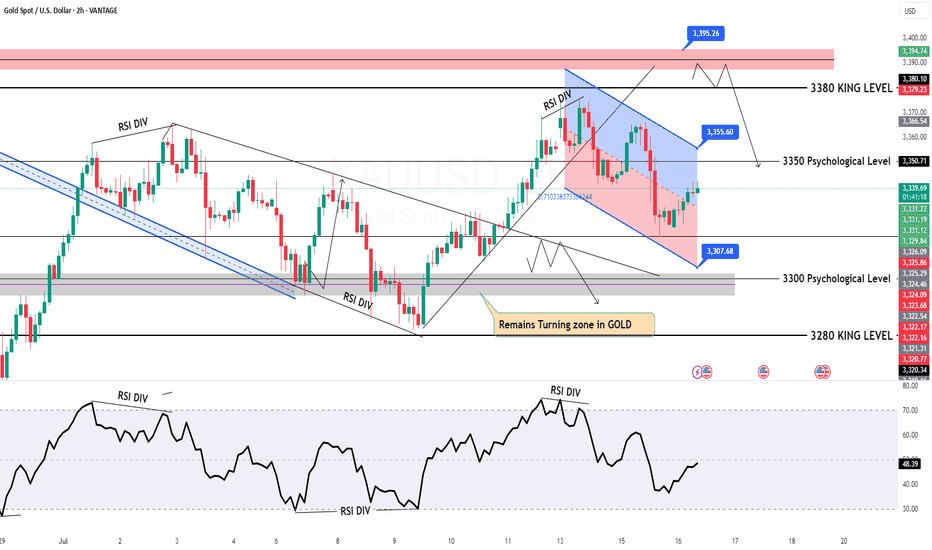

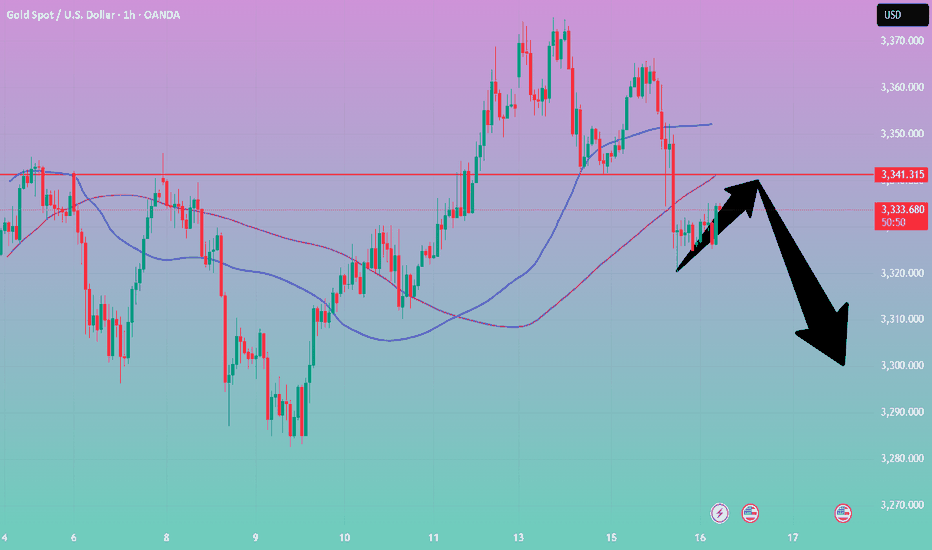

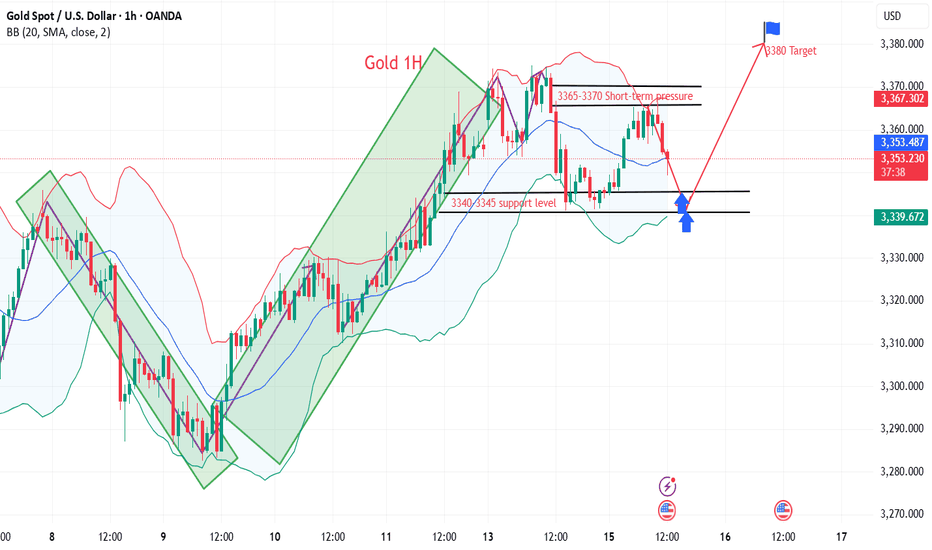

GOLD Intraday Chart Update For 16 July 2025Hello Traders,

Today we have major news is US PPI, currently market is in tight range between 3360 to 3310

all eyes on 3360 level breakout for the day for further upward continuation

Only break below 3315 market will goes further downside

Currently we also have Bearish channel in H2 TF

Disclaimer: Forex is Risky

Goldprice

Gold XAU/USD Analysis for July 15, 2025: Trading Strategy and KeThe market is showing a strong upward trend, as indicated by the yellow trendline.

Fibonacci Retracement Levels:

38.2% Fibonacci Level: 3,344.79

50% Fibonacci Level: 3,344.47

61.8% Fibonacci Level: 3,347.91

Resistance Zone: The price is approaching a strong resistance level at 3,370 USD.

Technical Observations:

Gold is currently moving upward but is encountering resistance at 3,361. The price tested the 61.8% Fibonacci level and is now facing some resistance.

The Fibonacci levels suggest that if the price breaks above 3,362, the next target could be 3,370 USD.

Support Zone: If the price retraces, support may emerge near the 3,340 region.

Gold XAU/USD Trading Strategy:

Bullish Scenario:

If the price breaks above resistance at 3,362, the next target would be the 3,370 level. This could be a signal to enter Long positions near the 3,344 to 3,348 range, with a target around 3,370.

Bearish Scenario:

A retracement to the support level at 3,340 is possible. If the price drops below 3,340, further downside could be expected. In this case, a Short position could be considered if the price falls below 3,340, with a target near 3,330.

With the current upward trend, gold XAU/USD may continue to rise if it breaks the 3,362 resistance level, with the next target being 3,370 USD. However, if the price turns lower and drops below the 3,340 support level, the market may continue to decline.

Note: Be sure to monitor the Fibonacci levels and price behavior closely to adjust your trading strategy accordingly for today. If this analysis was helpful, don't forget to save it and follow for more trading strategies!

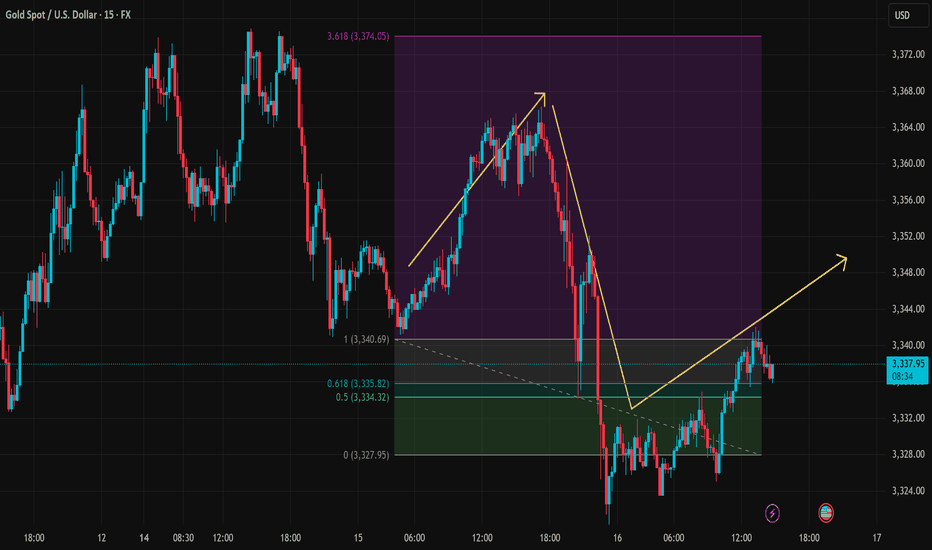

Gold Price Analysis Bullish Continuation PossibleBullish Trend Formation: We see a series of higher highs and higher lows forming on the chart, suggesting a potential continuation of the bullish trend. However, the market has recently pulled back from the previous peak at 3,340.69, which is now being tested as support.

Fibonacci Retracement Analysis:

The current pullback has reached the 0.5 level around 3,334.32, a strong support zone. This area could offer a potential long entry if the price reacts positively from here.

The 0.618 Fibonacci level at 3,335.82 is also significant, often acting as a final retracement level before the market continues its bullish move.

Support Testing: If the price holds above the 0.618 level, we could expect a price rally towards the resistance at 3,372.00, with possible extension above it.

Trend Continuation: If the price breaks below 3,335.82, consider watching for further downside potential with the next target being the 0.5 level, near 3,334.32.

Trade Strategy (Buy on Support):

Entry: Around 3,334.32 or 3,335.82 (depending on price action confirmation).

Target: 3,340.69 (next resistance zone).

Stop-Loss: Set just below the 0.5 Fibonacci level around 3,327.95 to manage risk effectively.

The current chart is showing a potential for a bullish continuation, with key support levels at 3,335.82 and 3,334.32, backed by Fibonacci retracement. Watching the price action around these levels will be crucial for entering a potential buy position.

Remember to adjust your strategy based on the actual market movements and confirm the trend with price action before making a trade.

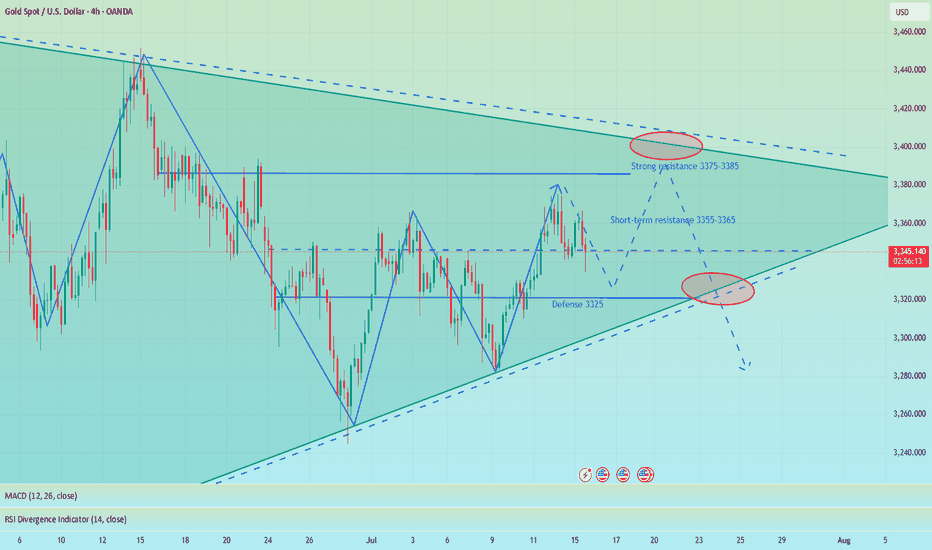

Public short selling profit, NY short-term multiple layoutInterest rate futures data showed that the results were in line with our previous expectations, with a lower rate cut this month and a higher probability of a 25 basis point cut in September. In the short term, gold may first take profits and then rebound. NY session trading has just begun. Bros can pay attention to the 3335-3330 area below. If it falls back and stabilizes, you can consider participating in long positions, defending 3325 and targeting 3355-3365.

OANDA:XAUUSD

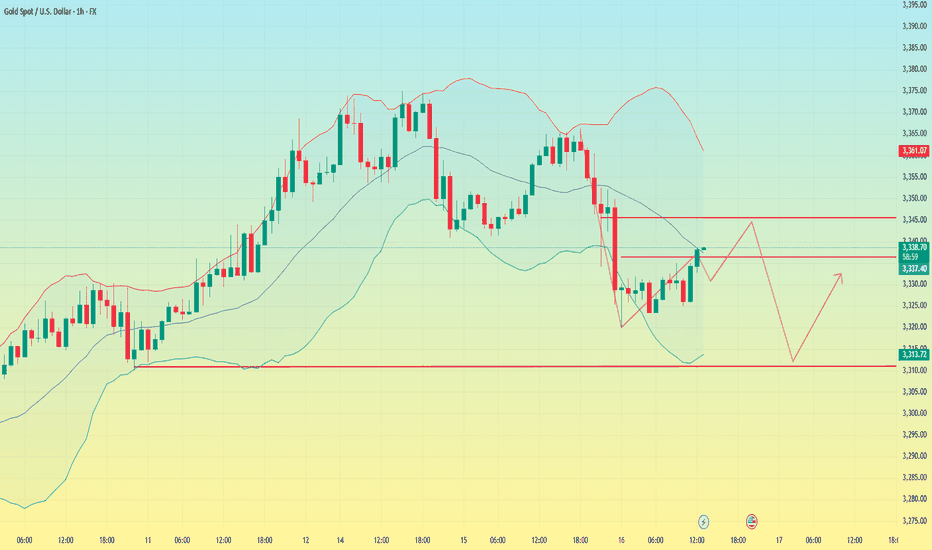

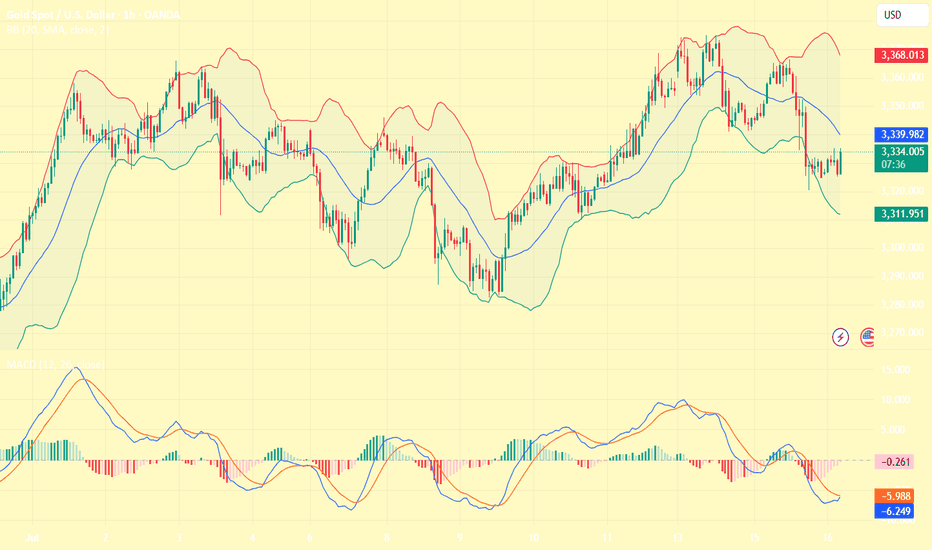

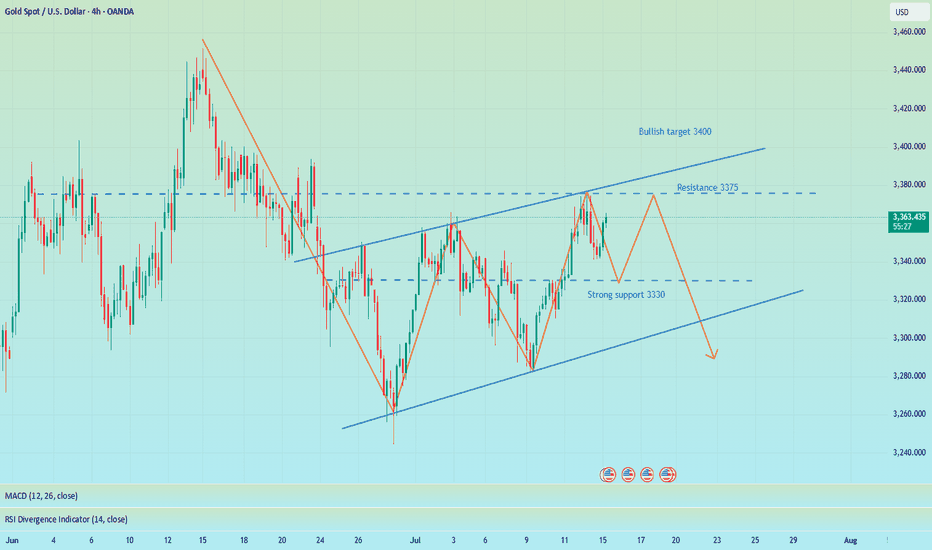

Gold fluctuates downward. Can it break through?The CPI data released is in line with expectations, the tariff storm is still continuing, inflation rebounds and the Fed's expectations of interest rate cuts have cooled. Gold rebounded to 3366 and then fell, and is currently fluctuating around 3330.

From the current trend, gold fell strongly and broke through the Bollinger middle rail and the moving average support. The daily line focuses on the Bollinger middle rail under pressure near 3340, and the short-term support is at 3310. At present, a staged top pattern has been formed and the K-line double top is around 3366. The Bollinger moves downward and the price is in a downward channel.

For short-term operations, Quaid believes that the strategy of rebound shorting can still be followed.

Short near 3345, stop loss 3355, profit range 3330-3310

Long near 3310, stop loss 3300, profit range 3330-3345

Gold fluctuates and moves lower! Gold price falls!Market news:

In the early Asian session on Wednesday (July 16), spot gold fluctuated slightly higher and is currently trading around $3,330/ounce. After the release of US inflation data, the market's focus shifted from macro data and interest rate prospects to policy risks again. The US dollar index strengthened by 0.6%, which also exacerbated the short-term pressure on London gold prices!

Although gold prices have shown a downward trend in the short term, market sentiment has not completely turned to pessimism. The uncertainty of tariff policies may provide support for gold prices. We are still optimistic about the long-term trend of gold, and the market's attention to tariffs will drive international gold prices to rebound in the future.

Next, investors will focus on the US Producer Price Index (PPI) to be released on Wednesday, as well as speeches by Fed officials to assess policy trends. Many institutions believe that in the context of intensified global policy games and increased volatility of the US dollar, the importance of international gold as a safe-haven and anti-inflation asset is still increasing.

Technical review:

Gold hit a high of 3,366 yesterday and was blocked and fell back. It broke down to 3,320 during the US trading session and closed with a long shadow on the daily line. Today, the trend is to continue to fluctuate, and there should not be much room below. The current support level is near the daily MA5 and the middle track. The next step is still the focus. If you want to rise, you can't go down here. If you go down, you will continue to sweep back to 3320 and 3300!

The daily line maintains a continuous negative structure. The further strengthening of the US index puts gold and silver under downward pressure. The gold price on the daily chart returns to below the MA10 daily moving average, the New York closing plus the 5/7-day moving average, the RSI indicator middle axis is flat, and the price is running in the middle and lower track of the Bollinger band. The four-hour chart and the hourly chart moving average cross open downward, the RSI indicator runs below the middle axis, and the Bollinger band hourly chart opens downward and runs in the middle and lower track of the price. The gold trading idea remains unchanged with the high-price selling layout as the main layout, and the low-price buying is auxiliary.

Today's analysis:

Gold has been very weak in the past two days, and it has been going up and down. Gold finally fell as expected yesterday. Gold won three consecutive victories yesterday. Gold bought at a high level and failed. Gold will be sold again next. Gold rebounded in the Asian session and continued to sell.

Gold's 1-hour moving average has also begun to turn downward from a high position. If the gold's 1-hour moving average forms a dead cross downward, the downward momentum of gold will increase, and gold still has room to fall. Gold fell below the previous double bottom support of 3346 in the US market yesterday. Now gold's 3346 short-term has begun to turn into resistance. Gold is under pressure at 3346 in the Asian market and continues to sell at high prices.

Operation ideas:

Short-term gold 3310-3313 buy, stop loss 3302, target 3340-3360;

Short-term gold 3346-3349 sell, stop loss 3358, target 3320-3300;

Key points:

First support level: 3320, second support level: 3308, third support level: 3292

First resistance level: 3346, second resistance level: 3360, third resistance level: 3376

XAU/USD(20250716) Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

3353.05

Support and resistance levels:

3386.70

3374.12

3365.96

3340.13

3331.97

3319.40

Trading strategy:

If it breaks through 3353.05, consider buying in, the first target price is 3365.96

If it breaks through 3340.13, consider selling in, the first target price is 3331.97

CPI triggers sell-off, 3330 can be short-term long📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

The short-term trend flag pattern has been formed, and our short-selling strategy perfectly hits the TP. According to current news, Trump has once again urged the Federal Reserve to cut interest rates. While there is almost no possibility of a rate cut this month, there is a high probability that a 25 basis point rate cut will be completed in September, which is also in line with our previous prediction of market trends.

The big negative line in 4H pierced the middle Bollinger band. Although the CPI data is bullish, it has little impact based on the announced value. Market expectations have been digested in advance, so there is no room for a big drop. The upper points still focus on the short-term resistance of 3355-3365. If it rebounds to this area first in the short term, you can consider shorting again. Focus on the strong support of 3330 below. As long as the retracement entity does not fall below 3330, gold will rise again and touch the resistance line of 3375-3385.

🎯 Trading Points:

BUY 3335-3325

TP 3355-3365

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD

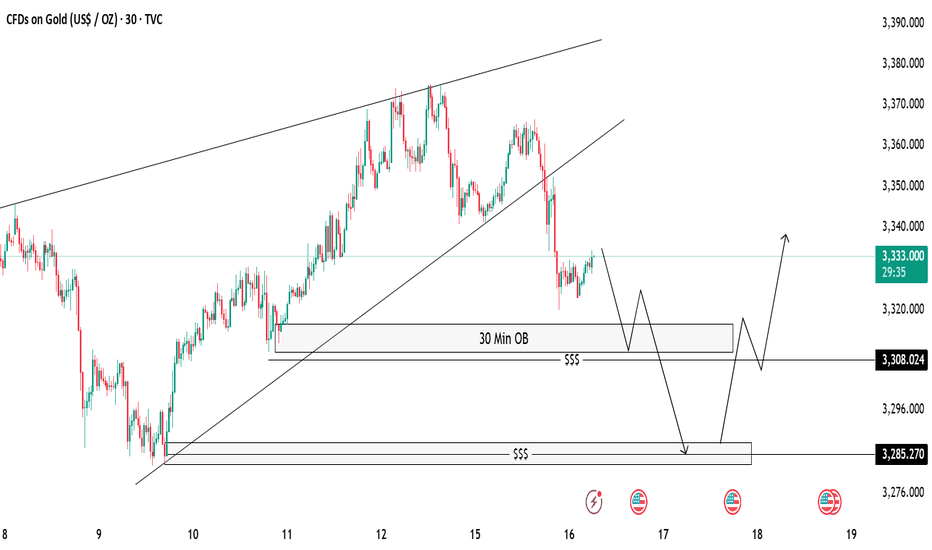

Gold 30-Min OB Analysis – Bounce or Drop..?Gold is showing a break of structure after a big sell-off 🔻. We have marked a 30-Minute Order Block (OB) 📍 which can act as a possible reaction zone.

📌 Two Scenarios We Are Watching:

✅ Scenario 1 (Bullish):

If price taps into the 30M OB and shows bullish rejection 🟢, we can look for buy opportunities, targeting the previous highs near 3335-3340 🎯.

❌ Scenario 2 (Bearish):

If price fails to hold the OB, we will watch for a liquidity sweep (marked with $$$) and expect price to move lower towards the next demand zone near 3285 📉.

⚠️ Key Notes:

Always wait for confirmation before entry.

Patience is the key 🧘♂️ — let the market come to us.

Gold Likely to Extend Gains as USD Weakens, but Faces Resistance📊 Market Move:

Gold surged to a three-week high near $3,370/oz, driven by safe-haven demand amid renewed trade tensions between the U.S. and EU/Mexico and threats of a 100% tariff on Russian imports.

Investors are now focused on upcoming U.S. CPI data, which could trigger sharp moves if inflation comes in below expectations.

📉 Technical Analysis:

• Key Resistance: ~$3,365–$3,372; a breakout could open the way to $3,400–$3,440

• Nearest Support: ~$3,340 (S1), then ~$3,326 (SMA50), and deeper at $3,300–$3,320 (Fibonacci zone)

• EMA: Price remains above short-term EMAs (20/50/100), suggesting a continuing bullish bias

• Candlesticks / Volume / Momentum:

• RSI is neutral-to-bullish around 54; MACD shows strengthening bullish momentum

• Bollinger Bands are narrowing, signaling potential for a breakout

📌 Outlook:

Gold may continue edging higher or consolidate around the $3,365–$3,372 resistance zone if no new geopolitical shocks occur. However, if U.S. CPI comes in below expectations or if USD/Yields weaken, gold could rally further toward $3,400–$3,440.

________________________________________

💡 Suggested Trading Strategy

🔻 SELL XAU/USD at: $3,370–3,373

🎯 TP: 40/80/200 pips

❌ SL: $3,376

🔺 BUY XAU/USD at: $3,340–3,337

🎯 TP: 40/80/200 pips

❌ SL: $3,334

CPI is coming, gold 3340-3375 pay attention to the breakthrough

Review of yesterday's market trends and technical points:

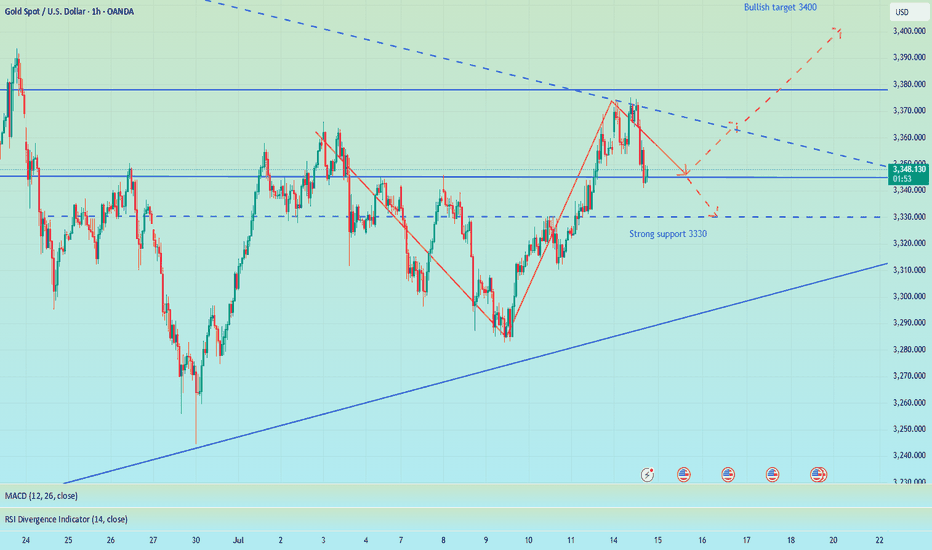

Gold: Yesterday's opening gapped up and touched the upper track of the short-term channel and the 618 split resistance level of 3374. After being under pressure, it filled the gap and continued to choose to be bullish after stabilizing close to the middle track of the hourly line; the European session attacked 3374 many times without success, and the US session lost the middle track of the hourly line downward, which means that it is not urgent to be bullish repeatedly above the intraday low; finally lost the lower track of the short-term channel, so there will be a certain downward correction, but follow the trend of last Thursday and Friday. , the downward correction space is not large, just still stable above the daily middle track 3340, so use this as a defense, so continue to try to be bullish, today as expected ushered in a wave of higher;

Today's market analysis and interpretation:

First, the gold daily level: three consecutive positives and negative closing is a correction. According to the recent shock cycle, today is expected to close positive, and the focus is on whether the market can continue to rise in the future; today, the first thing to pay attention to is whether the middle track 3340 can stabilize and continue to rise, because yesterday's negative line is considered to be a correction. If the market can continue to fluctuate, then there is hope for testing 3400 and above; on the contrary, if it falls back to 3340 or below today, it will continue to hover below the resistance level of 3375, and the lower track line of the convergence triangle will support above 3300; then the CPI inflation data released today will be relatively important, and the market expects it to increase to 2.7% this time. Once the announced value is greater than or equal to 2.7%, then inflation will rise, which will weaken the interest rate cut and suppress the gold price; on the contrary, if the announced value is less than 2.7%, it does not meet the The market is expected to boost gold prices; if it is less than or equal to 2.4%, the probability of interest rate cuts will be increased, which will significantly boost gold prices;

Second, the 4-hour level of gold: today's focus is on the upper support of the lower middle track 3340 and the lower resistance of 3375 above, to see which side is effectively broken;

Third, the hourly level of gold: after stabilizing 3340 today, it will break through the early morning resistance level of 3351-52 and hit the 3365-66 line, so the overnight low bullishness will be successful; Currently it is running in a narrow range of 3365-3356, which means waiting for today's data; from a technical perspective, pay attention to the support of the middle track 3352 on the bottom. If it stabilizes, you can continue to be bullish. Pay attention to the resistance of 3374-75 on the top. Only when the big sun or continuous sun breaks through can new room for pull-up be opened; if the data is bearish and the middle track is not held downward, there is no rush to be bullish. Wait for the downward momentum to slow down, and a stop-loss signal will appear. If there are signs of sideways trading at the bottom, choose to layout low and long. Below 3340, there is still 3334 and 618 support, which is also the annual average. If it goes down again, it will give a good bottom speculation low. You can directly sell below 3310. The market will still repeatedly attack the resistance of 3365 and 3374 if it is stable; as long as it converges along the lower track of the daily triangle, the lows gradually move up, and every time it approaches the low, it is a good bottom speculation point, and there is basically a pull-up of 50-100 US dollars.

Will CPI data boost gold to 3,400?

💡Message Strategy

Gold prices rebounded modestly in the Asian session, supported by a weaker dollar and safe-haven demand. The market is currently focusing on the upcoming June CPI data from the United States, and investors are reassessing whether the Federal Reserve may start a rate cut cycle this year.

The overall CPI (year-on-year) is expected to grow by 2.7%, and the core CPI may reach 3.0%. If the data is lower than expected, it will strengthen the market's bet on a rate cut in September, which is bearish for the dollar and bullish for gold.

The current market has expected that the probability of the Federal Reserve cutting interest rates in September is about 60%, and the probability of a 50 basis point rate cut before the end of the year is about 50%.

📊Technical aspects

Gold price (XAU/USD) maintains a bullish structure as a whole and is currently testing the key resistance level of $3365. If it can effectively break through this area, it will open up the upside, with the target pointing to $3400 or even $3435.

On the daily chart, MACD maintains a positive opening, and the momentum indicator shows that buying is still active, and the short-term trend is to continue to rise. On the contrary, if the gold price is blocked near 3365-3370, it may fall back to the support area of 3340 US dollars. Further support is near 3326 and 3300 US dollars, which is still regarded as a potential area for bargain hunting.

💰Strategy Package

Long Position:3345-3355,SL:3335,Target: 3380-3400

It is expected to fluctuate and fall before CPI data📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

The 1H chart shows that the gold price continued to pull back last night and then fluctuated at the bottom, and continued the rebound trend this morning. The key pressure level is the top and bottom conversion level. The current rebound in gold is only a secondary confirmation of the top structure at the 30-minute level. After reaching 3365, it has shown signs of short-term pressure. In a volatile market, if the price begins to consolidate horizontally, it may indicate the end of this round of volatile upward trend, and it will enter a downward phase later. Considering the market sensitivity before the release of CPI data, it is recommended to focus on the volatile decline trend. After today's rebound, it is necessary to focus on the 3365-3368 area as a short-selling range, and the long-short defense position is set at yesterday's intraday high of 3375. The support below focuses on the 3350-3340 range.

🎯 Trading Points:

SELL 3358-3368

TP 3345-3333

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD

XAU/USD 15 July Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

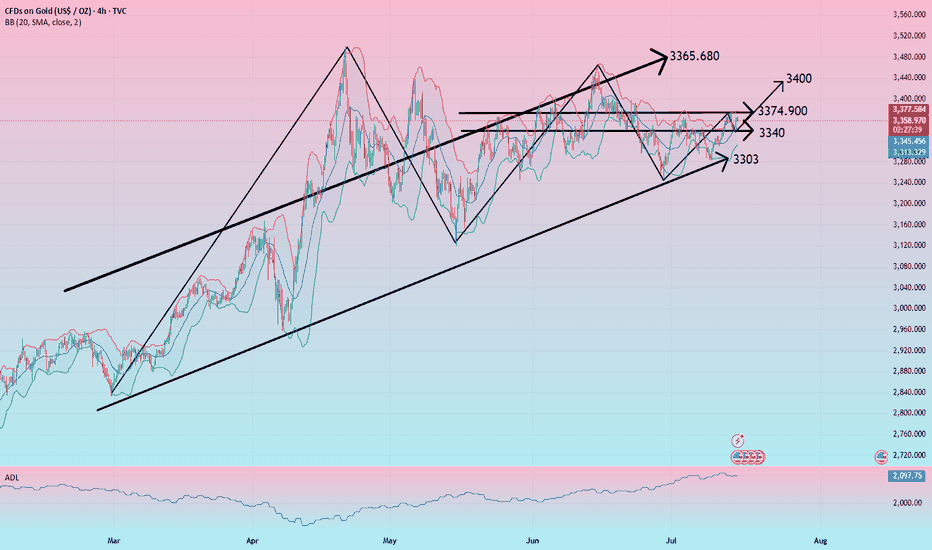

Converging triangle, may rise again in the short termUnder the influence of recent tariffs and the Federal Reserve's interest rate cuts, the main trend of the gold market remains bullish, but from the weekly and monthly level analysis, there is a high probability that it will pull back again after this round of highs and maintain a large range of fluctuations at a high level. Technical analysis shows that gold currently does not have the conditions for a unilateral surge at the daily level. Although the key level of 3345 has been broken, the continuity of the market is extremely poor, and volatility is still the main theme. At present, the trend of gold has formed a converging triangle pattern, and it may rise again in the short term. However, we need to be vigilant that the weekly line may form a high-rise and fall pattern, and the price of gold may fall back to 3300! Therefore, in today's late trading, you can consider retreating to the 3335-3330 area to go long

OANDA:XAUUSD

Gold Aiming Higher: Bullish Momentum Toward Key S&D ZoneHello guys!

The main bullish trend remains intact on Gold. After forming a solid base near the QML level, price has been respecting the ascending channel structure and is now pushing toward the upper boundary of that channel.

The current price action shows strength and momentum, and with the recent breakout above the midline of the channel, it signals that buyers are likely to push price toward the next key area of interest.

The target is clearly defined: the supply zone around 3409–3423, which has previously acted as a major resistance area.

Core idea:

Main trend: Bullish

Structure: Ascending channel

Support confirmed: QML zone bounce

Current behavior: Price moving along the top of the channel

Target: 3409–3423 supply zone

GOLD (XAU/USD) MA Breakout – High-Probability Long Setup!💰🚨 GOLD HEIST ALERT! XAU/USD MASTER PLAN (Thief Trading Style) 🎯

🔥 Steal Pips Like a Pro – High-Probability Gold Breakout Strategy! 🔥

🎯 Thief Trading’s GOLD Heist Strategy (Swing/Day Trade) �💸

👋 Hey there, Market Pirates & Profit Snatchers! 🌍✨

Based on our 🔥Thief Trading Style🔥 analysis, we’re plotting a major heist on XAU/USD (GOLD). The plan? Buy the breakout, escape before the cops (resistance) arrive! 🚔💨

📈 ENTRY ZONE: The Heist Begins!

🚀 "Wait for the MA Breakout (3400) – Then Strike!"

Bullish Confirmation: Enter on a 15M/30M pullback after MA breakout.

Thief’s Trick: Use Buy Stop above MA or Buy Limit near swing lows for best risk-reward.

DCA/Layering Strategy: Deploy multiple limit orders to maximize gains.

🔔 Set an ALERT! Don’t miss the breakout – thieves move fast! ⏳

🛑 STOP LOSS: Protect Your Loot!

📍 Thief’s SL Placement: 3330.00 (4H Swing Low) – Adjust based on your risk & lot size.

⚠️ WARNING: If using Buy Stop, DO NOT set SL until after breakout – unless you love unnecessary losses! 🔥

🎯 TARGET: Escape with the Gold!

🏴☠️ Take Profit Zone: 3460.00 (or Exit Early if Bears Show Up!)

Scalpers: Only trade LONG side – use trailing SL to lock in profits.

Swing Traders: Ride the wave but watch for resistance traps!

📰 MARKET CONTEXT: Why This Heist?

Neutral Trend (But Bullish Potential! 🐂)

Key Factors: Geopolitics, COT Data, Macro Trends, Sentiment Shift

🚨 News Alert: Avoid new trades during high-impact news – trailing SL saves profits!

💥 BOOST THIS HEIST! (Like & Share for More Pips!)

💖 Hit the 👍 Boost Button to strengthen our Thief Trading Crew!

🚀 More Heist Plans Coming Soon – Stay Tuned!

⚠️ DISCLAIMER (Stay Safe, Thieves!)

This is NOT financial advice. Do your own analysis & manage risk.

Markets change fast! Adapt or get caught.

🎯 Happy Trading, Pirates! Let’s Steal Some Gold! 🏴☠️💛

Gold/XAUUSD Analysis Breaks Bullish Channel – Targeting 3400+🟨 Market Context:

Gold (XAU/USD) has recently completed a significant technical move that signals the potential start of a strong bullish continuation phase. After a period of consolidation inside a descending channel, price has broken above key resistance levels and is showing firm buyer strength across the board.

🔍 Technical Structure Breakdown:

🔹 Descending Channel (Consolidation Phase)

For several sessions, gold was confined within a well-defined descending channel, which typically indicates a temporary correction in a broader bullish trend. This phase served as a liquidity-building zone where smart money accumulated long positions.

🔹 Breakout & Retest Confirmation

The breakout above the upper boundary of the channel was clean and impulsive, confirming bullish intent. This breakout aligned perfectly with a previous demand zone (now retested as support), adding strong confluence.

Key Breakout Zone: $3,330–$3,340

Retest Action: Price pulled back to test the breakout zone, respected it, and printed a bullish reversal.

This behavior confirms the “breakout–retest–continuation” pattern—highly reliable in trending markets.

🔹 SR Interchange – Key Pivot Zone

The level around $3,340 served a dual role:

Previously acted as resistance within the channel.

Now acting as support post-breakout (SR flip).

This interchange area is significant because it reinforces the idea that bulls are now defending this level aggressively.

🔹 Bullish Pattern Confirmation

A bullish price pattern has formed exactly at the SR zone and near the trendline. This double confluence (pattern + level) provides high-probability trade setups and confirms the entry point for buyers.

🔹 Ascending Trendline Support

An emerging bullish trendline is now guiding the move upward, confirming that the market has shifted its short-term trend. Every bounce on this trendline reinforces bullish structure and validates higher-low formations.

🎯 Price Targets & Expectations:

✅ Previous Target Zone:

Around $3,375, already tapped and respected.

This shows that gold is following technical targets with precision.

🎯 Next Bullish Target:

$3,400 – $3,410 zone stands as the next supply region.

This area is a major psychological resistance and aligns with historical reaction points.

🧠 Trading Insight & Strategy:

With current price action and momentum, buying dips remains the optimal approach, provided the price stays above the SR Interchange zone.

🔽 Entry Zone: $3,345 – $3,350

📈 Targets:

TP1: $3,375 (partial exit)

TP2: $3,400–$3,410 (final target)

❌ Invalidation Zone (Stop Loss): Below $3,330

Breaking below this would invalidate the breakout structure and possibly signal a false breakout.

📌 Summary:

✅ Clear breakout from descending channel

✅ Retest of previous demand and SR flip zone

✅ Bullish pattern confirmed on key support

✅ Ascending trendline intact

🎯 Next logical move: $3,400+

The gold market is giving strong bullish cues, and this setup could be a textbook example of “buy the breakout, ride the trend.”

Stay sharp, trade smart, and keep your risk in check. 👑

XAU/USD(20250715) Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

3353.05

Support and resistance levels:

3386.70

3374.12

3365.96

3340.13

3331.97

3319.40

Trading strategy:

If it breaks through 3353.05, consider buying in, the first target price is 3365.96

If it breaks through 3340.13, consider selling in, the first target price is 3331.97

Today's summary and tomorrow's market forecast📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

Bros, I had some things to deal with just now so I went out for a while. Now I come back to share my ideas. When the market is blindly chasing longs, I chose to give a bearish trading opportunity. I know that after I proposed the idea of shorting to test the support level of 3340-3330 below, many people were skeptical and even looked at it with a sarcastic attitude. After all, most people in the market are long. But facts and results have proved that only by following the trend can there be better room for operation. When doing transactions, you must first have a clear goal. Those who follow the crowd will often only blame their mistakes on others or luck.

Regarding the arrangements for future trading, first of all, 3375-3385 above is still an important short-term resistance. If today's closing is above 3360, then 3375 will most likely be tested again during the Asia-Europe trading session. Once it goes up again, it is very likely to break through the resistance area of 3375-3385. Before the US data, the price may stay at 3390 or 3400. On the contrary, if today's closing is below 3360, then the price still has room for adjustment. In this way, 3340 will not be the low point of this week. The bearish volatility in the Asian and European sessions will also test the strong support of 3330-3320.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD

Gold----Buy near 3348, target 3369-3389Gold market analysis:

Looking back at last week's market, the market performance on Monday and Tuesday last week was quite abnormal, belonging to the rhythm of a big oscillation. The following three trading days were basically relatively normal, and the market rose all the way after the buy-in. The overall market was a bottoming-out and rebounding market. Recently, investors are very confused about whether the general trend is bullish or bearish? First of all, we need to distinguish how long the general trend cycle is? If you look at the weekly line, you can at least see a 2-4 week trend. If you want to see a trend for a month, then you have to look at the weekly K-shaped and monthly trend. I understand that the long-term trend is at least a trend of one month to half a year. With the current instability of the international situation, the trend of Russia and Ukraine, the situation in the Middle East, and Trump's global tariff war, I think the half-year trend is bullish. We are short-term traders, and basically can't see that far. Looking at the trend of one week at most is the limit. Playing with long-term trends requires a 100-point mentality, and playing with short-term trends only requires technology. The first thing every Monday is to figure out the trend of the week. Buy short-term climb at the weekly close. This week's thinking is bullish first. We estimate that there will be a decline in the second half of the week. Today's weekly line is treated as a low-price buy first, and pay attention to the retracement to the support to buy. The low point of Friday's retracement near 3348 is a new support, and it is also the starting point of the pattern support 3344. In addition, the hourly stepping point is near 3342. If it does not break 3342 today, insist on buying. If it breaks, adjust the thinking to be bearish in time. A small step on the Asian session is also an opportunity to get on the train.

Pressure 3397, support 3348, 3345, 3342, the watershed of strength and weakness in the market is 3342.

Fundamental analysis:

Last week, Trump increased tariffs on Canada and will soon increase tariffs on Brazil. There is no signal of stopping the tariff war. It is long-term bullish for gold. The situation in the Middle East has not completely stopped, and it is also a long-term suppression of the US dollar to support gold.

Operation suggestion:

Gold----Buy near 3348, target 3369-3389

Good opportunity to wait for recovery and buy GoldOANDA:XAUUSD Confirmation of breaking Key level 3330 on Friday has formed an Uptrend in Gold. Reaction at GAP 3368 is obvious in an uptrend. Gold trend is favoring buying to 3388 and 3400 next week.

Support: 3345-3331

Resistance: 3387-3400

BUY Trigger: Retest and Reject support 3345

BUY Trigger: 3331 ( Strong support zone)

Target: 3400

SELL Trigger: rejection 3387 with bearish confirmation

Leave your comments on the idea. I am happy to read your views.