XAUUSD top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Goldsignals

Gold’s Price Action: New Highs or Correction Ahead?Yesterday, gold reached yet another all-time high, slightly above 2,880.

However, the price quickly dropped by 200 pips, finding support at 2,660.

Since then, gold has been consolidating, but a correction appears to be looming.

In the posted 30-minute chart, we can see a small head-and-shoulders pattern forming.

A break below the newly established support and the neckline of the pattern could lead to a further drop to 2,640.

Although trading at this stage is extremely risky, I believe gold is more likely to correct at this point rather than make a new ATH.

GOLD TRADING POINT UPDATE > READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold traders SMC trading poi nt update you on New technical analysis setup list time post signals 🚀 Hit sucksfully My target 🎯 point 2877 Now ✅ update you on New technical analysis update on gold 🪙 Gold still going to bullish trend 📈 🚀 today us session. More bullish on Gold take a New ATH 2904 I'm long Now 2869 + 2904 Good luck 💯🤞

Key Resistance level 2880 + 2904

Key Support level 2866 - 2854 - 2845

Mr SMC Trading point

Plaes support boost 🚀 analysis follow)

GOLD TRADING UPDATE > READ THE CHTAPIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold traders SMC trading point update you on New technical analysis setup for Gold 🪙 Gold still holding it up rising Gold 🪙 today take again 💪 new ATH 2845 I will see again for New ATH 2880 ) Gold Traders SMC-Trading Point update technical patterns b. SMC ) Gold recovery samll trade Short 😀 2830 - 2817 that is good support level of buying zone ☺️ 🥂 good luck 🤞

Key Resistance level 2845 + 2880

Key Support level 2830 - 2817 - 2772

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD (XAUUSD): The Next Resistance is Here:

Many Gold traders are now speculating where is the next strong

resistance on XAUUSD chart.

I see a very peculiar zone ahead that is based on a significant

rising trend line that the market has been respecting since 2023

and 2900 psychological level.

Probabilities will be high to see at least a pullback from that zone.

❤️Please, support my work with like, thank you!❤️

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

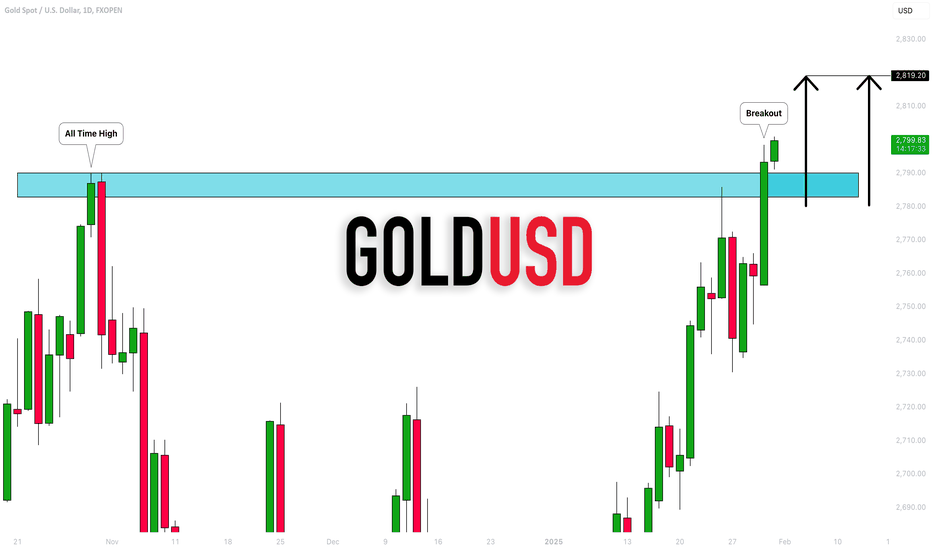

Gold Hits New ATH – How Much Higher Can It Go?In yesterday's XAU/USD analysis, I mentioned that a correction could occur, potentially bringing Gold down to the 2770 zone.

I even opened a trade based on this idea.

However, after an initial drop to the 2810 zone, Gold reversed and surged to a new all-time high.

Fortunately, I had not entered a large-volume trade, and with active management throughout the day, I kept my losses minimal.

Now, the key question is: How much higher can Gold go?

Looking at the chart, as I previously explained, Gold has been steadily rising within an ascending channel.

Yesterday, it even broke above the channel’s resistance, and at the time of writing, it is trading at 2860.

In my opinion, buying at this price carries too much risk.

I prefer to wait for a blow-off top and signs of weakness before considering a sell trade.

For now, I am staying out of the Gold market.

GOLD TRADING POINT UPDATE .READ THE CHAPTIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold traders SMC trading point update you on New technical analysis setup for Gold 🪙 Gold list week take a New All Time high ATH 2817 ) Gold Traders SMC-Trading Point still ses a bullish trend 📈 🚀 this week take a New 🆕 ATH 2837 fisrt take support breakdown moving 😃 up trand that expect it. Next week Two strong 🪨💪 support level 2785 2772 that entry buying said if close below 👇 that level that expect Short Trade. 2724 2703 )

Key Resistance level 2817+ 2837

Key Support level 2785 - 2772 - 2724 - 2703

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

Gold could start a correctionYesterday, after an intraday correction during the Asian session, OANDA:XAUUSD bulls regained control and pushed the price to a new all-time high of 2830.

Since the start of the year, gold has been trading within a tight ascending channel.

Given that the price touched the upper boundary of this channel yesterday, a test of the lower boundary could be expected next.

At the time of writing, the price is hovering around minor support, and a break below this level could expose the 2770 zone.

Despite the strong uptrend, my strategy is to sell into rallies—though this approach carries significant risk.

A new all-time high would invalidate this scenario.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

It wasn't quite exact, however, we managed to get the move down that we wanted for the short, stopped at our Red box support which was active, got the bounce, got a lovely long, then the short from the region we wanted....what an end to the day. We've completed our bias level targets for the day and the target of 2828 which we gave traders nearly two weeks ago and yesterday in the KOG Report.

A choppy opening with gaps across the markets, but Excalibur and the indicators were not threatened at all.

So, now we have the support level below 2807-10 and the resistance region 2830-5 region. We would like to see a retest of this new high so if we do pullback into the support level and hold, it's likely we will see a new all time high again in the sessions to come.

Can we long? Not recommended up here unless we get back down into 2775 regions. Otherwise, keep an eye on the levels above, looks like a curveball is on its way!

KOG’s Bias for the week:

Bearish below 2810 with targets below 2795✅, 2775✅ and below that 2755.

Bullish on break of 2810 with targets above 2820✅, 2824✅, 2828✅ and above that 2835

RED BOXES:

Break of 2810 for 2815✅, 2818✅, 2828✅, 2830✅ and 2834 in extension of the move

Break of 2790 for 2785✅, 2877✅, 2765 and 2755 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Gold Long Setup off Support with Favorable Risk-to-RewardIn this setup, you identified a key support zone around the green area (roughly 2811–2812) and planned to enter a long position there. The idea is that price will bounce off this support and push upward toward the next resistance levels (marked in red around 2816–2817). Your take-profit target is placed near the upper resistance area, aiming for a move of about 15 points (0.54%), while your stop-loss is set below the lower support (around 2807), risking roughly 11 points (0.41%). This creates a favorable risk-to-reward ratio. Essentially, you’re looking for a bullish continuation if price holds above support and breaks past the weak resistance, while limiting your downside if the support fails.

THE KOG REPORT THE KOG REPORT

In last week’s KOG Report we said we would be looking for the deeper pull back from the open and then hunt the long trades into the levels we published as our bias and red box targets. We managed to get the short early part of the week into the level we wanted 2730-35 giving us the long trade and a phenomenal pip capture.

We then published the FOMC KOG REPORT and stated a similar scenario, only this time expecting price to give us an undercut low before then resuming the move into all time highs. Price didn’t capture the liquidity from below enabling traders to keep positions from below and then carry trades up completing every target level down and up for the week!

A fantastic week in Camelot and for those who followed, not only on Gold but all the other pairs we trade and analyse, completing 28 targets during and high volatility and demanding week. Well done to the team!

So, what can we expect in the week ahead?

We’re looking for two potential moves this week to start with. Ideally, we want to see the market open, test that high around the 2810-7 region and see a rejection there. If we can get that RIP there we feel the move downside can commence firstly into the 2775 region and below that 2755-60. That’s the level for us to watch for a potential long trade back up but we’ll treat it level to level unless the 2890-95 region is broken.

Our target level of 2828 is still active, however, we would again like to see a deeper pull back before attempting that long trade as we’re too high and It’s too dangerous up here.

On the flip, if we break above that 2810 level and can hold above it, we’ll be looking to complete our target level and based on a clean set up, a potential swing short for the bigger capture may come from up there.

Crucial level here is 2790 which has been circled on the chart, it’s likely they will use this level as a key level for this week.

KOG’s Bias for the week:

Bearish below 2810 with targets below 2795, 2775 and below that 2755.

Bullish on break of 2810 with targets above 2820, 2824, 2828 and above that 2835

RED BOXES:

Break of 2810 for 2815, 2818, 2828, 2830 and 2834 in extension of the move

Break of 2790 for 2785, 2877, 2765 and 2755 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Will Economic Data Push Gold to New ATH or Cause a Reversal?Yesterday, the Federal Reserve announced the Funding Rate , and Jerome Powell's speech followed. These events created market volatility, influencing traders’ sentiment towards gold. Now, we turn our attention to today's key economic data releases .

Today's Key Data Releases & Gold Impact :

Advance GDP : The reported 2.3% is weaker than expected (2.7%), which may create mild support for gold as it signals slower economic growth. A stronger GDP reading would have strengthened the USD, putting downward pressure on gold.

Unemployment Claims : The 207K claims are better than expected (224K), suggesting a strong labor market, which may limit gold’s upside as the USD gains strength.

Advance GDP Price Index : The reported 2.2% inflation is lower than the expected 2.5%, which could reduce gold’s appeal, as it suggests easing inflationary pressure.

Given today’s key economic data, gold is likely to face downward pressure due to stronger labor market data and lower inflation, although the weaker GDP might provide some support in the short term. Expect volatility based on the combination of GDP growth and inflation trends.

------------------------------------

Gold ( OANDA:XAUUSD ) is approaching its Potential Reversal Zone(PRZ) and All-Time High(ATH=$2,790.17) .

According to the theory of Elliott waves , Gold seems to be completing microwave 5 of the main wave 5 . The main wave 5 can be completed in PRZ . ( Of course, if the other wave counting scenario happens, we should have a correction from PRZ ).

I expect Gold to follow the Roadmap I specified in the chart.

Be sure to follow the updated ideas.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

XAUUSD Channel Up unfazed by Tariff War.Gold (XAUUSD) is rising today following the Tariff announcements between the U.S. and their strongest trade partners. This rise is taking place just before the price touched the 4H MA50 (blue trend-line) which has been the absolute Support (hence buy entry) of January's Channel Up for the past month.

With the 4H RSI also making (so far) a V-shaped reversal, similar to all 4 previous Higher Lows of the Channel Up, we believe that this is once more a buy opportunity. All previous bottoms (Higher Lows) rebounded to the 1.618 Fibonacci extension (from High to Low). This gives us a 2845 Target for the next technical Higher High.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

THE KOG REPORT - 3 months in the making!A different update this time as it's the end of the month and Gold has made ANOTHER ATH!

3 Months ago, pre-election we projected the move we anticipated, plotting the highs and the lows to target in order to capture the move into the new ATH. The red arrow is the projection from the 31st of Oct, the green arrows are the actual move. Pinned below are the original posts.

During the week, every week we update traders with our thoughts and projections, the KOG REPORT and again on an intra-day level managed to capture opportunities both on the sell side and buy side to capture this move.

We decided a month ago to call it complete however, as there were signs on the chart that gave us that deeper pullback, but, we managed to get back on track and here we are, not far from that target level.

We just wanted to take this opportunity to say thank you to all those who followed us on the reports, the bias level targets, the red box targets and the projections. We can honestly say it didn't go to badly.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG