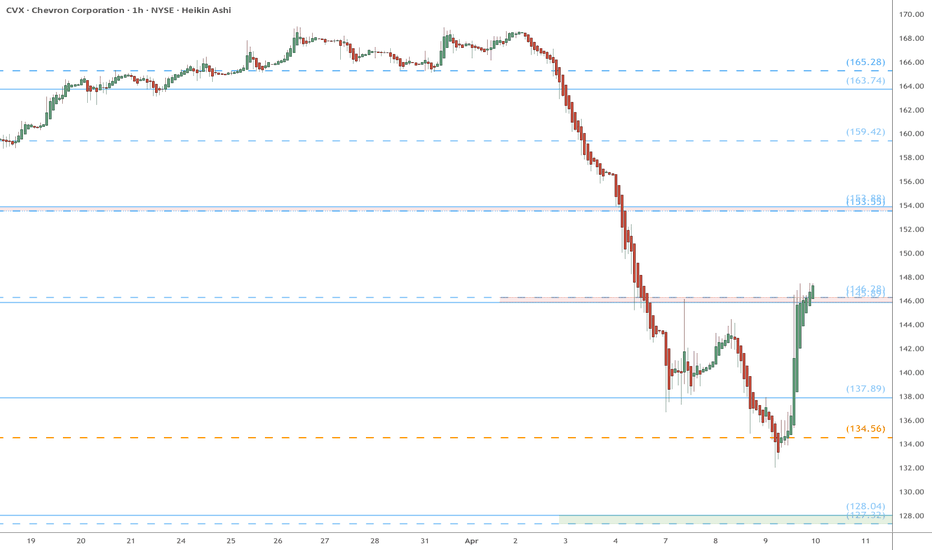

CVX eyes on $146: Proven Resistance to stop bounce or Break?CVX got a Tariff Relief bounce into resistance.

Look for a dip or break and retest for long entry.

Or if Oil keeps getting spilled then short here.

$ 145.89-146.28 is the exact zone of interest.

$ 153.55-153.88 above is quite achievable.

$ 127.32-128.04 below a good shorting target.

==========================================

Goldenratio

CRM eyes on $262-265: Golden Genesis + Covid fibs for next leg CRM got a Tariff Relief bounce into resistance.

Looking for a dip or break and retest to buy.

If you missed the lower support, look here.

$ 262.54-265.36 is the exact zone of interest.

$ 254.42 below is first support for dip entry.

=========================================

DELL watch $70 then 67: Supports for a possible dead-cat bounce DELL crashing more than others from tariff-tantrum.

Pierced a minor support on its way to a major support.

Should get a dead-cat bounce to major resistance soon.

$ 70.27 - 70.90 is the minor support to watch.

$ 66.78 - 67.35 is the major Support below.k

$ 76.64 - 77.15 is now a major resistance above.

================================================

XAU.usd heads up at $3,222.15: Golden fib should give us a dipPart of my ongoing analysis, see related ideas.

We got a dip and a strong bounce EXACTLY where expected.

Now testing the first major hurdle, a Golden fib at $3,222.15.

Looking for a dip here soon, then find targets for re-entry long.

=======================================================

Previous Analysis calling for $2964 dip to buy:

=======================================================

SONY eyes on $24: Tariff Relief bounce at resistance to Dip Buy SONY bounced into a key resistance that bulls must break.

Looking for a dip or Break-n-Retest for long entries or adds.

Japan looks to be on Trump's good side so this might recover.

$ 23.90-23.97 is the exact resistance zone to watch.

$ 22.82-23.09 is the first support to watch for the dip.

=====================================================

META watch $486/89: Major Support for at least a DeadCat bounce META dropping even though it is mostly immune to tariffs.

Now approaching a major support zone just below $490.

This should give at least a "dead cat" bounce to $508 fib.

$485.95 - 489.05 is the exact support zone of interest.

=================================================

.

BTC headed to 75k? dead cat at 77.7k then 73-75k support comingBTC was holding well against the market's Tariff-Tantrum.

But a significant dip is starting on a Sunday (as often does).

If sentiment continues into Monday, we should see 75k soon.

====================================================

Previous Charts below

====================================================

$ 105k cycle Top call:

$ 82K Bounce call:

$ 73K previous cycle top (and current retest target):

============================================================

SNA eyes on $310: Major fib cluster support to start buying?SNA looks headed to a major support zone around $310.

Most of its products are US made so tariffs are less scary.

Auto Repair industry will gain so Snap-On should benefit.

$ 309.63 - 311.13 is the exact zone of interest.

==================================================

.

ULTA watch $370 above, 349 below: Golden fibs to define key zoneULTA holding up reasonably well compared to the market.

Bound by Golden Genesis above and a Golden Covid below.

Watch for break of either Golden to determine next move.

$370.57 above, $349.27 below are the exact levels to watch.

=====================================================

.

FDX watch $244.36: SemiMajor Covid fib giving furious resistanceFDX dumped upon last earnings but has been trying to recover.

Currently struggling against a semi-major covid fib at $244.26

It seems likely it will reject to green support zone $231 -233

======================================================

BTC eyes on 82k: Pit Stop en-route to 75k? or bounce into 85k? BTC at a significant fib cluster going into Sunday evening.

Bulls must hold 82k til Monday US open for a hopeful bounce.

Bears will try to snap it and cascade down towards 80k then 75k.

========================================================

.