US Banks on Fire | Revenues Soar, and So Do the ProfitsWho Needs a Recession? Banks Are Swimming in Cash!

The largest U.S. banks have reported some of their best quarterly performances in recent years, with surging trading revenues, a resurgence in dealmaking, and an overall renewal of corporate confidence playing pivotal roles. Let’s break down the key details of the results.

Market Recovery

Across the major banks, investment banking and trading activities recorded impressive performances. Goldman Sachs saw investment banking revenue increase by 24%, while Bank of America (BofA) experienced a massive 44% jump, marking its strongest quarter in three years.

The market volatility stemming from factors like the U.S. election and changing expectations around interest rates continued to fuel robust trading revenues. Morgan Stanley’s equities division, for example, reached an all-time high, while JPMorgan and Goldman Sachs enjoyed notable gains in fixed-income trading.

A surge in CEO optimism has led to an uptick in mergers and acquisitions (M&A), initial public offerings (IPOs), and private credit demand. Morgan Stanley, in particular, is seeing the largest M&A pipeline in seven years, signaling a sustained wave of dealmaking.

Mixed Results for NII

Net interest income showed varying results across the banks, but forward guidance indicates that NII will likely see moderate growth in 2025, spurred by continued loan demand and higher asset yields.

Credit Risks on the Rise

Consumer lending pressures have persisted, with JPMorgan’s charge-offs rising by 9%. Many banks are preparing for a further increase in delinquencies, particularly in credit cards.

Commercial Real Estate Challenges

While the office sector remains under stress, banks are managing their exposures cautiously and have yet to face significant shocks in this area.

Regulatory Scrutiny Continues

Citigroup lowered its 2026 profitability target as it undergoes a transformation, while Bank of America faced increased scrutiny over its anti-money laundering compliance.

Resilient U.S. Economy

Banks are reporting strong consumer spending, loan growth, and corporate profitability, which supports an optimistic outlook for earnings growth heading into 2025.

Performance Breakdown for Each Bank

JPMorgan Chase

- JPMorgan posted a record annual net income of $58.5 billion, marking an 18% increase from the previous year.

- Investment banking saw a 46% surge in revenue, driven by strong advisory and equity underwriting.

- Trading revenue climbed by 21%, led by a 20% increase in fixed-income trading.

- Despite the impressive results, JPMorgan is still facing challenges such as rising charge-offs and pressures on loan margins. CEO Jamie Dimon emphasized concerns about persistent inflation and growing geopolitical risks.

Bank of America

- BofA experienced an 11% year over year growth in revenue, reaching $25.3 billion, with net income up 112% from the previous year.

- The investment banking division saw a dramatic 44% rise in revenue, the highest in three years, thanks to strong debt and equity underwriting.

- Trading revenue grew by 10%, driven by solid performance in fixed income (up 13%) and equities (up 6%) as market volatility spurred client activity.

- BofA also reported growth in its consumer and wealth management divisions, with credit card fees and asset management showing strength. Client balances grew to $4.3 trillion, a 12% increase from the previous year.

- After several quarters of decline, BofA’s NII grew by 3%, exceeding expectations and signaling stability. The bank expects NII to continue rising through 2025, with projections of $15.7 billion per quarter by the end of the year.

Wells Fargo

- Wells Fargo’s revenue remained flat at $20.4 billion, but net income surged by 50%.

- NII declined by 8% year-over-year but is expected to rise slightly in 2025 due to higher reinvestment rates on maturing assets.

- The bank made significant progress in cost-cutting efforts, reducing non-interest expenses by 12%, thanks to workforce reductions and efficiency initiatives.

- Investment banking fees rose by 59%, benefiting from the broader market recovery and the bank’s renewed focus on its Wall Street presence.

- Wells Fargo returned $25 billion to shareholders in 2024, including a 15% dividend increase and $20 billion in stock buybacks. However, the bank continues to face regulatory constraints, notably the asset cap imposed by the Federal Reserve.

- Looking ahead to 2025, Wells Fargo anticipates modest growth in fee-based revenue, with cost discipline and efficiency gains driving improvements.

Morgan Stanley

- Morgan Stanley saw a 26% increase in revenue, reaching $16.2 billion, while net income soared by 142%.

- Equity trading revenue jumped by 51%, setting a new all-time high as market volatility sparked increased client activity, particularly in prime brokerage and risk-repositioning trades.

- Investment banking revenue grew by 25%, fueled by strong demand for debt underwriting, stock sales, and M&A activity. CEO Ted Pick noted that the M&A pipeline is the strongest in seven years, signaling a potential multi-year recovery in dealmaking.

- Morgan Stanley’s wealth management division saw $56.5 billion in net new assets, increasing total client assets to $7.9 trillion. The firm is pushing toward its goal of $10 trillion in assets under management.

- In response to growing business complexities, the firm launched a new Integrated Firm Management division to streamline services across investment banking, trading, and wealth management.

Goldman Sachs

- Goldman Sachs experienced a 23% increase in revenue, reaching $13.9 billion, while net income more than doubled, up 105%.

- Record performance in equity trading contributed to a 32% increase in revenue from this segment, as market volatility drove greater client activity.

- Investment banking revenue grew by 24%, boosted by significant gains in equity and debt underwriting.

- The firm’s asset management division saw an 8% rise in assets under management, reaching $3.1 trillion, while management fees exceeded $10 billion for the year.

- Goldman is winding down legacy balance-sheet investments but also saw a gain of $472 million from these investments in Q4. The firm’s recent launch of its Capital Solutions Group is aimed at capturing growth opportunities in private credit and alternative financing.

Citigroup

- Citigroup posted a 12% increase in revenue, reaching $19.6 billion, with non-interest revenue surging 62%.

- Fixed-income and equity markets were key drivers, growing 37% and 34%, respectively, as market volatility tied to the U.S. election boosted performance.

- Investment banking revenue climbed by 35%, supported by strong corporate debt issuance and a pickup in dealmaking activity.

- The bank unveiled a $20 billion stock repurchase program, signaling confidence in future earnings.

- Citigroup also made strides in controlling operating expenses, which declined by 2% quarter-over-quarter. However, the bank lowered its 2026 return on tangible common equity (RoTCE) guidance to 10%-11% due to the costs of its ongoing transformation.

- CEO Jane Fraser emphasized Citigroup’s long-term growth trajectory, noting improvements in credit quality and continued progress with the strategic overhaul, including the postponed IPO of Banamex, the bank’s Mexican retail unit, now expected in 2026.

Long story short

Heading into 2025, the major U.S. banks are in strong positions, buoyed by a favorable economic backdrop, continued growth in trading, and a rebound in corporate dealmaking. Despite challenges such as rising credit risks, regulatory hurdles, and potential macroeconomic uncertainties, the outlook remains positive. With a recovering IPO market, continued wealth management growth, and strong trading revenue, the banks are poised to capitalize on the renewed corporate optimism. The key question will be whether the dealmaking frenzy continues or whether uncertainties in the global economy and market dynamics could temper the rally.

Goldmansachs

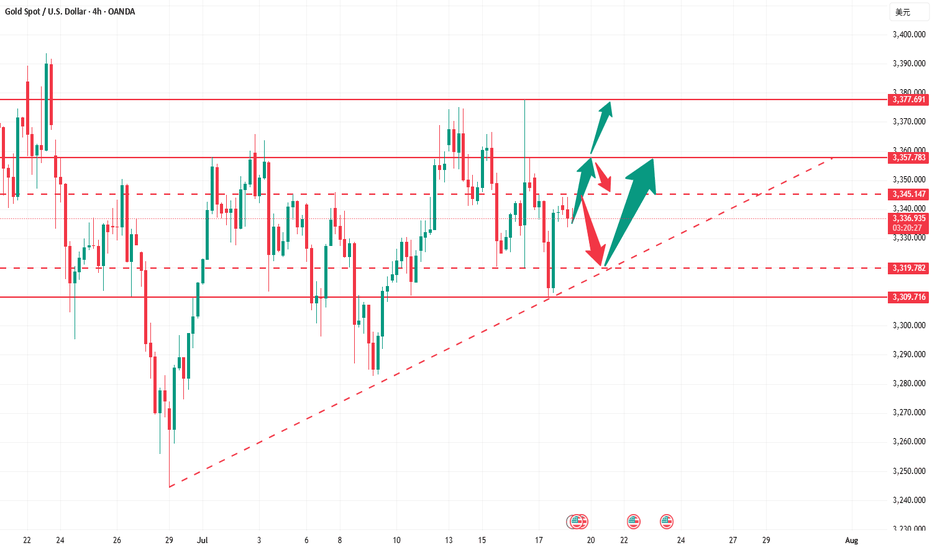

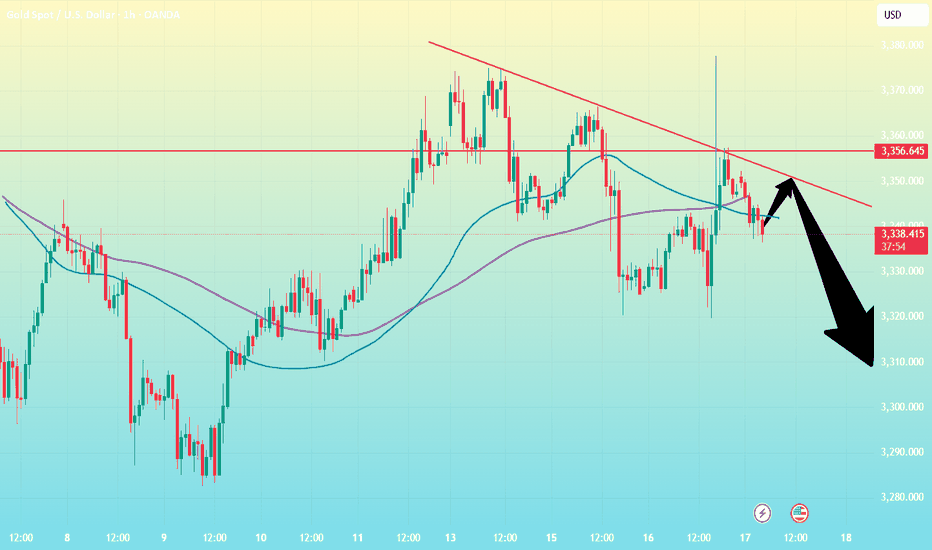

How to find solid trading opportunities amid gold volatility?Gold opened at around 3338, and then fluctuated and fell after reaching the highest point of 3344. The 3313 long orders that were publicly deployed yesterday reached the target range of 3327-3330 as expected and stopped profit smoothly. Although the overall trend is weak, it has never effectively left the range, and the typical bottoming rebound structure is still an important basis for the low-multiple thinking. The market rose to around 3340 in the short term and then fell again. The overall operation fluctuated and consolidated below 3340, and failed to reach the expected short order entry position, and maintained fluctuations until the close.

At present, gold is still in the range of fluctuations. Although the hourly line has some fluctuations, there is no obvious directional breakthrough, and it is more of a consolidation and accumulation state. The upper short-term suppression focuses on the 3345-3355 line, which is the current primary resistance area; the lower support focuses on the 3325-3315 area, and the judgment of the long and short key nodes is maintained. The daily structure shows a yin-yang staggered pattern. The market sentiment is cautious and the long and short forces are relatively balanced. Before an effective breakthrough is formed, the operation should be based on support and pressure points to avoid chasing ups and downs and do a good job of risk control.

Operation suggestions are as follows:

1. Go long near 3325-3315, with a target of 3340-3345.

2. Go short near 3345-3355, with a target of 3325-3320.

Today is Friday, and it is recommended to respond steadily, focusing on the competition for key support and resistance areas. I will prompt more real-time strategies and entry points at the bottom, remember to pay attention to it as soon as possible.

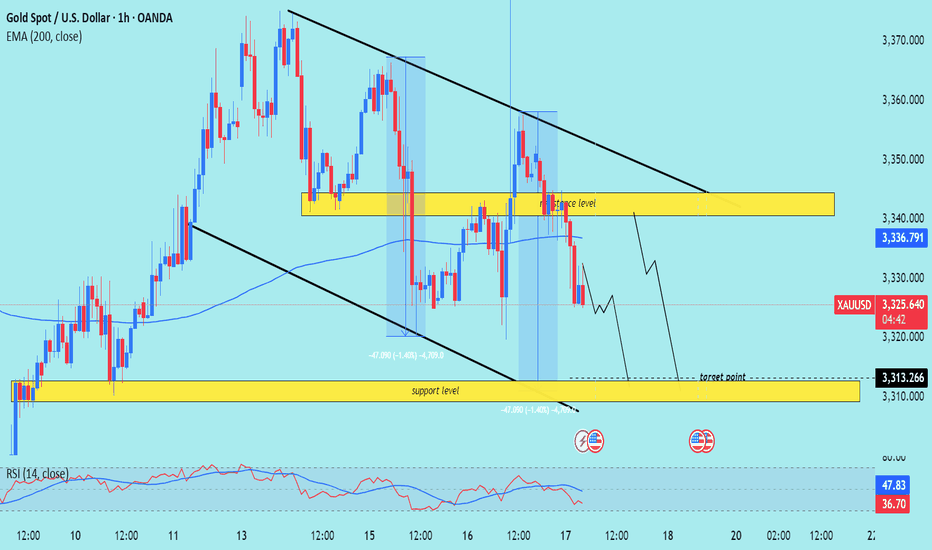

XAU/USD) bearish Trend Read The captionSMC trading point update

Technical analysis of XAU/USD (Gold Spot vs US Dollar) on the 1-hour timeframe. Here's a breakdown

---

Technical Breakdown:

1. Descending Channel:

Price is trading within a clearly defined downward-sloping channel (black trendlines).

This suggests a short-term bearish trend.

2. Resistance Zone (Yellow Box at 3,335–3,340):

Price recently rejected from this resistance area.

This zone aligns with both the 200 EMA and previous structure, strengthening its validity.

3. EMA Confluence:

The 200 EMA (3,336.798) is acting as dynamic resistance.

Price is currently below the EMA, confirming the bearish bias.

4. Support/Target Zone:

The projected target zone is around 3,313.266, labeled as a support level.

This level has acted as previous structure support, increasing its significance.

5. RSI Analysis:

RSI is at 37.18, close to the oversold region, but not yet fully exhausted.

Suggests there’s still room for a downside move before any potential bounce.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Entry: Below the resistance zone (~3,335–3,340)

Target: 3,313 (support zone)

Invalidation: Break and hold above 3,340–3,345

Risk Note: Watch for potential consolidation or fakeouts before continuation.

Please support boost 🚀 this analysis)

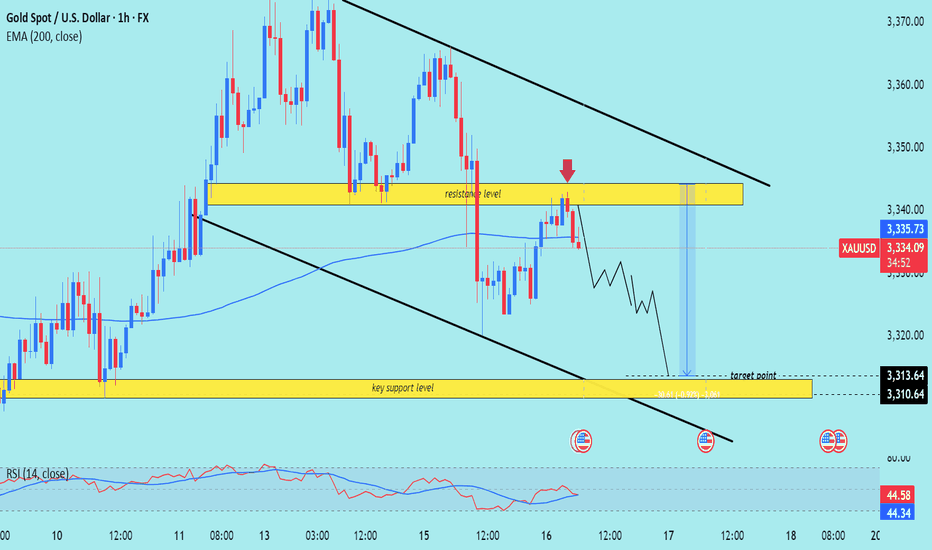

XUA/USD) Bearish Analysis Read The captionSMC trading point update

Technical analysis of XAU/USD (Gold vs USD) on the 1-hour timeframe. Here's a breakdown

Technical Analysis Summary

1. Descending Channel:

The price is moving within a clear descending channel, indicating a bearish market structure.

Recent price action rejected the upper boundary of the channel, strengthening the downtrend bias.

2. Resistance Rejection:

A key resistance level around 3,340–3,345 was retested (marked with a red arrow) and rejected.

Price has already shown early bearish candles post-rejection, suggesting weakness at that level.

3. 200 EMA (Exponential Moving Average):

Price is currently hovering around the 200 EMA, and a clean break below it could accelerate the bearish move.

4. RSI Indicator:

RSI is around 46, below neutral 50, showing bearish momentum is building but not yet oversold.

No divergence is present, supporting the idea of continuation.

---

Bearish Playbook

Entry Idea: After the rejection at the resistance zone and confirmation of lower highs.

Target: 3,313 – 3,310 zone (marked as the “key support level” and “target point”).

Risk Management: A stop loss above 3,345 (above the resistance zone) would be a prudent protection level.

---

Confluences Supporting the Short Setup:

Rejection at horizontal resistance.

Alignment with the descending trendline/channel.

Price trading near or below the 200 EMA.

RSI slightly bearish.

Caution:

Watch out for any macroeconomic news or high-impact events (highlighted with the economic event icons) that could inject volatility.

A strong break back above the resistance could invalidate this bearish setup.

Mr SMC Trading point

Conclusion:

This setup anticipates a bearish continuation targeting the 3,310 support zone. Ideal for short-term traders looking for downside opportunities, provided price respects the trend and fails to reclaim the resistance.

Please support boost 🚀 this analysis)

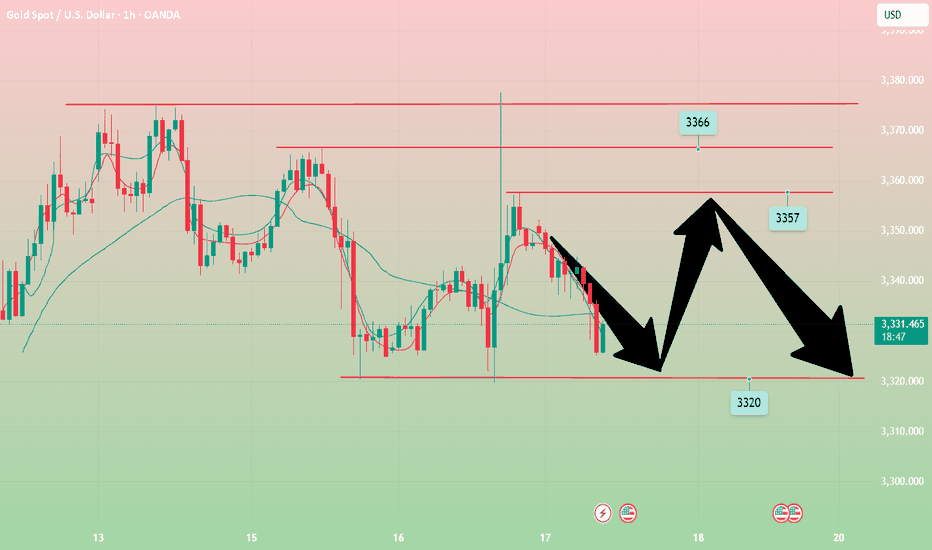

Gold----Sell near 3357, target 3330---3320Gold market analysis:

Yesterday's gold daily Asian session was still a normal shock drop. We sold at 3340 and 3341 twice to 3322 to make all profits. 3320 is the previous low point and the moving average support position. This position is also a strong support today. Yesterday, the Trump and Powell incidents made gold strongly rise to around 3377. In addition, the Middle East bully bombed Syria again, which is also the main reason for the surge in gold. However, the fundamentals are only short-lived. In the end, the gold daily line closed positive, but closed with a super long upper shadow line. Selling is still not dead. Today's gold buying and selling have opportunities, and the possibility of a direct decline is small. I estimate that the Asian session will be repaired, and our ideas for buying and selling in the Asian session can be intercepted. If it breaks 3320, consider chasing and selling again, which means that selling has started again.

The highest rebound in the Asian session was around 3352, and the highest position in 1 hour was around 3357. Today's small suppression in the white session is 3357. The following support focuses on two positions, one is 3320, and the other is 3330. I estimate that the fluctuation range of the Asian session is 3320-3357. Let's observe and wait for the position in the Asian session.

Pressure 3352 and 3357, strong pressure 3366, support 3320 and 3330, and the watershed of strength and weakness in the market is 3350.

Fundamental analysis:

Trump's dissatisfaction with Powell has not been a day or two, and the conflict is inevitable. The impact on gold is also short-term. Yesterday's pull-up and dive is a case in point.

Operation suggestion:

Gold----Sell near 3357, target 3330---3320

Gold price fluctuates! Gold operation guide!Market news:

In the early Asian session on Thursday (July 17), spot gold fluctuated in a narrow range and is currently trading around $3,341 per ounce. Rumors that Trump plans to fire Federal Reserve Chairman Powell caused violent market fluctuations. The US dollar once plummeted, and then narrowed the decline; while the London gold price gave up most of its gains after soaring. If Powell is fired in advance, it may be unfavorable to the US dollar, because it will shake the outside world's confidence in the US financial system and the safe-haven status of the US dollar.

Trump's repeated statements have caused the international gold price to experience violent fluctuations in a short period of time. The market's concerns about the independence of the Federal Reserve have become an important driving force for the rise in gold prices. However, geopolitical tensions still support gold prices. Israel launched an airstrike on Damascus, Syria on Wednesday, destroying the Ministry of Defense building, which is very close to the Syrian presidential palace. Trump's trade policy has further injected uncertainty into the gold market.

Technical Review:

The news that Trump's big mouth "considered replacing Federal Reserve Chairman Powell" caused violent fluctuations in the financial market. Although the storm subsided after Trump's denial, Wall Street has sounded the alarm. Rumors that Trump will fire Powell caused market volatility, and the US dollar index plunged and closed down 0.36% during the session. Spot gold was on a roller coaster ride, rising sharply from 3320 to 3377 in the late trading, then plunged back to 3336 and then rose again to 3357 before closing sideways around the 3350 mark.Technical daily chart structure alternates between positive and negative cycles to maintain the adjustment of the Bollinger band middle track, the indicator is neutral, the Bollinger band closes, and the RSI indicator is flat. The four-hour chart and hourly chart indicators are neutral. Affected by market news, the gold price alternates between long and short cycles and fluctuates widely, the moving average is glued, the RSI indicator middle axis is flat, and the Bollinger band is flat and closed. Gold maintains a wide range of fluctuations, selling at high prices and buying at low prices.

Today's analysis:

The gold market last night was quite exciting. In the middle of the night, Trump claimed that he would fire Powell. After the news came out, gold soared by more than 50 US dollars in a short period of time, but the market was only controlled by emotions in a short period of time. After all, the chairman of the Federal Reserve is independent, and Trump cannot have the right to fire Powell. Once the emotions passed, although gold fell sharply, it also pushed up the trend of gold prices to a certain extent! At present, after the strong rise of gold in 1 hour, it quickly fell back and closed with a long upper shadow line. The change in gold buying did not successfully stabilize. Then this market is actually a kind of catharsis of the news. The confidence of gold buying in directly rising again is not very sufficient. The gold 1-hour moving average is still in the form of dead cross selling. So gold rebounds or continues to sell.The gold 1-hour pattern excludes the influence of the upper shadow line stimulated by yesterday's news. In fact, the whole rhythm is still fluctuating and falling. The upper shadow time is not long, and it is probably just a temptation to buy. After the ups and downs of gold last night, it rebounded again to the 3360 line or continued to fall under pressure. So gold continued to rebound under pressure and continued to sell at high prices below 3360.

Operation ideas:

Buy short-term gold at 3325-3328, stop loss at 3317, target at 3350-3370;

Sell short-term gold at 3357-3360, stop loss at 3368, target at 3340-3320;

Key points:

First support level: 3330, second support level: 3319, third support level: 3303

First resistance level: 3358, second resistance level: 3370, third resistance level: 3386

Gold----Buy near 3348, target 3369-3389Gold market analysis:

Looking back at last week's market, the market performance on Monday and Tuesday last week was quite abnormal, belonging to the rhythm of a big oscillation. The following three trading days were basically relatively normal, and the market rose all the way after the buy-in. The overall market was a bottoming-out and rebounding market. Recently, investors are very confused about whether the general trend is bullish or bearish? First of all, we need to distinguish how long the general trend cycle is? If you look at the weekly line, you can at least see a 2-4 week trend. If you want to see a trend for a month, then you have to look at the weekly K-shaped and monthly trend. I understand that the long-term trend is at least a trend of one month to half a year. With the current instability of the international situation, the trend of Russia and Ukraine, the situation in the Middle East, and Trump's global tariff war, I think the half-year trend is bullish. We are short-term traders, and basically can't see that far. Looking at the trend of one week at most is the limit. Playing with long-term trends requires a 100-point mentality, and playing with short-term trends only requires technology. The first thing every Monday is to figure out the trend of the week. Buy short-term climb at the weekly close. This week's thinking is bullish first. We estimate that there will be a decline in the second half of the week. Today's weekly line is treated as a low-price buy first, and pay attention to the retracement to the support to buy. The low point of Friday's retracement near 3348 is a new support, and it is also the starting point of the pattern support 3344. In addition, the hourly stepping point is near 3342. If it does not break 3342 today, insist on buying. If it breaks, adjust the thinking to be bearish in time. A small step on the Asian session is also an opportunity to get on the train.

Pressure 3397, support 3348, 3345, 3342, the watershed of strength and weakness in the market is 3342.

Fundamental analysis:

Last week, Trump increased tariffs on Canada and will soon increase tariffs on Brazil. There is no signal of stopping the tariff war. It is long-term bullish for gold. The situation in the Middle East has not completely stopped, and it is also a long-term suppression of the US dollar to support gold.

Operation suggestion:

Gold----Buy near 3348, target 3369-3389

XUA/USD) Bullish Analysis Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) analysis on the 3-hour

---

Gold (XAU/USD) 3H Technical Analysis Summary

Market Structure: Bullish breakout

Price has successfully broken above both the downtrend line and the support zone (highlighted in yellow), signaling a shift in structure from bearish to bullish.

Key Support Zone:

The yellow zone (~3,335–3,355) was previously a resistance area. After the breakout, it is acting as a strong support level and has been retested.

Trendlines:

Downtrend line: Broken and retested.

Uptrend line: Guiding current price action, supporting higher lows and forming an ascending channel.

200 EMA (blue line):

Price is trading above the EMA 200 (~3,331), confirming bullish bias and providing dynamic support.

Momentum (RSI 14):

RSI is around 67.85, showing strong bullish momentum.

Nearing overbought, so a minor pullback or consolidation could occur before continuation.

Volume:

Increase in buying volume near breakout area suggests institutional interest or strong buyer conviction.

Mr SMC trading point

---

Conclusion:

Price has shifted into a bullish continuation pattern.

A successful break and retest of structure and trendlines increases the likelihood of further upside.

As long as price holds above the yellow support zone and the uptrend line, bullish momentum is favored.

Short-term pullbacks may offer new long opportunities.

---

Please support boost 🚀 this analysis)

XAU/USD technical analysis setup Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 6-hour timeframe, focusing on a key resistance zone that could trigger either a bullish breakout or a bearish reversal.

---

Analysis Summary

Current Price: $3,357.95

Trend Context: Price is testing a strong resistance zone with a possible breakout or rejection in play.

---

Scenario 1 – Bullish Breakout

1. Resistance Zone: $3,357–$3,372

Multiple previous rejections.

A confirmed close above $3,372.77 signals bullish strength.

2. Upside Targets:

Target 1: $3,393.87

Target 2: $3,452.08

3. Indicators:

RSI at 63.74, approaching overbought but still with room to rally.

EMA 200 is trending upward, supporting bullish bias.

---

Scenario 2 – Bearish Rejection

1. If price fails to close above $3,372.77, a rejection from resistance is likely.

2. Downside Targets:

Reversal projected toward the key support zone at $3,246.97

EMA 200 at $3,300.97 may provide temporary support before breakdown.

---

Trade Ideas

Direction Entry Level Stop-Loss Target 1 Target 2

Bullish Close above $3,372 Below $3,346 $3,393.87 $3,452.08

Bearish Rejection from $3,357–$3,372 Above $3,380 $3,300 → $3,246.97

Mr SMC Trading point

---

Summary

This is a critical decision point for Gold. A breakout above resistance can propel price to $3,450, while rejection could drive price back to $3,246. The reaction at the current zone will dictate the next major swing.

Please support boost 🚀 this analysis)

The idea remains unchanged, NY3360-3365 is emptyThe idea remains unchanged during the NY period. Although gold has currently reached a high of around 3348, it has not stabilized above it. If gold successfully breaks through 3350 in the short term, it may reach 3360 or 3365. In the 4H cycle, it presents a step-by-step upward pattern. The K-line is temporarily fluctuating sideways near the upper track. At the same time, 3345 has formed a double top pattern. Combined with Thursday's low of 3310, an inverted triangle oscillation range of 3345-3310 is formed in the short term. This week's trend needs to pay close attention to the breakthrough direction of this range. Short-term long positions can be taken after the trend is confirmed.

XAUUSD@3330-3320 long TP 3345-3365

OANDA:XAUUSD

Don’t chase shorts when gold is at a low level, wait for a rebou

From the 4-hour analysis, today's upper short-term resistance focuses on the hourly top and bottom conversion position near 3318-24. The intraday rebound relies on this position to go short once and look down. The lower short-term support focuses on the vicinity of 3280. The overall support relies on the 3280-3325 area to maintain the main tone of high-altitude low-multiple cycles. In the middle position, watch more and move less, and follow orders cautiously, and wait patiently for key points to enter the market.

Gold operation strategy:

Gold 3285-3287 line long, stop loss 3277, target 3315-23 line, break and continue to hold

Gold fell under pressure, and the watershed is 3321.

⭐️Gold Information:

During the Asian session on Wednesday, gold prices (XAU/USD) continued to be under pressure, falling below the $3,300 mark, hitting the lowest point in more than a week. The decline in gold prices comes as the market generally believes that the Federal Reserve (Fed) will maintain high interest rates for a longer period of time, especially as the market expects that tough U.S. tariffs may exacerbate inflation in the coming months.

Such expectations have pushed up U.S. Treasury yields and stabilized the U.S. dollar (USD) near a two-week high hit on Tuesday - a key resistance for the non-yielding precious metal, which continues to face downward pressure.

⭐️Personal comments:

Gold price fell below support, Dow Jones H1 pattern, gold price fell below 3300

⭐️Set gold price:

🔥Sell gold area: 3344-3446 SL 3351

TP1: $3335

TP2: $3320

TP3: $3302

🔥Buy gold area: $3256-$3254 SL $3249

TP1: $3268

TP2: $3280

TP3: $3298

⭐️Technical analysis:

Set reasonable sell orders based on technical indicators EMA 34, EMA89 and support and resistance areas.

XAU/USD) bearish Trand analysis Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 3-hour timeframe, projecting further downside after rejection from a resistance zone aligned with a descending trendline.

---

Analysis Summary

Trend Bias: Bearish

Current Price: ~$3,301.96

Structure: Price is respecting a descending channel, with multiple rejections from the upper boundary and key resistance zone.

---

Key Technical Insights

1. Resistance Zone & Downtrend Line:

Price was rejected from a resistance block near the EMA 200 (~$3,331) and descending trendline.

This level has repeatedly triggered strong downside moves (highlighted with red arrows).

2. EMA 200 Reaction:

The EMA 200 at $3,331.10 is acting as dynamic resistance.

Each time price reaches or crosses above this line, selling pressure increases.

3. Bearish Price Projection:

After recent rejection, the chart anticipates a pullback to the support zone between $3,248.26 and $3,245.71.

A deeper drop toward $3,159.13 is projected as a next major target, consistent with previous price moves.

4. RSI Indicator:

RSI at 40.24 suggests bearish momentum is still in play but not yet oversold—indicating room for more downside.

---

Bearish Trade Idea

Element Level / Description

Entry Zone Below resistance: $3,310–$3,320

Target 1 $3,248.26–$3,245.71 (support zone)

Target 2 $3,159.13 (channel base / next support)

Stop-Loss Above $3,335 (above resistance zone)

---

Risk Considerations

Fundamental catalysts: Gold is sensitive to USD strength, interest rate decisions, and macroeconomic data.

Invalidation: A strong breakout and close above the descending trendline and EMA 200 would negate the bearish outlook.

---

Summary

This analysis outlines a bearish setup for XAU/USD, supported by trendline resistance, EMA rejection, and RSI momentum. If current structure holds, a move toward the $3,245 and $3,159 levels is likely.

Please support boost 🚀 this analysis)

Short-term gold bulls and bears are anxious,3330 becomes the keyAt present, the market has been fluctuating narrowly in the range of 3330-3320, and both bulls and bears are in a stalemate. However, gold has formed a double-layer head and shoulders bottom pattern, so the short-term bullish trend is definitely unchanged. In the previous post, I also mentioned that if the rebound in the European session is weak and gold continues to be below 3345, then the short-term NY session may usher in a retracement and a second bottom. Therefore, I still hold a long order of 3325-3315, and temporarily modify the TP to the 3335 line. I expect that there may be a retracement here, but there may also be a direct retracement. No matter what the situation is, we need to stabilize before entering the market.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD FXOPEN:XAUUSD OANDA:XAUUSD TVC:GOLD

Gold's rise is consistent with my analysis

Today's market analysis and interpretation:

First, the weekly gold level: Last week, it closed with a positive K, and the closing price just returned to the lower track of the upward channel, and the 10-day moving average stood on it again; this does not rule out that the negative line break last week was an illusion; this week, the corresponding channel lower track resistance is just last week's high of 3365. Once it stands on the channel again, it is expected to gradually strengthen in the medium term

Second, the daily gold level: Yesterday, it closed with a long lower shadow cross K, so 3296 has a stabilization signal, and the wave of shocks after closing negative last week may end here; today, after filling the shadow line, it has to continue to try to be bullish, and when it breaks through and stands on the middle track, it can try to test 3400-3430

Third, the hourly gold level: Yesterday, the opening jumped and pulled up sharply, and then fell back immediately, falling from 3342 to 3296 under pressure, and the US market directly rose from 3296 to 3340; Today is exactly the same, with a gap up and a sharp pull, and it immediately fell back after touching the 3346 line. The Asian and European sessions fluctuated and stepped back to 3320; due to the loss of the middle track, there may be further room for decline before it breaks through again. The resistance is the middle track of 3330 and the upper track of the yellow channel at 3337. The support is 618 split support 3315, and further down is 3307 and 786 split support. If the support is stabilized, it will continue to be bullish. The short-term double top is 3345-46. If it breaks through and stands above, it can hit around 3365, or even 3400 and above.

Gold: update hello friends✋️

According to the recent growth of gold, you can see that it is constantly resisting and forming a falling pattern.

For this reason, it can be a warning that the fall can continue and the price will fall to the specified limits.

🔥Follow us for more signals🔥

*Trade safely with us*

Gold/USD Bullish Reversal from Support Zone Gold/USD Bullish Reversal from Support Zone 🟢📈

Technical Analysis:

Support Zone: Price is consistently respecting the horizontal support range near 3,305 – 3,310, confirming it as a strong demand zone (marked by multiple orange circles and previous bounce reactions).

Bullish Structure: After breaking the descending trendline, the price has retested the trendline and horizontal support zone, forming a higher low — a classic bullish reversal signal.

Target Projection: The measured move projection targets a potential upside near 3,366.979, aligned with previous highs.

Bullish Candlestick Patterns: Green arrows highlight bullish price action at significant reversal points, confirming buyer strength at support.

Harmonic Pattern: The shaded harmonic pattern suggests completion near the previous lows, which aligns with the reversal zone.

Conclusion:

As long as the price holds above the support area and respects the trendline retest, bulls may push toward the projected target. A break below the zone would invalidate this bullish setup.

XAU/USD) order block back up trand Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, focusing on a potential reversal from a key support/order block zone. Here's a full breakdown

---

Chart Analysis – XAU/USD (1H)

1. Key Zone: Support Level / Order Block (Yellow Box)

The price is currently testing a strong support zone that previously acted as a bullish order block (demand area).

This zone is also near a diagonal trendline and a prior breakout level, adding confluence to the setup.

2. Reversal Anticipation (Black Zigzag Path)

The chart suggests two possible scenarios from the support area:

A bullish bounce leading price up toward:

Target 1: 3,343.05 (near 200 EMA)

Target 2: 3,364.62 (upper resistance)

A break below the yellow support zone, triggering a deeper move toward:

Key support: 3,247.55

3. RSI Oversold Signal

RSI (14) is at 32.66, which is near oversold territory, signaling potential for a bullish reversal if buying pressure steps in.

4. EMA (200 - Blue Line)

EMA at 3,330.95 currently acts as dynamic resistance.

If price bounces from the order block, this EMA may serve as the first reaction level before further upside.

Mr SMC Trading point

---

Summary

Bias: Bullish bounce if price holds above 3,296.04 (order block support).

Entry Zone: Current price near 3,301 or confirmation bounce candle.

Targets:

TP1: 3,343.05

TP2: 3,364.62

Invalidation: Strong break and close below 3,296.04 may open the path to 3,247.55.

RSI: Favoring reversal conditions (near oversold).

---

Please support boost 🚀 this analysis)

XAU/USD) support level back bullish trend Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) on the 3-hour timeframe, suggesting a long trade idea with a clearly defined support zone and target projection. Here's the detailed breakdown:

---

Chart Breakdown (3H - XAU/USD)

1. Support Zone (Yellow Box):

Price reacted strongly to the 3,244–3,300 area, which is identified as a key support level.

This area has historically seen demand and is now acting as a base for potential bullish continuation.

2. Falling Wedge Breakout:

A falling wedge pattern has been broken to the upside, which is typically a bullish reversal signal.

The breakout indicates a shift from the previous bearish momentum into bullish strength.

3. EMA 200 Confirmation:

Price is now above the 200 EMA (3,333.347), supporting a bullish bias.

This can act as dynamic support going forward.

4. RSI Momentum:

RSI at 62.00, indicating growing bullish momentum without being overbought.

The RSI has also broken above a previous local high, confirming strength.

5. Target Projection:

The projected move (blue arrowed box) suggests a potential rally of +105.305 points (3.20%), targeting the 3,394.503 level.

This level aligns with previous price structure and acts as the next major resistance.

6. Anticipated Price Path (Black Zigzag Line):

Price is expected to pull back slightly, retesting the wedge breakout or support zone.

After this retest, a bullish continuation toward the target point is projected.

Mr SMC Trading point

---

Summary:

Bias: Bullish

Pattern: Falling wedge breakout + support retest

Entry Zone: Around 3,300–3,320 on a retest

Target: 3,394.503

Invalidation: Strong break and close below 3,244.166

Confirmation: Bullish price action near support + sustained RSI strength

Please support boost 🚀 this analysis)

XAUUSD – Gold at a Key AreaGold is now in a crucial zone with short potential.

If the market provides a valid bearish signal, I’ll take the short.

But if this zone breaks and confirms with a pullback, I’ll switch bias and go long.

💡 Remember:

We don’t control the market — we just try to profit using structure, setups, and solid risk management.

📌 Always risk max 1% per trade.

If the market goes against your bias, you only lose 1% — not your whole account.

🧠 One trade won’t make you rich,

But one reckless trade can destroy everything.

No gambling.

Just discipline, structure, and smart execution.

GOLD/USD Bearish Rejection From Resistance Zone – Potential DropGOLD/USD Bearish Rejection From Resistance Zone – Potential Drop Ahead! 🎯

📊 Technical Analysis Summary:

The chart illustrates a bearish setup forming after multiple rejection points near a key resistance zone around 3,360–3,380 USD.

🔍 Key Observations:

🔴 Double Rejection Pattern:

Red arrows highlight strong bearish rejections from resistance.

Indicates sellers are defending this zone aggressively.

🟠 Support Turned Resistance:

The previous support (labelled as "SUPPOT") is now acting as resistance.

Classic bearish retest behavior.

🔷 Bearish Flag Formation:

Price consolidates in a descending flag pattern.

Breakdown below the flag suggests continuation to the downside.

🎯 Target Zone:

If breakdown confirms, price may drop towards target area near 3,275–3,280 USD (marked as “TARGET FAXS”).

🟧 Important Reaction Zones:

Multiple orange circles indicate zones of high reaction – historically significant for both buyers and sellers.

📌 Conclusion:

Unless bulls reclaim the 3,360–3,380 resistance zone convincingly, the bias remains bearish, and the next leg down may target the 3,280 USD area.

🔔 Traders should watch for a clean break below 3,320 to confirm bearish continuation.

This week's market review and next week's market strategy analys

Gold trading has ended this week. This week can be said to be very exciting. It closed with a positive line this week, with the lowest point near 3247, and then rebounded to 3365 and then retreated. When the non-farm data were all negative, the lowest point fell to 3311 and rebounded. Gold did not fall below the support of 3300. This shows that the gold bulls are still there. We also went long at the bottom many times after the non-farm data. I believe that traders who follow me can see that we have publicly gone long at 3324 many times and exited with all profits. We firmly believe that the retracement is an opportunity to go long, and the market result is just as I analyzed. The bulls returned to the range before the non-farm data. Since the market is closed on Friday for Independence Day, the overall fluctuation of gold will not be large. We will continue to be bullish on gold next week, and the operation will continue to be mainly based on retracement and long. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me.

From the 4-hour analysis, pay attention to the 3324 support line below, focus on the 3316 support line, and pay attention to the 3345-50 short-term resistance above, and focus on the 3365-70 line suppression. The overall low-multiple cycle participation main tone remains unchanged. In the middle position, watch more and do less, be cautious in chasing orders, and patiently wait for key points to participate. I will release signals on the free channel for specific operation strategies, and pay attention in time.

Gold operation strategy:

Gold 3324-30 line long, stop loss 3315, target 3365-70 line, continue to hold if broken

Go short before breaking 3350, go long before falling to 3320📰 News information:

1. Geopolitical situation

2. Tariff implementation and interest rate cut bill

📈 Technical Analysis:

As I said, the US stock market closed early today, and the market will lack some momentum. It is difficult to have a large fluctuation. It is expected to fluctuate and consolidate. I also explained in the previous post that the upper pressure in the short term is at 3340-3350. If it is touched, we can try to short and defend 3360. If it falls back to 3323, we can try to go long for the first time. If it continues to fall, it is expected to reach 3315-3305. Therefore, if it first touches 3323, go long, SL 3316, and consider going long if it touches 15-05 below.

🎯 Trading Points:

SELL 3340-33350

TP 3330-3320-3310-3300

BUY 3323

TP 3333-3340-3350

BUY 3315-3305

TP 3325-3333-3340

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD