Weekly Outlook – XAUUSD Key Levels Map🟩 Weekly Outlook – XAUUSD Key Levels Map

📍 Premium Supply Zone:

‣ 3246 – 3275 → Price currently testing this premium area; potential reaction zone.

📍 Wick High / Liquidity:

‣ 3246.07 → Weekly wick = clear liquidity, useful for sweep/rejection monitoring.

📍 Weekly FVG (Fair Value Gap):

‣ 3085.16 → First key imbalance zone below current price, valid draw for bearish correction.

📍 Equilibrium Zone (Macro Weekly):

‣ ~2800 → Midpoint between recent major swing low and swing high = macro balance area.

📍 Origin of Macro CHoCH:

‣ 2372.54 → Anchored zone for deeper corrections; institutional footprint from structural shift.

Goldpattern

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: 17th February 2025

Hello Traders,

Here’s a weekly chart analysis of GOLD, offering an in-depth look at recent market trends and future outlook. Since October 2023, our consistent tracking has achieved 100% target accuracy, as shown by the Golden Circle markers on the charts. Let’s break down the highlights and what’s next.

Recap of Last Week’s Successes

Weekly Chart Highlights:

* EMA5 crossed and settled above Entry ✅ 2735 reached

* Bullish Target TP1: 2877 ✅ Achieved

* GoldTurn Levels at 2875 activated twice ✅ Reached

What’s Next for GOLD? Bullish or Bearish?

After hitting ENTRY LEVELS at 2735 and TP1 2877, we saw a small close above 2877 last week, leaving 3018 open as a potential target. We mentioned that an EMA5 lock would confirm this movement.

While EMA5 hasn’t locked yet, the close from last week provided a solid push upward, gaining over 500 pips. The long-term gap remains open, with more movement likely after last week’s candle body close.

Key Level: 2735 remains a critical zone.

GoldTurn Levels at 2875 and 2735 are active, and the price may revisit these levels before bouncing back to reach TP1 and beyond.

Recommendations & Strategy:

* Focus on EMA5: Watch its behavior around 2877 for key signals on short- and long-term trades.

* Support Levels: GoldTurn levels at 2875 and 2735 are vital for identifying reversal points and prime dip-buying opportunities.

* FVG Support: A range between 2835 and 2850 is also supportive.

For precise entry and exit points, check our daily, 12H, 4H, and 1H analyses for clearer market guidance.

We’ll continue to provide daily updates, insights, and strategies on our TradingView and YouTube channels every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

Road to 3200Gold had a strong 4hr timeframe rejection from the 2960-2980 zone.

Also had a triple bottom in the same area.

Showing super strong signs of another bullish run.

Gold is making the strong move up to the 3140 area once 3100 is broke.

Should get a small rejection off the 3140 zone before a strong push up to a new all time high.

Next all time high goal is 3200 🚀

Short Notes:

•Run up to 3140 (Small rejection/load up zone)

•Then Load up zone 3110-3100

•Take Profit area 3200

As always, trade safe during these high volatility times and go crush it!💰

XAUUSD Daily Sniper Plan – April 8, 2025“Goldie’s mood swings: from drama queen to calculated killer.”

Gold decided to throw a tantrum after NFP and play peek-a-boo with everyone’s SL. But beneath the chaos lies structure—and we speak structure fluently. Let’s map this battlefield with sniper entries and cold logic. No guessing, just high confluence.

📌 Macro Context

🏛️ Geopolitical: Israel-Iran tensions still simmering. Headlines = spikes. Stay nimble.

💰 Fundamentals: Stronger USD post-NFP; Fed tone remains hawkish.

🔍 Technical Environment:

H1/H4 break of bullish structure

D1 printed a brutal engulfing candle

EMA 5/21/50 all pointing down on M30–H1, kissing goodbye to bullish hopes (for now)

“The spike was no accident. Smart money never sleeps.”

📉 Bias: Bearish intraday flow under OB 2980–3000

🔻 SELL SETUPS

🟥 SELL SETUP 1 – OB Rejection Sniper

📍 Entry: 2995–3000

🧠 Why: H1 valid OB + imbalance + bearish CHoCH on M5

🎯 TP1: 2960

🎯 TP2: 2915

🛑 SL: 3008

💬 Classic OB rejection. Look for a wick grab then drop on LTF.

🟥 SELL SETUP 2 – Stop Hunt Pop

📍 Entry: 3010–3015

🧠 Why: Liquidity sweep above 3000, into bearish FVG zone

🎯 TP1: 2975

🎯 TP2: 2940

🛑 SL: 3019

💡 Ideal on a fast pump, then M1 bearish structure shift confirmation.

🟥 SELL SETUP 3 – EMA50 Tap & Fade

📍 Entry: 3035–3040

🧠 Why: Confluence of bearish trendline retest + EMA50 (H1)

🎯 TP1: 2990

🎯 TP2: 2950

🛑 SL: 3046

🎯 Catch the fakeout bounce. Risk defined. Trend respected.

🟩 BUY SETUPS

🟩 BUY SETUP 1 – Deep Discount Bounce

📍 Entry: 2945–2955

🧠 Why: M30 OB + unmitigated FVG + 0.618 FIB

🎯 TP1: 2990

🎯 TP2: 3030

🛑 SL: 2938

💬 Only valid if 2960 gets flushed cleanly with momentum shift.

🟩 BUY SETUP 2 – Retest of Previous Demand

📍 Entry: 2905–2915

🧠 Why: Unmitigated H4 OB zone + previous bounce structure

🎯 TP1: 2960

🎯 TP2: 3000

🛑 SL: 2895

📈 Take this if we get heavy stop hunts early and DXY slows.

🟩 BUY SETUP 3 – Extreme Demand Sweep

📍 Entry: 2885–2895

🧠 Why: HTF demand zone + psychological 2900 + imbalance

🎯 TP1: 2950

🎯 TP2: 2980

🛑 SL: 2878

🧠 Perfect for the brave — sniper only on strong bounce confirmation (M5).

⚔️ Key Levels Recap:

🔸 3000–2980: Valid OB resistance zone

🔸 2960–2950: Discount reaction base

🔸 2915 / 2890: Deeper liquidity zones

🔸 3045: SL invalidation on bearish bias

🔸 2880: Final demand for aggressive longs

🧠 Strategy Notes:

Watch for manipulation moves into OB or imbalance before taking entries.

Wait for CHoCH or PA confirmation on M1–M5 before executing.

Don’t chase — sniper setups only.

💬 "Goldie might be emotional, but our setups aren’t."

🗣️ Let’s grow together!

🔥 If this sniper plan gave you clarity, drop a like & follow on TradingView 💬

Let’s grow a strong trading community built on structure, not signals.

Stay sharp & stay kind, legends! 💛

📌 No guessing. No chasing. Just smart money and structure.

XAUUSD Weekly Swing Trade Setup (Targeting New Highs)

Entry 2990

Last week's price action in XAUUSD was dramatic. Initial surges, driven by tariff announcements, propelled the pair to record highs. However, this was followed by a significant correction, leaving the market in a state of uncertainty as we enter the new week.

Considering the current market context (tariff implications, upcoming US economic data, central bank commentary) and the potential for continued volatility, this swing trade idea is indeed ambitious.

The Core Strategy:

We are anticipating a further decline in XAUUSD to a major support level. The key to this trade will be observing a strong rejection at this support, indicating renewed buying pressure. The ultimate goal is to capitalize on this potential rebound and ride the momentum towards making new all-time highs.

Key Considerations for the Coming Week:

Identify the Major Support Level: Pinpointing this level is crucial. It could be a significant previous swing low, a key Fibonacci retracement level, or a strong psychological barrier. Careful technical analysis is required to determine the most probable zone.

Confirmation of Rejection: We will be looking for clear bullish price action at the identified support. This could include bullish candlestick patterns (e.g., engulfing bar, pin bar), positive divergence on momentum indicators, or a break of a short-term downtrend line.

Risk Management: Given the ambition of targeting new all-time highs after a significant correction, robust risk management is paramount. This includes setting a well-defined stop-loss order below the identified support level to protect capital in case the rejection doesn't materialize. Position sizing should also be carefully considered.

Potential Catalysts: Be aware of the upcoming economic data and central bank commentary, as these events could significantly impact price action and either support or invalidate this trade idea.

Patience is Key: This is a swing trade, and the anticipated move may take time to develop. Avoid premature entry and wait for clear confirmation of the rejection at the support level.

In essence, this is a contrarian swing trade based on the expectation that the underlying bullish drivers for gold will reassert themselves after the recent correction. We are aiming to buy low at a significant support level with the high-conviction target of reaching new all-time highs.

Disclaimer: This is a potential trade setup idea and not financial advice. Trading Forex involves significant risk, and you could lose your capital. Conduct thorough research and analysis before making any trading decisions.

Gold is still weak, rebound can still be shortedThe 1-hour moving average of gold still continues to cross downwards, and the strength of gold shorts has not weakened; gold rebounds are still mainly short selling. Although gold rose after covering the gap for one hour, the upper shadow line soon fell. Gold is still weak overall, and gold is under pressure near 3050 in the short term.

Trading idea: short gold near 3042, stop loss 3052, target 3022

The above is purely a sharing of personal opinions and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

XAUUSD Daily Plan – April 7 | Sniper EntriesNo guessing. No chasing. Just structure, logic, and precision entries. Based on current structure from H4 down to M15, price is hovering above a major reaction zone, and both bulls and bears have valid reasons to get involved — only if the zone speaks. Let’s map the battlefield 👇

🔹 Market Snapshot:

After the perfect sniper short from 3135, price printed a series of LHs and lower closes.

Now reacting from the 3015–3020 demand/FVG zone, respecting both internal structure and a long-term trendline.

RSI recovering from oversold on M15/H1. Volatility likely as we approach NFP aftermath flow.

🟩 BUY SCENARIO 1 – “The Bounce from the Base”

📍 Entry: 3020–3015

🧠 Why: Bullish M15 FVG, trendline support, RSI reversal

🎯 TP1: 3086

🎯 TP2: 3130

🛑 SL: 3008 (below swing low + OB invalidation)

💬 Classic sniper entry on bullish reaction + CHoCH on M5

🟩 BUY SCENARIO 2 – “Deeper Tap, Higher Reward”

📍 Entry: 2975–2965

🧠 Why: Untouched M30 OB + imbalance zone + D1 demand

🎯 TP1: 3050

🎯 TP2: 3086

🛑 SL: 2958 (below OB + psychological 2960)

⚠️ Only take if 3010 breaks clean and flushes into this area

🔻 SELL SCENARIO 1 – “Short the Retest”

📍 Entry: 3107–3115

🧠 Why: M15 OB + unmitigated FVG + CHoCH after LH

🎯 TP1: 3030

🎯 TP2: 3010

🛑 SL: 3119 (above OB + intraday wick space)

💬 Look for M1–M5 confirmation & bearish PA

🔻 SELL SCENARIO 2 – “The Premium Re-Entry”

📍 Entry: 3135–3142

🧠 Why: Strong OB zone, premium liquidity grab, equal highs

🎯 TP1: 3086

🎯 TP2: 3020

🛑 SL: 3148 (above liquidity + invalidation of OB)

🧠 Still valid if price rallies fast — best with RSI divergence

🧭 Key Levels Recap

3142 – Upper premium OB

3115 – Intraday LH rejection

3020 – Bullish FVG + trendline

2965 – Deeper demand zone

2958 / 3148 – Final SL protection areas

💬 Let’s Grow together

If this sniper plan helps refine your view: ✅ Like if it aligns with your bias

🔔 Follow for clean, daily smart money plans

💬 Drop a comment with your scenario or questions

We're here to build consistency — one precise setup at a time. 🎯

Stay sharp, stay kind! 💛

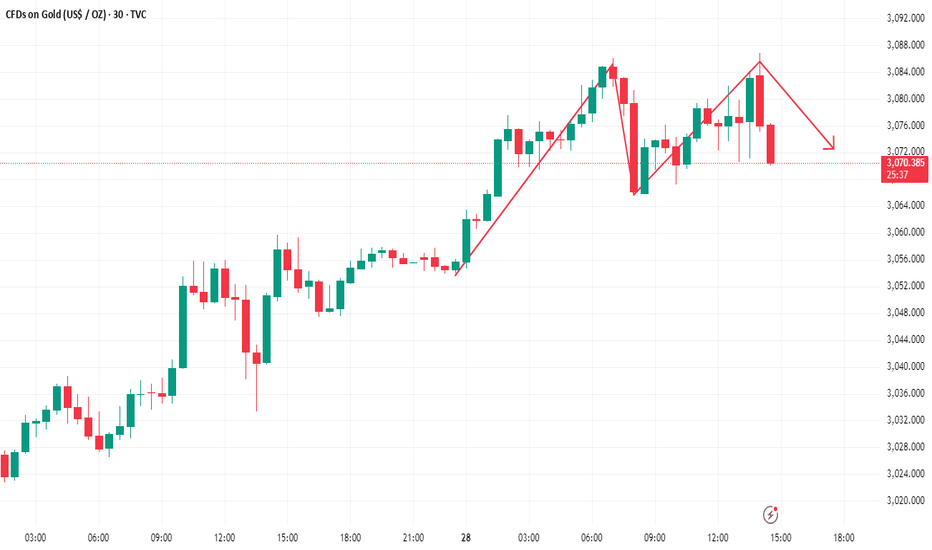

Gold continues to fall, what will happen next week?After the gold price fluctuated sharply at the high level in the past two days, gold finally broke down on Friday. In fact, the market was too active in the past two days, and the overall volatility was very large. In fact, it was still a little difficult to trade. Although the overall outlook is bearish, the rebound amplitude is actually not small each time. Now sometimes it rebounds more than 20 US dollars in a few minutes, so it may continue to fall after a loss. Now that the gold daily high is covered by dark clouds, how should we trade next week?

The gold 1-hour moving average has formed a death cross downward, so the gold shorts still have power, and the short-term gold can only rebound. After the rebound, the shorts will continue, and then the gold will enter a shock. After the high-level plunge of gold, the shorts will be more dominant in the short term. Unless there is a big positive news, it is difficult for gold to rise directly. The resistance for gold's rebound is 3076. If it is under pressure, then gold's rebound will mainly continue to be short on highs.

GOLD Bullish Trend Continues After FVG Test🟢 GOLD is maintaining strong bullish momentum after successfully testing a Fair Value Gap (FVG). A Break of Structure (BOS) confirms the uptrend, with higher lows forming—a clear sign of continuation.

📊 Analysis:

✅ Bullish Trend: The price structure confirms an uptrend with higher highs and higher lows.

✅ Fake Reversal Break of Structure (BOS): A key level has been broken, signaling reversal but based on current momentum that follows it shows Buyers continued strength.

✅ FVG Test Success: Price respected the Fair Value Gap, reinforcing buying pressure.

✅ 🎯 Target: , aligning with .

✅ 📈 Momentum: Strong upward drive suggests further gains ahead.

🔮 Potential Scenario:

The price is likely to continue climbing, forming a new higher high toward the target level.

📢 Confirmation Signals to Watch:

📌 Volume: Increasing volume on bullish moves.

📌 Candlestick Patterns: Bullish signals at key support levels.

📌 Moving Averages: Price holding above critical moving averages.

📌 🚨 Disclaimer: This is not financial advice. Trade responsibly and conduct your own research.

🔗 Tags:

#GOLD #XAUUSD #Bullish #TechnicalAnalysis #TradingView #FVG #BreakOfStructure #TrendAnalysis #PriceAction #MarketAnalysis

What reason do we have to go short?Gold hit a high and then fell back to meet the support of the moving average. Can you make money by going long on gold above 3130? In a bullish trend, just do what bulls should do and don’t worry too much about gold peaking. The market will give a signal when gold peaks. At present, we continue to do more in the trend.

You can't make money from such a simple market?After gold stepped back, it hit a new high again. Gold bulls continued to be strong. Gold broke through 3127 again, so the bulls are even better.

The gold 1-hour moving average continues to cross upwards and diverges. The support of the gold 1-hour moving average has moved up to 3096, but gold is now far away from the moving average, so wait patiently for adjustments and then step back to continue to buy. The gold 1-hour lowest yesterday fell to around 3100 and then stabilized again, so today gold will continue to buy on dips above 3100.

Trading ideas for reference:

Go long near gold 3110, sl: 3100, tp: 3130

Gold is crazy. When will it peak?Gold has experienced a wave of rapid declines and market washouts. It successfully made many people get off the market with one move, and then it continued to rise all the way. It is really strong.

At present, it seems that gold is getting closer and closer to the top, but you can still take advantage of the pullback to make long orders, but you must not stay in the long term.

At present, gold is getting closer and closer to the top, but you can still take advantage of the correction to go long, but don't be a long-term investor. Gold can take advantage of the trend to take long positions above 3100

Gold weekly chart with both buy and sell levels 30-03-25Gold weekly forcast with both Buy and sell levels

gold in an uptrend all week from last weeks buy level it ran 553 pips wit little to no drawdown.

For this week we are looking at 2 levels for both buy and sell entries .

For a buy ill look at entering at 3091 expecting 3098 to 3100 as first resistance , if we brreak we can expect 3112 as next resistance on the way to 3136.

For a sell ill look at entering at 3076 expecting 3068 to 3066 as first support , if broke we can expect 3054 to 3050 as next support.

With these trades its best to just wait for levels for a conformation and the bigger moves.

last weeks buy are did not register until Thursday morning but when it hit there was no drawdown and closure at the high gave 533 pips.

As always with these trades wait for levels and secure on the way by either taking profit or reducing lot size.

Trade is based on support and resistance, trend lines and fibonacci levels from the higher time frame.

Ill update as the week progresses , stay safe

XAUUSD H4 Trading Plan (Intraday Outlook)Bias: 📈 Bullish (Strong Continuation)

Current Price: ~$3,093

Context: Price is accelerating after breaking key resistance, maintaining bullish structure.

🧠 1. Market Structure (H4)

Structure remains bullish, with well-defined HH & HL.

Recent consolidation block (OB + FVG): price broke out cleanly and is now expanding.

Short-term trend leg is steep → potential for shallow intraday pullbacks.

📌 2. Key Levels from Your Chart

🔝 Upside Target

3,120.14 – Major H4 resistance / next liquidity zone

🟦 Intraday Support Zones

3,049.57 – recent H4 resistance, now flipped support (ideal for pullback entries)

3,000.65 – clean structure zone, possible FVG fill

2,977.64 – origin of last impulse

2,960.27 / 2,899.69 – deeper HTF demand / OB zones

🔍 3. Order Blocks & Liquidity

🔲 OB zone breakout (highlighted gray area) → now acting as demand

💧Buy-side liquidity rests above 3,120

Any retracement into 3,049 / 3,000 could be used by Smart Money for re-entry longs

📅 4. Trade Scenarios (H4)

✅ Scenario A: Bullish Continuation

Price holds above 3,049 → intraday continuation toward:

🎯 3,120

🎯 Potential extension: 3,150+

📌 Ideal setup: bullish engulfing or BOS + FVG entry on pullback to 3,049 zone

🔁 Scenario B: Pullback Before Continuation

Rejection near 3,100–3,120 leads to pullback toward:

🔁 3,049

🔁 3,000 (FVG / previous OB)

Monitor price action at those levels for continuation entries.

🟥 Scenario C: Bearish Shift (Low Probability for Now)

Break below 2,960 with strong bearish momentum → opens door toward:

🔻 2,899

This would invalidate current bullish short-term structure.

🧭 Summary

Trend is strong, momentum is clean → only looking for buy setups on dips.

Watch for continuation above 3,049 and especially reactive price action near 3,120.

If pullback occurs, 3,000 zone is prime location for re-entry longs.

Gold weekly forcast with both Buy and sell levels 30-5-25Gold weekly forcast with both Buy and sell levels

gold in an uptrend all week from last weeks buy level it ran 553 pips wit little to no drawdown.

For this week we are looking at 2 levels for both buy and sell entries .

For a buy ill look at entering at 3091 expecting 3098 to 3100 as first resistance , if we brreak we can expect 3112 as next resistance on the way to 3136.

For a sell ill look at entering at 3076 expecting 3068 to 3066 as first support , if broke we can expect 3054 to 3050 as next support.

With these trades its best to just wait for levels for a conformation and the bigger moves.

last weeks buy are did not register until Thursday morning but when it hit there was no drawdown and closure at the high gave 533 pips.

As always with these trades wait for levels and secure on the way by either taking profit or reducing lot size.

Trade is based on support and resistance, trend lines and fibonacci levels from the higher time frame.

Ill update as the week progresses , stay safe

Last Friday, 3085 was shorted to make a profit, next week?Gold fell back on Friday after rising higher, and gold encountered resistance at 3085. However, gold is still just adjusting for the time being. Gold rebounded after the adjustment, and gold bulls are still relatively strong. You can continue to buy gold after it falls next week. After all, gold bulls are strong now, but don't chase it at high levels, and wait for it to fall before buying more.

The 1-hour chart of gold still shows a golden cross with upward bullish divergence. After the adjustment, the gold bulls did not weaken, but continued to be strong. Therefore, the decline of gold is just an adjustment. Gold can continue to go long after the adjustment next week. Gold rose again after bottoming near 3067 on Friday. The gold moving average support has now moved up to a line near 3072. Therefore, gold is still a support area in this range. Then if gold falls back to support near 3070 next week, it will still be long on dips.

A real correction for gold could be comingGold 30-minute chart is beginning to have the possibility of a double top, so don't chase long for now. If you want to go long, wait patiently for a pullback, otherwise the high adjustment may also be large. Gold can be shorted on rallies. If gold falls below 3060, then the real adjustment of gold may come.

The market is changing rapidly. Since the strength of gold has been insufficient after breaking through new highs, don't chase too much.

GOLD DAILY CHART MID/LONG TERM UPDATEGOLD Daily Chart Update: Precision Analysis for Confident Trading (10th Feb 2024)

Hello Traders,

Here’s the latest update on the GOLD daily chart that we’ve been meticulously tracking and trading. Below, we provide an enhanced breakdown of recent movements, updated key levels, and actionable insights for the days ahead.

Recap of Recent Success in our previous chart:

Our recent analysis delivered remarkable accuracy:

* ENTRY LEVEL 2744: ✅ DONE

* TARGET TP1 (2807): ✅ DONE

* TARGET TP2 (2870): ✅ DONE

* EMA5 crossed and held above both Entry Level (2744) and TP1 (2807), confirming bullish momentum toward TP2 (2870). ✅ DONE

* The FVG zone at 2790 acted as strong support, facilitating upward momentum. ✅ DONE

* EMA5 correction at 2839 was completed successfully. ✅ DONE

* GOLD achieved a new ATH at 2886 after hitting TP2 (2870). ✅DONE

What’s Next for GOLD?

The price is now oscillating between critical weighted levels, with gaps both above and below 2870.

Key Levels to Watch:

Resistance Level: 2870

* A daily candle close above 2870 will confirm bullish momentum, with potential targets toward higher levels.

* Failure to close above this level may trigger a short-term reversal.

EMA5 Behavior:

* Or If EMA5 crosses and locks above 2870, it strengthens the bullish case.

* If EMA5 fails to hold, expect a pullback to key GOLDTURN levels.

Updated Support Levels (GOLDTURN Zones):

2801

2744

2671

2595

Key Scenarios:

* A bullish scenario could see the price retesting 2870 as resistance before pushing higher.

* A bearish scenario may unfold if the price fails to sustain above 2870, leading to a retest of

Recommendations:

* Capitalize on Dip Opportunities: Use smaller timeframes (1H, 4H) to trade around GOLDTURN levels, targeting 30–40 pips per trade.

* Stay focused on shorter trades in this range-bound market to manage volatility effectively.

Long-Term Bias:

Maintain a bullish outlook while viewing pullbacks as buying opportunities.

Accumulate positions near key support levels for a safer approach instead of chasing highs.

Final Note:

Trade with confidence and precision. Our analysis ensures you’re well-prepared to navigate the evolving market landscape. Stay updated with our daily insights across multiple timeframes for deeper clarity.

Thank you for your continued trust! Don’t forget to like, share, and comment to support our work.

Best regards,

The Quantum Trading Mastery Team

Gold’s rebound is an opportunity for short sellingGold is still oscillating, and a rebound is an opportunity for short selling. Since gold is still oscillating within the box, you can go short if it rebounds to a high level. Gold is still oscillating within a large range for 1 hour. Since gold has not effectively broken through, you can continue to short after rebounding. If it breaks through the box shock, then gold will consider taking advantage of the trend and go long.

GOLD 1H CHART TRADING PLAN FOR THE DAY / READ CAPTIONAnalysis of the 1H Timeframe Chart for Gold (XAU/USD)

Previous Chart Review

The bearish move from the ENTRY LEVEL at 2,796 reached Take Profit 1 (TP1) at 2,778, validating the support at GOLDTURN levels AT 2,778.

GOLDTURN acted as a critical support level, rejecting lower prices and triggering a bullish rebound.

The upward move successfully achieved:

TP1: 2,798 ✅

TP2: 2,807 ✅

TP3: 2,817 ✅

Current Market Structure

Key Resistance Levels:

Supply Zone: 2,830.57 (Highs above TP3)

Bullish targets identified at:

2,837 (TP2)

2,856 (TP3) for extended upward momentum.

Support Levels:

Immediate support: GOLDTURN levels at 2,813

Additional supports:

2,803

2,793

2,783

2,774

Retracement range: 2,732–2,740

EMA Analysis:

The EMA5 (2,815.20) is a key pivot zone, indicating short-term trends:

A break and hold above 2,817 it suggests continuation of bullish momentum.

A break below it signals a possible test of support levels.

Trend Analysis:

Current candles reflect a potential pullback to the 2,813 level.

A bullish continuation above 2,817 could confirm upward momentum toward 2,837 and beyond.

A failure to hold above 2,813 may test lower GOLDTURN levels.

Trading Plan:

Bullish Strategy:

Monitor EMA5 crossing and holding above 2,817 for:

Immediate targets: 2,837, followed by 2,856.

Buy dips at support levels (2,813, 2,803, 2,793) targeting 30–40 pip gains.

Bearish Risks:

Downside triggers include:

EMA5 crossing below 2,817 leading to a test of 2,798.

Sustained moves below 2,798 may target 2,744 and 2,732–2,740.

Range Confirmation:

Await confirmation through a break and lock above/below key levels:

Bullish continuation: Above 2,837.

Bearish momentum: Below 2,813.

Long-Term Outlook

The bullish bias remains intact, with pullbacks offering opportunities to accumulate positions.

Focus remains on risk management by entering at support levels and exiting at predefined targets (20–40 pips per level).

Final Thoughts

Confidence and discipline are essential to navigate market fluctuations effectively.

This structured approach ensures traders are prepared for both bullish and bearish scenarios.

Check out further updates and multi-timeframe for more insights!

Please support us by liking, comments and boosting if you think our analysis is worth it.

The Quantum Trading Mastery

1H GOLD ROUTE MAP AND TRADING ANAYLISHi Traders,

Check out our 1H chart levels and trading analysis.

As expected, our analysis has played out perfectly last 2 days. The EMA5 crossed and held above various levels, reaching our bullish target of 2745 and breaking through the resistance level as well. We highlighted that the next directional move would be confirmed once the EMA5 crossed and locked above weighted levels—and that’s exactly what happened.

Currently, the price is moving between two weighed levels, with a gap above at 2751 and a gap below at 2738. We need to see the EMA5 cross and lock on either of these levels to confirm the next range.

Until then, we can expect the levels to be tested side by side until one of the weighed levels breaks and locks, confirming the direction of the next move.

Remember to focus on buying dips. Our updated levels and weighed zones will help track downward movements and capitalize on upward bounces.

Continue to buy dips at our support levels, targeting 25–35 pips per trade. Each level structure typically provides bounces within this range, making it ideal for precise entry and exit opportunities.

BULLISH TARGET

2765

EMA5 CROSS AND LOCK ABOVE 2724 WILL OPEN THE FOLLOWING BULLISH TARGET

2738 DONE

EMA5 CROSS AND LOCK ABOVE 2738 WILL OPEN THE FOLLOWING BULLISH TARGET

2751

EMA5 CROSS AND LOCK ABOVE 2751 WILL OPEN THE FOLLOWING BULLISH TARGET

2765

EMA5 CROSS AND LOCK ABOVE 2765 WILL OPEN THE FOLLOWING BULLISH TARGET

2786

BEARISH TARGETS

2691 DONE

EMA5 CROSS AND LOCK BELOW 2691 WILL OPEN THE FOLLOWING BEARISH TARGET

2673

EMA5 CROSS AND LOCK BELOW 2673 WILL OPEN THE FOLLOWING BEARISH TARGET

2663 - 2645

EMA5 CROSS AND LOCK BELOW 2645 WILL OPEN THE SWING RANGE

SWING RANGE

2630 - 2615

as always, we’ll keep you updated throughout the week with regular insights on how we’re managing active ideas and setups. Thank you all for your continued support, including your likes, comments, and follows – we truly appreciate it!

TheQuantumTraders