Gold - Expecting Bullish Continuation In The Short TermH4 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Goldlongsetup

Let's talk about Trump, gold continues to rise

After Trump came to power again, a series of measures have deeply affected the global political and economic landscape. His policy is like a carefully planned chess game, and every move is hidden. At present, various signs indicate that Europe has become his target, and Trump is trying to achieve the strategic plot of "bleeding Europe and kicking it out of the negotiation table" by a series of means.

1. Promoting Russia-Ukraine peace talks: interest calculations under the appearance of peace

After Trump came to power, he actively devoted himself to promoting Russia-Ukraine peace talks. At first glance, it seems to contribute to world peace, but in fact it contains multiple interests of the United States. From a geopolitical perspective, the Russia-Ukraine conflict has been protracted, Russia's national strength has been continuously depleted in this war of attrition, and Europe is also deeply trapped in it. Due to sanctions on Russia, Europe's own energy supply channels have been blocked and the economy has suffered a heavy blow. If Trump succeeds in promoting peace talks, Russia will be able to get a breathing space and regain its position in the geopolitical map of Europe. In this way, Europe will lose the foundation for its tough stance against Russia. In the future strategic game with the United States, due to the internal contradictions and the change of geopolitical pattern, it will inevitably fall into a more passive and weak position.

From an economic perspective, during the Russia-Ukraine conflict, a large amount of funds flowed out of Europe due to the need for risk aversion. In theory, once Russia and Ukraine achieve peace talks, there is a possibility that these funds will flow back to Europe and stabilize the European economy. However, when promoting peace talks, the Trump administration cleverly set additional conditions, such as requiring Europe to move closer to the United States in key areas such as trade and energy cooperation. Otherwise, it will not go all out to promote the peace talks in the direction that Europe expects. This makes Europe have to listen to the United States on the road to economic recovery and gradually become a vassal of the United States' economic interests.

2. Energy pricing power game: directly hit the lifeline of the European economy

The Trump administration has listed the Alaska liquefied natural gas development project as a national priority. This move has dual strategic intentions: on the one hand, it is expected that the project will help increase the production and export of US oil and natural gas, thereby achieving the US's "energy dominance"; on the other hand, it is a "secret killer move" against the European energy market.

For a long time, the United States has been committed to breaking Europe's dependence on Russian energy and making Europe rely on US energy supply. Trump puts pressure on European allies to force them to buy expensive US energy. Take Japan and South Korea as examples. In order to avoid the US "tariff stick", they are considering investing in large natural gas projects in Alaska, and some European countries are also facing similar huge pressure. As the share of US energy in the European market gradually increases, the United States will gradually gain the right to speak on European energy pricing. Once it controls this key power, the United States can adjust energy prices at will, and with high-priced energy, it can extract the "blood" of European economic development, causing the production costs of European companies to rise sharply, and weakening Europe's overall economic competitiveness in all aspects.

3. Trade war continues: Europe becomes a "victim"

Trump vigorously promotes the trade war, and his tariff policy is like a double-edged sword. While causing harm to trading partners, it also brings certain impacts to the US economy itself. However, the Trump administration obviously has a longer-term strategic layout. In this trade war, Europe is gradually becoming a "victim".

The United States imposes high tariffs on European goods, causing European export companies to be in trouble. The share of European automobiles, high-end manufacturing products, etc. in the US market has dropped sharply. At the same time, the Trump administration cleverly used the chaos in the global trade pattern caused by the trade war to force European companies to move their production bases to the United States to enjoy various preferential policies provided by the United States. This move not only further weakened the foundation of Europe's manufacturing industry, but also caused Europe's position in the global industrial chain to continue to decline. Affected by the trade war, Europe's economic growth momentum is insufficient, a large amount of capital has flowed out, and the unemployment rate has continued to rise.

4. Release the inflation haze: shift the economic crisis to Europe

For a long time, the United States has been plagued by inflationary pressure. In order to alleviate its own economic crisis, the Trump administration intends to release the inflationary pressure in the United States. By continuously printing money and expanding fiscal deficits, the United States attempted to pass on inflationary pressure to the world, and Europe was the first to bear the brunt.

Europe and the United States are closely linked economically. As the US dollar is the world's main reserve currency, the US release of inflation has caused the dollar to depreciate. As a result, the large amount of US dollar assets held by Europe has shrunk. At the same time, the cost of importing US goods from Europe has become more expensive, which has further pushed up domestic prices in Europe. The European Central Bank is therefore in a dilemma: if it follows the United States in adopting loose monetary policies, it will further aggravate inflation; if it tightens monetary policy, it will inhibit economic growth. In this case, the European economy is stuck in a quagmire, and the United States has successfully passed on part of the cost of the economic crisis to Europe.

Trump's series of measures after taking office, whether it is promoting peace talks between Russia and Ukraine, competing for energy pricing power, continuing the trade war, or releasing US inflationary pressure, each step is precisely moving in the direction of "bleeding Europe and kicking it out of the negotiation table". Europe is facing unprecedented severe challenges in this economic war without gunpowder. Where the European economy will go in the future and how the global economic landscape will evolve will largely depend on the subsequent actions of the Trump administration and Europe's own response strategy.

Through trade wars, energy exports and other means, when the euro gradually weakens with the overall economic strength of Europe, Trump will obtain more powerful negotiation resources, thereby transferring the investment costs of the entire Russian-Ukrainian battlefield to the European economy, and he can harvest more resources.

Of course, Europe cannot be slaughtered, so returning to the current issue, the media has been reporting that Trump wants to replace Federal Reserve Chairman Powell. On the one hand, Trump hopes that the Federal Reserve will quickly cut interest rates to boost the prosperity of the US stock market. But on the other hand, Trump hopes to test whether Europe will follow the Federal Reserve in cutting interest rates by cutting interest rates. If Europe does not cut interest rates, it will inevitably lead to a greater advantage for manufacturing to return to the United States. Europe will accelerate the loss of the economic foundation of manufacturing. But if Europe follows the interest rate cut, combined with the results of the trade tariff war, it will be more open to consume the excess capacity of the United States. This will allow Trump to accelerate the transfer and digestion of US inflation.

This is a very important reason why Trump wants to replace Powell, but every time he speaks to the media, Powell is very tough and emphasizes the need to maintain the independence of the Federal Reserve. One implements its own external economic policy from the perspective of commercial asset competition. The other maintains the stability of the dollar from the perspective of currency stability. The contradiction arises in that one wants to expand without considering the risks and only cares about making money. Powell, on the other hand, considers economic stability and risks. After all, the US government is more like working for the Federal Reserve, one is like a board of directors and the other is like a CEO. The money bag is still in the Federal Reserve, and Trump needs the money bag to support his economic policy to achieve his desired goals and his own political achievements.

In a recent media speech, Trump mentioned: Gold holders make the rules. This sentence led to a crazy rise in gold prices, but then we saw that the gold price rushed to $3,500 per ounce, and then there would be a large amount of selling as long as it reached the US market stage. In my opinion, this is a selling performance led by the US government, selling at a high price to other central banks willing to take over. The gold sold by the United States at a high price must not allow other central banks to transport gold from the United States. In this way, the high-level selling seems to be exchanged for more US dollars. But the performance of gold prices rising and falling, anyway, the physical gold is still in the United States. That is, gold holders make the rules. When the United States sells gold to a certain extent and the price of gold is low enough, it will buy back gold at a low price. This is done. The gold is still in the United States, but the debt of the United States can disappear out of thin air.

Of course, this is just a way for the US government to pay off its debts. No matter how much the tariffs are added, it is actually to distinguish between enemies and friends. This crazy trade war will not last long. Not only the United States knows that it is coming, but we also know it. The reason why he still wants to do this is nothing more than to get more bargaining chips at the negotiating table. At the same time, he shows his allies how hard he is trying to suppress China's economy. But the fact is that in the future, his allies will provide blood, and he will just move his lips. After all, taking the lead in the route of suppressing China, whether or not he has achieved results, his attitude is strong enough, so he can ask his allies for more supplies later.

So we only need to pay attention to Trump in the future, how to bleed the global economy. How to dissolve the US debt. Suppress the euro, and thus announce the dominance of the US dollar again. For Asian countries, it seems that they are just watching him act. Who will win this economic war? As for who will be the final winner? There is no winner, it is just a development in confrontation. In essence, if Europe wants to escape from the clutches of the United States, it seems that it can only seek other trade models and increase Europe's infrastructure to Asia, thereby linking the economy of the entire Eurasian continent and forming the rise of the inland economy. However, Europe is currently facing a problem, that is, China's infrastructure has a global credibility and market share. It is almost impossible to be challenged. It depends on whether Europe is willing to withdraw from the stage of history, develop in a downturn, and find new ways of cooperation.

Finally, gold is bullish at 3331, with a target of around 3360

GOLD → Holdings are still insufficient, and there is still potenThe gold market has pulled back sharply one day after hitting an intraday record high of more than $3,500 an ounce. But Quaid believes that the gold rally is far from over as gold is severely under-owned and still cheap by some indicators.

Investors may see some short-term volatility as gold's parabolic move above $3,400 an ounce has made it "overbought at certain technical levels." However, overall, gold is still widely ignored by investors.

This could be a good technical target for gold. Comparing historical gold prices to the cost curve, the ratio shows that we can go further.

Although the opportunity cost of holding gold will remain high, gold remains an important safe-haven asset.

While a large number of investors continue to ignore gold, there is one group in the market that is buying as much of the precious metal as possible, and that is central banks.

Central banks will continue to buy gold as they question the reliability of the United States as a trading partner. The dollar is still weakening despite the selling of long-term U.S. bonds. This shouldn't happen, so there are definitely signs that not all US Treasuries are traditional safe-haven assets, and gold will benefit from this.

I hope this comprehensive analysis by Quaid can help all traders.

If you have other ideas, please leave a message to Quaid and we will discuss its trend together.

GOLD: Two Prominent Buying Areas to buy Gold From!Hey there! So, gold took a dip after hitting the $3500 mark, and it’s now at $3370. But here’s the thing, we think it might bounce back soon because it’s filled the liquidity gap. There are two possible points where it could turn around: right now or at $3330. Keep an eye on it and trade safely! Good luck!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

Gold Short Term UpdateGold on M15 formed a valid descending trendline with 4 touches rejected

so now we're waiting for a M15 candle to broke and close above the touch of the trendline to activate the long (buy) trade

Trade safe and don't forget to trade with risk management

Follow us for more updates and ideas

GOLD Trending Higher - Can buyers push toward 3,500$?OANDA:XAUUSD is trading within a clear ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting there's chances for potential continuation on the upside.

The price has recently broken above a key resistance zone and may come back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward the 3,500 target , which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook stays intact. However, a failure to hold above this level could invalidate the bullish scenario and increase the likelihood of a pullback toward the channel’s lower boundary.

The recent surge in gold prices is driven by escalating U.S.-China trade tensions and a weakening U.S. dollar. Gold reached a record high of $3,390 per ounce, fueled by concerns over global economic stability and increased demand for safe-haven assets. Analysts have raised their three-month gold forecast, due to ongoing market uncertainties.

Despite the upward momentum, I think still gold may be overbought in the near term, indicating potential for a short-term correction . Nevertheless, the overall bullish trend remains strong, supported by geopolitical tensions, central bank purchases, and investor demand for strong assets.

#XAUUSD: Bullish Rally To Continue $3550 Area! Gold’s been on a steady upward climb, and it seems like it might keep going up. The only thing that’s really driving it up is the fundamentals. Right now, the price is super high, and selling it could be risky.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

Cheers,

Team Setupsfx_

Gold’s Epic Surge: Why I’m Hyped for a Massive Breakout Here’s what I’m seeing with gold at $3,426, and why I’m glued to these levels just for you:

I’m betting if we smash past $3,426, gold’s sprinting to $3,454.

But if we hit a wall at $3,461, I’m bracing for a dip to $3,359. I’ve seen sellers pile in at highs before, and if they do, it’s just a quick nap before gold wakes up.

Kris/Mindbloome Exchange

Trader Smarter Live Better

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD Weekly Outlook | Bullish Bias Remains StrongGold (XAU/USD) continues its powerful rally, printing two consecutive bullish weekly candles that reflect increasing momentum and strong buying pressure. The most recent weekly candle opened at 3229.79, dipped slightly to 3193.60, then surged to a high of 3357.67, and finally closed strong at 3327.46—just a few points off the high.

The week prior also closed bullish at 3167.72, (closed well above the open of 3034.91 with significant range).

XAUUSD Weekly timeframe

✅ Weekly Bias: Strongly Bullish

We’re clearly in a higher high, higher low structure on the weekly timeframe, and there's been no sign of exhaustion yet. Last week's candle had a small bottom wick and a large body, showing that bulls dominated from open to close.

🔑 Key Zones to Watch:

Support:

🔹 3320–3211

Resistance / Targets:

🔹 3375

🔹 3400–3420 → Psychological and potential profit-taking area

📌 Trade Idea:

I’ll be watching for bullish setups on a pullback into the 3311–3320 zone. If Gold retests this area and forms bullish price action (e.g., bullish engulfing or rejection wicks on 1H or 4H), I’ll consider long entries.

🎯 TP1: 3370–3380

🎯 TP2: 3400–3420

🛑 SL: Below 3283-3298 (structure invalidation)

📣 Final Thoughts:

Gold continues to be a beast, driven by a mix of macroeconomic uncertainty, central bank accumulation, and safe haven flows. As long as the structure remains intact, dips are for buying.

Let me know in the comments—are you bullish on Gold this coming week? Or do you see a reversal coming soon?

Gold prices continue to rise as profit-taking takes place? Will Gold prices fell from an all-time high of $3,357 an ounce after Fed Chairman Powell warned that the Fed's goals could conflict, sparking concerns about stagflation. Regarding trade negotiations, U.S. President Trump said they were progressing well, adding that he was very confident of reaching a trade deal with the European Union and China. This statement has boosted market risk appetite and hit safe-haven gold.

So the previous decline only reflects investors taking profits before the long holiday weekend. However, the weak dollar and trade tensions have kept it above $3,300 an ounce.

Quaid believes that there is no short selling, only longs, and there have been many one-sided markets during this period. Judging from the current trend chart, it is still running upward and has shown signs of rising bottoms, which shows that the bulls have occupied a more advantageous position. If the big positive line continues to break new highs next week, there will be an opportunity to continue to attack 3,400.

For next week, the bullish position of gold retracement is around 3,290.

Quaid wants to say to everyone: Before going out to sea, fishermen don't know where the fish are. But they still choose to go because they believe they will return with a full load. And you, my friend, don't know whether you can make a profit, but you still need to try. Success is not something that will happen in the future, but from the moment you choose and decide to do it, you will gain something if you persist in believing. The same is true for Huang Investment. You may still be confused at the moment, but as long as you persist, the problem will eventually be solved.

GOLD: What happened?Hello friends

The trend is very bullish and given the recent events in the world, the possibility of a decline is decreasing, so we can buy in pullbacks that the price is making in steps and with capital management and risk, price targets have also been specified.

*Trade safely with us*

GOLD ROUTE MAP UPDATEHey Everyone,

A PITASTIC day on the charts with our targets getting smashed, confirmed with ema5 cross and lock to give us plenty of time to get in for the action.

After support and bounce from 3201 Goldturn into 3230 we stated that we will now look for a break and lock above 3230 for a continuation into the Bullish targets above. We got the lock opening the levels above hitting our Bullish target at 3261, followed with a further cross and lock opening 3292, which was hit perfectly and then our final lock for today above 3292 opened 3324 now complete - what a day!!!!!

We will now look for a lock above 3324 for a continuation into our final target 3352 or a rejection here will see price test the Goldturn below for support and bounce.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3261 - DONE

EMA5 CROSS AND LOCK ABOVE 3261 WILL OPEN THE FOLLOWING BULLISH TARGET

3292 - DONE

EMA5 CROSS AND LOCK ABOVE 3292 WILL OPEN THE FOLLOWING BULLISH TARGET

3324 - DONE

EMA5 CROSS AND LOCK ABOVE 3324 WILL OPEN THE FOLLOWING BULLISH TARGET

3352

BEARISH TARGETS

3230 - DONE

EMA5 CROSS AND LOCK BELOW 3230 WILL OPEN THE FOLLOWING BEARISH TARGET

3201 - DONE

EMA5 CROSS AND LOCK BELOW 3201 WILL OPEN THE RETRACEMENT RANGE

3179

3152

EMA5 CROSS AND LOCK BELOW 3152 WILL OPEN THE SWING RANGE

3120

3094

EMA5 CROSS AND LOCK BELOW 3094 WILL OPEN THE SECONDARY SWING RANGE

SECONDARY SWING RANGE

3069 - 3038

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold hovers at the All-Time High (ATH)Gold Analysis Update:

As Gold hovers at the All-Time High (ATH), it's crucial to observe how the market behaves during the London session, which is known for its high liquidity and volatility. After taking the Asian session high, the price action is now poised to potentially revisit the marked Fair Value Gap (FVG) zone.

If the market retraces to this zone and provides a bullish confirmation, such as a strong bullish candlestick pattern or a break above a key resistance level, it could set the stage for a beautiful buy-side trade setup. This would potentially offer a lucrative trading opportunity for those looking to capitalize on the ongoing bullish trend.

Let's closely monitor the price action and wait for the market to provide a clear signal before making any trading decisions.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD LIVE TRADE AND EDUCATIONAL BREAKDOWN 18K PROFITGold price retains its positive bias above $3,200 amid US-China trade war, bearish USD

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair.

Gold, adjustment is a buying opportunity

📌 Driving events

At the critical moment of the tariff war, there were signs of easing, but the market did not buy it when it came to the gold market. The US policy changed faster than turning a book, which made the market overwhelmed. Therefore, even if the latest US statement was somewhat easing, gold did not fall as a result. The current market is an extreme casino, which depends entirely on whether the correct trading signals and entry timing are grasped in time.

After the tariff war, major investment banks have recently raised their expectations for gold prices this year. Goldman Sachs' latest forecast is that the gold price may rise to $3,700 this year. In extreme cases, the gold price may hit $4,200. This forecast seems unreliable, but it is actually very mysterious. Goldman Sachs' forecasts cannot be all accurate, nor can they be all inaccurate. What does this extreme situation refer to? Obviously, there are only two points, the first is the economy, and the second is the war. Apart from these two points, there is no more significant news that can push the gold price to $4,200.

So, is it possible for the current fundamentals to have the situation predicted by Goldman Sachs? Obviously, there is. The global trade war initiated by Trump will cause all economic turmoil, and the economy will enter an accelerated recession. In addition, the United States attempts to take down Iran in order to control the Middle East and raise oil prices. If a war breaks out in Iran, the Strait of Hormuz, the lifeline of oil in the entire Middle East, will be blocked, and oil may rise to a rare height. This is the purpose of the United States. Once the above two situations occur at the same time, it is not surprising that the price of gold rises to $4,200. Therefore, instead of predicting how much the price of gold will rise, it is better to pay attention to the real-time dynamics of the United States' tariff war and layout in the Middle East.

With 36 trillion U.S. debts hanging over his head, Trump is like a child who is desperate to lose, betting on the credit of the United States. Of course, the United States has the possibility of winning the bet. The tariff war is naturally impossible for the United States to win, but the United States will not lose. In the layout of the Middle East, the United States still has the probability of winning. Although Iran is the strongest combat force in the Middle East, the United States has been deeply involved in the Middle East for many years and has also won almost all the expected goals, and is experienced. The world is calling Trump a madman, a psychopath, and a fool. In my opinion, Trump is not crazy, but may be a king.

📊Commentary Analysis and 💰Strategy

I have said that any pullback in gold is an opportunity to get on board. Buy more when the pullback is big and buy less when the pullback is small. Although it is at a high level and the risk is extremely high, it is all assumptions. The fact is that gold has always been strong. The only thing to remember is that once you are afraid of heights, don't go short. You can be timid and watch the war, but you can't go against the trend.

After the tariff war eased, gold did not fall. After a slight adjustment yesterday, it did not continue the decline. It is now strong again and stands above 3230. It rose sharply due to the tariff war, but it did not fall sharply due to the easing of tariffs. There must be a reason. In terms of technical trends, gold 3190 area forms a new support platform, and the 4-hour level forms a high-level shock pattern. This high-level shock pattern is still bullish. Once it breaks through, it will start a new wave of upward trend. At present, the trend is good and the bullish trend remains unchanged.

The market fluctuates rapidly. We have already entered long orders near 3210 in the morning. Any intraday retracement support level is a long opportunity. We should grasp it flexibly.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

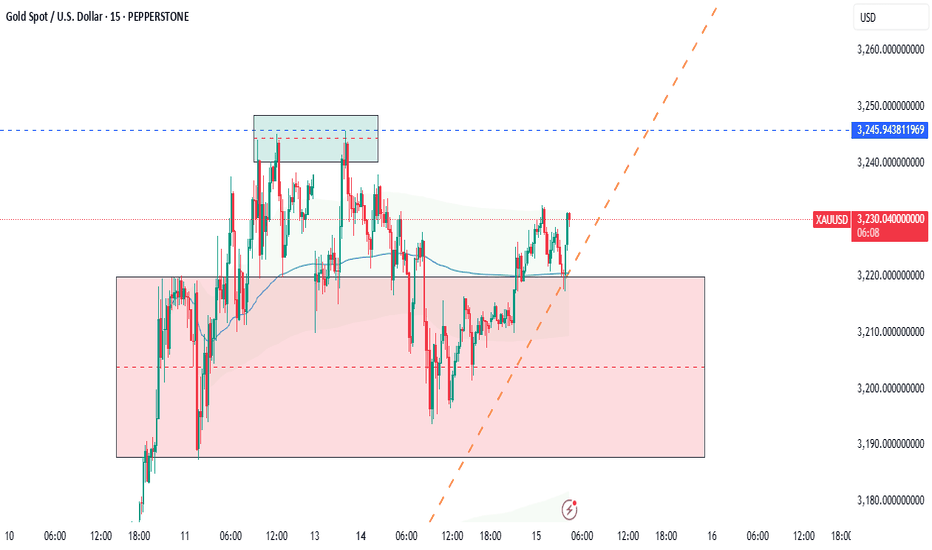

XAUUSD Technicals & FundamentalsA classic range-bound consolidation with a potential breakout setup forming.

🔧 Key Technical Levels:

Resistance: Around $3,280 — if price breaks this cleanly, bulls could push for a strong continuation.

Immediate Resistance Zone: $3,240–3,245

Support: Around $3,220 (key short-term structure)

Pivot Zone: Near $3,200–3,190 — a break below here could signal deeper downside toward $3,160

Volume: Noticeably dropping (marked by the red arrow), which often precedes a strong move. Low volume = indecision = potential volatility spike incoming.

🧠 Chart Pattern Insight:

A bullish flag/pennant type setup is visible — consolidation after an impulsive uptrend.

Arrows indicate the two primary scenarios:

📈 Upside: Break above $3,245 with volume could trigger a run toward $3,280+

📉 Downside: Break below $3,220 could drag price down to retest pivot zones or even $3,160

📰 Fundamental Factors to Watch Today:

📅 Key Events/Data Releases:

U.S. Economic Data:

Retail Sales (March) — A surprise in consumer spending could sway USD and gold.

Empire State Manufacturing Index — May affect interest rate expectations indirectly.

Fed Speak: Any comments by FOMC members on inflation, rate hikes, or balance sheet could jolt markets.

⚖️ Sentiment Snapshot:

Short-term: Neutral to bullish (sideways consolidation near highs)

Medium-term: Bullish bias remains intact above $3,200

Volatility Risk: High — expect fakeouts before a confirmed breakout.