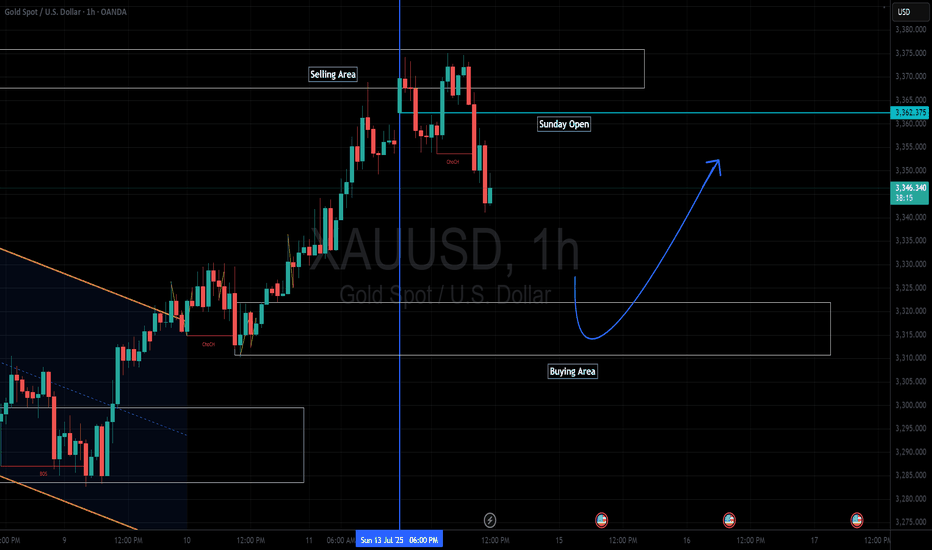

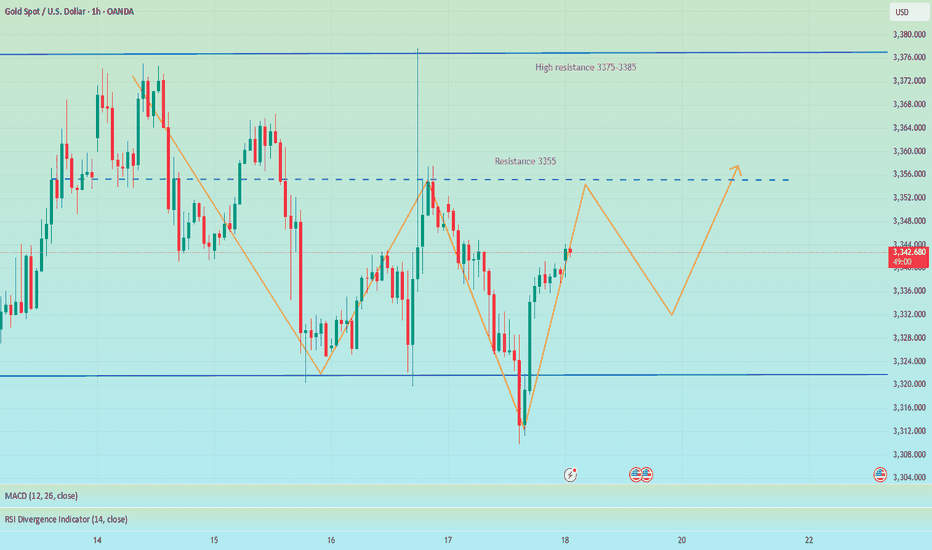

GOLD - Price may bounce up to $3375 level from support lineHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

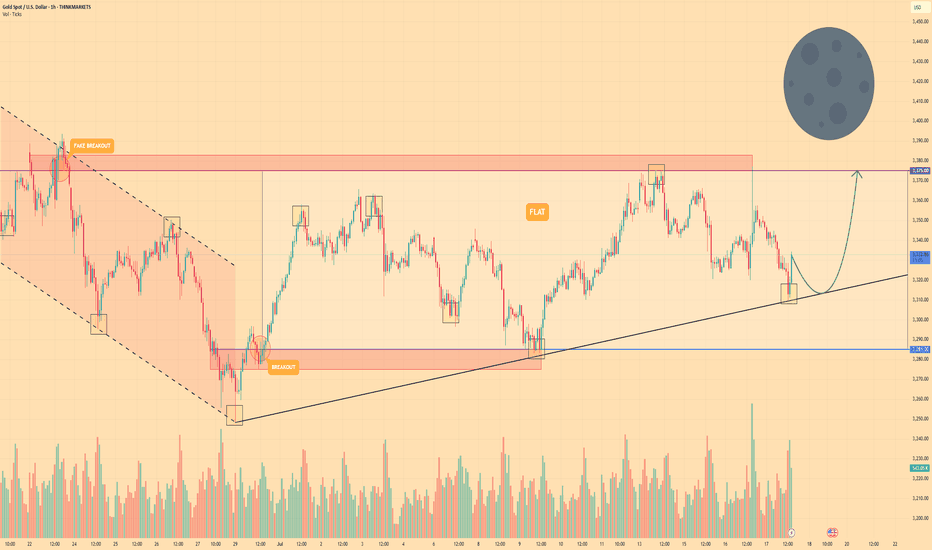

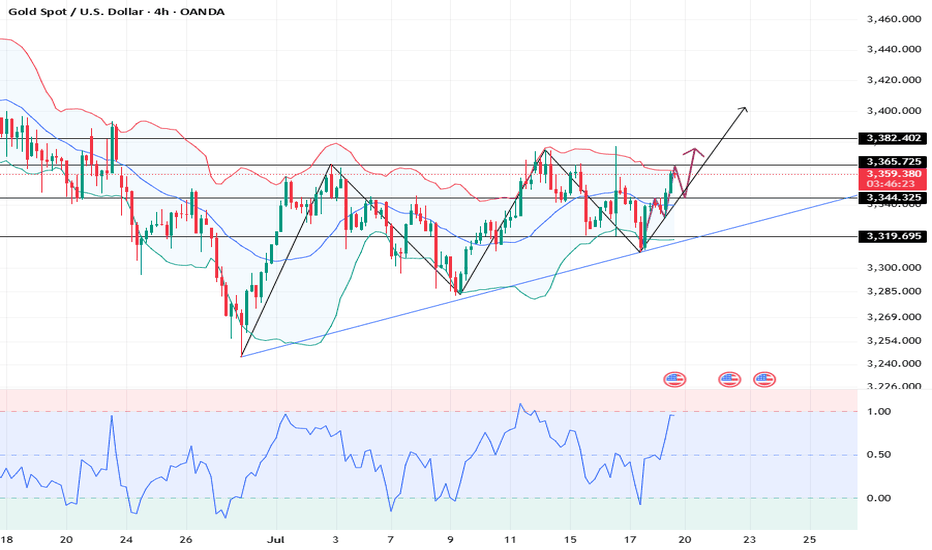

Initially, the price action was confined within a descending channel before a decisive bullish breakout occurred.

This first breakout triggered a strong upward impulse, setting the stage for the current market structure.

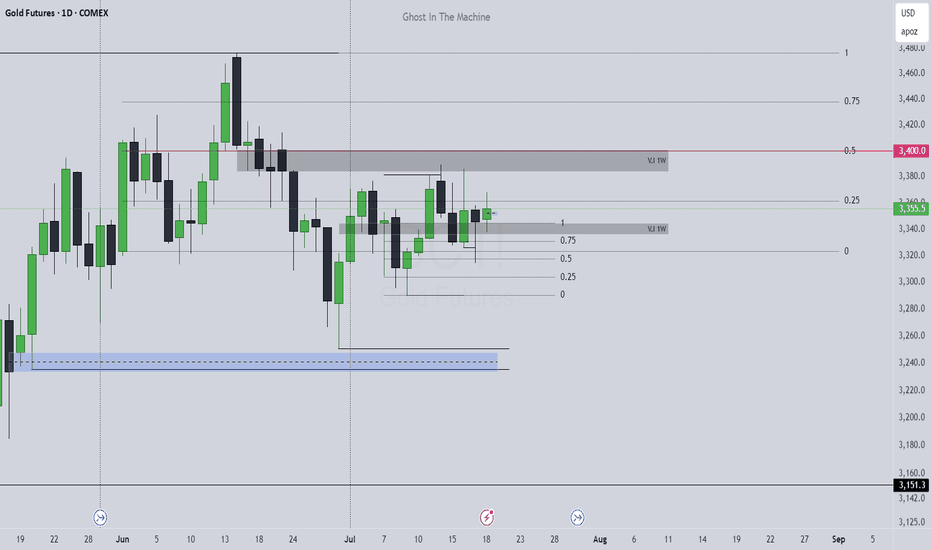

The price is now consolidating in a wide flat range, bounded by support near the $3285 level and resistance at $3375.

An ascending support line is providing dynamic support within this consolidation pattern, indicating underlying buying pressure.

I expect a brief retest of this support line, which should act as a launchpad for the price to move higher.

The primary target for this long setup is the $3375 resistance level, marking the top of the current flat range.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold

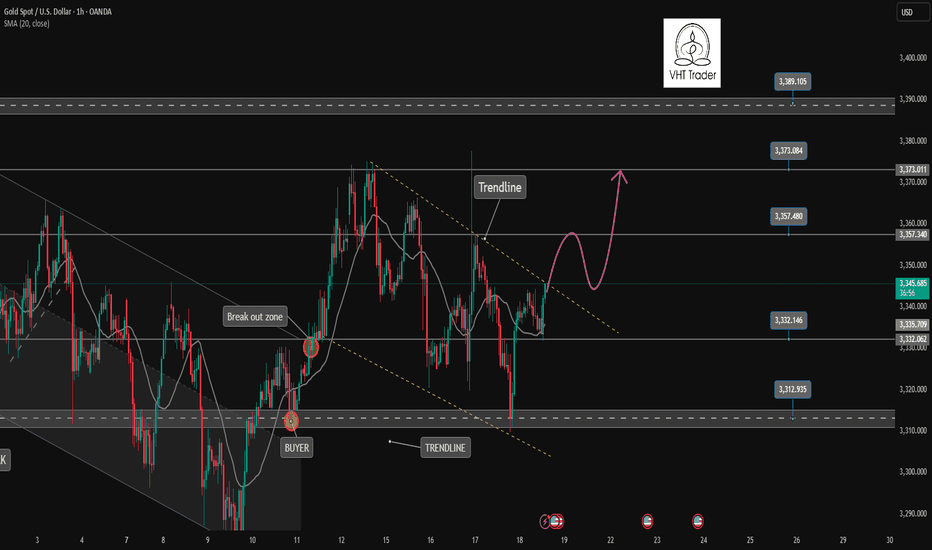

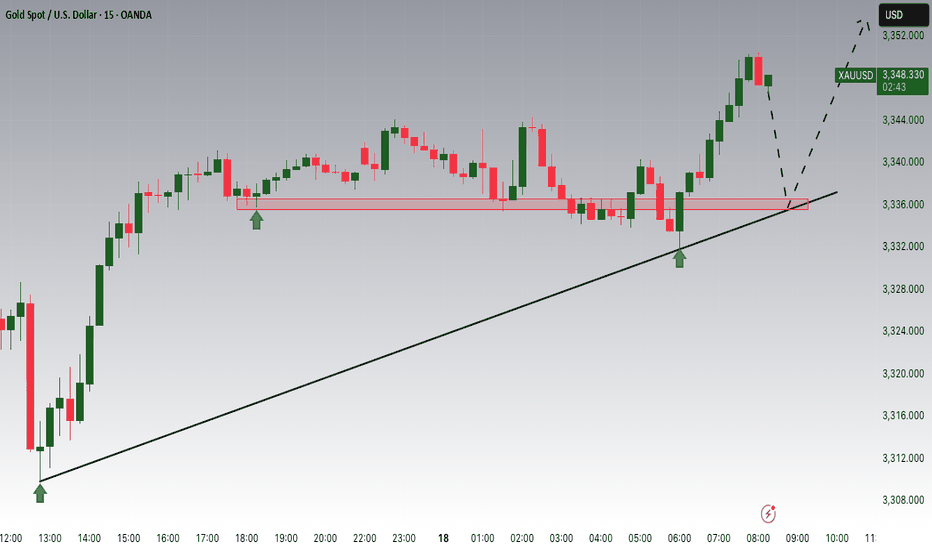

Gold breaks trendline and returns to uptrend. BUY NOW!✏️ OANDA:XAUUSD A deep sweep to 3310 and bounce back to the trading range. Gold is reacting at the Trendline around the price zone of 3344. This is an important price zone that if broken will return to the uptrend and head towards 3373 soon. 3332 plays an important role in the current bullish wave structure, which is a suitable SL placement point for BUY signals.

📉 Key Levels

Support: 3332-3312

Resistance: 3344-3357-3373-3389

BUY trigger: Break and trading above Resistance 3344 (trendline, top uptrend wave 1)

BUY DCA trigger: Break Resistance 3353

Target 3373

Leave your comments on the idea. I am happy to read your views.

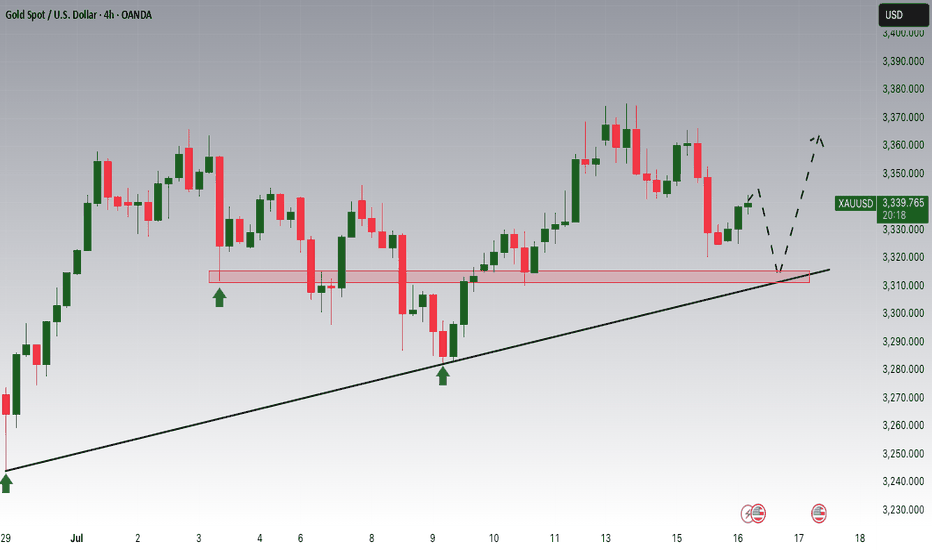

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

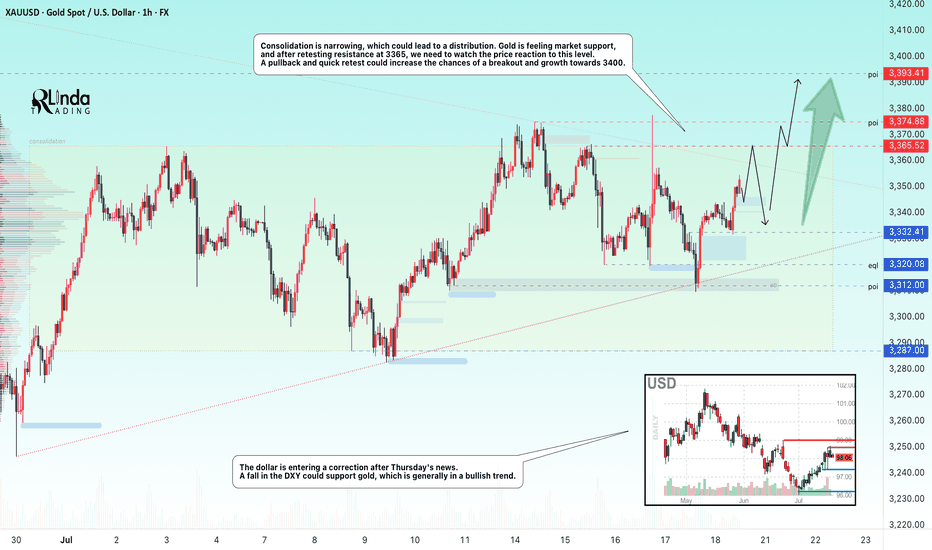

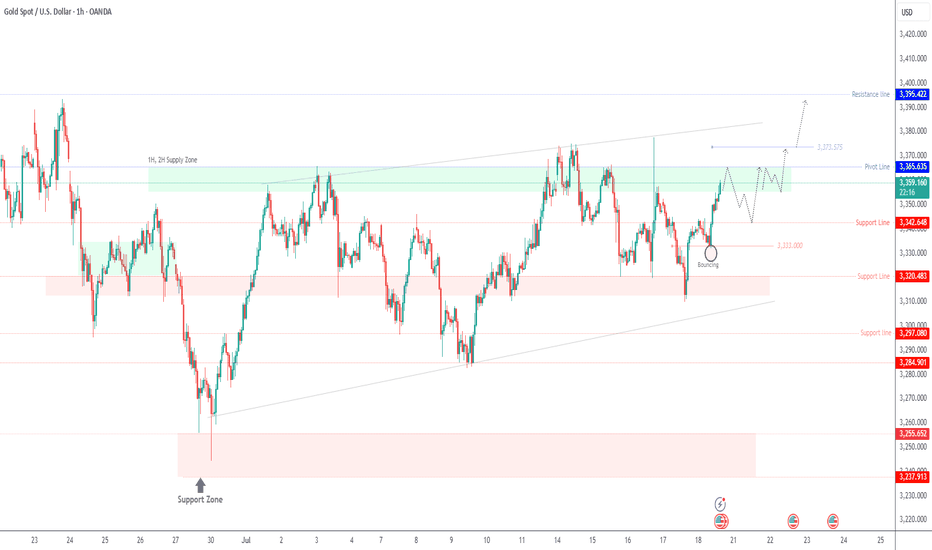

GOLD → Retest of consolidation resistance. Chances of a breakoutFX:XAUUSD bounces off support at 3312, forming a false breakdown at 3320. The price is heading towards consolidation resistance. The chances of continued growth are increasing...

Gold rebounded from its low amid statements by Fed member Waller about a possible rate cut in July. However, strong US sales and labor market data strengthened the dollar and held back XAU/USD growth. Despite statements by some Fed members about maintaining a tight policy, traders continue to expect rate cuts before the end of the year. The focus is on new economic data that could affect the dollar and gold prices.

Technically, consolidation is narrowing, which could lead to distribution. Gold is feeling market support, and after retesting resistance at 3365, we need to watch the price reaction to the level. A pullback and quick retest could increase the chances of a breakout and growth to 3400.

Resistance levels: 3365, 3375

Support levels: 3332, 3320, 3312

There is a high probability that there will be an attempt to break through the consolidation resistance amid expectations of a rate cut. This phase may be accompanied by either a correction to retest and return for a breakout, or a breakout and consolidation of the price above the level. Today, Friday, I expect a retest and correction, as there may not be enough local potential for a breakout of this level, and the price has already lost some of its momentum since the opening of the session...

Best regards, Linda!

18/07 Gold Outlook Market Tensions Mount Liquidity Zones in Play Gold Outlook – Market Tensions Mount, Liquidity Zones in Play

Price action heats up as we enter the final trading day of the week. Are you ready to ride the wave or get caught in the liquidity sweep?

🔍 Market Sentiment & Global Highlights

Gold rebounded strongly after dropping on better-than-expected US data. However, several macro risks are keeping gold buyers in the game:

Buy-the-dip activity emerged amid concerns that Trump’s tariff policies may fuel inflation.

Rate cut expectations remain strong as US core inflation shows no signs of cooling.

Geopolitical risks intensified as Israel conducted fresh airstrikes on Syria.

EU threatens $84B in tariffs on US goods should trade talks break down.

💡 These tensions are giving gold strong support — especially as traders prepare for potential volatility into the weekend.

📈 Technical Overview – Liquidity Zones at Play

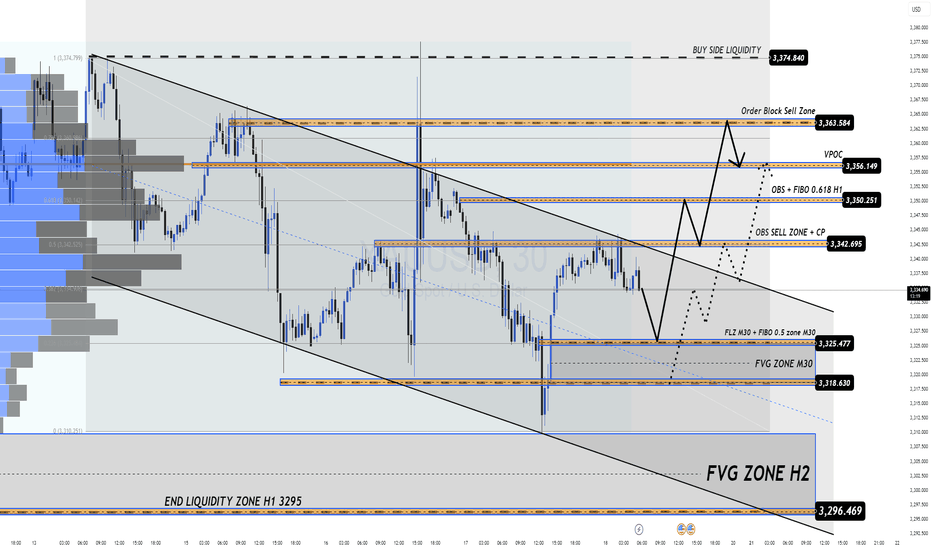

Yesterday's bounce from FLZ H2 (3310) — a critical demand and liquidity zone — triggered a clean reversal. Sellers took profit, volume shifted, and buyers regained control. Price has since pushed up to retest the OBS SELL ZONE + CP Pattern near the 334x area with a sharp reaction.

For today, price is likely to revisit lower liquidity pockets (M30–H2) before making the next directional move.

🔑 Key Levels to Watch

🟢 BUY ZONE: 3318 – 3316

Stop Loss: 3312

Take Profits: 3322 – 3326 – 3330 – 3335 – 3340 – 3345 – 3350 – 3360+

⚡ BUY SCALP ZONE: 3326 – 3324

Stop Loss: 3320

Take Profits: 3330 – 3335 – 3340 – 3345 – 3350 – 3360

🔴 SELL ZONE: 3363 – 3365

Stop Loss: 3370

Take Profits: 3360 – 3355 – 3350 – 3346 – 3342 – 3338 – 3335 – 3330

⚠️ Final Notes

Today’s session has no major news releases, but as it’s the end of the week, we may see liquidity grabs and unexpected volatility. Stay disciplined, stick to your plan, and always respect TP/SL.

🔔 Follow the key zones carefully – volatility loves indecision.

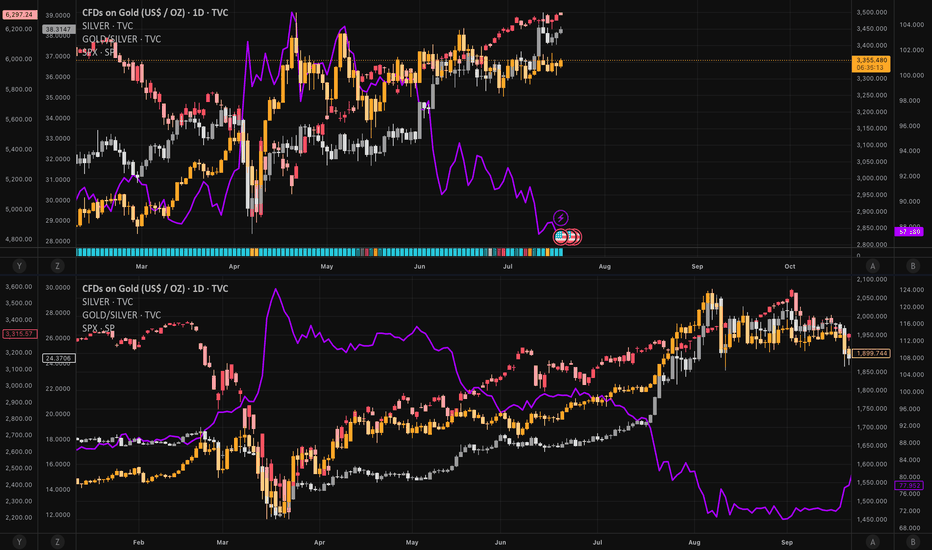

Gold - The clear top formation!🪙Gold ( TVC:GOLD ) just created a top formation:

🔎Analysis summary:

Over the past four months, Gold has overall been moving sideways. Following a previous blow-off rally of about +25%, this cycle is very similar to the 2008 bullish cycle. Bulls are starting to slow down which will most likely result in the creation of at least a short term top formation.

📝Levels to watch:

$3.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Double Top + Zigzag Complete: Are Bears About to Take Over Gold?Yesterday, the financial markets in general, including Gold ( OANDA:XAUUSD ) , acted like a roller coaster after the news of Powell's dismissal . After this news was denied , Gold returned to its main trend, which I published in my previous idea .

Gold is currently re-attacking the Support line , Support zone($3,326-$3,325) and 50_SMA(Daily) .

In terms of classic technical analysis , it seems that gold has formed a Double Top Pattern for support breakdowns, where a Support line breakdown can also be accompanied by a neckline breakdown .

From the perspective of Elliott Wave theory , it seems that Gold has managed to complete the Zigzag Correction(ABC/5-3-5) , and we should wait for the next bearish waves .

I expect Gold to break its supports and move towards $3,290 ; support breaks are best done with high momentum . An important price that can change the direction of Gold's downside is $3,350 .

Note: If Gold breaks the Resistance lines and forms an hourly candle above $3,351(Stop Loss (SL)), we can expect further Gold gains.

Gold Analyze (XAUUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Long and short fluctuations, the market is waiting for a break📰 News information:

1. Powell responds to White House issues

2. Will other countries impose reciprocal sanctions on tariffs?

📈 Technical Analysis:

Although the MACD indicator of the gold hourly line formed a golden cross, the market reached a high of around 3361, and the RSI indicator was close to the overbought area, so we need to be cautious about corrections. From the 4H chart, the MACD second golden cross is on the zero axis. Currently, we are paying attention to the moving average SMA5 near 3343, and the SMA60 support line 3332. If the 4H upward trend falls back, we need to go long. At present, gold is still running above, and there is no good participation point in the short term, but on the whole, we should pay attention to the support of 3345-3332 below, and we can consider going long if it retreats and stabilizes. We continue to pay attention to the resistance pressure of 3375-3385 above, and we can try to go short if it does not break.

🎯 Trading Points:

SELL 3375-3385

TP 3365-3355

BUY 3345-3332

TP 3365-3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

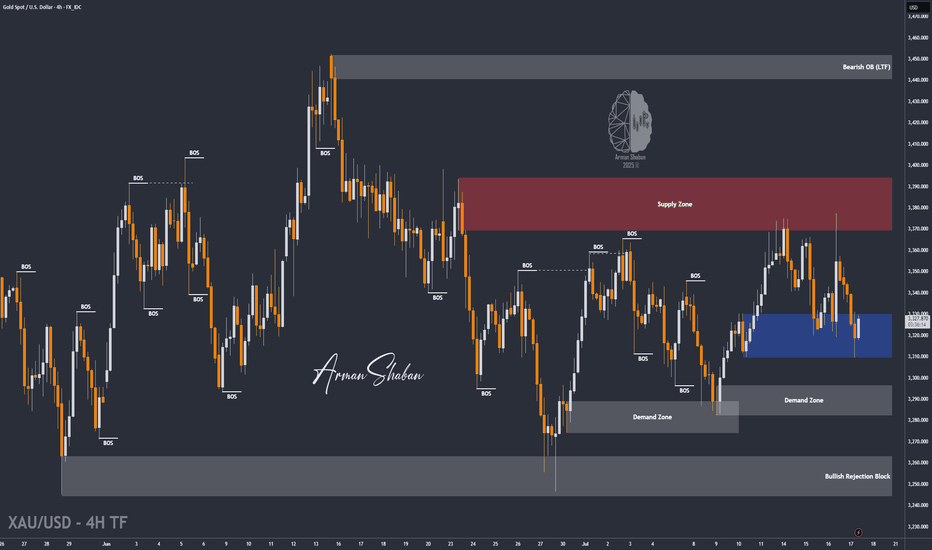

XAU/USD | First LONG to $3345, Then a Potential DROP Below $3300By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

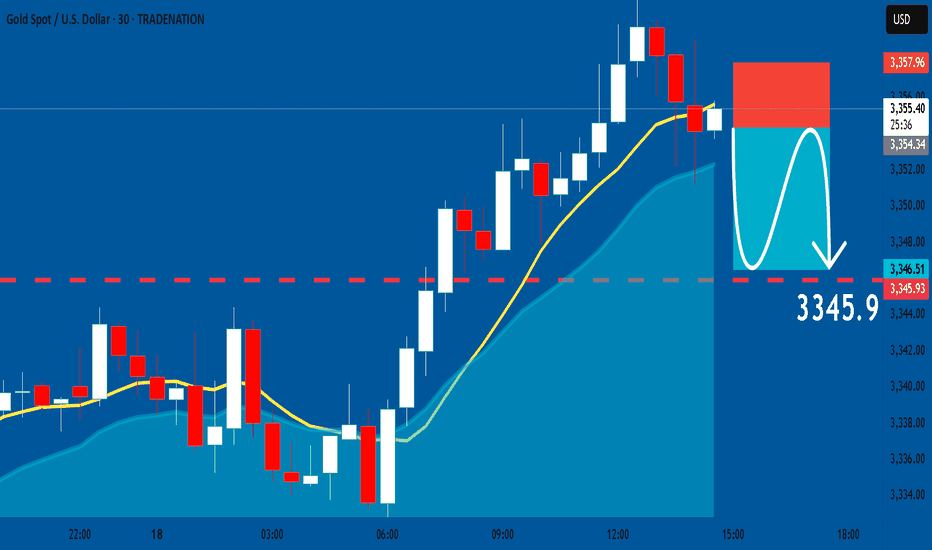

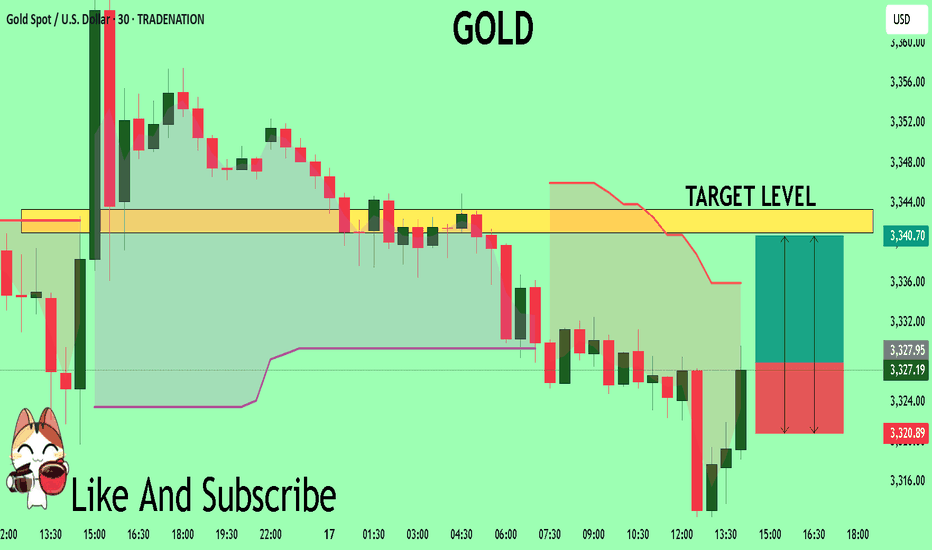

GOLD: Short Trade Explained

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 3354.53

Stop - 3357.9

Take - 3345.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

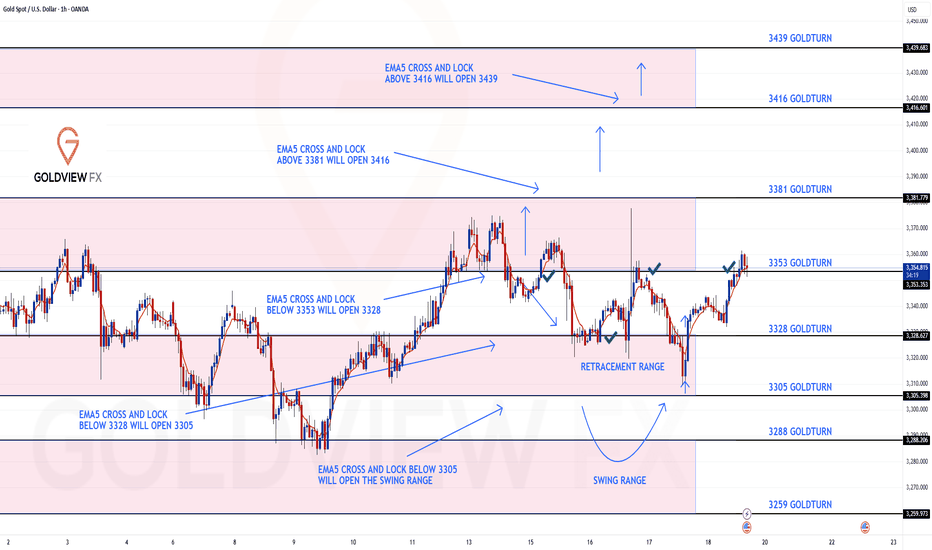

GOLD ROUTE MAP UPDATEHey Everyone,

End of week update following up on yesterday’s 1H chart outlook.

✅ 3353 was hit and respected to the pip, just as we mapped out and highlighted yesterday.

We saw the EMA5 cross and lock above 3328, confirming continuation.

The market respected structure beautifully

Rejections gave us clean dip buying entries

EMA5 methodology guided our execution

High probability Goldturn levels played out exactly as planned

Our discipline and patience were rewarded, yet again. Another strong end to the week.

We will now come back Sunday with a full multi timeframe analysis to prepare for next week’s setups, including updated views on the higher timeframes, EMA alignments, and structure expectations going forward.

Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

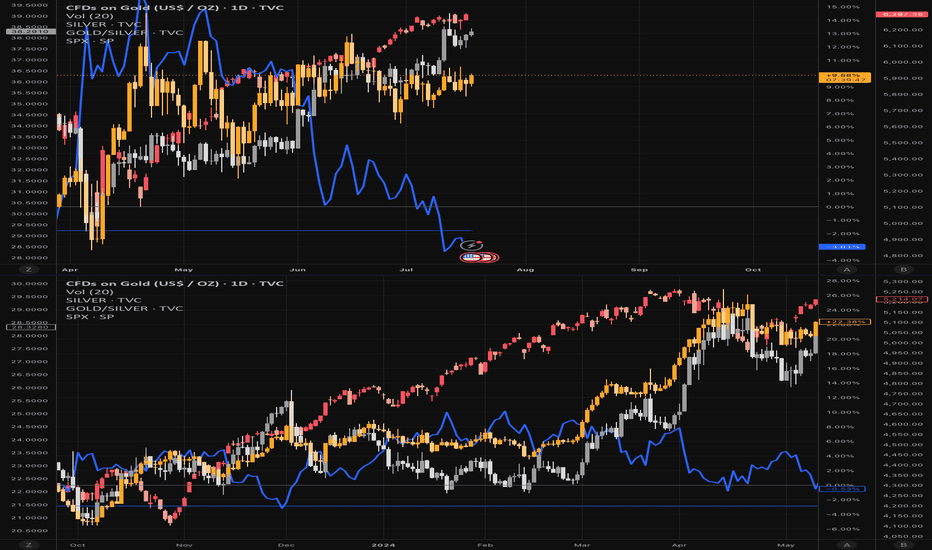

Bear-Trap armed: Gold ticks 4 / 5 boxes - waiting for the spark1️⃣ Why the 2020 déjà-vu is EVEN louder

2025 (now) 2020 (pre-rally)

TradingView ideas still bearish 💬

> 70 % 60 % bearish

Managed-money net-longs ≈ 115 k

-35 % from Apr. –25 % from peak

+ $741 m PM-ETF inflow Record IN-flows

G/S ratio 87 (< 90) Fell to 95

S&P keeps making highs Ditto

2️⃣ What’s still different

Real 10-y TIPS yield +0.7 % vs -1 % in 2020 → smaller monetary tail-wind.

Gold is already at an infl-adj. record – expect a short & sharp squeeze, not a fresh multi-year super-cycle (yet).

3️⃣ Checklist – updated

Signal Status 18 Jul Comment

———————————————————

Gold DAILY close ≥ $3 200–3 250 YES – $3 354 ✔

G/S ratio < 90 YES – 87 ✔

CFTC net-longs < 150 k YES – ~115 k ✔

ETF flows turn positive. YES – $741 m ✔

Equity stress (VIX > 25 or SPX −5 %) NOT YET – VIX 16.5 ✖

4 / 5 boxes = 99 % primed. One spark missing.

4️⃣ What could light the fuse

Date Potential trigger Why it matters

22 Jul Mega-tech Q2 earnings (NVDA/AMD) Any guidance miss → SPX wobble

30 Jul FOMC Fed holds but sounds dovish USD dump + yield spike risk

1 Aug Trump s “reciprocal” duties Imported-inflation scare → VIX pop

Early Aug. DXY crashes < 96 in < 5 days. Disorderly USD slide = funding stress

Hit ≥ 2 of: DXY < 96, VIX > 25, SPX -5 % or HY-spread +75 bp → final ✔.

Bottom line

The bear-trap thesis aged well: sentiment, positioning, ETFs, and G/S ratio have already clicked bullish.

Only equity-market stress is missing. A fast USD slide or a tariff shock right after a neutral Fed is the most likely detonator.

Stay nimble: Collect premium inside $3 250-3 400 while volatility sleeps – but keep alarms on VIX 25 and DXY 96. One red headline could still launch the squeeze.

Disclaimer: Educational opinion, not investment advice. Futures & CFD trading is risky – do your own research and consult a professional.

1 minute ago

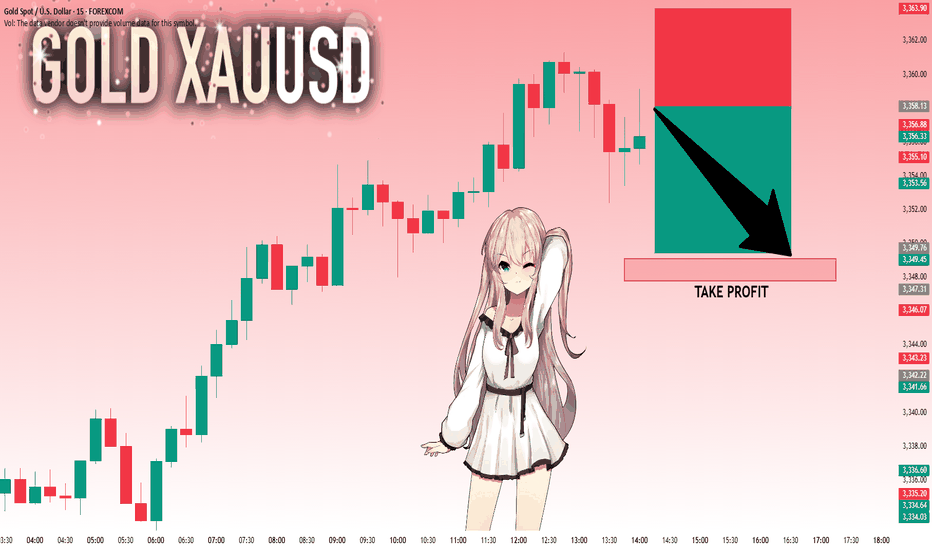

GOLD: Local Bearish Bias! Short!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 3,358.13 will confirm the new direction downwards with the target being the next key level of 3,349.76.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

GOLD What Next? BUY!

My dear friends,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 3328.1 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 3340.9

Recommended Stop Loss - 3320.8

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

The short-selling idea remains unchanged, defend 3355📰 News information:

1. Powell responds to White House issues

2. Will other countries impose reciprocal sanctions on tariffs?

📈 Technical Analysis:

Gold closed with a long lower shadow on the daily line yesterday and closed with a doji on the hourly line. In the short term, gold may continue to rise and is expected to touch the 3355 line. If gold cannot break through and stabilize above 3355, then gold may fall back. We can still consider shorting, and the target can be 3330. If the trend is as expected, it may form the embryonic form of a head and shoulders bottom. On the contrary, if the gold price breaks through 3355, stop loss on short positions and pay attention to the high resistance of 3375-3385.

🎯 Trading Points:

SELL 3340-3355

TP 3330-3320

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

Bear-Trap armed: Gold ticks 4 / 5 boxes - waiting for the spark

1️⃣ Why the 2020 déjà-vu is EVEN louder

2025 (now) 2020 (pre-rally)

TradingView ideas still bearish 💬

> 70 % 60 % bearish

Managed-money net-longs ≈ 115 k

(-35 % from Apr) –25 % from peak

+ $741 m PM-ETF inflow, first after months Record IN-flows

G/S ratio 87 (< 90) Fell to 95

S&P keeps making highs. Ditto

2️⃣ What’s still different

Real 10-y TIPS yield +0.7 % vs -1 % in 2020 → smaller monetary tail-wind.

Gold is already at an infl-adj. record – expect a short & sharp squeeze, not a fresh multi-year super-cycle (yet).

3️⃣ Checklist – updated

Signal Status 18 Jul Comment

———————————————————

Gold DAILY close ≥ $3 200–3 250 YES – $3 354 ✔

G/S ratio < 90 YES – 87 ✔

CFTC net-longs < 150 k YES – ~115 k ✔

ETF flows turn positive. YES – $741 m ✔

Equity stress (VIX > 25 or SPX −5 %) NOT YET – VIX 16.5 ✖

4 / 5 boxes = 99 % primed. One spark missing.

4️⃣ What could light the fuse

Date Potential trigger Why it matters

22 Jul Mega-tech Q2 earnings (NVDA/AMD) Any guidance miss → SPX wobble

30 Jul FOMC Fed holds but sounds dovish USD dump + yield spike risk

1 Aug Trump s “reciprocal” duties Imported-inflation scare → VIX pop

Early Aug. DXY crashes < 96 in < 5 days. Disorderly USD slide = funding stress

Hit ≥ 2 of: DXY < 96, VIX > 25, SPX -5 % or HY-spread +75 bp → final ✔.

Bottom line

The bear-trap thesis aged well: sentiment, positioning, ETFs, and G/S ratio have already clicked bullish.

Only equity-market stress is missing. A fast USD slide or a tariff shock right after a neutral Fed is the most likely detonator.

Stay nimble: Collect premium inside $3 250-3 400 while volatility sleeps – but keep alarms on VIX 25 and DXY 96. One red headline could still launch the squeeze.

Disclaimer: Educational opinion, not investment advice. Futures & CFD trading is risky – do your own research and consult a professional.

XAUUSD: Market Analysis and Strategy for July 18Gold technical analysis

Daily chart resistance: 3382, support: 3310

Four-hour chart resistance: 3375, support: 3332

One-hour chart resistance: 3365, support: 3345.

From a technical perspective, the price of gold has recently formed a wide range of fluctuations in the range of 3310-3365 US dollars, reflecting the unclear market direction. At present, the short-term moving average of gold is supported at 3332, and other periodic indicators are also in a bullish arrangement. The overall decline at the hourly level is limited, and the bulls still have the momentum to rebound.

3310 on the daily chart constitutes a key support. If it falls below, it may fall to the July low of 3287-3282. On the upside, if the resistance level of 3366 US dollars is effectively broken, it may trigger short stop losses and push the gold price back to the 3400 US dollar mark. Pay attention to the resistance of 3366-3377 above and the support of 3345/3332 below

BUY: 3345near

SELL: 3365near

Gold Eyes 3365 – Breakout or Rejection?GOLD | Technical Outlook

Gold maintains bullish momentum as long as it trades above 3355, aiming to test the 3365 resistance level.

However, signs of rejection at 3365 may emerge, especially if the 4H candle closes below this level. In that case, expect a period of sideways consolidation between 3365 and 3342.

A confirmed 1H candle close above 3365 would signal bullish continuation toward 3373, with an extended target at 3395.

Key Levels:

• Pivot: 3355

• Resistance: 3365 / 3375 / 3395

• Support: 3342 / 3333

Outlook:

• Bullish above 3355

• Breakout above 3365 confirms further upside

• Rejection at 3365 may lead to short-term range-bound movement