Gold Approaches New Resistance – Potential Short-Term Pullback📊 Market Update

Gold is currently trading around $3,368–$3,370/oz, up approximately 0.5% today, supported by a weaker USD and slightly declining US Treasury yields. This comes amid global trade concerns and expectations that the Fed may adjust policy in upcoming meetings.

📉 Technical Analysis

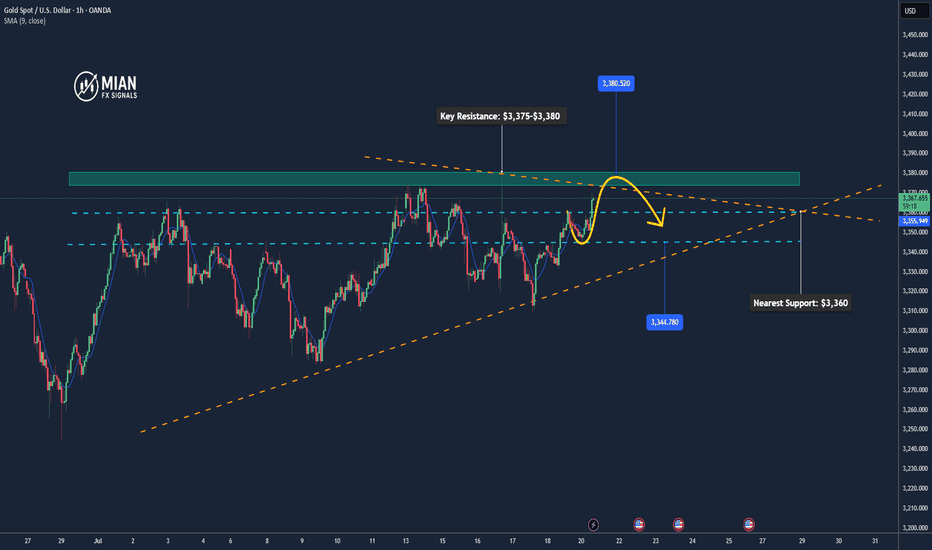

•Key Resistance: $3,375–$3,380 (pivot R2: $3,374.9, R3: $3,389.6)

•Nearest Support: $3,360 (S1: $3,335.8)

•EMA: Price is trading above the EMA9 / EMA20 / EMA50 / EMA200, confirming a strong uptrend

•Candlestick / Volume / Momentum:

o MACD & ADX still confirm strong bullish momentum

o Price consolidating in a rectangle range of $3,352–$3,366 → watch for breakout or rejection at resistance

📌 Outlook

Gold may pull back slightly if it fails to break through the $3,375–$3,380 resistance area and RSI continues hovering near overbought levels.

💡 Suggested Trade Strategy

🔻 SELL XAU/USD at: $3,375–$3,380

🎯 TP: 40/80/200 pips

❌ SL: $3,385

🔺 BUY XAU/USD at: $3,345–$3,348

🎯 TP: 40/80/200 pips

❌ SL: $3,339

Goldshortterm

Gold Falls After Rejection at 3350 – Eyes on Short-Term Pullback📊 Market Drivers:

• Gold spiked to $3,350/oz early in the day but later dropped to $3,310/oz as profit-taking kicked in and U.S. yields recovered slightly.

• Market is in a wait-and-see mode ahead of PCE inflation data on Friday, limiting upside momentum late in the session.

📉 Technical Analysis:

• Key resistance: $3,345–3,350 (daily high)

• Nearest support: $3,310 – session low; then $3,290

• EMA09: Price trading above EMA09, but below EMA21, signaling a neutral bias

• Candle/momentum: Formed shooting star reversal near $3,348 on H1 with declining volume → short-term weakness ahead

📌 Outlook:

Gold may pull back toward $3,300–3,290 short-term if USD rebounds and selling persists. But medium-term bullish bias remains if inflation data disappoints and USD continues weakening.

💡 Trade Ideas:

🔻 SELL XAU/USD at: 3,335–3,345

🎯 TP: 3,315

❌ SL: 3,352

🔺 BUY XAU/USD at: 3,295–3,305

🎯 TP: 3,315

❌ SL: 3,285

Gold May Slightly Pull Back Around 3,350 USD📊 Market Overview

• Gold is currently trading around 3,340–3,345 USD/oz, supported by a weaker USD and lower U.S. yields, with 60 bps Fed rate cut expected by year-end, starting in September

• The Israel–Iran ceasefire has eased safe-haven demand, triggering a mild pullback, while support remains near 3,300 USD

📉 Technical Analysis

• Key resistance:

3,370 USD (short-term peak)

3,380–3,400 USD (prior highs)

• Nearest support:

3,300 (technical bounce zone)

Next at 3,275 (momentum weak)

• EMA:

Price trading below the 9-period EMA on H4, indicating a mild bearish/choppy short-term trend

• Candles/volume/momentum:

RSI & Stochastics near neutral suggest consolidation or minor retracement .

📌 Outlook

Gold may pull back to 3,300–3,320 if the USD rebounds or geopolitical tensions ease further. However, a Fed rate cut in September or renewed Middle East instability could drive prices back up to 3,370–3,400.

💡 Suggested Trade Plan

• SELL XAU/USD: at 3,365–3,370

o 🎯 TP: 3,345–3,340

o ❌ SL: 3,380

• BUY XAU/USD: at 3,300–3,310

o 🎯 TP: 3,320–3,330

o ❌ SL: 3,290

Gold Gains Ahead of Fed📊 Market Overview

• Reason: Gold is trading around ~$3,380–$3,400/oz, supported by geopolitical tensions in the Middle East and expectations that the Fed will maintain high interest rates before potentially cutting later this year.

• Weak U.S. economic data (retail sales, housing, industrial production) also adds to safe-haven demand, providing further support for gold prices.

📉 Technical Analysis

• Key resistance: $3,410 – $3,465

• Nearest support: $3,340 – $3,300

• EMA 09 (short-term): Price remains above the 09 EMA, rebounding from ~$3,366 and holding above the 50 EMA → indicates a bullish trend is still intact.

• Candlestick patterns & volume: Bearish engulfing appeared on June 17 but lacked follow-through. Lower volume suggests range-bound movement ahead of the Fed announcement.

📌 Outlook

Gold may continue to rise modestly (bullish) in the short term if:

• The Fed keeps rates unchanged or takes a moderately hawkish stance,

• Geopolitical risks persist,

• U.S. economic data continues to show weakness.

However, a surprise from the Fed or a strong USD could lead to a pullback. Watch key levels: $3,340 (support), $3,410 (resistance).

💡 Suggested Trading Strategy

🔻 SELL XAU/USD

Entry zone: $3,410–$3,420

• 🎯 TP: ~$3,390 – $3,400

• ❌ SL: ~$3,430

•

🔺 BUY XAU/USD

Entry zone: $3,340–$3,350

• 🎯 TP: ~$3,360 – $3,370

• ❌ SL: ~$3,330

After the Pullback, Gold May Head Toward the 3500 Mark📊 Market Overview:

Gold surged to 3444 during the Asian session on rising expectations of an early Fed rate cut after softer-than-expected US CPI data. However, profit-taking pushed prices back to the 3425 zone.

📉 Technical Analysis:

• Key Resistance: 3444

• Nearest Support: 3403 – 3406

• EMA 9: Price remains above EMA 9 → trend is still bullish.

• Momentum & RSI: RSI has cooled off from near-overbought territory (~70), suggesting a short-term pullback may occur.

📌 Outlook:

Gold may correct slightly toward support before resuming its upward trend if the 3403–3406 zone holds firm.

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD at: 3440 – 3444

🎯 TP: 3420

❌ SL: 3449

🔺 BUY XAU/USD at: 3406 – 3403

🎯 TP: 3426

❌ SL: 3399

Gold May Undergo Short-Term Correction Before Continuing Uptrend📊 Market Overview:

Gold prices are currently around $3,307/oz, up 0.5% on June 2, supported by safe-haven demand amid escalating geopolitical tensions and trade concerns. However, after reaching a peak of $3,500 in April, gold has corrected as market sentiment shifted towards riskier assets due to easing US-China trade tensions.

📉 Technical Analysis:

• Key Resistance: $3,325 – $3,350

• Nearest Support: $3,280 – $3,265

• EMA: Price is above EMA 09 → uptrend.

• Candlestick Patterns / Volume / Momentum: Gold is in a consolidation phase with a slight upward bias. Technical indicators like RSI(14) at 56.183 and MACD(12,26) signaling buy suggest continued upward momentum.

📌 Outlook:

Gold may experience a short-term correction if it fails to hold the $3,280 support level. However, the long-term trend remains positive if the price stays above EMA 09 and does not break key support.

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3,325 – $3,330

🎯 TP: $3,305

❌ SL: $3,335

BUY XAU/USD at: $3,280

🎯 TP: $3,300

❌ SL: $3,270

Gold May Undergo Short-Term Correction Amid Technical Resistance📊 Market Overview:

Gold is currently trading around $3,314/oz, slightly down after testing resistance near $3,350. The market faces pressure from a strengthening USD and inflation concerns. Investors are closely monitoring signals from the Federal Reserve regarding future monetary policy.

📉 Technical Analysis:

• Key Resistance: $3,350

• Nearest Support: $3,200

• EMA: Current price is near the 50-day EMA, indicating a potential trend reversal if resistance holds.

📌 Outlook:

Gold may decline in the short term if it fails to break above the $3,350 resistance and the USD continues to strengthen.

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3330

o 🎯 TP: $3,310

o ❌ SL: $3,340

BUY XAU/USD at: $3,230

o 🎯 TP: $3,250

o ❌ SL: $3,220

Is Gold’s Momentum Strong Enough to Break $3,400?📊 Market Overview:

Gold prices retreated slightly as stronger-than-expected U.S. consumer confidence data boosted expectations that the Federal Reserve may keep interest rates elevated for an extended period. This lent strength to the U.S. dollar, weighing on gold. Meanwhile, a more stable geopolitical tone—particularly in U.S.-EU trade discussions—has reduced safe-haven flows into gold.

📉 Technical Analysis:

• Key Resistance: $3,345 – $3,355

• Nearest Support: $3,270 – $3,280

📌 Outlook:

Gold may remain under pressure in the short term if the U.S. dollar stays firm and the Fed’s hawkish stance persists. However, the $3,270 support zone remains a key pivot for any potential rebound.

💡 Suggested Trading Strategy:

SELL XAU/USD at: $3,345 - $3,350

🎯 TP: $3,325

❌ SL: $3,355

BUY XAU/USD at: $3,270 – $3,280

🎯 TP: $3,290

❌ SL: $3,260

Gold Rises on Tariff News, But Caution NeededGold prices surged after the U.S. President announced a 50% tariff on EU imports, triggering safe-haven demand. However, analysts warn that this may be a short-term FOMO reaction rather than the start of a sustainable rally.

📰 Key Drivers:

- The tariff announcement spooked markets, boosting gold temporarily.

- The U.S. dollar dipped slightly, but bond yields remain high – a bearish sign for gold.

- No immediate EU retaliation weakens the long-term bullish case.

🔍 Technical Outlook:

- Resistance: $3350 – being tested but not yet clearly broken.

- Support: $3310 – may be revisited if upward momentum fades.

- EMA 09: Price remains above, but fading volume and long upper wick suggest weakening strength.

- Price Action: Sharp move looks emotion-driven; correction likely if no follow-up catalyst appears.

📉 Short-Term View:

Despite the surge, gold’s rise may be temporary. If no escalation occurs, a short-term pullback is likely as markets reassess the impact.

💡 Suggested Trade Setup (Short-Term Bearish):

SELL XAU/USD at 3345 – 3350

🎯 TP: 3330

❌ SL: 3355

BUY XAU/USD at 3310 – 3312

🎯 TP: 3325 – 3327

❌ SL: 3305

Gold May Continue Rising – Signs of Short-Term Recovery EmergingGold is showing a strong recovery from the recent low of $3280/oz and has now surpassed the key resistance at $3325, currently trading around $3330. The upward momentum remains intact as gold continues to trade above the EMA 09, indicating that bulls are still in control in the short term.

There is a possibility that gold could retrace slightly to the $3310 zone to gather momentum before pushing higher toward the next resistance at $3350.

Key factors supporting the short-term bullish outlook:

• The US dollar has temporarily weakened after economic data came in less impressive, giving gold room to rise.

• Gold demand has seen a slight rebound from ETFs after recent sell-offs.

• Geopolitical tensions in the Middle East and cautious sentiment in equity markets continue to support gold as a safe-haven asset.

🔍 Technical Analysis:

• Price remains above the EMA 09, indicating the bullish trend is still intact.

• Nearest support: $3310 – could be an attractive entry point for buyers.

• Next resistance: $3350 – serves as the immediate upside target.

• Bullish candlestick patterns are forming with no strong reversal signals so far.

💡 Suggested Trade Strategy (Short-Term Bias: Bullish):

• BUY XAU/USD at 3310 – 3312

🎯 TP: 3325 – 3327

❌ SL: 3307

• BUY XAU/USD at 3320 – 3322

🎯 TP: 3335 – 3337

❌ SL: 3317

Fed Signals No Rate Cuts Until Sept – Gold Under PressureFed’s Interest Rate Outlook:

- Two senior Federal Reserve officials – New York Fed President John Williams and Atlanta Fed President Raphael Bostic – signaled that the Fed is unlikely to cut interest rates before September 2025.

- The Fed needs more time to assess the economic impact of new trade policies from the Trump administration.

- Trade tariffs and ongoing negotiations are creating major uncertainties, making it difficult for businesses and households to plan financially.

- The probability of a rate cut in June has dropped to just 10%, and expected rate cuts for 2025 have been revised down from four to only two.

Impact on Global Gold Prices:

✅ 1. Short-term – Downward Pressure:

Prolonged high interest rates → stronger US dollar → gold prices face downward pressure as gold yields no interest.

🔄 2. Medium-term – Mixed Outlook:

- If trade talks fail and tariffs increase, leading to economic and inflation risks → gold may benefit as a safe-haven asset.

- Conversely, if trade tensions ease and inflation stays under control, expectations for rate cuts will decline further → gold may continue facing selling pressure.

💡 Short-Term Trade Scenarios:

SELL XAU/USD Zone : 3249 - 3252

💰 TP : 3247 – 3242

🚨 SL $3257

BUY XAU/USD Zone: 3190

💰 TP : 3195 – 3200

🚨 SL $3185

Gold price outlook: short term increase📝 NEWS

Gold Prices Rise as Moody’s Downgrades U.S. Credit Rating

- Moody’s downgraded the U.S. credit rating from Aaa to Aa1, citing concerns over high public debt and unsustainable fiscal spending.

- The move boosted demand for safe-haven assets, leading to a weaker U.S. dollar and rising U.S. Treasury yields.

- Spot gold prices rose 0.5% to $3,217.49/oz, while June gold futures gained 1% to $3,220.17/oz.

- Other precious metals also saw modest gains:

- Silver +0.5% to $32.530/oz

- Platinum +0.1% to $991.50/oz

Market Outlook

- In the coming week, the market will closely watch a busy U.S. economic calendar, including:

- Speeches from Federal Reserve officials

- Preliminary PMI data

- Key housing indicators

- These events are expected to influence short-term monetary policy expectations.

Technical View: Gold Poised to Continue Rising

⚠️ Gold is expected to continue its upward trend amid rising trade tensions between the U.S. and China, with little progress in ongoing tariff negotiations.

💡 Short-Term Trade Scenarios:

🚨 SELL XAU : zone 3247-3250

SL: 3255

TP: 50 - 100 - 300pips

🚨 BUY XAU : zone 3188-3191

SL: 3183

TP: 50 - 100 - 300pips

GOLD MARKET OVERVIEW – WEEKLY SUMMARY 📉 Key Developments

• Gold price (XAU/USD) dropped from a weekly high of $3,252 to a low of $3,154, indicating strong selling pressure.

• U.S. bond yields have edged higher, making gold less attractive to investors.

• Recent inflation data suggests the Federal Reserve may maintain higher interest rates for longer, adding downward pressure on gold.

• Profit-taking has intensified following a strong rally in previous weeks when gold hit multiple all-time highs.

🔮 Expected Short-Term Scenario

• Market sentiment leans towards profit-taking, especially since the $3,200–$3,250 zone has failed to hold.

• The inability to sustain higher levels indicates weakening buying momentum, increasing the likelihood of a deeper correction.

• Over the past week, gold formed strong bearish candles and repeatedly tested the $3,150 support zone, signaling that this level is weakening and could be broken soon.

📉 Conclusion & Outlook for Next Week

Based on:

• Weak price behavior

• Negative technical indicators

• Profit-taking sentiment

• Bearish macroeconomic backdrop

→ The scenario of breaking below $3,150 support and continuing downward toward $3,100 or lower is highly plausible in the coming week.

📌 SHORT-TERM TRADING STRATEGIES

🔻 SELL

• Entry Zone (SELL): 3245 – 3248

• Take Profit (TP): 3235 – 3238

• Stop Loss (SL): 3253

🔼 BUY

• Entry Zone (BUY): 3120 – 3123

• Take Profit (TP): 3133 – 3135

• Stop Loss (SL): 3116

🔁 Note: Only enter trades based on clear confirmation signals. Manage risk carefully — limit exposure to no more than 1–2% of your account per trade.

Bullish Momentum Builds as Gold Trades Within 3200–3250 RangeSHORT-TERM GOLD ANALYSIS – XAUUSD

🟢 GOLD SURGES TO $3250 FOLLOWING FED CHAIR'S SPEECH

Gold prices spiked to the $3250 region after a reassuring speech by the new Fed Chair, which helped calm market sentiment. The move reflects renewed demand for safe-haven assets.

📉 Currently, XAUUSD is trading around the 3220 area, testing short-term resistance levels and potentially building momentum for another upward push.

🔎 Key short-term price zone:

In the short term, gold is likely to range between $3200 and $3250, forming a short-term trading zone where accumulation and directional moves may develop.

✅ Short-Term Trade Setup

🔹BUY:

Entry: 3205

Take Profit (TP): 3210

Stop Loss (SL): 3200

🔹SELL :

Entry: 3241

Take Profit (TP): 3236

Stop Loss (SL): 3246

⚠️ Notes:

These setups are best suited for short-term traders using lower timeframes (M15–H1).

Monitor price action closely around 3200 and 3250 for confirmation before entering trades.

Always apply proper risk management to avoid overexposure, especially with ongoing market reactions to Fed news.

Short-Term Outlook: Gold Slumps After Breaking Key Support📉 Short-Term Trend Analysis – XAU/USD

- Gold (XAU/USD) is under heavy selling pressure after decisively breaking below the key support level at $3,200, marking a significant shift in short-term momentum.

- The $3,176 zone, which marks the April 11 low, now serves as a crucial technical support. A clear break below this level could open the door for a deeper drop toward the next key support around $3,140.

If the $3,176 level fails to hold and bearish momentum continues, the market is likely to push lower toward the $3,140 support zone.

📰 Fundamental Drivers Behind the Decline

No major news has been released today, but the market continues to be weighed down by:

- Ongoing U.S.-China trade tensions, which remain unresolved.

- U.S. CPI data for April came in weaker than expected, causing investors to adjust interest rate expectations and favoring short-term downside for gold.

🔮 Short-Term Technical Scenario

After breaching the $3,200 support level, gold is expected to consolidate briefly in the $3,176–$3,190 range before potentially resuming its downtrend.

💡 Short-Term XAU/USD Trade Setups

🔻 SELL

Entry Zone: 3193 – 3190

Take Profit: 3188 – 3185

Stop Loss: 3198

🔺 BUY

Entry Zone: 3179 – 3176

Take Profit: 3184 – 3181

Stop Loss: 3171

📌 Note:

In the current market environment, short-term strategies are preferred.

Apply strict risk management as volatility may increase due to geopolitical headlines or technical retracements.

Closely monitor price action around $3,176 — a confirmed break below this level could accelerate the move toward $3,140.

[XAU/USD Analysis – 1H Timeframe] - as expectedAs predicted in the previous post, gold (XAU/USD) reacted precisely at the 3243 resistance zone — a strong supply area where our short-term SELL setup was triggered. Price then reversed and moved downward as expected.

At the moment, the trade plan remains unchanged. You can refer to the detailed setup in my previous post on my personal page. Here's the updated short-term strategy

💡 Short-Term Trade Scenarios:

SELL XAU/USD

📍 Entry Zone: 3240 – 3243

💰 Take Profit: 3235 – 3238

🚨 Stop Loss: 3245

BUY XAU/USD

📍 Entry Zone: 3219 – 3222

💰 Take Profit: 3224 – 3227

🚨 Stop Loss: 3214

The market is currently trading within a narrow range, so the short-term strategy is to “buy low – sell high” within this zone, with tight risk management. A clear breakout beyond 3245 or 3214 may require a reassessment of the trading strategy based on momentum and volume.

⏳ Note: This is a short-term analysis based on the 1H timeframe and is not intended for overnight holding unless supported by a clear setup.

Gold Sideways: A Short-Term Opportunity for Smart Traders⚙️ 1. Short-Term Trend

On the 1-hour timeframe, gold price is consolidating in a narrow range between $3,220 – $3,243 following a pullback from the recent peak at $3,265. Recent candlesticks suggest that selling pressure is weakening, but no clear reversal signal has appeared yet. The main trend remains slightly bearish within a tight channel, awaiting a breakout.

📍 2. Key Technical Levels

• Nearby Resistance:

o $3,230: A mid-session resistance level that has been tested multiple times but not yet convincingly broken.

o $3,243: Intraday high. A break above this level could trigger a move toward $3,265, with potential extension to $3,280.

• Key Support:

o $3,220: Minor intraday support, currently under repeated testing.

o $3,200: Strong support and a critical technical level. A breakdown below this level may lead to further decline toward $3,185 – $3,170.

📈 3. Technical Indicators

• EMA 50 & 200 (H1): Price is trading between the 50 and 200 EMAs, indicating consolidation and indecision before a breakout.

• RSI (14): Hovering around 45–50, suggesting slowing bearish momentum, but no clear sign of a bullish reversal.

💡 Short-Term Trade Scenarios:

SELL XAU/USD Zone : 3240 – 3243

💰 TP : 3235 – 3238

🚨 SL $3245

BUY XAU/USD Zone: 3219 – 3222

💰 TP : 3224 – 3227

🚨 SL $3214

⚠️ Trading Note

Volatility may spike if there is news from the Fed or new geopolitical developments.

XAUUSD 15 mins ChartThis chart captures a consolidation phase forming between two critical levels:

🔑 Key Zones:

Resistance Zone: ~$3,240–$3,245

This zone has acted as a ceiling where price repeatedly rejected. It's a liquidity cluster and decision area for bulls and bears.

Support Zone: ~$3,223–$3,225

Well-respected bottom of the range. Every touch here sees a reaction, signaling that buyers defend this zone for now.

🔄 Market Structure:

Sideways/Range-bound between $3,225 and $3,245.

Price is consolidating after a sharp move down.

Multiple failed breakouts, indicating indecision before news/events.

🔀 Scenarios:

✅ Bullish Breakout Setup:

Break and retest above $3,245 with strong volume could lead to a move toward:

First target: $3,260–$3,270

Extended target: $3,300 (previous structure)

Trigger confirmation: Break of highs at ~$3,245 with candle body close above.

🚨 Bearish Breakdown Setup:

Failure to break the purple zone + breakdown of support at $3,223 may open:

Immediate target: $3,200

Extended target: $3,180–$3,160 range

Trigger confirmation: Break and candle close below $3,223 with spike in volume.

🔄 Neutral/Bounce Range Trading:

Until a breakout, this is a mean-reversion range. Trades between $3,225 and $3,245 can be scalped with tight stops.

📊 Volume & Price Behavior:

Volume is decreasing slightly within the range → suggesting buildup before a news-related breakout.

Large move likely after breakout from this compression.

Gold Technical Analysis🔹 Price Structure:

Price is in a short-term downtrend channel.

Currently trading at $3,336, heading towards a major support zone around $3,315–$3,310.

RSI at 36.6 is nearing oversold territory – indicating downside momentum slowing.

🔹 Key Zones:

Support: $3,315 (major support with bounce potential)

Resistance: $3,380 (target if support holds)

Breakdown target: $3,290 (if major support breaks)

🔹 Price Action Possibilities:

🔁 Bounce Scenario: Price touches major support, RSI bounces, and price rallies back to $3,380 (drawn with the up arrow).

🔻 Breakdown Scenario: Price fails to hold support and drops toward $3,290 (red arrow path).

Are we about to see Gold bounce back?After yesterday's big drop off the back of Trump's pick for Treasury Secretary and news of a potential ceasefire between Israel and Lebanon, the gold price reached a low of 2605 before settling in a range between 2615 and 2630.

The drop is a little surprising given the Trump pick had been known for several days and it appears that he might help temper the President Elect's plans for levelling tariffs. There are also signs that the proposed ceasefire plan may struggle to get through the Israeli parliament whilst the two nations continue to attack each other.

Currently, Gold is finding strong resistance at 2628-33, the 1H did close slightly above in a small sign that we might be about to see further gains. If this happens the the gold price should find a clear ride to the next fib retracement level at 2650 and then 2663. There is some significant economic news due today including the House Price Index, Consumer Confidence and the FOMC minutes. Given there's no clear direction at the moment we could see a shift in sentiment as each piece of news hits the market.

For the moment the price looks to be rebounding off yesterday's lows and the weekly chart show's the price movement remaining well within the established long term uptrend.