After repeated tug-of-war, where will gold go?At present, the gold market is divided between long and short positions. The Federal Reserve may maintain high interest rates, which weakens the investment appeal of gold; however, trade frictions and geopolitical risks provide safe-haven support for gold. Overall, market sentiment is mixed, with bulls lacking confidence, but bears have not been able to fully control the situation. Last week's strong non-farm data reduced market expectations for a rate cut in July, pushing up U.S. bond yields and the dollar, putting pressure on gold, which does not generate interest. In addition, Trump said on social media that he would impose a 10% tariff on countries that "support anti-U.S. policies." The market is waiting for the release of the minutes of the Fed's June meeting, which will more clearly show policymakers' views on the current economic situation and future policies, and may determine the direction of interest rates. If the minutes show that the Fed is inclined to maintain high interest rates for a longer period of time, gold prices may continue to face downward pressure.

From a technical perspective, gold was under pressure at a high level at the opening, so gold is expected to fall today. Today's key pressure level is 3345. Before the price effectively breaks through and stabilizes at 3345, any rebound is a short-selling opportunity; once it stabilizes at 3345, the bottom pattern is confirmed to be established, and the bulls will start an upward market. At this time, the short-selling idea should be abandoned. From a technical point of view, the 1-hour chart has shown a trend from weak to strong, and the Bollinger Bands are opening and diverging upward, indicating that the market may accelerate upward. Today's operation suggestion is to focus on low-long and high-short as a supplement. In terms of specific points, the lower support is 3327-3320, and the upper resistance is 3355-3360.

Operation strategy:

1. It is recommended to buy gold when it rebounds to around 3327-3320, with the target at 3340-3350.

2. It is recommended to sell gold when it rebounds to around 3345-3355, with the target at 3330-3320.

Goldsignals

Gold is expected to regain bullish momentum and continue to 3360Yesterday, gold rebounded from 3296 and was able to reach around 3345. Although the process was rather painful, we have to admit that gold bulls still have the energy to wrestle with bears, and the gold market is not one-sidedly dominated by bears. As gold gradually tested and confirmed the effectiveness of support during the retracement process and then rebounded effectively, the short-term structure of gold gradually changed and began to favor bulls.

After gold hit bottom and rebounded yesterday, we can clearly see from the short-term structure that gold has successfully constructed a head and shoulders bottom structure in the three areas of 3295-3244-3296 in the short term, thus playing an absolute supporting role in the structure; and in the process of repeated testing of gold, there are signs of constructing a head and shoulders bottom structure in the three areas of 3310-3296-3325 locally again. Under the effect of the structural support resonance of the head and shoulders bottom, gold may not go below 3320 again, and may even regain the bullish trend and continue to the 3345-3355 area.

So I think there is a lot of profit potential in going long on gold. We can go long on gold with the 3330-3320 area as support and look towards the target area: 3340-3350-3360

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold price analysis July 8In the previous US session, strong buying pressure pushed gold prices up and formed a bullish hammer candlestick pattern on the D1 chart - a potential sign for an uptrend recovery.

🔄 Today's scenario: The correction in the early session is considered a good opportunity to buy, expecting the price to continue the uptrend.

📍 Nearest resistance zone:

The price is currently facing the resistance zone of 3344 in the European session. If gold breaks 3344, the next target will be 3365 - the gap zone that has not been filled.

However, according to the wave structure, it would be more optimal if the price has a retest to the 3320 zone, accumulates more buying momentum and then breaks out strongly through 3344.

📉 Bearish scenario:

If 3320 is broken, especially with a trendline and support zone breakout signal, a sell strategy can be activated with a lower target.

🔸 Support: 3320 – 3297

🔸 Resistance: 3345 – 3352 – 3365

🔸 Sell is triggered if: Price breaks 3320, confirms breaking trendline & support zone.

💬 Do you have any comments on this trading plan? Leave a comment!

Seize the correction: It’s the right time to short goldThe current rebound is only a technical adjustment rather than a trend reversal. The rebound in the falling market is a good opportunity to arrange short orders. The hourly chart shows that the moving average pressure continues to move down to around 3340-3345. This position also serves as the long-short watershed in the previous intensive trading area, forming a key resistance barrier. If the gold price rebounds and approaches the area below 3345 and a stagflation signal appears or a top structure is formed, it can be regarded as a clear short signal. It is recommended to enter the market to seize the downward space. The current market direction is clear, and the exhaustion of the rebound is the best time to enter the market. Relying on the technical pressure level, the short position can be accurately arranged.

XAUUSD is getting ready to explode to $4000Gold (XAUUSD) is trading around its 1D MA50 (blue trend-line) having practically been accumulating since the April 22 High. Ever since the 1D MA100 (green trend-line) turned into a long-term Support (2023), Gold has experienced similar Accumulation Phases another 3 times.

On all of those occasions, the price broke out to the upside in the form of a Channel Up, reaching at least the 2.5 Fibonacci extension.

With the 1D MACD close to forming a Bullish Cross around the 0.0 mark, which is the level that always started the Channel Up during those 3 previous Accumulation Phases, we expect the market to start breaking upwards and towards the end of the year hit at least $4000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Under Pressure After NFP Beat – More Downside Ahead?Moments ago, the US Non-Farm Payrolls surprised to the upside at 147K (vs 111K forecast), while the Unemployment Rate dropped to 4.1% (vs 4.3% expected) .

This stronger-than-expected labor market data reinforces the idea that the Fed has no immediate reason to cut rates. As a result, the USD( TVC:DXY ) strengthened, and gold came under renewed selling pressure.

If the dollar momentum continues, Gold ( OANDA:XAUUSD ) may face further downside in the short term.

In terms of Technical Analysis , Gold fell below the Resistance zone($3,350-$3,326) again after the announcement of US indices and is currently moving near the Support lines and 50_SMA(Daily) .

In terms of Elliott wave theory , it seems that Gold has completed 5 impulsive waves in the one-hour time frame, and we should now wait for corrective waves .

I expect Gold to fall again after the upward correction , and the Support zone($3,312-$3,290) could be the target.

Note: Stop Loss (SL) = $3,365

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Gold Faces Pressure After Rejection at $3,376 ResistanceFenzoFx—Gold dropped from the $3,376.0 resistance, a level reinforced by the anchored VWAP. June’s bounce at $3,250.0 marks a key support for the broader bullish trend.

If the $3,250.0 support holds, XAU/USD can potentially resume its uptrend. However, a close below $3,236.6 would invalidate the bullish scenario.

Gold Consolidates Around 3,310 – Waiting for a Breakout📊 Market Developments:

• Gold is currently holding near $3,310, which aligns with the weekly pivot level on TradingView.

• With the upcoming FOMC minutes and key data (CPI, NFP) approaching, the market remains cautious. The USD is stable, keeping gold in a tight range.

📉 Technical Analysis:

• Short-term Resistance: $3,325–3,335 (H4 supply zone)

• Nearest Support: $3,300–3,305 (weekly pivot + H1/H4 lows)

• EMA 09 on H4: Price is trading below EMA09 → short-term bearish bias.

• Candlestick/Volume/Momentum: Lower highs on H4 candles with declining volume indicate weak buying momentum and a possible continuation of consolidation or mild pullback.

📌 Outlook:

• As long as gold stays below $3,305 and the USD remains firm, a pullback toward $3,300–3,295 is likely.

• A break above the $3,325–3,335 resistance zone could trigger a rally toward $3,350 or higher.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD at: $3,322–3,325

🎯 TP: $3,300

❌ SL: $3,332

🔺 BUY XAU/USD at: $3,300–3,303

🎯 TP: $3,325–3,335

❌ SL: $3,295

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest structure analysis

and important supports and resistances for Gold for next week.

Resistance 1: 3356 - 3368 area

Resistance 2: 3391 - 3403 area

Resistance 3: 3443 - 3452 area

Resistance 4: 3493 - 3501 area

Support 1: 3230 - 3274 area

Support 2: 3120 - 3177 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Weekly Chart Buying area📊 XAU/USD (Gold) Price Analysis – 4H Chart

🕒 Date: July 6, 2025

🔍 Technical Overview:

Gold is currently trading around the $3,337 level, showing signs of consolidation after a recent bounce.

🔸 Key Zones:

🟡 Resistance Area 1: $3,295 - $3,310

🟡 Resistance Area 2: $3,250 - $3,270

🟡 Target Zone: $3,390 - $3,410

📈 Possible Scenarios:

Price may retrace to the $3,295 - $3,310 resistance area, hold support, and aim for the $3,390 - $3,410 target zone.

A deeper pullback to the lower $3,250 - $3,270 resistance turned support area may occur before a stronger bullish move.

Breakout confirmation will come on a clean close above the $3,337 level with volume.

📌 Bias: Bullish above the $3,295 level

📌 Watch for: Bullish price action or liquidity grabs near support zones

💡 This setup is based on structure, liquidity zones, and institutional footprints.

Gold Pulls Back After Strong US NFP Data📊 Market Overview:

U.S. June Non-Farm Payrolls came in at 147,000 vs. 110,000 expected, strengthening the dollar and reducing expectations for a July Fed rate cut. As a result, gold dropped nearly 1%, trading in the $3,328–3,332 zone

📉 Technical Analysis:

• Key Resistance: $3,350 – $3,360

• Immediate Support: $3,322 – $3,328

• EMA: Price has fallen below the 09 EMA, indicating a bearish short-term trend.

• Candle/Volume/Momentum: A strong bearish candle with increased volume shows significant selling pressure post-NFP

📌 Outlook:

Gold may continue its downtrend in the short term if the dollar remains strong and no fresh bullish triggers emerge. A drop toward $3,322–$3,328 is possible.

💡 Trade Ideas:

🔻 SELL XAU/USD at: $3,342 – $3,345

🎯 TP: $3,322

❌ SL: $3,348

🔺 BUY XAU/USD at: $3,322 – $3,325

🎯 TP: $3,345

❌ SL: $3,316

GOLD - at CUT n REVERSE Area? holds or not??#GOLD.. market palced around 3317 18 as day low so far but hour closed above 3323 that was our area.

so keep close our region that is around 3320 to 3323

that is our ultimate region for now and if market hold it in that case we can expect bounce again

NOTE: below 3320 we will go for cut n reverse on confirmation.

good luck

trade wisely

GOLD (XAUUSD): Potential Scenarios Explained

Here is my updated technical outlook for Gold with potential scenarios.

Bullish Scenario

The price is currently testing a significant daily resistance cluster.

Its bullish breakout and a daily candle close above 3368 will

provide a strong confirmation.

More growth will be expected then.

Bearish Scenario

For now, the market is consolidating on the underlined resistance.

The price is stuck within a horizontal range on a 4H time frame now.

Your bearish signal will be a breakout of its support and a 4H candle

close below 3310.

It will provide a strong bearish confirmation.

The market might be weak and remain within a 4H range today.

But, everything can happen, so watch carefully.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Drops as NFP Beats, USD Gains📊 Market Overview:

• June’s Non-Farm Payrolls came in stronger than expected at +147K (vs 110K forecast), with unemployment ticking down to 4.1%.

• The US Dollar surged (DXY up ~0.5%) and Treasury yields rebounded following the release.

• Gold dropped sharply after the report, hitting a session low of $3,311 and is now trading around $3,328.

📉 Technical Analysis:

• Key Resistance: $3,364

• Immediate Support: $3,311

• EMA 09 (H1): Price is below the 09 EMA → confirms short-term bearish trend.

• Pattern / Momentum: A bearish engulfing candle near $3,364 signaled strong seller control. The failure to bounce afterward suggests persistent bearish pressure. RSI is tilting lower, confirming weakening momentum.

📌 Outlook:

Gold may continue to decline toward the $3,300–$3,290 area if USD and yields remain firm, especially if upcoming US data (such as ISM Services PMI) also supports the dollar strength.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD at: $3,333 – $3,335

🎯 TP: $3,300

❌ SL: $3,339

🔺 BUY XAU/USD at: $3,293 – $3,290

🎯 TP: $3,330

❌ SL: $3,287

Continue to maintain the rhythm of short tradingUnder the influence of NFP, gold fell sharply as expected. What I had suggested before was proven correct by the market again. "Gold rose in advance to reserve room for the NFP market to fall." After NFP, gold fell to around 3311 and the decline narrowed. Therefore, we accurately seized the opportunity to go long on gold near 3312 and set TP: 3330. Obviously, gold successfully hit TP during the rebound and made an easy profit of 180 pips.

From the current gold structure, gold encountered resistance and retreated twice near 3365, and built a double top structure in the short-term structure. In order to eliminate the suppression of the double top structure, gold still needs to continue to fall after the rebound. After the cliff-like decline of gold, the short-term resistance is in the 3340-3345 area, and the short-term support below is in the 3320-3310 area.

So I think that gold can still continue to short gold after the rebound, and I have already shorted gold around 3336 with the 3340-3345 area as resistance. Now we just need to wait patiently for gold to hit TP. Let us wait and see!

Gold May Pull Back After Day’s High📊 Market Overview:

• Gold is currently trading around $3,350/oz, with the daily high at $3,366/oz.

• The rally stalled as traders took profits near the session high, while a slight rebound in the USD and rising U.S. Treasury yields weighed on gold’s momentum.

📉 Technical Analysis:

• Key Resistance: ~$3,366 (today’s high), with next level at ~$3,375–3,380 if breached.

• Nearest Support: ~$3,342 (intra-day low), stronger support seen at $3,329–3,330.

• EMA 9/21: Price is hovering near the EMA21 (~$3,350); this area is crucial to determine the short-term trend.

• Candle/Momentum Indicators:

o RSI is around 53-55, signaling a neutral stance;

o MACD shows weakening bullish momentum after hitting resistance.

📌 Viewpoint:

Gold may see a minor pullback in the short term, possibly testing the $3,342–3,329 zone after reacting to the daily high. However, if it holds above EMA21 and EMA50, the medium-term bullish trend remains intact.

💡 Suggested Trading Strategy

SELL XAU/USD at: $3,363–3,366

🎯 TP: 40/80/200 pips

❌ SL: $3,370

BUY XAU/USD at: $3,329–3,332

🎯 TP: 40/80/200 pips

❌ SL: $3,325

I have shorted gold as expected and held on patientlyEven under the influence of the ADP data, which is bullish for the gold market, gold has not effectively broken through 3350, and even showed signs of falling back after rising several times. The resistance above is becoming more and more obvious, which may further weaken the market's bullish sentiment and confidence, thereby strengthening the dominance of the bears.

Although gold has not effectively fallen yet, from the perspective of the gold structure, even if gold wants to rise, it still needs to be backtested and support confirmed before rising, and the current retracement is far from enough, so gold still has a need for structural retracement; and before the NFP market, gold rose slowly but was far from enough to break upward, and there was no volume support, so the illusion of gold rising may be to lure and capture more bulls;

Therefore, out of caution, I try to avoid chasing gold at high levels; and I believe that shorting gold is still the first choice for short-term trading at present. And I have executed short trades in the 3340-3350 area according to the trading plan, and held it patiently. I hope that gold can retreat to the 3320-3310-3300 area as expected.

Gold Sees Volatile Swings – Pullback Risk Remains📊 Market Highlights:

Gold surged to $3,351 earlier today after weaker-than-expected US ISM manufacturing data, which boosted expectations of a Fed rate cut. However, profit-taking quickly pushed prices down to $3,334 before recovering to $3,342.

📉 Technical Analysis:

• Key Resistance: $3,351

• Nearest Support: $3,334

• EMA: Price is above EMA 09 → uptrend still intact.

• Candles / Volume / Momentum: H1 candle shows a long upper wick, indicating selling pressure near the recent high. Bullish momentum is slowing, and volume has started to normalize.

📌 Outlook:

Gold may face a short-term pullback if it fails to break above $3,351 and the USD strengthens during the US session.

________________________________________

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD at: $3,345 – $3,350

🎯 TP: $3,334

❌ SL: $3,353

🔺 BUY XAU/USD at: $3,332 – $3,334

🎯 TP: $3,350

❌ SL: $3,323

Gold Pulls Back Slightly After Peaking at $3,357📊 Market Overview:

Gold rallied to $3,357 yesterday following weak US manufacturing PMI, sparking expectations of an upcoming Fed rate cut. This morning, prices are pulling back to around $3,340 as traders await the FOMC meeting minutes for further guidance.

📉 Technical Analysis:

• Near resistance: $3,357

• Key resistance: $3,370

• Near support: $3,330

• Major support: $3,318

• EMA: Price is still above the 09 EMA, but starting to slope downward → short-term weakness emerging.

• Candlestick & momentum: Doji candle with a long upper wick on H4 chart around $3,357 → showing fading bullish momentum. RSI dropping out of overbought zone confirms potential short-term pullback

📌 Outlook:

Gold is currently in a mild downward correction, and may continue to decline toward $3,330 – $3,318 if the FOMC minutes do not suggest strong dovish intent.

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD at: $3,350 – $3,354

🎯 TP: $3,330

❌ SL: $3,359

🔺 BUY XAU/USD at: $3,328 – $3,332

🎯 TP: $3,350

❌ SL: $3,318

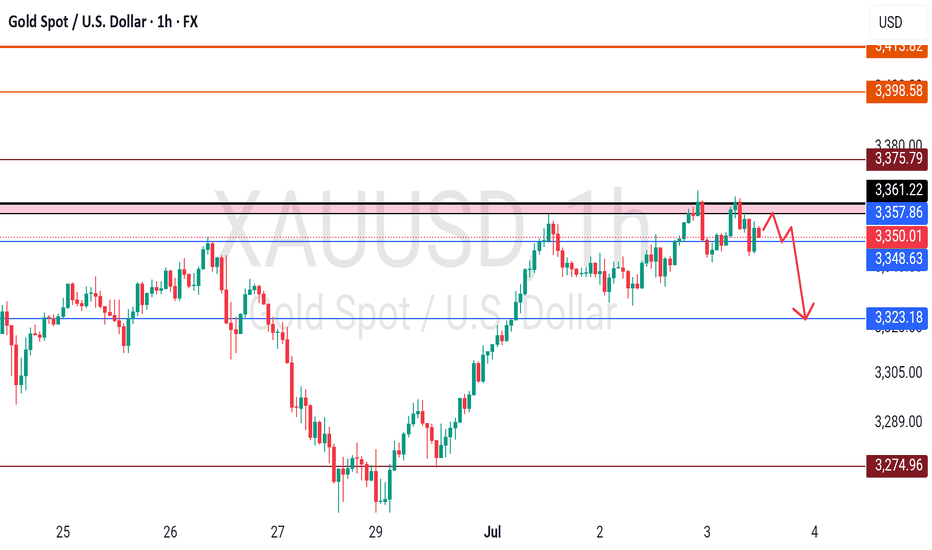

GOLD (XAUUSD): Bearish Move From Resistance

Gold went overbought after a test of a key daily resistance cluster.

A formation of multiple bearish imbalance candles on an hourly time frame

signifies a local dominance of the sellers.

The price will continue retracing at least to 3323 support.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.