Special attention needs to be paid to gold operations on FridayThe current price fluctuates around the 3300-3348 range, with resistance at 3348-3352 and support at 3295-3303. If it breaks through 3348, be wary of a second surge to around 3365; conversely, if it loses 3295, it may fall back to the 3275-55 area.

Gold recommendation: short sell near 3335-3345 when it rebounds. Target position 3320-3310.

Goldrush

The downside risk of gold increases!📌Fundamentals:

1. The conflict between India and Pakistan shows signs of escalation

2. US-Houthi ceasefire agreement

3. The Fed’s interest rate decision dominates this week’s market

4. International trade situation disturbs market sentiment

5. Market sentiment and capital flow

📊Technical aspects:

At present, on the hourly basis, gold is still under pressure at the small range resistance of 3400, and the current tariff crisis has cooled down. The data of the Fed's interest rate decision will cause a series of fluctuations in gold in the short term. At the same time, the market is betting that there will be further trend corrections, which may cause capital outflows in the market, which will further hit gold bulls!

There is actually a new round of operation opportunities in the short term. The short-term resistance should be around 3400, but since the game between major powers has not stopped, there will be no big negative factors. However, if the data layout does not fluctuate much, the market may not have a big dive. At present, we will temporarily play at the 3360-3400 level. If it breaks, we will make new adjustments!

🎯Practical strategy:

Gold: Short around 3390-3400 on the rebound, and the target is 3370-3360!

The Fed meeting is coming. Will gold fall?Today's news focus:

The US Federal Open Market Committee (FOMC) will announce the interest rate decision;

Fed Powell will hold a monetary policy press conference.

The market generally expects that this meeting will continue to maintain the previous data, because the impact of tariff policies on inflation and the economy still needs to be observed. The Fed's interest rate cut may be carried out in June. Since this interest rate decision does not update the economic forecast, the focus will be on the Fed's incidental comments on any signals of future interest rate cuts to support the economy. Since the decision to keep the interest rate unchanged has been fully digested by the market, Powell's tone at the press conference will be the key to changing the market's expectations for interest rate cuts this year.

Today's gold trend analysis:

At present, according to the hourly chart, gold is still under pressure at the range resistance above 3400; on the one hand, the current tariff storm has cooled down, and on the other hand, the interest rate cut has decreased; and the news data to be released will cause a series of fluctuations in gold in the short term. At the same time, the market is currently betting that the gold price will have a further trend correction, which may cause capital outflows from the market, which will further hit gold bulls.

Quide believes that there is still room for operation in the short term. The resistance level of short-term upward movement is around 3400, but since the game between major powers has not stopped, there will be no major negative factors; if the news data does not fluctuate much, the market may not have a big dive.

Operation strategy:

Short around 3400, stop loss at 3410, and take profit in the range of 3370-3360.

Quide will always pay attention to important news and can provide professional analysis and suggestions for everyone in a timely manner.

I hope to help everyone recover their losses in the gold trading market.

Gold shocks pull the trend towards the bearish side!Gold market trend analysis:

Gold technical analysis: You should have seen the exaggeration of gold, right? Gold has also experienced several major ups and downs in history, but this time is definitely one that can be recorded in the history books. The daily lines in the past few months are very exaggerated, and the rise and fall range is unprecedented. Just today's Asian market, a simple dive is dozens of points. This is the market. The market is always right. We need to respect it the most, rather than blindly look at it subjectively. Surviving in such a big market is the most important thing. Many times, the fluctuation of gold is basically not related to technicality. We try to follow the direct pursuit mode in operation, and we can catch big profits in such a big market. Last week, the weekly line closed with a big tombstone, the weekly line top appeared, and the air force appeared. In May, gold will at least adjust to around 3,000.

The above is the 4-hour pattern, which is repairing below the moving average. If the bulls break 3370 again, there is a possibility of rising again. Otherwise, gold will adjust deeply again. This wave of adjustment is at the weekly level. The daily pattern is also turning into a peaking mode. Note that the rise and fall of gold is not based on technical aspects, but more on fundamentals and big data, as well as the impact of tariffs. Without these influences, we will be bearish this week. If the decline of the big C wave continues, the target will be 3230 (the half point of the entire April rebound) in turn. 3165 is the Fibonacci 61.8 position of the callback and also the previous high point, which is easy to form a rebound. Today's gold focuses on two major suppressions, one is the hourly suppression around 3300, and the other is 3315 and 3328, both of which are opportunities for air forces. On the whole, today's short-term operation strategy for gold is to short on rebounds and to buy on pullbacks. The upper short-term focus is on the 3298-3300 resistance line, and the lower short-term focus is on the 3265-3260 support line. Friends must keep up with the rhythm. It is necessary to control the position and stop loss, set stop loss strictly, and do not resist single operation. The specific points are mainly based on real-time intraday trading. Welcome to experience, exchange real-time market conditions, and follow real-time orders.

Gold fluctuates in the short term, but you can still make a prof

Gold is still fluctuating. Due to the pressure from the upper moving average, don't chase high for the time being. Wait for gold to pull back and you can still continue to short.

During the US trading time today, short-term gold bulls have begun to be powerless, so when gold pulls back to around 3350, shorts can enter the market at any time, and gold still has the opportunity to adjust. Gold continues to wait and see the adjustment market in the short term, and pay attention to trading signals in time.

Keep an eye on the price and participate well. Grasp the rhythm of gold pullback short-selling transactions. You will find that this kind of fluctuation is much more fun than the big fluctuation.

📊Comment analysis

Gold is currently just a rebound. If there is no special risk-averse news for gold, it will still be difficult to go up directly. At least it will fluctuate first, and it is still a bearish fluctuation now.

💰Strategy Package

Short position:

Actively participate at 3350 points, profit target is around 3310 points

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the capital account

- Stop loss is 1-3% of the capital account

GOLD DAILY CHART MID/LONG TERM UPDATEGOLD Daily Chart Update: 24th FEB 2025

Hi Everyone,

Here’s the latest update on the GOLD daily chart, which we've been closely monitoring and trading. Below, we break down recent price movements, updated key levels, and provide actionable insights for the days ahead.

Recap of Recent Chart Success!

Gold recently achieved a record high of $2,954.80. Our analysis has consistently highlighted that after reaching each target level, prices tend to reverse by over 40+ pips to the GoldTurn level. This pattern was evident when, after hitting TP3 at $2,933, the price retraced more than 40+ pips to the GoldTurn level at 2870, which acted as a support, before rebounding bullishly to surpass resistance and reach the all-time high of $2,954.81.

Current Outlook: Bullish or Bearish?

Presently, gold's price is oscillating between a resistance gap at $2,990 and a support gap at $2,933. The $2,990 level serves as a key resistance, while $2,933 acts as support. Additionally, the Fair Value Gap (FVG) offers support at $2,920.

In summary, while the long-term outlook remains bullish due to factors like central bank demand and economic uncertainties, short-term fluctuations between the $2,933 support and $2,990 resistance levels are expected. Traders should monitor these key levels and indicators closely to inform their strategies.

KEY LEVEL: 2870

Resistance Levels: 2990, 3052

Support Levels (GoldTurn Levels): 2933, 2870, 2801, 2744, 2671, 2595

EMA5 Behavior:

* Or If EMA5 crosses and locks above 2933, it strengthens the bullish case.

* If EMA5 fails to hold above 2933, cross and lock below this level 2933, expect a pullback to key GOLDTURN levels below.

Recommendations:

* Capitalize on Dip Opportunities: Use smaller timeframes (1H, 4H) to trade around GOLDTURN levels, targeting 30–40 pips per trade.

* Stay focused on shorter trades in this range-bound market to manage volatility effectively.

Long-Term Bias:

Maintain a bullish outlook while viewing pullbacks as buying opportunities.

Accumulate positions near key support levels for a safer approach instead of chasing highs.

Final Note:

Trade with confidence and precision. Our analysis ensures you’re well-prepared to navigate the evolving market landscape. Stay updated with our daily insights across multiple timeframes for deeper clarity.

Thank you for your continued trust! Don’t forget to like, share, and comment to support our work.

Best regards,

The Quantum Trading Mastery Team

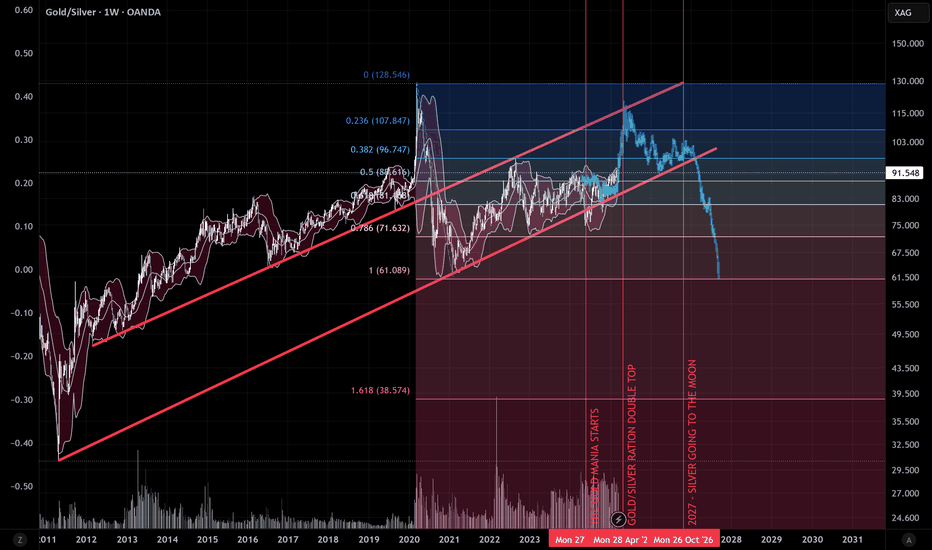

GOLD TO SILVER RATIO ABOUT TO TOP OUT !!OANDA:XAUXAG The current Gold rush and the weak demand in Retail for Silver, Platinum or even Palladium clearly shows that Gold TVC:GOLD is heading for a double top in the coming two to three months against Silver TVC:SILVER , after which Silver will start having the upper hand and totally outperform Gold (add in Platinum and Palladium as well). This would also perfectly coincide with my editorial Silver prediction to break the $45-50 barrier in 2027 from a year ago:

3.6 Technical Analysis of Short-term Gold OperationsThe US ADP employment data for February fell sharply. The market expected 140,000, but only 70,000 were released last night, which was cut in half. This data is not surprising. Since Musk established the efficiency department at the oval table on January 20, a large number of government employees have been reduced, and the reduction in employment is reasonable.

However, the consensus is that the number of employed people will decrease, which is good for gold, and washing the market has become a routine operation. After the data was released, gold not only did not rise, but fell rapidly, all the way to $2,894, and it seemed that it was about to fall by a waterfall. At that time, I said internally that we should be careful of the double kill of longs and shorts, but it was pulled back to above $2,920 in the late trading.

In 1 hour, the US market quickly returned to the top and bottom conversion of $2,894 last night. After this retracement, it was pulled up again, indicating that the market bulls are still dominant, but the current market is still dominated by fluctuations, not a unilateral rise, so try to avoid chasing more and wait for the decline before intervening.

Today, the dividing point is still 2895-2900. We will continue to go long after the pullback. The upper target is 2920-2935 US dollars. The US dollar has begun to weaken. Gold is just in the process of brewing. The single negative on the weekly line does not form a stage top.

3.4 Gold’s Dayang Extended ReboundYesterday, the gold market opened high at 2860.6 in the morning, then the market rose to 2876.9 and then fell back. After filling the gap to 2858.3, the market was supported and rose strongly. The daily line reached 2895.3 and then the market was consolidated. The daily line finally closed at 2893.3 and the market closed with a big positive line with a slight shadow. After this pattern ended, the daily line broke the short-term pressure and there is still a rebound demand today.

Short-term operation:

Buy: 75 Stop loss: 65 Target: 95 05 15

News affecting gold pricesNews:

Russia's nighttime attack damaged port infrastructure in the Odessa region of Ukraine.

Russian troops occupied Zelenpo and Dachne in eastern Ukraine.

In the past day, the Russian army lost about 1,200 soldiers, as well as 17 tanks, 16 armored personnel carriers and 81 artillery systems and other equipment.

Geopolitics is continuing to heat up, and gold prices are expected to continue to rise next week.

Viewpoint

The market is in a volatile range.

It is expected to show an upward trend in the next trading cycle.

Keep an eye on the subsequent sharing of views

USOIL it will go down and then up the price movement of WTI Crude Oil (USOIL) on a daily timeframe. It highlights a range between approximately 66.70 and75.21, suggesting potential price targets. The market is currently trading near the 71.41 level, within this range. A breakout above75.21 could indicate a bullish trend, while a drop below $66.70 might signal a bearish move. The chart suggests a period of consolidation with possible directional movements in the near future.

Gold XAUUSD How Long This Correction Will Continue! Read CaptionOANDA:XAUUSD forms a retreat and tests 2577 following a fake breakdown of 2546. After such a severe fall, it is a very reasonable response. The dollar is growing more quickly, and the fundamental context is still negative.

China's ambiguous economic figures heightened economic worries. Powell stated that there is no need to lower interest rates right now because the economy is still expanding, the job market is strong, and inflation is still above the 2% target, but this uncertainty regarding future rate reduction by the US Federal Reserve is still weighing on the markets.

Now, everyone's eyes are on the crucial retail sales data.

Technically, it is important to watch the resistance at 2589 and the 0.5-0.7 fibo. Below these areas, a false breakdown and consolidation could lead to a collapse.

Resistance levels: 2578, 2592, 2604.

Support levels: 2543, 2532, 2504

Key : 2565

OANDA:XAUUSD Gold is currently indicating that the pullback up might be a little drawn out. Before the news, MM will probably aim for liquidity (above these levels). Bears may become active in response to a false breakout, which would only boost sales.

However, the likelihood of a breakdown and decline will rise if there is a bounce from 0.5 fibo and a smooth recovery to 2546.

$USIRYY -U.S CPI (October/2024)ECONOMICS:USIRYY @2.6%

(October/2024)

source: U.S. Bureau of Labor Statistics

- US Inflation Rate Picks Up

The annual inflation rate in the US increased to 2.6% in October,

from 2.4% in September and in line with market expectations.

On a monthly basis, CPI rise by 0.2%, consistent with the previous three months with shelter index up 0.4%, accounting for over half of the monthly increase.

Meanwhile, core inflation stayed at 3.3% annually and 0.3% monthly.

Scenario GOLD levels update This view of gold actually somehow confirms that I should be on the good side of the market, outside of the original analysis, we could see a false breakout from which the price consolidated around the zone marked by me, which may show us a head-and-shoulders formation, which may be followed by a correction against this formation

Gold Trading Insights Ahead of the Election!Although gold didn’t fluctuate much today, our returns were quite impressive! These small range movements create excellent opportunities for agile buying and selling. As I mentioned yesterday, the New York market did indeed decline today, and the buy signal I provided at the open hit the TP of 2745 perfectly. I then began selling, ultimately closing the trade at 2733 with great results.

Tomorrow is the election, and I believe the results will boost the dollar, which could lead to a drop in gold prices. I plan to continue selling during tomorrow's New York session. What do you think?

Gold’s Push to 2766—But an $80 Correction May Be Coming!Gold is eyeing key levels at 2719, 2738, and up to 2766, but let’s not ignore the potential for an $80+ correction along the way. I’ll walk you through the key targets and where the market might throw us a curveball.

Join me as we break down the technical and figure out if gold is set to rally or hit a correction. If this analysis helped (or at least gave you something to think about), give it a like, drop your comments below, and hit follow for more updates. Your support keeps the content rolling—unlike gold, which might need a timeout soon!

Mindbloome Trader

Happy Trading

Is Gold HH confirmed ? 4H analysisGold is trading at record high with no sign of bearishness expecting Gold to go Higher High . But we have very important fed minute ahead FOMC , If Fed cuts rate by more than 0.5% will see atleast 2621-2650 and further even 2700.

This idea is valid only if it not breaks 2600 Levels

If rate cuts by only 0.25% we will see some correction but its a buy on every dips market .

Please do check b=my monthly analysis as well.

Don't forget to hit like , if you like my idea.

Disclaimer : Trading involves a significant risk of loss and is not suitable for all investors , This idea is meant for education purpose only , do your own research before risking your account.

FRES STONG BUY IMMEDIATE MONEY TO BE MADEPrice action rising from recent low towards short term resistance at 100 fib retrace level, with 728 to be next meaning full resistance.

Price action supported by hidden bullish divergence, increased metal prices and a rising earnings profile.

Action will be swift don't wait too long to buy.

8.22 Gold Trend Operation AnalysisThrough the analysis of automatic trend lines and trend charts, we know that gold has rebounded from the 2499 line below in the early trading. It is still a little short of the first support level below. The short-term 2508 line has become the critical point between long and short positions. The short-term upper 2518 line is the first pressure level. In the short term, it will continue to fluctuate and consolidate in this 20 US dollar space. In terms of operation, we continue to focus on buying on dips with the idea of high-altitude and low-multiple.

Short gold at 2518, stop loss at 2526, take profit at 2500;

Long gold at 2498, stop loss at 2490, take profit at 2513.

What are your different views on gold? Welcome to like and comment

8.21 Gold Trend Operation Analysis Short-termIn terms of the average daily fluctuation range, gold is currently in a fluctuating downward trend. The bullish momentum is obviously more difficult than before. The one-hour chart trend is basically sideways and the candle is weak.

Short-term operation points

2515 short, take profit 2505, stop loss 2522

2505 long, take profit 2520, stop loss 2500

8.20 Gold Trend Analysis2500 Golden Era has officially stabilized and will move towards 2600 in the future

Gold fluctuated and jumped from a low of 2486 to 2510 during the European session on Monday

The bulls are still continuing today. Currently, the gold price is trading at a high of 2523. On the Bollinger Bands, gold is below the middle track. The hammer line is long. If it touches the bottom, it can be bullish

In addition to the geopolitical situation, everyone is currently pinning their hopes on the trend of gold on Friday when Fed Chairman Powell will give a speech on the economic outlook at the Jackson Hole Annual Meeting

Support level 2515 2510 2500

Resistance level 2525 2535 2550

Gold roller coaster marketOscillating trend, long positions take profits!

The US data has mixed impacts on both long and short positions. The US retail sales data for July was impressive, triggering a series of market fluctuations.

Personal operation analysis:

Support level: 2445 2435 2425

Resistance level: 2470 2477 2490

The above data can be used for reference. Comments are welcome

8.15 Can the gold trend reach a new high?My personal outlook for gold in the future is that the price is expected to rise to a new high. The US dollar and earnings will continue to fall

But there may be deviations in the short term! You can also consider shorting at high levels!

With the positive CPI data released yesterday, gold should have created a new high, but it quickly fell back, causing gold to fall by 1.5%. This also allowed us to quickly seize the opportunity for short-term trading and quickly exit with profits!

I personally suspect that the situation last night was that big investors were using data to ship goods. They sold heavily when traders entered the market yesterday, causing gold to fall rapidly!

As for the data released tonight, retail sales, industrial production, and the number of people applying for unemployment benefits in August are important data for whether gold can stand on a new high, which will be a new trading opportunity!

If it is weaker than expected, the US dollar will continue to fall, while gold will rise all the way

At the same time, we will also make preparations for both situations