Gold’s latest strategic ideas, mainly short selling on reboundOn Monday (April 14), gold fluctuated slightly and remained around $3,197. Last Friday (April 11), the price of gold broke through $3,200, reaching a historical high of $3,245.26, with a weekly increase of 6.6%, the largest weekly increase since March 2020. This round of rise was mainly driven by the escalation of trade frictions, the plunge of the US dollar, the increase in expectations of the Federal Reserve's interest rate cuts and geopolitical risks. The weak US economic data and rising inflation expectations strengthened the safe-haven properties of gold.

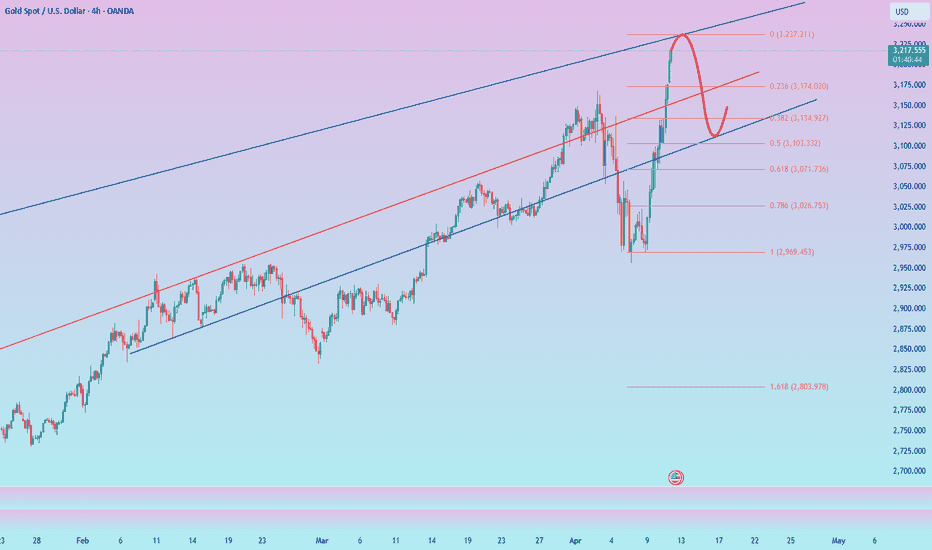

From a technical perspective, the daily level shows short-term correction pressure. On Monday, a small negative column with a long upper shadow was closed. Pay attention to the support of 3180 below. If it falls below, it may fall further. The 4-hour level shows a high-level oscillation pattern, with the upper resistance at 3235-3240 and the lower support around 3200-3180. In terms of operation, it is recommended to focus on high-altitude trading: shorting with a light position near 3225-3235 US dollars. If the gold price rebounds to around 3200 and stabilizes, you can try short-term long. Be alert to the intensification of market volatility.

Gold recommendation: shorting near 3225-3235 on the rebound, target 3205.

Goldsell

Gold prices remain strong, trade war panic boosts safe-haven dem

📌 Driving events

Atlanta Fed President Bostic's statement further strengthened the bullish logic of gold. He bluntly stated that the current economy has fallen into a state of "great pause" and suggested that the Fed maintain policy stability. This policy uncertainty, coupled with potential inflation risks, makes non-yielding gold show a unique charm. Historical experience shows that gold often outperforms other asset classes in a low interest rate environment and policy uncertainty. The current market expects that the Fed may be forced to cut interest rates when inflation is high, and this special situation has created an ideal upside space for gold.

The current gold market is showing a rare perfect resonance between technical and fundamental aspects. Trade war risks, policy uncertainty and inflation expectations together constitute the "golden triangle" of gold's rise. Considering that the potential impact of Trump's tariff policy has not yet been fully released, the Fed's policy path is still uncertain, and gold prices may open up more room for growth after breaking through historical highs. For investors, in the current macro environment, increasing gold holdings may become an important choice to hedge portfolio risks. This risk aversion frenzy caused by the trade war may have just begun.

📊Comment Analysis

From a technical perspective, the upward trend of gold prices has been further confirmed after breaking through the key resistance level of $3,200. Market analysts pointed out that as long as the price of gold remains above the support level of $3,180, the upward channel will remain intact.

Gold prices are trading sideways waiting for prices to rise and continue to hit new highs

💰Strategy Package

Long positions:

Actively participate at 3225-3235 points, with a profit target above 3240 points

Stop loss at 3210

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

What Goes Up Must Come Down – Gold on the Edge?After a parabolic run to new highs, gold is flashing signs of exhaustion.

📌 Price is hugging the upper Bollinger Band on the daily chart.

📌 RSI is in overbought territory (currently around 68.2) — similar to previous local tops.

📌 We're forming a steep, almost unsustainable channel — historically, these tend to break hard when they do.

If we see a break below $3,086 and lose that trendline, eyes shift to:

🔻 $2,932 — key support

🔻 $2,787 — prior breakout retest

🔻 $2,532 — long-term trendline support

Still bullish long-term, but short-term? A pullback might be healthy.

🛑 Risk Disclaimer

This is not financial advice. Trade responsibly and use proper risk management.

Sideways, continue to wait for a new ATH of 3270

📌 Driving Events

Bloomberg reported that gold prices climbed to near record highs as the United States planned to impose more tariffs, further exacerbating investor anxiety.

Bloomberg reported that the Trump administration launched an investigation into semiconductor and pharmaceutical imports, paving the way for tariffs

📊Comment Analysis

Gold prices are sideways, waiting for prices to rise and continue to hit new highs

💰Strategy Package

Long positions:

Actively participate at 3225-3235 points, with a profit target above 3240 points

Short positions:

Actively participate at 3245 points, with a profit target below 3230 points

⭐️ Note: Labaron hopes that traders can manage their funds properly

- Choose a lot size that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

Gold, adjustment is a buying opportunity

📌 Driving events

At the critical moment of the tariff war, there were signs of easing, but the market did not buy it when it came to the gold market. The US policy changed faster than turning a book, which made the market overwhelmed. Therefore, even if the latest US statement was somewhat easing, gold did not fall as a result. The current market is an extreme casino, which depends entirely on whether the correct trading signals and entry timing are grasped in time.

After the tariff war, major investment banks have recently raised their expectations for gold prices this year. Goldman Sachs' latest forecast is that the gold price may rise to $3,700 this year. In extreme cases, the gold price may hit $4,200. This forecast seems unreliable, but it is actually very mysterious. Goldman Sachs' forecasts cannot be all accurate, nor can they be all inaccurate. What does this extreme situation refer to? Obviously, there are only two points, the first is the economy, and the second is the war. Apart from these two points, there is no more significant news that can push the gold price to $4,200.

So, is it possible for the current fundamentals to have the situation predicted by Goldman Sachs? Obviously, there is. The global trade war initiated by Trump will cause all economic turmoil, and the economy will enter an accelerated recession. In addition, the United States attempts to take down Iran in order to control the Middle East and raise oil prices. If a war breaks out in Iran, the Strait of Hormuz, the lifeline of oil in the entire Middle East, will be blocked, and oil may rise to a rare height. This is the purpose of the United States. Once the above two situations occur at the same time, it is not surprising that the price of gold rises to $4,200. Therefore, instead of predicting how much the price of gold will rise, it is better to pay attention to the real-time dynamics of the United States' tariff war and layout in the Middle East.

With 36 trillion U.S. debts hanging over his head, Trump is like a child who is desperate to lose, betting on the credit of the United States. Of course, the United States has the possibility of winning the bet. The tariff war is naturally impossible for the United States to win, but the United States will not lose. In the layout of the Middle East, the United States still has the probability of winning. Although Iran is the strongest combat force in the Middle East, the United States has been deeply involved in the Middle East for many years and has also won almost all the expected goals, and is experienced. The world is calling Trump a madman, a psychopath, and a fool. In my opinion, Trump is not crazy, but may be a king.

📊Commentary Analysis and 💰Strategy

I have said that any pullback in gold is an opportunity to get on board. Buy more when the pullback is big and buy less when the pullback is small. Although it is at a high level and the risk is extremely high, it is all assumptions. The fact is that gold has always been strong. The only thing to remember is that once you are afraid of heights, don't go short. You can be timid and watch the war, but you can't go against the trend.

After the tariff war eased, gold did not fall. After a slight adjustment yesterday, it did not continue the decline. It is now strong again and stands above 3230. It rose sharply due to the tariff war, but it did not fall sharply due to the easing of tariffs. There must be a reason. In terms of technical trends, gold 3190 area forms a new support platform, and the 4-hour level forms a high-level shock pattern. This high-level shock pattern is still bullish. Once it breaks through, it will start a new wave of upward trend. At present, the trend is good and the bullish trend remains unchanged.

The market fluctuates rapidly. We have already entered long orders near 3210 in the morning. Any intraday retracement support level is a long opportunity. We should grasp it flexibly.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

Bearish Divergence on RSI - Daily Chart - Gold - XAUUSDWe have Bearish Divergence on the RSI Daily Chart for Gold - XAUUSD. This is fairly unusual and suggests the next path will be down. I therefore suggest a down day tomorrow - a red candle if that's your color scheme - and perhaps beyond, perhaps going to the 50% retracement of the previous upwards move (on the Daily chart) or beyond. My target price is indicated on the chart.

Bullish momentum is strong, keep an eye on key positions

📌 Driving events

On Monday (April 14), spot gold fell slightly during the day, hitting a record high of $3,245.42/ounce earlier before falling back. Despite a small adjustment during the day, the price of gold remained above the key mark of $3,200/ounce, indicating that the overall market sentiment is still cautiously optimistic. The main factors driving this round of market conditions include uncertainty in the global trade environment, a weaker dollar, and continued warming of safe-haven demand. During the session, investors' reactions to the latest tariff remarks increased gold price volatility, but fundamental and technical support remained solid, and the strong pattern of gold did not show any significant shakes.

📊 Commentary and analysis

From a technical perspective, the trend of spot gold continued its recent strong pattern. On the daily level, gold prices have continued to run along the rising channel since breaking through $3,000/ounce. Although there was a small correction during the day, the overall bullish trend was not damaged. The current price is firmly above $3,200/ounce, which has become a key psychological and support level in the short term. If the gold price can continue to hold this area, bulls may further challenge $3,250/ounce or even higher.

On the hourly chart, after the gold price surged to $3,245.42/ounce in the morning, it was suppressed by short-term profit-taking and showed signs of decline.

However, from a longer-term perspective, the upward slope of gold prices since the end of last year has remained stable, and there has been no significant retracement after breaking through key resistance levels many times, reflecting the resilience of the bulls. Analysts pointed out that the support of $3,200/ounce is strong. If the subsequent price can hold this level, the bulls may exert their strength again in the next few days.

💰Strategy package

Upper pressure - 3260-3280

Lower support - 3210-3200

Start time 3220-30 Continue to go long

Take profit 3240

Stop loss 3210

⭐️Note: Labaron hopes that traders can properly manage their capital

- Choose the number of lots that matches your capital

- Take profit equals 4-7% of the capital account

- Stop loss equals 1-3% of the capital account

Risks gradually accumulate, and short gold in batchesAt present, the highest price of gold has reached around 3244, but it soon fell back to below 3240; and the PPI data is obviously bullish for gold, but gold has not shown a significant upward fluctuation, indicating that as gold rises sharply, market sentiment tends to be more cautious, so that liquidity is insufficient. So from this point of view, gold still has a need for a correction!

In the past three trading days, the increase in gold has reached $270. So even if gold remains strong at present, we should not blindly chase more gold. On the contrary, we can still gradually establish short positions in batches. As long as we strictly control the number of transactions in the transaction, we don’t have to worry too much about the transaction risk!

Let us wait patiently for the market to gradually accumulate risk sentiment. Once it accumulates to the critical point, it only takes one opportunity for gold to collapse soon.

Continue to go long during the US trading session

📌 Driving events

The recent global economic situation is complex and changeable, and major events have far-reaching impacts. In terms of trade, although the United States has exempted some products from tariffs, repeated policies have led to increased trade tensions. Asian powers have imposed a 125% tariff on US imports, impacting the global industrial chain and supply chain. Looking ahead to this week, investors need to pay attention to the trade situation and risk aversion. The US "terrorist data" and the European Central Bank's interest rate decision will also affect the global financial market. Policymakers and investors need to respond with caution.

📊Commentary Analysis

In terms of gold, the overall gold price showed a sharp rise last Friday.

As for the four-hour level, the current focus needs to be on the support level of the 3200 area. This position is the key dividing line that determines the short-term trend of gold. If the price is above this position, it will continue to be long in the short term. Let us wait and see, waiting for good news from everyone.

💰Strategy package

Upper pressure——3260-3280

Lower support——3210-3200

Target 3220-30 to continue to do more

Take profit 3250

Stop loss 3210

⭐️Note: Labaron hopes that traders can properly manage their capital

- Choose the number of lots that matches your capital

- Take profit equals 4-7% of the capital account

- Stop loss equals 1-3% of the capital account

Gold------Buy near 3220, target 3245-3260Gold market analysis:

Now everyone is waiting for a sharp drop in gold, because the previous strong bottom pull did not leave too many people with the opportunity to step back. There are many sell orders in the market. I still think that individual investors should not hold on to it. I have not seen an individual investor who holds on to it and makes a profit. Gold has risen to the highest record in history, and it is also the time point with the largest fluctuation in the past year. Many newcomers basically find it difficult to escape such a big market. Newcomers hold on to it and increase their positions when they are wrong. Veterans run faster than rabbits when they are wrong, and they hold on to it when they are right. Last week's gold weekly line was again a big positive, and the K-line moving average broke up again. There is no top to the weekly line. The indicator shows that the next target of the weekly line is 3400. In the short term, we need to find a good rhythm and opportunity to follow the buying.

The gold chart shows that the short-term moving average has begun to rise, and the buying pattern support has reached around 3209. Today's Asian market prices are strong above this position. The short-term moving average support is around 3218. In addition, the suppression of 3245 is also obvious. If it breaks, it will pull up a lot of space again. Those who like to see 3245 in the Asian market are an opportunity. If you want to follow the trend, you have to give up. The short-term retracement is our opportunity to get on the train again.

Pressure 3245, big suppression is invisible, small support 3218 and 3209, the strength and weakness watershed of the market is 3209.

Fundamental analysis:

Previous CPI data also showed that gold suppressed the US dollar. This week, the market will rest on Good Friday, and Powell will speak.

Operation suggestions:

Gold------Buy near 3220, target 3245-3260

Analysis of gold market price structure and trends.Layout ideas。On Thursday, the US dollar index broke down sharply, successfully stimulating the market's risk-averse funds to return to the gold market again, and the gold price rose again. Let's briefly sort it out!

First: The tariff issue of the trade war caused the global market to plummet, and gold fell accordingly. The main reason was that it was necessary to sell gold, recover funds, and fill the capital margin in the stock market, foreign exchange market, and bond market; therefore, gold also plummeted downward in the past few days;

Second: The U.S. dollar index plummeted and broke through, driving market funds back into the gold market, and the gold price hit a record high again;

In yesterday's analysis of spot, you can look back at yesterday's analysis of the daily K indicator. There are two situations, restart Golden cross means breaking the top and reaching a new high. You can look back at yesterday's analysis. This is also a common indicator trend.

Spot gold opened yesterday from 3081 and quickly fell to 3071 before rebounding to around 3100. After that, the price fell back to 3078-80 and rose to around 3132. The price fell back to 3103 from around 3132 and then rebounded to around 3136 and bottomed out around 3113-16 and rose to 3175. The price fell from 3175 to around 3152-54 and then rose again to around 3176 and closed. The opening price fluctuated and rose above 3200. From yesterday's trend: 3180 and 3100 are the bottom supports, but the area around 3100 has fallen back and repaired yesterday, so 3132-36 and 3116 are the current support points. Yesterday, it also directly rose and broke through 3134-36 and then rose without stepping back. At the same time, the price rose to 3174-76 and then retreated to 3152-54, so the current support point is around 3176. The opening price directly rose from this position. Currently, 3190 is the nearest support. Comprehensive important support: ①3176 ②3134 ?③3100 ? The small support distribution in the middle is 3190-3167-3154-3115

Spot gold market analysis:

Ⅰ: Spot gold daily MACD golden cross is initially established, and the dynamic indicator STO quickly repairs upward, which represents the bullish trend of prices. At present, there is no resistance point to judge because it is a historical high, so we can only try it based on small cycle indicators. The current support point of the daily line is located near the MA5 and MA10 moving averages, 3096-3088, and it is not necessary to consider it far away from the candlestick chart.

Ⅱ: Spot gold 4-hour current MACD high golden cross oscillates with large volume, and the dynamic indicator STO is overbought, which represents high-level price fluctuations. Because the indicators are at relatively high levels, they may face short-term peak signals at any time. Currently, we focus on the support line of 3176 near the MA5 moving average.

Ⅲ: Spot gold hourly MACD golden cross is currently oscillating with large volume, and the dynamic indicator STO is running overbought, which means that the hourly line is still oscillating and strong. The current focus is on the 3245 line. If it breaks through 3245 this hour, it will continue to look for highs. Otherwise, a small cycle peaking signal will be formed at this position. The current support below the hourly line is located at the MA5 and MA10 moving averages, and the focus is on the MA10 support 3185 line. Comprehensive thinking: The current price is oscillating at a high level, and the short-term focus is on the 3245 line. If it breaks through, the price will continue to move upward. The current focus below is the support near 3190. If it falls below, the price may move to around 3150-3135.

Strategy: Currently, the 3440-50 area is temporarily set to see pressure adjustment

Go long if the key support is stabilized below, and pay attention to 3187-3170 -3153-you can go long

Gold may face sharp fluctuations,The risk of downside increases!Technical analysis: Gold daily line rose by more than $100 on Thursday, creating a rare single-day increase in more than ten years. The cumulative increase in three days exceeded $200, and the technical indicators were overbought. The current gold price is in the stage of accelerating to the top. In the short term, pay attention to the resistance of the 3245-3250 area, and be alert to the risk of falling back after a high. Although the trend is still strong, the effectiveness of technical analysis is weakened under the guidance of news. It is recommended to focus on high altitude. This week is the fifth week of rising, and the probability of a change on Friday increases.

Ⅰ: The daily indicator macd golden cross is initially established, and the smart indicator sto quickly repairs upward, representing the bullish trend of the price. At present, because it is a historical high, there is no resistance point to judge, so we can only try it based on the small cycle indicators. The current support point of the daily line is located near the moving average MA5 and MA10, 3096-3088, and it is not considered to be far away from the candlestick chart.

Ⅱ: The current macd high golden cross in 4 hours is oscillating with large volume, and the smart indicator sto is overbought, which means that the price is oscillating at a high level. Because the indicators are at a relatively high level, they may face short-term peak signals at any time. Currently, we are focusing on the support line of 3176 near the MA5 moving average.

Ⅲ: The hourly MACD is currently oscillating with large volume, and the dynamic indicator STO is overbought, which means that the hourly line is still oscillating strongly. The current focus is on the 3220 line*. If it breaks through 3220 this hour, it will continue to look for a high point. Otherwise, a small cycle peak signal will be formed at this position. The current support below the hourly line is located at the MA5 and MA10 moving averages, and the focus is on the MA10 support line of 3185. Comprehensive thinking: The current price is oscillating at a high level, and the short-term focus is on the 3220 line*. If it breaks through, the price will continue to move upward. The current focus below is the support near 3190. If it falls below, the price may move to around 3150-3135.

Strategy: Refer to 3440-45 for short selling

CFD Gold Chart Analysis: Wave 4 in FocusHello friends, let's analyze the Gold CFD chart from a technical perspective. As we can see, the higher degree Cycle Wave III (Red) has completed, and we're currently in Cycle degree Wave IV (Red). Within Wave IV, we expect a Primary Degree ((A)), ((B)), and ((C)) in Black. Wave ((A)) has completed, Wave ((B)) is almost complete, and Wave ((C)) is expected to follow.

Within Wave ((B)) in Black, we have Intermediate Degree Waves (A), (B), and (C) in Blue. Waves (A) and (B) are complete, and Wave (C) is nearing completion. Once Wave (C) in Blue completes, Wave ((B)) in Black will end, and Wave ((C)) in Black should begin.

According to theory, Wave ((A)) came down and then wave ((B)) retraced upwards so now Wave ((C)) should move downwards, forming a zigzag correction. The equality level is around $2858. However, we don't know if it will reach this level or extend/truncate.

The invalidation level for this view is 3169.23. If the price breaks above this level, our analysis will be invalidated.

This analysis is for educational purposes only and not trading advice. There's a risk of being completely wrong. Please consult your financial advisor before making any trades.

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Insight into the gold market situation and seize the opportunityHello everyone! After in-depth research and analysis of the recent market conditions, I believe that the current market has entered the stage of accelerating to the top.

From a technical point of view, such as the MACD top divergence sign, the KDJ indicator oversold, etc., all signs show that the market's upward momentum is gradually weakening, while the price is rising rapidly, which is often a typical feature of the peak stage.

The focus needs to be on the 3225-3235 area. This range has important resistance significance and has dense locked-in disks. On the other hand, through technical analysis tools such as the Fibonacci sequence, this range is also an important pressure range.

For investors with short trading rights, this is a rare opportunity to go high and short. When the price reaches the 3225-3235 area, it is a relatively ideal time to enter the short market. The one-hour moving average golden cross is formed, but after the upper rail of the Bollinger band is broken, the technical overbought risk increases, and the support near 3150 is effective. 80 points are also possible, so don't look at the current trend with a conventional perspective.

After the gold frenzy, there will soon be a sharp correctionTo be honest, I must admit that I still hold a short position. I think there should be many people holding short positions now, but they are unwilling to admit that they hold short positions because they are losing money.

I think it is not shameful to hold a short position now. Although gold has violently risen to around 3220, from the perspective of trading volume, gold is rising without volume. Without the support of trading volume, gold is destined to usher in a round of correction in the short term.

And I have reason to believe that the accelerated rise of gold is suspected of being manipulated by large institutional funds. There are two purposes. One is to accelerate the rise to attract more retail funds to flow into the market to take over; the other is to raise prices arbitrarily to make it easier to sell. So the faster gold rises, the easier it is to collapse! We first aim at the retracement target: 3150-3130 area,or even 3120.

So for short-term trading, I think we can still continue to short gold, and I am optimistic about the short position of gold! The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Accurately capture the gold pullback, shorting is the right timeDuring this period, spot gold has been like a rocket, advancing all the way and firmly in the upward channel. I have repeatedly reminded everyone before that once the US tariff stick is swung, the gold price will definitely rush up like a chicken blood. No, the facts prove that our prediction is quite reliable!

Tonight, the market ushered in another "big news" - the release of CPI data. As soon as this data came out, it directly gave the gold price a "heart shot", and the gold price was instantly pushed to around US$3160. This rise is too crazy! Interpret this data as soon as possible and pay close attention to the reaction of the gold market.

However, when the gold price rose to the previous high of US$3158-3168, it was like hitting a wall and began to "struggle". From my technical analysis point of view, there is a relatively strong resistance level in this range. It's like a person climbing a mountain, climbing to a certain height, and encountering a steep cliff. If you want to continue to go up, you have to work hard. At present, the gold price is under pressure at this position, and there are some signs of a correction. This provides us investors with a small opportunity to consider trying a short position here and earn some spread profits. I also suggest that investors can properly seize this short-term opportunity.

For example, the current gold market is like a fierce football game. The long team is strong and has been attacking all the way, and is in a dominant position. The short team can only seize the opportunity occasionally and make a quick counterattack. We investors are like coaches, and we must arrange tactics reasonably according to the situation on the field. When the long side is dominant, we can use short selling to increase our profits in a timely manner. I hope everyone can accurately grasp the market rhythm like an excellent coach.

Gold: Sell@3188-3200Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot.

However, we must approach this rationally — every new high is usually followed by a technical pullback.

Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum.

From a technical perspective, the sharp recent rally has shown signs of momentum exhaustion, with clear overbought signals emerging.

📌 Strategy Suggestion:

Consider building short positions around the 3188–3200 zone

If 3137 is broken, further downside could extend to 3112–3090

⚠️ Risk Management Notes:

The larger the rally, the stronger the pullback potential

Avoid chasing long positions at these levels to prevent getting trapped at the top

Keep position sizes under control and set stop-losses to guard against sudden volatility

Wishing everyone smooth trades and solid profits!

GOLD MCX MINOR RESISTANCEGOLDMCX

Gold Mcx has seen huge bull run today on 10th April 2025 (Thursday), Looking at the chart it can be clearly seen yellow metal on MCX is trading in upwrad trending channel pattern and around 92400-92500 Channel Pattern Resistance can be observed. There can be some profit booking seen from current levels, One can get out of long positions and reenter long position once GoldMCX closes above 92500, till then book profits on Long positions, or sell Gold MCX with Small stoploss of 92600

Will gold fall after a strong rise Goldmarket analysis referenceAnalysis of gold market trend: Today's gold is still fluctuating greatly under the influence of tariffs. Today, we have analyzed that gold has the risk of callback, and long positions are also falling back to lows! Trend realization analysis and ideas! From the surge on Wednesday, it can be seen that the risk aversion sentiment of gold has heated up again. The current highest is 3132, which is the first target point for the rise. If it continues to rise, it can see 3150 above, so there is still a lot of room above. Everyone should pay attention to trading with the trend as much as possible. In addition, there is another uncertain factor today. The US market will release CPI data, which will also bring abnormal fluctuations in gold. Therefore, the market will also fluctuate greatly today. Everyone should pay attention to controlling risks and managing positions well.

From a technical point of view, a positive line on the daily line directly changed the extremely weak adjustment state in the previous period. Now the positive line breaks the middle track of Bollinger and pulls up the moving average. Then, gold has entered an extremely strong state of bullish trend. In this state, it will continue to rise to the previous high of 3150. Therefore, the main direction today is definitely bullish. It is normal for the small cycle to adjust under the pressure of 3100. Now the Bollinger of the 4-hour cycle has just opened, and the unilateral trend has just taken the first wave of strength. There is no problem in the next wave to rise to the high point of the daily cycle. Therefore, as long as the 4-hour cycle falls back to the support of the unilateral moving average, it is an opportunity to do more. The support below is around 3070, and the rise of the hourly cycle is around 3060. Therefore, today's gold bullishness is expected to consider 3080 or 3070. The rise in the Asian and European sessions is still at 3130. If the US session breaks through 3136, consider seeing the high point of 3150. On the whole, today's short-term operation strategy for gold is to short on rebounds and to buy on pullbacks. The upper short-term focus is on the 3136-3155 resistance line, and the lower short-term focus is on the 3080-3078 support line. Friends must keep up with the rhythm. You must control your positions and stop losses, set stop losses strictly, and do not resist single operations. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market conditions.

Gold operation strategy reference: Short order strategy: Strategy 1: Short gold rebounds near 3133-3136, with a target of 3100-3090, and a break to look at the 3080 line.

Long order strategy: Strategy 2: Go long near the 3078-3080 pullback of gold, with a target of 3105-3125, and a break to look at the 3135 line.