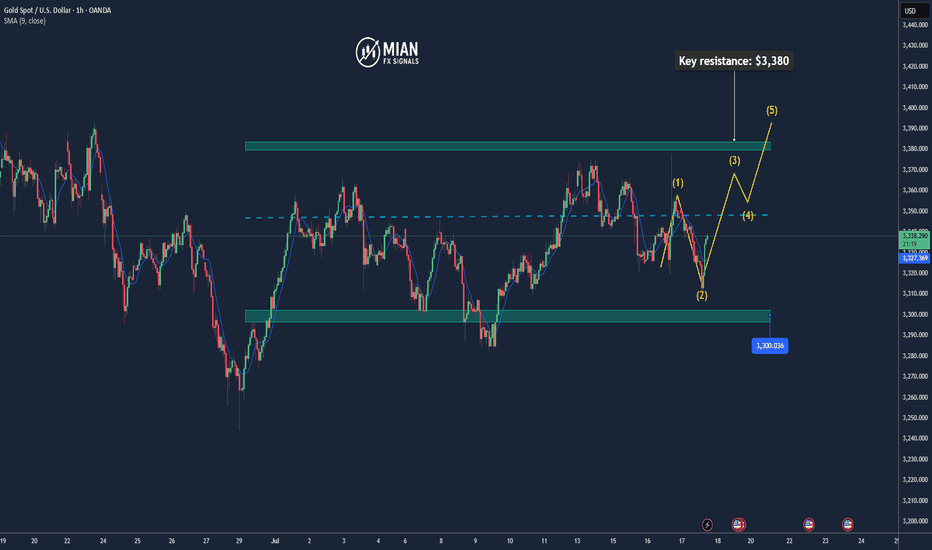

GOLD (XAUUSD): Sticking to the Plan

Update for my last Sunday's post for Gold.

Previously, we spotted a cup & handle pattern on a daily time frame.

It turned into an ascending triangle pattern - another bullish formation this week.

I am sticking to the same plan - our strong bullish signal is a breakout

of a neckline of the pattern and a daily candle close above 3378.

It will confirm a strong up movement.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Goldsignals

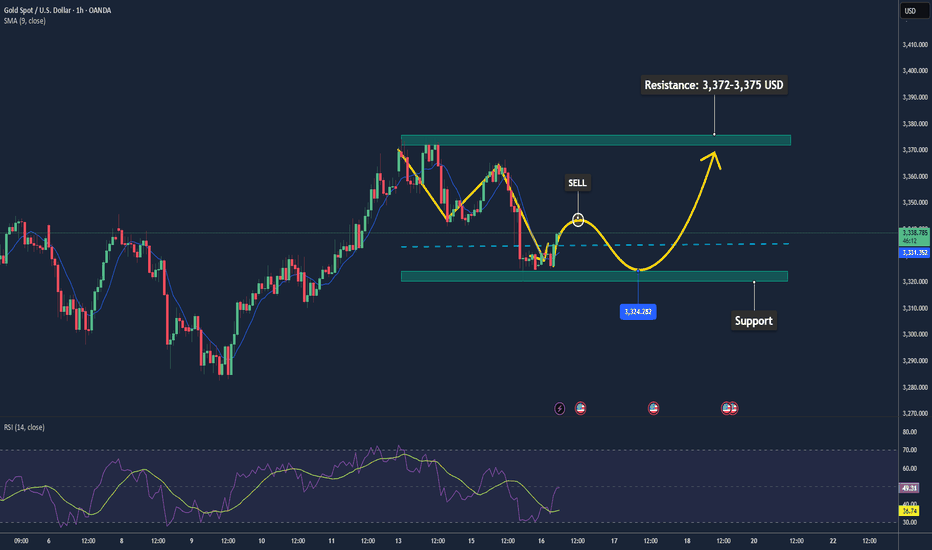

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

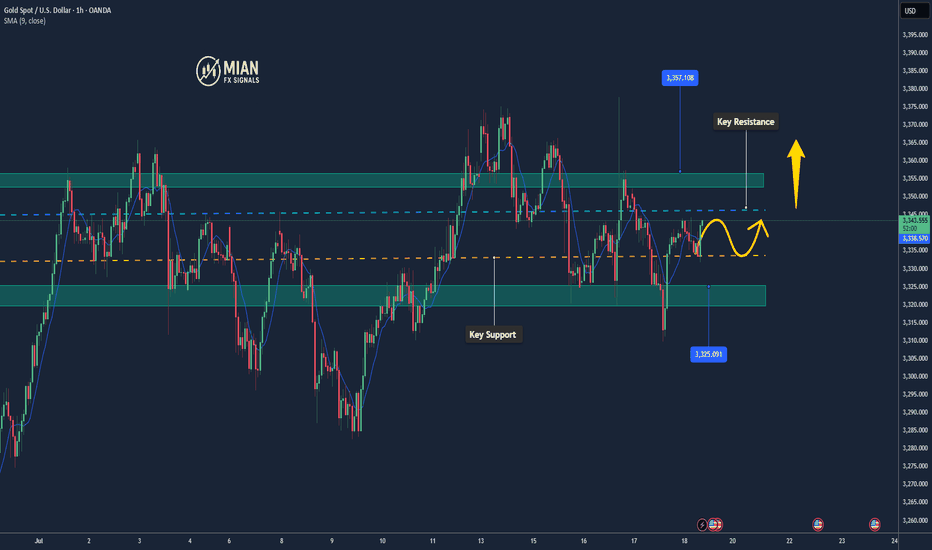

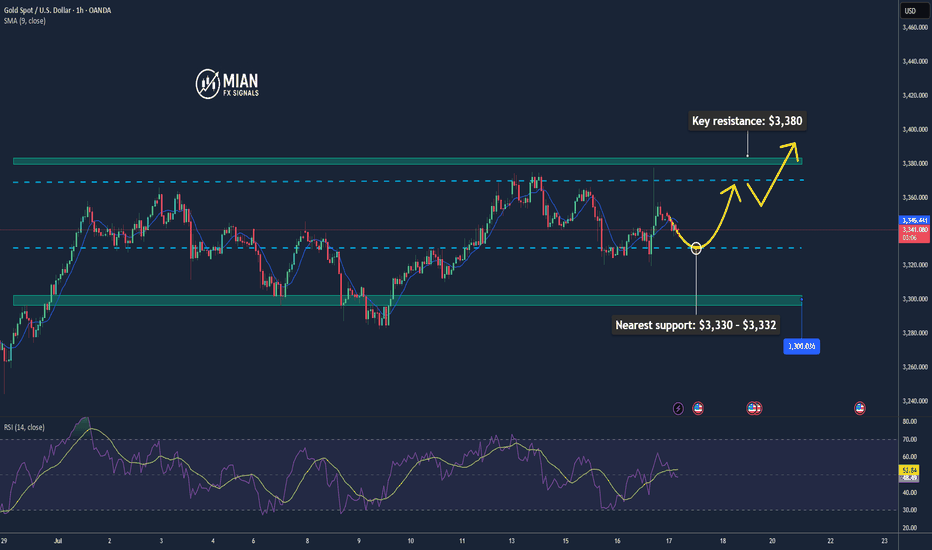

Gold Maintains Bullish Tone – Eyes on $3,350 Breakout📊 Market Overview

• Gold is trading around $3,339 – $3,340, after rebounding from the session low at $3,332.

• The USD is temporarily weakening, and safe-haven flows remain steady — key factors supporting gold.

• Markets are awaiting fresh U.S. economic data for clearer directional cues.

📉 Technical Analysis

• Key Resistance Levels:

– Near-term: $3,344 – $3,345

– Extended: $3,352 – $3,356 (weekly highs)

• Key Support Levels:

– Near-term: $3,332 – $3,335

– Extended: $3,320 – $3,325 (MA confluence + technical base)

• EMA: Price remains above EMA 09, confirming a short-term uptrend.

• Candle Pattern / Volume / Momentum: RSI is around 54–56; momentum remains positive but has cooled — suggesting potential consolidation.

📌 Outlook

Gold is maintaining a bullish technical structure — if it breaks above $3,345, a move toward $3,352 – $3,356 is likely. On the downside, a drop below $3,332 could trigger a retest of $3,325 – $3,320.

💡 Suggested Trading Strategy

🔺 BUY XAU/USD: $3,324 – $3,327

• 🎯 TP: 40/80/100 pips

• ❌ SL: $3,320

🔻 SELL XAU/USD :$3,352 – $3,355

• 🎯 TP: 40/80/100 pips

• ❌ SL: $3,359

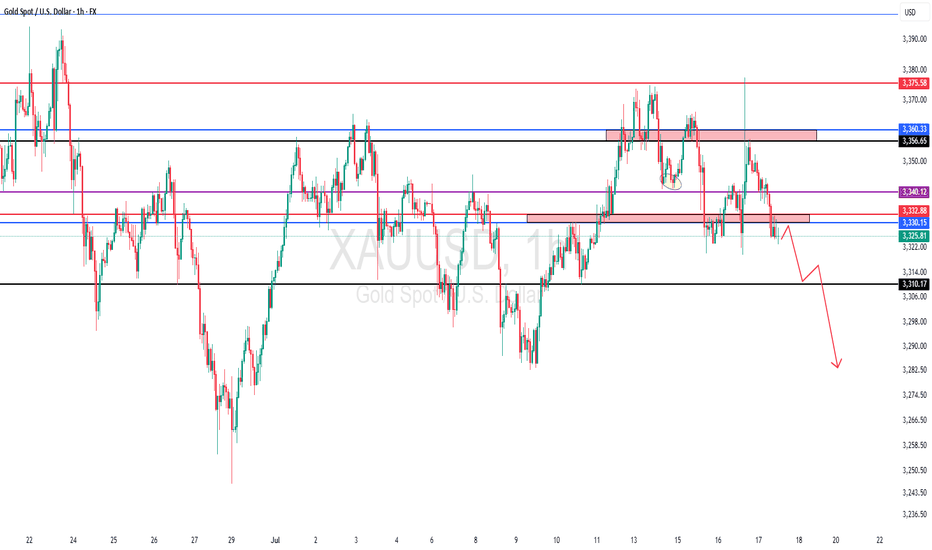

Double Top + Zigzag Complete: Are Bears About to Take Over Gold?Yesterday, the financial markets in general, including Gold ( OANDA:XAUUSD ) , acted like a roller coaster after the news of Powell's dismissal . After this news was denied , Gold returned to its main trend, which I published in my previous idea .

Gold is currently re-attacking the Support line , Support zone($3,326-$3,325) and 50_SMA(Daily) .

In terms of classic technical analysis , it seems that gold has formed a Double Top Pattern for support breakdowns, where a Support line breakdown can also be accompanied by a neckline breakdown .

From the perspective of Elliott Wave theory , it seems that Gold has managed to complete the Zigzag Correction(ABC/5-3-5) , and we should wait for the next bearish waves .

I expect Gold to break its supports and move towards $3,290 ; support breaks are best done with high momentum . An important price that can change the direction of Gold's downside is $3,350 .

Note: If Gold breaks the Resistance lines and forms an hourly candle above $3,351(Stop Loss (SL)), we can expect further Gold gains.

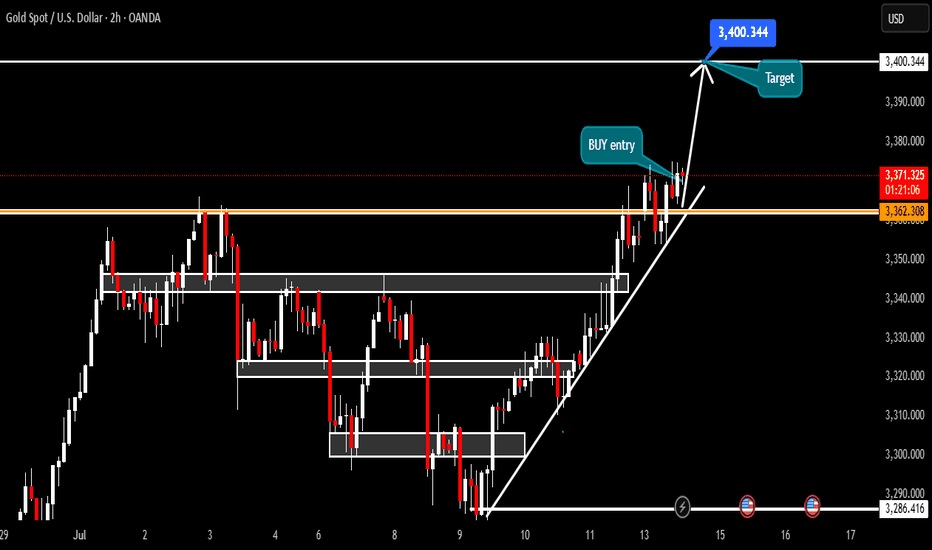

Gold Analyze (XAUUSD), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

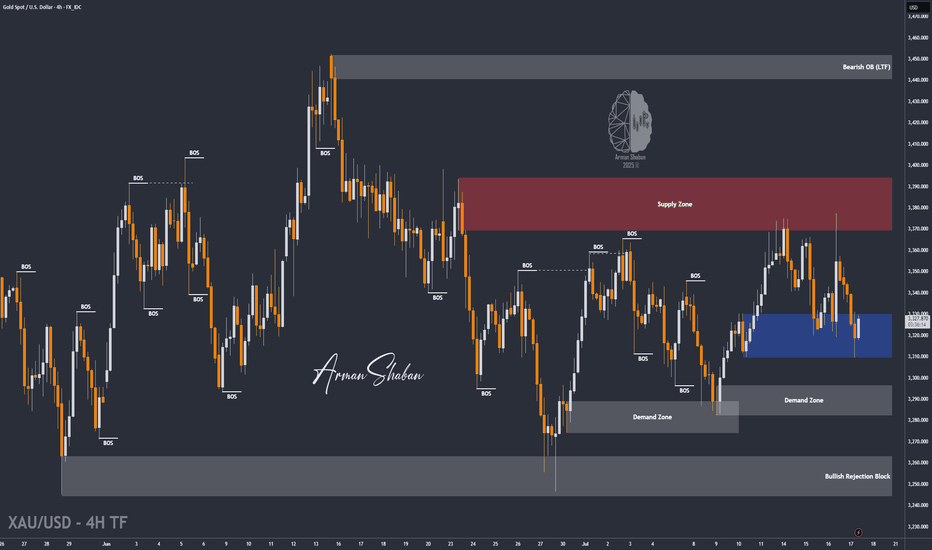

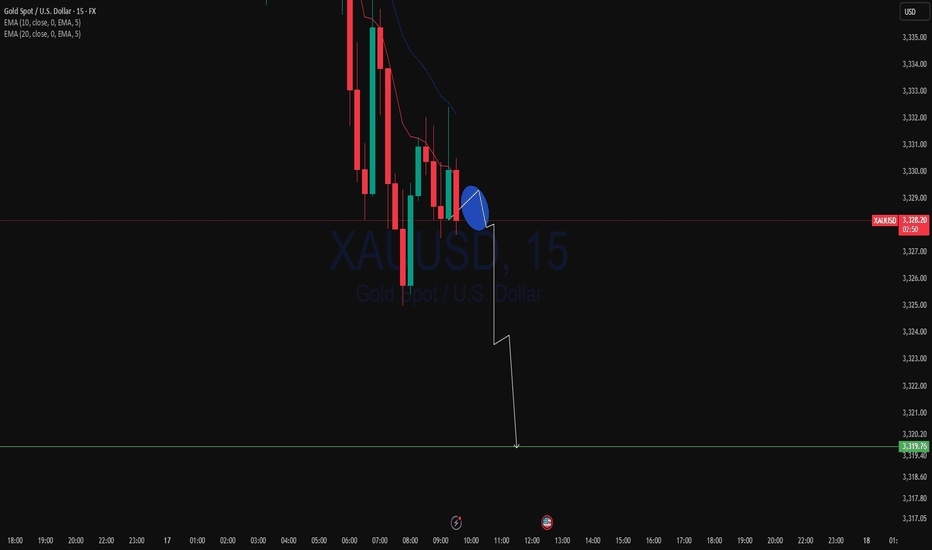

XAU/USD | First LONG to $3345, Then a Potential DROP Below $3300By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

TradeIdea – Gold (XAUUSD)Looks like a bullish breakout is brewing!

✅ Price has broken out of the descending channel

✅ Retested the global trendline support

✅ Reclaimed the 200-day moving average (MA200)

✅ Momentum indicator surged above the 100 mark

✅ Visible imbalance zone above — potential target area

📌 If price consolidates above $3350, consider a long setup:

🎯 Target 1: $3370

🎯 Target 2: $3375

🧠 Watch for confirmation before entry — structure and momentum alignment is key.

Gold Surges Late Session – Targeting $3,345+📊 Market Overview:

• Gold has just broken higher to $3,339, extending its bullish move after clearing the $3,335 resistance zone.

• Market sentiment remains supportive as the USD weakens and U.S. bond yields stabilize, while the Fed still shows no signs of cutting rates soon.

📉 Technical Analysis:

• Next resistance: $3,345 – $3,350

• Nearest support: $3,335 – $3,336

• EMA 09: Price remains above EMA 09 → confirms short-term uptrend

• Momentum: RSI stays bullish, and price continues to follow breakout momentum from the recent consolidation zone

📌 Outlook:

Gold is holding its bullish structure — if it stays above $3,335, a move toward $3,345–$3,350 is likely during the Asian session.

💡 Suggested Trading Strategy

🔺 BUY XAU/USD at: 3,336 – 3,338

🎯 TP: 3,350

❌ SL: 3,330

3340-3300: Lock in the buy high and sell low in this area!Under the influence of unemployment benefits and zero monthly sales data, gold fell sharply in the short term, but it did not effectively fall below 3310 during multiple tests, effectively curbing the further downward space of the shorts. Multiple structural supports are also concentrated in the 3310-3300 area, so as long as gold does not fall below this area, gold bulls still have the potential to rebound.

However, for the current gold market, it may be difficult to see a unilateral trend in the short term. After experiencing discontinuous surges and plunges, gold may focus on consolidation and repair, and the consolidation range may be limited to the 3340-3300 area.

So for short-term trading, first of all, I advocate going long on gold in the 3320-3310 area, and expect gold to rebound and reach the 3330-3340 area;

If gold reaches the 3335-3345 area as expected, we can start to consider shorting gold, and expect gold to step back to the 3320-3310 area during the shock and rectification process.

Gold Continues Short Term Uptrend📊 Market Overview:

💬Gold is currently trading around $3,340 – $3,352/oz, down slightly (~0.25%) on the day but still consolidating near recent highs around $3,500.

🌍 Geopolitical tensions (trade wars, Middle East conflicts) and strong central bank gold purchases continue to support long-term demand.

📅Markets are awaiting key U.S. inflation data and Fed signals, which may trigger volatility in the short term.

📉 Technical Analysis:

🔺Key resistance: $3,360 – $3,380, with the psychological zone at $3,400–$3,420.

🔻Nearest support: $3,330 – $3,332, followed by a firmer zone at $3,300–$3,326 (based on Fibonacci and moving averages).

• EMA/MA:

✅ Price is trading above the 50-day MA ($2,862), confirming a medium-term uptrend.

⚠️ While no specific EMA 09 data is noted, current price action suggests bullish momentum.

• Momentum / Candlestick / Volume:

📏RSI (14) is near 50–55, signaling positive momentum without being overbought.

🔄MACD is slightly negative but the overall structure remains bullish.

📌 Outlook:

Gold may continue to rise in the short term if it holds above the $3,330–$3,332 support zone, with potential to test resistance at $3,360–$3,380 and possibly revisit the $3,400 level.

A break below $3,330 could open the path toward deeper support around $3,300.

💡 Suggested Trading Strategy:

SELL XAU/USD: 3,367–3,370

🎯 TP: 40/80/200 pips

❌ SL: 3,374

BUY XAU/USD: 3,330–3,333

🎯 TP: 40/80/200 pips

❌ SL: 3,326

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

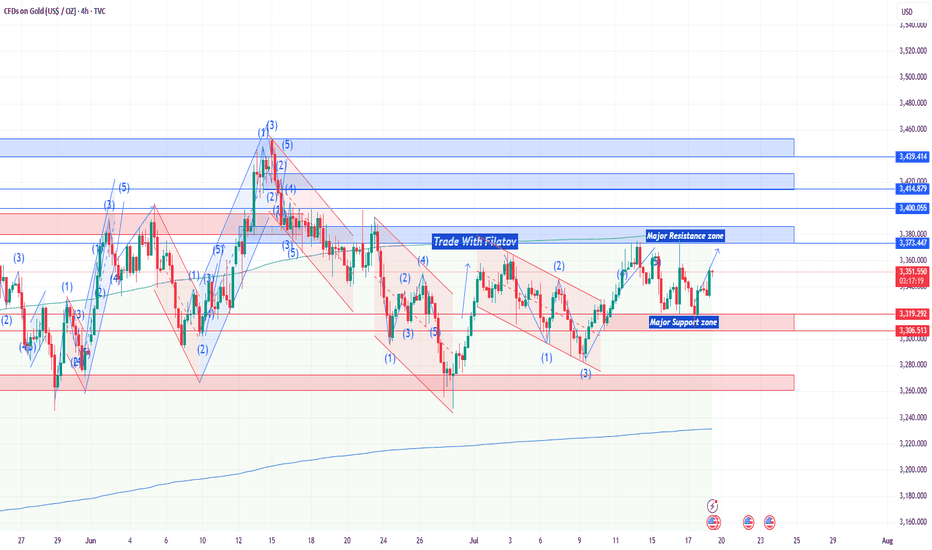

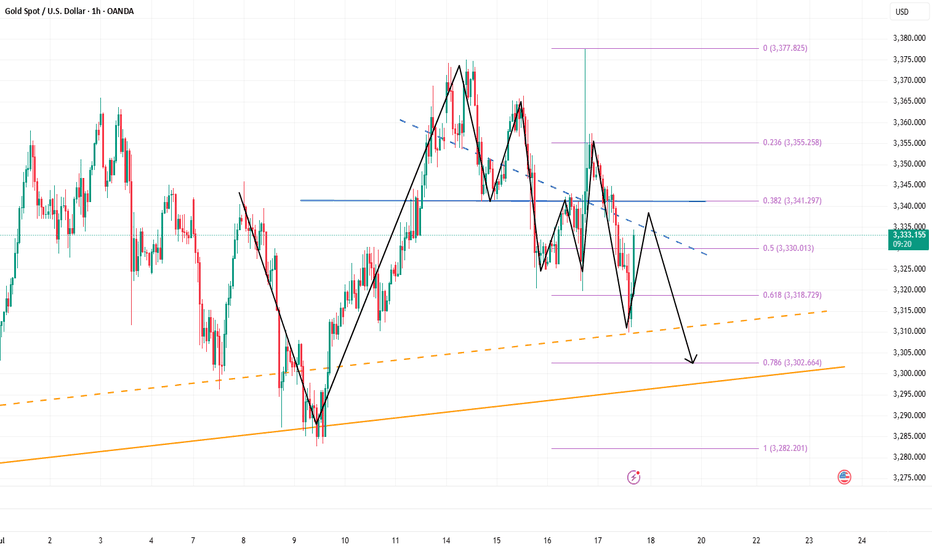

Gold Roadmap: Next Stop $3,325 After Ascending Channel Break?Gold ( OANDA:XAUUSD ) failed to touch the Potential Reversal Zone(PRZ) in the previous idea , and I took the position at $3,351 = Risk-free.

Gold is moving in the Resistance zone($3,366-$3,394) and has managed to break the lower line of the ascending channel .

In terms of Elliott Wave theory , with the break of the lower line of the ascending channel, it seems that gold has completed the Zigzag correction(ABC/5-3-5) .

I expect Gold to trend downward in the coming hours and succeed in breaking the Support zone($3,350-$3,325) and attacking the Support line again , and probably succeeding in breaking this line this time.

Note: Stop Loss (SL) = $3,396

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold Holds Key Support Zone📊 Market Summary

– Gold is currently trading at $3,338/oz, hovering near a key technical support level.

– US Treasury yields remain elevated and the USD is strong, both pressuring gold; however, ongoing concerns over US–EU/Mexico trade tensions continue to support safe-haven demand.

– The market is awaiting the upcoming US PPI data to determine the next directional move.

📉 Technical Analysis

• Key Resistance: $3,372 – $3,375 (23.6% Fibonacci zone – short-term ceiling)

• Nearest Support: $3,338 – $3,330 (tested and bounced at 3,338 per Oanda); deeper support at $3,325 – $3,320 if broken

• EMA 9: Price is below the MA20/50/100 but above MA200 (H1); EMA9 is flat, suggesting a sideways/consolidation trend

• Momentum / Indicators:

• RSI around 44–52 – neutral to slightly bullish

• MACD slightly positive; Stochastic above 50, hinting at short-term overbought conditions

📌 Outlook

– Gold is holding above the 3,338–3,330 support zone. If this level holds and rate-cut expectations strengthen, the price may rebound toward 3,372–3,375.

– However, if the USD continues to strengthen and PPI/CPI data surprises to the upside, gold could break support and head lower toward 3,325–3,320.

💡 Trade Strategy Proposal

🟣 SELL XAU/USD at 3,372 – 3,375

🎯 TP: ~ 40 / 80 / 200 pips

❌ SL: ~ 3,378

🟢 BUY XAU/USD at 3,330 – 3,333

🎯 TP: ~ 40 / 80 / 200 pips

❌ SL: ~ 3,327

GOLD - CUT n REVERSE area, what's next??#GOLD ... perfect move as per our video analysis and now market just reached at his today most expensive area, that is 3340-41

Keep close that area and only holding of that area can lead us towards further bounce otherwise not.

So keep in mind we should didn't holda our longs below 3340-41

And obviously we will go for cut n reverse below 3340-41 in confirmation.

Good luck

Trade wisely

Gold Likely to Extend Gains as USD Weakens, but Faces Resistance📊 Market Move:

Gold surged to a three-week high near $3,370/oz, driven by safe-haven demand amid renewed trade tensions between the U.S. and EU/Mexico and threats of a 100% tariff on Russian imports.

Investors are now focused on upcoming U.S. CPI data, which could trigger sharp moves if inflation comes in below expectations.

📉 Technical Analysis:

• Key Resistance: ~$3,365–$3,372; a breakout could open the way to $3,400–$3,440

• Nearest Support: ~$3,340 (S1), then ~$3,326 (SMA50), and deeper at $3,300–$3,320 (Fibonacci zone)

• EMA: Price remains above short-term EMAs (20/50/100), suggesting a continuing bullish bias

• Candlesticks / Volume / Momentum:

• RSI is neutral-to-bullish around 54; MACD shows strengthening bullish momentum

• Bollinger Bands are narrowing, signaling potential for a breakout

📌 Outlook:

Gold may continue edging higher or consolidate around the $3,365–$3,372 resistance zone if no new geopolitical shocks occur. However, if U.S. CPI comes in below expectations or if USD/Yields weaken, gold could rally further toward $3,400–$3,440.

________________________________________

💡 Suggested Trading Strategy

🔻 SELL XAU/USD at: $3,370–3,373

🎯 TP: 40/80/200 pips

❌ SL: $3,376

🔺 BUY XAU/USD at: $3,340–3,337

🎯 TP: 40/80/200 pips

❌ SL: $3,334

GOLD (XAUUSD): Mid-Term Outlook

Analysing a price action on Gold since March,

I see a couple of reliable bullish signals to consider.

As you can see, for the last 4 month, the market is respecting

a rising trend line as a support.

The last 4 Higher Lows are based on that vertical support.

The last test of a trend line triggered a strong bullish reaction.

The price successfully violated a resistance line of a bullish flag pattern,

where the market was correcting for almost a month.

A strong reaction to a trend line and a breakout of a resistance of the flag

provide 2 strong bullish signals.

I think that the market may grow more soon and reach at least 3430 resistance.

An underlined blue area will be a demand zone where buying orders will most likely accumulate.

❤️Please, support my work with like, thank you!❤️

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Two lines of defense for bulls: 3340 and 3330 are the key!Gold maintains a strong pattern in the short term, and it is recommended to mainly buy on dips. The short-term support below focuses on the neckline of the hourly line at 3340 last Friday. The more critical support is locked at the 3330 line. This range is an important watershed for judging the continuation of short-term bullish momentum. As long as the daily level can remain stable above the 3330 mark, the overall trend will remain upward. Before falling below this position, we should adhere to the idea of buying low and buying low, and rely on key support levels to arrange long orders. At present, the price has completed a technical breakthrough and broke through the upper edge of the 3330 convergence triangle under the dual positive factors of Trump's tariff landing to stimulate risk aversion and the support of the Fed's interest rate cut expectations, and formed three consecutive positive daily lines. It is necessary to pay attention to the short-term pressure at the 3375 line. The overall operation strategy will be combined with the real-time trend prompts during the trading session, and pay attention to the bottom in time.

XAUUSD Triangle about to break upwards aggressively.Gold (XAUUSD) has been trading within a Triangle pattern since the April 22 High. It is now above its 1D MA50 (blue trend-line), which has been turned into its Pivot and technically it is about to break upwards as it is running out of space.

As long as the 1D MA100 (green trend-line) holds, the market technically targets the 2.618 Fibonacci extension, which is what the last two Bullish Legs hit, which currently sits at 3770. A 1D RSI break above its own Lower Highs trend-line, could be an early buy signal.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold May Temporarily Correct Under Resistance Pressure📊 Market Overview:

• Gold reached resistance around $3,365–$3,370/oz before showing signs of cooling due to mild profit-taking.

• Ongoing trade tensions and geopolitical risks — such as President Trump’s tariff plan — continue to support safe-haven demand, driving gold close to a three-week high.

• Strong central bank purchases reinforce the long-term bullish outlook.

📉 Technical Analysis:

• Key Resistance: $3,365–$3,370

• Nearest Support: $3,300–$3,320

• EMA 09: Price is currently below the EMA 09, suggesting a potential short-term pullback. (Price is still above the EMA50, supporting the recent uptrend.)

• Candlestick patterns / Volume / Momentum:

o RSI near 57 – neutral but slightly declining.

o MACD and ADX remain bullish, indicating underlying strength but with possible short-term consolidation ahead.

📌 Outlook:

Gold may experience a short-term pullback if it fails to break through the $3,365–$3,370 zone and geopolitical tensions ease.

However, the medium-to-long-term trend remains bullish, especially as central banks continue to accumulate gold and global risks persist.

💡 Suggested Trading Strategy:

SELL XAU/USD: $3,363–$3,366

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,369

BUY XAU/USD : $3,317–$3,320

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,214

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to spike down into potentially the extension level 3310 and then give us the tap and bounce we wanted to be able to capture the long trade in to the 3345-50 region initially. It was those higher resistance levels that we said we would stick with and the bias was bearish below. This move resulted in a decent long trade upside into the region we wanted, and then the decline we witnessed mid-week completing all of our bearish target levels which were shared with everyone.

On top of that, we got the bounce we wanted for the long trade but only back up into the 3335 level which was an Excalibur active target. The rest, we just sat and watched on Friday as unless we were already in the move, the only thing we could have done is get in with the volume, which isn’t a great idea with the limited pull backs.

All in all, a great week in Camelot not only on Gold, but also the other pairs we trade with the DAX swing trade being a point to point swing move executed with precision by the team.

So, what can we expect in the week ahead?

We’ll keep it simple again this week but will say this, there seems we may see a curveball on the way this week. With tariff news over the weekend we may see price open across the markets with gaps, one thing we will say is if you see these gaps, don’t gap chase until you see a clean reversal!

We have the higher level here of 3375-85 resistance and lower support here 3350-45. If support holds on open we may see that push upside into the red box which is the one that needs to be monitored. Failure to breach can result in a correction all the way back down into the 3335 level initially. Again, this lower support level is the key level for this week and needs to be monitored for a breach which should then result in a completed correction of the move.

Our volume indicators are suggesting a higher high can take place here and if we do get a clean reversal we should see this pull back deeply. As usual we will follow the strategy that has been taught and let Excalibur guide the way.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360, 3373, 3375 and 3383 for now

Bearish below 3350 with targets below 3340, 3335, 3329, 3320 and 3310 for now

RED BOX TARGETS:

Break above 3365 for 3372, 3375, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340, 3335, 3329, 3322 and 3310 in extension of the move

It’s a HUGE RANGE this week so play caution, wait for the right set ups, don’t treat it like it’s your every day market condition. News from Tuesday so expect Monday to be choppy!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.