch for sentiment shifts around gold and broader risk appetite—these could be catalysts for RMS’s next leg.

#RMS #Gold #ASX #MJTrading #Forex #Trading #Investment

Gold is Nearing The Daily TrendHey Traders, in today's trading session we are monitoring XAUUSD for a buying opportunity around 3,260 zone, Gold is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 3,260 support and resistance area.

Trade safe, Joe.

GOLD ROUTE MAP UPDATEHey Everyone,

Absolutely beautiful to see our 1h chart idea playing out perfectly. After completing the bearish targets earlier this week, we had the ema5 cross and lock below 3306 opening the swing range.

- This played out perfectly hitting the first swing range level and doing exactly what it say son the tin giving the full swing into 3306 just like we highlighted.

We will now look for ema5 lock above 3306 for a continuation into the bullish targets above or failure to lock will see rejections into the lower Goldturns for suport and bounce.

If it continues to fail breakout above, into the first Bullish target, then we are likely to see the full swing range tested on the rejections.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3358

EMA5 CROSS AND LOCK ABOVE 3358 WILL OPEN THE FOLLOWING BULLISH TARGETS

3389

EMA5 CROSS AND LOCK ABOVE 3389 WILL OPEN THE FOLLOWING BULLISH TARGET

3416

EMA5 CROSS AND LOCK ABOVE 3416 WILL OPEN THE FOLLOWING BULLISH TARGET

3439

BEARISH TARGETS

3330 - DONE

EMA5 CROSS AND LOCK BELOW 3330 WILL OPEN THE FOLLOWING BEARISH TARGET

3306 - DONE

EMA5 CROSS AND LOCK BELOW 3306 WILL OPEN THE SWING RANGE

3283 - DONE

3254

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,311.90 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 3,301.31..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

GOLD (XAUUSD): Time to Recover?!

Gold reached an important rising trend line on a daily.

I see 2 nice intraday bullish reactions to that on a 4H time frame

and a double bottom pattern formation.

Its neckline breakout and a 4H candle close above 3309

will confirm a start of a bullish correctional movement.

Goal will be 3327.

Alternatively, a bearish breakout of the trend line will push

the prices lower.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HelenP I. Gold can rebound from trend line and start to move upHi folks today I'm prepared for you Gold analytics. In this chart, we can see that gold has formed a clear wedge pattern, and within it, we can also observe a smaller triangle forming. This structure reflects a narrowing price range and growing tension between buyers and sellers. After testing the upper boundary near the resistance zone at 3390 - 3410 points twice, gold started moving lower and now approaches the trend line again. This level has already held as support multiple times, and each time the price touched it, it showed a rebound with renewed buying interest. Now the price is again trading near this trend line, around the 1300s area, and a small triangle has formed inside the larger wedge. This triangle may act as a base for the next upward movement. I believe that as long as gold respects this trend line and doesn’t break below the 3250 - 3230 support zone, the probability of upward continuation remains strong. My current target is the 3390 resistance level, which aligns with the top boundary of both the wedge and the resistance zone. A breakout above the triangle may give the price enough momentum to approach this area again. That’s why I remain bullish in this situation and expect a bounce from current levels, followed by an upward move toward the resistance. If you like my analytics you may support me with your like/comment.❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

7.9 Latest gold trend analysis and operation layout📰 News information:

1. Federal Reserve meeting minutes

📈 Technical Analysis:

Our decision to close our positions at 3305 yesterday was undoubtedly a very strategic one. After reaching a high of around 3310 last night, it began to fall. At the same time, I also gave VIP members the news that it might fall back to around 3300. Since the opening, the lowest point has reached around 3285. The overall trend is still under our control.

At present, gold will still usher in technical corrections in the short term. The current price of 3293-3290 support can be considered for long positions. If the European session continues to fall below the low, you can try to go short during the NY session. If the European session continues to maintain sideways consolidation, you can consider retreating and going long during the NY session. As long as the key support of 3250 below is held, gold will maintain its consolidation trend in short-term trading. On the contrary, once it falls below 3250, gold may directly touch the 3200 mark. Focus on the minutes of the Federal Reserve meeting, which may further influence the trend of gold.

🎯 Trading Points:

BUY 3293-3290-3285

TP 3305-3310-3320

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

GOLD Trading Opportunity! SELL!

My dear subscribers,

My technical analysis for GOLD is below:

The price is coiling around a solid key level - 3297.6

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3291.9

My Stop Loss - 3301.3

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold at a Decision Point-Just as Tariff Headlines Return(July 9)📌

4H Technical Outlook by MJTrading

Price is compressing inside a falling channel, nested within a large symmetrical triangle, and now sits right at a high-stakes confluence zone — a perfect intersection of dynamic EMAs, rising trendline support, and local structure.

This could be a pivot point for the next major leg.

🧭 Key Scenarios:

🟢 Bullish Breakout Potential:

If price breaks above the falling channel and holds above $3,310–$3,320:

🎯 Target: $3,400, and eventually upper triangle resistance near $3,480–$3,500

✅ Watch for impulsive breakout + retest confirmation

🟡 Bearish Breakdown Risk:

If the rising trendline gives way and price closes below $3,275 (High Risk) and $3,245(Low Risk):

🎯 Targets: First $3,232, then key level $3,166

⚠️ Further weakness may expose $3,000 psychological support

🔍 Why It Matters:

• Symmetry + compression = potential volatility expansion

• Trump tariff headlines today (July 9) could trigger safe haven demand

• Strong historical respect of these trendlines

• EMAs aligning around decision zone

“Another BreathTaking Edge” — because this is one of those moments where market structure whispers louder than words.

🗣 Boost if you find value, and follow MJTrading for more clean setups.🚀🚀

#XAUUSD #Gold #TradingView #TechnicalAnalysis #ChartPatterns #PriceAction #BreakoutTrade #Forex #MJTrading

Zoom in to get closer to battlefield:

Zoom out to see where we are:

XAUUSD: Market analysis and strategy for July 9Gold technical analysis

Daily chart resistance level 3340, support level below 3245

Four-hour chart resistance level 3308, support level below 3264

One-hour chart resistance level 3296, support level below 3275.

The expectation that the Fed will keep interest rates unchanged in July has been widely accepted by the market, mainly because Trump announced that he would increase import tariffs on goods from many countries from August 1, triggering market concerns about rising inflation. This expectation pushed up the US 10-year Treasury yield, supporting the dollar to a two-week high, which put gold under downward pressure. On Tuesday, gold closed sharply lower at the daily level, with ma5 and ma10 running downward, indicating that the bears once again dominated. Today, the price of gold may continue to fall. Pay attention to the support near the lower track 3275. If the price of gold closes the real falling candle again today, it will drive the Bollinger Band opening downward, which will further confirm the downward trend. The market may start a new round of decline in the future. The 4-hour level K line continues to fall, and the Bollinger Band opening expands downward! The short-term key support position below is around 3275. After breaking through, it may fall to the previous low of 3266-3245; the important pressure position is around 3308!

SELL: 3296near

SELL: 3308near

BUY: 3250near

Gold Under Pressure as Dollar Strengthens – Watch Below 3297FX:XAUUSD – Technical & Fundamental Outlook

Gold prices declined on Monday, pressured by a stronger U.S. dollar following President Trump’s announcement of a potential 10% tariff on BRICS-aligned countries. The news supported the dollar and weakened demand for gold as a safe-haven asset.

Although uncertainty remains around U.S. trade negotiations ahead of the July 9 tariff deadline, signals of possible extensions and staggered implementation have further reduced short-term haven flows into gold.

Technical View:

Gold remains under bearish pressure while trading below 3320.

As long as the price stays under this level, we expect sideways consolidation between 3297 and 3320 until a breakout occurs.

A 1H close below 3297 would confirm bearish continuation, targeting 3281 and 3255.

A break above 3320 would invalidate the bearish outlook and shift momentum toward 3342.

Pivot: 3297

Support Levels: 3281 / 3255 / 3239

Resistance Levels: 3314 / 3320 / 3342

Previous idea: Click Here...

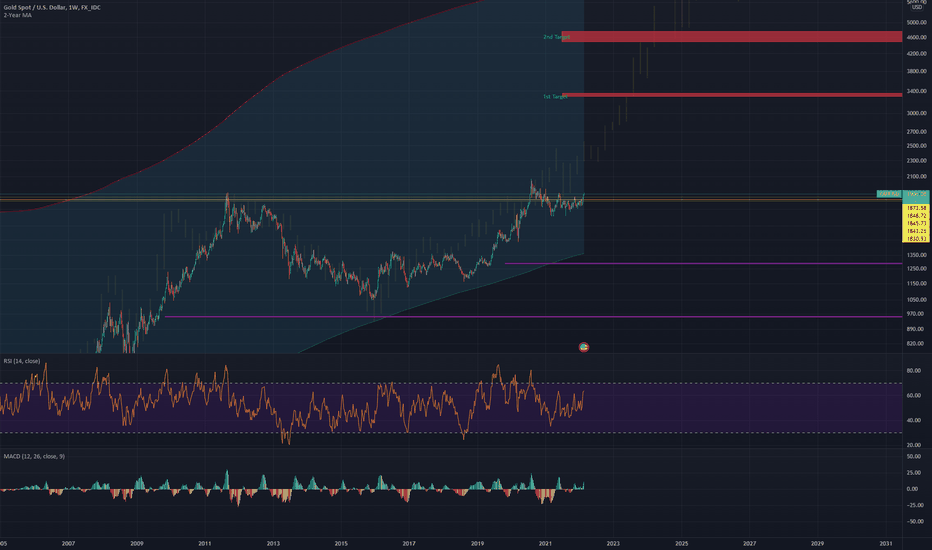

Bitcoin vs Gold: Driving the Point Home📉 Bitcoin vs Gold: Driving the Point Home The long-term comparison we can't afford to ignore.

Gold, after achieving mainstream status, weathered a 20-year consolidation phase, low volatility, muted investor excitement, but enduring presence. This historical precedent forces us to reconsider expectations for Bitcoin, now in its 15th year.

⚡ While Bitcoin’s adoption curve has been sharper, its market dominance has steadily declined since 2017. Despite intermittent, and often deceptive relief rallies, the trend remains downward. Altcoins, forks, and shifting narratives (DeFi, NFTs, meme tokens) continue to fragment attention and capital.

⚡ Could Bitcoin follow gold’s path and enter a prolonged era of post-hype consolidation? If so, the next bull run might be a decade away or more … if it happens at all. In an age of digital abundance, durability; not innovation, may define Bitcoin’s legacy.

📊 Chart Highlights: The latest image visualizes Bitcoin’s current phase against gold’s historical arc. The final label "Monetary Maturity" suggests a shift from speculative highs to a more sober test of endurance.

🔍 Will Bitcoin evolve into a true store of value or fade as just another chapter in financial innovation? Let the markets answer, but history offers clues. Only Time will tell.

#Bitcoin #Gold #CryptoAnalysis #BTCdominance #CryptoHistory #DigitalAssets #TradingView

CRYPTO:BTCUSD INDEX:BTCUSD TVC:SILVER NASDAQ:MSTR NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:DXY NYSE:CRCL

Strong USOIL Setup: Long from Support + 4.34 R/RHey Guys, hope you're all doing well!

I've placed a limit buy order on USOIL from a key support level. Below are the relevant levels for your reference:

- 🔵 Entry Level: 67.424

- 🔴 Stop Loss: 66.803

- 🟢 Target 1 (TP1): 67.908

- 🟢 Target 2 (TP2): 68.456

- 🟢 Target 3 (TP3): 70.036

📊 Risk/Reward Ratio: 4.34

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏