GS raises gold target to $4,000, UBS to $3,500 Goldman Sachs and UBS have issued another round of bullish forecasts for gold, citing ongoing market uncertainty (i.e., tariffs).

Goldman analysts now expect gold to reach $3,700 per ounce by the end of 2025, with a potential rise to $4,000 by mid-2026. UBS holds a slightly more conservative view, projecting $3,500 by December 2025.

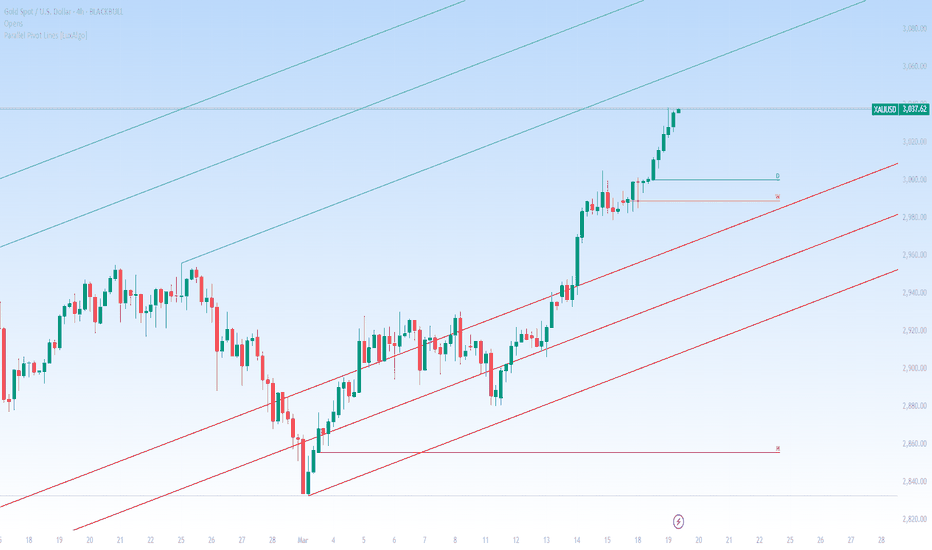

Technically, gold has pulled back from new all-time highs seen during the Asian session but potentially remains in a strong uptrend. With prices trading well above both the 50-day EMA and 200-day EMA, shallow retracements may find support, especially as tariff-related risks persist for at least the next 90 days.

Goldtrader

BTCUSDwhat a lovely week with super short on btcusd, well if you all look at the chart on daily frame as i draw the line clearly to understand what happend and what would happen next possibely. take a good risk management and wait for the conformation. there is as i mentioned on the chart a-plan and b-plan, what you all think let me know in the comment. if you like the analysis give it a like. happy sunday.

Liberation Day: Fear or greed in the air? We are less than hour out from the Liberation Day tariff announcements. The U.S. is preparing to roll out reciprocal tariffs on all countries, with rates set at 10%, 15%, and 20%, according to Sky News.

Investors hoping for certainty may be disappointed—this could mark the start of a longer phase of trade battles.

Mexico, once again, is reading the room. President Sheinbaum has confirmed Mexico won’t respond with tit-for-tat tariffs. They understand that the way to deal with Trump is to treat him with kid gloves.

Meanwhile, gold hit another record high, reaching $3,149.04 on Tuesday before pulling back a little. Buyers might have a better setup around the parallel pivot line to position for further upside.

GOLD 12H CHART ROUTE MAP ANALYSIS FOR THE WEEK12H GOLD Chart: Updated Analysis and Strategic Outlook (10the Feb 2024)

Hello Traders,

Here’s the latest 12H GOLD chart update, featuring a detailed review of recent movements and actionable insights for the upcoming market sessions. Our diligent tracking since October 2023 has consistently delivered 100% target accuracy, as evidenced by the marked Golden Circle areas on the charts. Let’s dive into the highlights and what lies ahead.

Previous Chart Review

* Entry Level 2814: ✅ DONE

* TP1 2858: ✅ DONE

* The price broke above the resistance level 2858 and reached a new ATH at 2886 last week.

* EMA5 held above 2858, which fueled the strong bullish push during Friday’s NFP release.

What’s Next for GOLD? Bullish or Bearish?

The price is currently consolidating around 2858, with EMA5 playing a crucial role in determining the next trajectory.

Resistance Levels: 2903, 2948, 2993

Support Levels (Activated GOLDTURN Levels):

2813 (Critical Weighted Level)

2770 (Critical Weighted Level)

2710 (Critical Weighted Level)

2664 (Major Support Level)

2599 (Lower Major Demand Zone and Retracement Range)

EMA5 Behavior (Red Line):

* Currently sitting below TP1 (2858) but indicating sustained bullish momentum.

* EMA5’s crossing and locking above or below key levels will signal the next move:

Bullish Scenarios:

Scenario 1: If EMA5 crosses and locks above TP1 (2858), expect a bullish rally toward 2903.

Scenario 2: If EMA5 crosses and locks above TP2 (2903), the next target is 2948.

Scenario 3: A further cross and lock above 2948 could drive the price to 2993.

Bearish Scenarios:

If EMA5 fails to sustain above TP1 (2858) and resistance levels hold, expect a pullback toward support zones:

Scenario 1: A cross and lock below Entry (2813) could lead to a decline toward 2770.

Scenario 2: A further drop below 2770 may target 2710 as the next support level.

Scenario 3: Continued bearish momentum could push the price toward 2664 and, ultimately, 2599 (Retracement Range).

Short-Term Strategy:

Anticipate possible reversals at weighted GOLDTURN levels 2813 and 2770.

Leverage 1H and 4H timeframes to capture pullbacks around these levels.

Target 30–40 pips per trade, focusing on shorter positions for effective risk management.

GOLDTURN levels provide reliable bounce opportunities, allowing you to buy at dip levels.

Long-Term Outlook:

Maintain a bullish bias while using pullbacks as buying opportunities.

Buying near key support levels ensures better entry points and mitigates risks, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with precision, discipline, and confidence. Our accurate, multi-timeframe analysis equips you to navigate the market effectively. Stay updated with daily insights to remain ahead of market trends.

We appreciate your support! Don’t forget to like, comment, and share this post to help others benefit.

Best regards,

📉💰 The Quantum Trading Mastery Team

2 more reasons to buy gold? Israel is sending a delegation to Washington for strategic talks on Iran, while Trump has reportedly given Tehran a two-month deadline for a nuclear deal—so far, Iran isn’t engaging.

So, the question is: Are we headed towards military conflict or a significant wave of sanctions?

Meanwhile, protests erupted after Erdoğan’s main rival was arrested, triggering a sharp selloff in Turkish markets. The lira hit record lows, forcing the central bank to intervene with nearly $10 billion in currency sales.

Turkey’s inflation remains elevated at 39%, with interest rates at 42.5%. Continued lira weakness could push inflation higher, forcing further rate hikes and adding to the country’s economic instability.

Best GOLD XAUUSD Consolidation Trading Strategy Explained

In article , you will learn how to identify and trade consolidation on Gold easily.

I will share with you my consolidation trading strategy and a lot of useful XAUUSD trading tips.

1. How to Identify Consolidation

In order to trade consolidation, you should learn to recognize that.

The best and reliable way to spot consolidation is to analyse a price action.

Consolidation is the state of the market when it STOPS updating higher highs & higher lows in a bullish trend OR lower lows & lower highs in a bearish trend.

In other words, it is the situation when the market IS NOT trending.

Most of the time, during such a period, the price forms a horizontal channel.

Above is a perfect example of a consolidation on Gold chart on a daily.

We see a horizontal parallel channel with multiple equal or almost equal highs and lows inside.

For a correct trading of a consolidation, you should correctly underline its boundaries.

Following the chart above, the upper boundary - the resistance, is based on the highest high and the highest candle close.

The lowest candle close and the lowest low compose the lower boundary - the support.

2. What Consolidation Means

Spotting the consolidating market, it is important to understand its meaning and the processes that happen inside.

Consolidation signifies that the market found a fair value.

Growth and bullish impulses occur because of the excess of demand on the market, while bearish moves happen because of the excess of supply.

When supply and demand find a balance, sideways movements start .

Look at the price movements on Gold above.

First, the market was rising because of a strong buying pressure.

Finally, the excess of buying interest was curbed by the sellers.

The market started to trade with a sideways range and found the equilibrium

At some moment, demand started to exceed the supply again and the consolidation was violated . The price updated the high and continued growth.

Usually, the violation of the consolidation happens because of some fundamental event that makes the market participants reassess the value of the asset.

At the same time, the institutional traders, the smart money accumulate their trading positions within the consolidation ranges. As the accumulation completes, they push the prices higher/lower, violating the consolidation.

3. How to Trade Consolidation

Once you identified a consolidation on Gold, there are 2 strategies to trade it.

The resistance of the consolidation provides a perfect zone to sell the market from. You simply put your stop loss above the resistance and your take profit should be the upper boundary of the support.

That is the example of a long trade from support of the consolidation on Gold.

The support of the sideways movement will be a safe zone to buy Gold from. Stop loss will lie below the support zone, take profit will be the lower boundary of the resistance.

AS the price reached a take profit level and tested a resistance, that is a short trade from that.

You can follow such a strategy till the price violates the consolidation and establishes a trend.

The market may stay a very extended period of time in sideways, providing a lot of profitable trading opportunities.

What I like about Gold consolidation trading is that the strategy is very straightforward and completely appropriate for beginners.

It works on any time frame and can be used for intraday, swing trading and scalping

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why gold may—or may not—reach $3,060 next Gold is now up 15.57% in 2025 after gaining 27.2% in 2024.

If the current momentum continues, traders may target the upper parallel trendline near $3,060 and rising.

Safe-haven demand is a key driver of this rally, but what could disrupt it?

For one, U.S. President Donald Trump and Russian President Vladimir Putin spoke for 90 minutes today, agreeing on steps toward a peace deal in Ukraine, including a pause on attacks on energy infrastructure. However, Putin declined to accept a broader 30-day ceasefire proposed by U.S. and Ukrainian officials.

Gold surges, just $17 away from $3,000 Gold is sprinting to new all-time highs and approaching the $3000 level. The price has just reached $2983 at the time of writing, just $17 away from the key $3000 level.

Alex Ebkarian from Allegiance Gold forecasts “prices to trade between $3,000 and $3,200 this year,”.

Momentum is currently being driven by uncertainty around Trump tariffs and stalled ceasefire talks with Vladimir Putin, who has outlined sweeping conditions for any potential truce.

The upcoming Federal Reserve meeting next Wednesday could also be influencing prices. While the central bank is expected to keep its rate at 4.25%-4.50% until at least June, with the current economic environment, a change in guidance from the Fed might be warranted. A delay in the anticipated June rate cut wouldn't be helpful for the gold price

4 reasons that Gold may have peaked: Gold can thrive on uncertainty, and for the past three years, Russia’s invasion of Ukraine has been a key driver. However, recent developments hopefully suggest a possible shift toward peace. While a complete resolution is uncertain, the beginning of peace talks, no matter how flawed they appear, could weaken gold’s safe-haven appeal.

Gold benefits from lower interest rates, as it competes with yield-bearing assets like bonds. Earlier in the year, markets expected the Federal Reserve to cut rates aggressively. However, recent economic data and Trump’s economic policies mean inflation could be a greater concern than initially thought. This has led to doubts about how quickly the Fed will ease policy. If rate cuts are delayed or scaled back, gold’s upside could be limited.

Gold and Bitcoin are seen as alternative stores of value. Bitcoin has recently fallen about 20% from its highs. This could suggest a broader shift in risk sentiment, potentially impacting gold if investors move back into the U.S. dollar or other assets.

Markets initially expected Trump to push aggressive tariffs, which would have fueled inflation and boosted gold. However, so far, his rhetoric has been more meandering than expected, with only a 10% tariff on Chinese imports. If markets believe that Trump’s trade policies will be less disruptive than previously thought, gold loses a key bullish narrative.

XAUUSDfinally over a year gold has rised 8600 pip which is incradibly insane, i see gold potentially trapping buyer at this high price my prediction is very simple it might may not be the same for sure.. as we still see how this month is going to close after all monthly 11 bullish candle and only 2 bearish candle has been performed, trade what you see, not what we think. happy weekend. what you think let me know in the comment.

Gold reacts to unserious peace talksThe United States and Russia recently held peace talks in Saudi Arabia without Ukraine’s participation. Russian officials did not mention offering any concessions and U.S. officials did not claim to have scored any in Tuesday's meeting.

Adding to the unseriousness of the talks, Donald Trump called Zelensky a “dictator,” and suggested that Ukraine is responsible for the war, echoing obvious Russian talking points.

Gold rose above $2,930 per ounce on Wednesday, just shy of last week’s record high of $2,940.

Technical indicators remain in extreme overbought territory, although extreme geopolitical uncertainty may call for extreme readings for longer. In the near term, the pullback appears corrective, with XAU/USD still holding above all key moving averages on the 4-hour chart.

GOLD (XAUUSD): Important Supports & Resistances to Watch

Here is my latest structure analysis for Gold.

Vertical Structures

Vertical Support 1: Rising trend line

Horizontal Structures

Support 1: 2869 - 2886 area

Support 2: 2770 - 2790 area

Resistance 1: 2941 - 2950 area

Resistance 2: 2998 - 3003 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

GOLD (XAUUSD): Your Trading Plan For Next Week Explained

Here is my price action analysis for Gold on a 4H.

The market is currently trading in a sideways after

an extended up movement that was completed 5th of February.

We see a horizontal parallel channel formation.

To confirm the next bullish wave, I suggest waiting for a breakout

of its resistance.

4H candle close above 2887 will confirm the violation.

A bullish continuation will be expected at least to 2900 then.

Alternatively, a bearish breakout of the support of the channel

may trigger a correctional movement.

❤️Please, support my work with like, thank you!❤️

XAUUSDwhat a greay weekend...gold is still pushing higher high finally made it to nearly 2900 , as weekly candle close strong bullish that seems like it might hit the cluster edge as predicted on the chart, i hope you all guys understand clean and clear, if not let me know in the comment.

looking for short from the edge of the cluster.

happy weekend.

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest structure analysis for Gold for next week.

Vertical Structures

Vertical Support 1: Rising Trend Line

Vertical Resistance 1: Rising Trend Line

Horizontal Structures

Resistance 1: 2816 - 2820 area

Support 1: 2786 - 2790 area

Support 2: 2718 - 2732 area

Support 3: 2689 - 2698 area

Support 4: 2655 - 2663 area

Support 5: 2614 - 2635 area

Support 6: 2596 - 2605 area

Support 7: 2583 - 2585 area

Consider these structures for pulback/breakout trading.

❤️Please, support my work with like, thank you!❤️

XAUUSD3 strong rejaction on 2730 finally gold rejected 4th time as well, strong strong suply zone. weekly candle was closed bullish, kind of confusion but as techniclly i see a short from , if price din return in favore back to 2730 could be a double top.

everything depend on the market opning on monday.

what are your thought, let me know in the comment.