XAUUSD ANALYSIS – JULY 18XAUUSD ANALYSIS – JULY 18: STRATEGY BASED ON FIBONACCI, TRENDLINE & STRUCTURE

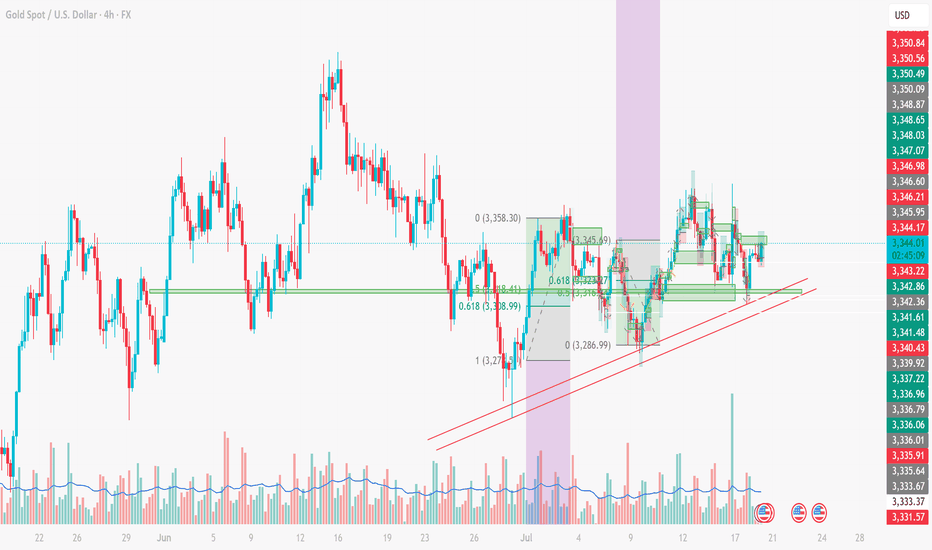

1. XAUUSD Technical Overview (4H Chart)

Gold (XAUUSD) is currently trading around 3,343 USD, showing signs of a slight rebound from key support. On the 4H timeframe, the price structure is forming higher lows, maintaining above a short-term rising trendline – a technically bullish signal.

2. Key Support & Resistance Zones

Immediate Supports:

3,338 USD: aligning with the 0.618 Fibonacci retracement – a zone tested multiple times.

3,333 – 3,335 USD: strong support, overlapping with EMA and rising trendline.

3,327 USD: previous swing low – last defense for the bullish structure.

Immediate Resistances:

3,345 – 3,346 USD: frequently rejected zone in recent sessions.

3,350 USD: psychological and technical resistance.

3,358 USD: recent swing high – breakout confirmation level.

3. Price Action & Fibonacci Confluence

Price is currently hovering between Fibo 0.5 (3,343 USD) and Fibo 0.618 (3,338 USD) – a potential bounce zone if bullish momentum holds.

The pullback from 3,358 to 3,286 has respected standard Fibonacci retracement levels, confirming technical price behavior.

4. Trendline Analysis

The ascending trendline from the 3,275 USD low remains intact, providing solid dynamic support.

If the price continues to bounce from this trendline, it may form a bullish continuation pattern (flag/pennant).

5. Suggested Trading Strategies

Long

Entry: 3,338 – 3,340 USD

SL: 3,327 USD

TP: 3,345 – 3,350 – 3,358 USD

Note: Buying the dip near Fib & trendline

Short

Entry: Below 3,327 USD (breakdown)

SL: Above 3,340 USD

TP: 3,310 – 3,298 USD

Notes: Only if price breaks trendline & support

6. Supporting Technical Indicators

EMA20/EMA50 show slight upward momentum – early bullish bias.

RSI (14) hovers near 50 – neutral zone, awaiting breakout confirmation.

Conclusion:

Gold is consolidating around a critical support zone. The short-term bias leans bullish if the 3,338 – 3,333 USD region holds and price breaks above 3,346 – 3,350 USD.

This is a key moment to position early using Fibonacci and trendline confluence.

👉 Follow for more strategies in upcoming sessions. Save this if you find it useful!

Do you have a different view? Share your thoughts in the comments below!

Goldshort

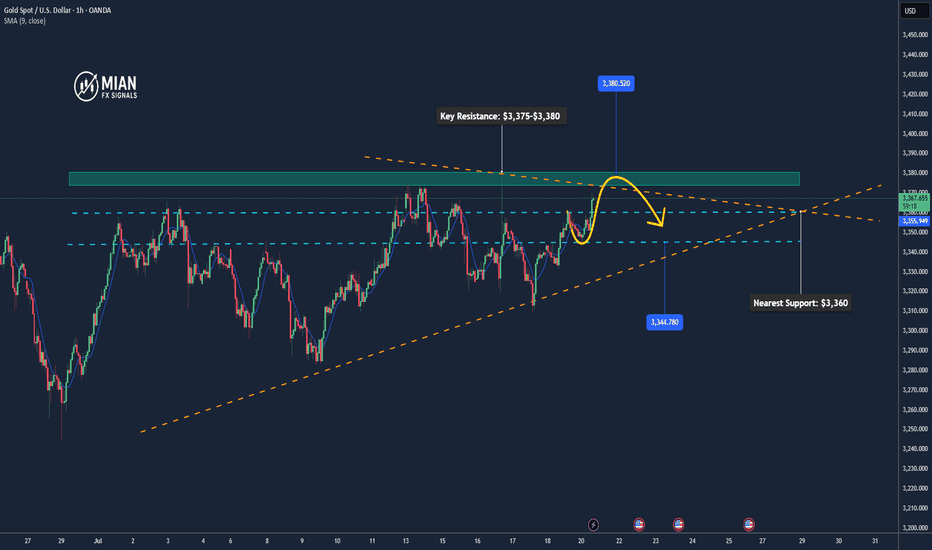

Gold Approaches New Resistance – Potential Short-Term Pullback📊 Market Update

Gold is currently trading around $3,368–$3,370/oz, up approximately 0.5% today, supported by a weaker USD and slightly declining US Treasury yields. This comes amid global trade concerns and expectations that the Fed may adjust policy in upcoming meetings.

📉 Technical Analysis

•Key Resistance: $3,375–$3,380 (pivot R2: $3,374.9, R3: $3,389.6)

•Nearest Support: $3,360 (S1: $3,335.8)

•EMA: Price is trading above the EMA9 / EMA20 / EMA50 / EMA200, confirming a strong uptrend

•Candlestick / Volume / Momentum:

o MACD & ADX still confirm strong bullish momentum

o Price consolidating in a rectangle range of $3,352–$3,366 → watch for breakout or rejection at resistance

📌 Outlook

Gold may pull back slightly if it fails to break through the $3,375–$3,380 resistance area and RSI continues hovering near overbought levels.

💡 Suggested Trade Strategy

🔻 SELL XAU/USD at: $3,375–$3,380

🎯 TP: 40/80/200 pips

❌ SL: $3,385

🔺 BUY XAU/USD at: $3,345–$3,348

🎯 TP: 40/80/200 pips

❌ SL: $3,339

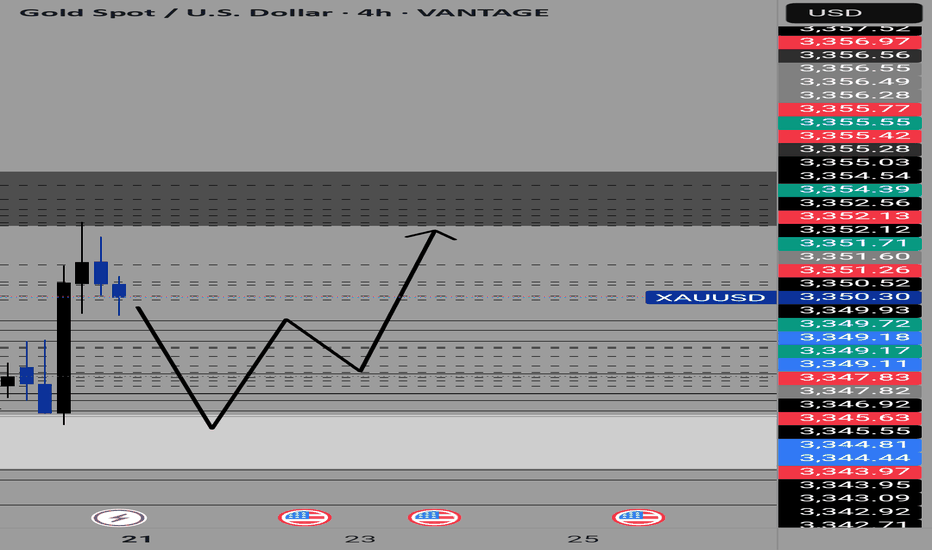

XAUUSD falling back to supportBearish Gold Analysis: Liquidity Sweep & Support Retest

The current price action in gold (XAU/USD) suggests a **bearish pullback** toward a key support level, likely driven by a **liquidity sweep** beneath recent lows before a potential reversal or continuation. Here’s why:

#### **1. Liquidity Sweep Beneath Support**

- The price has declined sharply, breaking below minor support levels (e.g., **3,350.30**) and sweeping the **3,342.71–3,347.82** zone.

- This move likely targeted **stop losses** beneath recent swing lows, a common market-maker strategy to collect liquidity before reversing or extending the trend.

#### **2. Bearish Momentum Confirmation**

- The **+0.34%** uptick appears weak compared to the preceding sell-off, indicating a possible **retest of resistance-turned-support**.

- The **4h exposure** suggests a short-term downtrend, with price rejecting higher levels and failing to hold above **3,350.49 (BUY zone)**.

#### **3. Support Level Retest**

- The next major support sits near **3,342.71–3,340.00**. A break below could trigger further downside toward **3,330.00**.

- If support holds, expect a **bullish reversal** as trapped sellers cover shorts, but failure here confirms bearish continuation.

#### **Key Takeaway**

Gold is **bearish short-term**, with price likely retesting support after sweeping liquidity. Watch for:

- **Break below 3,342.71** → Bearish continuation.

- **Rejection & bounce** → Potential reversal.

Traders should monitor order flow around these levels for confirmation.

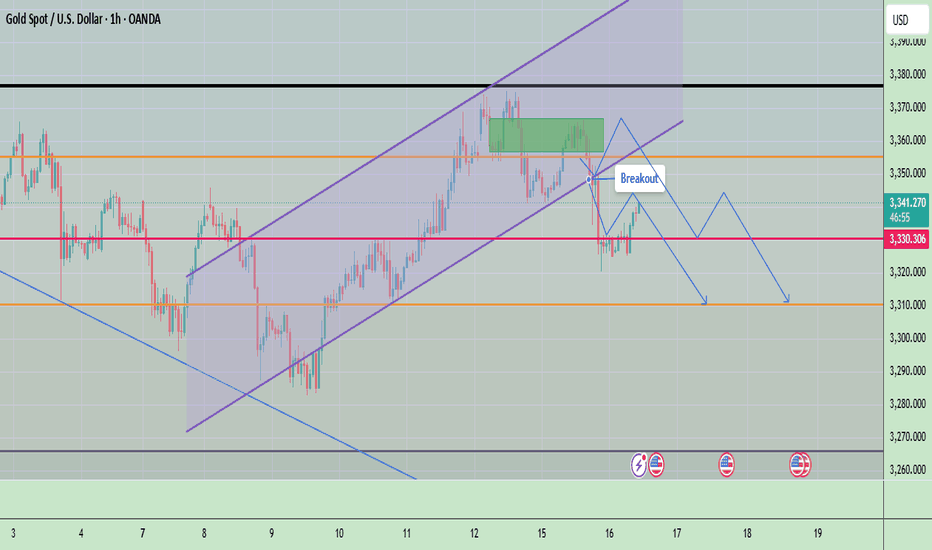

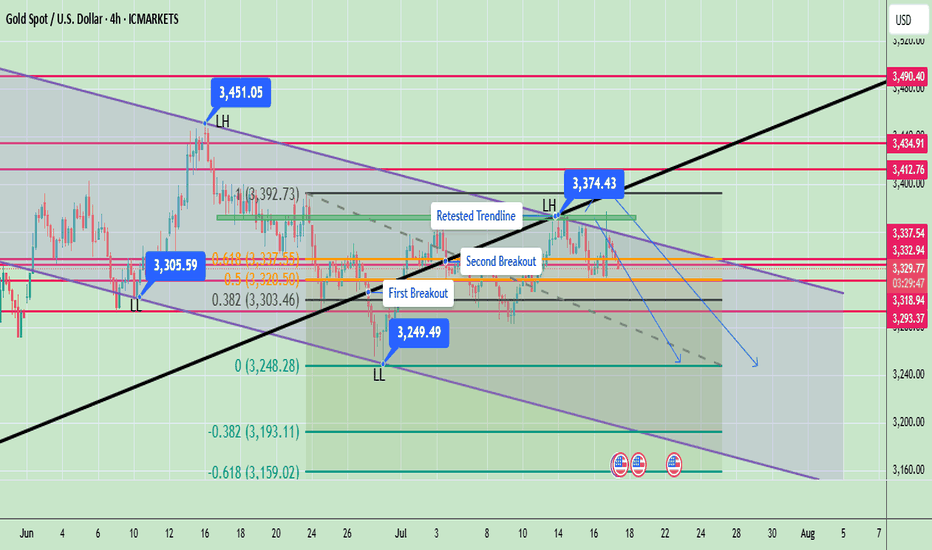

Gold Rejected Post-CPI – Bearish Momentum Building Below $3,365Gold is currently trading near $3,338, continuing to show signs of rejection after testing the key $3,365–$3,392 resistance zone. The market has reacted to the July 15 U.S. CPI release, and despite initial volatility, gold failed to break above its major diagonal trendline, forming a lower high, a strong technical sign of weakening bullish momentum.

If price breaks below $3,330, it could trigger a wave of selling pressure down to $3,303 and $3,248 in the coming days. Traders should monitor price behavior around these zones for short-term entry opportunities.

📌 Technical Breakdown

Resistance Zone:

- $3,365–$3,392 remains the critical ceiling where gold got rejected for the third time in recent sessions.

- This zone aligns with the top of the descending wedge, long-term black trendline.

Bearish Structure Forming:

- After multiple attempts, gold could not sustain above the resistance.

- A series of lower highs and a weakening bullish push suggest a bearish continuation is likely.

Support Levels to Watch:

- Immediate: $3,337

- Mid: $3,320

- Strong: $3,303 (0.382 Fib) and $3,293

- Final Target: $3,248 → $3,220 → $3,193

🔺 Bullish Invalidation Scenario

If gold manages a clean breakout and close above $3,392, this bearish setup will be invalidated. In that case, upside targets would include:

- $3,412

- $3,434

- $3,490 (macro trendline)

But at the moment, that seems unlikely unless driven by unexpected fundamentals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold Rejects Resistance Again – Gold Rejects Resistance Again ?Gold is currently trading near $3,335, showing signs of exhaustion after a failed breakout above the recent consolidation range. The market attempted to push higher but lacked strong momentum, leading to a pullback and possible shift in bias. The price is forming lower highs, indicating bearish pressure building up on the 4H timeframe. Gold is showing weakness after a second breakout followed by a possible retest failure. The market structure indicates a bearish bias

🔍 Market Structure Overview:

- Two Breakouts: Price attempted two bullish breakouts recently. The first breakout gained some traction, while the second failed to hold above resistance.

- Failed Retest: Price has now returned back near the previous breakout zone (~$3,332), signaling a potential bearish reversal pattern.

- The chart structure suggests a distribution phase, with price struggling to hold gains, and sellers slowly gaining control.

🧭 Key Support and Resistance Levels:

✅ Resistance Zones:

- $3,337.54 – Immediate resistance (recent rejection zone)

- $3,348.03 – Strong resistance if price pushes above $3,337

- $3,412.76 – Major resistance from previous swing high

- $3,490.40 – Long-term psychological resistance

🔻 Support Zones:

- $3,318.94 – Immediate support (just below current price)

- $3,303.46 – Key fib retracement (0.382 level)

- $3,248.28 – Strong horizontal support (major zone)

- $3,193.11 – Fibonacci extension level (-0.382)

- $3,159.02 – Next support zone (Fibo -0.618 level)

🟠 Current Bias:

Bearish to Neutral – as long as price remains below $3,337.

If price breaks and holds above $3,337 with volume, short-term bullish reversal is possible.

Yeterday there was a fake news and gold was pumped but after clarification it was dumped. It means buyers are not much interested till fed next meeting and the high price of the gold. Sellers will short the gold on every rise while buyers will wait for low price of the gold for long term trade.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

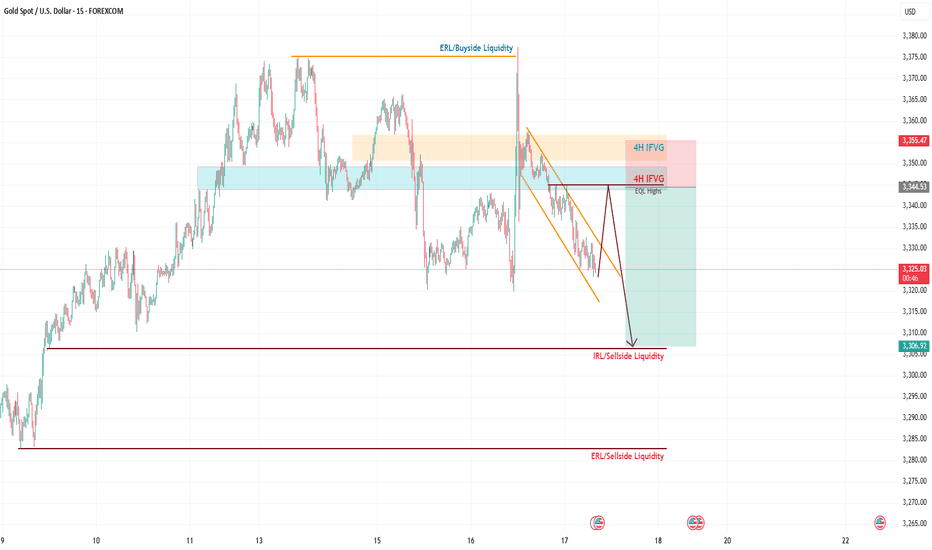

Gold Trading Idea: Short Opportunity on 15-Min Descending ChanneHello TradingView Community,

Following up on my Gold analysis from Monday, the price action has respected the levels I outlined (check my previous posts for the breakdown), delivering solid trade opportunities except yesterday's news-driven volatility. Today, we're eyeing a short setup on Gold based on the 15-minute timeframe.

Technical Analysis:

Gold is moving within a descending channel on the 15-min chart.

I've identified equal highs and a small FVG (Fair Value Gap) aligning with the 61.8% Fibonacci retracement of the channel's range.

This confluence zone is where I expect the price to react, potentially clearing liquidity above the channel before reversing.

Trade Plan:

Entry: Wait for the price to reach the confluence zone (equal highs + 61.8% Fib + FVG) and show a clear reaction (e.g., rejection or reversal pattern) before entering a short position.

Take Profit: Targeting 3310 level.

Risk Management: If the price fails to reach the zone and breaks lower, I'll stay out to avoid chasing trades. Patience is key here.

Stay disciplined, traders! Let the price come to our zone, and always manage your risk.

Follow for more setups, like this post if you found it helpful, and drop your thoughts in the comments below! Let’s discuss!

#Gold #XAUUSD #ShortSetup #TechnicalAnalysis

Gold May Temporarily Correct Under Resistance Pressure📊 Market Overview:

• Gold reached resistance around $3,365–$3,370/oz before showing signs of cooling due to mild profit-taking.

• Ongoing trade tensions and geopolitical risks — such as President Trump’s tariff plan — continue to support safe-haven demand, driving gold close to a three-week high.

• Strong central bank purchases reinforce the long-term bullish outlook.

📉 Technical Analysis:

• Key Resistance: $3,365–$3,370

• Nearest Support: $3,300–$3,320

• EMA 09: Price is currently below the EMA 09, suggesting a potential short-term pullback. (Price is still above the EMA50, supporting the recent uptrend.)

• Candlestick patterns / Volume / Momentum:

o RSI near 57 – neutral but slightly declining.

o MACD and ADX remain bullish, indicating underlying strength but with possible short-term consolidation ahead.

📌 Outlook:

Gold may experience a short-term pullback if it fails to break through the $3,365–$3,370 zone and geopolitical tensions ease.

However, the medium-to-long-term trend remains bullish, especially as central banks continue to accumulate gold and global risks persist.

💡 Suggested Trading Strategy:

SELL XAU/USD: $3,363–$3,366

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,369

BUY XAU/USD : $3,317–$3,320

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,214

Xauusd Up Gold stabilizes near $2,030, eyes on FOMC Minutes

Gold clings to marginal daily gains at around $2,030 on Wednesday after closing the first two days of the week in positive territory. The benchmark 10-year US Treasury bond yield edges lower ahead of FOMC Minutes, helping XAU/USD hold its ground.

From a technical perspective, sustained strength and acceptance above the 50-day SMA will set the stage for an extension of the recent recovery from the $1,984 region, or a two-month low touched last week. Given that oscillators on the daily chart have been gaining positive traction, the Gold price might then accelerate the positive move towards an intermediate hurdle near the $2,044-2,045 region en route to the $2,065 supply zone.

Gold now 2028

Target 2032

Target 2036

Target 2050

Target 2059

SL 2015

FOMC signal confirm

XAUUSD 4H SMC Analysis – Sell Opportunity Near Supply Zone Price is currently tapping into a 4H supply zone around 3353–3360, a strong area of previous sell-off and imbalance. We're expecting a potential reaction and rejection from this area, aligning with the following SMC confluences:

🔻 SMC Confluences:

Price swept short-term liquidity above previous highs (liquidity grab).

Price now tapping into a mitigation zone within premium pricing.

Bearish order block aligned around 3360.

FVG (Fair Value Gap) filled between 3345–3360.

Fibonacci 0.5–0.618 zone respected.

🎯 Sell Setup:

Entry: 3355–3360 (Confirmed reaction)

SL: Above 3373 zone (liquidity sweep buffer)

TP1: 3343 (short-term structure)

TP2: 3309 (previous support)

TP3: 3288 (strong 4H demand)

📌 Watch for M15–H1 bearish CHoCH (Change of Character) or BOS (Break of Structure) as confirmation before entry.

Gold Possible Retest of $3,365 Before Downside MoveGold is currently trading around $3,335, approaching a critical resistance level at $3,365, which has been marked as a “Main Resistance” on the chart. The recent price movement shows a strong bullish rebound from the $3,293–$3,300 support zone, breaking above two key trendlines labeled "Breakout."

The chart suggests a potential “retest” of the $3,365 resistance before another downward move, as marked by the annotation "Possible Retest and Then Down." This idea is reinforced by the broader descending channel pattern visible from late June, indicating that the larger structure still favors bearish continuation unless a strong breakout occurs above $3,365.

⚠️ Bearish Confluence

Price is inside a corrective channel, repeatedly failing to sustain above prior highs

$3,365 has held firm multiple times as resistance — a strong horizontal and trendline convergence zone

Price is still well below the swing high at $3,392

🟩 Bullish Scenario (If Invalidation Occurs)

If price breaks and closes above $3,365, it would invalidate the current bearish structure and open the door for upside targets like:

$3,392 (previous high)

$3,412

Possibly $3,434, which is a longer-term diagonal trendline resistance

At present, gold is in a corrective upward move within a broader bearish channel. The zone between $3,337–$3,365 will be key. A bearish rejection here would confirm downside continuation, with price potentially targeting $3,265–$3,220. However, a bullish breakout above $3,365 could invalidate the bearish view and suggest strength returning toward $3,392 and above.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD - 4H Bearish Rejection from Supply Zone | SMC AnalysisGold is showing signs of weakness after reacting strongly from a 4H Supply Zone around the 3331.72 level. Price tapped into the red supply zone, failed to break above, and is now forming lower highs — suggesting bearish momentum is building.

🔍 Key SMC Observations:

Supply Zone: Price rejected the 3331.72 level, which acted as a clear supply area based on past liquidity grabs and bearish institutional moves.

Change of Character (CHoCH): We saw a CHoCH around July 5th–6th, indicating a shift from bullish to bearish order flow.

Lower High Formation: Price failed to make a new high after tapping supply, showing signs of distribution.

Imbalance + Target Zone: Clean imbalance exists down to 3288.73 and potentially to the green demand zone around 3260–3270.

📍Trade Setup Idea:

Sell Opportunity: If price continues to reject the supply zone, look for bearish confirmation on the lower timeframes (e.g., 1H) to enter.

Target 1 (TP1): 3288.73 (near-term liquidity level)

Target 2 (TP2): 3260–3270 demand zone

Invalidation: A break and close above 3331.72 would invalidate the short-term bearish bias.

🔴 Watch for reaction around 3288.73 – if it holds, expect a possible bounce. If broken, further downside is likely.

Gold Drops to 3,284 – Short-Term Support at Risk📊 Market Overview

Gold fell sharply this morning to $3,284/oz amid a modest USD rebound and profit-taking pressure following several range-bound sessions. The lack of fresh catalysts also contributed to weaker momentum.

📉 Technical Analysis

• Key Resistance: 3,315 – 3,330

• Nearest Support: 3,280 – 3,275

• EMA 09: Price is currently trading below the EMA 09 on both the H1 and H4 timeframes → short-term bearish signal

• Candle Patterns & Momentum:

– H1 candle shows a bearish engulfing pattern near the 3,305 area → confirms downward pressure

– RSI is below 45, MACD has crossed below its signal line → bearish momentum dominant

– If the 3,275 level is breached, gold could continue to fall toward 3,260

📌 Outlook

Gold is leaning toward further downside unless it can hold above the 3,280 support level during today’s session.

💡 Trade Strategy

🔻 SELL XAU/USD at: 3,295 – 3,398

🎯 TP: 40/80/200 PIPS

❌ SL: 3,305

🔺 BUY XAU/USD at: 3,275 – 3,278

🎯 TP: 40/80/200 PIPS

❌ SL: 3,269

Gold Under Pressure as Dollar Strengthens – Watch Below 3297FX:XAUUSD – Technical & Fundamental Outlook

Gold prices declined on Monday, pressured by a stronger U.S. dollar following President Trump’s announcement of a potential 10% tariff on BRICS-aligned countries. The news supported the dollar and weakened demand for gold as a safe-haven asset.

Although uncertainty remains around U.S. trade negotiations ahead of the July 9 tariff deadline, signals of possible extensions and staggered implementation have further reduced short-term haven flows into gold.

Technical View:

Gold remains under bearish pressure while trading below 3320.

As long as the price stays under this level, we expect sideways consolidation between 3297 and 3320 until a breakout occurs.

A 1H close below 3297 would confirm bearish continuation, targeting 3281 and 3255.

A break above 3320 would invalidate the bearish outlook and shift momentum toward 3342.

Pivot: 3297

Support Levels: 3281 / 3255 / 3239

Resistance Levels: 3314 / 3320 / 3342

Previous idea: Click Here...

GOLD SHORT TRADE Gold Short Trade Setup !

Gold Sweep Liquidity And Make A Market Structure MSS + LIQUIDITY + FVG !

Se We Are Selling Gold At FVG Area

Giving You Signal Guys !

Gold Sell FVG ( 3315 - 3325 )

Stoploss : ( 3331 )

Target Level : 3310, 3305, 3300, 3290, 3280

Hop You Got The Signal Enjoy it See You In Another Setup !

Gold’s Trap Above QML: Bearish Play UnfoldingHello Guys!

Gold appears to be forming a textbook Quasimodo reversal setup after printing a lower high into a key supply zone. Price aggressively tapped into the QML area (around 3,350–3,360), where sellers previously stepped in, and we’re now seeing signs of rejection.

The engulf zone marked earlier confirms bearish intent. It broke structure and flipped momentum. Price is currently retesting below that engulf level, likely as a last attempt to grab liquidity before heading down.

The projected move suggests a drop toward the next significant demand zone around 3,295–3,285, where the price previously found a strong bullish reaction.

Bias: Bearish below QML

Target: 3,295 zone

Invalidation: Above 3,368 (high of supply zone)

Gold (XAU/USD): Playbook in ActionHello guys!

We’ve seen a textbook QML (Quasimodo Level) setup play out beautifully on gold. Price pushed into a key supply zone and formed a QML structure, followed by a clean engulfing of the previous demand. confirming smart money involvement. As expected, the target of that QML has now been hit, tapping into the major demand zone below.

After the deep sweep and reaction from demand, price retraced upward into a potential lower high area. Based on structure and liquidity dynamics, two potential scenarios are in play:

We’re executing a two-step plan here:

Step 1: Short position from the QML + supply area, aiming for the next blue demand zone. Liquidity has been taken above the high, confirming the setup.

If we get a clean reaction near the blue area, that’s our signal to flip long. We expect a pullback toward $3310 area.

Gold - Time to short XAUUSDIt may be difficult to have a bearish bias on gold, but the chart is saying sell!

After a prolonged bull run, you can see how price got rejected at $3,500. Subsequent bullish moves became weaker and weaker, you may even see a H&S pattern but more importantly the latest weaker bounce seems to indicate that the local support at 3272 may soon break.

If this plays out as I think, a nice trade will setup. I also took a quick look at the H1 chart and noted that we already have lower daily central pivots. Looking forward to see how PA in the next couple of days develops.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

GOLD1! Best Key Level !!This is the 1 hour Chart of Gold!.

Gold is forming a bearish structure and is consistently respecting the resistance zone, leading to a downward move. The key resistance area is between 97,800 and 97,400..

Gold is finding support in the 96,250 – 96,330 zone on the short time frame.

A breakdown below this level may trigger aggressive selling pressure.

Thank you !!

GOLD SHORT TRADEH1 TIMRFAME

1st Zone GOLD SHORT TRADE AT MAIN RESISTANCE AND ENGULFING ZONE

2nd Zone GOLD SHORT TRADE TLBP PULLBACK SELL AT SELL TRENDLINE

1st Signal : GOLD SELL MAIN RESISTANCE 3351- 3355

Stoploss : 3360

TP Level - 3345, 3340, 3335, 3330

2nd Signal : GOLD SELL TLBP PB TL 3360 - 3366

Stoploss : 3372

TP Levels - 3355, 3350, 3345, 3340, 3335, 3330

Manage Your Trade Properly

Gold Drops as NFP Beats, USD Gains📊 Market Overview:

• June’s Non-Farm Payrolls came in stronger than expected at +147K (vs 110K forecast), with unemployment ticking down to 4.1%.

• The US Dollar surged (DXY up ~0.5%) and Treasury yields rebounded following the release.

• Gold dropped sharply after the report, hitting a session low of $3,311 and is now trading around $3,328.

📉 Technical Analysis:

• Key Resistance: $3,364

• Immediate Support: $3,311

• EMA 09 (H1): Price is below the 09 EMA → confirms short-term bearish trend.

• Pattern / Momentum: A bearish engulfing candle near $3,364 signaled strong seller control. The failure to bounce afterward suggests persistent bearish pressure. RSI is tilting lower, confirming weakening momentum.

📌 Outlook:

Gold may continue to decline toward the $3,300–$3,290 area if USD and yields remain firm, especially if upcoming US data (such as ISM Services PMI) also supports the dollar strength.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD at: $3,333 – $3,335

🎯 TP: $3,300

❌ SL: $3,339

🔺 BUY XAU/USD at: $3,293 – $3,290

🎯 TP: $3,330

❌ SL: $3,287