Gold (XAU/USD) Bearish Setup – Potential Drop to $2,991This is a trading setup for Gold (XAU/USD) on the 30-minute timeframe, showing a potential bearish move.

Analysis:

Key Indicators:

200 EMA (blue line) at 3,019.55: Acting as a resistance level.

30 EMA (red line) at 3,017.45: Providing short-term trend guidance.

Price Action & Structure:

The price previously rejected from a resistance zone (purple area) and started forming lower highs.

Repeated bearish patterns suggest another potential drop.

The chart highlights measured moves of previous declines (-30.62, -24.75), indicating a possible repeat of the pattern.

Trade Setup:

Bearish Outlook: Price is expected to drop towards the target point at 2,991.43.

Entry: Near the break of the lower trendline in the ascending wedge.

Target: 2,991.43 (marked as "TARGET POINT").

Risk Management: Ensure proper stop-loss placement above recent highs.

Conclusion:

If price respects the pattern, a downward move is likely.

A confirmed break below support could accelerate the drop.

Goldsell

The opening situation is clear, practical guideGold news:

The rise of the US dollar index benefited from Trump's tariff policy. Just yesterday, Trump suddenly announced: a 25% tariff on the purchase of oil and natural gas from Venezuela, and claimed that individual tariffs would be reduced. The market's tense nerves were released, and the US dollar index rose sharply. As the end of the month approaches, the market needs to rebalance its investment portfolio, increase the allocation of US dollars to hedge against unknown risks, and push the US dollar to continue to rise. Yesterday, the market news was light. Today, the market will welcome the speech of Federal Reserve Board Governor Kugler on "Economic Outlook and Entrepreneurship". Immediately afterwards, New York Fed Williams will speak at a public event. In addition, there is the March Conference Board Consumer Confidence Index at 10 pm. The above events and data are concentrated in the evening tonight, which will have a certain impact on the market and need to be paid attention to. The price of gold has begun to retreat from its historical high, and the power of safe-haven buying has eased. This retreat momentum is expected to intensify further, especially in terms of technology.

Gold technical analysis:

Currently, the price of gold is running in a similar triangle range, and the correction cycle is prolonged. On the one hand, the bulls rebounded after the pressure, and it was difficult to return to the strong position directly; on the other hand, the retracement was supported by the key top and bottom conversion support belt of 3005-3000. This trading day focuses on the gains and losses below the low of 3000 at the end of last Friday, and the breakthrough below the 3030 pressure line above. If it fails to break through, it is likely to fluctuate around this range during the day.

Gold operation suggestions: short near the rebound of 3020-3025, long near the retracement of 3000-3005.

The two orders of gold on Monday were perfectly grasped, and now everyone has made a profit. The two orders on Monday ended perfectly. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

Gold (XAU/USD) Technical Analysis – Bearish Rejection Expected fThis chart represents an analysis of Gold (XAU/USD) on a 30-minute timeframe. Below is a breakdown of the key elements:

Key Observations:

Downtrend Formation

The price is trading within a downward channel, marked by two descending trendlines.

The overall trend appears bearish, indicating potential further declines.

Supply Zone (Resistance) Around $3,025 - $3,030

The price is approaching this key resistance area.

If the price fails to break above, it could lead to a rejection and continuation of the downtrend.

Demand Zone (Support) Around $3,000 - $3,006

This is the target area where buyers may step in to support the price.

A downward move towards this zone is anticipated.

Projected Price Movement

The blue arrows suggest a bearish scenario.

A rejection from the supply zone is expected to push the price downward.

The final target is the demand zone near $3,000.

Conclusion:

Bearish Bias: The price is currently in a downtrend, with the expectation of a rejection from resistance and a move toward the lower support zone.

Confirmation Needed: Watch for price action signals, such as rejection wicks or bearish candlesticks, to confirm the downward move

Price approaching OB POI with Trendline LiqPrice is currently bullish, structure turned bullish from last week's CHOCH and Mondays subsequent break of structures to make price bearish for the short=term, how short-term is price bearish for ? i have no idea but price will definitely still go for the ATH maybe inside this week or early next week which will be a new month (April).

Right now, I'm bearish still hence this setup, it's actually a decent setup though (OB+IDM to take out the trendline liq)

Disclaimer: Do your own analysis and please kindly risk what you can, apply proper risk and money management.

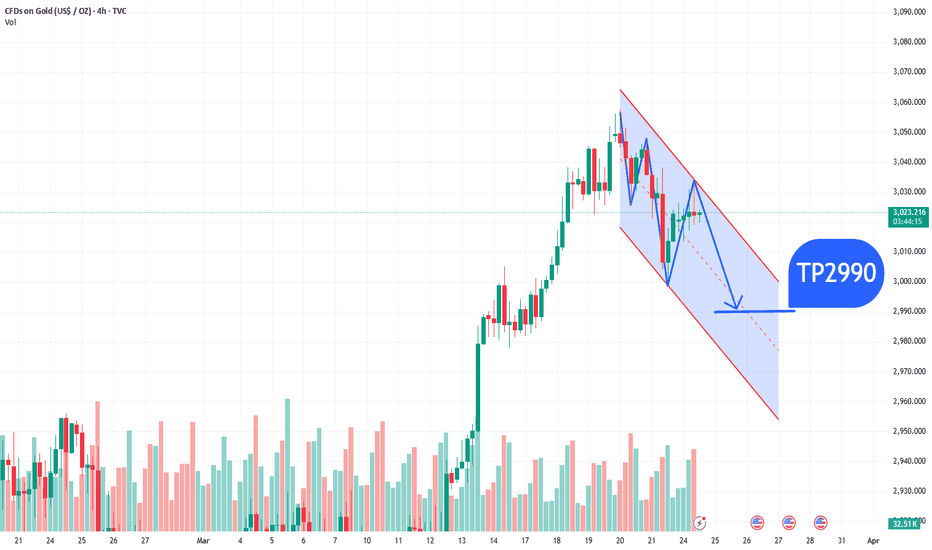

3000 is not broken, the rebound points to a new trendIn the current gold market, the downward trend is more obvious. However, it is noteworthy that gold has tested the key point of 3000 many times, and each time it breaks through, it is unstable. This fully shows that the defense above the 2995-2990 support area is extremely strong and difficult to be effectively broken in the short term.

Combined with the downward momentum observed in the 3000 point range, although it is in a downward trend, the possibility of a sharp decline is extremely small. Judging from the comprehensive judgment of technical analysis and market sentiment, gold will not only not continue to fall, but will most likely rebound. It is initially estimated that the rebound target will reach the area around 3015, and it is very likely to extend further to the area around 3025-3035. Let us look forward to the performance of gold together!

The content I shared recently about the gold market has received a lot of feedback, and everyone said it was very helpful!If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

XAUUSD , we encounter to the trendlineHello everyone

According to the the chart and the time , if the candle stick is closing to complete the candle stick pattern and cannot go up to the trendline you can take short position, BE AWARE .

if you have any question and need help send us messages

Thank you

AA

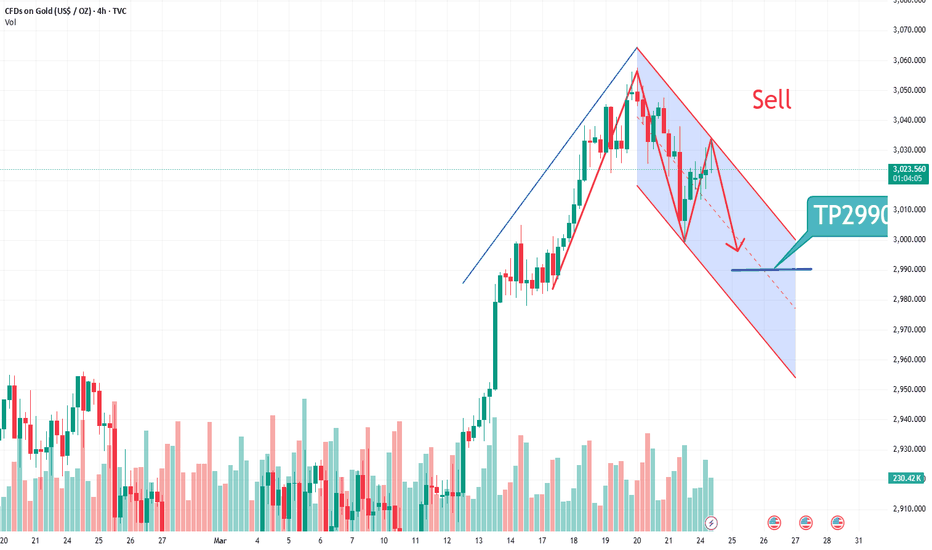

Gold----Sell near 3025, target 3000-2982Gold has risen too much before. There have been technical adjustments in the past two days. The general trend is still bullish, but we are just a short-term trader and we need to follow it. Yesterday, we just lost 3033 in the 3025 short position we arranged. In the evening, we went short again at 3031. Judging from the current performance, the market is in line with our expectations. Today's short-term continues to fluctuate. Note that the weekly buying and selling watershed is 2982, which is also the starting point of last week. The daily line has begun to attack downward. Is it the time to sell or just adjusted to continue to rise? Pay attention to two positions in the future. One is the low point of this wave, 2998, and the other is 2982. If these two positions cannot stop the decline, we will consider the adjustment of the big short position. Today's idea is to consider the opportunity to sell on the rebound.

The K-line pattern begins to decline. Today, we will focus on the suppression of 3025 and 3018. The K-line pattern forms a triangle to be broken. If the Asian session rebounds, consider selling it first. If the Asian session breaks the position of 2998, you can continue to sell it when it rebounds. The bottom of gold fluctuations is also at this position. If it breaks, it will be around 2982.

Suppression 3025 and 3018, strong pressure 3033, the strength and weakness watershed of the market is 3018.

Operation suggestion

Gold----Sell near 3025, target 3000-2982

Descending Channel in XAU/USD (Gold)Trade Setup for Descending Channel in XAU/USD (Gold)

**📉 Bearish Trade Setup (Sell Strategy)**

Since the price is trending within a descending channel, the best trade approach is to **sell at resistance** and **target support levels**.

**📌 Entry Points:**

🔹 **Sell Entry #1:** Near the upper boundary of the descending channel (~3,020 - 3,030).

🔹 **Sell Entry #2:** If price retests and fails to break above the 21 EMA (~3,015 - 3,018).

**🎯 Target Levels (Take Profit - TP):**

✅ **TP1:** 3,000 (Psychological level and lower channel support)

✅ **TP2:** 2,980 (Next major support zone)

✅ **TP3:** 2,960 (Extended target if the trend continues)

**🔒 Stop Loss (SL):**

🚨 **SL Above 3,035-3,040:** If price breaks out above the descending channel, it invalidates the setup.

**📊 Trade Confirmation:**

✅ **EMA Rejection:** Watch for price rejecting the **21 EMA (Blue Line)** as resistance.

✅ **Volume Analysis:** Look for increased selling volume when price approaches resistance.

✅ **Bearish Candlestick Patterns:** Such as **bearish engulfing, shooting star, or evening star** near resistance.

**📈 Alternative Bullish Setup (If Trend Breaks Upward)**

If price **breaks above 3,040 with strong volume**, it could signal a trend reversal. In this case:

🔹 **Buy Entry:** After a confirmed breakout & retest above 3,040.

🎯 **Targets:** 3,060 - 3,080.

🚨 **SL:** Below 3,030.

**Conclusion:**

🔻 **Primary Strategy: Sell on Rallies within the Channel.**

🔺 **Alternative Plan: Wait for a Bullish Breakout Before Buying.**

📉 **Stay disciplined with Stop Loss & Risk Management!*

Tue 25th Mar 2025 XAU/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAU/USD Sell. Enjoy the day all. Cheers. Jim

Gold (XAU/USD) Bearish Outlook: Key Levels to WatchBuddy'S dear friend SMC Trading Signals Update 🗾 🗺️

This chart represents the price action of Gold (XAU/USD) on a 1-hour timeframe, showing potential areas of resistance, support, and liquidity zones. Here’s a breakdown of the analysis:

Analysis of the Chart:

1. Resistance Level (3,023-3,030 zone)

The price has reacted multiple times (red arrows), indicating strong selling pressure.

A fair value gap (FVG) is present, suggesting potential mitigation before further movement.

2. Current Price (3,011.76)

The price is trending downward after rejecting the resistance level.

It is approaching the diamond zone, a potential short-term support before continuation.

3. Key Support Levels:

Diamond Zone (~3,000 region)

Could cause a temporary bounce before further decline.

Order Block (~2,952-2,938 zone)

This is a strong demand zone and a potential target area for price action.

4. Target Levels:

The analyst expects a downward move toward 2,952, aligning with a liquidity grab scenario.

5. RSI Indicator:

RSI is at 44.27, suggesting bearish momentum, with the possibility of further downside.

A break below 40 RSI may confirm more selling pressure.

Mr SMC Trading point

Risk Management Considerations:

Entry: A possible short entry could be around the FVG level (~3,020-3,030) if price retraces.

Stop Loss: Above 3,035 to avoid being trapped in a fake breakout.

Take Profit: Around 2,952-2,938 as per the target point.

USD Update & Impact on Gold:

If USD strengthens, gold may drop further due to their inverse correlation.

Key upcoming economic data (interest rate decisions, inflation reports) could increase volatility.

Pales support boost 🚀 analysis follow)

Perfect hit, interval thinking remains unchangedThe idea remains unchanged according to the previous article!

In the wave of financial markets, accurate prediction is the badge of strength. Previously, we firmly arranged short selling, and it turned out that this decision was extremely correct! The trend of gold perfectly matched our expectations, falling all the way back to the area around 3010-3000.

Next, new opportunities have emerged. We will adopt the high-altitude and low-multiple operation mode within the range. At present, we have decisively gone long in the area around 3010-3000. Every ups and downs of the market are opportunities for us to make profits. Let us be full of confidence and look forward to the subsequent wonderful performance of gold together, and work together to reap more fruits of victory!

If you don’t know when to enter the market, you can follow my 🌐signal. I will release specific signals in real time. Remember to pay attention to the 🌐signal in time.

The trend of gold has been weakFrom the current market analysis, the 4-hour chart shows that the gold price is weak, while the 1-hour chart tends to fluctuate and correct. Therefore, short-term operations can rely on $3030 and $3020 to bearish gold.

Note:

1. Determine the trading cycle, set the direction in the big cycle, and enter the market in the small cycle.

2. Follow the trend: 3 waves up and down without breaking the high and low points is a shock, and 3 waves of high and low points rising or falling is a trend. Don't do shocking market, don't stop if you don't understand it, and control your hands.

3. Wait for the position, pay attention to the profit and loss ratio when entering the market. Set a stop loss.

4. Don't trade emotionally, respect market uncertainty, and accept stop loss.

5. Finally, repeat the execution unconditionally.

I wish you a smooth transaction

Another Strong Start to the Week!Gold opened the week on a positive note without a significant pullback, rebounding quickly after touching a low of 3013. The overall price action remains range-bound with a bullish bias, though gold is still trading within the lower to middle Bollinger Bands. A clearer upside move may emerge once the correction phase concludes.

In the short term, resistance remains at the 3030-3040 zone. If this level holds, short positions can be considered. On the downside, key support levels to watch are 3012 and 3005, with the 3005-3000 range offering a potential buying opportunity.

Trading Strategy:

- Sell near 3030-3040resistance if it remains intact.

- Buy around the 3005-3000 support zone.

- Adopt a range-trading approach, focusing on shorting near resistance and buying near support.

I have always been glad that I can stick to my original intention. I can be dedicated to every friend who proposes cooperation. I will use my professional strength to help you make profits, recover your capital, and increase your funds. My reputation depends entirely on the publicity of customers. My strength has been honed in actual combat for a long time. Even if the road ahead is bumpy, as long as you give us trust, we will do our best to guide you and use your funds to the maximum effective limit, so that you can experience the feeling of profit in the ups and downs of the market! If you don’t know when to enter the market, you can pay attention to my 🌐 signal. I will release specific signals in real time. Remember to pay attention to the 🌐 signal in time.

Gold starts to pull back, continue to shortSince gold has already started to adjust at a high level, and gold bears have gradually started to exert their strength, can gold fall below 3000 again? We will wait and see.

Operation ideas:

It is recommended to go short at 3035-3030, stop loss at 3045, and target at 3005-3000;

GOLD ALERT | BIG DROP LOADING!🏦 Institutions Are Taking Profits – Are You Ready for the Next Move?

For the last 4 weeks, institutions have been reducing their long positions on #GOLD ( OANDA:XAUUSD ). This is exactly what I warned about – profit-taking from big players, signaling potential downside ahead.

technical down

Go short first, then go long, and grasp the rhythmGold overall rose and fell last week. After three consecutive positive weekly lines, the upper shadow line was closed. On Friday, it walked out of the adjustment space. The short-term rise slowed down slightly, and it was more inclined to fluctuate at a high level. The daily line turned negative and retreated to correct, and it was in a partial adjustment stage. In the 4H cycle, it did not stabilize above the 3047-57 mark mentioned earlier, so it walked out of the second downward exploration space, but combined with the intact structure of the three-month rising channel, the current retracement is more inclined to technical correction rather than trend reversal. From a spatial point of view, the 3030 line as the midpoint of the channel constitutes the primary resistance. If this position cannot be effectively broken through, the gold price may test the support of the 3000 integer mark downward. It is worth noting that the static resistance formed near 3050 resonates with the recent fundamental negatives, further suppressing the upward space.

The current strategy needs to focus on whether the 3026 opening high can be recovered in the oscillation range. If it stabilizes, it will be seen to 3035 last week's opening point; on the contrary, if it falls below the 3010 short-term moving average support, the shorts can follow the trend to the expected 3000 mark. It is recommended to adopt the range trading mode, and operate back and forth between high and low in the range of 3000-3035. Technically, we need to be alert to the stagflation signal formed by the continuous shortening of MACD and the closing of Bollinger Bands. It is recommended to avoid chasing highs and focus on the impact of US CPI data on the market.

Gold operation advice: Go short after rebounding around 3030-3040. Go long after stepping back to 3010-3000.If you don’t know when to enter the market, you can follow me. I will release specific signals in real time. Remember to pay attention in time.

Gold----Sell near 3026, target 3000-2982Gold market analysis:

Last week, gold kept rising, but suddenly turned around and began to give back on Friday. The position of 3020 was broken, and it was not so strong in the short term. Is the big top of gold coming? This is the focus of traders at present. Judging from the previous pattern and moving average indicators, its adjustment has not changed the weekly trend. The weekly line closed positive last week, but there was a relatively long upper shadow line. The big top requires time and space to exchange. At present, I think there are signs of building a top, but it has not reached the top. The long-term trend is still buying, and the short-term has begun to repair. This week, we should not keep bullish and should adjust. Today, we will first look at the range decline. The rhythm of the shock must be grasped to grab big profits.

The above analysis chart of gold shows that a downward trend channel has been formed in 1H. The suppression position of the downward trend channel is around 3032. If this position is not broken, it is basically weak. The suppression position of the hourly pattern is 3026, which is also the high point of today's Asian session. Today's idea is to sell based on these two positions if it rebounds first, and pay attention to the long position around 3000.

Support is 3000 and super support is 2982, suppression is 3026 and 3032, and the strength dividing line of the market is 3017.

Operation suggestion:

Gold----Sell near 3026, target 3000-2982

Opportunities and risks of today’s gold trend!Market news:

In the early Asian session on Monday (March 24), spot gold fluctuated in a narrow range and is currently trading around $3,022 per ounce. The international gold price fell 0.7% last Friday due to the strengthening of the US dollar and profit-taking. It once hit the 3,000 integer mark during the session. However, geopolitical and economic uncertainties linger, coupled with the expectation of a rate cut by the Federal Reserve, London gold prices are still supported by bargain hunting and safe-haven buying, and the weekly line has risen for the third consecutive week. In terms of geopolitical situation, Israel announced last week that it would launch sea, land and air attacks on Hamas in Gaza to force the other side to release the remaining hostages. This move means that Israel has abandoned the two-month ceasefire agreement and launched a full-scale air and ground offensive against Palestinian militant organizations. Traditionally, investment in the gold market is regarded as a safe investment in times of geopolitical and economic uncertainty, and usually performs strongly in a low-interest rate environment. This year, international gold has set 16 new record highs, reaching an all-time high of $3,057 per ounce. Although the gold market may face correction pressure in the short term, the long-term upward trend of gold has not changed. Factors such as global economic and political uncertainty, the Federal Reserve's monetary policy and geopolitical risks will continue to be the main driving force supporting gold prices. The PMI data of European and American countries in March will be released on this trading day, and investors need to pay close attention.

Technical Review:

The gold daily line fell and rebounded on Friday. After a sharp retracement of the 3000 mark, the gold price closed above 3020. The daily closing price was still above the MA10/7-day moving average. The RSI indicator was running at a high value of 70. As of now, the MA10/7-day moving average still remains open upward at 3023/3000 respectively! In the short-term four-hour chart, the gold price is in the middle and lower track of the Bollinger Band. The MA10/7-day moving average opens downward and currently suppresses 3028 and the middle track of the Bollinger Band at 3032. The RSI indicator returns to the middle axis 50 value for sorting. The hourly chart RSI indicator runs below the middle axis and the moving average is glued together, and the price is in the middle track of the Bollinger Band. It is expected that the trading at the beginning of the week will maintain a large range of consolidation!

Today's analysis:

From the large-scale weekly chart, the long-term bullish trend of gold remains unchanged. After the previous big negative correction, it has risen for three consecutive weeks. The bulls are stable. Last week, the overall market rose and fell. The price stabilized at 2982 at the beginning of the week and soared all the way to 3057 and fell back. The closing price was near 3023. The weekly K closed with a small positive line with an upper shadow. The short-term bullish structure remains unchanged, but it is necessary to pay attention to the short-term correction pressure brought by the upper shadow line to correct the short-term moving average indicator. The current 5-week moving average is near 2941 and the 10-week moving average is at 2872. The correction is completed and the bullish trend remains unchanged. After the market rose to the 3057 line, the bulls took profits. The market ran a downward trend, and the price touched the 2999 line at the lowest. The current decline is just a correction to the previous rise. After the correction, it continues to be bullish. Last Friday night, the market fell sharply and then bottomed out and rebounded, and the K line rebounded! As for whether the correction is over, from the perspective of form, this wave of falling K-line is running a double positive correction with consecutive negative declines, and then we need to pay attention to whether the market will rebound with three consecutive positives to restart the upward trend, or turn negative and continue to fall. Considering that the current technical side is biased towards selling, the short-term operation is mainly based on selling at high prices below 3038, supplemented by buying at low prices.

Operation ideas:

Buy short-term gold at 3000-3003, stop loss at 2992, target at 3020-3030;

Sell short-term gold at 3037-3040, stop loss at 3048, target at 3010-3000;

Key points:

First support level: 3013, second support level: 3005, third support level: 2992

First resistance level: 3030, second resistance level: 3035, third resistance level: 3046

Golden Signal: Go Short in the 3027-3037 AreaLast Friday, gold rebounded to near resistance. Although the indicator in the 30M level chart shows that there is still some rebound momentum, the space is not very large, because the head and shoulders pattern has appeared in the early stage, and the pressure on the bulls is still very large.

Therefore, in the intraday trading on Monday, we can focus on short trading around the resistance area of 3027-3040. The single needle bottoming provides good support, so TP does not need to be set too large for the time being. The previous rising point of 3007 is used as a reference support, and TP is controlled in the range of $10-$16. Personally, it is expected to be in the 3018-3011 area.

I will update the specific trading information during the intraday, please pay attention to the content of the intraday update. If you have any questions, you can leave me a message, and I will reply to you in time when I see it.

I wish you all a prosperous new week!

XAU/USD(20250324) Today's AnalysisToday's buying and selling boundaries:

3023

Support and resistance levels:

3071

3053

3041

3005

2993

2975

Trading strategy:

If the price breaks through 3023, consider buying, the first target price is 3041

If the price breaks through 3005, consider selling, the first target price is 2993

Next week's market strategy analysisGold fell on Friday, falling to the lowest level of 2999 and then began to rebound strongly. Overall, if we say that gold has peaked now, it is too early, because there are still many uncertainties to stimulate the increase in risk aversion, so it is possible that gold will rise again. However, the impact of the news is only one aspect of our reference. However, the impact of news is only one aspect for our reference. After all, a lot of information cannot be known in time. We can only say that we should pay attention to the existence of this risk factor, so we still start from the technical level. There is still room for gold to rebound next week. We will first focus on the short-term suppression of 3025-30.

From the hourly analysis, pay attention to the support of 3005-3000 below. If it does not break after the retracement, continue to be bullish. Pay attention to the short-term suppression of 3025-3030 above, and focus on the suppression of 3045-57 above. The operation still maintains the same rhythm of the main multi-trend. If you don’t know when to enter the market, you can pay attention to me. I will release specific signals in real time and pay attention to it in time.

Gold operation strategy for next week: Gold will go long after stepping back from 3005-3000, and the target is 3025-3030.

Analysis of gold price trend next week!Market news:

Mainly due to the strengthening of the US dollar and investors' continued profit-taking, the US Treasury yields are rising, which put pressure on the international gold price and suffered a fierce sell-off. The London gold price once fell to around the $3,000/ounce mark during the session, and then recovered some of its losses. The geopolitical and economic uncertainties are lingering, and coupled with the expectation of the Fed's interest rate cut, the international gold price has risen for the third consecutive week. In addition, the geopolitical situation in the Middle East, which has pushed the London gold price to continue to refresh the historical high this week, may continue to help the gold price rise. Traditionally, gold is regarded as a safe investment in times of geopolitical and economic uncertainty, and usually performs strongly in a low-interest environment. This year, gold has set 16 new historical highs! Overall, the gold price has been mainly driven by geopolitical tensions in the near future. If the situation in the Middle East escalates over the weekend, and all parties are responding to Trump's tariffs in early April, and there is a possibility of renegotiation of the mining agreement in Ukraine, market uncertainty will increase, and the gold price is expected to aim at around 3,100, refreshing the historical high again.

Technical Review:

Gold fell below the support of 3025, the low point on Friday, and came to 2999. In the past few days, I have been emphasizing that gold will have a big retracement. I also arranged short orders in advance and easily took dozens of points of profit. The current decline is far from enough. Gold will continue to fall and return to normal! The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour gold has now formed a head and shoulders top structure. Gold rebounds or continues to be short. The market is weak. The gold price tested the 3000 mark for the first time in the evening and has not yet broken it, but the market direction has turned short. If it does not break the first time, I believe there will be a second test in the future. Then the short-biased situation has been finalized. Long positions must be put aside first, because it is now a short market!

Next week's analysis:

Gold fell on Friday, falling below 3000 at the lowest, but then it began to rebound strongly. The gold market has begun to fluctuate, so what should gold do next week? Will gold continue to rush up or start to change at a high level? In fact, overall, if we say that gold has peaked now, it is too early, because there are still many uncertain factors to stimulate the increase of risk aversion, so it is possible to support gold to rise again. However, the impact of the news is only one aspect of our reference. After all, we cannot know a lot of information in time. We can only pay attention to the existence of this risk factor, so there is no need to be too speculative. We still start from the technical level. The 1-hour moving average of gold begins to turn downward. As long as gold does not rise strongly next week, the 1-hour moving average of gold may continue to move downward. Finally, if a downward dead cross short arrangement is formed, the downward space of gold can be truly opened. The resistance of the gold moving average has now moved down to around 3036. The high point on Friday was at the high point of the second rebound at 3037. So gold still has certain resistance in this range. Gold can be sold under the pressure of this range resistance next week, and it can be sold first when it rebounds around 3035.

Operation ideas:

Buy short-term gold at 3000-3003, stop loss at 2992, target at 3020-3030;

Sell short-term gold at 3035-3038, stop loss at 3047, target at 2990-3000;

Key points:

First support level: 3000, second support level: 2990, third support level: 2981

First resistance level: 3035, second resistance level: 3047, third resistance level: 3055