XAU/USD(20250325) Today's AnalysisToday's buying and selling boundaries:

3015

Support and resistance levels:

3046

3034

3027

3004

2996

2985

Trading strategy:

If the price breaks through 3015, consider buying, the first target price is 3027

If the price breaks through 3004, consider selling, the first target price is 2996

Goldsignals

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would anticipate a potential curveball and that being that price may just support on the open at the immediate support level and give the move upside into the 3010 and above that 3020 region which was achieved. We then updated traders with the FOMC report suggesting a further move upside into the 3050-55 region which is where we suggested the potential short will come from.

After the push up into the level and then some accumulation, Friday gave us the volume we needed to break away from the range and complete the move downside to end the week.

Again, nearly all of our bias level targets were completed, the bias level worked well, Excalibur performed well and the red box indi’s worked a dream, even in the choppy market conditions.

So, what can we expect in the week ahead?

We have an issue with gold at the moment, although it’s broken the immediate range, it’s still above 3000 with a larger range low around the 2990 and below that 2970-75 region. That potential swing point below is an area of interest for us this week and leading up towards the end of the month. For that reason, if we can support at the first red box below, and continue the move that started on Friday up into those 3025, 3030 and above that 3035-7 price points we’ll want to monitor this careful for a reversal to form. If we can get it, an opportunity to add or take the short may be available to traders, this time in attempt to break below the 3000 level into those lower support level mentioned and shown on the chart, which also correspond with the red boxes. As many of you have seen over the last year or so, we’ve been sharing these indicator boxes on the 4H for the wider community for free, as they are extremely powerful in identifying turning points and entry and exit points for traders. So let’s keep an eye on them this week for the break and closes, RIP’s and rejections.

We’re mostly looking for this one move to complete, however, there has to be a flip! This week, the flip is breaking above that 3035-37 level which will also be this week’s bias level. If we do breach, we’ll be looking at this to then continue higher, breaking 3050 and then resuming the move into the active Excalibur targets above which ideally, we don't want to see happen yet!

So, we know we want higher, what we do want though is better entry levels for the longs, until then, if we can capture these short trades we’ll of course gratefully take them.

KOG’s bias for the week:

Bearish below 3040 with targets below 3010, 3006, 2997, 2985 and below that 2978

Bullish on break of 3040 with targets above 3050, 3055, 3063 and above that 3067

RED BOXES:

Break above 3037 for 3040, 3047, 3050, 3055, 3063 and 3066 in extension of the move

Break below 3010 for 3006, 3000, 2997, 2990 and 2985 in extension of the move

This should give you an idea of your levels, please use them!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD The 4H MA50 makes all the difference.Gold (XAUUSD) is so far maintaining its long-term bullish trend and will continues to do so even on the short-term, as long as it holds the 4H MA50 (blue trend-line). There are three different Channel Up patterns involved and as long as the 4H MA50 holds, the (dotted) short-term Channel targets 3080 at least.

If the price breaks below the 4H MA50 and the dotted Channel Up, it would be best to close any buys and short instead, targeting the 4H MA200 (orange trend-line) at 2960. It has to be said that every time the 4H RSI traded downwards as it has since Wednesday, a stronger pull-back to the bottom of the long-term Channel Up took place, so that has to favor 2960.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Potential Gold price decline in the coming weekHello traders,

Gold experienced a significant decline during the last two days of the previous trading week. On Friday, we saw a break below the 3022 level, which led to a shift in market sentiment. While the long-term bullish momentum remains intact, the current price action suggests a strong pullback may be underway, potentially continuing into the coming week.

We should closely monitor the 3028 level for a potential selling opportunity, with the first target set at last week's low of 2999, and an extended target around 2966.

However, if Gold reclaims 3040, we may see bullish momentum resume, given the ongoing geopolitical tensions and risk-off sentiment, which means we need to be very careful and stick to a trading plan.

How do you plan to trade Gold this week? Share your thoughts in the comments!

If you found this analysis helpful, please support it with a boost. Make sure to follow to receive new updates.

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest support & resistance analysis

for Gold for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold’s Uptrend Strong, But Is a Short-Term Drop Coming?Gold ( OANDA:XAUUSD ) has increased by more than +5% over the past seven days and has managed to create new All-Time High(ATH) daily. The reasons for the increase in Gold prices include US economic statistics and the tensions in the Middle East that have increased these days.

The question is how long this bullish trend in Gold will continue. It seems that Gold needs at least a correction to continue its upward trend and I tried to find the starting zone of the correction with technical analysis tools (for the short term ).

Gold is moving near the Potential Reversal Zone(PRZ) , this zone could be a correction zone for Gold for at least the short term .

Gold also responds well to the Pitchfork tool lines , the Pitchfork lines can be considered as support and resistance lines for gold .

From an Elliott Wave theory perspective, Gold appears to be completing microwave 5 of main wave 5 (these five waves are likely to be part of main wave 3 ).

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect Gold to drop to at least $3,003 after breaking the Uptrend line , and my second target is $2,986 .

Note: The worst Stop Loss(SL) for your Short position could be $3,061.

Gold Analyze ( XAUUSD ), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD (XAUUSD): Selling Now is HIGH RISK

The head & shoulders pattern that I spotted earlier

perfectly played out and we saw a strong bearish move after the

NY session opening.

HOWEVER, be extremely careful.

Many traders started to sell heavily, anticipating an extended bearish reversal.

For now the price nicely respected 3000 psychological support

that previously was a resistance.

I suggest not placing any short trades this week.

Let's wait till Monday and how the market opens.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

3074 ! Next price zone, gold ATH reached⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) continue their consolidation phase into the European session on Thursday, as traders exercise caution amid slightly overbought conditions. Additionally, a prevailing risk-on sentiment limits the metal’s intraday advance to a new record high. However, downside risks remain contained due to lingering uncertainty surrounding US President Donald Trump’s aggressive trade policies and their potential ramifications for the global economic outlook.

⭐️Personal comments NOVA:

Bulls continue their excitement, pushing prices higher, amid global trade tensions.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3062 - $3064 SL $3067 scalping

TP1: $3058

TP2: $3050

TP3: $3040

🔥SELL GOLD zone: $3073 - $3075 SL $3080

TP1: $3065

TP2: $3050

TP3: $3040

🔥BUY GOLD zone: $3003 - $3001 SL $2996

TP1: $3009

TP2: $3015

TP3: $3023

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

MarketBreakdown | GOLD, GBPUSD, DOLLAR INDEX, EURAUD

Here are the updates & outlook for multiple instruments in my watch list.

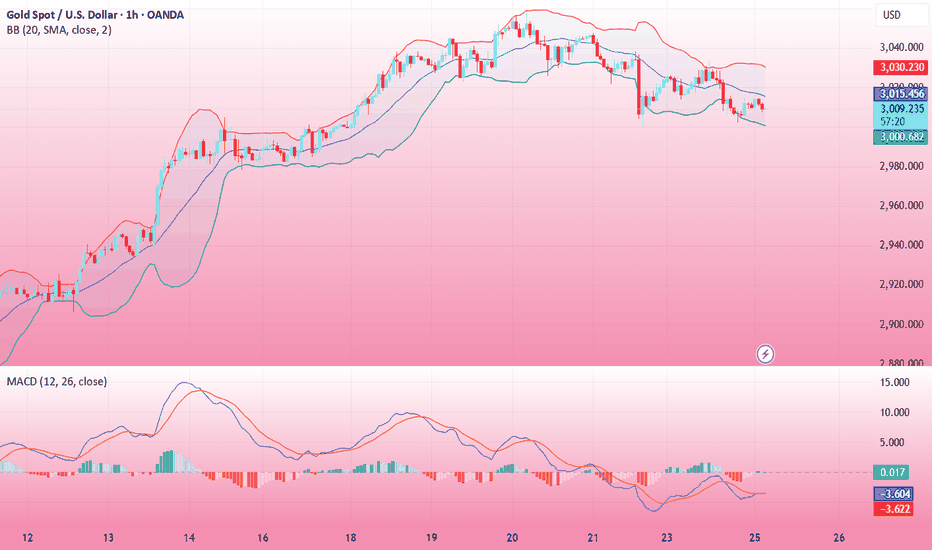

1️⃣ #GOLD XAUUSD 1H time frame 🥇

Earlier on Sunday, I shared a completed head & shoulders pattern on Gold.

Its neckline was respected and the price bounced from that, setting a new historic high.

That same neckline is now a perfect base for a new head & shoulders pattern.

The plan remains the same, if the price violates and closes below that

a correctional movement will be expected.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

GBPUSD looks weak and shows a clear signs of a strong overbought state.

We see a breakout attempt of a rising parallel channel at the moment.

Daily candle close below that will trigger a correctional movement with a high probability.

3️⃣ DOLLAR INDEX #DXY daily time frame 💵

Dollar Index shows clear strength after 2 recent US fundamental releases.

The last obstacle for the bulls is the underlined blue resistance,

its breakout and a daily candle close above will trigger more growth.

4️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

It feels like the pair is returning to a global bullish trend.

The price has recently retraced and perfectly respected the underlined support.

With a high probability, we will see a test of a current high soon.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold is still bullish Gold is now strongly heading up ⬆️ and might hit new prices. It’s safe to buy gold now and target new higher prices like hitting 3100 if possible.

Bulls are still active but might find a range around 3050 above and below before going much higher or lower.

If you need any advice please text me.

THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

While gold is relatively new to this range we have to entail some caution if we’re even going to consider trading this FOMC. Markets are a little fragile, we’re at ATH’s and the moves are extremely aggressive. So, we’ll highlight the red box levels and the potential move we’ll be looking for, sticking to the extreme and key levels, ignoring the intermediate levels.

Looking at the chart we have a support region below 3010-15 which if spiked into and held can push this back up this time to break above 3030 and attempt to attack that 3050 region. That in our opinion would be the first point to start looking for price to exhaust, but it will only give us the flip so longer scalps are likely to be all we’ll get.

If we break above the 3055 region we’re likely to go higher giving us a red box resistance level of 3065-75. It’s this level we would ideally like to target from a lot lower down if we can get that entry. For that reason, we have given the level below on the break of 3010 sitting around 2990-80, we’ll have to wait and see, but if we can get down there a nice swing could present itself.

RED BOX INDICATOR:

Break above 3030 for 3050, 3055, 3063 and 3070 in extension of the move

Break below 3020 for 3912, 3006, 2996 and 2990 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Major 25-year Resistance getting tested!Gold (XAUUSD) has been on a multi-decade uptrend since the 2000 bottom and shortly after the launch of its ETF. With the exception of the aggressive 2006 break-out, the majority of its price action has been inside the (blue) Channel Up but the use of the Fibonacci extension Channel allows us to catch the key levels of the post 2006 action too.

What's more important is that the market is testing the top of that (blue) Channel Up, i.e. the 1.0 Fibonacci level, for the first time since August 2020, which was a major market top and the start of a 3-year Bear Phase.

As mentioned, the only time this Resistance broke was in April 2006, when Gold truly turned parabolic. The question is, what will it be this time? A macro level bullish break-out to the Fib 1.5 extension or the more short-term dynamic of the top of the blue Channel Up and a rejection back to the long-term Support of 1M MA50 (blue trend-line)?

Tell us your thoughts in the comments section!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold is Pulling Back to Support lines & PRZ – Another Rally!?As I expected in my previous post , Gold ( OANDA:XAUUSD ) finally touched Potential Reversal Zone(PRZ) (of course with a lot of volatility).

From Elliott Wave theory , Gold appears to have completed the main wave 3 and is currently completing the main wave 4 . The main wave 4 is likely to end near the Support lines and Potential Reversal Zone(PRZ) .

I expect Gold to attack Potential Reversal Zone(PRZ) at least once more after completing the main wave 4 .

Can Gold make a new All-Time High(ATH) or Correction?

Note: There is also a possibility that the main wave 5 is a truncated wave because in PRZ we have the $3,000 round number.

Note: If Gold falls below $2,940, we can expect further declines.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

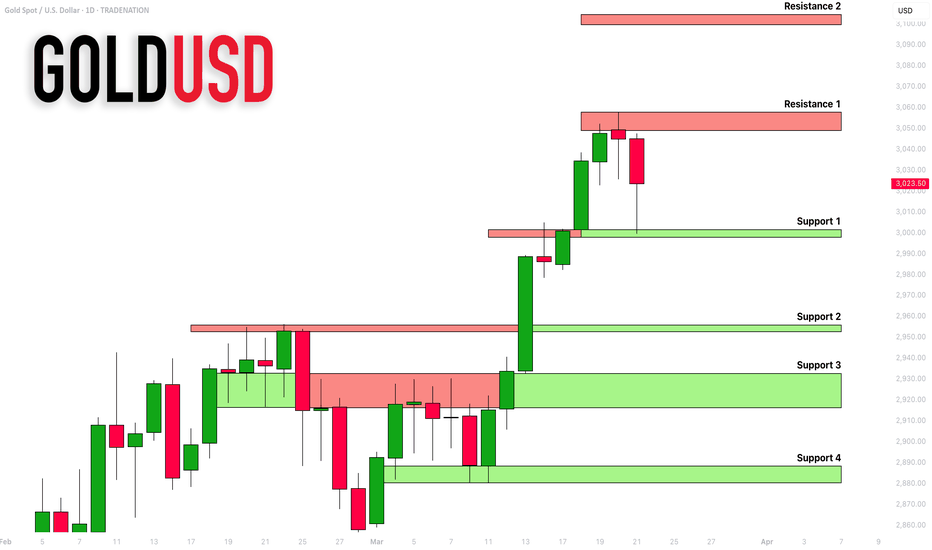

GOLD (XAUUSD): Detailed Support & Resistance Analysis

Here is my latest support and resistance analysis for Gold

ahead of the FED Interest Rate decision today.

Resistance 1: 3045 - 3050 area

Resistance 2: 3099 - 3103 area

Support 1: 2997 - 3001 area

Support 2: 2952 - 2956 area

Support 3: 2916 - 2933 area

Support 4: 2880 - 2888 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold is on Fire—But Can Bulls Hold the Line?Gold has been surging, and while I expected it to hit $3,000 this year, I definitely didn’t anticipate it happening in the first semester...

So, let’s address the big question: Can the bulls maintain this level?

Looking at the chart, since early March, TRADENATION:XAUUSD has climbed 2,000 pips (around 7%), but what stands out is that 1,500 of those pips (5%) came in just one week.

No matter how strong the bullish momentum and fundamentals are, I believe this kind of rally is unsustainable.

Technical Outlook

After pulling back from its all-time high of 2,950, gold made a false breakout, followed by an almost vertical move upward, briefly interrupted by two consolidation phases.

Fundamental Factors

The FOMC meeting is today, and while rates are expected to remain unchanged, the real market mover will be Jerome Powell’s press conference. His comments could trigger significant price action.

My Take

I expect gold to start correcting after the press conference, regardless of what Powell says. However, this is a highly risky trade, so I’ll stay on the sidelines until I see a clear reversal signal.

Final Thoughts

At the time of writing, gold is consolidating within another rectangular range, with resistance at 3,040. If we see a spike above and then a drop back to around 3,030, that would signal ( for me ) that gold has topped—at least for now. In that case, I’ll be looking to short with a target of at least 500 pips. Until then, my approach is simple: wait and see.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.