XAUUSD H1 Outlook – April 21, 2025🧭 Market Overview:

XAUUSD just printed new ATH at 3396, with price now pushing again into premium, currently testing 3392.7–3393.6 — a zone with weak high inducement. Price action is extremely vertical, with no clear pullback since 3285.

📈 H1 Structure:

Bullish CHoCH and BOS series from April 9

Trend is vertical, clean impulsive waves

No internal sign of exhaustion — yet

🧠 Context:

H1 candles show price slowing slightly around the weak high area. Smart money will look to trap late buyers above 3396 if price does not break cleanly.

🔼 Key Levels ABOVE Price

Type Zone Notes

🧲 Weak High Zone 3393.6–3396.0 Current zone – may act as final inducement trap

🎯 Fibo 1.0 Extension 3405–3415 First proper extension level for late buyers’ liquidation

🚨 Fibo 1.272 Zone 3445–3455 If we spike irrationally → this zone becomes the macro reversal trap

🔽 Key Levels BELOW Price

Type Zone Notes

🔵 Micro Demand 3340–3345 Small M15 OB zone – valid for reaction scalps only

🟢 Confirmed OB Zone 3284–3288 Last valid H1 OB + FVG confluence → strong buy reentry

⚓️ Macro Demand Base 3220–3235 Institutional reaccumulation zone from previous rally

🎯 H1 Bias:

Still bullish — but close to final exhaustion levels.

📌 Look for LTF reversal signs around 3393–3405 to consider safe short entries.

Goldidea

Gold fluctuates and adjusts, will next week be the key?Gold fell all the way in the US market on Friday, with the lowest falling to the 3283 line. However, gold once again rose as a risk aversion. Will gold return to a large range of shocks, or will the adjustment end? The trend of gold after the opening next week will be critical. If gold continues to rise strongly at the opening next week, then gold may end its adjustment, and gold bulls may continue to exert their strength

If gold is still under pressure at 3332 after the opening next week, then gold may continue to fluctuate downward in the short term, thereby driving the moving average to turn. If it directly breaks through 3332 strongly after the opening, then gold will start to fluctuate in a large range.

The current market is very volatile due to the impact of news, and the next trend of gold will become clear on Monday. I will continue to bring analysis to my friends on Monday

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Daily Sniper Plan – April 14, 2025🔥 XAUUSD Daily Sniper Plan – April 14, 2025

📍 Bias: Bearish short-term – price at premium levels

📈 HTF Trend: Bullish unless 3025 breaks

🌍 Macro:

🇺🇸 Trump tariffs + geopolitical instability still looming

Mixed U.S. data: CPI hot 🥵 / PPI weak = confusion → perfect trap setups

Liquidity zones active → both sides could get hunted

🔻 SELL SCENARIO 1 – “Sniper Trap from the Top”

📍 Entry: 3242 – 3248

🛑 SL: 3255

🎯 TP1: 3215

🎯 TP2: 3188

🎯 TP3: 3160

🧠 Why:

Fresh M15 OB + massive liquidity above 3242 swept → expecting rejection

RSI divergence building, M5 confirmation needed

🔻 SELL SCENARIO 2 – “Premium OB Rejection”

📍 Entry: 3260 – 3268

🛑 SL: 3275

🎯 TP1: 3235

🎯 TP2: 3200

🎯 TP3: 3165

🧠 Why:

Final premium OB + unmitigated zone on H1 + imbalance.

Ideal for NY session trap + bearish engulfing rejection.

🟢 BUY SCENARIO 1 – “Reactive Dip”

📍 Entry: 3180 – 3172

🛑 SL: 3165

🎯 TP1: 3205

🎯 TP2: 3230

🎯 TP3: 3250

🧠 Why:

Trendline + OB on M30 + internal structure support.

Needs bullish PA and CHoCH on M5.

🟢 BUY SCENARIO 2 – “Deep Clean FVG Tap”

📍 Entry: 3137 – 3142

🛑 SL: 3129

🎯 TP1: 3180

🎯 TP2: 3205

🎯 TP3: 3240

🧠 Why:

Major imbalance + H1 OB + RSI confluence.

Bullish engulfing or aggressive CHoCH needed on LTF.

📌 Key Zones Recap:

🔺 3248–3268 = Premium sell zone + liquidity trap

🔻 3180 = Internal demand + trendline confluence

🟦 3137 = Strong FVG + H1 OB

⚠️ 3025 = Final HTF support — if broken, expect shift in macro bias

📊 Technical Confluence

✅ SMC: CHoCH and BOS zones active

✅ FVGs: 3137–3145 + 3245–3265

✅ GAPS: Partial fill from 3180–3200

✅ RSI: Divergence above 3240

✅ FIBO: 61.8% zone aligned with 3170–3180

✅ EMA5/21/50/100/200: Price is testing EMA200 on H1

🤝 Final Thoughts

Gold’s premium levels are being tested. The game now is reaction, not prediction. Don’t chase — let price confirm.

🎯 No confirmation = No trade

🧠 Sniper mindset only: clean, high-confluence, risk-controlled.

💬 Engage & Grow Together

🔥 If this plan sharpens your bias, smash the ❤️

🧠 Comment your entries below – let’s discuss setups

🔔 Follow and subscribe for daily sniper drops — stay ahead, stay sharp!

📈 We trade precision, not noise.

XAUUSD – H1 Key Levels Outlook🧭 XAUUSD – H1 Key Levels Outlook

🔼 Key Resistance – 3,237–3,247 (Premium + Weak High Zone)

Why it matters: This is where price tapped into the premium range and formed a new weak high. Strong imbalance left here.

What to watch:

If price forms a CHoCH or M5 supply inside this zone, expect short-term rejection.

If price consolidates above 3,247 and locks with EMA5, the bullish narrative may extend.

🔄 Mid-Range Zone – 3,183–3,193 (Previous FVG + Breaker Structure)

Why it matters: Zone where price paused before the final impulse — now a reactive area with fair value gap.

What to watch:

First bounce or liquidity sweep here can provide short-term scalp opportunities.

Clean break and EMA lock below 3,183 would open the door for deeper retracement.

🟦 Support Zone – 3,108–3,122 (Prior BOS + Liquidity Pool)

Why it matters: Price broke above this zone strongly — now it may act as key demand.

What to watch:

If price returns and prints bullish CHoCH or rejection from OB on M15, valid sniper buy setup.

A failure to hold here would indicate possible revisit of lower demand.

🧊 Discount + Strong Demand – 2,965–2,980 (HL + Clean OB)

Why it matters: Untouched strong low paired with a clean bullish OB from April 9 reversal.

What to watch:

Ideal swing entry zone if market sells off deeper.

A CHoCH or BOS + engulfing in this zone = sniper long re-entry.

✅ Summary:

H1 confirms bullish flow, but current price is dancing in premium. Let price lead. If we reject the highs, focus on 3,193–3,183 and 3,122–3,108 for possible bounce points. A drop to 2,980 is extreme but worth prepping for.

💛 Trader’s Note:

Don’t chase — observe. Highs can deceive, but key levels always speak. If it doesn’t look clean, it’s not your trade. Keep your plan close, your bias neutral, and your mind calm. Let’s crush the week, one sniper play at a time! 🙌

📣 Join the Conversation!

Got your own levels or sniper zones in mind? Share them below — I love seeing how others view the battlefield! 🧠

If this breakdown helped or inspired you:

❤️ Like it

🔔 Follow and subscribe for daily sniper plays

💬 Comment to grow our trader tribe

Let’s build smarter and trade sharper — together 💥

#XAUUSD #SmartMoney #TradingCommunity #GoldAnalysis #SniperEntry

XAUUSD Entry on break of structure ?Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Analysis TodayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Daily Sniper Entry Plan – April 10, 2025 Multi-Timeframe Analysis (D1, H4, H1, M15)

D1: Bullish overall with higher highs and higher lows, price testing resistance near the 3100 area.

H4: Bullish continuation with clear market structure, price still finding support at lower levels.

H1: Structure showing a potential breakout to the upside but also needs confirmation from rejection at supply zones.

M15: Currently in a retracement, testing critical order block zones that could dictate the next big move.

Macroeconomic Context

Fed Rate & NFP: The Fed's dovish stance and recent NFP data support the continuation of bullish sentiment in gold.

CPI & ISM: Inflationary pressures remain, supporting demand for gold, and driving market uncertainty that adds to gold’s safe-haven appeal.

Trend Bias

Bullish Bias: The market is overall bullish, but be cautious around key resistance zones. Look for confirmation of breakouts or pullbacks before entering.

Bearish Bias: If price fails to break above key resistance, a correction could occur, targeting the identified sell zones.

Liquidity Zones & Imbalances

The zones at 3,035-3,040 and 3,066-3,068.50 represent significant demand and order block areas where price has previously reacted. These are prime for buy entries.

Keep an eye on 3,125-3,139 as the potential sell zone, where price has shown previous rejection.

💰 Key Zones

🟩 Buy Zones (Potential Bounce Zones):

🛒 3,066–3,068.50: Sweet spot for a bullish bounce! 📉

🛒 3,035–3,040: Deep value zone! If we get a bounce here, it’s gold! ✨

🟥 Sell Zones (Potential Reversal Zones):

🚫 3,125–3,139: Major resistance, could trap bulls! ⛔

🚫 3,095–3,108: Intraday fade; short potential here! 💥

🎯 Sniper Entries

🟩 Buy Scenario 1 – “Reclaim the Bounce”

📍 Entry: 3,066–3,068.50

💡 SL: Below 3,055

🎯 TP: 3,089 | 3,113.50 | 3,127

🧠 Trigger: Look for CHoCH or Bullish Engulfing on M1/M5 for confirmation.

🟩 Buy Scenario 2 – “Deep Value Pullback”

📍 Entry: 3,035–3,040

💡 SL: Below 3,025

🎯 TP: 3,080 | 3,095 | 3,110

⚡ Tip: Wait for a strong bullish reaction on M5/M15.

🟥 Sell Scenario 1 – “Double Top Trap”

📍 Entry: 3,125–3,139

💡 SL: Above 3,145

🎯 TP: 3,105 | 3,080 | 3,055

⚠️ Tip: Look for a rejection on M5 or M15, with a bearish engulfing.

🟥 Sell Scenario 2 – “Intraday Fade”

📍 Entry: 3,095–3,108

💡 SL: Above 3,110

🎯 TP: 3,080 | 3,060 | 3,040

⚡ Tip: Move SL to breakeven once TP1 hits quickly! 🏃♂️💨

⚠️ Trend Bias

📉 Bearish Short-Term: Watch for rejections at resistance. If the price pushes above 3,139, we may reconsider the bias. 💡

💥 Key Tips & Reminders:

🎯 Patience is Key: Wait for confirmation before entering any trades — no confirmation, no entry! 🕰️

🚀 Risk Management: Keep your SL tight, and only enter when you feel the setup is perfect! 🔥

💡 Be Smart, Trade Smart: Always manage your risk and stick to your plan. 🌟

🔔 Join the Community!

👍 Like this post if you found it useful!

💬 Comment with your thoughts or ask questions below!

🔔 Follow for more precise daily setups!

🔔 Subscribe to stay updated with the latest trading plans!

Stay sharp, stay kind, and let’s trade with precision! 💛

Gold trading ideas April 9th ahead of FOMC MinutesAll entries demand confirmation on M5 or M15;

Snipers don't chase—they wait for the market to come to their scope;

You’re not “late,” you’re loading up for a legendary entry.

🔻 SELL ZONE

📍 3045–3055

🛑 SL: 3065

Why: M15–H1 OB + imbalance fill from previous BOS

Liquidity grab probability during London

🎯 TP1: 3015 | TP2: 2971 | TP3: 2943

🔻 SELL ZONE

📍 3094–3109

🛑 SL: 3122

Why: D1/H4 OB + unmitigated FVG + resting equal highs

Textbook supply raid + swing short

🎯 TP1: 3055 | TP2: 3015 | TP3: 2965

🟢 BUY ZONE

📍 2965–2950

🛑 SL: 2948

Why: H1 demand + FVG + trendline bounce

RSI recovery + bullish CHoCH M15

🎯 TP1: 2990 | TP2: 3022 | TP3: 3044

🟢 BUY ZONE

📍 2922–2904

🛑 SL: 2890

Why: Unmitigated Daily OB + final imbalance

Psychological trap zone if swept

🎯 TP1: 2943 | TP2: 2982 | TP3: 3022

🟢 BUY ZONE

📍 2885–2894

🛑 SL: 2870

Why: Breaker + extreme OB + fib 0.786

Liquidity grab scenario with high RR

🎯 TP1: 2950 | TP2: 3000 | TP3: 3050

📌 Bonus Notes

🔐 Watch 3060–3080 – strong base area.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

📣 If this strategy sparked clarity, hit that like button and follow. 💛

Gold Price Analysis April 2The D1 candle has a red candle and the selling pressure has started to take profit of Gold but it is still unclear.

The most recent H4 candle cluster shows 2 important price zones 3135 and 3108. Breaking this boundary will form a new trend.

Trading plan: Gold pushes to 3108 and does not break this zone in the European session, then BUY GOLD to 3124. At the end of the European session, if it breaks 3124, then keep the order to 3135 and 3164 in the US session if it breaks the resistance. If it breaks 3108, do not buy anymore but wait for Sell Break out 3108, target day 3084, pay attention to the price reaction at 3100 (resistance of last night's session). If 3100 is broken, then SELL DCA, not BUY at 3100. Scenario 2: Price does not return to 3108 first but to 3124 in the European session. If it is not broken, then SELL 3124 to 3108 and breaks the 3108 area in the US session, then the TP scenario is the same as scenario 1. If 3124 is broken, then 3135 waits for a breakout when it breaks, it will be better to SELL down today. (Note the SELL scalp point around 3142)

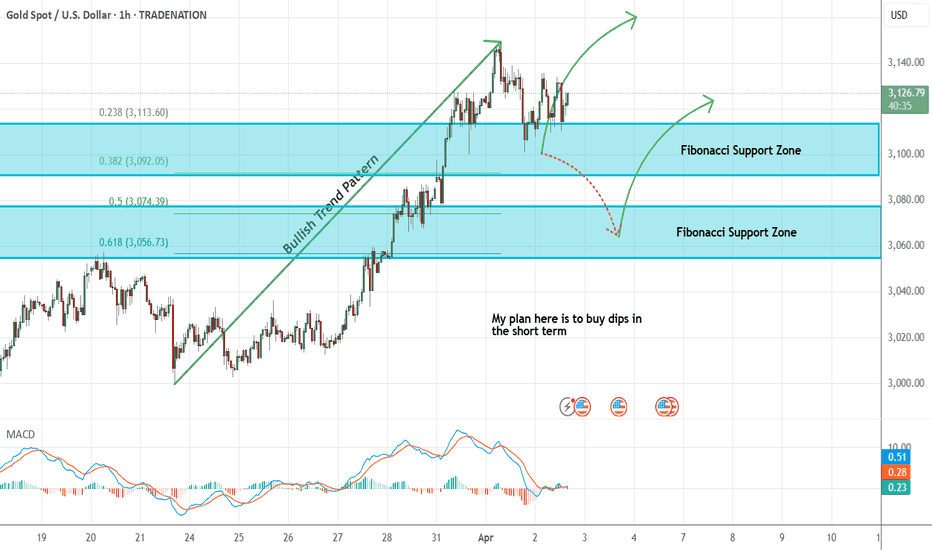

Gold - Looking To Buy Dips In The Short TermH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

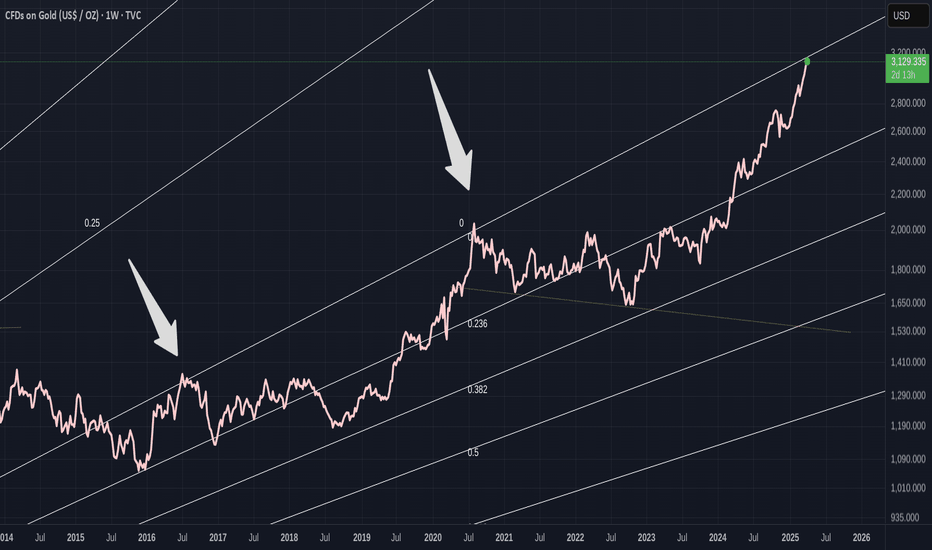

GOLD - on resistance- Could Bitcoin resume its Gains Over GoldAs you can see, GOLD has come to a point where it has been rejected twice previously.

And on each of the previous occasions, PA ended up back on the lower trend line., taking around 2 years to do so on each occasions

GOLD MOVES SO SLOW - mostly due to its HUGE market cap..... But thats another story

Has the recent rise of Gold come to a line of defeat ?

The Daily chart here shows how PA is stalling at this moment in time

Each push is getting Shorter. PA is tired.

PA is Getting OVERBOUGHT on many time frames. It needs a break

The thing is, Mr Trump will later today introduce the "liberation Tariffs"

The expectation is of FEAR as reprisals and reduced markets could cause issues in the USA , including reversing the Drop in inflation.

If the Tariffs backfire, the $ will Drop..and people will look to safe haves

Traditionally GOLD. Maybe Gold can break through its old nemesis of rejection.

But PA Is TIRED

BITCOIN has been under pressure recently, following posting a new ATH and this has taken a toll on the BTC XAUT trading pair while Gold has risen.

We can see how PA dropped and has in fact, fallen below the lower line of support.

But it needs to be understood is that RSI and MACD are now in very positive positions to make a push higher.

Gold is tired

In the Near Future, we may well see the tables turn in Bitcoins Favour again

But Me Trumps, today, May actually upset that idea.

We just have to wait and see how sentiment is towards Risk assets later today , after the announcement of these Tariffs.

But, in the Longer term, once the dust settles, I do see Bitcoin taking over again and continuing its rise to greatness.....

ENJOY

Time Will tell

GOLD is in buy zone!XAUUSD has just drop to daily support with strong price action formation on the lower timeframe with an inverted head & shoulder showing possible bounce off the daily support level. As long term trend is up, we may see a sudden bounce to neck line where daily resistance is.

A possible buy trade is high probability.

Gold Price Analysis April 1D1 candle is still showing a remarkable increase of Gold. Signaling that the uptrend will continue for another half.

The wave in the h4 frame is still continuing a strong uptrend and no correction wave has appeared.

H1 is trading in the border zone of 3126 and 3142. The trading plan for GOLD to close below 3032 shows a clear downtrend to 3106. On the contrary, if the candle closes above, wait for the 3142 zone to confirm that it does not break the price, then SELL to 3106. 3163-3165 is the Target for the BUY signal to break the ATH when the candle confirms above 3143

Gold Price Analysis March 31Fundamental Analysis

Gold price attracts safe-haven flows for the third straight day amid rising trade tensions.

Fed rate cut bets weigh on the USD and also lend support to the non-yielding yellow metal.

Overbought conditions on the daily chart now warrant some caution for bullish traders.

Technical Analysis

Gold continues to hit ATH levels and is very difficult to trade with a large amount of Fomo BUY. The important point to retest the BUY signal today is at 3100-3098. And 3145 is the target level for the ATH peak of Gold today.

What do you think of the above analysis? Please leave your comments.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY analysis week 14🌐Fundamental Analysis

The Federal Reserve (Fed) kept interest rates unchanged in the 4.25% - 4.50% range and forecast core PCE inflation to average 2.8% by year-end. The higher-than-expected inflation data reinforced expectations that the Fed will maintain current interest rates for an extended period. Investors are concerned that these tariffs could add to global inflationary pressures and trigger a recession.

In Japan, the Tokyo CPI rose sharply in March, boosting expectations that the Bank of Japan (BoJ) will continue to raise interest rates this year. The hot inflation data also supported the Yen's appreciation against other currencies.

🕯Technical Analysis

USDJPY is still in a bullish recovery. The pair is facing support at 149.200, preventing further declines. The weekly high around 151.100 is still acting as key resistance before the pair breaks out to 152.000. Conversely, if the trend breaks at 149.200, weekly support is seen at 148.300.

📈📉Trading Signals

SELL USDJPY 151.300-151.100 SL 150.500

SELL USDJPY 152.000-152.200 SL 152.400

BUY USDJPY 149.300-149.100 SL 148.900

Gold (XAU/USD) Technical Analysis and Surge Factors Current Price: Gold is trading around $3,074.31 per ounce, marking a significant rise of 0.6% and reaching a record high of $3,077.44.

Technical Analysis

Support and Resistance Levels:

Support: The psychological level at $3,000 has been a robust support, with prices consistently holding above this mark during recent consolidations.

Resistance: The new all-time high at $3,077.44 now serves as the immediate resistance level.

Moving Averages:

The 50-day Simple Moving Average (SMA) is trending upward, reinforcing the ongoing bullish momentum.

Relative Strength Index (RSI):

The RSI is approaching overbought territory, suggesting that while the bullish trend is strong, a short-term pullback could occur.

Key Factors Behind Today's Surge

U.S. Tariff Announcements:

President Donald Trump's recent implementation of a 25% tariff on auto imports has intensified fears of a global trade war. This uncertainty has driven investors towards safe-haven assets like gold.

Market Reactions:

The announcement led to a decline in Asian stock markets, with significant losses in South Korea and Japan. The auto industry, vital to these economies, faced substantial impacts, prompting investors to seek refuge in gold.

Analyst Forecasts:

Financial institutions have revised their gold price forecasts upwards. Citi Research increased its three-month gold price target to $3,200 per ounce, citing robust demand from official sectors and exchange-traded funds.

NOTE

Gold's ascent to record highs is primarily driven by escalating trade tensions and the resultant market uncertainty. Technical indicators support the bullish trend, though caution is warranted due to potential overbought conditions. Investors should monitor geopolitical developments and market reactions closely, as these will continue to influence gold's trajectory in the near term.

Stay Informed & Trade Wisely! 🛡️📈

Gold Analysis March 27Yesterday's D1 candle is still a contested candle with no clear winner. If it maintains this, there may be a strong sell-off on Friday.

The wave structure is expanding in an upward direction after a push into the Asian session. The price is reacting around the 3028 area. If gold cannot break 3028, it is possible to BUY back to the peak of the Asian session in the morning around 3038. If this peak is broken, DCA will add an order towards the target of 3044. On the contrary, if the European session cannot break the peak of 3038, SELL to 3020 and if the US breaks 3020, DCA SELL to 3006. On the contrary, if it does not break, Buy back around 3020 and the gold margin will fluctuate around 3020-3028 until the end of the day.

XAUUSD – Daily (D1) Analysis🧱 Market Structure

The D1 structure is clearly bullish – price is printing HHs and HLs consistently.

Current push is a continuation from previous consolidation, breaking structure upwards.

No CHoCH or BOS bearish yet – buyers still in control.

🔵 Key Zones (marked on your chart)

1. Near-term Liquidity / Resistance

Price is approaching a marked supply zone / premium area at the top (same one from W1).

This is likely to act as a reaction point – either:

Sweep liquidity and reverse

Break through and continue higher

2. Imbalances / Mitigation Zones Below Price

These zones are clean mitigation targets if price rejects from the top:

Zone Level Description

2955 Fair value gap / inefficiency (imbalance)

2790–2800 Strong structure zone + FVG + OB

2740–2750 Potential OB + previous consolidation

2495 Deep retracement level – less likely short-term

🧩 Order Flow Observation

Very little sign of exhaustion in candles right now.

The only reason to expect reversal is if:

Price hits the extreme premium zone

We see a strong daily rejection or

Lower timeframes shift (CHoCH / BOS)

📉 EMA Perspective (implied)

Assuming EMA 21/50/200:

Price is well above EMA 21 & 50, indicating strong short-term bullish trend.

A return to EMA 21 (probably around ~2950–2970) would be a healthy pullback.

📌 Bias – Daily

Term Bias Reason Daily

✅ Bullish Clean bullish structure, no shift Short-term

⚠️ Watchful

If price hits supply zone with reaction

Ideal setup

Rejection from premium + CHoCH on H4/H1

🧠 Trade Ideas (based on D1)

🔼 Bullish Scenario

Price holds above 3060 and breaks 3090+

Entry on breakout + retest of minor OB on H1

Target: ATH sweep and continuation

SL: Below minor HL / reaction low

🔽 Bearish Scenario

Price enters supply zone → forms bearish D1 candle (engulfing / pinbar)

Look for CHoCH on H4/H1 to enter short

Target levels: 2950 ➝ 2800 ➝ 2750

SL: Above daily high or OB

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Price Analysis March 25The D1 gold candlestick confirmed a clear decline. Some late-day buying pressure around 3000 pushed the gold price a bit.

H4 has formed a bearish wave with an important price of 3028. If H4 cannot break 3028 today, there will likely be a strong sell-off of gold at the end of the day.

Trading scenario. Gold is pushing up from the 3015 price zone. Target in the European session is 3027-3028. If this zone cannot be broken at the end of the session, SELL and hold at 3008. If the US confirms a break of 3008, hold at 2983. In case of a break of 3028, the sellers are weak. Be careful of false break of 3028. If the break is real, wait for 3035 to SELL today.

Gold does not push up to 3027 but closes below 3015, then SELL to 3008. At the end of the session, if it breaks 3008, hold to 2983. If it doesn't break, then BUY again to the 3008 area, target 3028.

XAUUSD The ultimate Sniper Entry Plan for 25 March 2025XAU/USD - Daily Review & Sniper Entry Plan - March 25th, 2025

✨ Overall Bias:

Monthly: Bullish, but with a candle showing exhaustion, potential pullback towards discount.

Weekly: Indecision, but we have a small CHoCH on the structure - possible correction towards the 2980 zone.

Daily: Clear bearish candle on Friday, followed by a mild correction on Monday. Liquidity grab below 3000, but close above.

🌐 Timeframe Breakdown:

D1:

Last confirmed CHoCH.

Imbalance and FVG in the 3022-3035 zone.

Potential bearish OB between 3031-3036.

RSI below 50, momentum fading.

H4:

Lower highs / lower lows structure.

Bearish confirmation: BOS + rejection from OB.

Imbalance 3016-3026.

EMA 21 and 50 acting as dynamic resistance.

H1:

Last CHoCH in the 3024 zone.

Bearish engulfing confirmation.

Unfilled FVG: 3016-3020.

RSI < 40, increasing volume on bearish candles.

M30 / M15:

BOS on M15 and retest in the area of interest.

Last swing high at 3018.13.

Liquidity above 3018 and 3024 (EQH), below 3000 (EQL).

🔹 Sniper Entry Scenarios

Scenario 1 (Short)

Entry: 3018 - 3022 (FVG zone + OB + 61.8% Fibonacci)

Confirmation: M15 bearish engulfing or BOS + retest.

SL: above 3028

TP1: 3000

TP2: 2985 (discount zone + liquidity)

Scenario 2 (Long - Countertrend/Scalp)

Entry: 2985 - 2990 (liquidity zone )

Confirmation: M15 BOS + bullish pattern (engulfing/pin)

SL: below 2979

TP1: 3000

TP2: 3015

🔹 POI (Key Zones):

3022-3028: FVG + OB + 61.8% Fibonacci - potential short zone

3018.13: EQH - liquidity inducement

2985: Daily OB + 78.6% Fibonacci - potential buy zone

🌍 EMA Guide:

EMA 5 < 21 on H1 and M30: bearish momentum

EMA 50 acting as dynamic resistance (on H1: 3022)

🔹 Conclusion: Favorable short on retracement to the 3018-3022 zone with confirmation. Target remains the 2985 zone for liquidity. Market response around 2985 will give clarity for potential buy/scalp.

⏳ Expectations: After the Daily close, we can expect liquidity inducement towards 3020+, followed by a dump towards 2990-2985.

🔔 Don't forget to Like, Share, and Follow for more updates! Let's hit that target together! 💰📈

👉 Like if you found this helpful and follow for future setups!