XAUUS SHORTStubborn XAUUSD, played with my TP1 a few times, almost hitting it but never really reached and instead it went the other way and touched my SL. However Im still on a strong sell in this. Opening at 3078 and still maintaining my previous TP 3005 because I know that's the direction that it will head to, if this reaches, it will cover 3days loss, and setting my SL on a much further rate. Personally, I dont use SL's but for Tradingview Im opting to put one as a good practice

Day12of100

L:4

W:1

Such a shame that my L days are way more than my W's but still believing in my trade and I know this will pick up. let's see how this new trade rolls. XAUUSD is already in it's all time high, so I believe soon enough my much awaited correction will happen, Il be patient :)

Goldshort

GOLD XAUUSD ShortI m short. Gold can go even to 3100.No matter I sell more

Wall Street goes full bull with tariffs and payrolls looming

Gold surges toward $3,100 amid unrelenting rally

Smart money knows one thing very clearly: a large part of the bad news is already baked into the prices, and there is limited room for further downside. Especially considering the parabolic moves we’ve seen

Never the less we are in overbought zone,A correction coming.That will be good chance to buy Gold again

A Gold'en Newtonian Sell-Off Porjected By MedianlinesSir Isaac Newton stated the Third Law of Motion in his landmark work, Philosophiæ Naturalis Principia Mathematica (commonly called the Principia), which was first published in 1687. This law appears in Book I, in the section titled Axioms, or Laws of Motion.

(Axiom: A self-evident truth)

Newton did explicitly present it as an axiom. In fact, it's Axiom III (or Law III) of his three fundamental laws of motion. Here's how he phrased it in the original Latin and in his own English translation:

"To every action there is always opposed an equal reaction: or the mutual actions of two bodies upon each other are always equal, and directed to contrary parts."

And what does this have to do with Medianlines / pitchforks?

This tool measures exactly that: the action — and the potential reaction!

Medianline traders know that pitchforks project the most probable direction that a market will follow. And that direction is based on the previous action, which triggered a reaction and thus initiated the path the market has taken so far.

…a little reciprocal, isn’t it? ;-)

So how does this fit into the chart?

The white pitchfork shows the most probable direction. It also outlines the extreme zones — the upper and lower median lines — and in the middle, the centerline, the equilibrium.

We see an “undershoot,” meaning a slightly exaggerated sell-off in relation to the lower extreme (the lower median line). And now, as of today, we’re seeing this overreaction mirrored exactly at the upper median line!

Question:

What happened after the lower “overshoot”?

New Question:

What do you think will happen now, after the market has overshot the upper median line?

100% guaranteed?

Nope!

But the probability is extremely high!

And that’s all we have when it comes to “predicting” in trading — probabilities.

Why? Because we can’t see the future, can we?

Gold?

Short!

Looking forward to constructive comments and input from you all

Summer is almost over for gold, winter is coming.To me it's a clear 5-way Elliot cycle.

And as I always say, trends usually target the Fibonacci range between 1.618 and 2.618.

I would never push for more, would be an unnecessary risk.

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

Gold’s Bearish Setup – What’s Next for $XAUUSD?Gold ( OANDA:XAUUSD ) fell to $3,003 as I expected in my previous post . Of course, since this is a round number , we can expect good support .

In terms of Classic Technical Analysis , Gold appears to have succeeded in breaking the neckline of the two patterns , the Head and Shoulders Pattern and the Three Falling Peaks Pattern .

Educational Note : The Three Falling Peaks is a bearish reversal pattern that occurs after an uptrend, where the price forms three consecutive lower peaks. Each peak represents a failed attempt to continue the uptrend, signaling weakening bullish momentum. A breakdown below the support confirms the pattern and signals a potential downtrend.

In terms of Elliott Wave theory , it seems that Gold has completed 5 impulsive waves and we should wait for corrective waves .

I expect Gold to attack the $3,000 at least once more after completing the pullback , and the next target could be the Support zone($2,989-$2,976) .

Note: If Gold goes above $3,039, we should expect more pumps.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

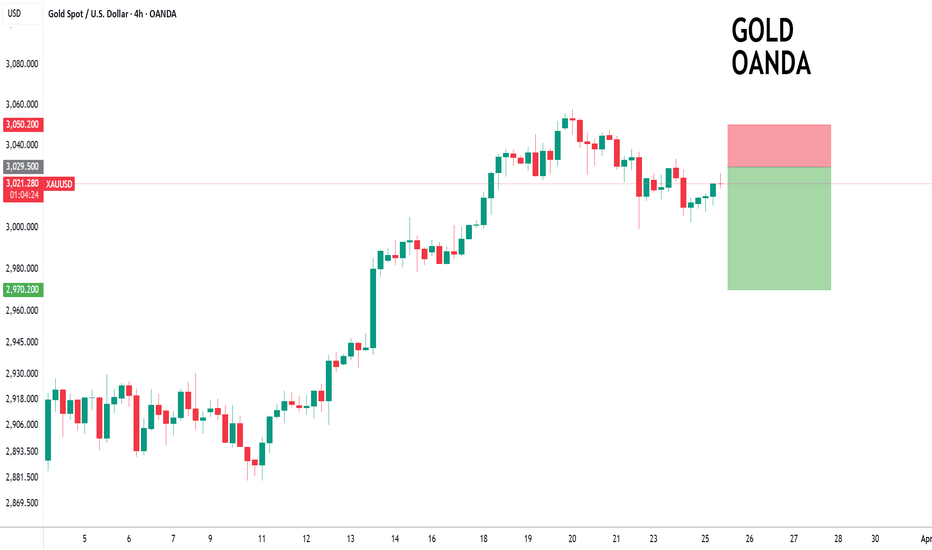

GOLD to turnaround?XAUUSD - 24h expiry

Previous support at 3030 now becomes resistance.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Posted a Bearish Inverted Hammer Bottom on the Daily chart.

A higher correction is expected.

The RSI is trending lower.

We look to Sell at 3029.5 (stop at 3050.2)

Our profit targets will be 2970.2 and 2960.2

Resistance: 3020.8 / 3033.3 / 3047.4

Support: 3014.5 / 2999.3 / 2978.4

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Gold (XAU/USD)– Bearish Setup Against the Main Trend (High Risk)hello guys.

In this 4-hour chart, we can see a Head and Shoulders pattern forming, which is typically a bearish reversal signal. The price has broken below the neckline of the pattern, suggesting a potential downside move. Additionally, the price is currently trading inside a descending channel, reinforcing the bearish momentum.

Bearish Scenario

A potential pullback to the upper boundary of the descending channel (around $3,030-$3,035) could serve as a selling opportunity.

The first target for the decline is around $3,000, a psychological level and previous support.

If momentum continues downward, the price could drop further to $2,962-$2,965, which aligns with strong historical support.

in higher timeframe:

The volume has noticeably declined towards the end of this uptrend, signaling a potential loss of bullish momentum. As prices reach new highs, the decreasing volume suggests that buyers are becoming exhausted, which often precedes a correction or reversal. This divergence between price action and volume indicates that the recent upward movement may not be sustainable, increasing the likelihood of a pullback in the near term.

Why This Trade is Super Risky?

Main Trend is Bullish – The overall market structure remains in an uptrend, so this short setup is against the major trend.

Liquidity & Buyer Pressure – The price could find strong buying pressure around $3,000, leading to a false breakdown.

Risk Management is Crucial – If entering a short position, risk should be minimal, with a tight stop-loss above $3,035-$3,040 to prevent excessive losses in case of invalidation.

📌 Conclusion:

This setup offers a potential short trade, but high caution is needed due to the bullish macro trend. Entering with low risk and tight stops is essential to manage exposure. If the price breaks above the descending channel, the bearish idea is invalidated.

(XAU/USD) Forming a Bearish Reversal–Key Short Setup Unfolding!Chart Pattern: Head and Shoulders Formation

The chart shows a potential Head and Shoulders pattern, which is a bearish reversal setup. The head is the highest peak, while the two shoulders form lower highs on both sides. The price has already broken below the neckline, indicating a sell opportunity.

Key Levels:

Resistance Levels:

$3,055.29 – Major resistance

$3,046.10 – Key level near recent highs

$3,030.58 – Short-term resistance where price is currently retesting

Support Levels (Potential Targets):

$2,981.18 – First support level

$2,939.81 - $2,931.99 – Strong demand zone

$2,881.49 – Major support level

Trade Setup:

Entry:

The price has broken below the neckline and is currently retesting the breakdown zone (~$3,030.58).

If the retest holds, it confirms a sell entry opportunity.

Target:

First target near $2,981.18

Second target around $2,939.81 - $2,931.99

Final target at $2,881.49 for a deeper correction

Stop-Loss:

A stop-loss above $3,046.10 to minimize risk

Market Sentiment:

The break below the neckline and a possible rejection at the retest area suggest further downside potential.

If buyers push the price above $3,046.10, the bearish outlook would be invalidated.

This setup presents a high-probability short trade if confirmation follows through after the retest. Traders should monitor price action around the retest zone before entering a position. 🚨📉

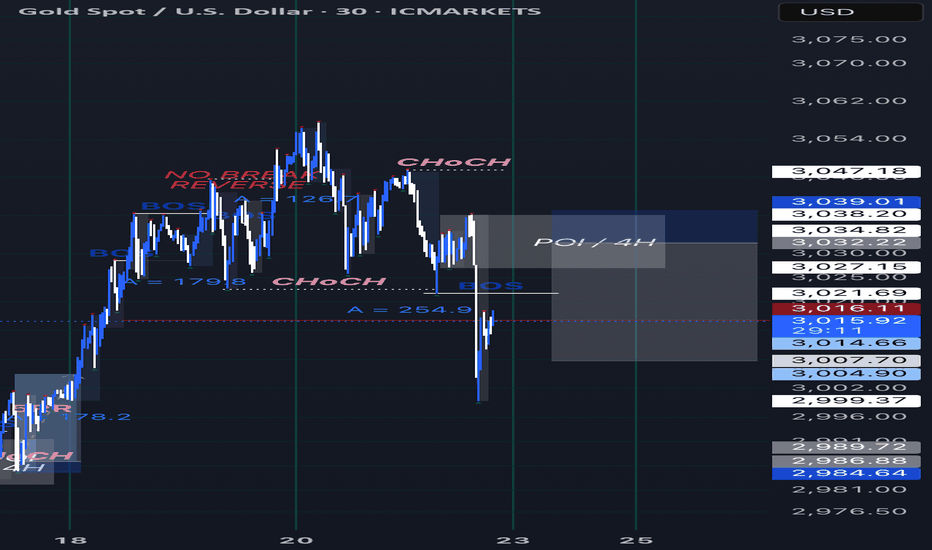

GOLD TRADE IDEA : SHORT (W.B. 24/03/2025)Gold ended on a high, seeking to return low. It changed character breaking the most recent low, signalling to me that it will seek to go low once it collects enough liquidity to expand again. What I drew up on the chart is essentially what will happen but it will be a hypothetical, I’d suggest that you refine if you are seeking to take this trade But theory still stands.

N.B.: This is not financial advice. Trade safely and with caution.

Gold - Expecting Retraces and Further Continuation LowerH1 - Bearish divergence on the moving averages of the MACD indicator.

Followed by bearish trend pattern in the form of three lower highs, lower lows structure

Strong bearish momentum

Potential drop after retraces if the strong resistance zone will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

----------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Reached it's Apex and is ready for a dumpIn my earlier posts I said that Gold has the potential to reach the U-MLH, which has become true.

Up there, the price of Gold is stretched. Yes it can go up even more beyond the Upper-Medianline-Parallel. But the overall numbers of occurrences are small.

So, at this natural stretch, price has a high probability to revert to the mean. And this is supported by the fact, that the overall indexes are heavenly oversold and already showing the signs of a pullback to the North (see my last NQ post).

Why not just watch how it plays out, and make a decision for a trade after the FOMC, or even tomorrow. Don't rush into these unknowing situations. Be patient and wait for clear signs to take action.

Gold day trade short Gold has been exhibiting a strong bullish trend; however, I’ve noticed some divergence today, suggesting a potential high for the session. Based on this observation, I’ve entered a short position, anticipating a pullback in gold prices.

I'm targeting the 2957 level, as there is significant liquidity below Friday’s lows, which serve as a key support level. I believe these levels need to be taken out before gold can continue its upward trajectory.

I’d love to hear your thoughts—let me know what you think! If you found this analysis useful, feel free to give it a boost.

Thanks!

Gold surges, just $17 away from $3,000 Gold is sprinting to new all-time highs and approaching the $3000 level. The price has just reached $2983 at the time of writing, just $17 away from the key $3000 level.

Alex Ebkarian from Allegiance Gold forecasts “prices to trade between $3,000 and $3,200 this year,”.

Momentum is currently being driven by uncertainty around Trump tariffs and stalled ceasefire talks with Vladimir Putin, who has outlined sweeping conditions for any potential truce.

The upcoming Federal Reserve meeting next Wednesday could also be influencing prices. While the central bank is expected to keep its rate at 4.25%-4.50% until at least June, with the current economic environment, a change in guidance from the Fed might be warranted. A delay in the anticipated June rate cut wouldn't be helpful for the gold price

Short positions are in trouble, how to get out of trouble?Bros, gold accelerated to above 2980 today under the stimulation of news. If you hold a short position in gold, you must be in a trading dilemma, so how to get rid of the trading dilemma has become the current primary goal.

First remember the key node, Thursday. Under normal circumstances, Thursday and Friday are the nodes most likely to cause market changes! And from the candle chart, it is just pulled back to the high area with the stimulation of news. From the regional conversion, we can clearly see that according to the current momentum of gold, it will only reach the area around 2980-2982 (there may be a technical false breakthrough). It is difficult to rise to the vicinity of the 3000 mark in one fell swoop.

If you still have sufficient margin levels to help you get out of trouble, you might as well consider adding more positions near 2980 to continue shorting gold, effectively raising your average cost price. After gold falls back, you can choose to close all short positions and turn losses into profits. However, because gold has risen sharply, we must lower our expectations for the extent of gold's retracement. If gold retraces to the 2940-2930 area, we can consider closing our positions, so that we can turn losses into profits! And I predict that gold will enter a correction market tomorrow at the latest!

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals