Goldprediction

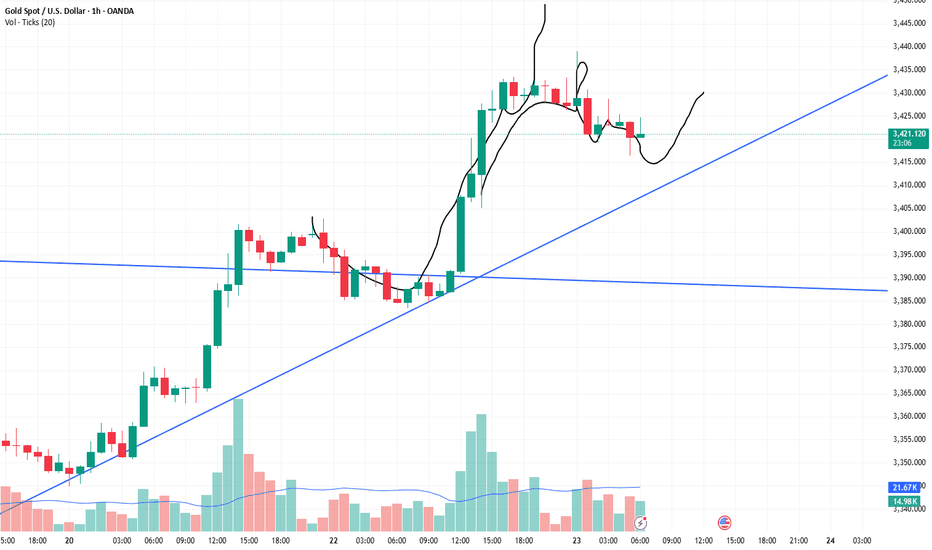

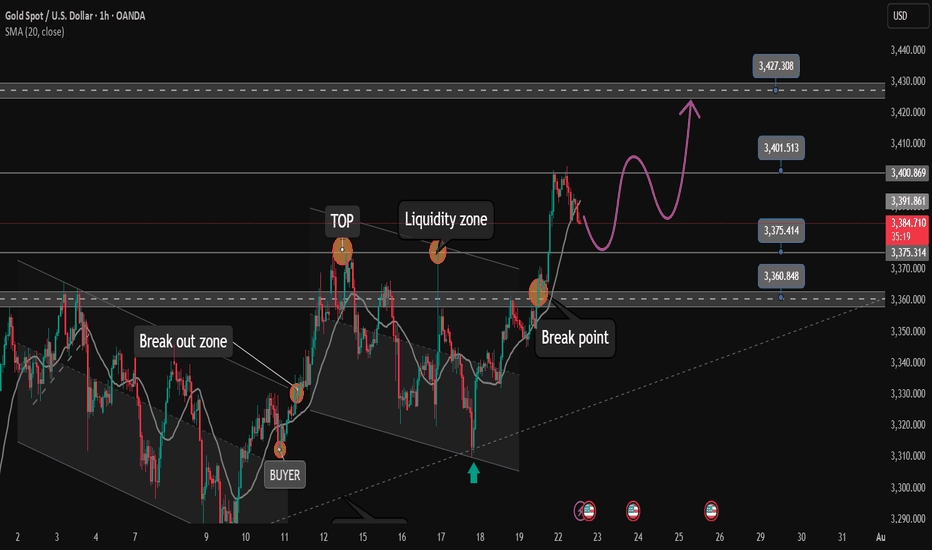

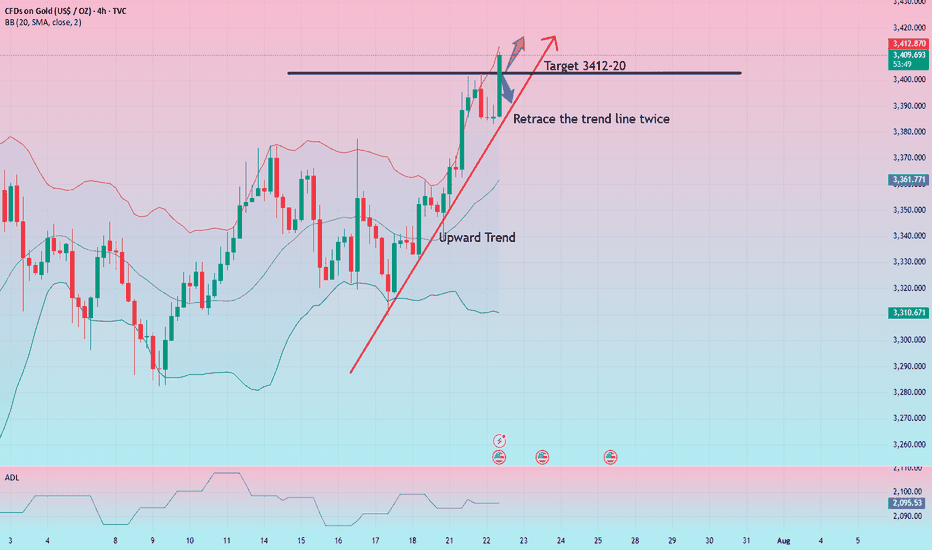

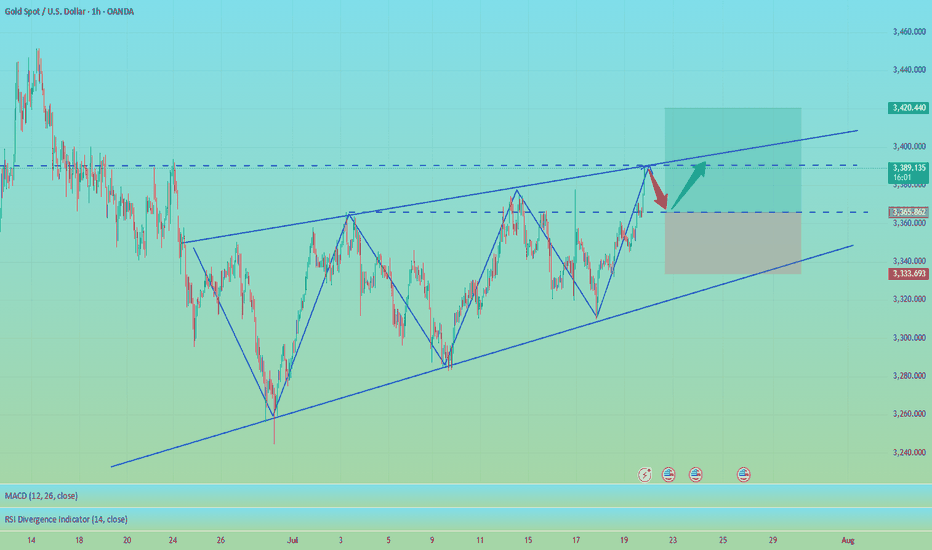

3400 has been reached, wait patiently for a pullback to go longGold opened on Monday with a volatile rise. After breaking through the 3360-65 area, the bulls turned strong. After breaking through the 3375~80 area in the evening, the bulls accelerated their rise, reaching the highest point of 3402. It fluctuated sideways in the late trading, and the daily line closed at around 3397 with a big positive line! Gold temporarily broke the small range oscillation pattern, but the bulls were not strong, and it still fluctuated upward.

From the perspective of the intraday cycle, after yesterday's rapid rise, the market fell into a serious overbought state; however, yesterday's $60 big positive line supported the bulls, and it is expected that the market will fluctuate; the next focus is still the 3400 mark area. The pressure in the 3400~05 area was dense last night, and adjustments may be made at any time before the breakthrough; and since the rise of 3282, it has just touched the upper edge of the parallel channel. The big sweep will continue, but the range is constantly changing!

So although gold broke the recent volatility yesterday and hit the 3400 mark with a big positive line; however, if it cannot stand above it, then it will continue to fall; recently we have repeatedly and many times emphasized the importance of the 3400 mark. If it stands here, the market will gradually rise to 3420~25 and break through to the 3450 area before looking for a decline.

Today we will continue to focus on the 3400 mark area. First, we will rush to the high altitude, with the goal of retracement to the 3375 and 3356 regional support platforms, and then pay attention to long opportunities; if the bulls stand above the 3400 mark, they will further bullishly impact 3420~25 and break through the 3450 area before falling back.

OANDA:XAUUSD

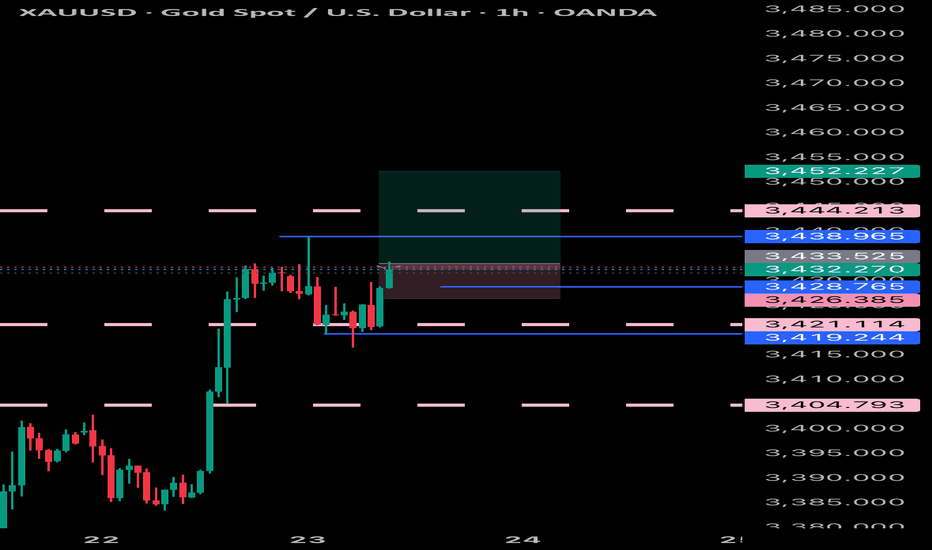

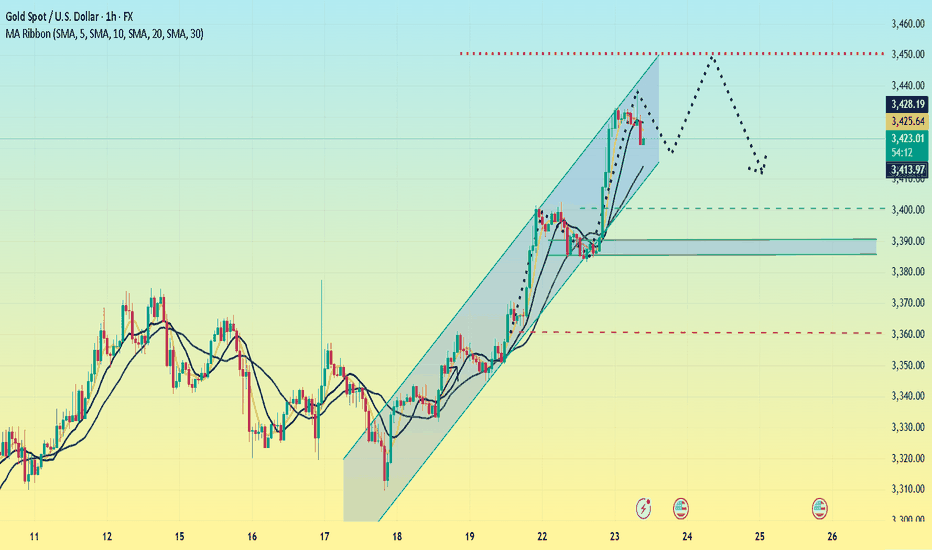

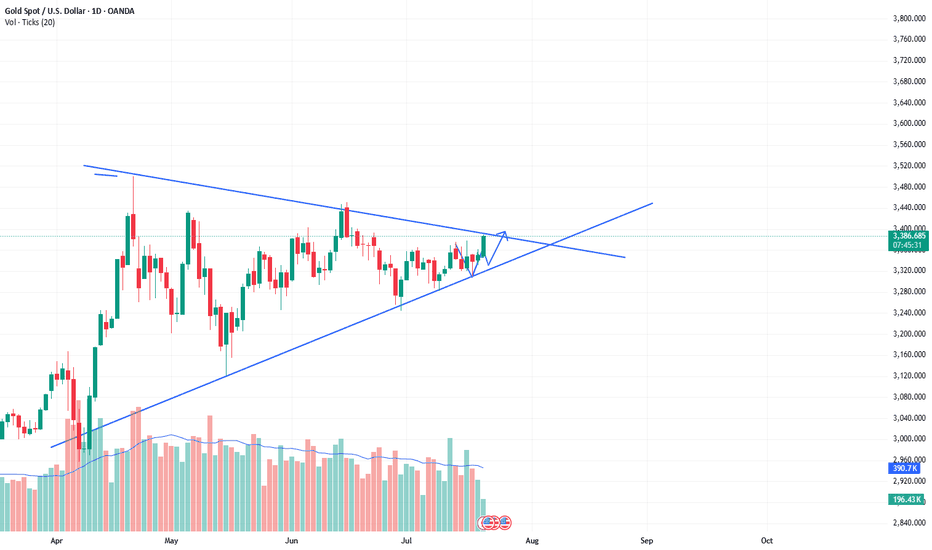

Gold bulls are on the offensive. Can they continue to chase?On Tuesday, as trade tensions and the conflict between the White House and the Federal Reserve continued, the US dollar index continued to fall, and continued to fall in the early US trading, once hitting a low of 97.28. Gold also continued to rise, once standing above the $3,430 mark, setting a new high in more than a month. From the current point of view of gold, this week has stood firm at two levels, 3,350 and 3,400. Next, it depends on whether it can continue to stand firm at the 3,450 level.

From the current hourly chart, Monday's high is around 3,400, and yesterday's low of the US market retracement on Tuesday was around 3,405. So theoretically, 3,400-3,405 has become a support position. And from the hourly chart range, the bottom trend line support is also about 3,400-3,405. Therefore, it is not ruled out that it will oscillate and retrace like yesterday, and then rise and stretch again.

Secondly, from the daily chart:

After gold stabilized at 3400, the current daily range has become 3400-3450. As we can see above, there have been three times of falling back after touching 3450. If it breaks and stabilizes above 3450 this time, the historical high of 3500 will most likely be refreshed. On the contrary, if it still cannot break through 3500 this time, the possibility of further pullback cannot be ruled out. For the next operation, I suggest paying attention to 3400-3405.

If it can retreat and stabilize at 3400-3405 during the European session, you can continue to enter the market and go long to around 3450. On the contrary, if it falls below 3400 today, then don't go long, as there may be a possibility of further retreat in the future.

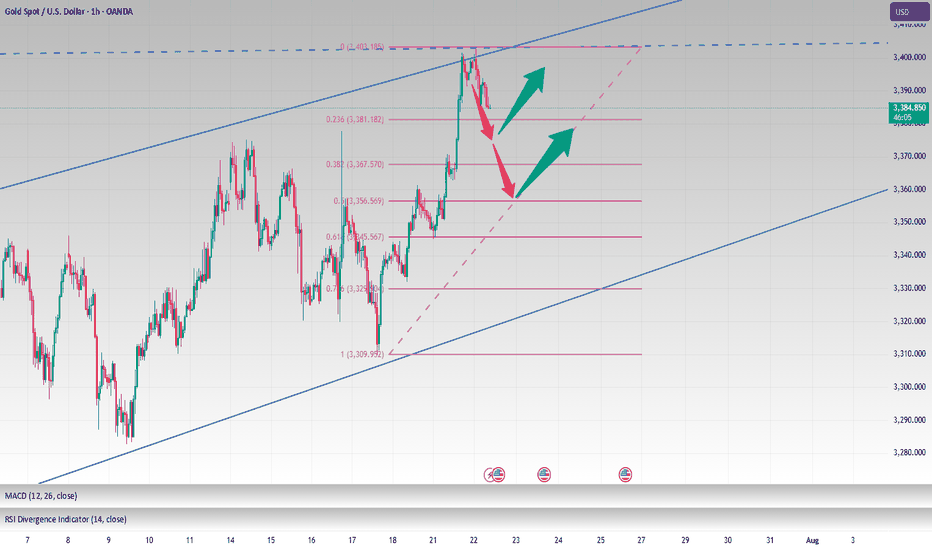

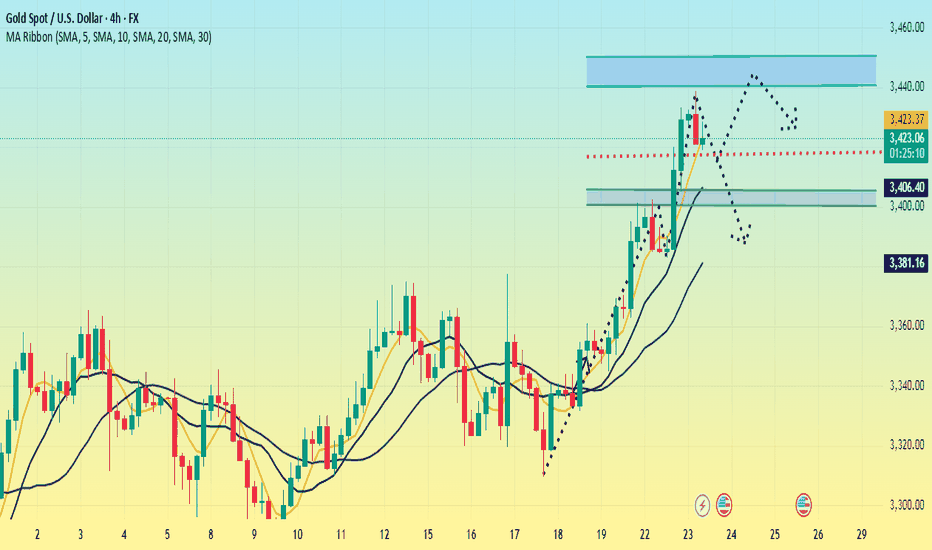

Gold Faces Key Fibonacci Resistance Is the Bullish Momentum FadiTrend Structure: Gold remains in a short-term bullish structure, with a clear series of higher highs and higher lows. However, price action shows signs of hesitation near a critical Fibonacci extension zone.

Key Resistance Zone:

$3,428 – $3,438: This area aligns with the 0.618 Fibonacci extension at 3,428.59 and the 0.0 level at 3,438.56, forming a confluence resistance zone that has started to trigger selling pressure.

Immediate Support Levels:

$3,422.62: The 1.0 Fibonacci extension, serving as the first support on a minor pullback.

$3,408 – $3,410: A potential bounce zone combining short-term trendline support and prior consolidation structure.

Fibonacci & Price Waves: The recent bullish leg from $3,330 to $3,438 has completed a 3.618 extension (noted at $3,330.91 on the purple projection). This increases the probability of a corrective retracement.

EMA & RSI (suggested for confirmation): EMA20 (not shown) should act as a dynamic support. Watch RSI for potential overbought signals or bearish divergence if it crosses above 70.

Trade Setups to Watch: Scenario 1 – Short Setup at Fibonacci Resistance Entry: $3,428 – $3,432, only if price action confirms rejection (e.g., bearish engulfing, pin bar)

Stop Loss: Above $3,438

Take Profit 1: $3,422

Take Profit 2: $3,410 (if trendline breaks)

Scenario 2 – Buy Setup on Pullback Entry: Around $3,408 – $3,410 upon bullish price action confirmation

Stop Loss: Below $3,400

Target: $3,428

Final Thoughts: Gold is approaching a strong resistance zone, and short-term pullback is likely unless bulls break through $3,438 with momentum. Traders should stay patient and wait for confirmation signals before entering. Remember: discipline beats impulse.

Follow for more updated strategies during the US session. Save this idea if you find it helpful! Let’s discuss your view in the comments below.

XAUUSD: Fluctuation of $30/ounce. Do you want to know?Yesterday, I frantically notified followers to buy around 3366-3375, and the market finally rose to 3430. This is a huge profit. I will continue to update it in the Band Trading Center Research Institute later. If you don’t want to miss it, follow me. If you see it but are still not sure how to trade. Then you can leave me a message at the Swing Trading Center Research Institute. I will reply to you one by one when I see it.

This week, some followers have achieved weekly profits of 50%-268%. If your profit is not ideal. Or don’t know how to trade. Remember to like and follow. I will lead everyone to victory.

Buy around 3400-3410. When will it close? I will post the results on the Swing Trading Center. Stay tuned.

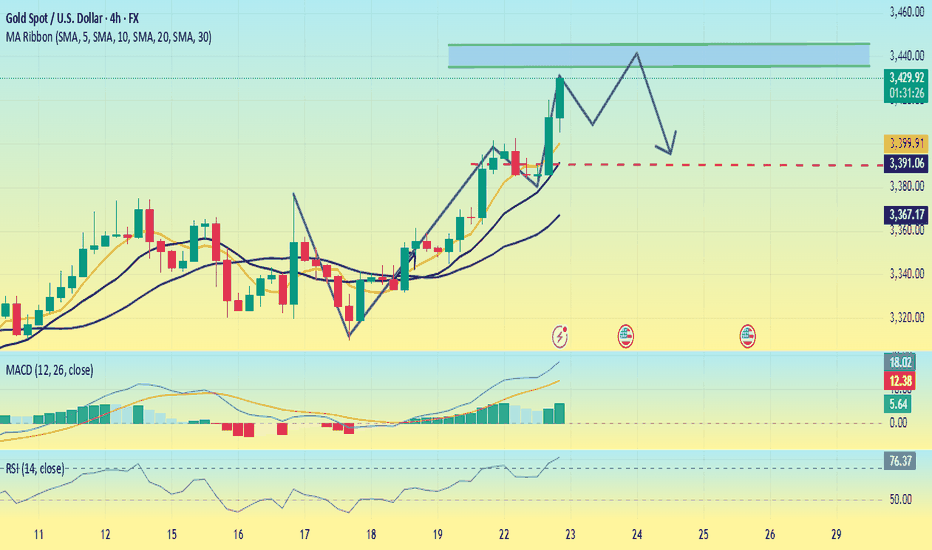

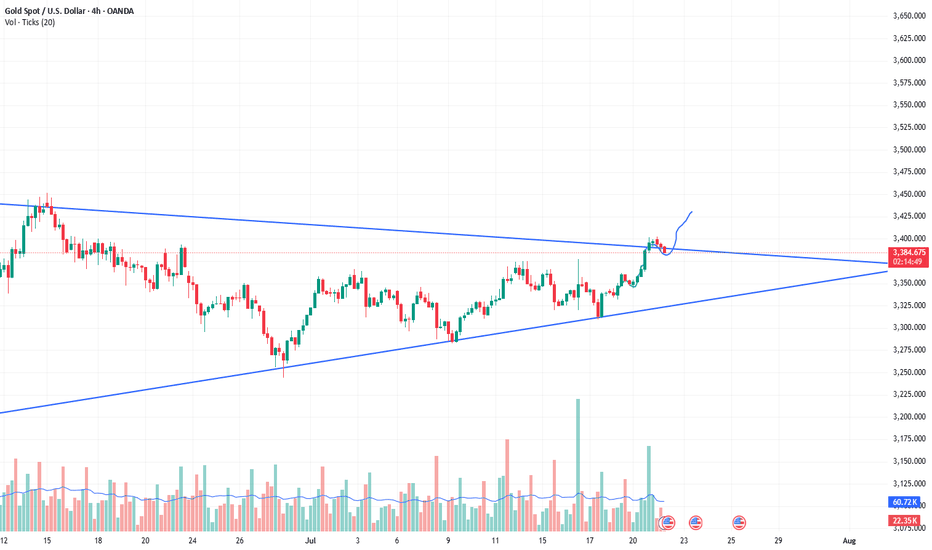

Gold is strong. Can it continue?On Tuesday, the overall gold price showed an upward trend. The highest price rose to 3433.32 on the day, and the lowest price fell to 3383.21, closing at 3431.46. On Tuesday, gold prices fluctuated during the early trading session and then corrected downward. During the European session, the price fluctuated mainly and fell weakly. It rose before the US session and hit the high point of the week again in the US session, and finally ended with a big positive line.

From the four-hour level, the technical adjustment needs, but the speculation of risk aversion suppressed this demand. There is a contradiction between the fundamentals and the technical aspects, and it is necessary to wait for the market sentiment to stabilize before clarifying the direction.

In the early Asian session, it hit a high of 3438 and then fell back. It is necessary to pay attention to the possibility of reaching the top. The support position is 3400-3405. If it falls to 3400, it may continue to adjust to around 3385. The probability of closing the negative line today is relatively high. If the price stabilizes above 3400, it is likely to maintain high fluctuations.

Today's market is complicated. Although the bullish trend has not changed, it is not advisable to be overly bullish. The operation is mainly shorting on rebounds, supplemented by long positions on pullbacks. The upper pressure position focuses on 3440-3450.

Operation strategy:

Short near 3440-3450, stop loss 3460, profit range 3420-3410.

Long near 3390, stop loss 3380, profit range 3420-3430.

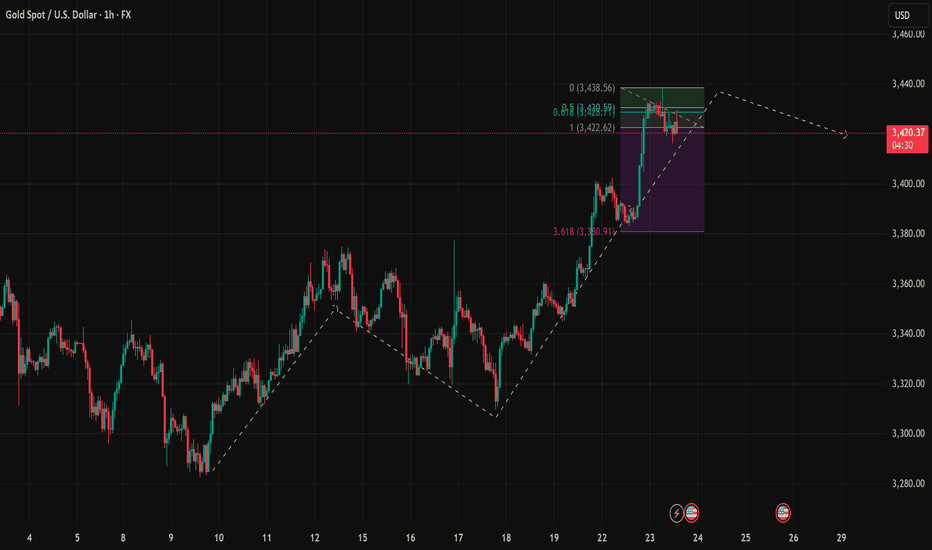

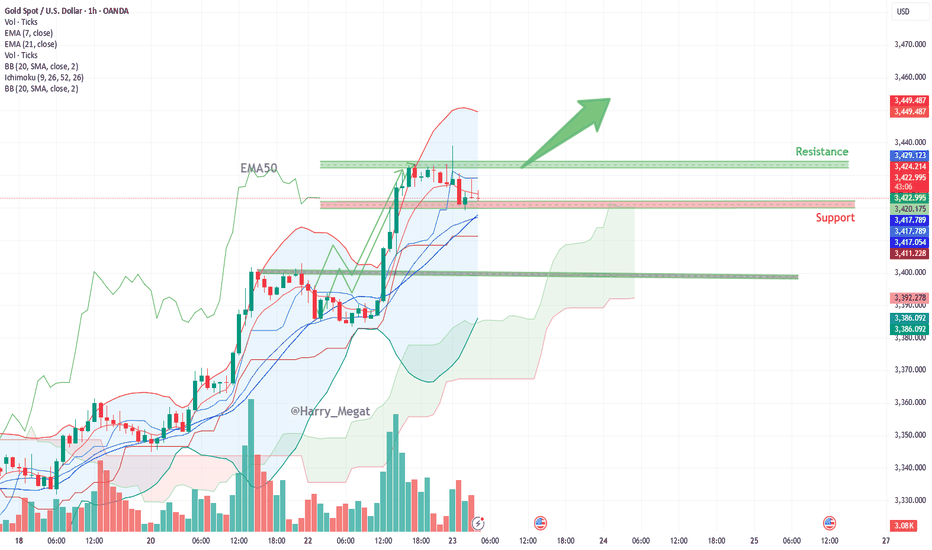

Gold Spot (XAU/USD) Chart analysis Gold Spot (XAU/USD) Chart analysis

**Chart Overview**

* **Current Price:** \~\$3,423.68

* **Recent Trend:** Bullish (Strong upward movement before recent consolidation)

* **Timeframe:** 1-hour chart

* **Indicators Used:**

* EMA 7 (Blue)

* EMA 21 (Purple)

* Bollinger Bands (Red/Green lines)

* Volume bars at bottom

**Bullish Momentum Signals**

1. **Strong Uptrend**:

* Price surged rapidly above \$3,400, breaking multiple resistance levels.

* Higher highs and higher lows confirm bullish structure.

2. **EMA Crossover**:

* The shorter-term EMA (7) is above the longer-term EMA (21), signaling a bullish bias.

* Price is currently near the EMAs, suggesting a possible retest of dynamic support.

3. **Bollinger Bands**:

* The price touched the **upper band**, indicating strong momentum.

* Bands are widening — a sign of increased volatility and continuation potential.

**Support and Resistance Zones**

* **Resistance Zone**: \~\$3,430–\$3,435

* Price was rejected here multiple times, indicating strong selling pressure.

* A breakout above this could send price toward the next level at \~\$3,450.

* **Support Zone**:

* Minor: \~\$3,417–\$3,418 (aligned with EMAs and lower Bollinger Band)

* Major: \~\$3,400 zone (previous breakout area and volume support)

**Bullish Setup**

* The **green arrow** suggests a bullish breakout is anticipated above \$3,430.

* If price holds above \$3,417 (EMA + BB support), the bulls could push it to **\$3,445–\$3,450** short-term.

**Risk**

* A break below \$3,417 and especially below \$3,400 could invalidate the bullish scenario and invite a correction.

* Watch for volume confirmation on any breakout to confirm strength.

**Conclusion**

Gold is in a **consolidation phase** after a strong rally. If support around \$3,417–\$3,418 holds, a breakout above \$3,430 could trigger a move to **\$3,445–\$3,450**. However, a break below EMAs would shift momentum back to neutral or bearish.

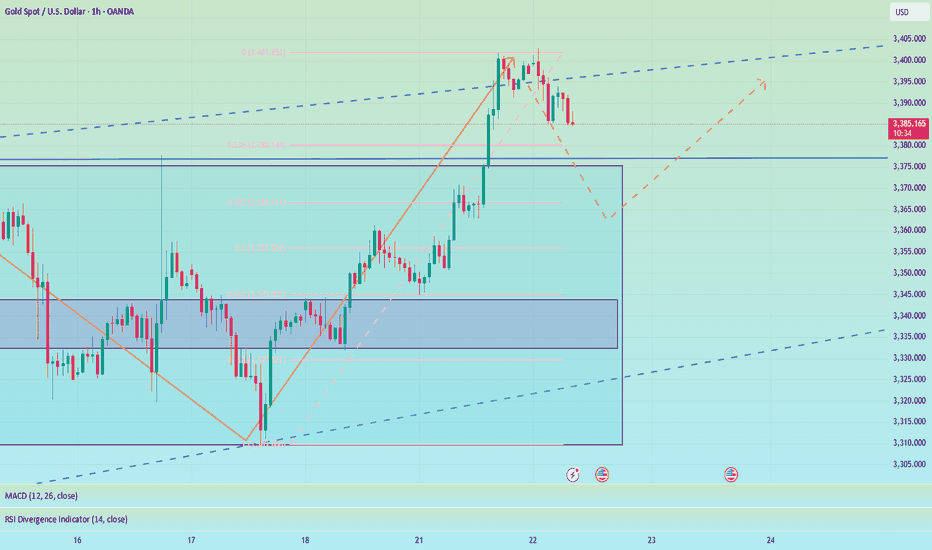

After reaching FULL TP. Relax and wait for strong support zone✏️Continuing yesterday's bullish wave structure, Gold has reached the Target level of 3400. In the European session, there is a possibility of a correction to some important support zones. And the US session will continue to aim for a level higher than 3400. Today's strategy is still quite similar to yesterday's strategy when waiting for the areas where buyers confirm to enter the market to FOMO according to the main trend.

📉 Key Levels

Support: 3375 - 3363

Resistance: 3400-3427

Buy Trigger: Rejects the support zone 3375 and reacts to the upside

Buy Trigger: Rebound from 3363

BUY DCA: Break and trading above 3400

Target 3427

Leave your comments on the idea. I am happy to read your views.

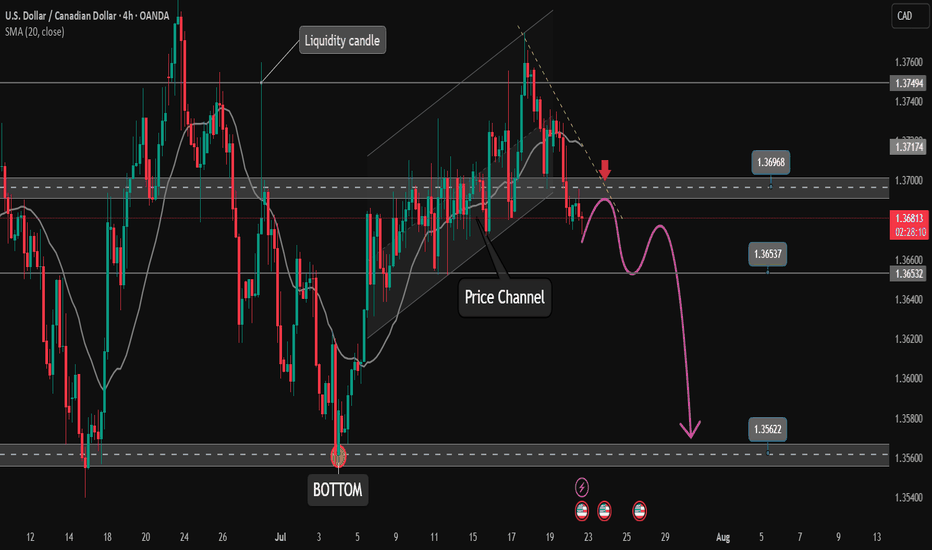

Price channel break. Will the downtrend take place?✏️USDCAD broke the price channel and started forming a bearish wave. The resistance zone of 1.370 played an important role in starting the bearish wave. 1.365 is the immediate support zone that the pair faces. If it wants to extend the decline, it needs to close the h1 candle below this price zone. The convergence between the trendline and the resistance of the Asian session will be a reliable support point for a downtrend to take place.

📉 Key Levels

Support: 1.365-1.356

Resistance: 1.370

SELL Trigger: Rejects bellow 1.370

SELL DCA Trigger: Break support 1.365

Target 1.356

BUY Trigger: Break and trading above resistance 1.370

Leave your comments on the idea. I am happy to read your views.

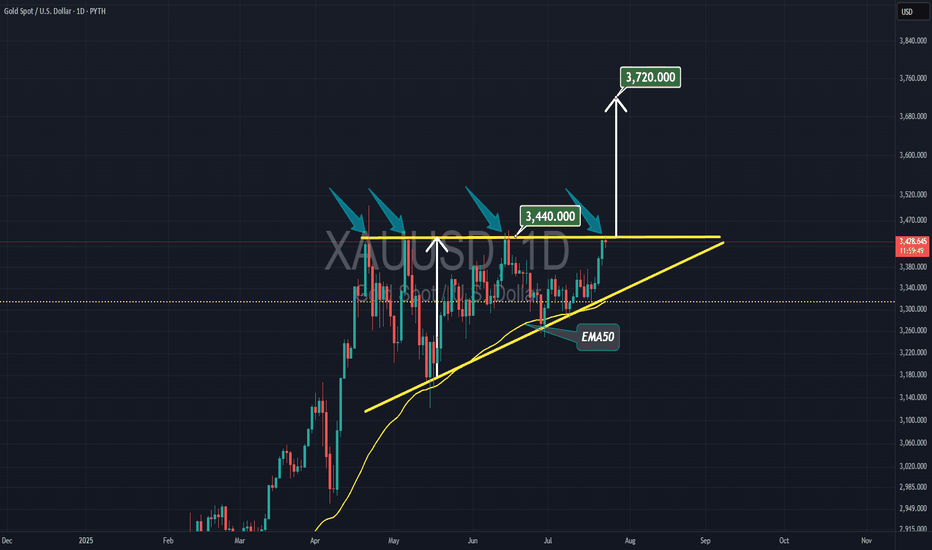

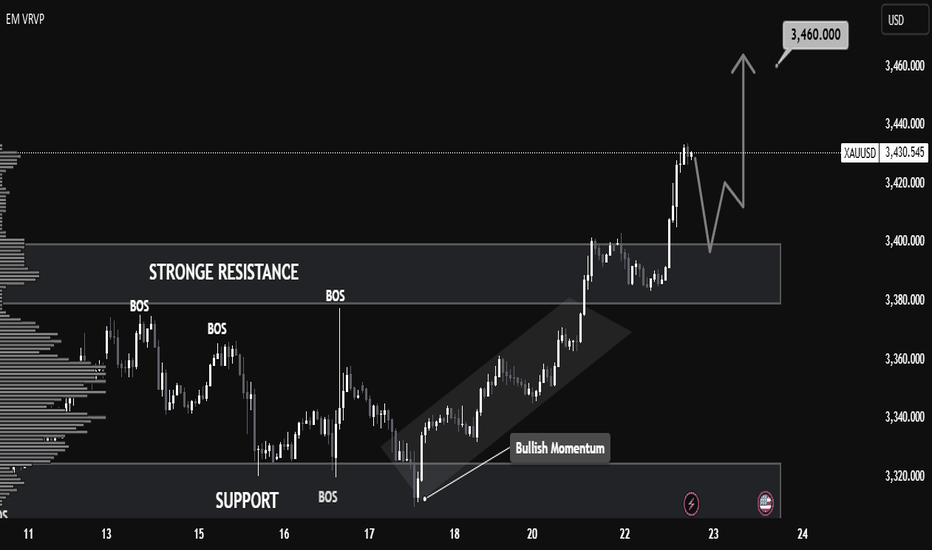

Gold stabilizes. Sets a new high?Gold continues to rise, with uncertainty in trade negotiations and the outcome of the Federal Reserve meeting being key variables. If no agreement is reached before August 1, the high tariffs imposed by the United States on major trading partners may trigger greater risk aversion demand, pushing gold prices further up; if the negotiations make a breakthrough, the market risk appetite will rebound, and gold prices may face correction pressure.

Gold has shown a strong upward trend recently. It closed with a small positive on Friday last week and closed with positive for two consecutive trading days this week, forming a three-day positive trend, with strong short-term momentum. In terms of indicators, the moving average diverges upward, with obvious bullish trend characteristics, and the support below needs to focus on the moving average performance. At present, the gold price has broken through the trend line formed by connecting the previous high points. The primary focus on the upside is near the previous high of 3452, which is an important short-term resistance level. The upper focus is on the previous high of 3452, which is an important short-term resistance level.

The first support below is the 3390-3385 area, which is close to yesterday's low and is also an early trading intensive area. The second support focuses on the vicinity of 3360.

In terms of operation, it is still mainly low-long, and short selling is not considered before the upward trend reaches 3450.

Operation strategy:

Short around 3450, stop loss 3460, profit range 3430-3310

Long around 3400, stop loss 3390, profit range 3420-3430

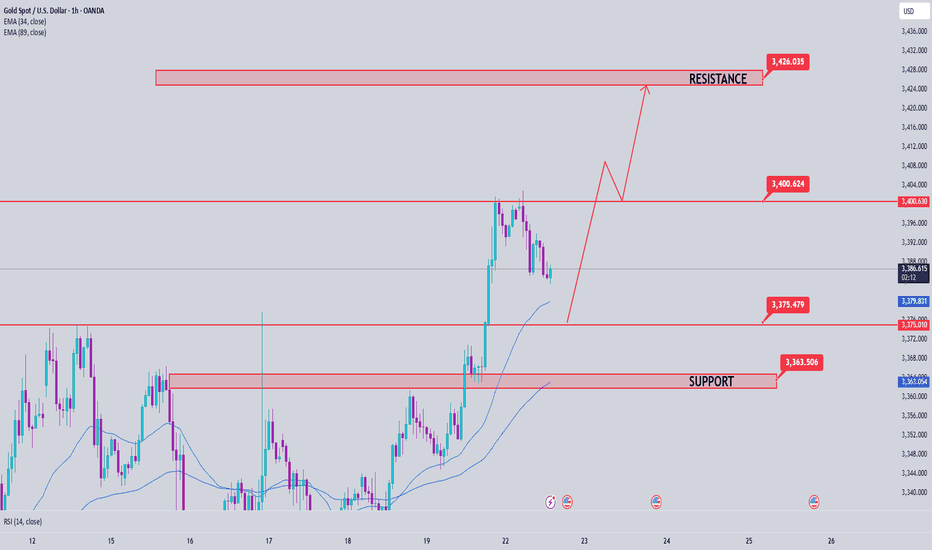

XAUUSD Technical Analysis – Resistance Turned Support, 📈 XAUUSD Technical Analysis – Resistance Turned Support, Bullish Continuation Expected

Gold (XAUUSD) has shown strong bullish momentum after breaking above the key resistance zone around $3,400, which now appears to be acting as a new support level. This structure shift signals a classic break-and-retest scenario, commonly observed in bullish continuations.

🔍 Key Observations:

Structure Shift: Previous resistance near $3,400 has been broken with strong bullish candles, suggesting buyer dominance. This level is now expected to serve as support.

Bullish Momentum: The move from the $3,320 support zone to above $3,430 was accompanied by clear trend formation and clean market structure, indicating sustained momentum.

Retest in Progress: Price is currently pulling back toward the new support zone ($3,400). If this area holds, a bullish reaction is expected.

Next Target: If support at $3,400 holds as expected, price could rally back toward the next resistance and projected target of $3,460.

📚 Educational Insight:

This setup illustrates the principle of resistance becoming support (RBS)—a foundational concept in technical analysis. After a breakout, a successful retest of former resistance often provides a high-probability entry point for trend continuation trades.

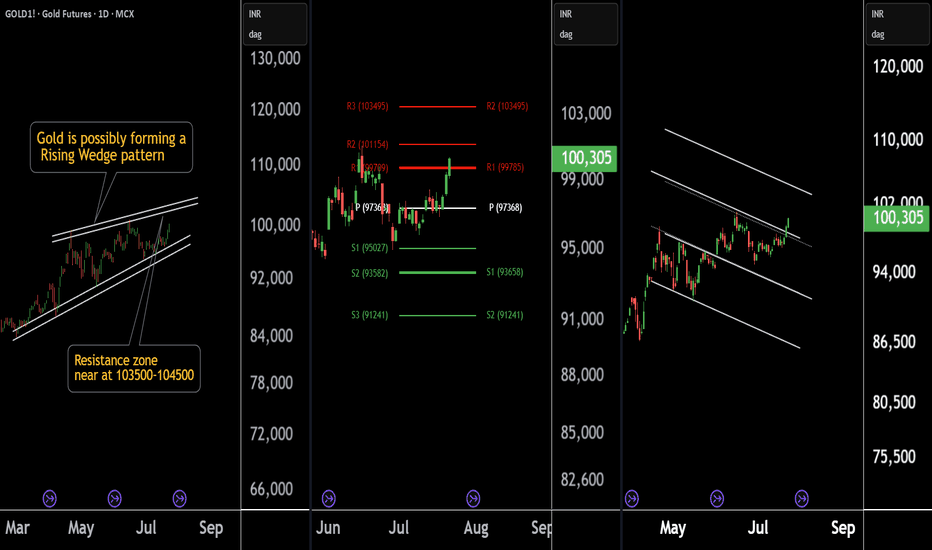

Gold at a Crossroad: Long or Short? Key Levels in FocusThere are three chart of Gold .

Gold1! is forming a Rising Wedge pattern, with resistance positioned between 103500-104000 levels.

Gold1! is facing Pivot Point resistance around the 103500 level, indicating potential supply pressure.

Gold1! is approaching the parallel channel resistance, and the upside move is nearly complete in percentage terms, with resistance around 103800-104000.

if this level sustain then we may see first of all higher prices then again fall in gold1!

Thank You !!

Bulls are still the main theme, 3400 is not the high point📰 News information:

1. Fed Chairman Powell delivers a welcome speech at a regulatory conference

2. The tariff deadline is approaching

📈 Technical Analysis:

Today's opening high reached around 3402, and did not effectively break through the upper resistance of 3405-3415. As I said yesterday, a decline and return to the moving average is an inevitable result. The tariff issue is still there, with the deadline on August 1, and the daily MACD indicator still shows a golden cross. The general direction of short-term bullishness has not changed, but from a technical point of view, gold still has room to fall to correct the overbought part.

Below the day, we first focus on the top and bottom conversion position of 3377-3375. As time goes by, the 4H middle track will probably resonate with the 50% position of the Fibonacci line at 3355, which is also a good long position I expect. Therefore, if the price falls back to 3380-3375 for the first time during the day, you can consider going long. If the price continues to fall, pay attention to the second opportunity to go long at 3355, with the target at 3390-3410.

🎯 Trading Points:

BUY 3380-3375

TP 3390-3410

BUY 3360-3350

TP 3370-3380

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

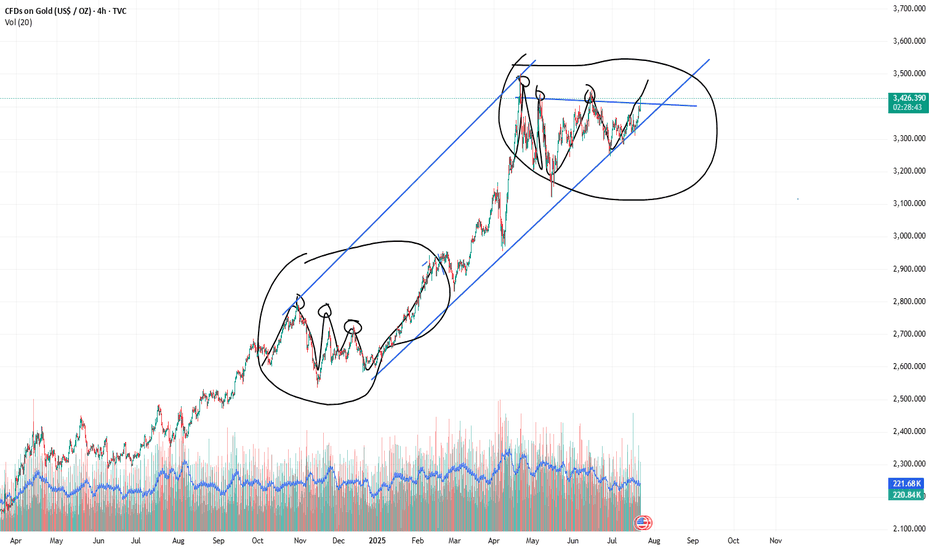

Gold is under pressure. Can it break through?Since the "W bottom" pattern was formed at the low of 3344 US dollars, the gold price broke through the neckline of 3380 and further stabilized at 3400 today, confirming the continuation of the medium-term upward trend. The moving average system is arranged in a bullish pattern, with the 5-day, 10-day and 20-day moving averages diverging upward in turn, and the support strength is stable.

The MACD indicator golden cross continues to expand, the upward momentum is enhanced, and no divergence occurs; the RSI indicator rises to around 76. Although it enters the overbought range, there is no obvious turn, indicating that the bullish momentum is still being released.

The current support level has risen to around 3390, and the support level has risen sharply. The resistance position needs to pay attention to 3430-3440. At present, several times have tested above 3430, but they have not stabilized above this position.

Operation suggestions:

3390-3400 light position to try more, stop loss 3360, profit range 3435-3445.

If it encounters resistance and falls back near 3435, you can consider short-term short orders with stop loss at 3445 and profit range at 3400-3380.

Although the upward momentum continues, some risk information still needs to be paid attention to; this week, we need to pay attention to the US June existing home sales data (July 23), the preliminary value of the second quarter GDP (July 25) and the core PCE price index (July 26). If the data is stronger than expected, it may trigger expectations of interest rate cuts.

Gold Price Analysis July 22Gold continues to maintain its upward momentum as expected, and yesterday's session reached the target of 3400. This is a signal that the bullish wave structure is still holding. In today's European trading session, the price is likely to make a technical correction to important support zones before continuing the main trend in the US session.

The current trading strategy still prioritizes following the uptrend, focusing on observing price reactions at support zones to find safe entry points. Waiting for buyers to confirm participation is a key factor to avoid FOMO at the wrong time.

🔑 Key Levels

Support: 3375 – 3363

Resistance: 3400 – 3427

✅ Trading Strategy

Buy Trigger #1: Price reacts positively and rejects the support zone at 3375

Buy Trigger #2: Price rebounds strongly from the deeper support zone at 3363

Buy DCA (Moving Average): When price breaks and holds above 3400

🎯 Next Target: 3427

📌 Note: It is necessary to closely monitor price reaction at support zones to determine whether buying power is strong enough. If there is no clear confirmation signal, it is better to stay on the sidelines and observe instead of FOMOing to place orders.

Gold breaks and turns upward! Will it break through 3403? Or wil

Gold fluctuated sideways for another day in this transaction, and only showed signs of further upward attack near the US market. The current gold price is around $3,400/ounce. The gold price is falling from the more than one-month high of $3,403/ounce hit in the early Asian session on Tuesday, and fell to the lowest level of 3,383 before turning around again. So how will the trend be today? Let me explain it to you below!

Why did gold rise across the board this week?

1 On Monday, the uncertainty surrounding the trade agreement between the United States, Japan and the European Union increased, raising concerns about the prospects for US economic growth and suppressing the US dollar. The fate of gold is still closely tied to the trend of the US dollar, which is currently under pressure from US President Trump's tariff negotiations.

2 In addition, Trump has repeatedly called on Federal Reserve Chairman Powell to resign, raising concerns about the independence of the Federal Reserve, causing US bond yields to continue to decline, and also putting pressure on the US dollar. The record rise in Wall Street stock indexes has weakened the safe-haven appeal of the US dollar and the attractiveness of yields, thereby helping gold prices to continue their gains since Friday.

What do you think of the future trend of gold!

From the current market situation, the trend is still in a very strong market, and the current high point of 3403 is in danger. It can only be said that if it breaks through again today, the upper pressure needs to see the 3420 line. This week's trend has not given any chance to step back. It is either a slow rise or a sudden strength in the sideways market. There is basically no chance to enter the market at a suitable position!

From the current 4-hour trend, there is basically no escape from today's strength, and the current problem is actually whether there is a suitable entry opportunity. Prepare for both hands. One is to look at the previous high of 3403. If it breaks through strongly, go long directly, and look at the 3412-20 line. If it retreats first, then look at the vicinity of 3385 and see the second rise in the US market!

Gold: Long near 3385-87, let go of 75, and the target is 3412-20! If it rises directly and breaks through 3403, you can try to break through long with a light position, and still look at the 3412-20 line above!

The bull market of xauusd continues, buy and wait for the rise.As predicted in the band trading center in advance over the weekend. The daily level trend is still very stable, and the breakthrough trend has been perfectly carried out. The current quotation is 3388. It is only a matter of time before it rises wildly to the position of 3430. The short-term will definitely break through. The current bull market is clear and has huge potential. The limit of the triangle consolidation phase is about to be broken. Then the bulls will continue to rise. Therefore, buying is the key operation plan.

XAUUSD:Retracement is a buying opportunityAfter the Asian market hit the highest position of 3403, there was some decline. The current gold price is 3386. From the short-term trend of the hourly level. It is still fluctuating at a high level. Combined with the trend of the daily level, there are signs of retracement and counterattack. There is no news dominance. It is purely a technical repair after hitting the high. This retracement can pay attention to the support near 3382-3378. The London and New York markets are still based on buying and profit.

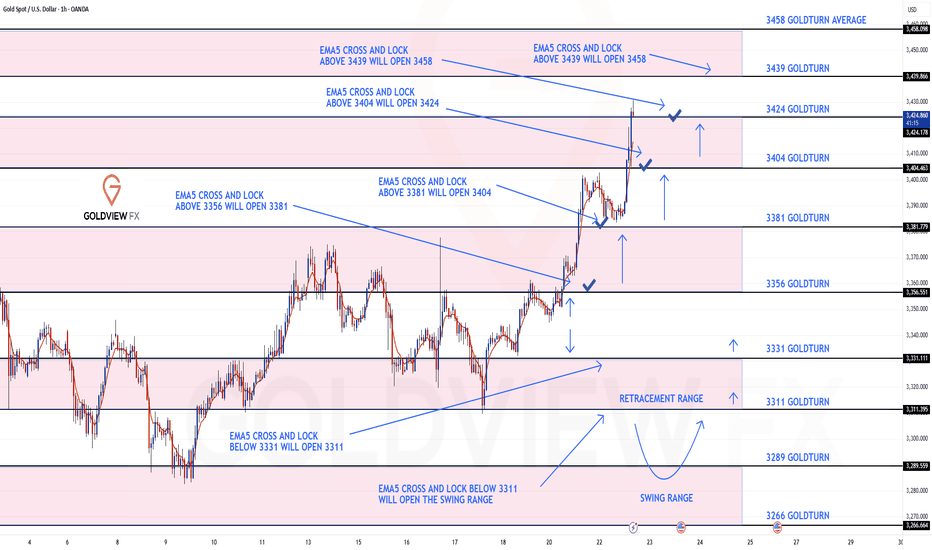

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the charts today with our analysis playing out perfectly like we analysed.

As a follow up from yesterday, after completing 3356, we noted that EMA5 cross and lock opening 3404, which was hit perfectly today as analysed. With strong momentum, we also cleared the 3424 Bullish Target.

We will now look for an EMA5 lock above 3424 to open the next bullish level at 3439. Alternatively, a rejection here may see lower Goldtruns tested for support and bounce.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels, taking 20 to 40 pips. As stated before, each of our level structures gives 20 to 40 pip bounces, which is enough for a nice entry and exit. If you backtest the levels we’ve shared every week for the past 24 months, you’ll see how effectively they were used to trade with or against short/mid-term swings and trends.

The swing ranges give bigger bounces than our weighted levels, that’s the difference between the two.

BULLISH TARGET

3356 - DONE

EMA5 CROSS AND LOCK ABOVE 3356 WILL OPEN THE FOLLOWING BULLISH TARGETS

3381 - DONE

EMA5 CROSS AND LOCK ABOVE 3381 WILL OPEN THE FOLLOWING BULLISH TARGET

3404 - DONE

EMA5 CROSS AND LOCK ABOVE 3404 WILL OPEN THE FOLLOWING BULLISH TARGET

3424 - DONE

EMA5 CROSS AND LOCK ABOVE 3424 WILL OPEN THE FOLLOWING BULLISH TARGET

3458

BEARISH TARGETS

3331

EMA5 CROSS AND LOCK BELOW 3331 WILL OPEN THE FOLLOWING BEARISH TARGET

3311

EMA5 CROSS AND LOCK BELOW 3311 WILL OPEN THE SWING RANGE

3289

3266

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold Bulls Back in Control as Trump Pressures Fed for Rate CutsHey Realistic Traders!

President Trump is ramping up pressure on the Fed to cut interest rates , saying the U.S. is falling behind countries with looser policies. As several Fed officials begin to shift their stance, expectations for rate cuts are growing. That’s putting pressure on the dollar and giving gold a fresh boost.

We’ll take a closer look at what this means for OANDA:XAUUSD (Gold) through technical analysis and explore its upside potential.

Technical Analysis

On the 4-hour chart, Gold has moved above the EMA-200, signaling a shift in momentum to the upside. Price has also broken out of a Descending Broadening Wedge (DBW) pattern, which often indicates the start of a bullish trend.

The breakout was confirmed by a Bullish Marubozu candle, reflecting strong buying pressure. To add further confirmation, the MACD has formed a bullish crossover, reinforcing the upward momentum.

Looking ahead, the first target is seen at 3417. If reached, a minor pullback toward the historical resistance zone (green area) may occur, with a potential continuation toward the second target at 3500.

This bullish outlook remains valid as long as the price stays above the stop-loss level at 3271 . A break below this level would invalidate the setup and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on XAUUSD.

Don't chase the bullish trend,wait for the short position layout#XAUUSD

The tariff policy recently announced by the US government is undoubtedly the focus of the current gold market. Trump also tied the tariffs to the trial of former Brazilian President Jair Bolsonaro, adding to policy uncertainty. ⚖️

The implementation of the tariff policy may push up commodity prices, thereby exacerbating inflationary pressure, which is both an opportunity and a challenge for gold📊. On the one hand, rising inflation expectations may enhance the attractiveness of gold as an anti-inflation asset; on the other hand, the strengthening of the US dollar and US Treasury yields may offset this positive. 💡

At present, the lower support has moved up to the 3375-3365 area, where a top-bottom conversion position will be formed. The upper short-term resistance level is 3387-3393, the previous high. If the market touches this for the first time, you can try to see a double top fall.

🚀SELL 3385-3390

🚀TP 3365-3355