IBM eyes on $243-245: Serious Support zone should give a bounce IBM was dipping on earnings even before market swoon.

It has take a second leg down to support at $243.03-245.84

Should get a decent bounce, even if going lower afterwards.

.

See "Related Publications" for previous charts ----------->>>>>>>>>>

Such as this plot which caught the EXACT BOTTOM:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

===========================================================

.

Goldenratio

MLM heads up at $613.37: Golden Genesis fib may STOP the SurgeMLM had news of acquisition and a partnerhip.

It has just hit a Golden Genesis fib at $613.37

Look for a Dip-to-Fib or Break-n-Retest to join.

Previous Analysis that caught the BREAK OUT up to this fib:

Hit BOOST and FOLLOW for more such a PRECISE and TIMELY charts.

==========================================================

.

HSBC eyes on $53.xx: Key Resistance to recovery of UpTrendHSBC looking quite strong compared to other banks.

Just poked through a key Resistance at $53.01-53.40

Strong break should retest highs above at $58.11-58.65

.

Previous Analysis that caught a long PERFECTLY

=================================================

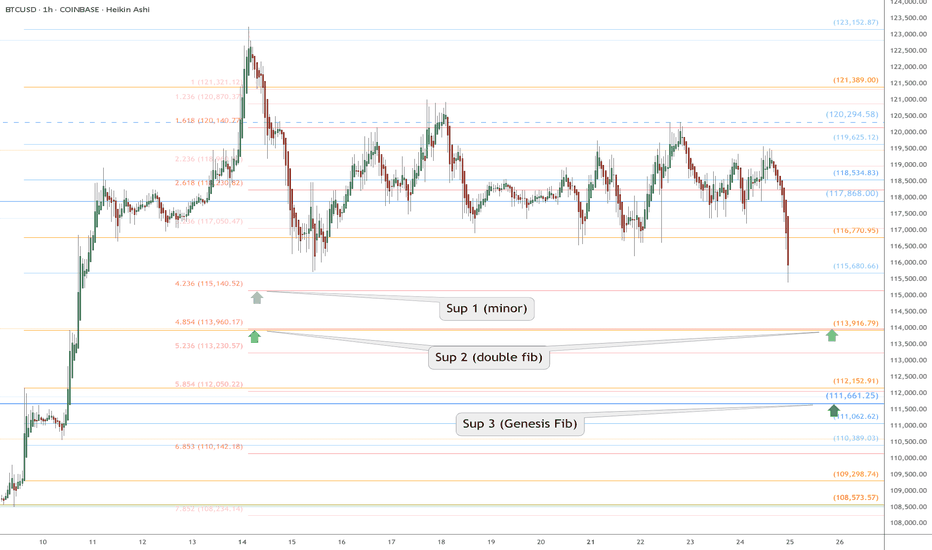

BTC Retrace RoadMap and 3 nearby supports worth watching NOWThis is a near-term followup to my big picture linked below.

Dip is underway after orbiting our Genesis Fib at 117.9k.

Quickly approaching the next three supports worth watching.

Supports get stronger below but each one needs to slow the dip.

$ 115,140 is a minor fib but possible end of dip wave.

$ 113,9xx is a double fib that should be pretty strong

$ 111,661 is the sister Genesis fib, and a MUST HOLD

.

Big Picture chart and why 117.9k was KEY

=======================================================

.

HOOD watch $110 then $113: Dual Golden fibs trying to TOP itHOOD has been a massive bull run since April lows.

Now battling a dual Golden fib zone $110.39-113.56.

Top of the zone is a well proven Golden Genesis fib.

See "Related Publications" for previous charts ------->>>>>>>

Such as this PERFECT catch of a serious bounce:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

WDC eyes on $78: Double Golden fib zone should slow the surge WDC earnings report caused a break out from consolidation.

Price spiked into a Double Golden fib zone at $77.81-78.18

This "very high gravity" confluence should hold price for a bit.

Previous analysis that caught HUGE BREAKOUT

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

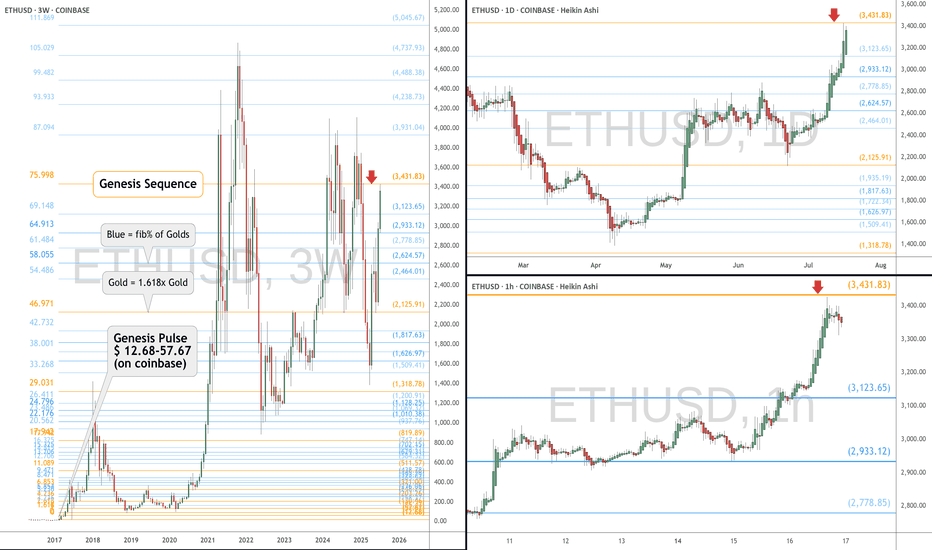

ETH eyes on $3431.83: Golden Genesis fib may END this SurgeETH finally got a surge after a long consolidation.

But has just hit a Golden Genesis fib at $3431.83

Like hitting a brick wall, it is now staggering back.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we reject here to end the surge.

It is PLAUSIBLE that we Break-n-Retest to continue.

We were here at this EXACT spot 8 months ago:

=============================================

.

EBAY watch $75.76-76.26: Key Support zone to launch next Leg UP EBAY trying to get back above its ATH from 2021.

Now testing a key support zone at $75.76-76.26.

Good but late long entry with StopLoss just below.

.

See "Related Pubications" for previous charts such as THE BOTTOM call:

Hit the BOOST and FOLLOW for more PRECISE and TIMELY charts.

=========================================================

ORCL heads up at $212 then 220: Double Golden Fibs may STOP runORCL has been flying off the last Earnings report.

About to hit DUAL Golden fibs at $212.67-220.21

Ultra-High Gravity objects in its price-continuum.

It is PROBABLE to consolidate within the zone.

It is POSSIBLE to reject and dip to a fib below.

It is PLAUSIBLE but unlikely to blow thru them.

.

My last Plot that caught the BreakOut EXACTLY:

=================================================

.

AEHR watch $15.99-16.27: Major Resistance may give a Dip BuyAEHR has been flying high with the general market.

Approaching a significant resistance into $16 round.

$15.99-16.27 is the exact zone of concern up here.

.

Previous analysis that caught the BreakOut:

===============================================

.

DQ heads up into $19: Major Resistance to book some profitsDQ has been flying off our bottom call (see below).

Now testing a major resistance zone at $18.69-18.99

Good spot to book some profits and look for a dip to buy.

.

Previous analysis that called the BOTTOM:

===================================================

.