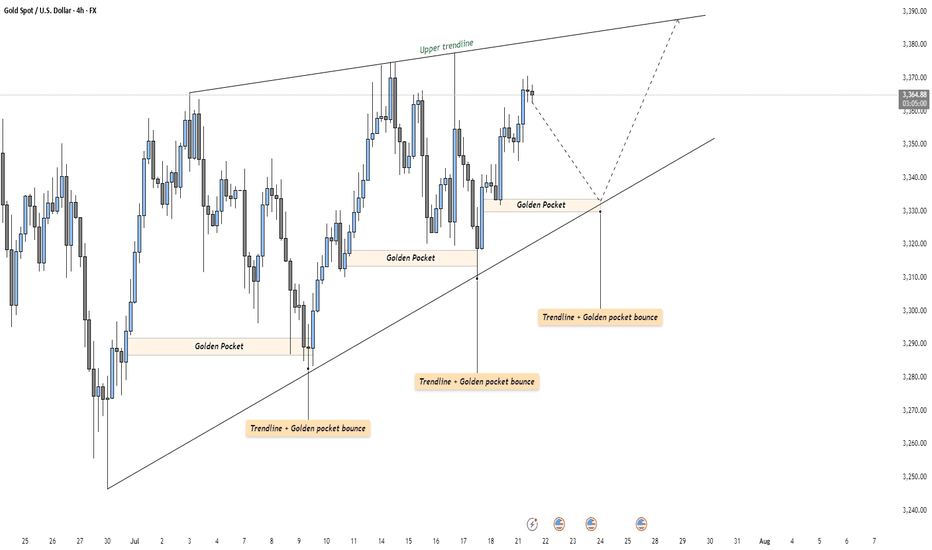

GOLD - Strong Trendline & Golden Pocket ContinuationMarket Context

Gold is currently trading within a rising wedge structure on the 4-hour timeframe. This formation typically represents a tightening market, where buyers continue to push higher — but with decreasing momentum. The confluence of both trendlines and repeated Golden Pocket bounces makes this setup technically rich and worth watching closely.

Golden Pocket & Trendline Confluence

Throughout the recent move up, price has consistently reacted to the 0.618–0.65 Fibonacci retracement zone — often referred to as the Golden Pocket. Each major retracement has found support not only at this zone but also at a rising trendline, showing strong alignment between horizontal and diagonal demand. This dual-layer support has repeatedly led to sharp rebounds, reinforcing the bullish structure.

What Comes Next?

Price is currently sitting just below the upper resistance of the wedge. If history repeats, a retracement toward the lower trendline could be the next logical step. A reaction in the same region — where the Golden Pocket once again overlaps the trendline — could offer a high-probability long opportunity for continuation toward the top of the wedge or even a breakout.

Alternatively, if price breaks below the trendline with conviction, it could signal exhaustion in the current structure, potentially flipping the bias toward a broader correction.

Final Thoughts

This is a textbook example of how technical confluence can guide trade planning — especially in clean, trending environments like this. Remember: patience is key. Let the market come to your levels.

If you enjoyed this breakdown, a like would go a long way — and feel free to share your thoughts or ideas in the comments below!

Goldenpocket

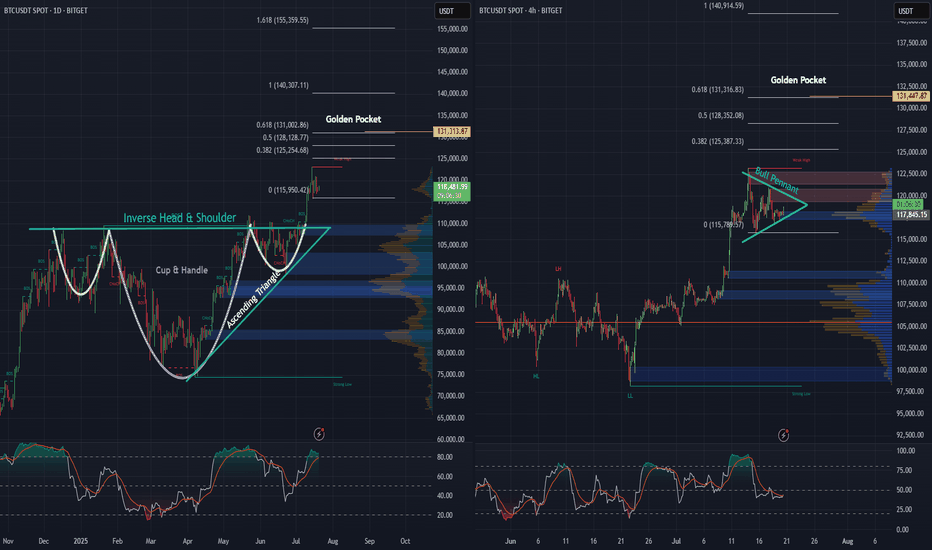

BTC daily, and 4 hr. Bullish Patterns Stack Up!Looking at the Daily and 4-hour charts for BTC, we can see multiple bullish formations unfolding.

An inverse head and shoulders - daily

A cup and handle - daily

An ascending triangle - daily

Price action looks strong, as we’ve begun the breakout from the neckline on the inverse H&S, as well as the cup and handle and ascending triangle simultaneously, and momentum is building fast.

Also, on the 4-hour chart, there’s a pretty substantial bull pennant taking shape. A breakout here could be the next leg up, and the push needed to keep momentum alive.

Zooming out, when we apply the trend-based Fibonacci extension, it reveals a $131,000 golden pocket, on both the the daily as well as the 4 hr. And that could be a major upside target if these bullish structures hold.

Stay tuned to see if BTC continues its move and sets a new all-time high.

RCI, Bear Flag On The Daily As Well As The 4hr Analyzing both the daily and 4-hour charts reveals a very prominent bear flag, which has formed following a steep decline. This pattern is often indicative of further downward movement, and it's hard to ignore the implications.

Word on the street is that they're currently in dire straits. Since the Shaw acquisition, they've hemorrhaged 11 billion in valuation. The situation is exacerbated by declining revenues and missed growth targets. In short, it's not looking promising.

If the trend continues downward, we might see the price testing the $19 USD mark sooner rather than later.

For those who are currently long on this or have any vested interest, it might be prudent to reconsider your position and cut your losses before it's too late.

Bitcoin - Will the $100K Level Hold?Since reaching its all-time high (ATH) on May 22nd at an impressive $112,000, Bitcoin (BTC) has entered a corrective phase that has caught the attention of traders and analysts alike. After a strong and relentless move to the upside, such a phase is not uncommon in crypto markets, where rapid rallies are often followed by cooling-off periods. As of now, BTC is trading at around $101,000, marking a decline from its peak but still maintaining a significant portion of its recent gains. This retracement has not only been healthy in terms of price structure but also offers potential opportunities for those closely monitoring key technical levels.

4H FVG

One important aspect of the move leading up to the ATH was the formation of a 4H Fair Value Gap (FVG). These imbalances, left behind during aggressive moves in the market, are often revisited and filled as part of a broader effort by price to return to equilibrium. The current FVG spans from approximately $100,500 to $99,800. This range is especially noteworthy, as such gaps tend to act as magnets for price action, creating zones of potential support where buyers may step in to defend the structure. As BTC approaches this region, it's plausible to expect at least a temporary bounce, particularly if market sentiment remains constructive.

Golden Pocket Fibonacci

Adding further weight to this zone is the confluence of the Golden Pocket, the area between the 0.618 and 0.65 Fibonacci retracement levels, derived from the latest upward leg. This specific Fibonacci region is widely regarded in technical analysis as a high-probability reversal zone, often attracting significant buying interest. Interestingly, the Golden Pocket aligns almost perfectly with the aforementioned FVG, both residing in the $100,500 to $99,800 range. The overlapping of these two technical indicators strengthens the case for this area to act as a firm support level, or at the very least, a point where the ongoing correction could take a breather.

Conclusion

Taken together, the alignment of the 4H FVG and the Golden Pocket around the $100,000 mark creates a technically compelling scenario. The psychological impact of a round number like $100,000 only adds to its potential as a battleground between buyers and sellers. If this zone holds, it could spark a notable bounce, either a temporary relief rally or potentially the beginning of a renewed leg to the upside, depending on broader market conditions.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

XRP Correction Complete? — Long Setup Aligned with Fib & OBXRP has completed a 5-wave impulse move. As expected, XRP is now in a corrective phase, pulling back after rejecting from a key resistance — and it’s doing so with technical precision.

The question now: where is the next high-probability long setup? Let’s break it down.

🧠 Market Structure & Key Zones

Using Fibonacci retracement from the base of the 5-wave impulse, we now have a potential golden pocket target aligned with major confluence.

🔽 Support Zone

🔹 0.618 Fib retracement: $2.2982

🔹 Daily Bullish Order Block: $2.2949

🔹 Daily 21 EMA: $2.329

🔹 Daily 21 SMA: $2.301

🔹 Liquidity pool

🔹 0.786 Fib Speed Fan (only if price drops between May 17–18)

This creates a high-confluence support cluster at ~$2.3 — a prime candidate for a long re-entry.

🟢 Long Trade Setup

Entry: Ladder between $2.32 and $2.28

Stop-loss: ~$2.21

Target: $2.7175 (0.618 Fib retracement of the corrective downtrend)

R:R: ~5:1

🔴 Short Setup (Conditional)

Trigger: Rejection at $2.7175

Entry: ~$2.7175

Stop-loss: Above $2.8033 (0.666 Fib) → set at ~$2.811

Take Profit: ~$2.56 or lower

R:R: ~2:1+ (dependent on entry confirmation and PA behaviour)

Shorts only valid if a clear rejection or SFP pattern emerges. If momentum is strong, this level may break — so wait for structure to confirm.

📘 Educational Insight: Why Confluence Matters

Too often, traders chase single-indicator signals. But real edge comes from confluence — when multiple tools (Fibs, MAs, Order Blocks, Liquidity, VWAPs, FVG, Speed Fans etc.) agree on the same zone. This alignment not only increases confidence in your entry, but also sharpens your risk management.

Think of it as building a case — the more aligned evidence you have, the stronger your trade thesis becomes.

📌 Summary

XRP is in a corrective phase after a 5-wave impulse

Clean rejection from weekly resistance → continuation of bearish trend

Long zone: ~$2.3

SL: ~$2.21 | TP: $2.7175 | R:R ~5:1

Optional short: $2.7175 rejection → SL $2.811 | TP $2.56

Precision isn’t about predicting — it’s about being ready when the chart speaks with clarity. Patience makes probability powerful.

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

Gold - Small rejection before $3400?Gold has been in a clear downtrend on the 4-hour timeframe, and during one of its recent declines, it left behind a 4-hour Fair Value Gap (FVG). Price is now climbing back toward this imbalance zone, suggesting that a critical test of resistance may be approaching.

Bounce from strong support

Just a few days ago, Gold found solid footing at a strong support area, which triggered a bounce. Since then, it has been pushing higher and is now nearing the 4-hour FVG. This zone represents a significant area of imbalance left unfilled during the prior selloff, and it's highly likely that price will react once it reaches this region.

FVG and Golden Pocket

Interestingly, this FVG aligns closely with the golden pocket, which lies between 3315 and 3325. While the golden pocket sits slightly above the midpoint of the FVG, there's a good chance Gold could tap into that area before showing signs of a pullback or rejection from the FVG itself.

Target to the downside

If price fails to break above this zone and reverses, the logical target to the downside would be the 3250 level. This area has acted as a key resistance in recent sessions, and if retested from above, it could serve as a strong support base for another potential leg higher.

Target if we break above the FVG

On the other hand, if Gold manages to break cleanly through the FVG with strong volume and momentum, the path could open toward a move up to the recent highs around 3430. In that scenario, the bullish continuation would likely require sustained buying interest and increased market participation to carry through.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

BTC - Will BTC revisit $102k or is a pump imminent?Bitcoin (BTC) has been in a consolidation phase for an extended period, marked by a lack of strong directional momentum and characterized by ranging price action. This type of market environment often leads to both liquidity grabs and choppy movement, and traders need to remain especially vigilant about key levels and structure shifts.

Liquidity grab

Yesterday, BTC managed to sweep the recent highs, grabbing liquidity above a short-term resistance zone before reversing and moving lower. This move appears to have been a classic stop-hunt or liquidity sweep, which was followed by a strong rejection. As price moved down from those highs, it left behind an unfilled gap on the 15-minute chart, what many refer to as a Fair Value Gap (FVG). This gap now acts as a magnet for price and is a key area to watch as we approach it again.

Market structure

On the 1-hour timeframe, BTC has now printed a lower low, suggesting a short-term shift in market structure to the downside. This structural break opens up the possibility for a lower high to form, setting up a classic trend continuation scenario. From a technical standpoint, the expectation would be for BTC to now create a lower high and then push lower, potentially targeting the range lows from yesterday and today. This provides an opportunity for a short setup with a favorable risk-to-reward (RR) ratio, estimated to be around 3:1, if the entry and stop are managed around the key resistance and structural levels.

Fibonaccy that aligns with the FVG

Currently, BTC is sitting at the Golden Pocket, the region between the 0.618 and 0.65 Fibonacci retracement levels. This area often serves as a reaction zone for price, and we are seeing some hesitation here. Interestingly, this Golden Pocket sits just below the aforementioned 15-minute FVG, and price appears to be gravitating toward this inefficiency, potentially looking to fill it before making a more decisive move.

What adds to the confluence at this level is the 0.786 Fibonacci retracement, which aligns almost perfectly with the top boundary of the Fair Value Gap. While many traders look to enter short positions at the 50% mark of the FVG, this added confluence makes the 0.786 + FVG top zone a more compelling entry point. This would allow for a tighter stop just above the gap or structure high, and thus improves the risk-to-reward ratio slightly compared to a more conservative FVG entry.

Conclusion

In summary, the plan would be to wait for BTC to either fill the FVG and reach the 0.786 level or show strong rejection signs there. A rejection from this zone would confirm the lower high thesis and offer a solid short setup aiming for a move back to the range low. With the current setup, market structure, and confluence levels lining up, this trade idea presents a tactical opportunity with clear invalidation and high RR potential.

Master HBAR with Fibonacci: The Golden Pocket BlueprintSince topping out at $0.20151, HBAR has spent the last nine days in a corrective pullback. Digging into a rich confluence of supports that offers a long trade setup. Here’s how to spot the high‑probability entries, manage your risk, and scale out for maximum reward.

Current Context

Two days ago, price was firmly rejected at the weekly open ($0.19029) right alongside the anchored VWAP drawn from the $0.28781 swing high.

HBAR now trades below the monthly open ($0.18210), the weekly open ($0.19029), and the daily open ($0.18024), sitting at about $0.177.

Just beneath today’s level lies the swing low at $0.17543. Breaching this could flush out stops before any meaningful bounce.

The Golden Support Zone

All signals converge between $0.170 and $0.1725:

The anchored VWAP from the $0.12488 low sits at around $0.17.

The 0.618 fib retracement of the $0.15396→$0.20239 move falls at $0.17246. Just under the swing low where the liquidity lies.

The secondary 0.666 fib retracement lands at $0.17014, reinforcing that floor.

Volume‑profile analysis of the past 27 days pins its Point of Control right at $0.17, great confluence with the anchored VWAP.

This “golden pocket” is your pivot for a low‑risk, high‑probability long.

Long Trade Setup

Ladder buy orders between the swing low ($0.17543) and the 0.666 fib at $0.17014.

Aim to average in around $0.1725.

Place a single stop‑loss just below $0.17

Scaling Your Exits

First Partial Exit at the monthly open ($0.18210). This offers roughly a 2:1 R:R.

Second Exit Zone around the weekly open and VWAP resistance (~$0.19) for about a 3:1 R:R.

Final Target at the 0.618 fib retracement of the entire down‑wave (from $0.28781 to $0.12488) near $0.2256. An astounding 10:1 payoff for the patient trader.

Keep in mind a potential false‑break (SFP) at $0.17543: if price briefly dips below then snaps back up, with increased volume.

Short Trade Setup

For traders looking to play the downside from the “golden pocket” flip, here’s a clear short strategy:

Entry Zone: Ladder short entries between the 0.618 fib at $0.22557 and the 0.666 fib at $0.23339.

Confluence: The 0.666 level aligns perfectly with the negative 0.618 fib from the prior swing, creating a resistance zone.

Stop‑Loss: Place your stop just above $0.23339, invalidating the confluence.

Take‑Profit: Target a return to around $0.206, where you can lock in gains as HBAR retests its previous high.

By scaling into shorts across that fib band, you balance your risk and capture the high‑odds reversal offered by stacked Fibonacci confluence. Let the golden pocket guide both your longs and shorts!

Key Takeaways

Confluence is king: VWAPs, Fibonacci retracements, Liquidity and volume‑profile all align in the $0.170–$0.175 zone.

Risk control: One stop‑loss under $0.17 protects the entire laddered entry.

Tiered targets: Small wins at $0.182, larger as you clear $0.19, and a big payoff if HBAR rallies toward $0.225. Trail your SL accordingly.

Patience pays: Wait for price to enter the golden pocket, avoid chasing!

With these confluences lining up and clear levels to work from, HBAR’s next high‑probability long setup is staring you in the face. Trade smart, size appropriately, and let the market reward your discipline.

Happy Trading!

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

BTC - Golden Pocket test & what comes next?Bitcoin (BTC) has been steadily recovering from its January correction, entering a promising uptrend that has now brought it to a crucial technical juncture: the Golden Pocket Fibonacci zone, which lies between the 61.8% and 65% retracement levels. This area is widely watched by traders, as it often serves as a springboard for either significant reversals or continuation of the trend.

4H timeframe

On the 4H timeframe, BTC recently formed an ascending triangle, a classic bullish continuation pattern. The price managed to break above the triangle’s resistance, but it failed to hold above this level, closing back below the breakout zone. This lack of follow-through signals weakness and suggests that a short-term pullback could be imminent.

Daily timeframe

Turning to the daily chart, the situation becomes even clearer. After reaching the Golden Pocket, BTC printed a bearish engulfing candlestick, a strong reversal signal. The subsequent price action saw BTC break below both the 4H support and a daily FVG, further strengthening the case for a deeper correction or trend reversal. If this downward momentum continues, the next major support zone is likely between $89,000 and $91,000. This area marks an imbalance created during the previous rally and is a natural target for buyers to step in.

However, the bullish scenario is not entirely off the table. If BTC can reclaim and hold above the Golden Pocket, it would signal a resumption of the uptrend, with the next key target being the psychologically significant $100,000 level. For now, though, the technical structure suggests that a retracement toward the $89–91k zone is more likely before any attempt at new highs.

Conclusion

In summary, Bitcoin’s recent test of the Golden Pocket Fibonacci zone has resulted in a short-term rejection. The immediate outlook is cautious, with a likely retracement toward $89–91k. Traders should watch closely for confirmation signals in both price action and volume before making new commitments. A successful hold above the Golden Pocket would open the door for a rally toward $100,000, but for now, patience and careful observation are advised.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

AERGO: Golden Pocket Hit – Crash Incoming?On April 3rd, AERGO hit a historic low of $0.04746—and just 13 days later, it's trading around $0.60, an astonishing +1500% surge in less than two weeks. The rapid rise begs the question: What are the bulls aiming for next, and how sustainable is this move?

Key Observations:

Explosive Rally:

AERGO’s meteoric move from $0.04746 to $0.70 in just 13 days has propelled the coin into uncharted territory. Such a dramatic spike is not only eye-catching but also raises concerns about overextension.

RSI Overbought:

The daily RSI sits at 98, indicating extreme overbought conditions. This level suggests that the current rally is unsustainable and may be ripe for a pullback.

Historical Resistance Levels:

Looking back at 2021, key highs were established around $0.60 to $0.62. These levels serve as critical resistance zones.

Fibonacci Confluence:

Taking the Fibonacci retracement from the low at $0.04746 to the previous rally's high at $1.0809 (April 13, 2024), the 0.618 level is projected at $0.68613. The bulls just tested that golden pocket.

Trade Strategy & Potential Setups:

For Longs:

With the market showing signs of being overbought (RSI at 98) and the explosive move possibly winding down, this may be the perfect opportunity to take profits rather than accumulate further.

Take Profit Consideration:

Target: Near the 0.618 fib retracement at $0.68613.

Observation: If bulls push beyond this level, the move might extend — however, the risk of a sharp pullback is high given current overbought conditions.

For Shorts:

A corrective move is very much on the table, and traders looking to short should focus on the key resistance zone between $0.60 and $0.70.

Short Setup:

Entry: Look to initiate shorts near the $0.60–$0.70 zone.

Target: $0.4 and $0.2 as take profit targets

The Big Question:

Will AERGO drop as sharply as it surged? Given the extreme overbought conditions and the rapid, unsustainable spike, a healthy—and perhaps brutal—correction seems very possible. Keep a close eye on volume and price action near the $0.60–$0.70 resistance zone and be ready to adjust positions accordingly.

Anyone riding this wave has experienced one of the wildest moves in recent memory. For those in long positions, consider taking profits now; for potential short traders, watch those key levels tightly. The market's rhythm will soon reveal its next chapter.

SOL Bulls Strike Back — But Is It Sustainable?Solana continues to respect technicals with precision — after a +42.9% move from the $95 low, we're now at a pivotal moment in price structure. Let’s break down what’s happening and where the high-probability setups lie.

📍 Key Bounce Zone – Golden Pocket Confluence

Local Low: $95.26

Golden Pocket Zone (0.618–0.666): $97.09–$94.82

This area acted as a major demand zone, with price sharply rebounding.

First Volume Spike: Followed by retracement into Golden Pocket Zone at $102.

Second Volume Spike: Occurred right after touching Anchored VWAP ($108.21) from the $95.26 low, which added beautiful confluence with the Golden Pocket Zone – a secondary high-conviction long entry.

📈 Rally to Resistance – Short-Term Climax

After the anchored VWAP retest, SOL rallied into the key resistance zone aligned with the 0.786 Fib retracement from the previous down move — a historically reactive level and a prime profit-taking zone.

Monthly 21 EMA ($135.83) and the monthly 21 SMA ($133) — both key dynamic resistance zones.

Low-volume retest of that key high suggests buyer exhaustion, not continuation — a classic setup for a short-term reversal.

🧭 Current Market Structure

Current Price Action: Trading above both the weekly open ($128.38) and the monthly open ($124.54).

This forms a critical S/R zone between $124–$128, now acting as a potential battleground for bulls and bears.

As long as price stays above this zone, momentum remains with the bulls.

🔍 What to Watch Next – Reclaim or Reject?

Key Support to Watch:

$125 (psychological level) and monthly open at $124.54 – This zone is likely to be liquidity-hunted. Expect a sweep of this low, look for the reaction.

Daily Support Confluence: currently at 21 EMA: $123.77 & 21 SMA: $123.27

1.) 📈 Scenario A – Bullish Reclaim:

If SOL sweeps the low and shows strong buying reaction (bullish engulfing candle, volume spike), it sets up a potential long opportunity towards the weekly open, to watch for the next reaction.

2.) 📉 Scenario B – Failed Hold:

If there's no bullish reaction at $124–$125, expect further downside.

First target = $122

Second target = $120.65

🎯 Tactical Game Plan

Bulls:

Watch for reaction at $124–$125 – potential scalp long with tight SL.

Confirmation on volume expansion and break of $128.38 for continuation.

Re-enter long after clean retest of weekly open from above.

Bears:

Short setup possible if weekly/monthly open is broken and retested as resistance.

First TP = $122, second TP = $120.65.

DENT - Potential Price Reversal at Golden Pocket and FVG ZoneIn this TradingView chart for the DENT/USDT perpetual contract on the 4-hour timeframe, the current price action is being analyzed with a focus on key Fibonacci and market structure levels that indicate potential price movement. Below is an extensive description of the setup:

1. Golden Pocket Support Zone:

- Highlighted in yellow, this area represents the golden pocket derived from a significant upward trend. The golden pocket, located between the 0.618 and 0.65 Fibonacci retracement levels, is known as a high-probability reversal zone.

- The price recently reacted off this level, signaling potential bullish interest in the zone.

2. Fair Value Gap (FVG):

- The blue zone above current price action highlights an unfilled Fair Value Gap (FVG) left behind during the prior downtrend. This area, located near 0.00078, may act as a potential liquidity target if the price begins to retrace upward.

- The Fibonacci retracement is also drawn, intersecting with this zone, reinforcing its significance as a key resistance area.

3. Potential Scenarios:

- Bullish Retracement: The green path anticipates a short-term upward move where the price may climb toward the FVG resistance zone. This move could align with traders looking to target the imbalance created by previous price action.

- Bearish Continuation: The red arrow outlines the scenario where price, after testing the FVG, resumes its downward trajectory, breaking through the golden pocket and continuing its bearish trend.

4. Technical Overview:

- The chart shows clear evidence of a prior bearish trend, with current price action suggesting a temporary pause or reversal. Traders should monitor price behavior around the golden pocket and FVG zones for confirmation of either scenario.

- Breakdowns below the golden pocket could indicate further downside momentum, while breakouts above the FVG might suggest a shift in market sentiment.

This setup provides a roadmap for potential price action and highlights critical levels for traders to watch for entry, exit, and risk management.

Mastering Fibonacci Retracements & Extensions on TradingView!1. Introduction to Fibonacci in Trading

Fibonacci levels are widely used in trading to identify potential reversal zones, support, and resistance levels. These levels are derived from the Fibonacci sequence, a mathematical pattern found in nature and financial markets. Traders rely on Fibonacci retracements to find potential entry points and Fibonacci extensions to determine profit targets. The most critical area of interest is the golden pocket zone, which ranges between 0.618 and 0.65. Price often reacts strongly in this zone, either reversing or continuing its trend, making it a key level for traders to watch.

2. Key Fibonacci Levels for Trading

Several Fibonacci levels are commonly used in trading. The 0.5 level, although not an actual Fibonacci number, is often observed as a psychological retracement level. The golden pocket zone, which consists of the 0.618 and 0.65 levels, is considered the most important for potential reversals. The 0.786 level represents a deeper retracement and is frequently used by traders for more precise entries before a strong price move. On the other hand, Fibonacci extensions, such as -0.618 and -1.618, are used to project potential price targets. These levels serve as reference points for identifying support and resistance, allowing traders to make more informed trading decisions.

3. How to Draw Fibonacci Retracements on TradingView

To effectively use Fibonacci retracements, traders must first identify a swing high and a swing low on the chart. This process starts by recognizing a strong uptrend or downtrend. Once identified, the Fibonacci tool in TradingView can be used to plot retracement levels. By selecting the swing low and dragging it to the swing high in a bullish setup, or vice versa in a bearish setup, traders can visualize the key Fibonacci levels. It is essential to adjust the settings to only display 0.5, 0.618, 0.65, 0.786, -0.618, and -1.618 for better clarity. This method provides a structured approach to analyzing potential price reactions and planning trades with greater accuracy.

4. Trading Strategies Using Fibonacci Levels

A. The Golden Pocket Entry Strategy (0.618–0.65)

One of the most reliable trading strategies involving Fibonacci retracements is based on the golden pocket zone. When price retraces to the 0.618–0.65 area, traders look for confirmation signals before entering a trade. These confirmations may include bullish or bearish candlestick patterns, such as engulfing candles, pin bars, or hammer formations. Additionally, traders may use momentum indicators like RSI or MACD to identify divergences, which suggest a potential trend reversal. A spike in volume at these levels can further validate the trade setup. A typical strategy involves entering a trade within the golden pocket, setting a stop-loss slightly below the 0.786 level for risk management, and targeting Fibonacci extensions for profit-taking.

B. Fibonacci Extensions (-0.618 & -1.618) for Profit Targets

Fibonacci extensions serve as valuable tools for setting take-profit levels in trending markets. Once price confirms a reversal from a retracement level, traders use extensions to project future price movements. The -0.618 extension is often considered a conservative target, providing an early profit-taking opportunity. Meanwhile, the -1.618 extension is a more aggressive target, generally used in strong trends where price momentum is high. By integrating Fibonacci extensions into their strategy, traders can optimize their exits, ensuring they capture the full potential of a move while minimizing premature exits.

5. Common Mistakes & How to Avoid Them

Despite its effectiveness, Fibonacci analysis requires proper execution. One common mistake traders make is drawing Fibonacci levels incorrectly by selecting the wrong swing points. Accuracy in identifying the correct high and low points is crucial for reliable retracement levels. Another mistake is over-reliance on Fibonacci without additional confirmations. Traders should always seek confluence with other technical indicators, such as support and resistance levels, moving averages, or volume analysis. Additionally, failing to wait for confirmation signals can lead to premature entries, increasing the risk of losses. Understanding these pitfalls and applying Fibonacci with proper validation techniques can significantly improve trading outcomes.

6. Pro Tips for Using Fibonacci Like a Pro

For best results, traders should use Fibonacci analysis on higher timeframes, such as the 1-hour, 4-hour, or daily charts, as these provide more reliable signals compared to lower timeframes. Confluence plays a crucial role in validating Fibonacci levels, so traders should always look for overlapping support and resistance, trendlines, or moving averages. Additionally, backtesting Fibonacci strategies using TradingView’s replay mode can help traders refine their approach and gain confidence in their setups before applying them in live trading. By combining Fibonacci with other technical tools and maintaining discipline in execution, traders can enhance their decision-making process and improve their overall trading success.

Final Thoughts

Mastering Fibonacci retracements and extensions can significantly improve trade accuracy. By focusing on the golden pocket zone (0.618–0.65) and using Fibonacci extensions like -0.618 and -1.618 as profit targets, traders can refine their strategies and maximize profitability. Understanding how price interacts with these levels and applying additional confirmations ensures more precise trade entries and exits. With practice and proper analysis, Fibonacci can become a powerful tool in any trader’s arsenal.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Bitcoin, Mind The Gap (85,720) The massive move initiated from Trumps tweet Sunday about the Crypto Strategic Reserve has left a massive gap on the Bitcoin Futures Chart. Gaps tend to get fill sooner rather than later, with a high 90% hit rate on gaps getting filled.

We could see a pullback this week to fill the gap with another run up following back above 90k to save the weekly close ... again.

We see confluence with the golden pocket (0.6128 - 0.65 Fib) here on that retracement and also the most amount of volume (VPVR) being traded there.

A final test of the demand below 90k, which if shown as support, will lead us back into the range of 90k to 110k.

Bitcoin Breaks Key Support: Is $72K the Next Target?Bitcoin has officially broken below the $91,000 support level, a key structural low that previously acted as a strong base for price action. This breakdown is significant, as it signals a shift in market sentiment and opens the door for a potential retest of lower price levels.

The first major area of interest now lies in the green Fair Value Gap (FVG) at the $80,000 level. This region represents an imbalance that has yet to be fully filled, making it a likely point of support where buyers could step in. However, the strength of this level will be critical to monitor

if bulls fail to defend it, we could see an even deeper correction.

🚨 Why Is $72K an Important Level?

If Bitcoin fails to hold above the $80,000 FVG, the next major target would be the red Fair Value Gap around $72,000, which also aligns with the golden pocket retracement zone (between the 0.618-0.65 Fibonacci levels). This area is a strong draw on liquidity, meaning that large players in the market could be targeting this level to accumulate Bitcoin at a discount.

Historically, golden pocket regions often act as high-probability reversal zones, but if sentiment remains weak, we could even see a deeper correction towards lower Fibonacci retracement levels, such as the 0.786 zone at around $64,000.

🔥 Key Factors Driving Bitcoin’s Recent Drop

Several major events and macroeconomic factors are currently weighing on Bitcoin’s price action:

📉 Loss of Trump-Driven Crypto Euphoria

Bitcoin and the broader crypto market initially surged on speculation that Donald Trump’s return to the political spotlight would lead to favorable regulations for the industry. However, recent developments have dampened this optimism. Policy details remain unclear, and investors are beginning to question whether the market got ahead of itself.

🔓 Major Crypto Security Concerns

A recent record-breaking $1.5 billion hack on crypto exchange Bybit has raised security fears across the industry. This has led to increased outflows from centralized exchanges as investors rush to secure their assets, adding sell pressure to the market.

⚖️ Regulatory Uncertainty & SEC Scrutiny

The SEC has formed a new task force focused on digital assets, signaling more regulatory oversight in the near future. While some see this as a step toward legitimizing crypto, others fear it could bring stricter enforcement actions, particularly against DeFi platforms and stablecoins.

📊 Declining On-Chain Metrics & Miner Sell-offs

On-chain data suggests that miners have been selling Bitcoin at an increased rate, likely to cover operational costs as mining difficulty continues to rise. This has added additional downward pressure on price.

🔍 Key Levels to Watch Moving Forward

✅ $80,000 (Green FVG) → First major support zone

✅ $72,000 (Red FVG & Golden Pocket) → Strong liquidity draw if $80K fails

🚨 Below $72,000 → Potential retracement toward the 64K-65K region

📢 Final Thoughts: What’s Next for Bitcoin?

Bitcoin is at a critical inflection point whether we hold $80K or drop toward $72K will determine the next major trend. The current breakdown suggests more downside in the short term, but these lower levels could offer an excellent buying opportunity for long-term investors.

With upcoming regulatory decisions, macroeconomic uncertainty, and potential geopolitical factors, traders should remain cautious and watch key support levels closely.

👉 Are you buying the dip, or do you think Bitcoin has further to fall? Let me know your thoughts in the comments! 🚀📉

BTC Price Target #2: A Bounce Off the 200 MA or Golden PocketA case more bullish than an undoing of the move of BTC from $60K to six digits...

Price action could plausibly retrace to the 200d MA or Golden Pocket of the move from the 10/10/24 Swing Low and find support on either.

This case would likely play out as a violent wick down and v-shaped return to VAL of the volume profile. If we are talking a Golden Pocket retracement, a noteworthy CME Gap would be filled.

Bitcoin's Next Big Move? Critical $103K Resistance Ahead!Bitcoin has broken out of its recent consolidation range after a classic liquidity sweep at the lows. As marked on the chart (red line), we saw a significant stop-loss hunt below the previous support level, triggering a cascade of liquidations before BTC swiftly rebounded. This move confirmed bullish intent, allowing Bitcoin to reclaim momentum and push back toward the critical psychological level of $100K.

Now, all eyes are on the $103K resistance zone, which is a major confluence area for multiple reasons:

📌 Fair Value Gap (FVG) – This imbalance in price action suggests that liquidity is resting in this region, making it a key level for market reactions.

📌 Fibonacci Golden Pocket (0.618 - 0.65 retracement) – One of the strongest retracement levels in trading, often acting as a magnet for price action before a decisive move.

📌 Historical Resistance – This area has already been tested twice (marked as "First Hit" and "Second Hit" on the chart) and resulted in strong rejections both times.

What’s Next for Bitcoin?

🔹 Bullish Scenario: If BTC can break through $103K with strong volume, we could see a continuation towards $105K - $107K, with a potential extension toward $110K in the mid-term.

🔹 Bearish Scenario: A rejection from this resistance could lead to another pullback, possibly back to the $96K support level or even lower before another attempt to push higher.

Why This Level Matters:

The liquidity structure here is key. Many traders will have short positions stacked at this resistance, and a breakout could trigger a short squeeze, fueling a rapid move higher. However, if sellers overpower buyers in this zone, BTC could struggle to sustain its gains and might need another accumulation phase before making a decisive breakout.

Final Thoughts

This is a critical moment for Bitcoin. Will the bulls break through $103K and continue the rally, or will this level act as a major roadblock once again? Watch this level closely, and let me know your thoughts in the comments!

SOL 4H RANGESOLANA is down -40% from making a new ATH to the bottom of the crash wick @ $175. Looking at the chart, unless BTC decides to gap down again from a TA standpoint SOL looks good here.

A triple tap of the bottom with a reclaim of the bullish orderblock that coincides with the golden pocket zone from local LTF high to low, followed by a strong reaction from that zone. Q1 is historically good for altcoins and so the all of these points added together the R:R at this level is good IMO.

Profit taking through the range quarters.

The idea is invalid once price accepts below the triple tap bottom under $170.

Will LINK Hold or Dive Deeper? Major Support Ahead!LINK has been range-bound for the past two weeks, struggling to break through the $26-$27 Key Zone. After multiple strong rejections, price started slowly to pull back, now approaching a critical support zone, the 0.618 Fibonacci retracement at $21.41.

Key Levels & Recent Price Action:

0.618 Fib Retracement ($21.41)

Weekly Level ($20.96) & 0.666 Fib → Additional confluence reinforcing this support zone

Fib Speed Fan (0.8) → Aligns with this level, making it a high-probability bounce area

Short Trade Recap

Today, the weekly level was tested, leading to a rejection, offering a valid short setup.

For the short trade target the dOpen was hit perfectly, acting as a key intraday level.

Now, the big question:

Will LINK lose the dOpen and head lower to finally test the 0.618 retracement?

Or will buyers step in to defend this level?

Long Setup & Upside Potential:

Entry Zone: $21.41 - $20.96 (Golden Pocket)

Stop Loss: Below 0.786 Fib

Take Profit: $30 psychological level, $35 - 0.618 Fib

Why This Trade Setup is High-Probability:

Liquidity Sweep Potential → A dip into this range could liquidate long positions, creating a strong buying opportunity

Golden Pocket Confluence → 0.618 & 0.666 Fibs + Weekly Support = A strong demand zone

Final Thoughts:

If LINK breaks below the dOpen, the swing low and the 0.618 fib retracement becomes the key level to watch for a high-probability long entry.

If price reacts strongly to this support zone, a long trade could target $30+ in the coming future, offering an excellent risk-to-reward setup!

DEEP in the Game: Perfect Long Setup UnfoldingDEEP has recently shown an impressive move, surging by +65% in just one day. This is a strong sign of momentum, but now we are at an interesting stage, with price ranging within certain key levels.

Key Price Levels:

1.) Resistance at $0.276255 (Weekly Level & Fib 0.618):

DEEP has been reacting precisely to Fibonacci levels and key price zones. After reaching the 0.618 Fib retracement, it encountered strong resistance near the weekly level at $0.276255. Since then, the price has been in a pullback phase

2.) Head and Shoulders Pattern:

After the impulsive move, DEEP formed a head and shoulders pattern, which was broken to the downside. The classic pattern completion confirms a bearish bias, but the subsequent retest of the broken neckline leads us to the current range

3.) Support at $0.209732 (Fib & Liquidity Zone):

The Fib retracement 0.786 of this 5-wave impulse aligns with $0.209732, where we also see liquidity stacking up. This is an ideal support area where we might see a bounce, given the confluence of the head and shoulders target aligning here

The Fib retracement 0.618 from the larger wave is close at $0.208073, giving us even more confirmation of the importance of this region

4.) Fib Speed Fan:

Additionally, the Fib speed fan places the 0.818 level right at this support zone. This adds another layer of confidence to the idea that this could be a strong entry point for the long setup

Trade Setup:

The combination of these factors creates an ideal long setup:

Entry Range: The key levels we are looking at for entering are between $0.21 and $0.208.

Major Confluences: We have the Fib retracement 0.618 from the larger wave, head and shoulders target and Fib speed fan support all aligning here. This is not just coincidence, it's a perfect storm of technical support!

Stop Loss (SL):

Place the SL below the 0.786 level for now. This would provide a good margin to avoid unnecessary market noise, with the option to ladder your stop loss towards this 0.786 level depending on price action

Target Range:

A 2:1 risk-to-reward ratio or higher. This price point aligns with a previous key level of resistance and is an excellent target based on this setup

Confirmation:

Before executing, always look for confirmation:

Volume: Ensure there's enough volume to support the move

Candlestick Pattern: Look for a solid reversal candle at the support zone (e.g. bullish engulfing, hammer, etc.)

Order Flow: Ensure that the order flow is in favour of the long position, signaling that buyers are stepping in

Remember, trading is all about patience and confirmation. Keep an eye on volume, candlestick patterns and overall order flow before jumping in.

Let’s see how DEEP plays out.