3.31 Gold US market operation analysis suggestions!Gold intraday analysis and operation: How to judge the next step after gold breaks through 3130!

Gold's strong rise in the Asian session has brought the price of gold close to 3130 and finally stagnated at 3127. The impact of the US market has not yet appeared, but with the current trend, the volatility of gold tonight will not be too small. The overall idea is to maintain the low north. The intraday volatility range is maintained within the range of 40 points between 3090 and 3130. The current increase has exceeded market expectations. Although there is selling pressure, it is all suppressed by the bulls!

US market pressure focus: 3130-3150 above and 3110-3095 below

The above analysis is a personal analysis suggestion, I hope it can bring some gains to everyone!

We will update regularly every day and introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention, we are very grateful

Goldpreis

Gold surges and then falls, indicating an imminent fallGold early stage layout plan: Long and short strategy all the way to stop profit in the actual market, huge profits, witnessed by the whole network!

Technical analysis of gold: At present, Trump's tariff policy will be officially announced on Wednesday. Today, Asian stock markets fell across the board in the Asian session, because Asian stock markets opened the earliest. According to historical laws, the stock market's reaction is the fastest. European stocks may also fall across the board. The short-term decline in the stock market often brings a short-term rebound in the price of gold. Focus on the trend of the US stock market. Once the US stock market falls sharply and rapidly, it is often accompanied by a rapid decline in the price of gold. In the morning, the price of gold has rebounded by more than 50 points from the low of 3076 to 3127. After rebounding by more than 50 points, we can intervene in short selling at 3120-25, and close the position when it falls back to around 3105-15. Today, the European and American sessions focus on the breakout of 3127-30. If the European session fails to break higher, then this point may become a short-term high point. It is best to take long positions when it falls back to around 3105-3100. Finally, I would like to advise all retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, then shorting may be the best choice. It is better not to do it than to make mistakes! Watching more and doing less is also a suitable strategy. I will remind you of the specific operation strategy during the trading session, and you should pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate and exchange!

Gold operation strategy: short gold at 3120-25, target 3105-3115, and go long at 3110-3100.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, and operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform you in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

Profit again, follow-up operation strategyBrothers, as I mentioned in my last opinion, gold is facing support below 3030-3020, so I still prefer to go long on gold in terms of trading. Today, we went long on gold near 3023 according to the strategy of short first and long later. Just when gold rose to around 3038, I manually closed my long position and easily made a profit of 140 pips again.

Today, Friday, gold hit the highest level of 3047 in the morning and started to fluctuate and fall. As of now, gold has hit the lowest level near 3021 and started to rebound. The 3025-15 line below is also the support position we have been talking about. Here we can find opportunities to intervene in long orders. We must be cautious in operation on Friday. All profits have been made this week. Since the announcement of the US interest rate decision, gold has been running all the way and has set a new record high again. Again, don’t chase gold at high levels, look for opportunities to go long when it falls back, and the operation is mainly to go long when it falls back. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, the short-term support of 3025-3015 is concerned, and the important support of 3000-05 is focused on. If it does not break, it will continue to be bullish. The upper target is to pay attention to the upper pressure. Before the daily level does not fall below the lower support, the main long rhythm will remain unchanged. I will inform you of the specific operation strategy in time, so please pay attention to it in time. Gold operation strategy: Gold will go long after stepping back on the 3025-3015 first line.

Next week’s opening trend forecast and layout!Early layout plan for gold: long and short strategies in the real market, all the way to profit, rich profits, witnessed by the whole network!

Technical analysis of gold: Gold rose again at the end of Friday, and finally closed the daily line with a bald positive line. After a brief adjustment, it rose again. Then, there will be high points to see next week. Continue to maintain the main decline and long, and do not guess the top for the bullish trend. This week is also a long and short strategy to stop profit all the way, and the intraday harvest is rich! The daily support is near 3057, but the strong will not have too much retracement, otherwise it will turn into shock, and the low point of the fall is near 3073. On Monday, the strong will rely on this position to be bullish. The upper pressure is near 3087. Don’t chase more before breaking the position. Breaking the position will gradually see above 3100! Next week, we will continue to focus on retracement and long, but don’t chase more. After all, the technical side needs to step back and adjust. Stepping back and long is the way to go with the trend. Maintain the main retracement and long, and watch more and move less in the middle position. Be cautious and chase orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the trading session, please pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long when gold falls back to 3070-60.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes. Once there are changes, we will inform you in time, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

GOLD XAUUSD ShortI m short. Gold can go even to 3100.No matter I sell more

Wall Street goes full bull with tariffs and payrolls looming

Gold surges toward $3,100 amid unrelenting rally

Smart money knows one thing very clearly: a large part of the bad news is already baked into the prices, and there is limited room for further downside. Especially considering the parabolic moves we’ve seen

Never the less we are in overbought zone,A correction coming.That will be good chance to buy Gold again

Accurately predict the timing of short position entryAs of now, we have made profits during the trading session. But gold hit the 3048 area yesterday. What should we do if some brothers did not close the order in time? We have made corresponding adjustments according to the current market.

Gold news:

On Friday, the price of gold climbed to 3083, mainly driven by factors such as rising risk aversion, the Federal Reserve's interest rate cuts, the global central bank's gold buying boom and increased inflationary pressure. The tense situation in the Middle East, global economic uncertainty and expectations of a depreciation of the US dollar have further enhanced the attractiveness of gold. This week, gold is expected to rise for the fourth consecutive week. The US PCE (personal consumption expenditure) data to be released tonight has attracted much attention from the market because it is the core indicator of the Federal Reserve to measure inflation and may have a significant impact on market expectations and asset prices. If the PCE data triggers concerns about stagflation, it may cause US Treasury yields to rise, further boosting gold prices. If the data eases inflationary pressures, it may boost risky assets, but gold may rise simultaneously due to rising expectations of interest rate cuts. Boosted by risk aversion, gold advanced all the way yesterday afternoon, hitting a new high of 3059 during the US trading session. Today's market continued to rise at the opening, and the current highest has reached 3086. Gold bulls rose like a tiger, where is the top?

Gold technical analysis: From the wave point of view, the large level is no longer repeated. The daily line 2832 runs a standard 5-wave structure upward, wave 1 2832-2929, wave 2 2929-2880, wave 3 2880-3057, wave 4 3057-2999. Yesterday's market broke through 3057 and rose. The current market is in the 5th wave. From the wave rule, wave 1 runs 97 US dollars. If the amplitude of wave 1 and wave 5 is equal, the high point of wave 5 can be seen near 3097. Using the Fibonacci retracement extension line, pay attention to the two resistance levels of 3088-3108 above. Therefore, the short-term continues to follow the trend of low-multiple bullishness. Pay attention to whether there is a structure to go short near 3108 above. Gold is currently high, and it is bound to fall back. This crazy bull trend cannot last long. This is inevitable. The gold price is currently seriously off track, that is, it is directly off track. This is unreasonable. Return is inevitable. There must be a deep fall today. The support below is around 3050, which is also the target of the fall.

Gold operation strategy: Short gold 3075-70 to increase the number of transactions. Target 3060-3050

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Follow your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. The short profit area of 3060-3050 is all closed.

3. In gold trading, we will continue to pay attention to news and technical changes, inform in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

Summary of this weekThis week, the gold market continued its bull market, breaking through the historical high of 84 and closing. The gold price broke through the psychological barrier of 3,000. The market sentiment continued to be optimistic.

In this week's trading, we took the main approach of going long, holding long positions, buying back, and making significant profits, achieving the expected goals.

Next week, we will continue to make steady progress and formulate a more efficient profit plan.

If you also want to learn gold trading skills and profits in the market, then join my team.

Wish you all: Have a good weekend

XAU/USD(20250328) Today's AnalysisToday's buying and selling boundaries:

3044.62

Support and resistance levels

3086.39

3070.78

3060.65

3028.58

3018.45

3002.84

Trading strategy:

If it breaks through 3060.65, consider buying, the first target price is 3070

If it breaks through 3044.62, consider selling, the first target price is 3028

Public strategy all correctSo far, everyone has made a profit by following the trading plan. We arranged short orders at 3032 and 3052 for gold, but the short-term trend was strong, so we all left the market at 3038! We collected another 80 points of profit! The operation idea is very clear.

News analysis: Why is 3026 so critical? Looking back at the rebound of gold prices in the past few days, it is not difficult to find that many previous rebounds have retreated near 3026. At the same time, this point is also the first time that gold prices have bottomed out and rebounded from 3056 before this round. After breaking through, it rebounded many times but failed to pass. This is a typical watershed between longs and shorts. In fact, yesterday's gold price had already meant to break upward, but the market tension was limited yesterday. The first wave of impact to 3038 this morning has already sounded the horn of the bulls' charge. Unfortunately, it was not sure whether 3026 could be held at that time. If the high position is near 3030, the defense should be placed below 3020, which is a little big. There is no reverse follow-up to keep up with the rhythm of this wave of rebound.

Technical analysis of gold: The current idea of the end of the trading day is very clear. We chose to take short positions below the previous historical high of 3055-57 for the second time. The short positions of 3050-52 have now retreated to around 3038. Since there has been a high-level decline, it shows that the bulls are not that strong. There has been no breakout in one go. The probability of breaking 3055 tonight is gradually decreasing. The end of the trading day will most likely remain in the 3030-50 range for consolidation, and the focus will be on tonight's closing point. If the high-level close is above 45, the gold price may set a new high tomorrow; if the closing line is below 35, it will maintain a high level of volatility tomorrow, Friday.

Operation strategy: If gold falls back to around 3030-35, you can take long positions. Gold can still be shorted around 3055-58

Trading discipline:

1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Operate according to our operation plan. The information in the market is complicated. Blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. All short-selling profit-taking areas 3050-3045 are closed.

3. In gold trading, we will continue to pay attention to news and technical changes. Once there is a change, we will inform you in time and strictly implement trading strategies and trading disciplines to move forward steadily in a volatile market and achieve steady appreciation of assets.

Gold shocks converge, trading strategy fully analyzedTechnical analysis of gold: Gold has slightly risen and fallen during the day, and the overall trend remains in a volatile trend. Gold is currently maintaining a narrow range of fluctuations on the daily trend, but the short-term moving average has gradually diverged downward, and there are signs of weakening in the short term on the daily line. The 4-hour level trend is temporarily maintained in a volatile state, and the price is temporarily compressed between 3010-3030. The short-term moving average continues to maintain a state close to adhesion and flattening, tending to maintain a volatile trend in the short term. It is necessary to pay attention to the continued downward trend after a small break in the 4-hour level trend. In the small-level cycle trend, after touching the previous support band, there are signs of stabilization again. Pay attention to the short-term adjustment.

Gold is about to explode in a big market. The obvious box-shaped oscillation triangle is converging, that is, it has become narrower, and the oscillation has lasted too long. If it can break through 3038 with consecutive positive lines, then today will basically continue a wave of pull-ups, so there is a high probability that the 4-hour middle track or the daily 5-day moving average will break. On the contrary, if the psychological barrier of 3000 is lost, the market may fall back to the support zone of 2971-2997 for correction. On the whole, today's short-term operation of gold suggests that callbacks should be the main focus, and rebound shorts should be supplemented. The top short-term focus is on the first-line resistance of 3030-3036, and the bottom short-term focus is on the first-line support of 3010-3012. Friends, you must keep up with the rhythm. Gold operation strategy: short gold rebound near 3028-3035, and go long on the pullback of 3015-3010.

How to break the position of gold as it narrows in shock?Technical analysis of gold: Gold has slightly risen and fallen during the day, and the overall trend remains in a volatile trend. Gold is currently maintaining a narrow range of fluctuations on the daily trend, but the short-term moving average has gradually diverged downward, and there are signs of weakening in the short term on the daily line. The 4-hour level trend is temporarily maintained in a volatile state, and the price is temporarily compressed between 3010-3030. The short-term moving average continues to maintain a state close to adhesion and flattening, tending to maintain a volatile trend in the short term. It is necessary to pay attention to the continued downward trend after a small break in the 4-hour level trend. In the small-level cycle trend, after touching the previous support band, there are signs of stabilization again. Pay attention to the short-term adjustment.

From the overall situation, gold is definitely in the bull market stage. At present, there is strong buying defense at the 3000 mark, and the "W" double bottom Zou shape has appeared below. If it successfully breaks through the 3035 watershed, it is expected to test the pressure near 3045 and the historical high of 3057. Now the low point of the callback begins to move up slowly, showing a small upward trend. First, we will overestimate and undervalue in the 3030-3010 range. We can see that the current gold trend is also narrowing. There is no problem with short-term shock operations, but pay attention to the breakout after continuous shocks. The daily cycle hovers around the angle of the short-term moving average. There is a choice of direction at any time. Follow the breakout. Overall, today's short-term operation strategy for gold is mainly long on callbacks, and short on rebounds. The short-term focus on the upper resistance of 3030-3036, and the short-term focus on the lower support of 3010-3012. Friends must keep up with the rhythm. Gold operation strategy reference: short gold rebounds near 3030-3034, with a target of 3020-3015, and long gold callbacks near 3010-3014, with a target of 3020-3025.

If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Gold has been in a good range recently, which is perfect!Congratulations to everyone for realizing the range idea again。It should be noted here that since the bulls rose strongly in the early stage, the market turned to bearish, or the rhythm of bullish adjustment will not be so fast. Therefore, yesterday's daily line turned positive, not the return of bulls, but a correction in the process of decline. On the one hand, the adjustment of bulls is not enough, and the indicators show that there is still further exploration. On the other hand, although the current shock has rebounded, the strength is not strong and the continuity is poor. It is a shock upward trend and may fall at any time. Be cautious when looking at bullish. Only by matching the market and the time point can you get the correct direction. Trading focuses on ideas and planning, and doing yourself well is more important than anything else.If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

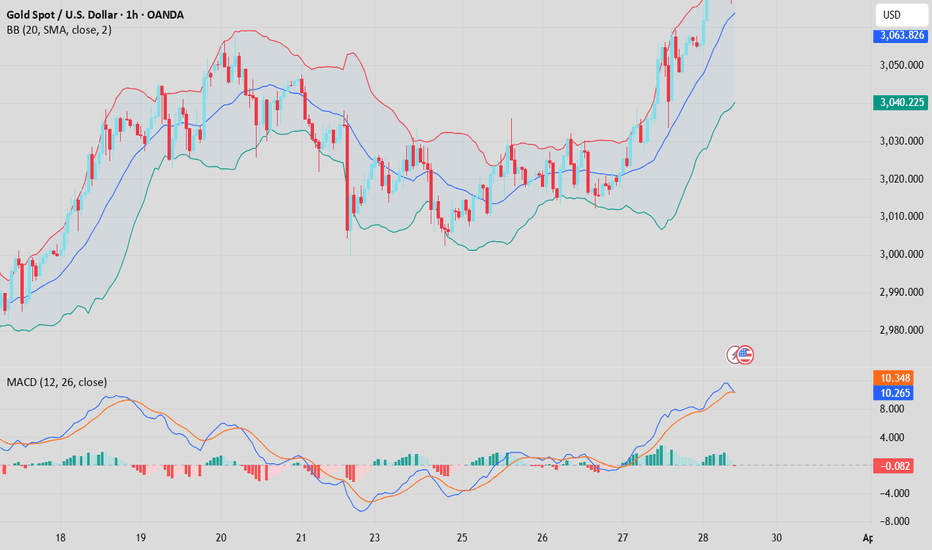

Gold hourly line pattern chart;

Gold once touched the 3002 line to stabilize, and the daily line level fell back three times in a row. There is still room for decline in the short term. Pay attention to the obvious support of the 3000 mark below. If it does not break, it will still be a repeated trend. On the contrary, there will be a continuous decline. In terms of operation, continue to go short on the rebound! Operation suggestion: short at 3025-3030. The target is 3016-3010. On the contrary, if it falls back to 3010-3005, go long and the target is 3020-3025.

So amazing! Accurate again, follow-up strategyToday, the first wave of gold price retreated from around 3026 to around 3013 in the Asian session. The lower support is obviously moving up gradually. Yesterday's white session also started to rise from above 2310. The two retracements before the US session only reached 3014 before rebounding quickly. At present, the focus on the upper side is the suppression of 3030-35. The hourly line of gold is now oscillating in the range box. Only after gold breaks through the box, will the gold market appear. Gold hit the 3035 line on Tuesday, but gold quickly fell back after hitting the high. We actually shorted at the 3032 line. The perfect harvest was harvested after stepping back. Gold did not break through the 3030-35 line suppression we mentioned above. If it breaks through the 3035 line and stands firm, then the bulls will rise and hit a new high. Our operation of stepping back to do more ideas remains unchanged, but we should not chase more directly, otherwise the adjustment of stepping back will be more uncomfortable. Be a steady hunter and wait quietly for the appearance of prey.

From the 4-hour trend, the upper short-term resistance focuses on 3030-35, and the lower support focuses on 3000-3005. Relying on this range, the layout of the long and short oscillation range is maintained. In the middle position, watch more and move less and chase orders cautiously, and wait patiently for key points to enter the market. I will inform you of the specific operation strategy in time. Gold operation strategy: 1. Go long when gold falls back to 3010-3000. If the subsequent market breaks through the 3035-3040 resistance line, we will adjust whether to go short based on the technical and news aspects and notify everyone in time.If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Interval oscillation, opportunities are within your graspMy dear friends, the gold range idea has been fulfilled again. Do you still remember the batch shorting gold strategy we laid out before? Facts have proved that our vision and judgment are extremely accurate! At present, the gold price has successfully reached the target area. Congratulations to everyone for making a profit again. This wave of operations is simply beautiful. I am honored to be recognized and encouraged by everyone. We set sail on the road of trading. I will bring my trading strategy plan, and you will bring your execution discipline. I believe we will definitely have good results.

But investment is never a one-shot deal. The current profit is only a phased result. The gold market has always been turbulent, and the subsequent trend is full of uncertainty. The operation strategy plan can first refer to the unchanged range thinking method I mentioned earlier, the high-altitude and low-multiple operation strategy, and conduct in-depth technical and news analysis. Gold will temporarily maintain a volatile thinking approach. The large range focuses on 3035-3000, and is in horizontal consolidation. In the 4H cycle, the Bollinger Bands are also in a closed state, and the K-line is interlaced at the middle track. In the short-term sideways consolidation and accumulation stage, the operation relies on 3035 as the critical point of adjustment. Below this position, continue to look at the callback, recover and stabilize, and then adjust the thinking. Pay attention to the support of 3012 and 3000 below. Maintain high-altitude and low-multiple operations as a whole, and follow up after the breakthrough. The specific operation is combined with the short-term pattern. Once there is a new change, I will inform you as soon as possible. Operation suggestion: Gold is short near 3030-35, and the target is 3020 and 3015! It is long near 3010-3000. The target is 3015 and 3026!If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Go long and win, then go short on the reboundToday, the layout of gold is to go long in batches near 3005-3008, and 3020 is a successful profit. Now the rebound continues to go short.

In terms of the daily line structure, yesterday's rebound of gold first touched the pressure of the 5-day line, and then the market retreated to the vicinity of the 10-day line. The overall trend is in line with expectations, fluctuating within the daily average range, and the rhythm of rising first and then falling also increases the expectation of the continuation of the short-term market adjustment. The pressure of the 10-day line can continue to be paid attention to on the upper side of gold during the day, but the 10-day line has now moved down to the vicinity of 3027, and today's market opened near the 5-day line 3012. Combined with the trend of the hourly chart, gold fell again to the vicinity of 3000 overnight, indicating that the short-term trend still follows the technical trend, but the main sentiment of the market is still controlled by the bulls. If the fundamentals unexpectedly break out with good news, the bulls' sentiment may go crazy at any time. In the day, we can pay attention to the pressure near the short-term trend line 3025 on the upper side of gold, and continue to pay attention to the competition around 3005-00 on the lower side. If 3000 is lost, we will look for a larger space to retrace. If the market has been fluctuating above 3000 today, the risk of short-term market variables will increase.

For specific operations, it is recommended to be short at 3020-3025, and look at 3015-3005.

If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

The opening situation is clear, practical guideGold news:

The rise of the US dollar index benefited from Trump's tariff policy. Just yesterday, Trump suddenly announced: a 25% tariff on the purchase of oil and natural gas from Venezuela, and claimed that individual tariffs would be reduced. The market's tense nerves were released, and the US dollar index rose sharply. As the end of the month approaches, the market needs to rebalance its investment portfolio, increase the allocation of US dollars to hedge against unknown risks, and push the US dollar to continue to rise. Yesterday, the market news was light. Today, the market will welcome the speech of Federal Reserve Board Governor Kugler on "Economic Outlook and Entrepreneurship". Immediately afterwards, New York Fed Williams will speak at a public event. In addition, there is the March Conference Board Consumer Confidence Index at 10 pm. The above events and data are concentrated in the evening tonight, which will have a certain impact on the market and need to be paid attention to. The price of gold has begun to retreat from its historical high, and the power of safe-haven buying has eased. This retreat momentum is expected to intensify further, especially in terms of technology.

Gold technical analysis:

Currently, the price of gold is running in a similar triangle range, and the correction cycle is prolonged. On the one hand, the bulls rebounded after the pressure, and it was difficult to return to the strong position directly; on the other hand, the retracement was supported by the key top and bottom conversion support belt of 3005-3000. This trading day focuses on the gains and losses below the low of 3000 at the end of last Friday, and the breakthrough below the 3030 pressure line above. If it fails to break through, it is likely to fluctuate around this range during the day.

Gold operation suggestions: short near the rebound of 3020-3025, long near the retracement of 3000-3005.

The two orders of gold on Monday were perfectly grasped, and now everyone has made a profit. The two orders on Monday ended perfectly. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

Gold (XAU/USD) Technical Analysis – Bearish Rejection Expected fThis chart represents an analysis of Gold (XAU/USD) on a 30-minute timeframe. Below is a breakdown of the key elements:

Key Observations:

Downtrend Formation

The price is trading within a downward channel, marked by two descending trendlines.

The overall trend appears bearish, indicating potential further declines.

Supply Zone (Resistance) Around $3,025 - $3,030

The price is approaching this key resistance area.

If the price fails to break above, it could lead to a rejection and continuation of the downtrend.

Demand Zone (Support) Around $3,000 - $3,006

This is the target area where buyers may step in to support the price.

A downward move towards this zone is anticipated.

Projected Price Movement

The blue arrows suggest a bearish scenario.

A rejection from the supply zone is expected to push the price downward.

The final target is the demand zone near $3,000.

Conclusion:

Bearish Bias: The price is currently in a downtrend, with the expectation of a rejection from resistance and a move toward the lower support zone.

Confirmation Needed: Watch for price action signals, such as rejection wicks or bearish candlesticks, to confirm the downward move

3000 is not broken, the rebound points to a new trendIn the current gold market, the downward trend is more obvious. However, it is noteworthy that gold has tested the key point of 3000 many times, and each time it breaks through, it is unstable. This fully shows that the defense above the 2995-2990 support area is extremely strong and difficult to be effectively broken in the short term.

Combined with the downward momentum observed in the 3000 point range, although it is in a downward trend, the possibility of a sharp decline is extremely small. Judging from the comprehensive judgment of technical analysis and market sentiment, gold will not only not continue to fall, but will most likely rebound. It is initially estimated that the rebound target will reach the area around 3015, and it is very likely to extend further to the area around 3025-3035. Let us look forward to the performance of gold together!

The content I shared recently about the gold market has received a lot of feedback, and everyone said it was very helpful!If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

Gold (XAU/USD) Bearish Outlook: Key Levels to WatchBuddy'S dear friend SMC Trading Signals Update 🗾 🗺️

This chart represents the price action of Gold (XAU/USD) on a 1-hour timeframe, showing potential areas of resistance, support, and liquidity zones. Here’s a breakdown of the analysis:

Analysis of the Chart:

1. Resistance Level (3,023-3,030 zone)

The price has reacted multiple times (red arrows), indicating strong selling pressure.

A fair value gap (FVG) is present, suggesting potential mitigation before further movement.

2. Current Price (3,011.76)

The price is trending downward after rejecting the resistance level.

It is approaching the diamond zone, a potential short-term support before continuation.

3. Key Support Levels:

Diamond Zone (~3,000 region)

Could cause a temporary bounce before further decline.

Order Block (~2,952-2,938 zone)

This is a strong demand zone and a potential target area for price action.

4. Target Levels:

The analyst expects a downward move toward 2,952, aligning with a liquidity grab scenario.

5. RSI Indicator:

RSI is at 44.27, suggesting bearish momentum, with the possibility of further downside.

A break below 40 RSI may confirm more selling pressure.

Mr SMC Trading point

Risk Management Considerations:

Entry: A possible short entry could be around the FVG level (~3,020-3,030) if price retraces.

Stop Loss: Above 3,035 to avoid being trapped in a fake breakout.

Take Profit: Around 2,952-2,938 as per the target point.

USD Update & Impact on Gold:

If USD strengthens, gold may drop further due to their inverse correlation.

Key upcoming economic data (interest rate decisions, inflation reports) could increase volatility.

Pales support boost 🚀 analysis follow)

Another Strong Start to the Week!Gold opened the week on a positive note without a significant pullback, rebounding quickly after touching a low of 3013. The overall price action remains range-bound with a bullish bias, though gold is still trading within the lower to middle Bollinger Bands. A clearer upside move may emerge once the correction phase concludes.

In the short term, resistance remains at the 3030-3040 zone. If this level holds, short positions can be considered. On the downside, key support levels to watch are 3012 and 3005, with the 3005-3000 range offering a potential buying opportunity.

Trading Strategy:

- Sell near 3030-3040resistance if it remains intact.

- Buy around the 3005-3000 support zone.

- Adopt a range-trading approach, focusing on shorting near resistance and buying near support.

I have always been glad that I can stick to my original intention. I can be dedicated to every friend who proposes cooperation. I will use my professional strength to help you make profits, recover your capital, and increase your funds. My reputation depends entirely on the publicity of customers. My strength has been honed in actual combat for a long time. Even if the road ahead is bumpy, as long as you give us trust, we will do our best to guide you and use your funds to the maximum effective limit, so that you can experience the feeling of profit in the ups and downs of the market! If you don’t know when to enter the market, you can pay attention to my 🌐 signal. I will release specific signals in real time. Remember to pay attention to the 🌐 signal in time.

GOLD ALERT | BIG DROP LOADING!🏦 Institutions Are Taking Profits – Are You Ready for the Next Move?

For the last 4 weeks, institutions have been reducing their long positions on #GOLD ( OANDA:XAUUSD ). This is exactly what I warned about – profit-taking from big players, signaling potential downside ahead.

technical down

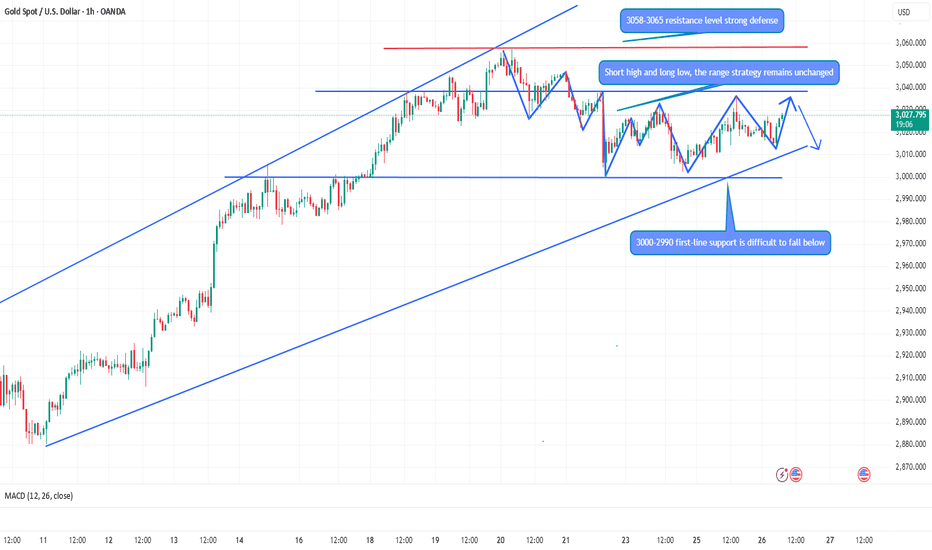

Go short first, then go long, and grasp the rhythmGold overall rose and fell last week. After three consecutive positive weekly lines, the upper shadow line was closed. On Friday, it walked out of the adjustment space. The short-term rise slowed down slightly, and it was more inclined to fluctuate at a high level. The daily line turned negative and retreated to correct, and it was in a partial adjustment stage. In the 4H cycle, it did not stabilize above the 3047-57 mark mentioned earlier, so it walked out of the second downward exploration space, but combined with the intact structure of the three-month rising channel, the current retracement is more inclined to technical correction rather than trend reversal. From a spatial point of view, the 3030 line as the midpoint of the channel constitutes the primary resistance. If this position cannot be effectively broken through, the gold price may test the support of the 3000 integer mark downward. It is worth noting that the static resistance formed near 3050 resonates with the recent fundamental negatives, further suppressing the upward space.

The current strategy needs to focus on whether the 3026 opening high can be recovered in the oscillation range. If it stabilizes, it will be seen to 3035 last week's opening point; on the contrary, if it falls below the 3010 short-term moving average support, the shorts can follow the trend to the expected 3000 mark. It is recommended to adopt the range trading mode, and operate back and forth between high and low in the range of 3000-3035. Technically, we need to be alert to the stagflation signal formed by the continuous shortening of MACD and the closing of Bollinger Bands. It is recommended to avoid chasing highs and focus on the impact of US CPI data on the market.

Gold operation advice: Go short after rebounding around 3030-3040. Go long after stepping back to 3010-3000.If you don’t know when to enter the market, you can follow me. I will release specific signals in real time. Remember to pay attention in time.

Next week's market strategy analysisGold fell on Friday, falling to the lowest level of 2999 and then began to rebound strongly. Overall, if we say that gold has peaked now, it is too early, because there are still many uncertainties to stimulate the increase in risk aversion, so it is possible that gold will rise again. However, the impact of the news is only one aspect of our reference. However, the impact of news is only one aspect for our reference. After all, a lot of information cannot be known in time. We can only say that we should pay attention to the existence of this risk factor, so we still start from the technical level. There is still room for gold to rebound next week. We will first focus on the short-term suppression of 3025-30.

From the hourly analysis, pay attention to the support of 3005-3000 below. If it does not break after the retracement, continue to be bullish. Pay attention to the short-term suppression of 3025-3030 above, and focus on the suppression of 3045-57 above. The operation still maintains the same rhythm of the main multi-trend. If you don’t know when to enter the market, you can pay attention to me. I will release specific signals in real time and pay attention to it in time.

Gold operation strategy for next week: Gold will go long after stepping back from 3005-3000, and the target is 3025-3030.

Golden Strategy Perfect HitWalk together and witness the harvest! In the ups and downs of the trading market. With the trust and persistence of my trading strategies and trading plans, everyone successfully pocketed the fruits of victory. Sometimes you don't even need to know how to trade. Having an accurate and precise analysis guide is crucial and is the basis for profit. Similar accurate signals are available every day. Traders don't know when to enter the market? Then you can follow me. When the opportunity comes, I will promptly release more accurate signals in my trading center. Welcome everyone.