AEM. Looking for Gold miners? Agnico Eagle Mines is your pick!Agnico Eagle Mines ( NYSE:AEM ) is the gold mining company that I picked as a long-term investment over many other miners such as Equinox and Barrick Gold. I picked it based on which countries have USD Swap Lines , an idea explained by Katusa Research in one of his videos on YouTube. I will explain it briefly here. A USD swap line is an open channel between the US Federal Reserve and certain central banks such that the bank can borrow USD at any time almost instantly up to a certain limit (such as $100 billion dollars). This provides the liquidity necessary for those central banks to settle their balance sheets, loans, settle large money transfers and currency conversions, and do other central-bank-y things that you can read online. In practice, what this means is that it is much cheaper and much more reliable for, say, an American gold mining company to realize earnings from its oversees mining operations if those mines were located in Canada or Mexico (USD Swap line countries) rather than if the mines were located in Turkey for example.

You can find here the list of worldwide central banks that have USD Swap Lines, or I can save you time and list them here:

Before CV-19, the US Federal Reserve had standing USD liquidity swap lines with the central banks of the following countries with a ceiling of $100 billion each:

Canada.

England.

Japan.

European Union.

Switzerland.

And on March 20, 2020, the Federal Reserve extended this arrangement to nine more central banks:

$60 billion for each of:

Singapore.

Australia.

Brazil.

Denmark.

South Korea.

Mexico.

and $30 billion to each of:

New Zealand.

Norway.

Sweden.

As it happens, Agnico Eagle Mines has almost all of its revenue coming from mines located in USD Swap Line countries as opposed to Barrick gold which relies on mines located in Argentina, Chile, Cote d’Ivoire, the Congo, Peru, Saudi Arabia, Tanzania, and other similarly Non-USD-swap-line countries. That alone puts me at more ease of mind as an investor. And I recommend that you weigh in this element in all other kinds of investments.

That's it for fundamental analysis. From the technical analysis side, AEM has been struggling with the ascending trend line. I believe this will be long-time support once we settle above it. I see two paths for price which I determined by two things:

1. The long curve which you can see in the following chart:

2. The Linear time cycle of 272 days, which nicely aligned many momentum shifts. We can use as an approximate indicator next to other clues later when we're approaching the next time zone and are looking for signs of reversal or momentum.

The rest is in the chart. I drew two paths and I expect the lowest point to be the support at $55.60. I am more confident in the higher price path that takes us to $175 by April 2022.

Conclusion : This is a long-term investment for those that chose to invest in gold miners. I believe AEM is a solid pick and is set for growth.

Goldminers

XAU A lot of confluence here on the bottom trend line of my leading diagonal & the bottom trend line from the March 2020 lows, so much bearish sentiment in XAU currently & also $DXY seem about done with the push. On top of all that yields seem ready to drop, we could have a nice set up for XAU to at least retest the ATH's & breaking that opens the door for $2400.

Miners seem all about done & also they r so bloody wrecked that if I had extra $$$$ I would load up on those gold miner stocks IMO. Anyway just my thoughts guy always DYOR. Good Luck!

GDX... still in bear modeGDX... no change in trajectory - bearish.

Previously, called and exited near the top in August 2020 and expected this bearish tones.

Noted BRB Buy Signal triggered as well as the RPM attemping to turn bullish.

Otherwise, MACD is clearly heading down and GDX gapped down to break two support levels in one candle.

More downside seen, at least to 30. possible maximum stretch to 26.

Hummingbird Resources set to bounce from channel's bottomHummingbird Resources LSE:HUM is a gold miner, which stocks are traded on the London Stock Exchange.

It benefits from a very low valuation with a PER of less than 4 at the time of publishing.

After a lengthy consolidation inside a descending channel the stock price now hits the lower channel's boundary in a super oversold condition.

It is time for a bounce in direction of the upper channel boundary, before expecting a channel's break to the upside.

Gold miners arragement Some gold miners operate synchronously.

They have been falling since the peak of August.

They are quite sensitive to movements in gold prices, maintaining a positive correlation.

They are trading below their 200 day simple moving average (undervalued signal).

Its last 2 peaks have occurred in the first week of the month, 2 months apart.

What is the possibility that another peak occurs in early March?

Either everyone goes up or everyone goes down.

I get the impression that they are going to rebound at the same time.

Gold Still Trending Inside Bull FlagGold price has created a descending parallel channel on the chart, and since it occurred after a significant move up it is more commonly referred to as a ‘bull flag’ due to the overall structure of the move resembling that of a pole and flag. The anticipated move here if price can remain inside of the upper half of the bull flag is a continued move higher and a break through and above the upper channel line. Should that happen price will likely march back up to test the recent all-time high made on Aug 10th of $2075/oz, which I’d expect to be taken out and a new all-time high near $2200/oz be made based on other charts that will be shared later with more detailed analysis.

Looking back at 2020 gold price performed extremely well, gaining roughly +43% from the March lows near $1450/oz to the August high of $2075/oz. I’d attribute most of those gains to gold being a fear hedge during times of uncertainty in markets, which we saw plenty of in 2020. Gold also by nature performs well when the underlying currency it is priced in is being inflated(money printing). With a new round of $600 checks recently having been sent out by the outgoing administration, and $1400 checks on the way from the incoming administration, gold should continue to outperform over the next few years as stimulus checks and corporate bailouts appear to be the new norm and a necessity for the economy during these unprecedented times. Regardless of the reason, money printing is inherently bullish for gold so physical and mining shares will continue to be a portion of the portfolio.

GDX continues its original path - DOWN to 30GDX... one of my favouorites, but now is in a major retracement.

Again, three out of four factors are not favourable:

1. USD rising

2. Gold bearish

3. Equities Bearish (or soon to be)

Only Low Interest Rates are favourable.

The weekly chart has a GAP DOWN (ignore the BRB Buy signal for now), and it closed below the weekly 55EMA, which is a significant development.

MACD is crossing down soon in bear territory, and the RPM is pushing down again!

Shifted downside target to 30, mid Feb 2021.

GDX resumes its original pathA month ago, the GDX gapped up above the 55EMA to break a downtrending cycle. But it was not sustainable, as previously observed.

This week saw the concomitant plummet, alongside Gold, which closed the previous Gap Up with a Gap Down, bringing the week closure below the 55EMA. This is a failed breakout.

Technicals support this bearish turn of events, with the MACD and the Price Momentum crossing down.

The drivers for this downside move have been described previously...

Target 32-33 in Feb 2021.

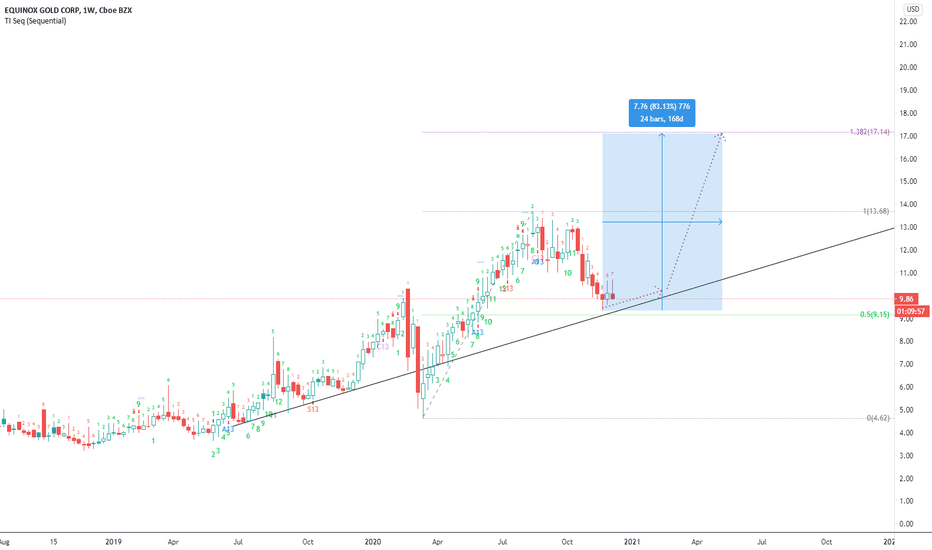

Equinox Gold setting base for an upward moveI believe Equinox Gold is valued much higher than current stock price, but I'm only following technical analysis here. This trend line has held for 18 months, and the swing gives indication for the volume of the coming upward momentum. I chose 1.382 of the previous swing to determine my target. I'm not confident about the target. I think time analysis will prove better method here. Also, the momentum for a launch upwards has not shown yet. I'm assuming it's going to be in a few weeks. So I'll be updating this as we go along.

Gold Bull Flag Breakout AttemptGold price #xauusd is attempting to break above the upper line of the downtrend channel which would be a bull flag breakout, and the expected result of the bull flag pattern. The next resistance level stems from the local high made in early November at $1,966/oz. The stop-loss level stems from the local low made in early December at $1,763/oz. A break above the red line is bullish, a break below the yellow line is bearish.

The Price Percent Oscillator(PPO) shows the green PPO line rolling back up above the 0 level which is bullish as a move belwo the 0 level would indicate a shift to bearish price momentum in the intermediate-term. What we want to see going forward is for the green PPO line to cross back above the purple signal line as this would indicate a shift back to bullish price momentum in the short-term. The PPO indicator is currently reading bullish overall.

The Average Directional Index(ADX) shows the green +DI line above the purple -DI line which indicates a postive trend behind price in the short-term. The histogram in teh back round is green and declining which means that the dominant trend(bullish) is weakening. What we want to see going forward is for the green +DI line to remain above the purple -DI line and for the histogram bars in the background to begin rising to indicate a strengthening bull trend. Overall, the ADX is reading bullish.

The Traders Dynamic Index(TDI) shows the multi-color RSI line currently green and trending back above the centerline of the Bollinger Bands which indicates that momentum is shifting bullish in the short-term. The TDI background is currently green and filling the 40-80 levels which indicates that price has bullish momentum in the intermediate-term. When the bulk of the RSI action is between the 40-80 levels the overall momentum behind price is considered to be bullish.

Overall, gold price is looking good for a re-test of the $2,000/oz level and will more than likely push through it this next time. The most important thing that we learned in 2020 is that there is no limit to the trillions of dollars that will be printed and spent to prop up the stock market. Gold and silver should perform well for the foresseable future because printed money and low interest rates are the only thing keeping the stock market going. Those happen to be two perfect reasons to own precious metals, both physical and stocks.

GOLD MINERS GDX bearish tonesPlease see Chart... recent minor failures hint of bearish tones, and technicals are crossing down.

Overall, the equity markets are pushing higher on air and expecting a serious pullback soon, after a surprise trigger.

Gold prices are not moving despite USD weakening... this is bad for Gold, and Gold Miners particularly.

Once the USD jumps, and Gold drops, then the Gold Miners will be in double jeopardy.

I like GDX, but it is reeking of danger right now. I would be very wary IMHO...

Starts PMs Production Next Year in a $1700+ and $19+ EnvironmentI prefer to look at and use logarithmic charts because they're less dramatic but included the regular one for comparison.

DYDD.

The targets I put on the chart are conservative. Conceivably a $3 to $5+ stock. In the medium and long-run I think it makes new all-time highs.

Technical Analysis doesn't have to be fancy.

EURO RESSOURCES - 2020 - Gold PEA francais - DaillyEURO RESSOURCES - 2020 - Gold PEA francais - Dailly

Almaden Minerals Ltd. - 2020 - Dailly NovemberAlmaden Minerals Ltd. - 2020 - Dailly November

As announced on November 18th, the Company discovered several areas of veining cropping out within the SE Alteration Zone of the Ixtaca Project while mapping promising clay alteration in the area.

Seventeen samples of the veining were collected and submitted for analysis to ALS Global in Zacatecas, Mexico. All but one sample returned below detection gold and silver, with the exception returning a value of 62 ppb gold. However, even though the outcrops are leached and weathered, many of the samples also returned elevated values for epithermal pathfinder elements which are commonly found in the higher parts of epithermal alteration zones.